2024 Retirement Planning Calendar

Key Points – 2024 Retirement Planning Calendar

- The 2023 Retirement Planning Calendar Was Our Inaugural Retirement Planning Calendar—What’s New in 2024?

- Important Dates to Know with Retirement Planning

- Specific Things to Keep in Mind for Q4

- Yearly Items to Consider

- Milestone Dates and Birthdays

2024 Retirement Planning Calendar

What Is the 2024 Retirement Planning Calendar?

After creating our inaugural retirement planning calendar in 2023, there wasn’t a doubt in our mind that we’d create another one for 2024. If you didn’t download our 2023 Retirement Planning Calendar, here’s what you can expect from this year’s edition.

The goal of our 2024 Retirement Planning Calendar is to help you through 2024 as you venture to and through retirement. This calendar will be updated regularly to include new dates, links, and more. Download your copy using the form below. If you download it, we’ll make sure to keep you updated as we make changes to the calendar.

*Please note that our firm observes the same holidays as the New York Stock Exchange

Download the 2024 Retirement Planning Calendar

Download the Retirement Planning Calendar

Once you click Get the Calendar the calendar should download as a PDF. We’ll also send it to the email provided.

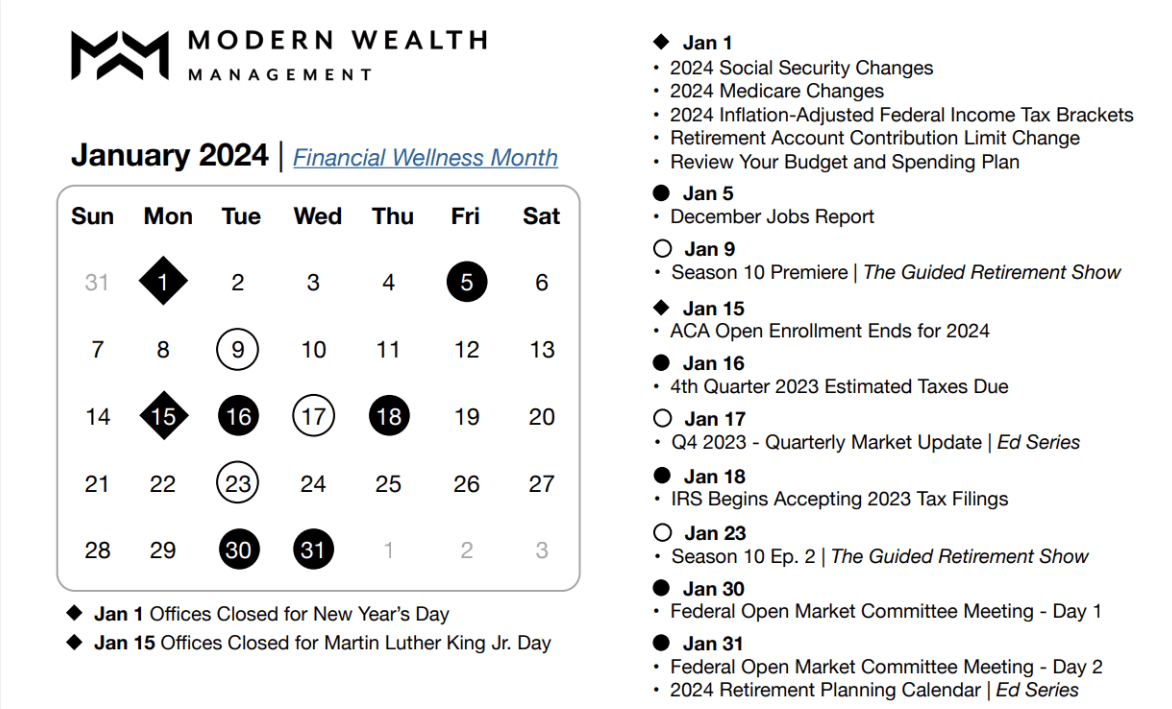

January 2024 | Financial Wellness Month

Retirement Planning Calendar

Have you ever had a new-year, new-me mantra to begin a calendar year? The beginning of the year is always a popular time to go back to the gym, start eating healthier, and get your financial life in order. So, it’s easy to understand why January is Financial Wellness Month. As you focus on your financial well-being to begin 2024, we hope that our Retirement Planning Calendar can be a useful resource.

January 1:

- 2024 Social Security Changes

- Social Security recipients are getting a 3.2% cost-of-living adjustment increase for 2024.

- 2024 Medicare Changes

- What’s new about Medicare for 2024? The Medicare & You 2024 handbook covers everything you need to know.

- 2024 Inflation-Adjusted Federal Income Tax Brackets

- The IRS established inflation-adjusted tax brackets for 2024.

- Retirement Account Contribution Limits Changes

- New 2024 contribution limits take effect. Check your plan to see how this affects your savings goals.

- Review Your Budget and Spending Plan

- Spending plan is a term we like to use for budget. Doesn’t that sound a bit more fun? The beginning of the year is a great time to review your spending plan and make any necessary changes.

January 5:

- December Jobs Report

- We can’t put 2023 completely behind us just yet. The December jobs report and actions of the Federal Reserve could help paint a picture of what’s in store for 2024.

January 9:

- Season 10 Premiere | The Guided Retirement Show

- Our Director of Investments, Stephen Tuckwood, CFA, has quickly become one of the most frequently featured guests on The Guided Retirement Show. For the Season 10 premiere, Tuck and Dean Barber will discuss the critical topic of constructing the right portfolio via strategic investing as you transition into and go through retirement. They’ll discuss the nuances of proper portfolio construction and the changing dynamics of investment rules during the retirement phase.

January 15:

- ACA Open Enrollment Ends for 2024

- ACA health insurance open enrollment ends.

January 16:

- Quarterly Estimated Taxes Due – 4th Quarter 2023

- Don’t forget to file your estimated taxes for the fourth quarter of 2023.

January 17:

- Q4 2023 Quarterly Market Update – Educational Series

- A few of our managing directors started sharing their insight on the markets as a part of our educational series in 2023 with our quarterly market updates. They’ll continue to do so in 2024. Check out the takeaways that Dean Barber and Bud Kasper, CFP®, AIF® have from Q4 2023.

January 18:

- IRS Begins Accepting 2023 Tax Filings

- Our CPAs are buckled up and ready to go. The 2023 tax season is officially underway.

January 23:

- Season 10 Episode 2 | The Guided Retirement Show

- Back for his eighth appearance on The Guided Retirement Show, LSA Portfolio Analytics President and Founder Brad Kasper joins Dean Barber to discuss growth vs. value investing in 2024. Brad shares that value could potentially outperform growth as we look at investing for the rest of the year. Why might he think that? Brad has plenty of data to share with Dean to back up his reasoning.

January 30:

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets to discuss interest rate policy.

January 31:

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

- 2024 Retirement Planning Calendar – Educational Series

- Chris Rett, CFP®, AIF® kicks off our educational series for 2024 by giving a rundown of the 2024 Retirement Planning Calendar.

