What Is Financial Wellbeing?

Key Points – What Is Financial Wellbeing?

- Defining and Measuring Financial Wellbeing

- Key Considerations for Financial Wellbeing

- The Role of Wise Spending

- The Emotional Benefits of Planning

- 7 Minutes to Read | 22 Minutes to Watch

What Is Financial Wellbeing?

Defining a Healthy Relationship with Money

Financial wellbeing is a term frequently mentioned, but what does it really mean? Bud Kasper and Logan DeGreave dive into the concept of financial wellbeing and explore its various aspects on this episode of America’s Wealth Management Show. From measuring financial success to the importance of planning, we will provide insights and tips to help you achieve financial wellbeing in your life.

Defining Financial Wellbeing

Financial wellbeing refers to the positive perception of one’s financial situation and its overall impact on their life. It is closely tied to a person’s satisfaction and fulfillment in not only their financial matters, but their goals for life in general.

Measuring Financial Wellbeing

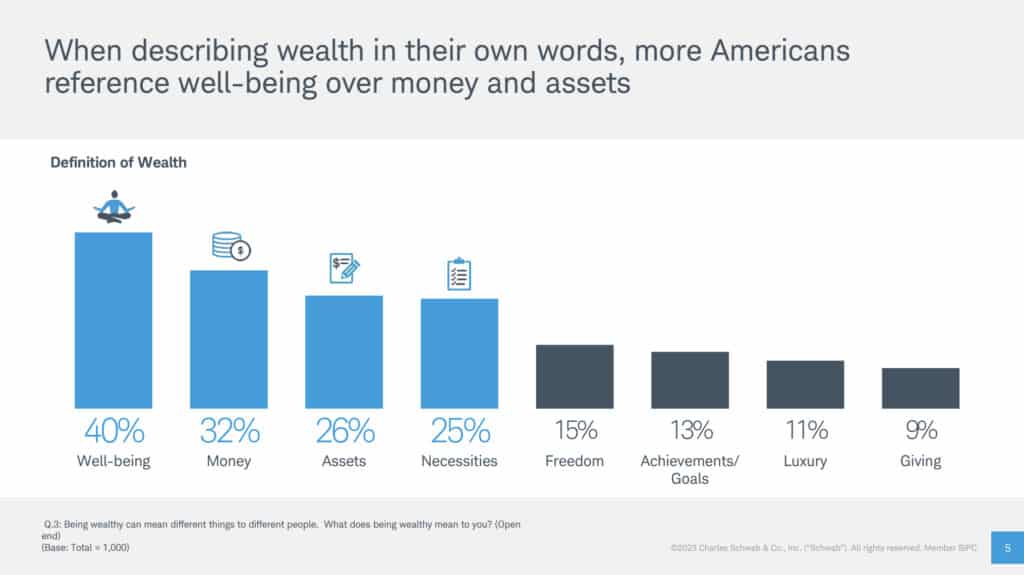

A well-constructed financial plan serves as a guidepost to assess your financial wellbeing. It allows you to evaluate your progress and make informed decisions. Charles Schwab recently released their 2023 Modern Wealth Survey (no relation). In that study, when asked in their own words what “wealth” meant to them, 40% referenced “wellbeing” over “money” and “assets.”

Charles Schwab 2023 Modern Wealth Survey

The Role of Comprehensive Planning

Financial wellbeing goes beyond investment performance. It involves assembling a team of professionals to navigate various financial challenges. You need to consider aspects like taxes, estate planning, long-term care, and more to ensure comprehensive financial and emotional well-being. That’s why having CPAs, CFP®, and estate planning and insurance specialists working together on your behalf is a crucial piece of the puzzle.

Key Considerations for Financial Wellbeing

“Your two largest wealth eroding factors in retirement are taxes. We know that both of those costs are probably going to go up into the future. But here’s the thing. When you’re doing your own financial planning, if you’re not planning for inflation, planning for increased taxes, planning for health care, Medicare premium supplements, etcetera, all of these things can create some uncertainty.” – Logan DeGreave

- Inflation: Accounting for inflation is essential in maintaining financial stability. Everyone feels inflation in their daily lives today from the grocery store to the gas pump. However, we know that things like education and healthcare expenses tend to rise over more quickly over time, so using different inflation rates for different factors can help prevent uncertainty.

- Taxes and Healthcare Costs: As mentioned before, healthcare inflates more quickly than other factors. So, it’s no surprise that taxes and healthcare expenses are significant factors eroding wealth in retirement. Proper tax and healthcare cost management strategies should be incorporated into your financial plan.

- Social Security Optimization: Maximizing Social Security benefits requires understanding when and how and when to claim them within the context of your overall financial plan. Considering factors like provisional income and tax implications can make a huge difference in the claiming process.

- Financial Security & Goals: Evaluating your assets beyond retirement accounts provides a clearer picture of your financial security. When you align those assets and resources with your goals, financial security becomes about managing your finances to achieve those goals instead of worrying about specific account values.

