Claiming Your Social Security

Strategies to maximize your Social Security benefits.

In this webinar, CFP® professional Will Doty discusses the importance of properly claiming your Social Security. During this on-demand webinar, Will covers the differences in claiming strategies, spousal situations, the impact of Social Security on taxes, and more. This webinar is designed to give you a better understanding of how Social Security fits into your overall financial plan.

Complimentary Consultation Share this Video

Items Mentioned in this Webinar:

Podcast: How to Maximize Your Social Security Benefits

If you would like to discuss strategies for claiming your Social Security, we can help. Schedule a complimentary consultation below or give us a call at 913-393-1000.

Video Transcript

Thank you, everybody, for attending this webinar on Social Security. I’m William Doty, a CERTIFIED FINANCIAL PLANNER™ here with Modern Wealth Management. I’d like to thank everybody for joining us today.

Understanding the Value of Social Security

We’ll be talking about understanding the value of Social Security and its importance. It’s a big piece of income for many people, and sometimes it’s just taken for granted.

So we want to make sure that we go into great detail to help you understand all the complexities and all the different claiming strategies that may be at your fingertips.

A Social Security Case Study

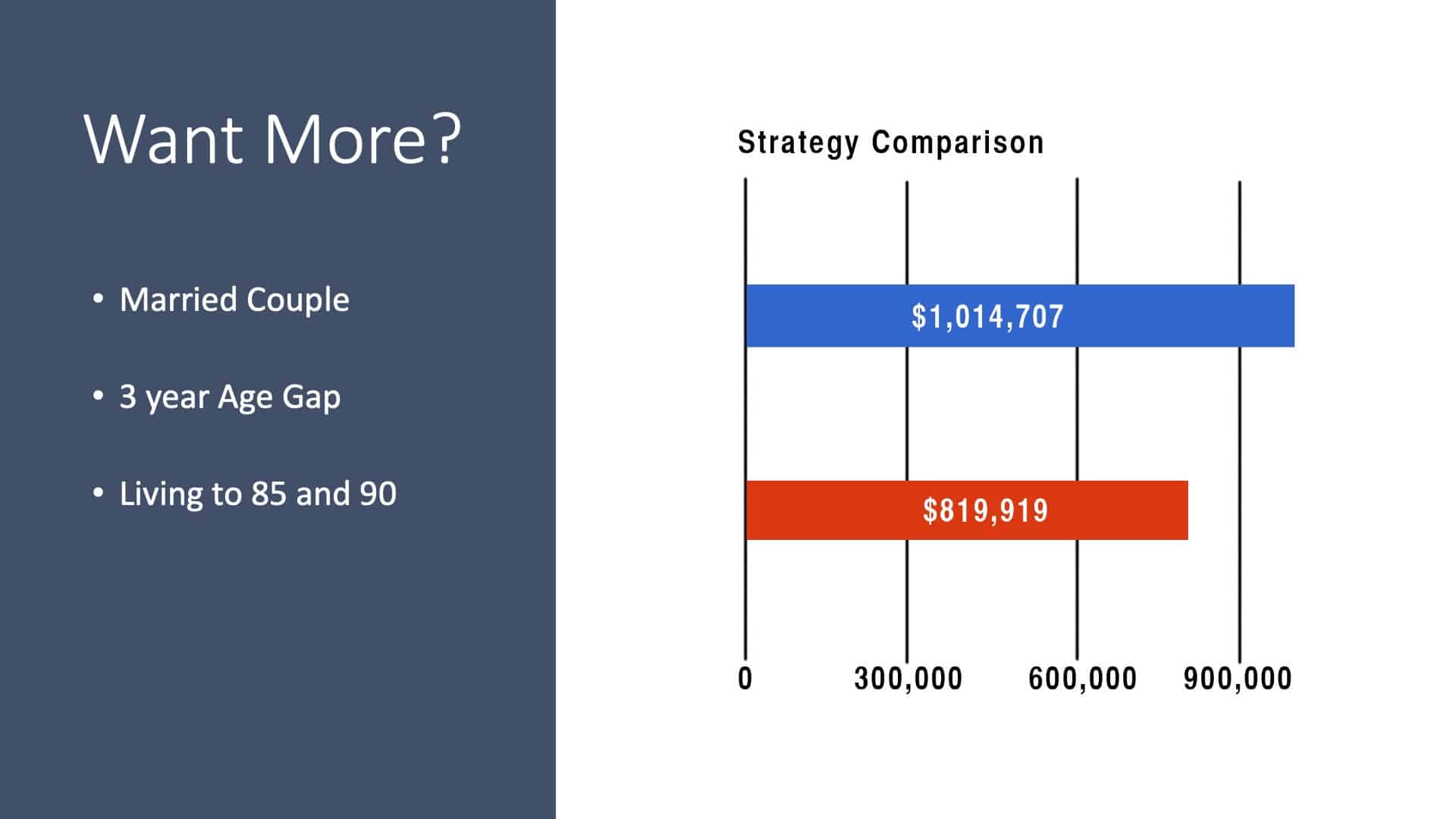

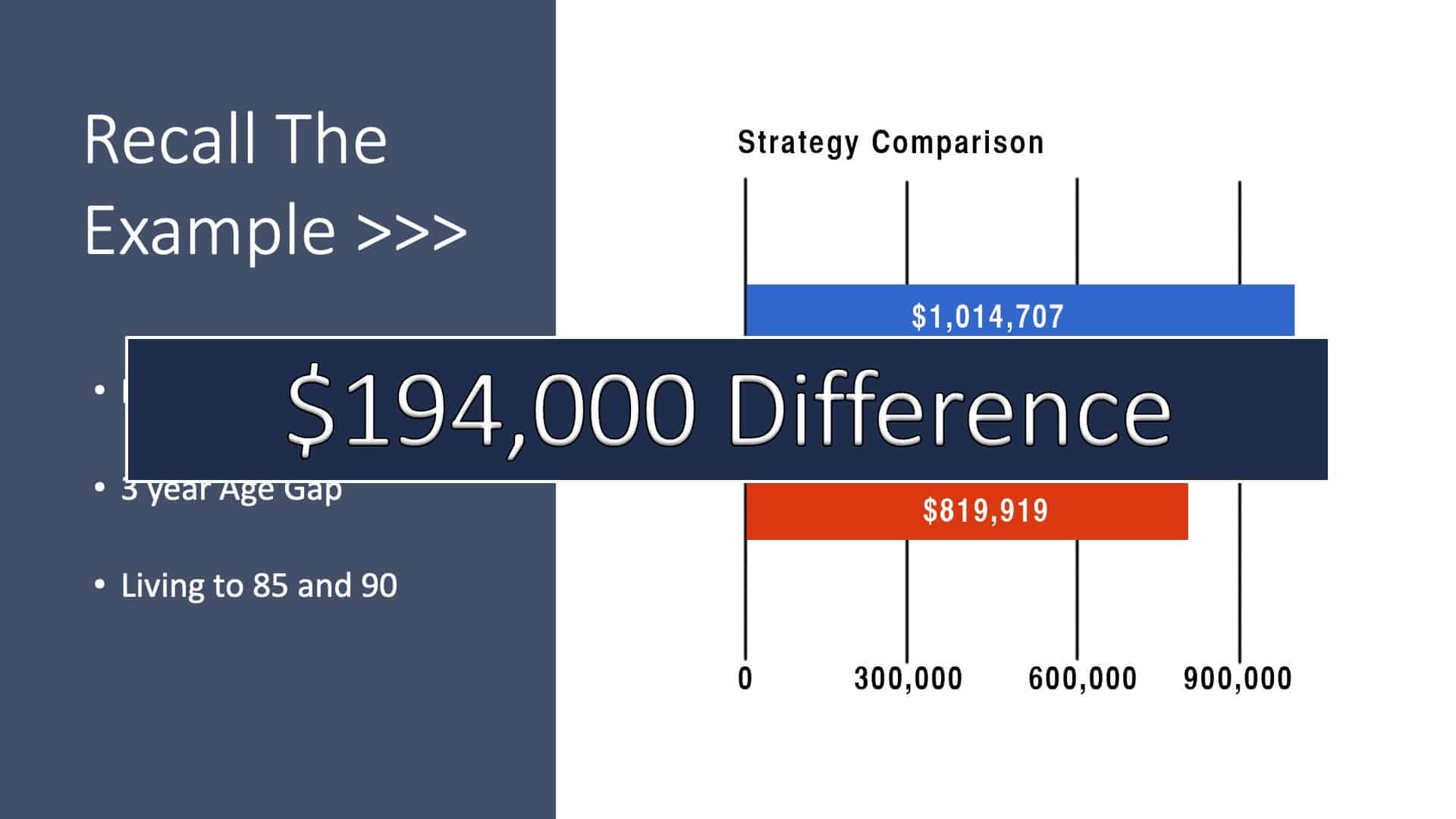

So first, we want to look at a little case study here. We have a married couple with a three-year age gap between them, projected to live to the age of 85 and 90.

What you see in the chart on the strategy comparison, if they were to claim early, Social Security ended up driving $800,000+ of fixed income to them.

But if they were to do a comparison against the different claiming options, it generated a little over a million. We can see it’s big dollars that we’re talking about here. So we do want to make sure that we understand what those options are.

Three Major Categories of Benefits

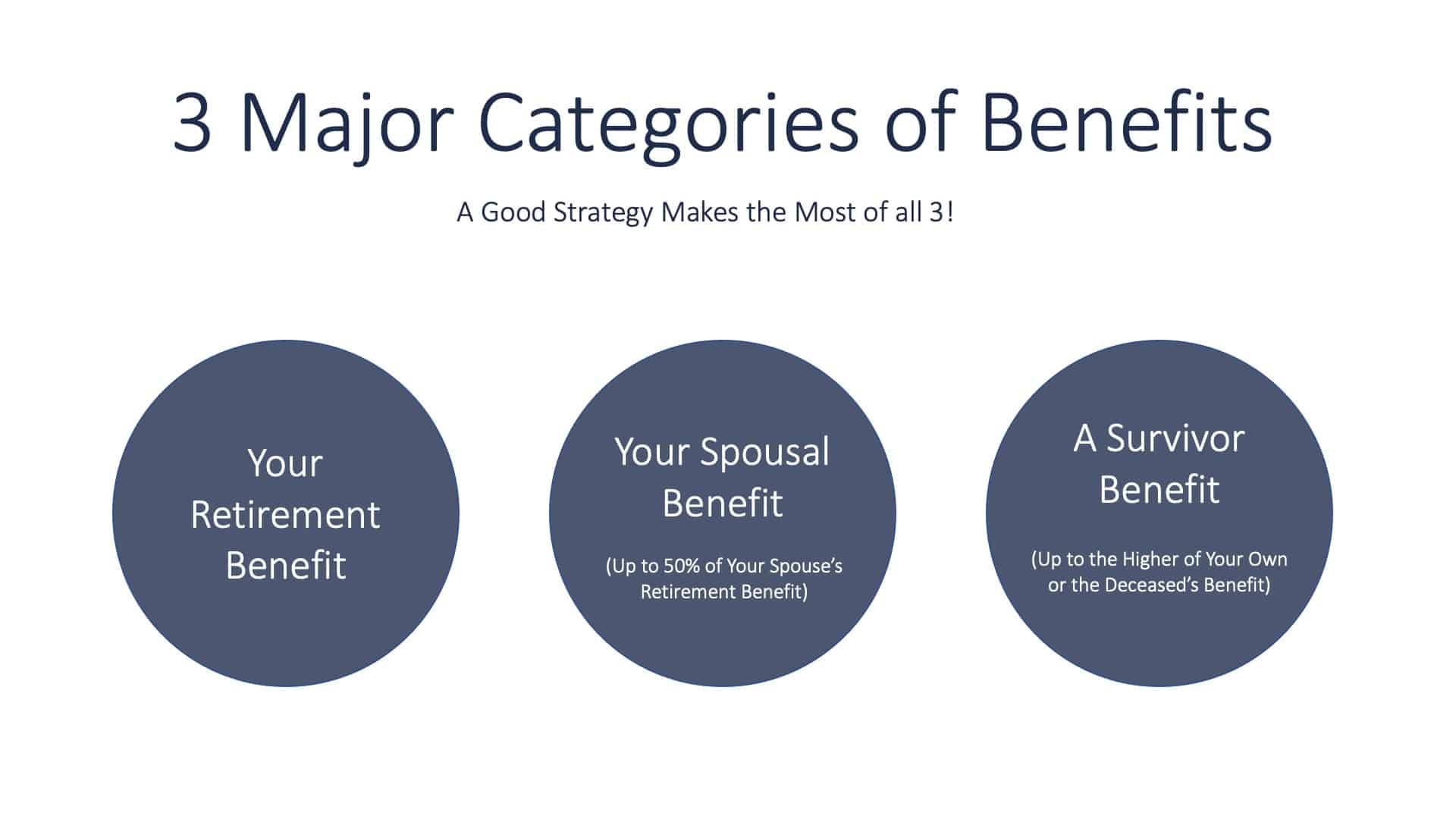

Now, when we’re looking at your benefits, we actually want to look at all three areas. So we want to understand:

- Your personal benefit

- Your potential spousal benefit, or your spouse’s spousal benefit

- The survivor benefit

So when we’re maximizing, we’re trying to maximize in all three areas. And I know many times people get caught up in just their own personal, but we want to look at it from every angle we can; kind of leave no stone unturned.