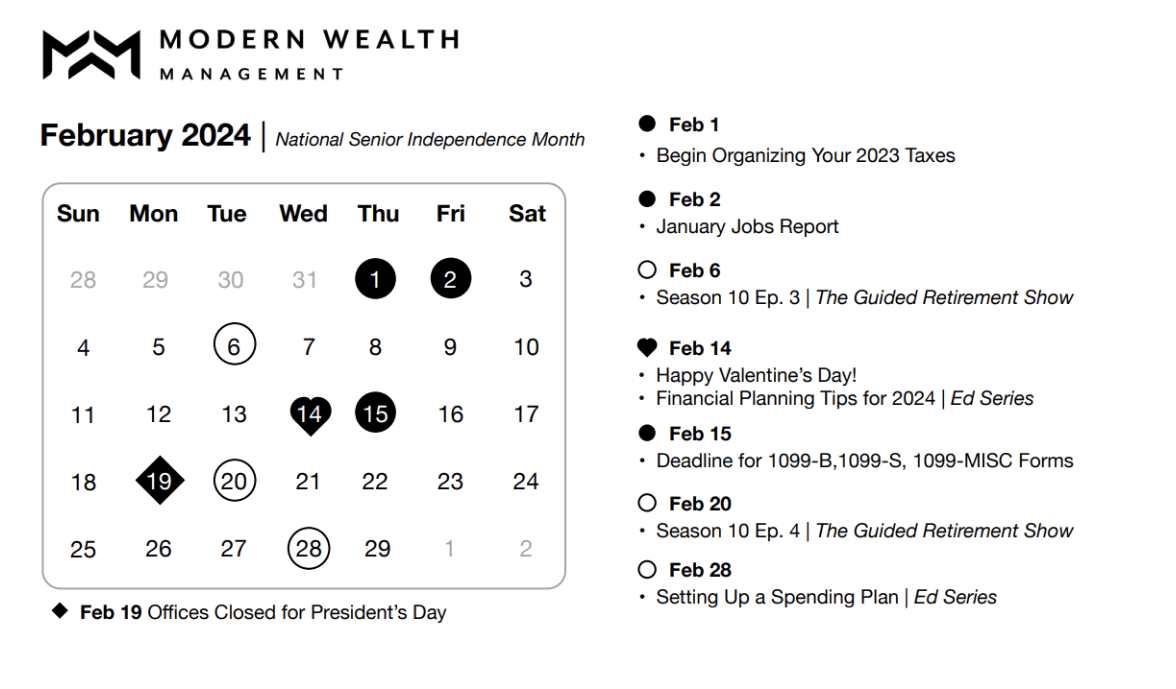

February 2024 | National Senior Independence Month

Retirement Planning Calendar

The later years of life tend to be a time where we become more dependent on receiving assistance for various needs. It can be very difficult to accept that help because there’s a sense of satisfaction and accomplishment for being able to do basic things on your own for as long as possible. National Senior Independence Month raises awareness about different resources that can help seniors remain independent.

February 1:

- Start Organizing Your 2023 Taxes

- Don’t let Tax Day sneak up on you. As you’re gathering your tax documents, make sure that you have our Tax Reduction Strategies guide handy and are avoiding common tax filing errors.

February 2:

- January Jobs Report

- Check out the January Jobs Report from the U.S. Bureau of Labor Statistics.

February 6:

- Season 10 Episode 3 | The Guided Retirement Show

- Making his third appearance on The Guided Retirement Show, Marty James, CPA, PFS joins Dean Barber to discuss how to qualify for Affordable Care Act subsidies. Qualifying for the Affordable Care Act subsidies can greatly reduce the cost of health insurance prior to becoming eligible for Medicare. Who doesn’t want that?! Marty and Dean are both excited to touch on this topic, so let’s see what they have to share.

February 14:

- Happy Valentine’s Day!

- You might be thinking, why is Valentine’s Day on a Retirement Planning Calendar? Well, one of the best ways to show how much you love your significant other is by practicing couples retirement planning. Even if you’re the one who is more financially savvy between you two, your retirement plan isn’t complete if it’s not incorporating your partner’s needs, wants, and wishes.

- Financial Planning Tips for 2024 – Educational Series

- We don’t have a crystal ball to tell you exactly how 2024 will play out from a financial perspective. No one does. But there is one thing that we can say with certainty: a financial plan can help provide you clarity even during times.

February 15:

- Deadline for 1099-B Forms

- This is the due date for furnishing statements to recipients for Forms 1099-B, 1099-S, and 1099-MISC (if amounts are reported in boxes 8 or 10).

February 20:

- Season 10 Episode 4 | The Guided Retirement Show

- Drew Jones, CFP®, AIF® has a passion in working with small business owners, helping them get their business to be as valuable as it can possibly be before facilitating an exit strategy. As Drew makes his third appearance on The Guided Retirement Show, he and Dean Barber will discuss what small business owners need to do when it comes to retirement planning.

February 28:

- Setting up a Spending Plan for Retirement | Educational Series

- Setting up a spending plan for retirement is one of the most critical components of a financial plan. Monitoring the costs of your needs, wants, and wishes in retirement is crucial to having confidence about your financial life.

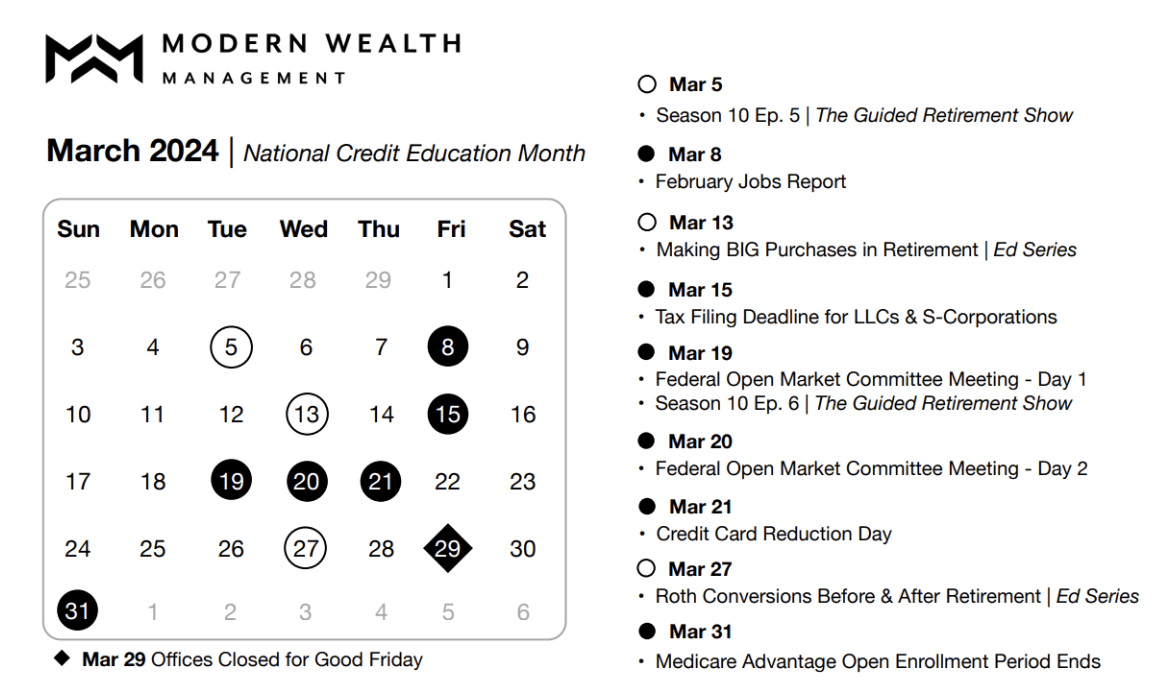

March 2024 | National Credit Education Month

Retirement Planning Calendar

Did you know that March is National Credit Education Month? There are all different kinds of debt—credit card debt, student loans, mortgages, etc. High-interest credit card debt is not something that you want to carry into retirement. That’s bad debt. But what about a mortgage with a low interest rate? That’s good debt. Check out our podcast on the difference between good debt and bad debt to kick off National Credit Education Month.

