Retirement Planning Resources: The Modern Financial Planning Tools and Relationships We Utilize at Modern Wealth

Key Points – Retirement Planning Resources: The Modern Financial Planning Tools and Relationships We Utilize at Modern Wealth

- Building Your Plan with Our Industry-Leading Financial Planning Tool

- The Importance of Multi-Year Tax Planning

- Figuring Out When You and Your Spouse Should Claim Social Security

- Retirement Planning Resources for Investment Tracking and Investment Risk

- 10 Minutes to Read

Understanding What Retirement Planning Resources Are Available to You

Two months ago, Modern Wealth Management President and Co-Founder Jason Gordo joined Dean Barber and Bud Kasper on America’s Wealth Management Show to talk a little bit about Modern Wealth Management’s mission. Our mission is to help provide you confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love. To help you understand how we do that, we’re going to highlight the retirement planning resources that are available to you and the financial planning tools that our Modern Wealth advisors use.

We’re thankful that our valued clients understand the importance of working with a team of professionals like we have at Modern Wealth. The best planning tools, even ours, can’t match the value of a team of professionals working together on your plan. That’s why we recommend exploring the planning tool first and then consulting one of our advisors who can help you better understand your current situation, any opportunities you can take advantage of, and if there are any issues that need to be addressed.

There are so many people who take the DIY (do-it-yourself) approach to retirement planning that overlook key components of a financial plan just because they aren’t aware of the resources available to them. If you’re one of those people, this article is for you. We want you to benefit from the retirement planning resources that we’re making available to you.

Modern Wealth’s Retirement Planning Resources

1. Continuing Education

There’s a reason we have people like America’s IRA Expert Ed Slott as a guest on The Guided Retirement Show. To that end, we want to make sure that we’re passing along the education we receive to you. Our education center, which includes podcasts, webinars, and articles, gives you a wealth of financial education all in one place. We hope that you find it to be a very beneficial retirement planning resource.

“I’ve always said from the time we started doing America’s Wealth Management Show, our workshops, and everything else that if our clients would pay attention to everything we said, they would be smarter than the average advisor. The education we receive serves two purposes. Number one, it prevents them from being taken advantage of by financial salespeople. Number two, it allows us to have an intelligent conversation with them because they understand what we’re talking about.” – Dean Barber

Sign Up for Our Newsletter!

In addition to posting a wide variety of content in our education center, we include our most recent articles, podcasts, and videos in our weekly newsletter. Make sure to sign up below to stay up to date with our latest educational content.

We’re Continuously Educating Ourselves as Well

We tell our clients all the time that they can’t just build their financial plan, never update it, and expect to be OK throughout retirement. So, your plan needs to be forward-looking and fluid. Think about it. Your goals, health, family situation, and lifestyle are just a few personal things that will change in retirement. Make sure that your plan is updated as those things change.

Your plan also needs to be updated to reflect changes in the tax code, which are constant. That’s no small task given the size and complexity of the current and future tax codes. That’s why our advisors and other financial professionals spend hours upon hours studying the never-ending legislative changes. They want to understand how those changes can impact someone’s plan and then educate them about it so they can make more informed decisions.

Of course, we have all the financial industry continuing education that we must complete annually. There’s continuing education required of our CFP® Professionals and CPAs and insurance continuing education, but there’s more. Our Director of Tax, Corey Hulstein, gains industry-leading insight from American Institute of Certified Public Accountant conferences. Dean, Bud, Logan DeGraeve, Will Doty, and Drew Jones are all members of Ed Slott’s Elite IRA Advisor GroupSM. Along with attending two Slott workshops a year, they’re testing on the new material about IRAs to maintain their membership. Several of our advisors are also members of the Financial Planning Association, which has continuing education requirements of its own. Needless to say, our team dedicates a lot of time and energy to being at the top of their fields in knowledge and insight.

2. Tax Planning Team

When you started planning for retirement, what was your mindset about taxes? Were you doing everything you could to pay the least possible amount in taxes each year? That’s a common but problematic approach. While that might provide you some short-term satisfaction, it likely won’t bring near as big of a smile to your face as multi-year tax planning. We have an in-house tax team that can show you both.

Tax planning is all about paying as little tax as legally possible over your lifetime rather than in one calendar year. That should always be the goal. It’s important to keep in mind what your current tax rate is compared to what your tax rates will be in the future.

We feel like we’ve been yelling from the rooftops that the Tax Cuts and Jobs Act is sunsetting in 2026. That means that we’ll be reverting to the tax rates of 2017, which are higher than the current rates. Our clients know that, but did you? One of the beauties of our multi-year tax planning tool is that it evolves with legislation. Financial planning needs to be forward-looking, and that’s exactly what we’re doing with figuring out what tax planning strategies will work best for you. These are pivotal retirement planning resources.