Restricted Application Applicablicability

There is still one application out there that is special, and a few of you do have the ability to use it. We’re going to cover that today. And that is called the restricted application.

It’s no longer an option for some of us due to the 2015 Bipartisan Budget Act, which changed many of the Social Security rules. So we’ll go through a couple of case scenarios on that.

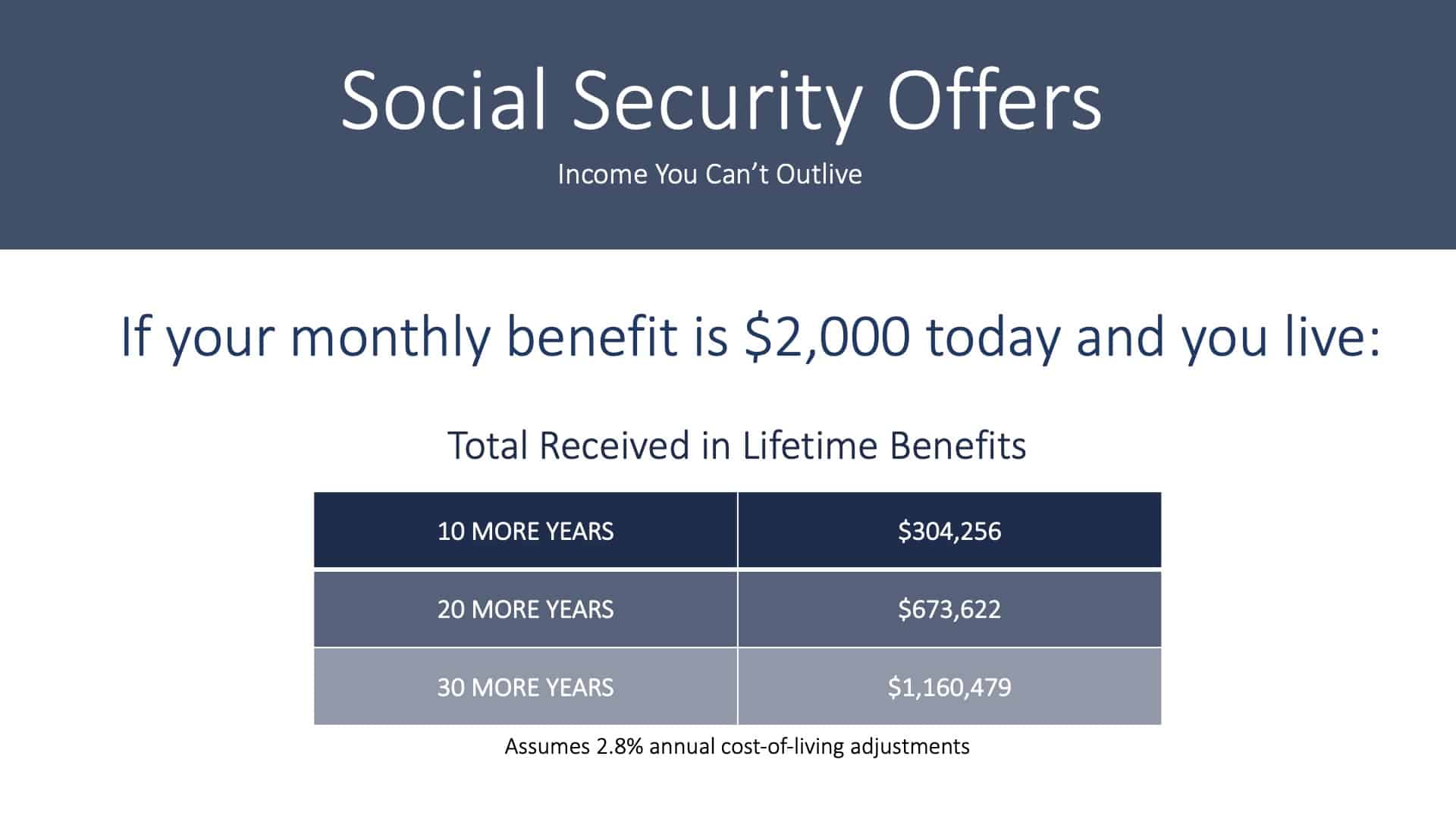

Social Security Offers: Income You Can’t Outlive

When we look at Social Security benefits, and we look at an individual that is receiving $2,000 today and what they would wind up receiving in lifetime benefits, if they live 10, 20, or 30 years, assuming that 1.6% cost of living adjustment, you can see it really adds up over 20 years, over half a million.

Once we get out to 30 years, almost a million dollars of income, again, it’s a big chunk of income for you in retirement. We want to make sure that we understand it and how it relates to you.

Social Security Offers: Annual Inflation Adjustments

Now, this is a look at your benefits and the effect of cost of living over time. So if you started with a $2,000 benefit and we received our 1.6% cost of living adjustment, you can see that in 20 years, that $2,000 is now $2,747. If you make it 30 years, it’s now $3,219.

When you think about it, if you delay your benefits, you start with a bigger base. Therefore, all of those costs of living adjustments wind up being bigger dollars later on down the road.

It doesn’t mean that the lane is the right option for everybody, but we definitely want to understand it.

Your Benefit Will Depend On…

These are some things your benefit will depend on.

Number one, how much did you earn over these years throughout your working career? If you look at your Social Security statement, you can go through your earnings history and see what you’ve earned. The other is at which age do you apply for your benefit?

Again, when do you start? Do you start at 62? Do you go at your full retirement age, or do you wait until the age of 70 when you max out?

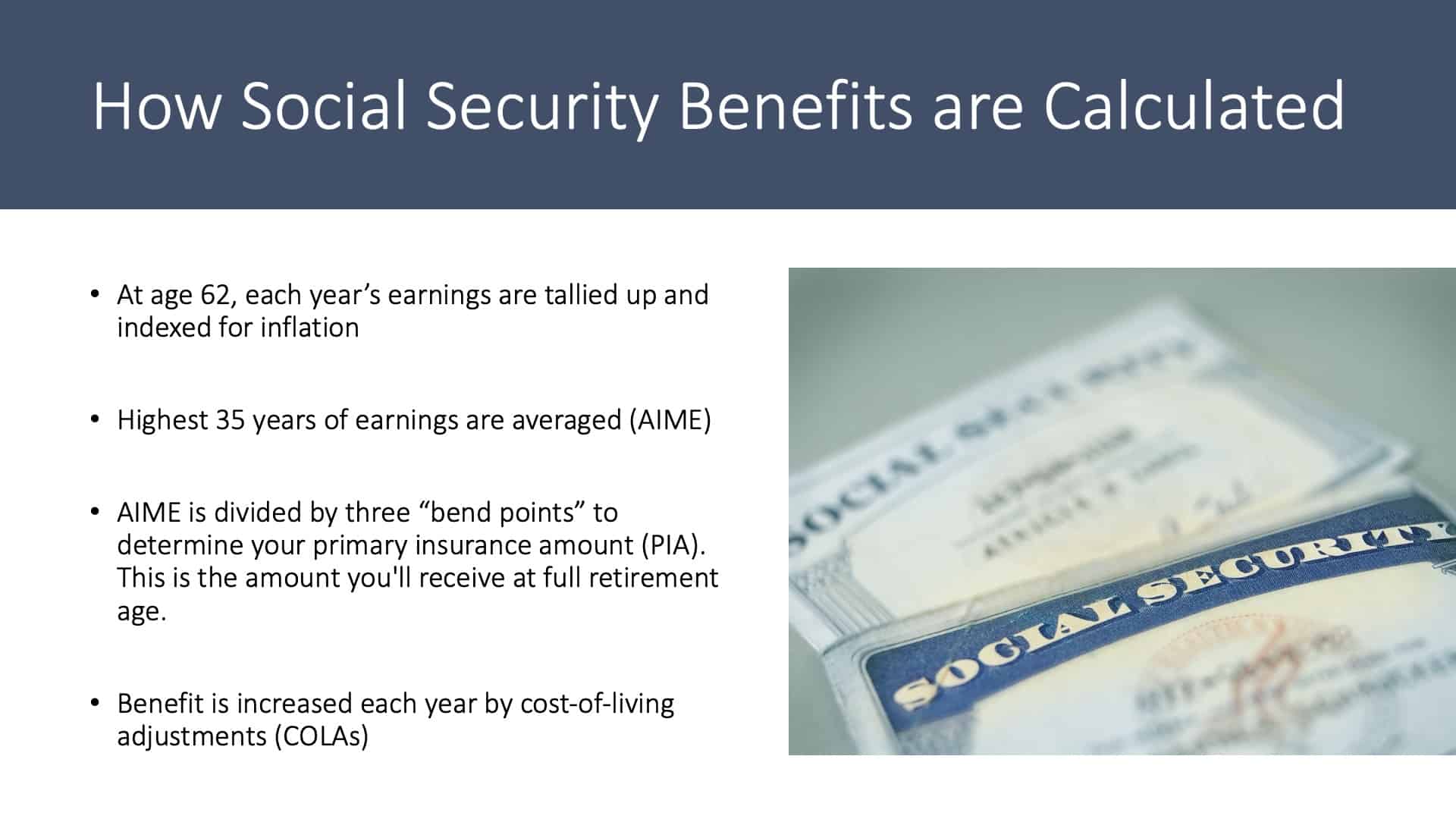

How Social Security Benefits are Calculated

This slide is talking about how your Social Security benefits are going to be calculated. So at the age of 62, all of our earnings are tallied up and indexed for inflation. And what goes into the calculation is the highest 35 years. Many people think that it’s chronological, going 35 years backward from the last day you work, it’s actually not.

Again, it’s all hedged for inflation. And the acronym is AIME, which stands for Average Indexed Monthly Earnings. And that is then taken against three different bend points in a slide here. In a moment, we’ll show you how that calculation is made. And then your benefits after that are increased with the cost of living.

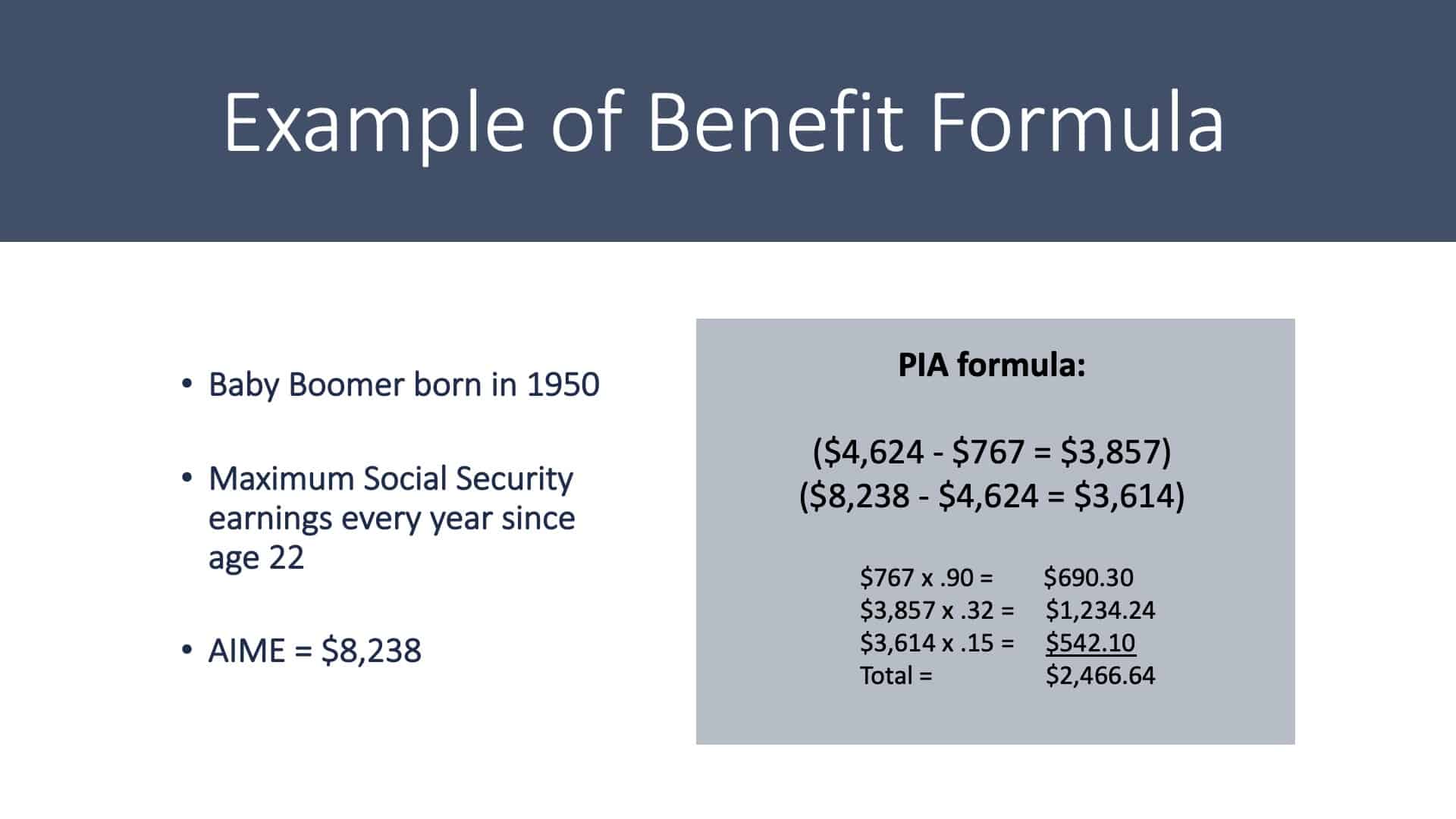

Example of the Benefit Formula

So on this slide, we see an example of the formula. We can see a baby boomer born in 1950, who maximized their Social Security earnings every single year since the age of 22, ended up with an AIME amount of $8,238. If you look at the formula in the box, we’re showing bend points, and you can see how much of those dollars you wind up receiving.