March 5:

- Season 10 Episode 5 | The Guided Retirement Show

- How much do you think you need each month to spend in retirement? There are many factors that will go into determining that number. On this episode of The Guided Retirement Show, Logan DeGraeve, CFP®, AIF® and Chris Rett, CFP®, AIF® walk through a case study that looks into how much money you would need to spend $10,000 net a month in retirement.

March 10:

- February Jobs Report

- Check out the February Jobs Report from the U.S. Bureau of Labor Statistics.

March 13:

- Making BIG Purchase in Retirement – Educational Series

- Is there a big purchase you’ve always dreamed of making? We’ve worked with so many people who have wanted to take a dream vacation, buy a new car, or purchase a second home, but have struggled to go through with it until we put it into their financial plan. This is why we build your financial plan to incorporate your goals and dreams and then stress test it to determine its probability of success.

March 15:

- Tax Filing Deadline for LLCs and S-Corporations

- Make sure you’re up to date on your tax filing deadlines if you’re a business owner.

March 19:

- Season 10 Episode 6 | The Guided Retirement Show

- A lot of people think that wealth planning is just about the management of money. That is part of wealth planning, but it’s far from being the only part. Modern Wealth Management Managing Director Jeremiah Johnson, AIF® elaborates on that with Dean Barber on this episode of The Guided Retirement Show.

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets for the second time in 2024 to discuss interest rate policy.

March 20:

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

March 21:

- Credit Card Reduction Day

- This isn’t a well-known holiday, but it’s certainly fitting that it’s during National Credit Education Month. Whether it’s today or any other day, make sure to get rid of your outstanding credit card debt.

March 27:

- Revisiting Roth Conversions Before and After Retirement – Educational Series

- Roth conversions are a tax planning strategy that can result in a substantial amount of tax savings over your lifetime. We’ll examine how Roth conversions can make sense for people before and after retirement.

March 31:

- Medicare Advantage Open Enrollment Period Ends

- It’s the final day of the Medicare Advantage open enrollment period. While the main Medicare open enrollment period runs from October 15 through December 7, Medicare Advantage open enrollment goes from January 1 to March 31.

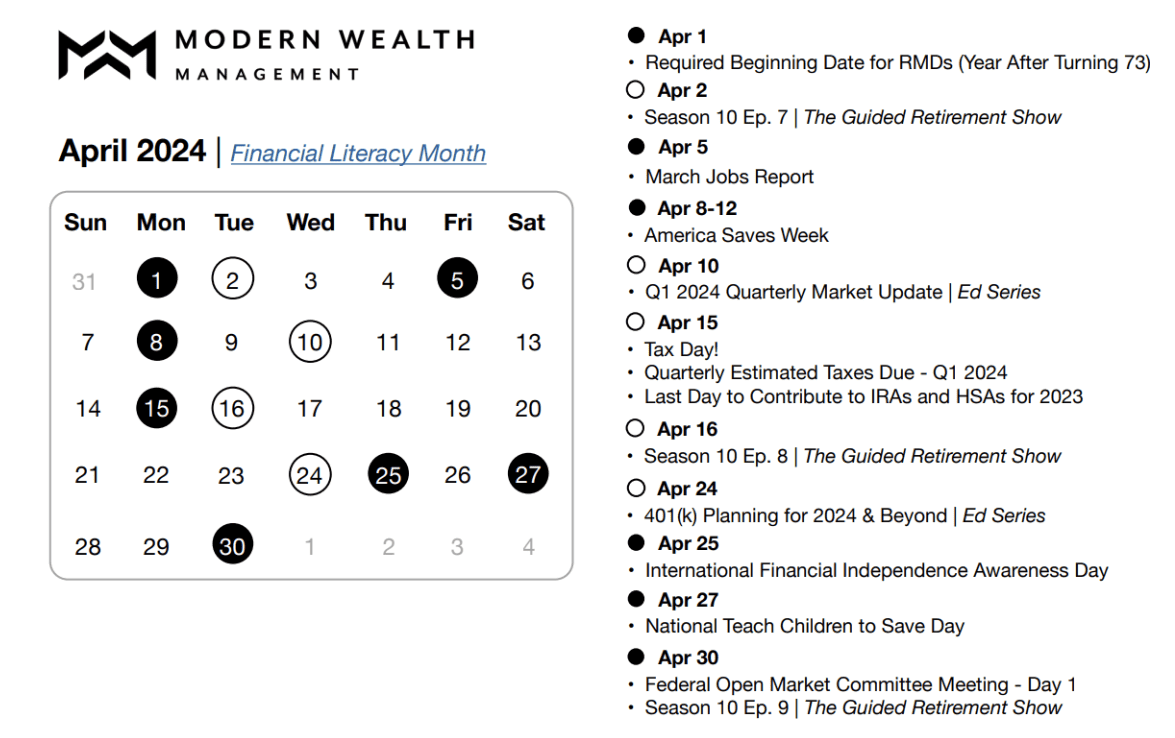

April 2024 | Financial Literacy Month

Retirement Planning Calendar

Where do you think you stand when it comes to financial literacy? Take a couple of minutes to take the TIAA Institute’s six-question quiz to see if you have a grasp on some key financial topics, such as interest rates, inflation, risk diversification, bond pricing, mortgages, and compound interest.

April 1:

- Required Beginning Date for RMDs (Year After Turning 73)

- The Required Beginning Date for RMDs is April 1 of the year following the year you turn age 73. That rule went into effect on January 1, 2023, as a part of SECURE 2.0. So, if you turn 73 in 2024, your Required Beginning Date for RMDs is April 1, 2025.

April 2:

- Season 10 Episode 7 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

April 5:

- March Jobs Report

- Check out the March Jobs Report from the U.S. Bureau of Labor Statistics.

April 8-12:

- America Saves Week

- America Saves is a non-profit organization that is passionate about educating Americans about saving money, reducing debt, building wealth, and creating better financial habits. So are we at Modern Wealth!

April 10:

- Q1 2024 Quarterly Market Update | Educational Series

- The first quarter of 2024 is in the books. We examine what’s going on in the markets and how things could shape up going forward.

April 15:

- Tax Day

- It’s Tax Day! Your taxes for the 2023 tax year are due. You can request a six-month extension if you’re unable to file by this date but remember that it’s not an extension to pay taxes. You must pay your taxes for the 2023 tax year prior to April 15 to avoid penalties and interest on what you owe. Don’t forget that forward-looking tax planning can help with alleviating the stress of tax compliance.

- Quarterly Estimated Taxes Due – 1st Quarter 2024

- Don’t forget to file your estimated taxes for Q1 2024.

- Last Day to Contribute to Your IRA, Roth IRA, or HSA for the 2023 Tax Year

- This is the final day that you can make contributions to crucial retirement accounts, so make sure to maximize your contributions for the 2023 tax year.

April 16:

- Season 10 Episode 8 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

April 24:

- 401(k) Planning for 2024 and Beyond | Educational Series

- There’s a good chance that your 401(k) will be your largest asset heading into retirement, so it’s pivotal to understand how to optimize it. Let’s review what to consider as you’re saving to your 401(k).

April 25:

- International Financial Independence Awareness Day

- We’re all about celebrating financial independence at Modern Wealth, but this “holiday” was established on this day for the wrong reasons in 2019. It was set for 4/25 to implore to consider problematic retirement rules of thumb—namely the 4% rule and saving 25x your annual expenses. Rather than following any retirement rules of thumb, you need to create a personalized financial plan, ideally 10-15 years before you plan to retire. If you don’t have a financial plan, today is a great day to change that. It’s truly the only way you’ll know whether you’re financially independent.

April 27:

- National Teach Children to Save Day

- This day is observed as a part of Financial Literacy Month. It’s never too early to start teaching your children how to save. They’ll be thankful for that education once they’re starting their own families and trying to build wealth in their 20s and 30s.