3. Social Security Planning Tools

Our next retirement planning resource that we want to talk about looks at the timing of claiming Social Security. When are you planning to claim your Social Security benefits? This isn’t a decision that’s just about you. You need to keep your spouse in mind as well.

There are hundreds of iterations for when the average 62-year-old couple can claim Social Security. The difference between the best and the worst claiming strategy can be hundreds of thousands of dollars. We want to maximize the amount of Social Security income for you and your spouse over the course of your lifetimes. So, our advisors ability to leverage platforms that allow us to see these iterations for you and make the most educated decision for your plan is crucial.

4. Robust Research Platforms

Now, let’s dive into what our thorough investment research platforms can do. Our advisors utilize high level investment tracking software that analyzes money flow into asset classes and individual stocks. Those of you that have watched Dean’s Monthly Economic Updates have seen a glimpse of this software’s capabilities. The bottom line that we keep in mind when using this retirement planning resource is to help clients and prospective clients to make informed decisions. Do you want to buy, sell, or hold on to what you have? Regardless of your decisions, it’s prudent to take some time to do some research. We highly recommend doing so alongside a professional instead of acting on fear or greed.

Our advisors also use a tool to help clients understand investment risk. It’s another thing that we stress test your financial plan for so you can see how your plan performs in different economic environments. How much risk are you comfortable with taking? Do you need to rebalance? Are you taking too much risk? Are you taking too little risk? You need to know that information sooner rather than later.

5. Relationships with Insurance Specialists

Our retirement planning resources don’t just involve software either. Bill Page, who is our estate plan and insurance coordinator and a client service specialist, lends a helping hand to our clients in a few different areas. To start off, Bill helps us coordinate the great relationships we have with various insurance specialists.

Many of them have been featured on The Guided Retirement Show or the Modern Wealth Management Educational Series. Check out the following interviews that Dean has done to get a glimpse of what the insurance specialists we work with can bring to the table.

- ABCs of Medicare with Tom Allen

- Mortgage Tips for Different Phases in Life with Tim Kay

- The Ins and Outs of Property and Casualty Insurance with Sarah Askren

6. Estate Planning Relationships

Just as it’s critical to consider your spouse when claiming Social Security, it’s even more important to consider your heirs and where your money will go when you’re no longer here. That requires estate planning, or what we like to call, “family financial planning.” One thing we’re very thankful for at Modern Wealth is to be working with the third and fourth generations of some families. That type of trust is only achieved through family financial planning, and that trust makes it easy for us to come to work every day.

In addition to his role on the insurance side, Bill meets with our clients and their advisor to discuss their estate planning needs. He then coordinates meetings with estate planning attorneys to try to ensure that our clients’ estate planning needs are met. The relationships we’ve built with various estate planning attorneys are yet another retirement planning resource that we’re proud to offer.

7. Our Industry-Leading Financial Planning Tool

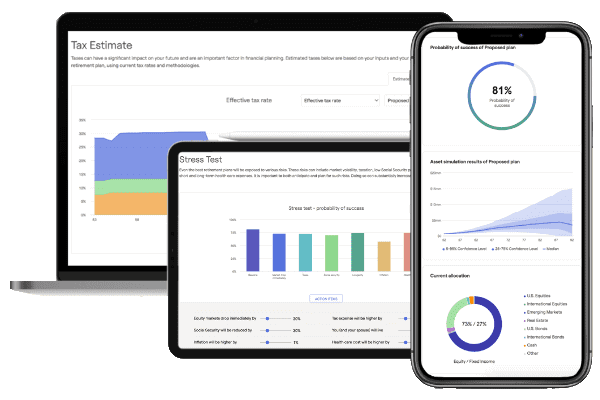

Whether you used our financial planning tool to begin building your financial plan before becoming a Modern Wealth client or you’ve watched your advisor use it during a meeting, you’ve likely seen some of the unique things our tool can do. If you haven’t used it and have just been using a retirement calculator that gives you quick answers, there’s so much you’re missing out on.

Take a moment to think about this list of things that retirement calculators miss (that our tool doesn’t). These are some very important items that our financial planning tool factors into your plan. If your current plan isn’t accounting for these things, it’s largely inadequate and shouldn’t be relied on as accurate.

- Insurance

- Current Tax Rates Sunset in 2026

- Debt Modules and Calculators

- Medical Expenses

- Social Security

- Inflation

- Required Minimum Distributions

- Your Asset Allocation and Potential Returns

- Your Personal Goals for Retirement

Building a Plan That’s Unique to You

We’re going to go over a few of those points more in depth as we review our other retirement planning resources. But first, we want to share a few more intricacies of our financial planning tool. When starting the retirement planning process, there’s one question that people want to know the answer to: How much do I need to retire? Well, our experience shows that there’s a lot more that goes into answering that question than you might think.

