2023 Social Security Benefits to Increase

Key Points – 2023 Social Security Benefits to Increase

- Social Security 8.7% Cost-of-Living Adjustment (COLA) for 2023 highest since 1981

- Looking Back at 1981

- Medicare Part B Premiums and 2023 Social Security Benefits

- Risk of Recession and Lower Future COLAs

- 3 Minutes to Read

2023 Social Security Benefits to Increase

An 8.7% Increase

Starting in 2023, 70 million Social Security recipients will see an 8.7% bump in their benefits with the new cost-of-living adjustment (COLA). For reference, last year beneficiaries saw a 5.9% increase, and in 2021 there was a 1.3% increase.

The increase comes as most Americans battle increased prices caused by rampant inflation throughout 2022. The goal is to give seniors more peace of mind as costs increase.

The Largest Increase in 40 Years, Why?

The 2023 COLA increase is the largest in 40 years. In 1981, the increase was 11.2%. Does anyone want to venture a guess as to what was going on in 1981? Well, in the third quarter of 1981, the U.S. economy went into a recession. Inflation was at 10.32% in 1981 and the Fed was doing all it could to bring prices down.

We don’t need to go down the rabbit hole of everything that went on then, but it helps to add context to our current economy and why this COLA increase is here now. Today, we have inflation sitting at 8.2% and a Federal Reserve who is battling that inflation by rapidly raising rates, increasing the risk of a recession.

How are Social Security Cost-of-Living Adjustments Calculated?

COLA increases are calculated by the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If the CPI-W doesn’t increase in that period, then there is no COLA.