April 30:

- Season 10 Episode 9 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets for the third time in 2024 to discuss interest rate policy.

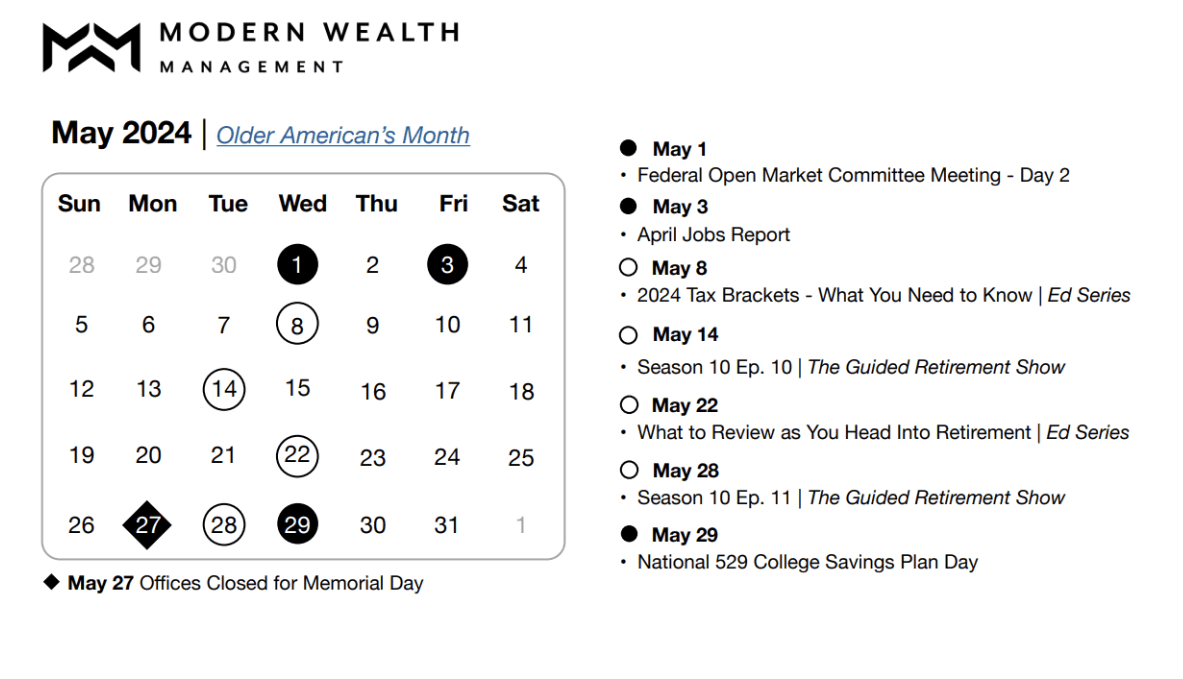

May 2024 | Older Americans Month

Retirement Planning Calendar

As you’re setting up a spending plan for retirement, think of a typical retirement as being in three phases—your go-go, slow-go, and no-go years. Your spending during your go-go years will look a lot different than your no-go years. We want to make sure you’re prepared for your later years in life well before they happen so that something like a long-term care stay or death of a spouse won’t derail your retirement. Longevity risk is also a very real fear for older Americans. A financial plan can help provide the clarity and confidence that you need to get to and through retirement.

May 1:

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

May 3:

- April Jobs Report

- Check out the April Jobs Report from the U.S. Bureau of Labor Statistics.

May 8:

- 2024 Tax Brackets – What You Need to Know | Educational Series

- How do the 2024 tax brackets compare to 2023’s tax brackets? We’ll dive into that and look ahead to some big changes for the 2026 tax brackets (and how to plan accordingly).

May 12:

- Happy Mother’s Day!

- Aren’t moms the best? Whether you’re a mom or your mom continues to be a big part of your life, we hope you have a wonderful Mother’s Day!

May 14:

- Season 10 Episode 10 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

May 22:

- What to Review as You Head into Retirement – Educational Series

- We have a hunch that there will probably be a few items from our Retirement Plan Checklist that we’ll be touching on for this!

May 28:

- Season 10 Episode 11 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

May 29:

- National 529 College Savings Plan Day

- High school and college graduations are big achievements, but obviously take a lot of work to happen. And the student isn’t the only one putting their blood, sweat, and tears into their education. A 529 plan can help your child/grandchild with covering those monumental educational expenses all while offering you some tax benefits.

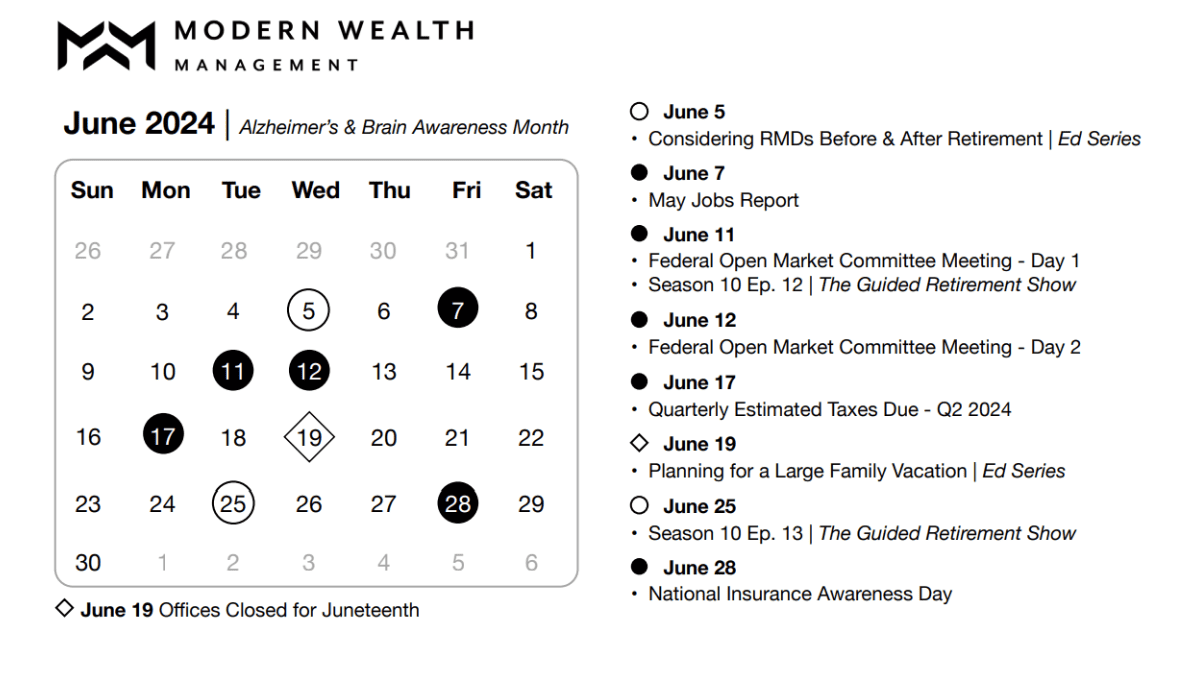

June 2024 | Alzheimer’s & Brain Awareness Month

Retirement Planning Calendar

Watching someone you love battle Alzheimer’s, or any kind of cognitive impairment, is never easy. Unfortunately, it’s something that can happen even if they’re otherwise healthy. It’s one of many reasons why we encourage people to build an estate plan sooner rather than later. It’s critical to keep your beneficiaries and other aspects of estate planning up-to-date so you’re not putting your spouse and/or children into difficult situations.