Out of the first bend point, you get to keep 90%. At the second bend point, you keep 32%. And then anything that’s above that second bend point, you only get to keep 15%. For this individual, even though their index monthly earnings were $8,200, their benefit calculation is $2,466.

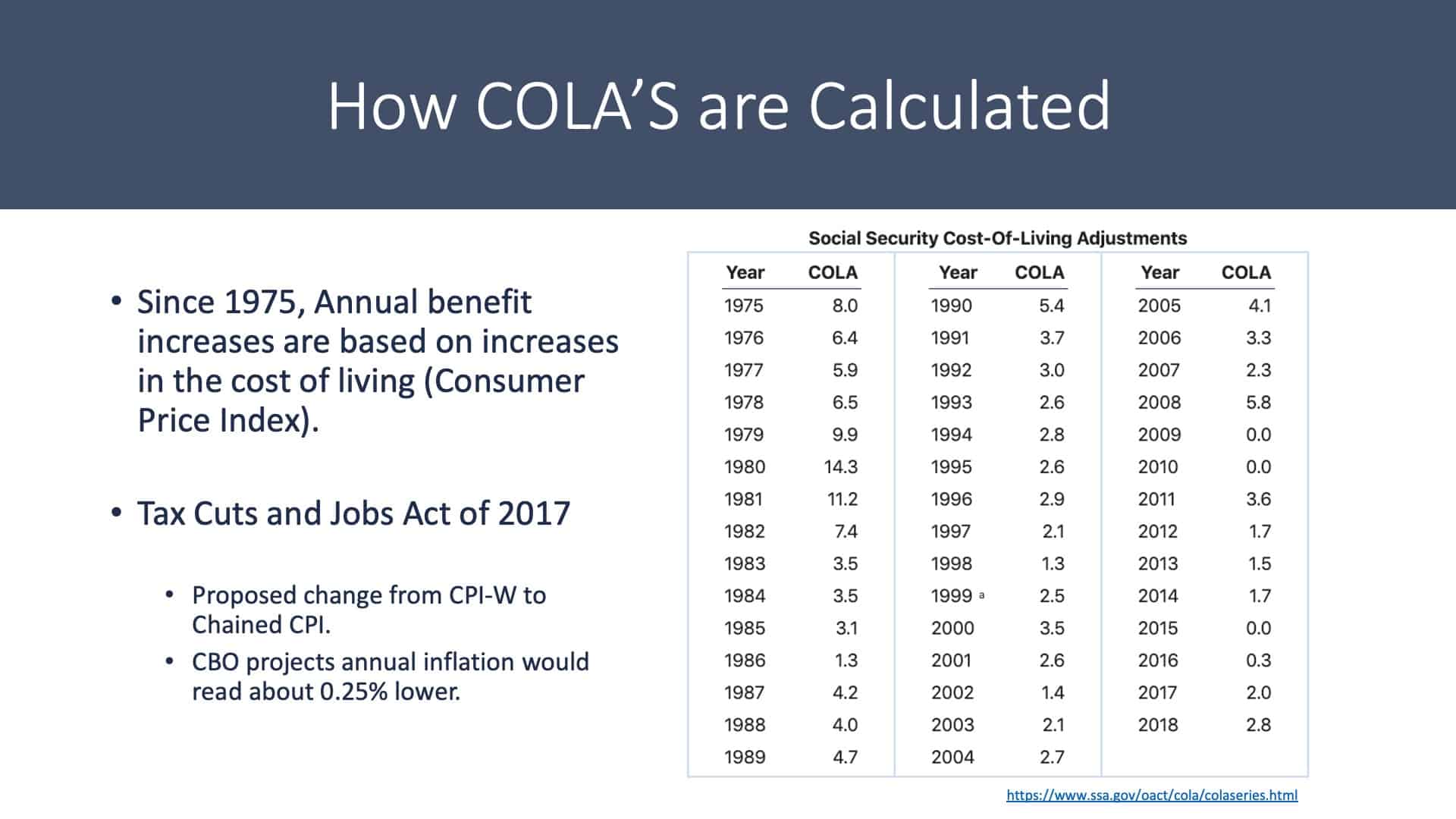

How COLAs are Calculated

This chart is just going over cost of living adjustments. So we can see that since 1975, people on Social Security have been receiving cost of living adjustments, and you can see that number does vary greatly.

It may go up, it may go down, but we want to make sure that we understand it.

When we look at the Tax Cuts and Jobs Act of 2017, there were proposed changes to CPI-W to Chained CPI.

Therefore, we’re planning on a lower cost of living adjustment going forward than potentially what we’ve seen in the past.

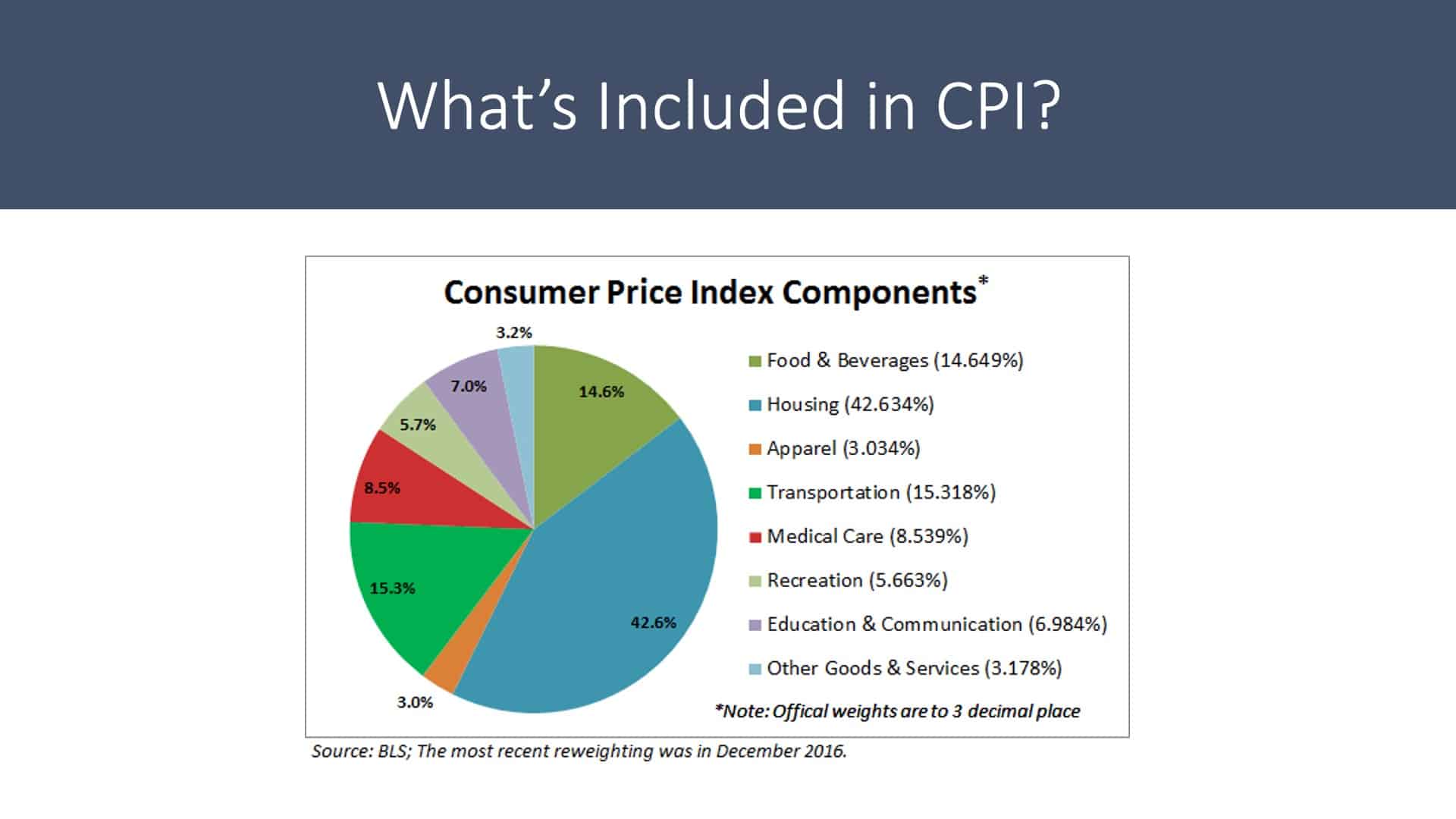

What’s Included in CPI?

A lot of people have questions about what is in the CPI? So again, that’s the Consumer Price Index.

So you can see here on the chart the different components and how much they make the consumer price index and their influence.

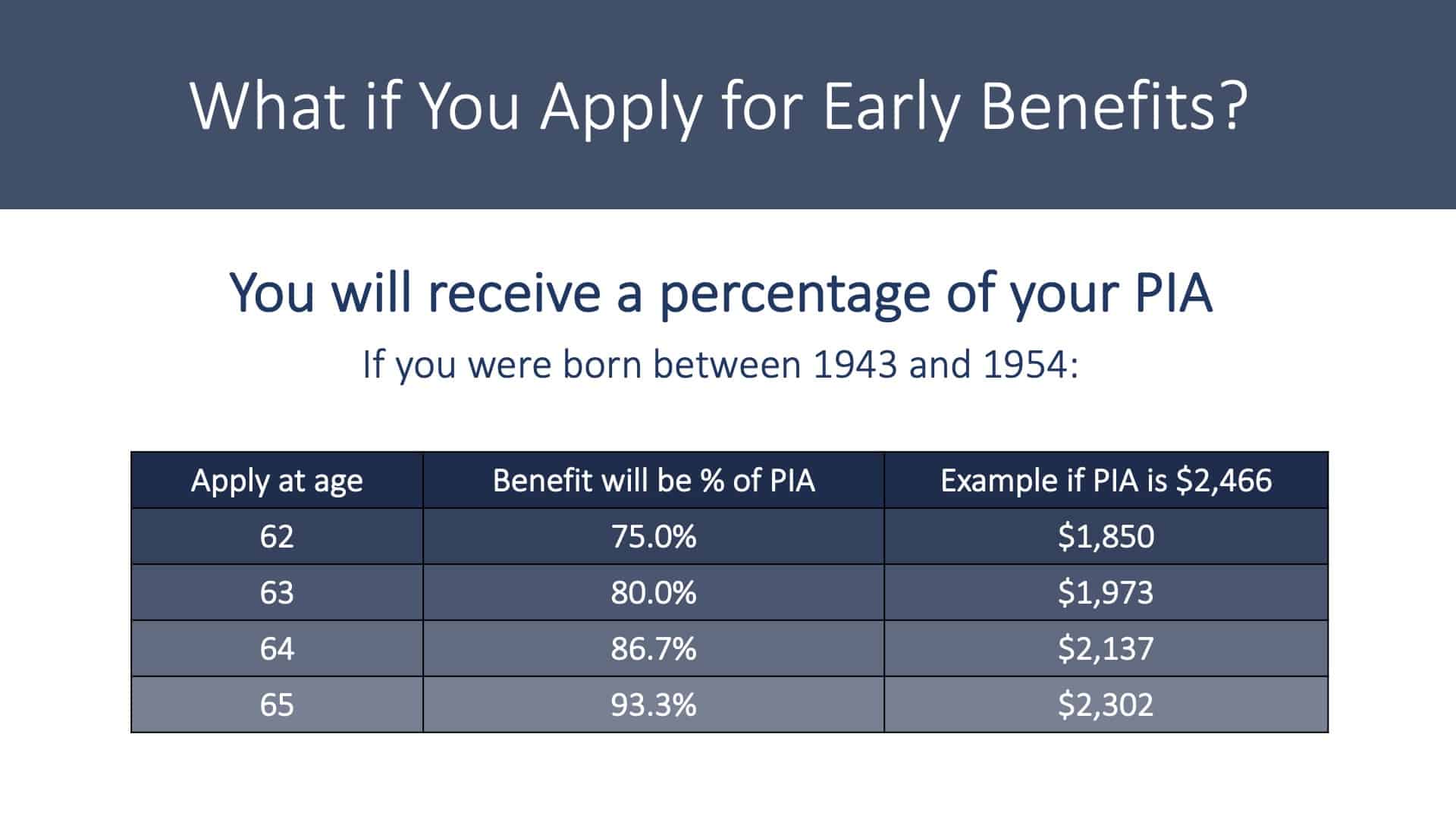

What if You Apply for Early Benefits?