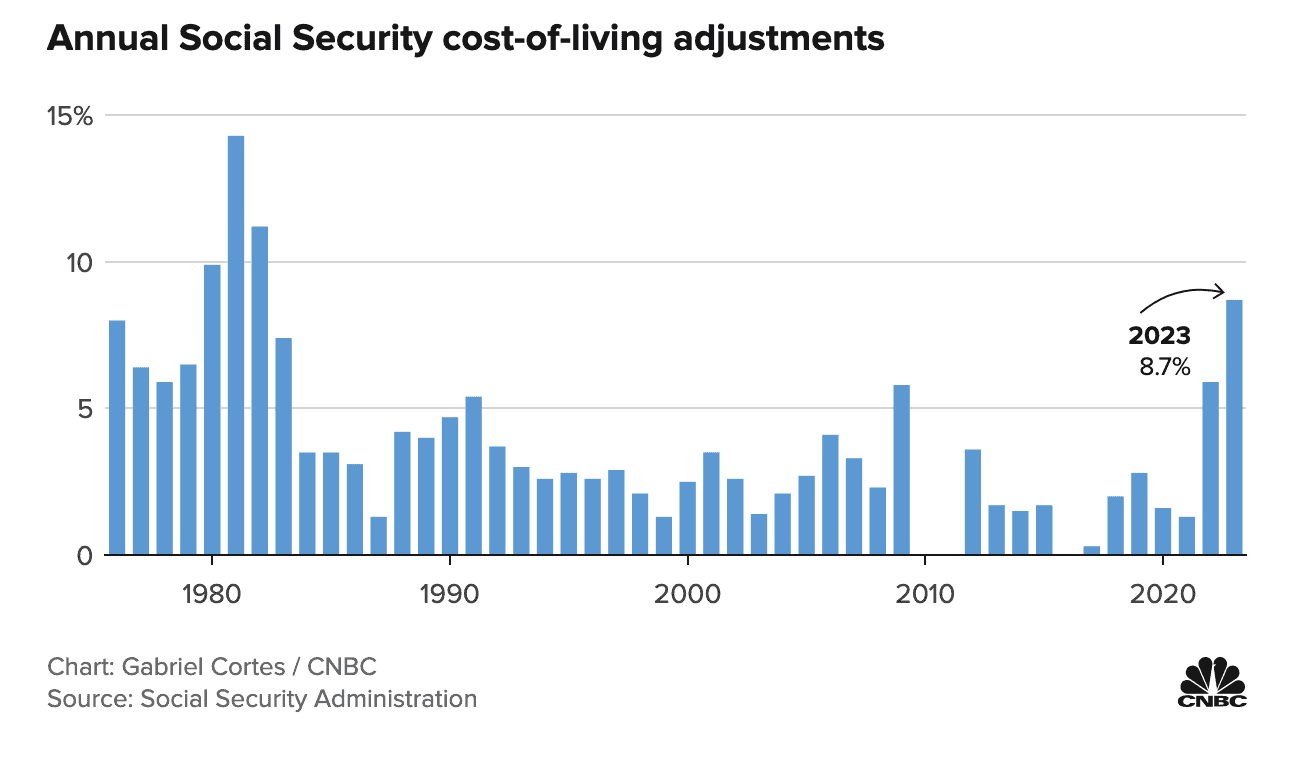

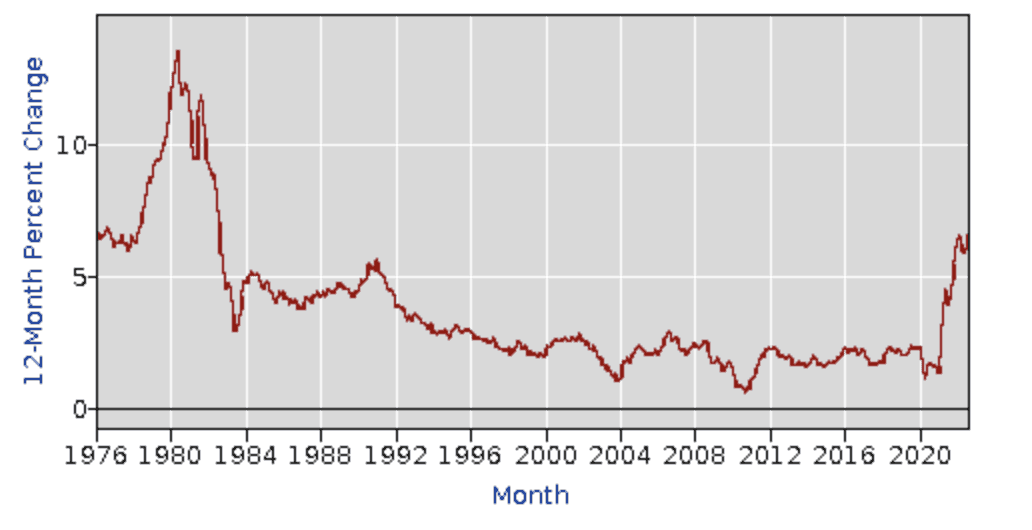

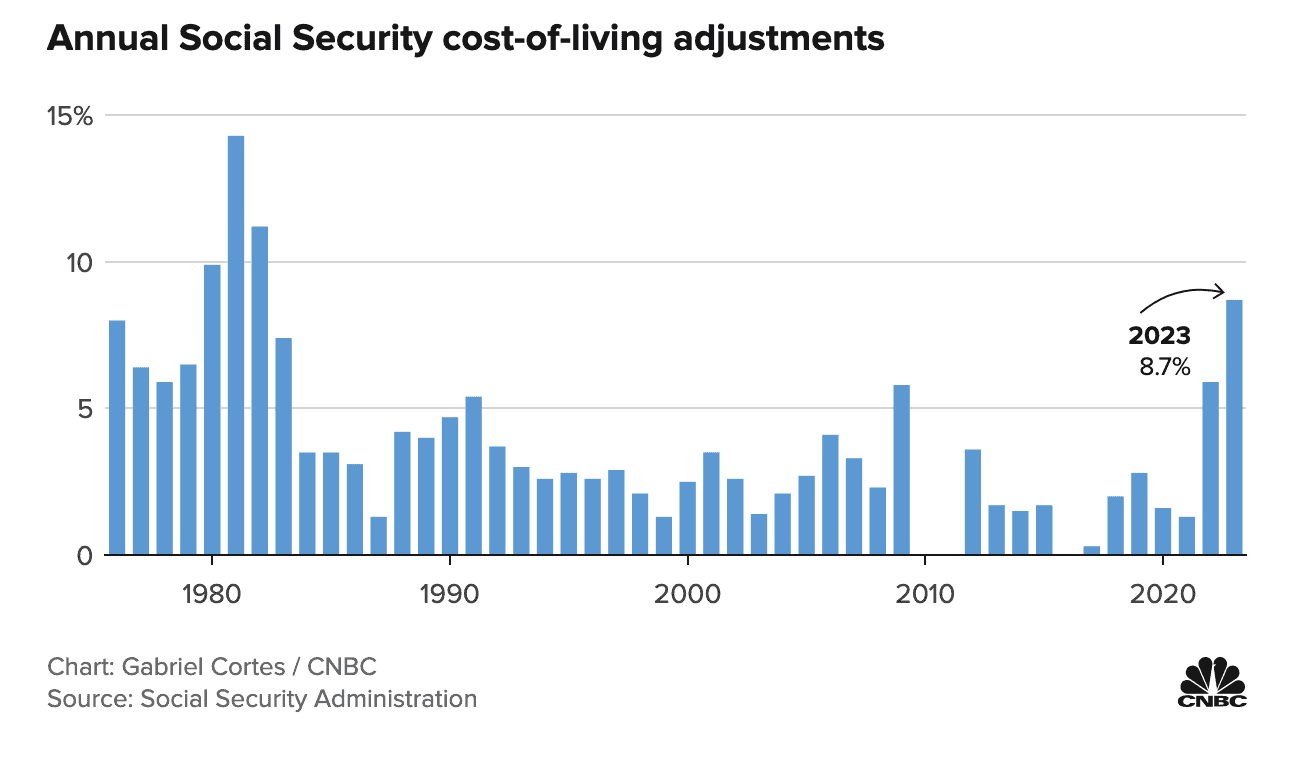

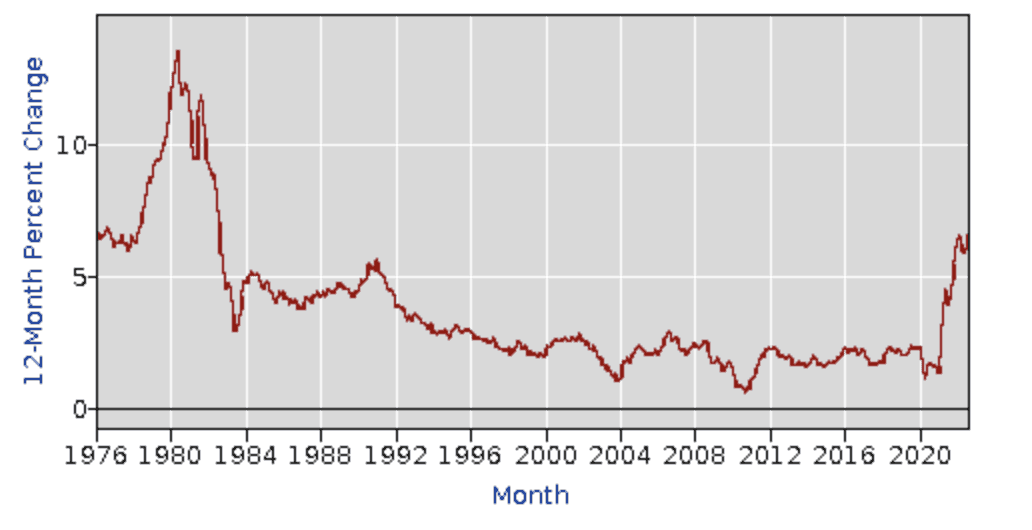

Since inflation is so directly tied to COLA increases, it makes sense that the 2022 and 2023 adjustments were our highest since 1981. Check out the chart from CNBC below that shows the COLAs since 1976 (Figure 1) and compare it to Figure 2 from the U.S. Bureau of Labor Statistics showing inflation since 1976.