June 5:

- Considering RMDs Before and After Retirement – Educational Series

- Required Minimum Distributions are the minimum amount that you must take out of your retirement account or IRA each year. They exist so that people can’t keep funds in their retirement accounts indefinitely, put off taxes, and simply pass on their retirement funds to their loved ones as an inheritance. It’s important to know the rules for how to plan around RMDs, so we’re going to go through what to consider with RMDs before and after retirement.

June 7:

- May Jobs Report

- Check out the May Jobs Report from the U.S. Bureau of Labor Statistics.

June 11:

- Season 10 Episode 12 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets for the fourth time in 2024 to discuss interest rate policy.

June 15:

- Quarterly Estimated Taxes Due – 2nd Quarter 2024

- Don’t forget to file your estimated taxes for Q2 2024.

June 17:

- Happy Father’s Day!

- Doesn’t it seem like dads can superheroes at times? Whether you’re a dad or your dad continues to be a big part of your life, we hope you have a wonderful Father’s Day!

June 19:

- Planning for a Large Family Vacation – Educational Series

- One of our main goals is to build financial plans for people to help them do the things they love with the people they love. A lot of people enjoy getting the best of both worlds with that during large family vacations. If you’re one of those people, you’ll want to tune in for this.

June 25:

- Season 10 Episode 13 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

June 28:

- National Insurance Awareness Day

- Do you know whether you’re under-insured or over-insured? Celebrate National Insurance Awareness Day by checking your coverages and updating them if necessary.

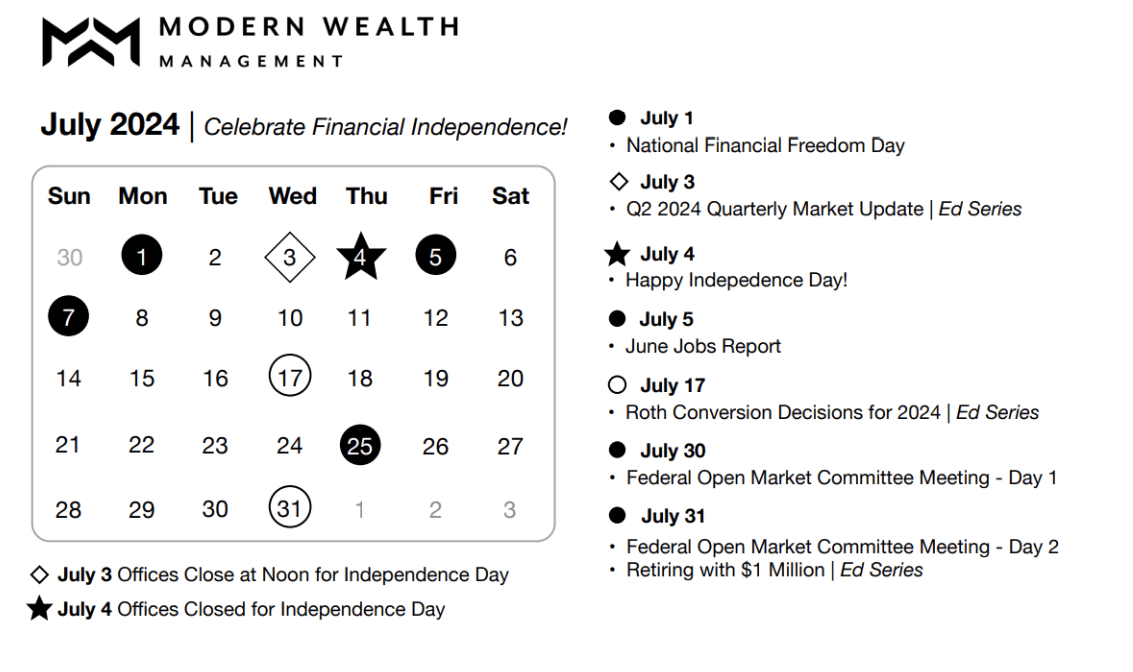

July 2024 | Celebrate Financial Independence!

Retirement Planning Calendar

One of the favorite aspects of the Fourth of July for so many people is being able to celebrate our freedoms as Americans with the people they love. But what if every day was the Fourth of July? Well, in many cases, it can be in retirement. But how much do you need to retire?

The only way you can get the clarity to answer that question is by creating a comprehensive financial plan. A personalized plan can truly tell you whether you are financially independent. And when you’re financially independent, every day really can feel like the Fourth of July. You’re doing all the things you want to do for the reasons you want to do them (and not because you need a paycheck). If you want to keep working, it’s because you really love your job and not because you need the money.

July 1:

- National Financial Freedom Day

- If you’re not financially independent, find a team of professionals to work with that can help you get there. The goal is for every day to be National Financial Freedom Day.

July 3:

- Q2 2024 Quarterly Market Update – Educational Series

- It’s halftime for 2024. That means it’s time again to assess market performances from the second quarter.

July 5:

- June Jobs Report

- Check out the June Jobs Report from the U.S. Bureau of Labor Statistics.

July 17:

- Roth Conversion Decisions for 2024 – Educational Series

- As Bud Kasper, CFP® likes to say, the three best reasons to do Roth conversions are no future tax, no future tax, and no future tax. Bud is a converted Rothaholic and makes a good point. But there is still a lot more to consider with Roth conversions. They can help a lot of people, but they’re not for everyone. Let’s look at what to consider with Roth conversion decisions for 2024.

July 27:

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets for the fifth time in 2024 to discuss interest rate policy.

July 28:

- Retiring with $1 Million – Educational Series

- Did you know that if you have $1 million in a traditional 401(k)/IRA, you don’t actually have $1 million? That’s because you won’t be taxed until you access those funds since they are tax-deferred assets. We’re going to compare a few different couples who have saved $1 million for retirement to explain why where you save to matters.

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

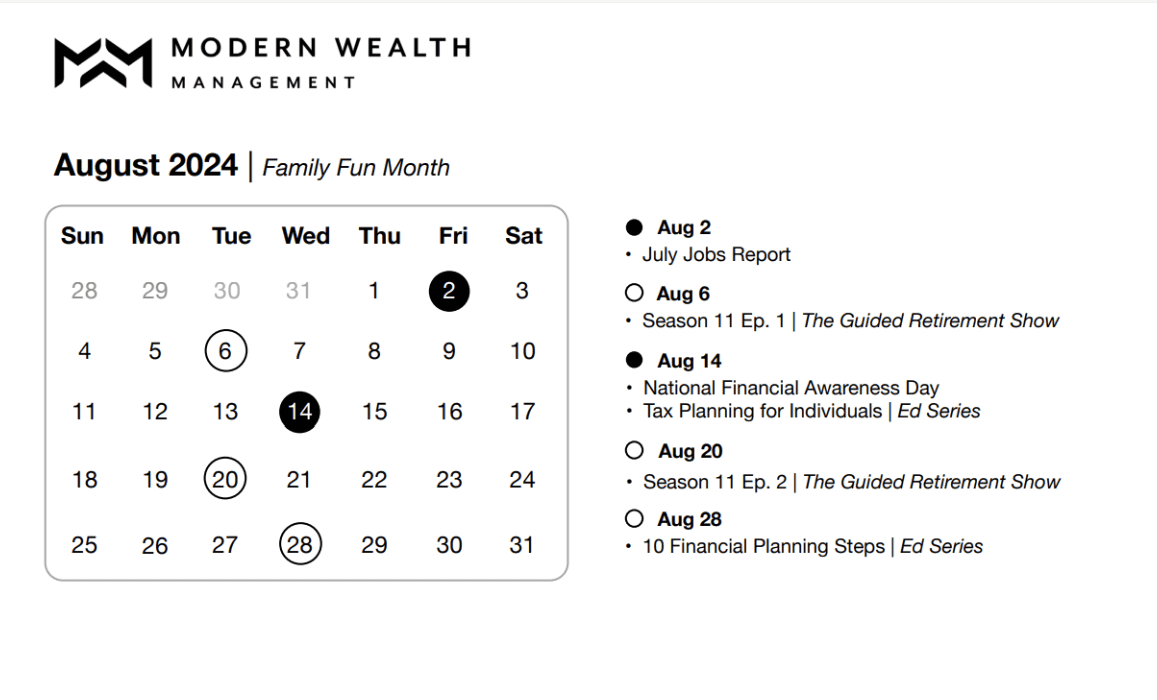

August 2024 | Family Fun Month

Retirement Planning Calendar

What’s your No. 1 goal for retirement? For so many people, it’s spending more time with family. Life can feel like it’s going 100 mph sometimes, especially during August when kids and grandkids are heading back to school. Make sure you take some time during Family Fun Month to slow down and really enjoy some of your family’s favorite activities.