So now, let’s talk about if you apply for your benefits early. You’ll see on the screen an acronym PIA, which stands for Primary Insurance Amount and is looking at an individual born between 1943 in 1954.

Their full retirement age benefit is at age 66. When our full retirement benefits are allowed, it depends upon the year in which you were born.

Some of you will be at 66; others may be at some variation of an even month. So you could be 66 in two months, 66 in 10 months or some of us right now are at age 67.

So now we’re looking at that same individual calculation of the $2,466. And what happens if you would have applied at the age of 62? If we apply at the age of 62, we wind up getting our benefit reduced.

Anytime that we’re before our full retirement age, that is when we take a permanent reduction. So again, we want to understand it. That doesn’t mean it’s the wrong choice, and we just want to understand that complexity.

So when you look at it at your age of 62, you’re going to receive 75% of whatever your primary insurance amount is. Again, that’s your full benefits that you would receive at your full retirement age. If you continue to delay each year, we can see how much more benefit you get. If you were to wait until 64, it represents 86.7% of your full retirement benefit.

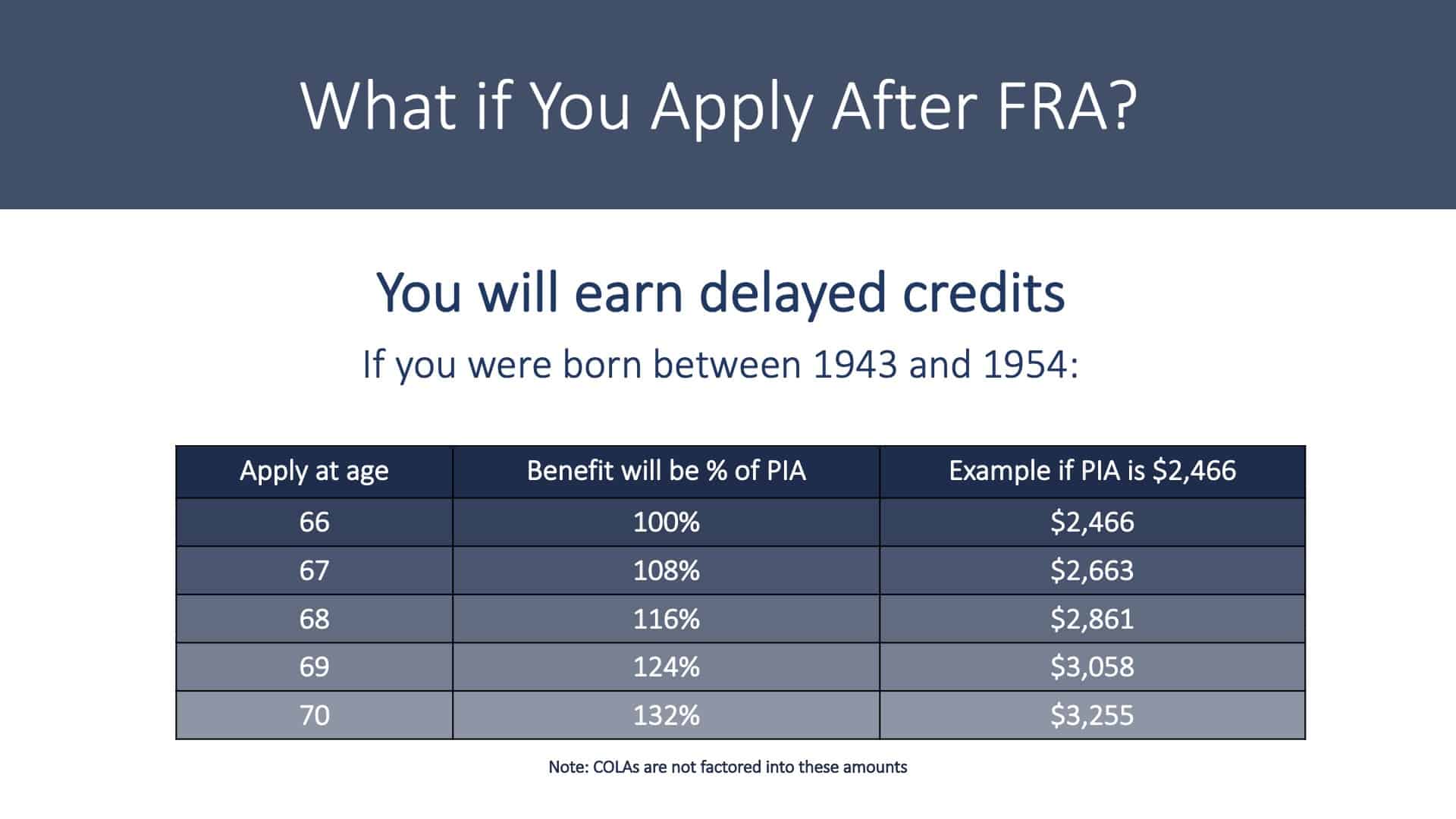

What if You Apply After Full Retirement Age?

So what happens if you apply after your full retirement age? Looking at the same individual who would have a full retirement age of 66, at 66, you would receive a hundred percent of your calculated benefit.

For this individual’s $2,466, if you see in the chart here, delaying until 70, you’re going to receive 132% of your benefit amount. For this individual, it would wind up being $3,255.

You can see it’s a significant increase because we get an 8% delayed credit if we delay anything past our full retirement age. For people with a different variation, that’ll change how much of that credit you can receive because, again, it doesn’t start until after full retirement age. But if you are 66, that is how the calculation would work.

Spousal Benefits

Now let’s talk about spousal benefits. If you are eligible for spousal benefits, you may be able to receive half of the primary wage earner in the household’s benefit amount.

Now very similar to our own benefit, where if we take it before our full retirement age, there will also be that same reduction effect. So for a spouse, if they wanted to start at the age of 62, their spousal benefit would represent about 35% of what the primary wage earner’s amount would have been.

So, for example, John’s primary insurance amount is $2,000. Jane’s primary insurance amount is $800. If Jane were to apply at her full retirement age, her benefit from spousal benefits would be 50% of John’s. So, therefore, she would wind up receiving $1,000.

Rules for Spousal Benefits

Let’s talk about the rules for spousal benefits. The primary worker must have filed an order for the spouse to come in and claim for spousal benefits. So a caveat that you want to understand; the spouse must be at least 62 for the reduced benefits and 66 for full benefits.

Now, one huge difference here is that there is no delayed credit for the spouse. So once you obtain the age of 66 or whatever your full retirement age is, if you’re eligible to turn on the spousal benefit, go ahead and do it because you’re not going to receive a delayed credit for anything after your full retirement age.

Divorced Spouse Benefits

For any of you out there that may be divorced, you may qualify for your spouse’s benefits. And there are a couple of rules. You have to been married for at least ten years, and you cannot currently be remarried.

Rules for Divorced-Spouse Benefits

When we look at rules for the divorced spouse, more than one ex-spouse can receive benefits from the same worker’s record.

This is a very interesting little loophole. So if I use myself for an example, say hypothetically, I got married when I was 20, divorced at 31, married again at 32, divorced at 43, and then so forth and so on. Each one of those spouses would have the ability to claim a spousal benefit off of me.

This spousal benefit does not affect me. I’m not even notified if an ex-spouse were to file. That’s a big question that a lot of people have. And again, it won’t either side of anybody’s benefit. Now, if you wind up getting remarried, then that divorced spouse benefit will cease, and then it’ll be reevaluated on, do you go on your own benefit, or do you go on your new spouse’s benefit at that point.

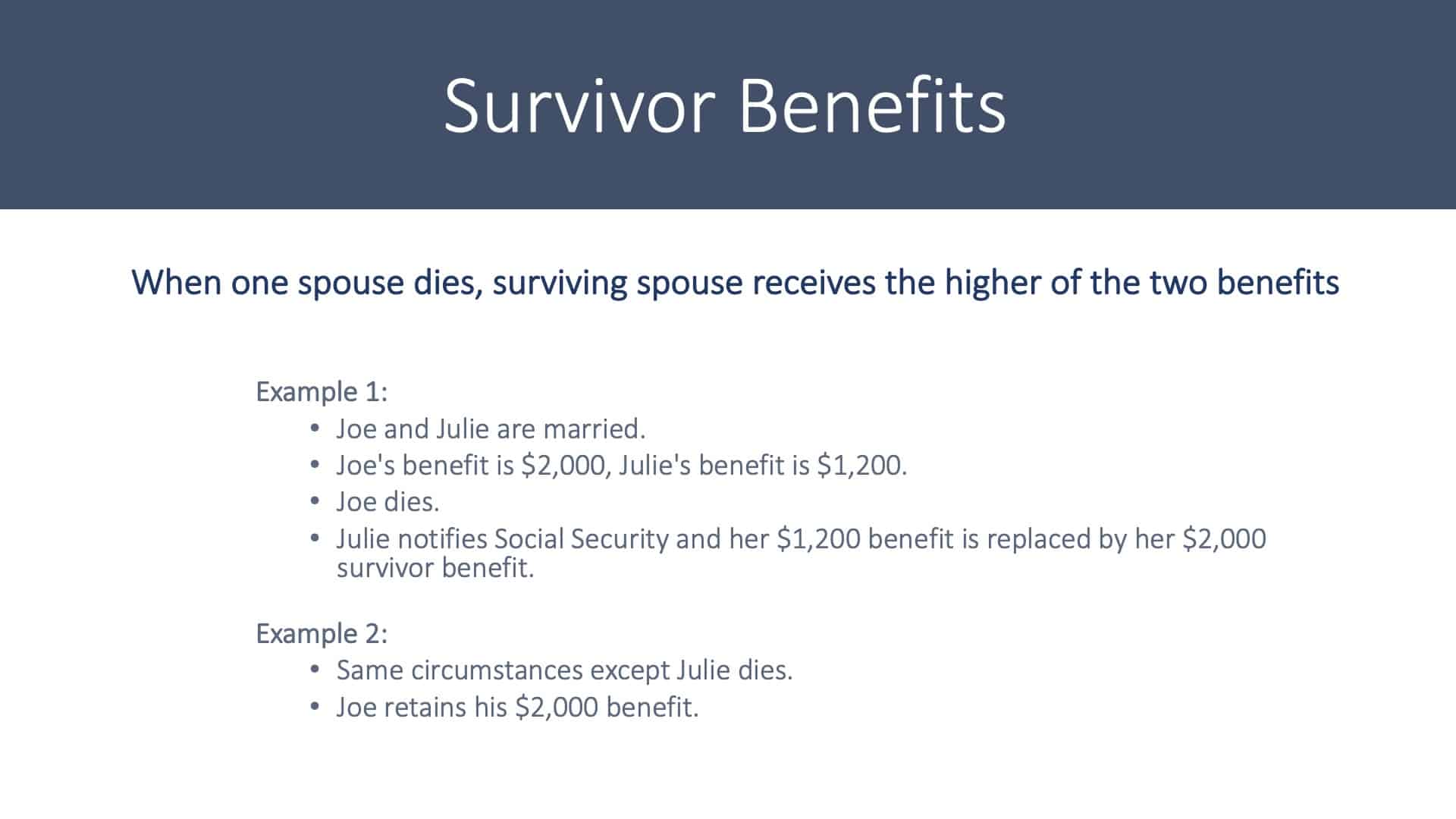

Survivor Benefits

So another area that we look to maximize is the survivor benefit. When one spouse dies, we want to understand what happens and how do we maximize it. So we’ve got to have an example here. Example one; Joe and Julie are married. Joe’s benefit is $2,000 per month, Julie’s benefit is $1,200. Unfortunately, Joe passes away.

So what happens is Julie notifies Social Security, and her benefit of $1,200 will be replaced by the $2,000 of Joe. Once again, one of us dies; the other will assume the larger of the two benefits. So if your benefit is the larger of the two and your spouse is the one that passes away, that spouse’s benefit would stop. It’s always the larger of the two.

Example number two. We’re looking at what happens if Julie passes away now. So same numbers, Joe retains his $2,000 a month benefit. So again, Julie’s will stop.

