Social Security Administration Announces 3.2% COLA Increase for 2024

Key Points – Social Security Administration Announces 3.2% COLA Increase for 2024

- Remembering That Cost-of-Living Adjustments Are Tied to Inflation

- Looking Back at Last Year’s Historic 8.7% COLA Announcement for 2023

- Social Security Cost-of-Living Adjustments Over the Years

- Factoring in Medicare Part B Premiums

- 3 Minutes to Read

Breaking Down the 3.2% COLA Increase for 2024

The Social Security Administration announced on October 12 that around 71 million Social Security and Supplemental Security Income (SSI) recipients will receive a 3.2% cost-of-living adjustment (COLA) increase to their benefits in 2024. Beginning in January, Social Security benefits will go up roughly $50 a month.

The 66 million-plus people receiving Social Security benefits will get the 3.2% COLA increase starting in 2024. For the 7.5 million SSI recipients, that COLA increase will take place on December 29. Keep in mind that there are some people who are Social Security and SSI recipients.

“Social Security and SSI benefits will increase in 2024, and this will help millions of people keep up with expenses.” – Kilolo Kijakazi, Acting Commissioner of Social Security

That “keep up with expenses” part is very important. Rather than viewing the 2024 COLA increase as a “boost” to your Social Security benefits, it’s critical to understand that COLAs are designed to keep up with inflation. That’s why the 8.7% COLA increase for 2023 was one of the highest cost-of-living adjustments on record. It was in response to the highest inflation levels we had seen in 40 years.