August 2:

- July Jobs Report

- Check out the July Jobs Report from the U.S. Bureau of Labor Statistics.

August 6:

- Season 11 Premiere | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

August 14:

- National Financial Awareness Day

- It’s National Financial Awareness Day 365 days a year at Modern Wealth. We’re committed to bringing financial awareness and education to anyone and everyone.

- Tax Planning for Individuals – Educational Series

- So many people get caught up in trying to mitigate as much tax as possible in one year. They’re oftentimes amazed when they shift their approach to mitigating taxes over their lifetime and seeing the impact of forward-looking tax planning.

August 20:

- Season 11 Episode 2 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

August 28:

- 10 Financial Planning Steps – Educational Series

- One of the hardest things to do when it comes to financial planning is getting started. We’ll go over 10 steps that can help with that.

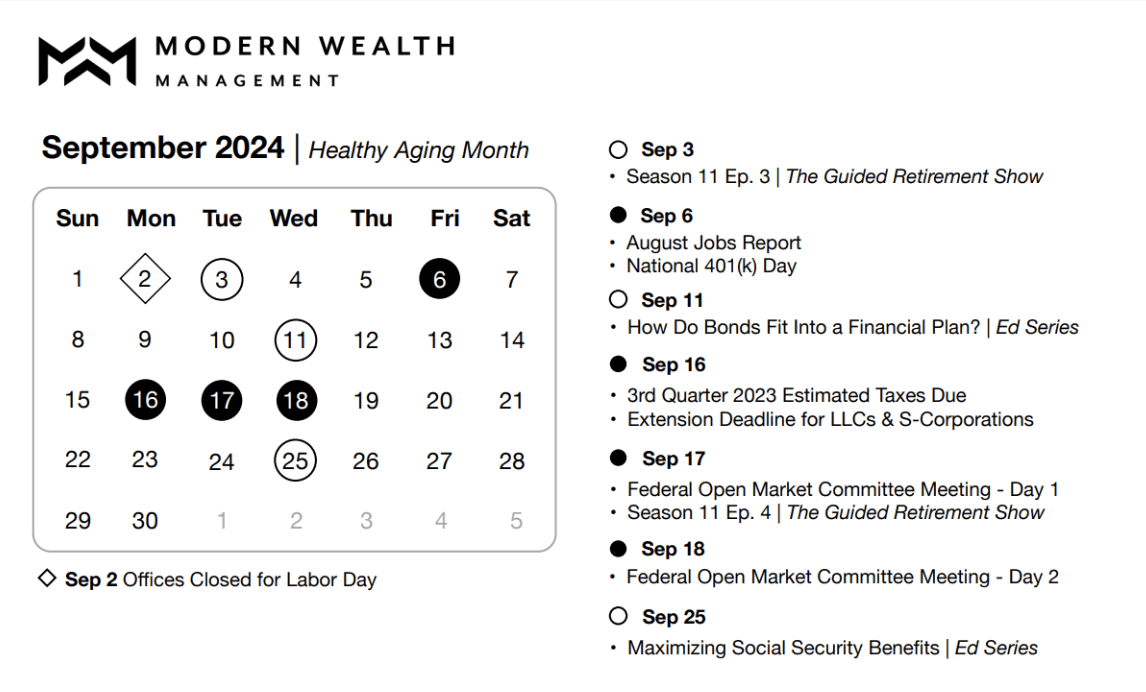

September 2024 | Healthy Aging Month

Retirement Planning Calendar

The U.S. Department of Health and Human Services recognizes Healthy Aging Monthly to various options for how people can remain healthy as they get older. This ties right back in with Financial Wellness Month back in January. Are you still doing all those things to keep yourself in good shape psychically and mentally that you set out to do at the beginning of the year. Let’s finish the year strong!

September 3:

- Season 11 Episode 3 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

September 6:

- August Jobs Report

- Check out the July Jobs Report from the U.S. Bureau of Labor Statistics.

- National 401(k) Day

- On National 401(k) Day, take a few minutes and think about what to do with your 401(k) after retirement. Do you want to leave it in its existing plan or roll it over to an IRA? There are pros and cons to both.

September 11:

- How Do Bonds Fit into a Financial Plan? – Educational Series

- We’ve spent a lot of time looking at how bonds have performed over the past few years in times of heightened volatility. Let’s examine how they fit into a financial plan.

September 16:

- Quarterly Estimated Taxes Due – 3rd Quarter 2024

- Don’t forget to file your estimated taxes for Q3 2024.

- Extension Deadline for LLCs & S-Corporations

- Stay up to date on your tax filing deadlines if you’re a business owner.

September 17:

- Season 11 Episode 4 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets for the sixth time in 2024 to discuss interest rate policy.

September 18:

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

September 25:

- Maximizing Social Security Benefits – Educational Series

- The difference between you and your spouse’s best and worse Social Security claiming strategy can be a substantial amount of retirement income. You only get one shot at this, so it’s critical to make the right decision of when to claim to maximize your benefits for you and your spouse over your lifetimes.