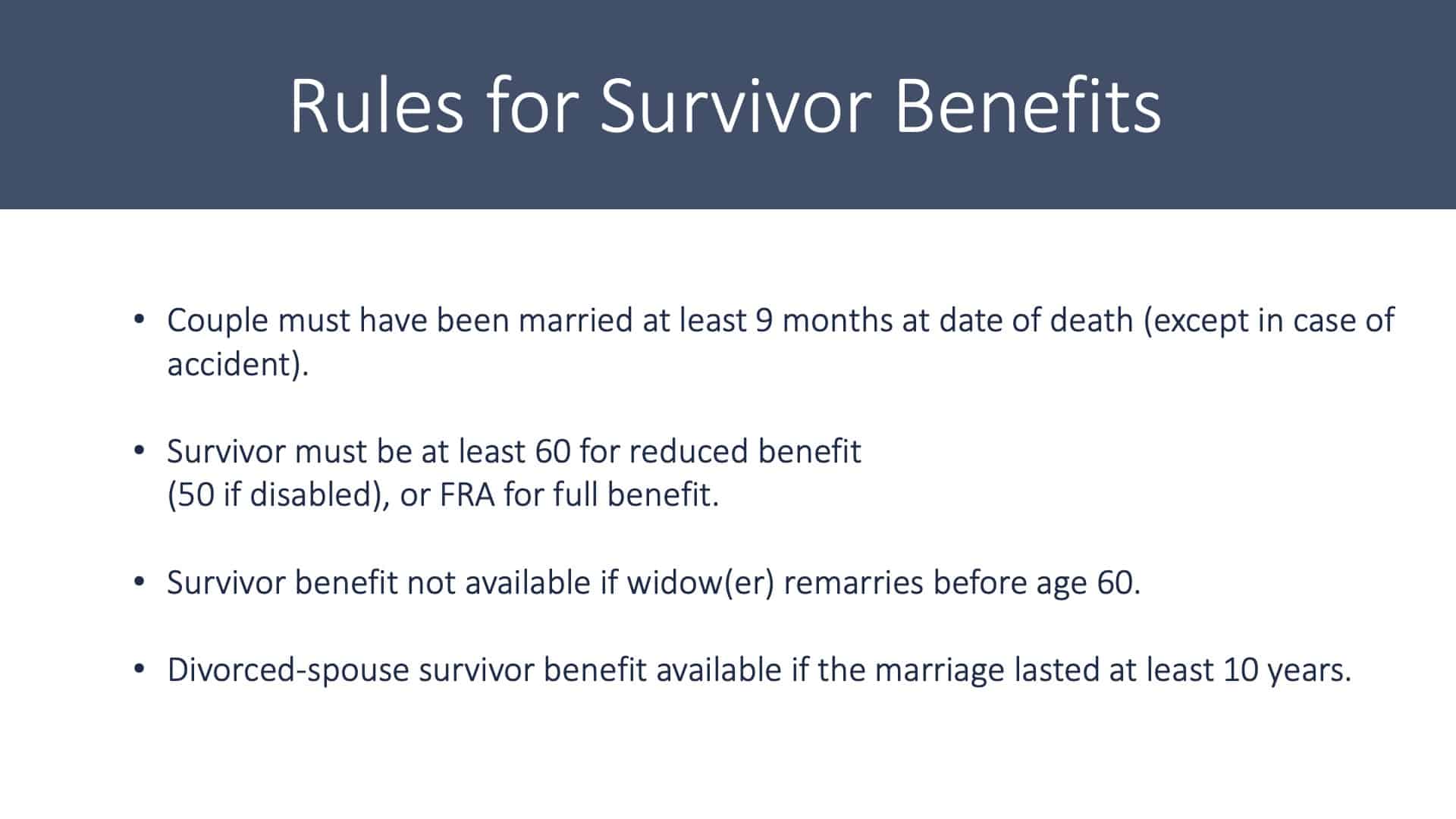

Rules for Survivor Benefits

Couples must have been married at least nine months at the date of death, except in the case of accidents. The survivor must be at least the age of 60 to receive reduced benefits. As early actually as 50 if they’re disabled.

But again, it’s all going to be calculated, and if you take it early, you’re going to see a reduction. So you do want to keep that in mind. And survivor benefit is not available if the widow remarries before the age of 60.

If you, unfortunately, lost your spouse very young and you wound up getting married at the age of 58, you can’t go back to your first spouse’s benefit to try to claim a survivor.

You’re now with your new spouse. Interestingly, if you marry after 60, you can still acquire your deceased spouse before that benefit. The same thing, we need to be at least married for ten years if you’re going for a divorced widow’s benefit. So the divorce rules are always that ten years requirement of being married.

Factors to Consider

There are some different factors to consider when you’re thinking about claiming your Social Security. Factor number one, what’s my health status? If I have cancer, I don’t think my mortality will be too long with my life expectancy; well, maybe that means I should claim sooner than later, or vice versa.

Obviously, your need for income. How much money do you need to live on? Do you have enough saved up in other buckets that you can live on it while you’re delaying Social Security or maybe not?

If you plan to work, if you wind up working and claim early, there is an earnings test that we’ll go over shortly that could take away some of your benefits.

So again, something to understand. That doesn’t mean it’s not the right thing to do. You just want to understand that complexity. And then ultimately, what is your survivor need? If you were to pass away, what amount of money do they need, and is delaying your own going to put them in a better position at that point?

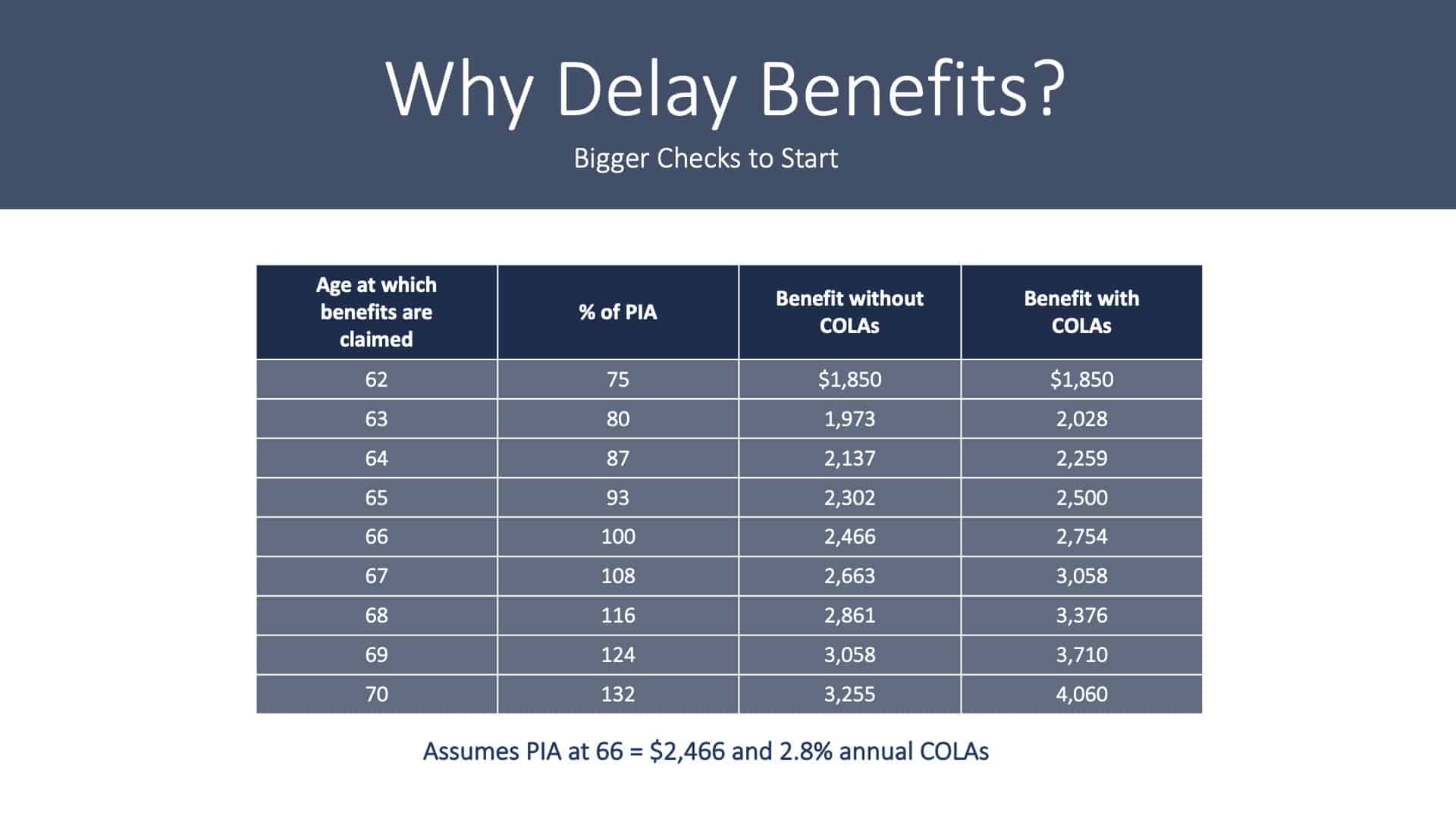

Why Delay Benefits? Bigger Checks to Start

Here’s a chart on why to delay. So we can see if we have claimed our benefit at the age of 62, we can again see how much of our primary insurance amount percent we would receive.

We can also look at the effects of cost of living adjustments or without the cost of living adjustment. So we can see that if we were 62 and we’re using the same example here, the $2,466 a month.

If you claimed at 62, it’s 75% of your primary insurance amount, and you would end up receiving $1,850. Now, if you were to delay until 70, again, you get the 132% because of the delayed credits. So that would be $3,255 based upon that $2,466, without any cost of living adjustments.

If you look at it now on the far right bottom corner with the cost of living adjustments, that benefit now comes up to $4,060. Again, we just want to understand all these dynamics.

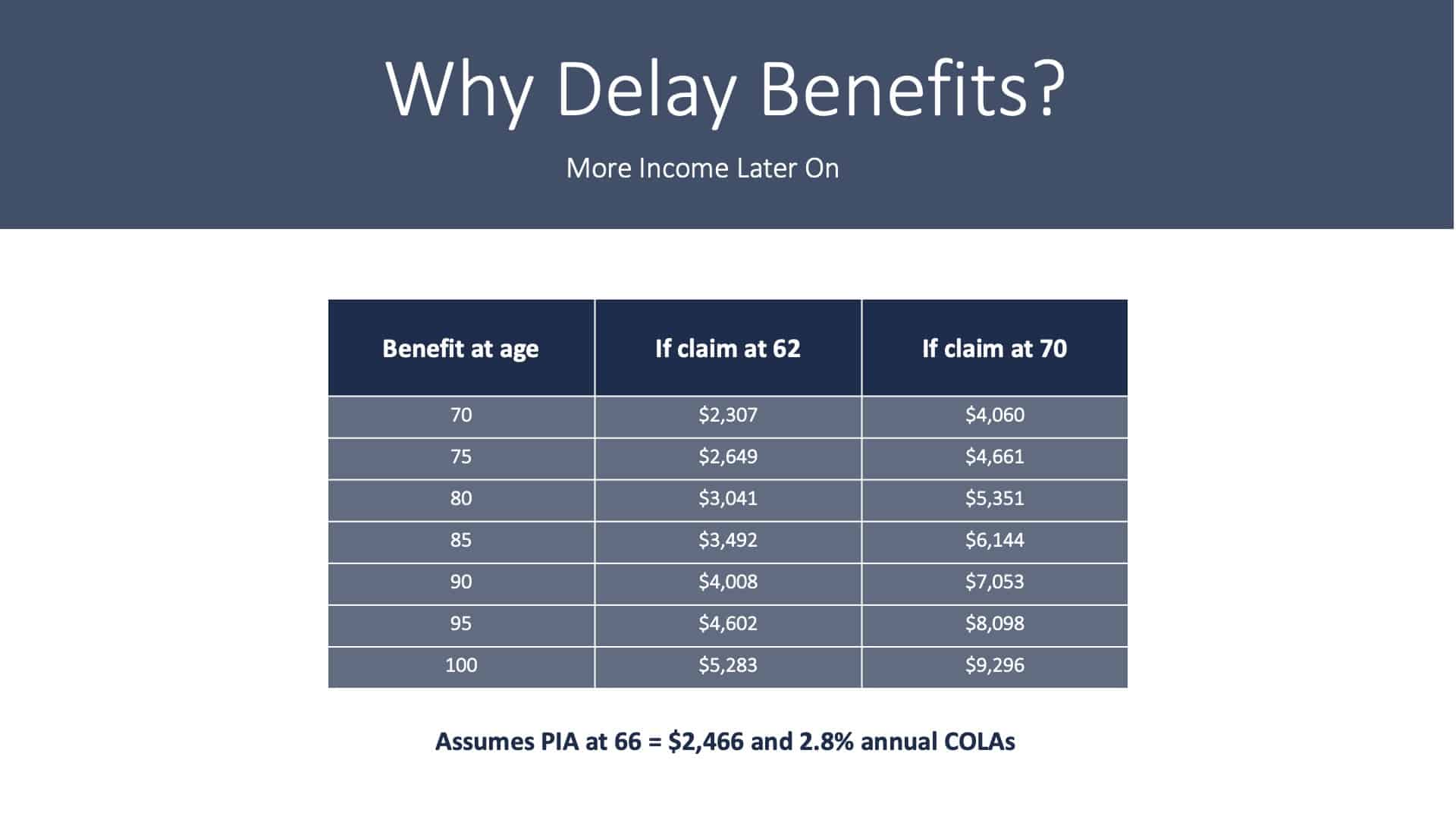

Why Delay Benefits? More Income Later On

Looking at your benefits and saying, okay, well, what happens if I would’ve claimed at 62 and made it to certain ages, and what happens if I claimed at 70 and made it to certain ages?