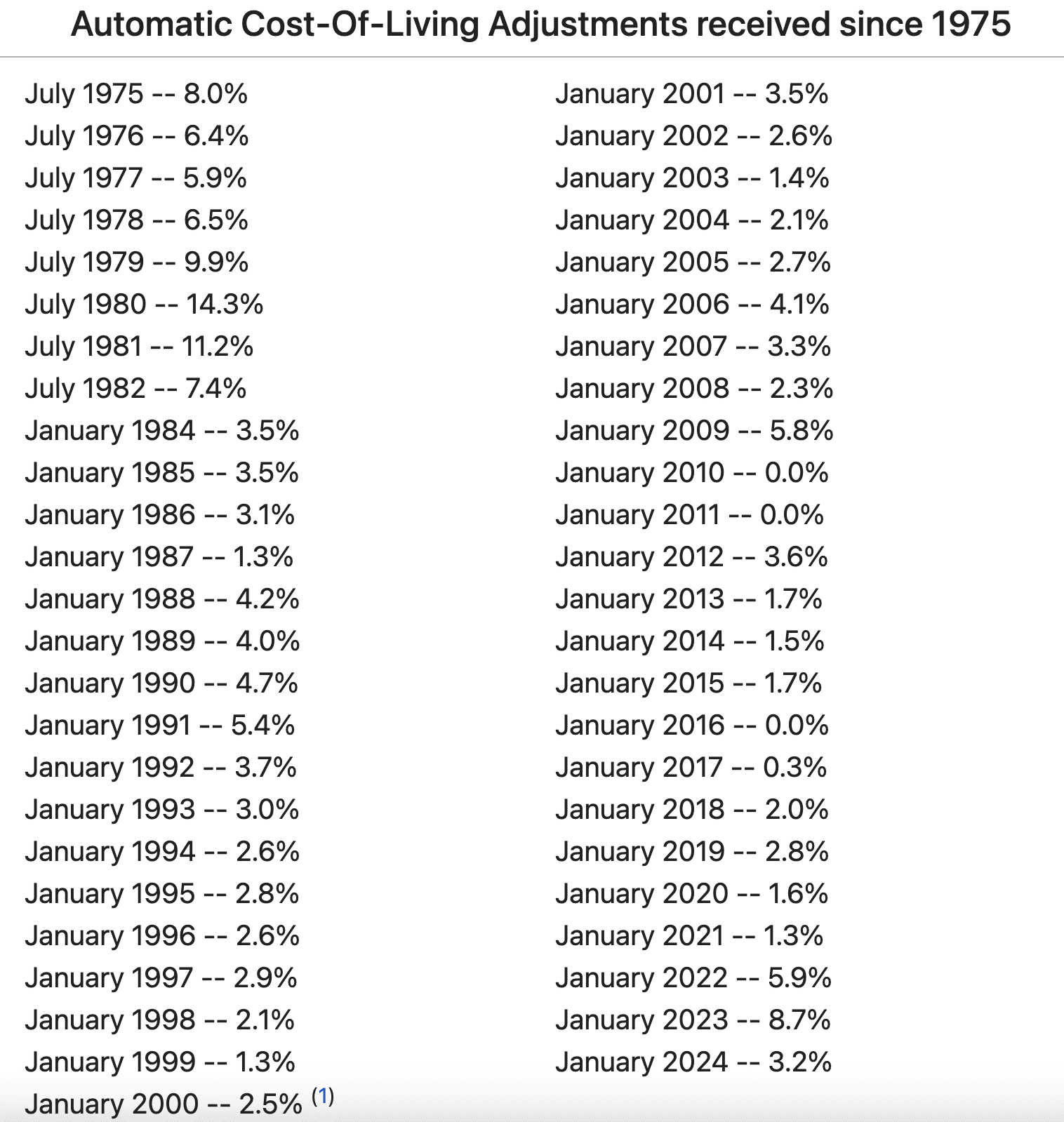

COLA Over the Years

So, let’s look back at what happened 40 years ago when inflation was at record highs and see how that impacted COLAs. Last year’s COLA increase was the highest since 1981.

FIGURE 1 – Social Security Cost-of-Living Adjustments – Social Security Administration

Understanding How COLA Is Calculated

COLA increases are calculated by the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If the CPI-W doesn’t increase in that period, then there is no COLA. See 2010, 2011, and 2016.

Medicare Part B Premiums

One other big takeaway from last year’s COLA increase was the Medicare premiums actually went down. Medicare Part B premiums went from $170.10 in 2022 to $164.90 in 2023 since the cost of the first approved drug to treat dementia wasn’t as high as Medicare anticipated. Medicare Part B premiums are automatically deducted from Social Security benefits, so recipients were able to keep more of their COLA last year.

Well, the standard monthly Medicare Part B premium will be $174.70 in 2024. That was also announced Thursday by the Centers for Medicare and Medicaid Services. This year’s raise in the Medicare Part B premium is primarily attributed to anticipated increases in health care spending.

Other Social Security Adjustments Besides the COLA Increase for 2024

In addition to the COLA increase for 2024, there are some annual other adjustments related to Social Security to make note of that occur each January based on the increase of average wages. In 2023, the maximum amount of earnings subject to the Social Security tax was $160,200. That maximum moves up to $168,600 for 2024.

How Social Security Fits into Your Overall Financial Plan

And yes, while many people don’t realize it until they look into claiming their Social Security, up to 85% of your Social Security can be taxable. There are more than 600 different iterations of how a 62-year-old couple can claim Social Security. The difference between the best and worst iteration can be a substantial amount of retirement income. Remember that the longer you delay claiming Social Security, the bigger the benefit.

So, you can see that this COLA increase for 2024 isn’t just about Social Security. Taxes and Medicare are two big components of it. It’s yet another reason why it’s critical to work with a financial planning team to help you make sense of how changes like the COLA increase for 2024 will personally impact you.

At a minimum, make sure that you’re working with a CFP® Professional who works alongside a CPA to review your financial planning from a tax perspective. Their goal should be crafting a plan that has you paying as little tax as possible over your lifetime, not just in one year. Claiming Social Security is a huge part of that.

If you have any questions about the 3.2% COLA increase for 2024 could personally impact you, let us know. You can schedule with us to further discuss your situation by clicking here. We look forward to meeting with you soon and showing you how it can all come together in a comprehensive financial plan.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.