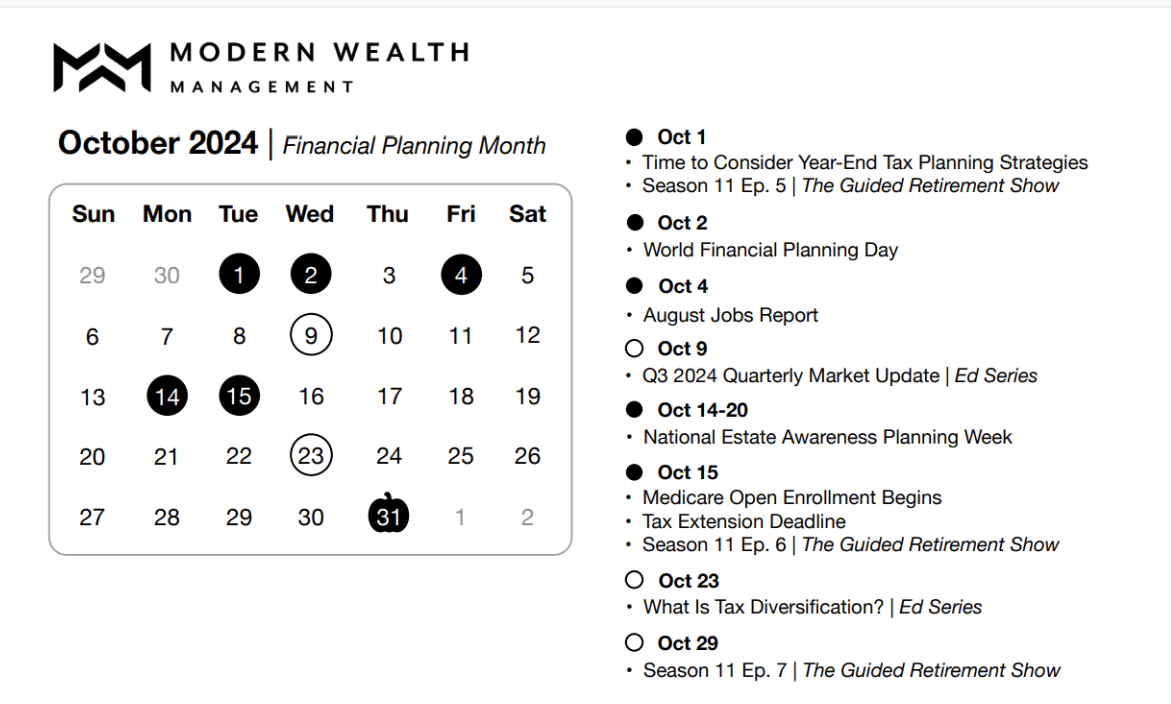

October 2024 | Financial Planning Month

Retirement Planning Calendar

What is financial planning? From risk management and taxes to estate planning and investment management, there’s so much that goes into the financial planning process. If you don’t already have a goals-based plan that consider each of those four components, that’s where it all starts as you’re planning for retirement. If you do have one, that’s great! Take some time to review it during Financial Planning Month to make sure it’s up to date.

October 1:

- Time to Consider Year-End Tax Planning Strategies

- Roth conversions, Qualified Charitable Distributions, tax-loss harvesting, oh my! These are just a few year-end tax planning strategies to consider. Meet with your tax professional to see what tax planning opportunities are available to you as we approach the end of the year.

- Season 11 Episode 5 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

October 2:

- World Financial Planning Day

- Did you know that there’s an art and a science to financial planning? The science part is the math, such as the tax laws and rules to follow. The art part of financial planning is the responsibility of a CFP® Professional, as they need to learn what’s important to you and build a plan accordingly that can help you achieve your goals prior to and during retirement.

October 4:

- September Jobs Report

- Check out the September Jobs Report from the U.S. Bureau of Labor Statistics.

October 9:

- Q3 2024 Quarterly Market Update – Educational Series

- We’ve reached the fourth quarter of 2024. We’re hopeful for a strong finish for the markets this year, but first let’s look back and see how they performed in Q3.

October 14-20:

- National Estate Planning Awareness Week

- The National Association of Estate Planners & Councils designates the third week of October as National Estate Planning Awareness Week. Take some time this week to review your estate planning options with your loved ones.

October 15:

- Medicare Open Enrollment Begins

- It’s the first day of the Medicare Open Enrollment period. Review your coverages and make changes as necessary prior to December 7.

- Tax Extension Deadline

- If you filed for an extension ahead of Tax Day to file your return, that six-month extension deadline has arrived.

- Season 11 Episode 6 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

October 23:

- What Is Tax Diversification? – Educational Series

- Do you know about the three tax buckets? You have the option of saving to tax-deferred, taxable, or tax-free buckets. It’s critical to have tax diversification so that you have good tax flexibility.

October 29:

- Season 11 Episode 7 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

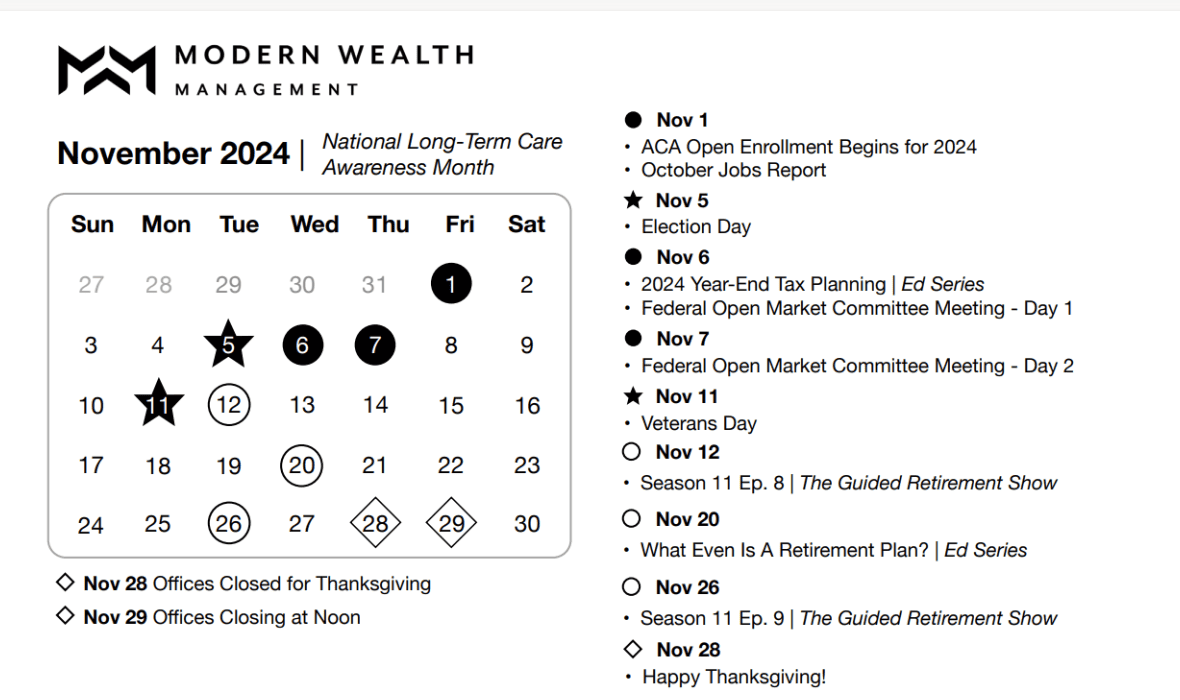

November 2024 | National Long-Term Care Awareness Month

Retirement Planning Calendar

Are you ready for Thanksgiving? It’s such a fun-filled day with family, great food, football, and other Thanksgiving festivities. But remember that the holidays can be an extremely difficult time of the year for those who have lost a loved one or have a family that’s ill and/or in the middle of a long-term care stay. Whether you or someone you know is in the middle of a long-term care stay, it’s not an easy situation to deal with. One way that can help relieve the stress of the situation, though, is to have already planned for the possibility of a long-term care stay.

November 1:

- ACA Open Enrollment Begins for 2025

- Don’t miss ACA Open Enrollment if you depend on it for your insurance.

- October Jobs Report

- Check out the September Jobs Report from the U.S. Bureau of Labor Statistics.

November 5:

- Election Day

- Don’t forget to go vote!

November 6:

- Year-End Tax Planning for 2024 – Educational Series

- You might be thinking, “Why are you talking about taxes when Tax Day isn’t until April?” Well, we don’t want you to be dreading Tax Day each year. Doing year-end tax planning is key in order for that to happen.

- Federal Open Market Committee Meeting – Day 1

- The FOMC meets for the seventh time in 2024 to discuss interest rate policy.

November 7:

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

November 11:

- Veterans Day

- We can’t thank all the veterans out there enough for their service to our country. The least we can do at Modern Wealth along with thanking them for their service is to make sure that they’re aware of the financial planning opportunities available to them as veterans.

November 12:

- Season 11 Episode 8 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

November 20:

- What Even Is a Retirement Plan? – Educational Series

- We use the terms financial plan and retirement plan a ton, but what exactly are they? We figured it would be a good idea to explain that on our educational series.