This shows you the effect of compounding interest of that cost of living adjustment and starting with a bigger base.

If you delayed, your base is bigger, so every little raise is more dollars. So when we look at the chart, if we were 62 and we made it to 85, our benefit only grew to $3,492. But if we were to have delayed until 70, our benefit is now $6,144. Again, there is a huge dynamic that you want to understand for yourself, your plan, and your spouse, who may be on that widow’s benefit.

Applying for Social Security

Some things to consider are your income needs, both now and in the future, and your potential life expectancy. Did people in your family all die young? Did they live a long time? These are all things you want to think about. And then also your spouse’s life expectancy as well. And we want to consider everything.

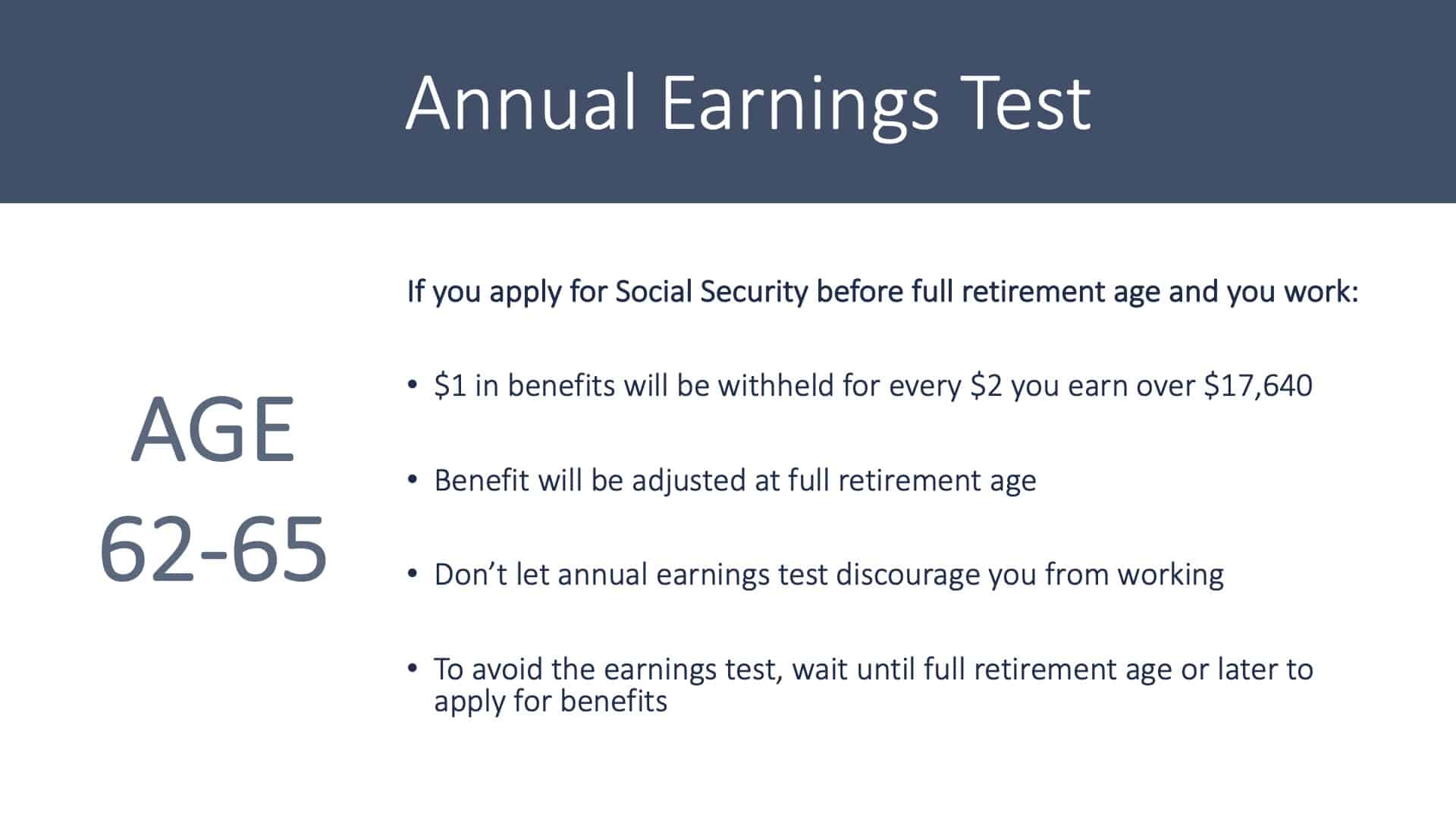

Annual Earnings Test

Now let’s talk about the annual earnings test. Much like the reduction effect, and there are many little “gotchas” when we look at claiming Social Security before our full retirement age. So that’s a crucial thing to understand.

In this chart, you can see what would happen if you file between 62 and 65 if you were to continue to work. If you have a pension, that does not count, and this is you going out W-2 or 1099 and earning an income.

But if you were to earn too much, you can see in the chart here that if you made over $18,240, a $1 benefit would be withheld for every $2 you earn over that amount.

So, if you will continue to work but you’re not going to make more than $18,240, not a big deal. It doesn’t affect your benefit. Now one thing to understand is that anything that’s withheld, it’s not gone forever.

They actually will recalculate when you obtain full retirement age and add those withheld dollars back to your benefit, but they stretch those across the lifetime. So again, you have to live a long time to capture all those dollars back.

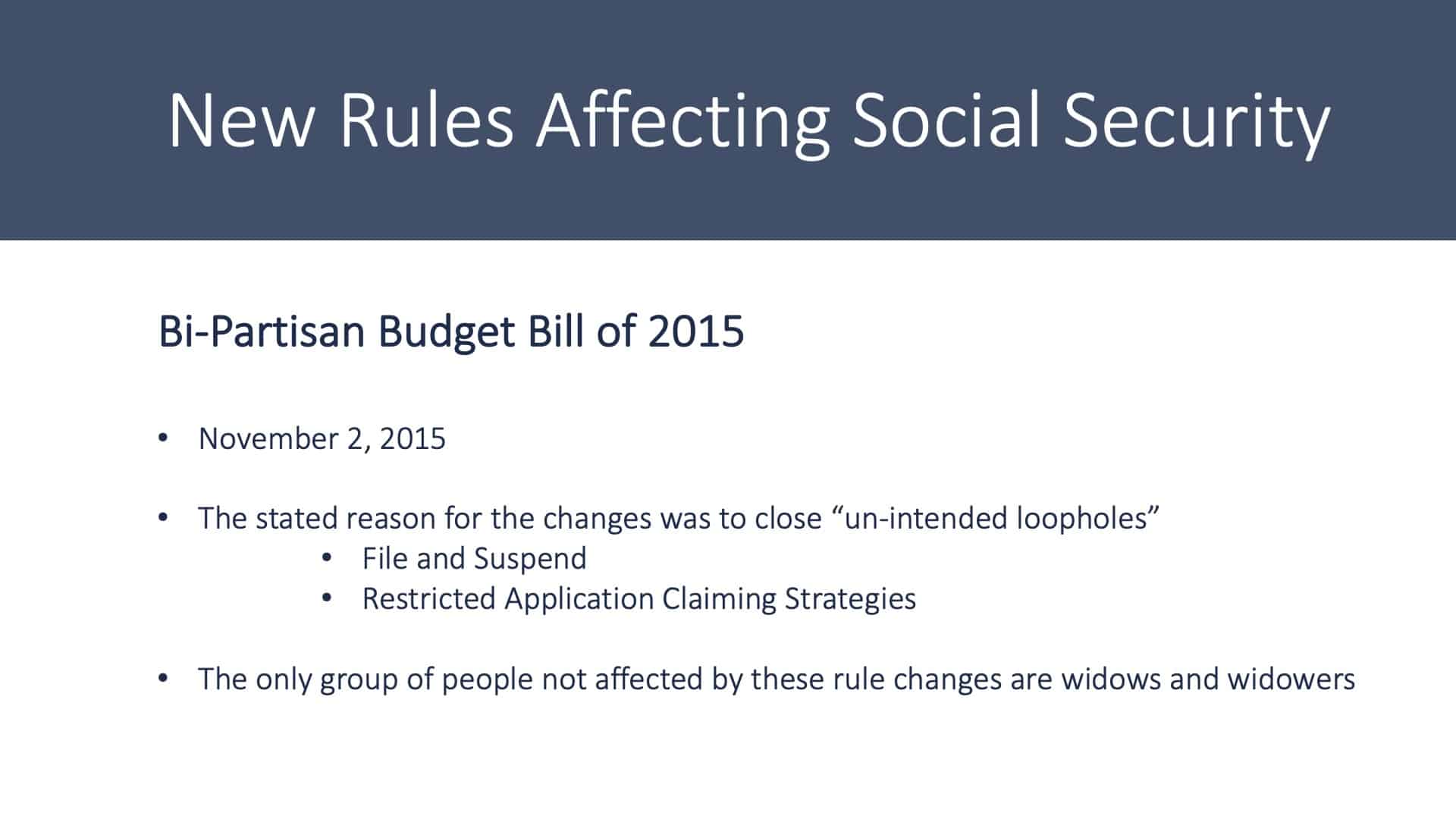

New Rules Affecting Social Security

All right. So let’s talk about the Bipartisan Budget Bill of 2015. Again, this past November 2, 2015, and essentially they wanted to close unintended loopholes, they refer to them as file and suspend with the restricted application.

There was a strategy that planners used a lot. So it was kind of a big blow to us when that did come through, but we still want to understand there are still many options for Social Security, but you need to know which group you fall into.

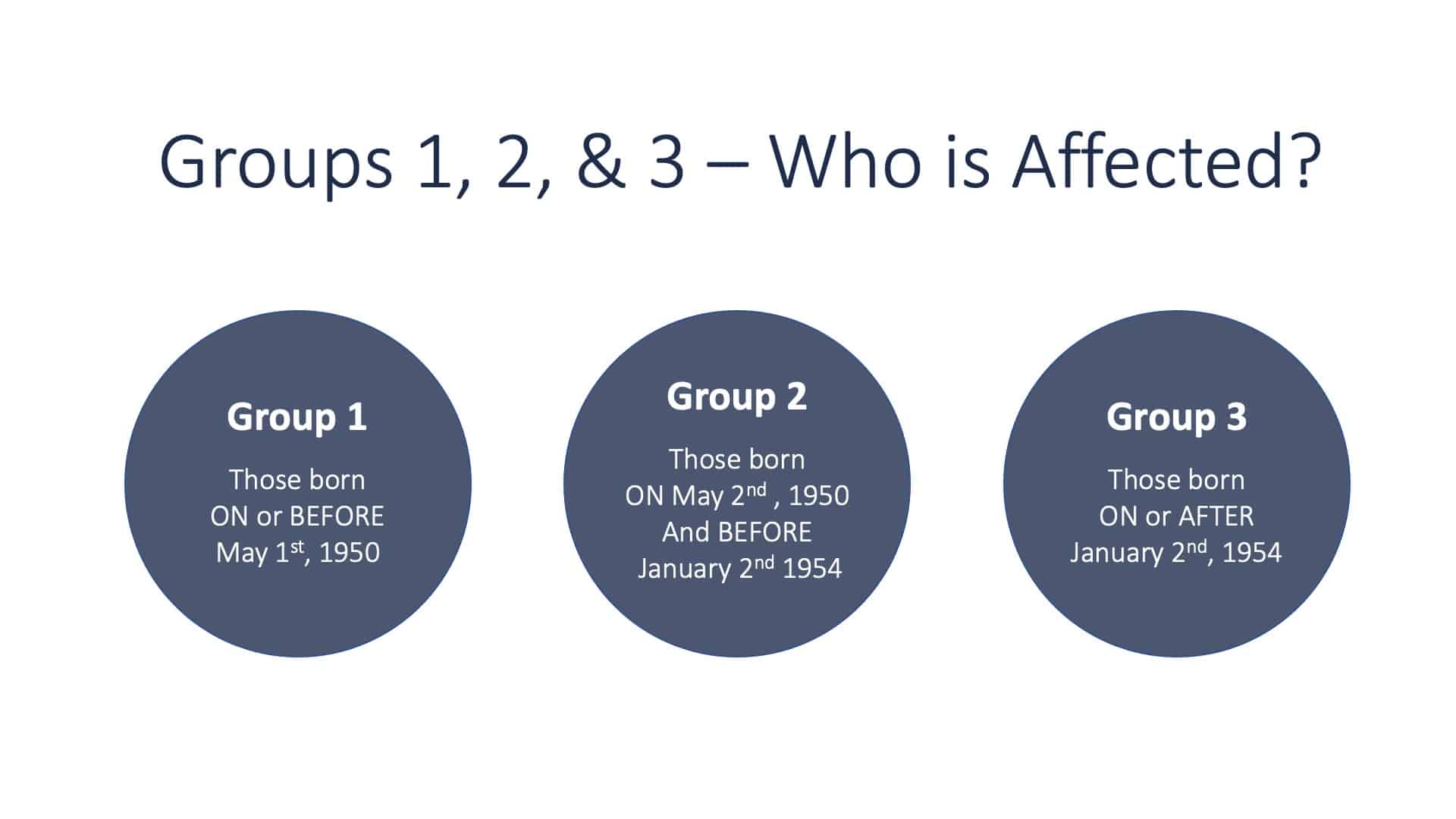

Groups 1, 2, and 3 – Who is Affected?