The Importance of Financial Preparedness

Financial wellbeing is closely tied to preparedness for unexpected events. Medical emergencies can quickly lead to overwhelming debt, emphasizing the need for a comprehensive financial plan that considers potential emergencies and includes strategies to mitigate their impact.

The Role of Wise Spending

Careful spending habits significantly contribute to financial wellbeing. Prioritizing expenses that align with your financial goals, rather than indulging in fleeting experiences, ensures long-term financial security. Now, this doesn’t mean you can’t take great vacations with your family or buy that dream car. Instead, you just need to put these goals into your plan and see how it impacts your overall ability to achieve the retirement you desire.

Student Loan Challenges

“For the 25, 30, 35-year-old, even 40-year-old that has payments that are starting again after COVID caused pauses. It’s going to be stressful. You need to start planning now of how you’re going to fit that in. What do we know? Inflation is high. People aren’t saving money. Credit card debt is high. So I think that that’s critical. Planning, planning, planning, planning.” – Logan DeGreave

Student loans are a common concern for individuals striving for financial wellbeing. Uncertainty surrounding loan forgiveness proposals and the resumption of interest accrual post-COVID-19 adds to the stress. Planning and budgeting for impending repayment obligations are crucial to avoid unnecessary financial strain. Once again, having a financial plan that integrates all of your assets, liabilities, and goals for your future can provide clarity in your financial wellbeing.

Addressing Legacy Planning

Legacy planning is often overlooked but plays a significant role in financial wellbeing. Creating an estate plan and working with an estate planning attorney, regardless of wealth, ensures that your wishes are carried out and minimizes challenges for loved ones. With the ever-evolving legislative landscape around retirement and legacy, it’s important to have a team of professionals to address your plan’s needs.

The SECURE Act and SECURE 2.0 have brought significant changes to how you can pass down retirement accounts to your heirs, particularly IRAs. Check out a some of the education we’ve created around these new laws on retirement rules:

The Emotional Benefits of Planning

Financial planning not only impacts numbers and figures but also has an emotional impact. It alleviates stress and anxiety by providing a roadmap for your financial journey and empowering you to make informed decisions. You should have a clear picture of your desired retirement lifestyle so your financial plan can provide the wellbeing you want and deserve.

Retirement Planning Resources

Utilizing financial planning tools and retirement planning resources can enhance financial wellbeing. Our goal is to provide education to those who are seeking to understand their financial futures and create the wellbeing they are looking for in retirement.

Find more educational resources from Modern Wealth Management below:

- Education Center: Articles, Downloads, Podcasts, and more

- America’s Wealth Management Show: New episodes every Monday and Thursday

- Available on YouTube and your favorite podcast app

- The Guided Retirement Show: Interviews with subject matter experts on retirement related topics

- Available on YouTube and your favorite podcast app

- Financial Planning Tool: Access the same financial planning tool Modern Wealth advisors use with our clients. Build your plan from the comfort of your own home and work directly with an advisor to identify issues and opportunities. Start building your plan.

So, What Is Financial Wellbeing?

Financial wellbeing encompasses various aspects of our financial lives and is essential for our overall happiness and peace of mind. By understanding the key elements of financial wellbeing, such as measuring financial success, comprehensive planning, addressing legacy planning, and the importance of wise spending, you can take proactive steps towards achieving financial security and fulfillment. Financial preparedness, including planning for unexpected events and managing student loan challenges, is crucial to maintain stability.

Seek guidance from certified financial planners and estate planning attorneys to ensure comprehensive and informed decision-making. Remember that financial wellbeing is a journey that requires ongoing effort and adjustments. Embrace the process, make informed decisions, and utilize available resources to unlock a lifetime of financial security and fulfillment. Your financial wellbeing is within reach, and by implementing the right strategies and mindset, you can create a solid foundation for a brighter financial future.

As always, we’re here to help you achieve that goal of wellbeing, financial or otherwise. If you would like help developing a plan that works for your retirement goals, schedule a conversation with a CFP® professional by clicking below. We can meet in-person, via virtual meeting, or on the phone.

What Is Financial Wellbeing? | Watch Guide

00:00 – Introduction

00:34 – Defining & Measuring Financial Wellbeing

03:07 – What Do People Miss?

07:16 – How Much Do You Need to Have Good Wellbeing?

10:03 – What Does Wellbeing Mean to Different Ages?

14:05 – Let’s Talk About Lifestyle and Wellbeing

16:50 – What Hampers Wellbeing?

19:23 – What Did We Learn Today?

Resources Mentioned in the Episode

Articles

- What Is Tax Planning?

- Rising Long-Term Care Costs

- Components of a Complete Financial Plan

- 10 Ways to Fight Inflation in Retirement

- Maximizing Social Security Benefits

- Planning for a Large Family Vacation

- Retirement Planning Resources: Modern Financial Planning

- What Is a Monte Carlo Simulation?

Previous Episodes

- IRAs Are Bad for Wealth Transfer

- Congress Passes New Retirement Rules

- Rebalancing Your Portfolio: Looking at a Midyear Rebalance

- What to Know About CDs, Bonds, and Treasuries

- Is Inflation Slowing?

- Federal Reserve Pauses Interest Rate Hikes

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.