November 26:

- Season 11 Episode 9 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

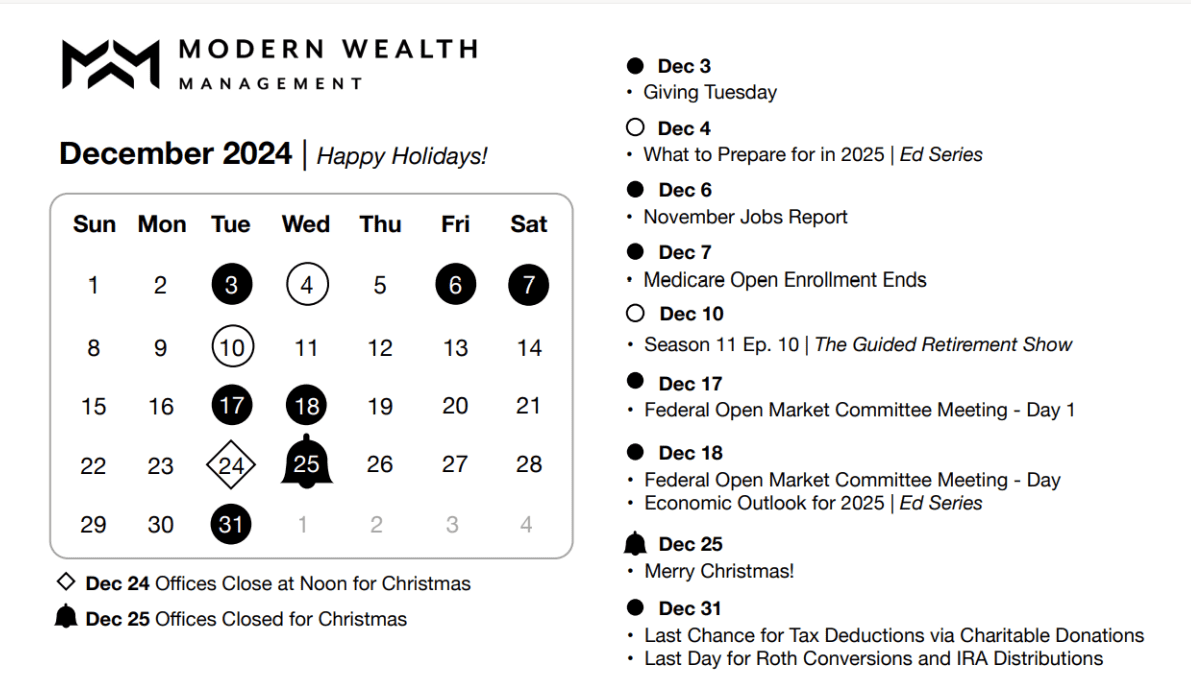

December 2024 | Happy Holidays!

Retirement Planning Calendar

It’s the most wonderful time of the year! We hope that you and yours are doing well this holiday season. While we hope that Santa brings you some great gifts this year, remember how rewarding it feels to give to those who need it most. December 4 is Giving Tuesday, so it’s a great time to get into the giving spirit. Tis the season for charitable giving!

December 3:

- Giving Tuesday

- The Tuesday following Thanksgiving is known as Giving Tuesday. Charitable giving is very popular among our client base and many others. From Qualified Charitable Distributions to donor-advised funds, make sure that you understand how to give to your favorite charities in a tax-efficient manner.

December 4:

- What to Prepare for in 2025? – Educational Series

- It’s so important to have a forward-looking approach to financial planning. So, let’s think about what to prepare for in 2025.

December 6:

- November Jobs Report

- Check out the September Jobs Report from the U.S. Bureau of Labor Statistics.

December 7:

- Medicare Open Enrollment Ends

- The Medicare Open Enrollment period ends December 7th. Don’t forget to review your coverages.

December 10:

- Season 11 Episode 10 | The Guided Retirement Show

- We’ll let you know who our guest will be closer to the release date.

December 17:

- Federal Open Market Committee Meeting – Day 1

- It’s the final meeting of 2023 for the FOMC.

December 18:

- Economic Outlook for 2025 – Ed Series

- There are only two weeks left in 2024. We’re going to break down what has happened this year (and in past years) to help us come up with an economic outlook for 2025. Remember that while history never repeats itself, it does often rhymes.

- Federal Open Market Committee Meeting – Day 2

- Stay tuned to hear from FOMC Chairman Jerome Powell on the Fed’s actions.

December 31:

- Last Chance for Tax Deductions via Charitable Donations

- Don’t forget to consult with a tax professional about tax planning strategies such as Roth conversions, QCDs, and planning for RMDs to close out the year.

- Last Day for Roth Conversions & IRA Distributions

- Additionally, don’t miss out on the last day for Roth conversions or IRA distributions. Meet with your advisor about this sooner rather than later so that you don’t have it hanging over your head at year’s end.

Final Quarter Tasks | Start These in October

- Project income for 2024 and 2025

- Review unrealized investment gains and losses

- Collect cost-basis information on sold investments

- Review sales of appreciated property

- Review potential credits and deductions

- Track donations to charity

- Take required minimum distributions

- Review Medicare enrollment options

- Review and fund trusts

- Contribute to college education or gift cash to family

- Review any gifting plans

Annual Items | Things to Consider Each Year

- Review beneficiaries on all IRAs, investments, pensions, life insurance, bank accounts, etc.

- Discuss your gifting strategy for family and charity

- Review your estate plan and beneficiaries

- Review your health care directives and power of attorney

- Review your multi-year tax strategy to pay as little as possible over your lifetime, not just in a single year

- Rebalance your portfolio as needed in order to achieve your overarching goals

Big Birthdays | Notable Birthday Milestones

- Age 50

- Catch-up contributions can begin for IRAs and 401(k) plans

- Age 55

- Penalty-free distributions allowed from 401(k) if retired

- Age 59 1/2

- Penalty-free distributions allowed from IRA and qualified plans, and Roth IRAs at least five years old

- Age 60

- Eligible for reduced Social Security survivor benefit. Check with your advisor first!

- Age 62

- Social Security retirement benefit claiming can begin at a reduced amount. Check with your advisor first!

- Age 65

- Apply for Medicare (Parts A & B) three months prior to turning 65. Coverage begins the 1st of the month you turn 65.

- Age 66/67

- Full Social Security retirement benefits can be claimed

- Age 70

- Delayed Social Security credits no longer accrue. Apply to get maximum benefits

- Age 73

- Start making Required Minimum Distributions (RMDs) April 1st of the year you turn 73

Practicing Proactive Financial Planning for 2024 and Beyond

We wish nothing but the best for you and your loved ones in 2024! It’s our hope that our 2024 Retirement Planning Calendar can serve as a resource throughout the year.

One thing we should note is that this calendar will look different on December 31, 2024, than it will on January 1, 2024. But if you think about it, that makes a lot of sense. If you review your financial plan on January 1 and then don’t review it again until December 31, you’re not going to have a complete plan at the end of the year.

Whether there are tax law changes or significant swings with interest rates or your personal goals and life is changing, there will be changes throughout the year. Make sure you’re meeting with your CFP® Professional and other financial professionals to update your plan as necessary throughout the year.

Even if you look back at our 2024 Retirement Planning Calendar in February or March, it’s going to look different. We’ll be updating it throughout the year with new dates, links, etc. Make sure to download your copy via the form below. It’s printer-friendly! So, print a black and white copy and put it on your refrigerator so you don’t miss a date. We’ll make sure to keep you updated as we make changes to the calendar.

Download the 2024 Retirement Planning Calendar

Once you click Get the Calendar the calendar should download as a PDF. We’ll also send it to the email provided.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.