So when we look at the different groups, we just call them simply group one, group two, group three. We can see group one are those born on or before May 1, 1950.

Group one, individuals still have all the abilities. Now, they’re getting to a point where claiming strategies are pretty much a moot point at this point with their age.

Group two are those that still can use the restricted application. But again, the caveat is your spouse that you’re going to restrict against needs to a file, then they can not suspend.

Group two, as you can see, May 2, 1950, and as long as you’re born before January 2, 1954. And then we have group three, which is everybody else.

So if you’re born January 2, 1954, or after, you are now in group three, which means you no longer have the ability to use the restricted application at all. That is entirely off the table.

Example: “Claim Now, Claim More Later”

So we’re going to walk through some examples now. So this is, “claim now, claim more later.” When we look at the example, we have Mike and Mary they’re 66 years of age.

Mike’s primary insurance amount is $2,000, and Mary’s is $800. We can see that Mary files for her benefit at the age of 66, Mike files for his spousal benefit at the same time and begins to collect the $400.

So again, Mike was eligible to claim the restricted application. But again, Mary had to file for him to have that window open up. Then Mike winds up waiting until 70 on his own benefit and getting his benefit up to 2,640. So again, that is still an option for some of you that are out there. And we just want to understand if it is.

Social Security Claiming Case One

So case number one, we have John, he’s 65 in 2015. Jane is 62 in October of 2015. We assume that John’s primary insurance amount is $2,500, Jane’s is $1,300.

They’re living to the ages of 85 and 90, and we’re using a 2.7% inflation rate with a 1% real rate of return to look at the dollars in today’s dollars.

Case One: Strategy Comparison

So we can see by the chart, if they were both to file at the age of 62, a little over $800,000 would be there for their income based on those ages. But if they followed potentially a recommended strategy, it was going to be over a million.

Case One: Conclusion

So again, we’re talking about big dollars here. So we can see in the example, to get to the recommended, John files his benefits at the age of 68 and 11 months, collecting $3,420. Jane files for the spousal benefit at the age of 66, receiving the $1,390 a month, and then she switches to her own benefit at the age of 70, which is a little over $2,000.

That is still an option that we want to understand, and that equates to be $188,000 over their lifetime by doing that strategy. So again, big dollars.

Social Security Claiming Case Two

Case number two, we have John, age 61, in January of 2016, and Jane turned 59 in January of 2016. We’re looking at similar amounts. John’s primary insurance amount is $2,400, and Jane’s is $9,000.

They have the same death ages and cost of living inflation assumptions.

Case Two: Strategy Comparison

We can see by the chart. If they were to claim early, their benefits would give them $700,000 over their lifetime, a little over $700. And if they were to do a recommended strategy, that’s a little over $800,000. So again, a big difference here.

Case Two: Conclusion

In case two, we can see here that John files a standard application at the age of 70. His approximate benefit amount is $3,880, and Jane files for benefit under her own earnings record at the age of 66 and six months.

At this time, there is no spousal benefit because John is delaying, but Jane can get some spousal later. So what we see is that she receives her $1,055 a month.

Then at the age of 68, John has now filed, which has opened up the door for spousal benefits for Jane. So she gets a little pay raise of 371. So again, we can see by that strategy. It still equated to be $122,000 more of lifetime income.

Taxation of Social Security Benefits

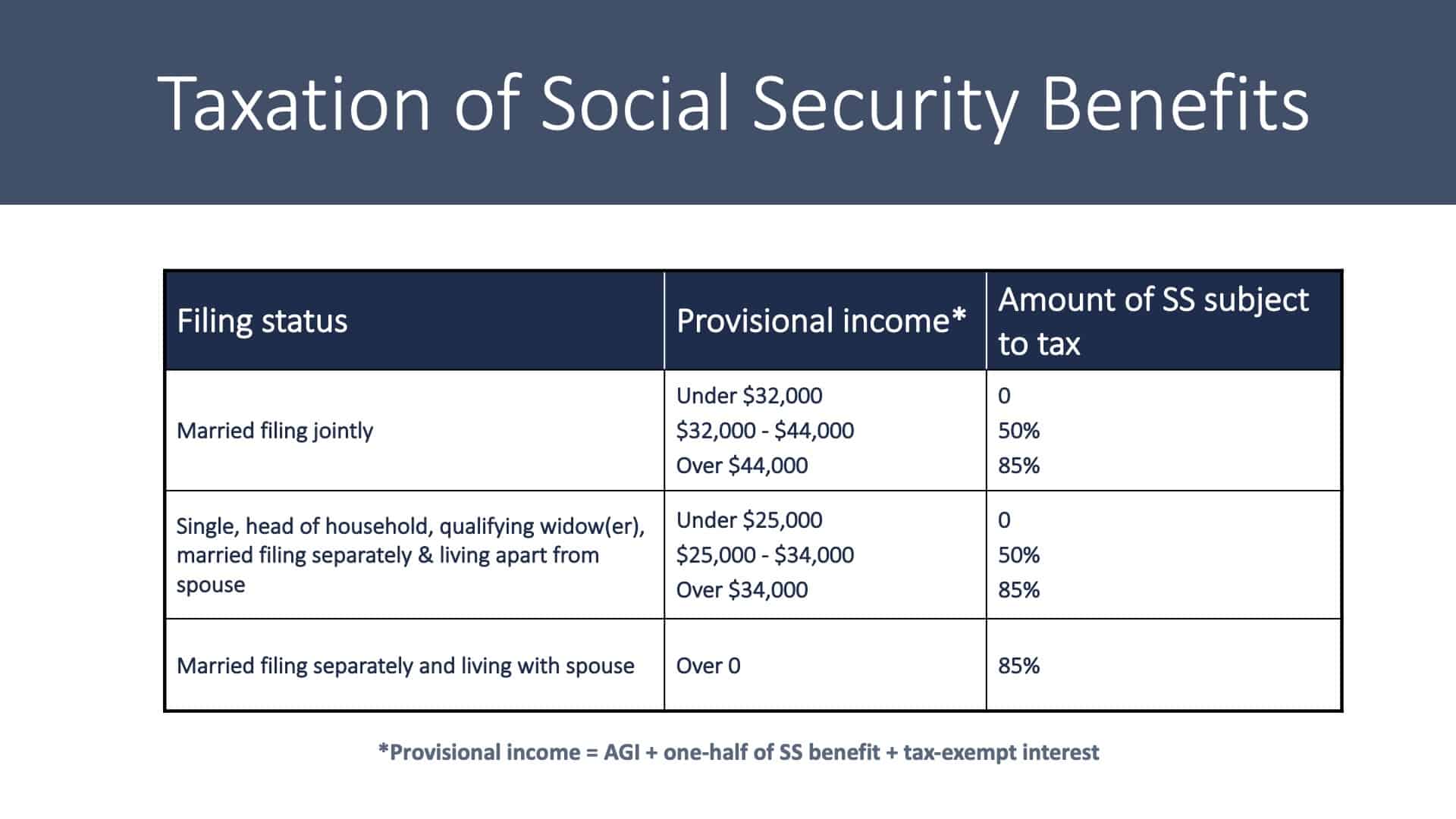

Let’s talk about taxation and Social Security. So we can see here on the chart. Unfortunately, your Social Security benefits are not tax-free, and there’s also an income test call provisional income test. And we can see if you’re married, filing jointly.

If you make under $32,000, none of your Social Security benefit is subject to tax. If you make 32 to 44, up to 50% of your benefit could become taxable income. And if you make over 44, up to 85% could be taxable income. So again, I want to be very clear that it’s not 85% of your benefit is taxed or gone away to taxes, I should say.

But up to 85% of the benefit becomes ordinary income taxes at whatever tax rate you are. Multiple different things can flow into here, and we want to understand it to make sure that we understand how you’re being taxed.

The provisional income is equal to your adjusted gross income, that is, the AGI plus one-half of your Social Security benefit plus tax-exempt interest.

So for those who may have a large brokerage account where you are in many municipal bonds that pay tax-free income from a federal level, that income still gets counted in your provisional income test. So it even may affect the taxation on your Social Security.

Ways to Minimize Taxes on Your Social Security Benefits

You could reduce income from other different types of tax-advantaged investments. Again, municipal bonds do not qualify.

Something else that we want to understand long-term is what happens when you turn. For most people now, it’s the age 72. It was 70 and a half, but the SECURE Act changes that. But when we obtain the age of 72, we have to take our required minimum distribution.

So for some of you, you’re delaying taking money out of your IRA, but you don’t see may be the potential of the tax nightmare that hits you when you’re 72. So again, we want to understand that.

When we’re looking at your plan, structuring the income, and how all these things play together. How do we minimize taxes for the long haul?

Recall the Example

All right, so again, let’s go back to where we were in the beginning. And looking at our strategy comparison of the married couple, three years age gap. Again, looking at life expectancy is to 85 and 90. Also, we can see in the chart the difference. It’s a lot of money, $194,000 difference by doing a different claiming strategy.

Again, it is very important to understand your options and understand how it relates to your plan. This is a snapshot from just one of the many software packages we use here at Modern Wealth Management to analyze what those Social Security options are.

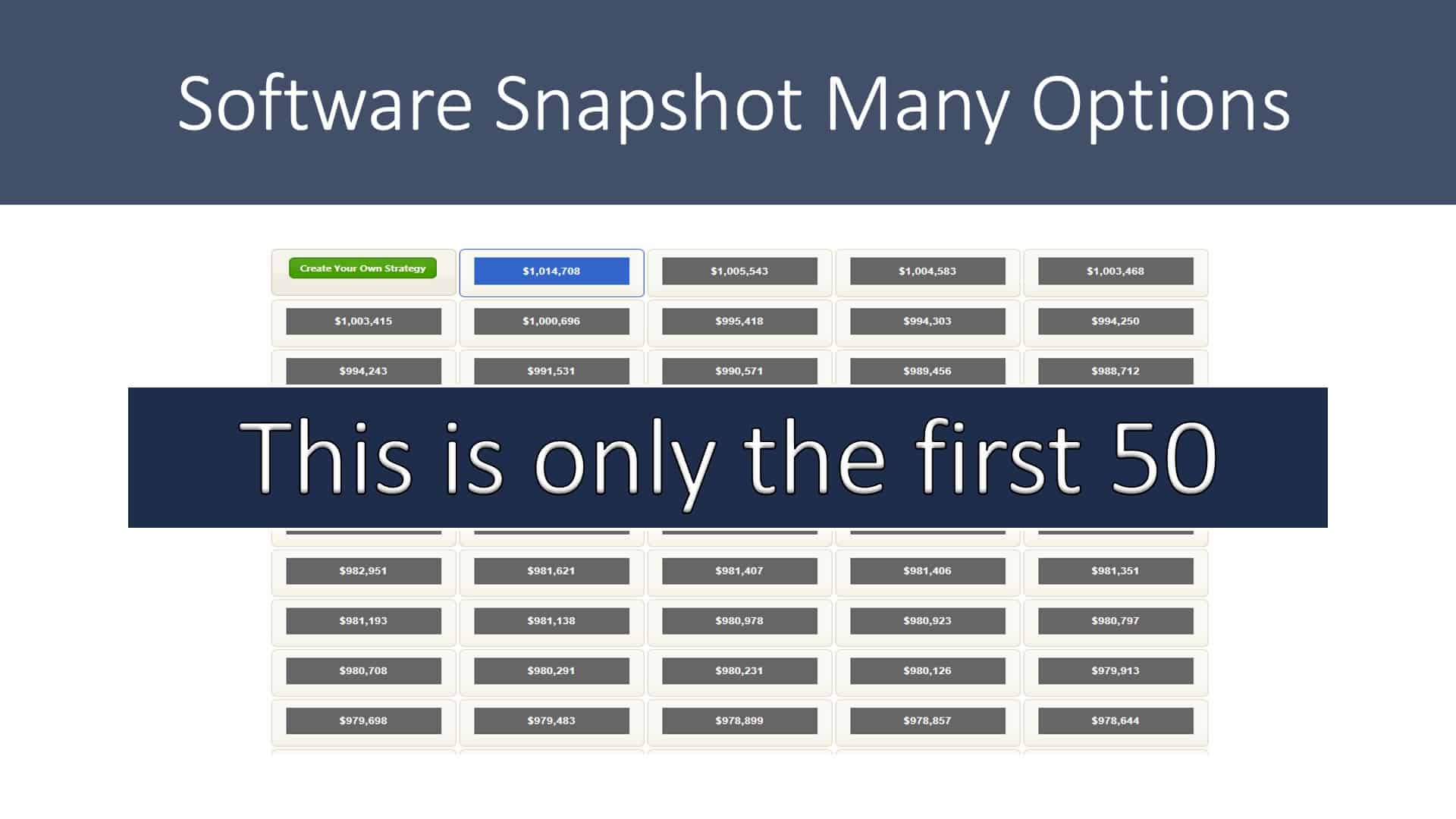

Software Snapshot

If you look at the slide, quite a few times boxes, and there’s a different dollar amount in each box if you notice. Well, this is only the first 50 of the calculation.