FIGURE 1 – Annual Social Security Cost-of-Living Adjustments – Social Security Administration/CNBC

FIGURE 1 – Annual Social Security Cost-of-Living Adjustments – Social Security Administration/CNBC FIGURE 2 – Inflation Since 1976 – U.S. Bureau of Labor Statistics

FIGURE 2 – Inflation Since 1976 – U.S. Bureau of Labor Statistics2023 Social Security and Medicare Part B Premiums

Two huge factors impacting a senior’s benefit checks are Medicare Part B premiums and taxes. The good news is that Medicare premiums are going down this year.

After the approval of the first drug to treat dementia, Medicare was fearful that the price of that drug would be exorbitant. So, premiums were up to $170.10 in 2022.

The cost of that drug was not a high as anticipated. So, for 2023, Medicare Part B premiums have gone down to $164.90. That’s $5.20 lower than in 2022. That savings is passed to seniors as often those payments come from Social Security benefit checks. This allows them to keep even more of the cost-of-living adjustment for 2023.

The Social Security Trust Fund

Currently, the Social Security trust fund is solvent through 2035 before it can’t pay 100% of benefits. After that, the program can pay just 80% of benefits. When historic increases such as the 2023 COLA occur, it puts more pressure on the fund. It’s something to keep an eye on when we see increases of this magnitude.

Risk of Recession and Lower Future COLAs

FIGURE 1 – Annual Social Security Cost-of-Living Adjustments – Social Security Administration/CNBC

FIGURE 1 – Annual Social Security Cost-of-Living Adjustments – Social Security Administration/CNBC FIGURE 2 – Inflation Since 1976 – U.S. Bureau of Labor Statistics

FIGURE 2 – Inflation Since 1976 – U.S. Bureau of Labor StatisticsIf we look back at Figures 1 and 2, you can see that we had 0% COLAs in 2010 and 2011. These came in the wake of a, then historic, 5.8% COLA in 2009. As the Fed works to bring inflation down today, the risk of recession is high. Since COLAs are directly tied to rises in costs per the CPI-W, there is risk of 0% COLAs in the future if we fall into a recession. Those who recall 2010 and 2011 may remember the excess stress this put on themselves or the seniors in their lives.

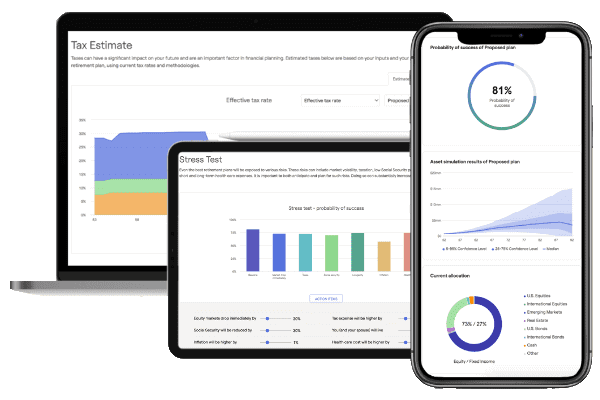

Social Security is Part of a Well-Crafted Financial Plan

We say it often here at Modern Wealth Management, but it all comes down to the financial plan. Social Security benefits are a crucial piece of that plan and can impact many other parts as we noted with Medicare above. It can also impact your taxes! If you haven’t claimed your Social Security benefits yet and would like to better understand your situation, you can find a few resources below, including our financial planning tool, that allows you to plan claiming your benefits in different scenarios.

VIDEO: MAXIMIZING SOCIAL SECURITY BENEFITS

DOWNLOAD: SOCIAL SECURITY DECISIONS GUIDE

Additionally, we’re always here for your questions or concerns, if you would like to discuss your Social Security situation with a CFP® professional, click here to schedule a conversation.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.