You might be surprised how many different calculations there are. This tool alone will calculate every single month claiming option for you and your spouse between the ages of 62 and 70. So again, we get to look at everything and make sure we understand it.

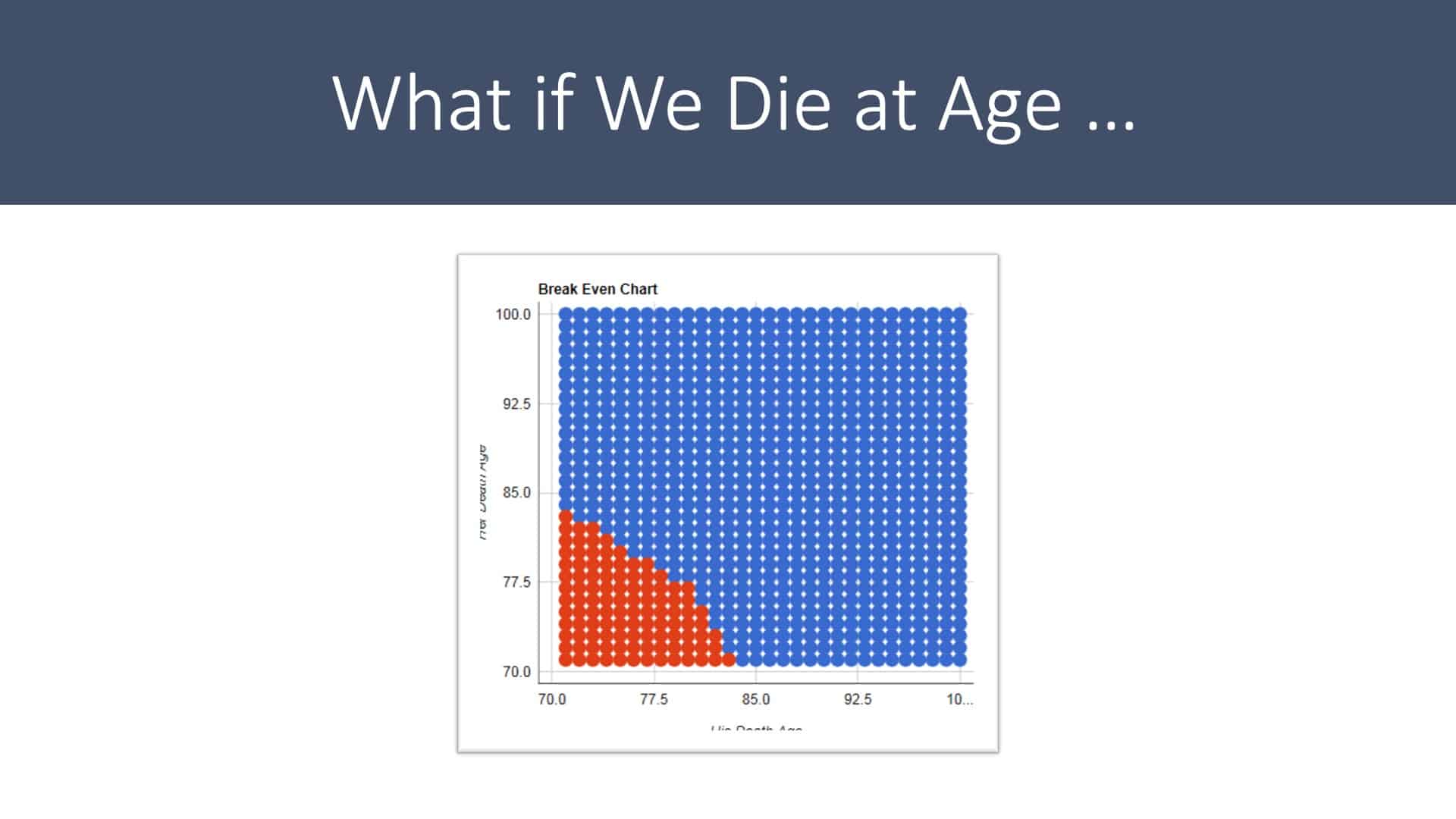

What if We Die at Age…

So a lot of people are concerned about, okay, well, what if I die young? Should I have delayed my benefit? We can also help you understand that by looking at breakeven and looking at a marital breakeven.

So what you see here on the chart is the difference between the red dots and the blue just tells us that if you made it to whatever that age that dot is on as a combined couple, which strategy would have paid you more dollars. So we can see that if you guys both made it to 77 and a half, unfortunately, you fell on the red dot, claiming early would have been better.

Unfortunately, this is something we don’t know going into it how long we’re going to live. We can also see if this couple made it to 85, then doing the delayed strategy was much more beneficial than a dollar amount.

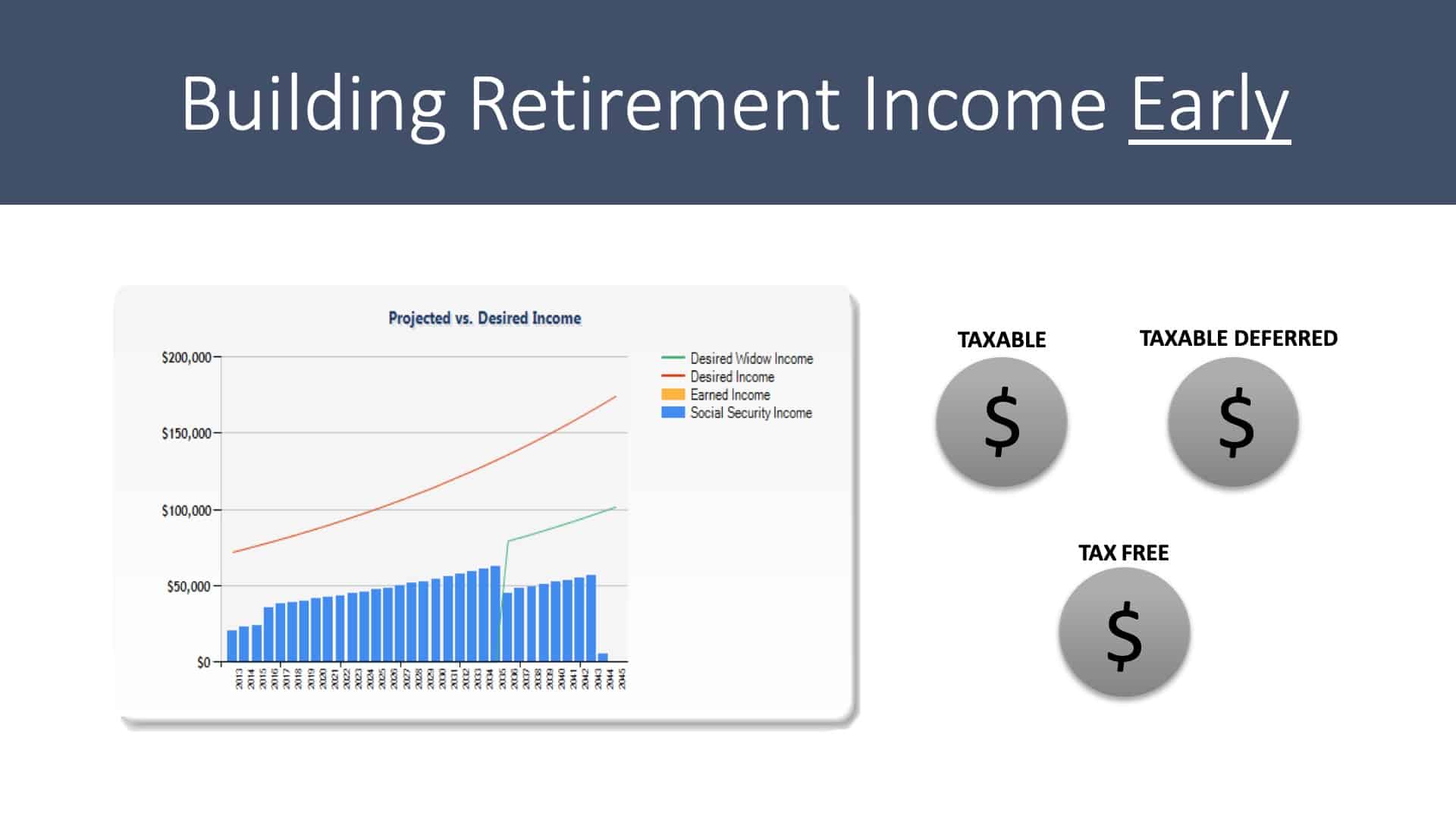

Building Retirement Income Early

And this is an essential concept that we want to understand, and looking at you’re taking income early from Social Security. So you can see in the chart, the blue columns are your Social Security income. The red curving line is the amount of money that this client couple wants to spend in retirement.

And then you see on the right the three different buckets. So the three different buckets are referring to how we saved our money over our lifetime. How did we build our net worth?

The Buckets

So you have bucket number one, which is taxable. I know it’s a confusing term because it’s after-tax money, but it’s the money that you get taxed on by any dividends and interest it creates or any capital gains. Some of you have a very large taxable bucket, some of you may have a smaller taxable bucket, but again, we want to understand it.

The next one, taxable deferred. So again, tax-deferred buckets could be your IRA. It could be a 401(k), a 403(b), 457. There are many different types of tax-deferred buckets.

And in your tax-deferred bucket, you are going to pay income taxes, not as your investments earn money inside of that bucket, but every dollar that comes out is a hundred percent taxable income. So again, a hundred percent of that dollar will flow into your tax return at whatever tax rate you are at.

And then, for a select few of you, you may have some tax-free. So tax-free is referring to Roth. So this is money that went in after-tax and will forever grow tax-free. And any dollar you take out of that bucket will be tax-free. Now, there are a couple of caveats to that, you have to be above the age of 59 and a half, and you also had to have had that money in starting at least five years prior if it’s contributory.

And if you’re doing a strategy such as Roth conversion, each conversion Has its own five-year time window. A lot of moving parts, again, you want to make sure that you understand it or your professional understands that. So what we wind up seeing is how we use these three buckets to fill in that gap between Social Security and what you want to live on?

Building Retirement Income Best

Now, let’s look at what might be a better strategy. You can see on the blue bars the amount of Social Security income coming in. You can see early on that we did not claim early, so there’s no income coming in from Social Security.

So this is where understanding your three buckets becomes very important. If you are in a position where you have a ton in that taxable bucket, again the after-tax money, we may be able to use that bucket to create a tax strategy by delaying Social Security.

Again, we may be able to show uncle Sam that it looks like you’re making no money even though you’re creating your living expenses and start moving money from that tax-deferred bucket to Roth. So again, these are all interrelated, so hopefully, you see that.

You can also see for this client couple because they chose to delay, later on in life, that gap between their Social Security income and their goal is much more narrow. Therefore, maybe their investments don’t have to work as hard once they get to that point in their life. So a lot Of different moving factors.

Consider Social Security in the Context of:

Things to consider when you’re looking at the context of your Social Security. Do you have a pension? Again, do you have tax-deferred accounts? And we want to understand what your required minimum distribution will be?

The slide says 70 and a half, for some of you, but under the new law with Secure Act, it is now 72. So again, we want to understand that, making sure that we’re not creating a big tax balloon later on in life. Your investment portfolio flows into that and whether or you want to work. So, if we file early, there’s an earnings test. Does it matter or not?

Again, everybody’s situation is entirely different.

Social Security is Too Important for Guesswork

So Social Security is too important to guess. That’s why we look at it from multiple different angles for our clients. If you are a client, if you have any questions, feel free to call your advisor. And if you’re not a client and you do have questions, do schedule a complimentary consultation by clicking here.

Also, Dean recently did a podcast with some Social Security experts maximizing your Social Security benefits. Be sure to check it out here.

Thanks for joining me today.

If you’re not a client, please schedule a complimentary consultation so we can help you understand the complexities of Social Security as it relates to you.

Schedule Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.