One thing you’ll quickly realize by using our financial planning tool is that you need a personalized financial plan that’s based on your situation, goals, and objectives. It shouldn’t resemble someone’s plan that you might be close to. No matter how similar to them you are, your financial plan will fail if you try to go off your friend or family member’s plan. Remember, everyone’s situation is different—no matter how similar they may seem at the surface. Your plan is YOUR plan.

Information to Include in Our Financial Planning Tool

In our financial planning tool, you’ll be asked to include the following information.

Your Family Profile: Add your family members and pertinent details such as ages, residence(s), and retirement dates.

Salary and Other Income: Enter you and your spouse’s salaries, Social Security benefits if you and/or your spouse have started claiming it, and any other income sources.

Your Savings: Include specific amounts for you and your spouse’s retirement savings—your 401(k)s, IRAs, cash, etc.

Link Your Accounts: Link your banking, investment, and insurance accounts as well as credit cards, loans, and any other assets.

Your Expenses: Enter your family’s general monthly expenses (not including mortgage or insurance premiums).

Your Goals: This might be listed last, but it’s arguably the most important step. What does your money need to do for you for and your spouse to accomplish your needs, wants, and wishes? What do you want your retirement lifestyle to look like?

What’s Your Probability of Success?

Once you complete that information, our financial planning tool will rate your plan’s probability of success. The target range you should be shooting for on your plan’s probability of success is in the 75-90% range. You’re probably asking, why not 100%? Good question. Here’s why.

If your plan has a 100% probability of success, you’re overfunded. You’re likely doing one (or two or all three) of the following: saving too much, not spending enough, or taking on unnecessary risk. If your plan’s probability of success is well below that ideal range, you likely are on the opposite end of the spectrum of those three things.

We’re going to emphasize it again later, but the retirement planning process doesn’t end once you get in that ideal probability of success range. You’ll need to update your plan over time because your life and everything in it isn’t just going to stay the same throughout your retirement. Let’s run through a couple of scenarios that you could encounter during retirement and explain how our financial planning tool comes into play.

Stress Testing Your Plan

Scenario 1: You want to pay for you a family vacation with your children and grandchildren. However, you’re worried about still being OK in retirement after paying for it due to the high inflation we’ve experienced. If you’re not working with a CFP® Professional and don’t have a financial plan, chances are that you’re either going to delay taking the trip, cancel the trip completely, or take the trip but then be fearful of spending very much afterward.

Well, go back up to our list of things that retirement calculators miss (that our tool doesn’t). Inflation is on there. Our advisors will stress test your plan against other time periods where we’ve experienced high inflation, a prolonged bear market, and other negative economic trends during your retirement. So, have your advisor put that family vacation into your plan and see what it does to your probability of success. Since the possibility of those various negative conditions have already been considered, the probability of success MAY only move one or two percentage points. You won’t know though until you have plan and can make these adjustments to see the outcomes.

Scenario 2: Your spouse suddenly becomes ill and will require a long-term care stay. A long-term care stay obviously won’t be on your goals list when you’re completing your plan. However, the possibility of you or your spouse requiring one is another thing that our advisors stress test for. If that scenario or some other health issue does surface, let your advisor know. We’ll make sure that your focus can remain on your spouse’s health and we’ll look at what spending adjustments, if any, need to be made to your plan.

Coming Soon

To stay true to our firm’s name, we’re continuously looking for ways to enhance the financial planning experience for our clients. That being said, we are currently vetting opportunities to provide better clarity on things like health care, Medicare, and more. Dean frequently shares how taxes and health care are the two biggest wealth-eroding factors in retirement, so this is something we’re looking forward to sharing with you as another helpful retirement resource. We’re excited to share more details with you soon.

Are You Using These Retirement Planning Resources?

If you’re not a Modern Wealth client, does your advisor share retirement planning resources and education with you? Do they show you a probability of success for your retirement plan with the resources and goals you have? Or do they even talk about them at all? That would be a red flag that you might be working with an investment advisor or a financial salesperson.

Our team of financial professionals puts our clients’ interests ahead of our own. That’s the philosophy across the board for our CFP® Professionals, CPAs, and specialists in estate planning, investments, and risk management. Hopefully, you’re already understanding that that’s the case with all these retirement planning resources that are available to you.

Now that we’ve reviewed our retirement planning resources, we want to show you what they can do for you. It’s time to build your financial plan from the comfort of your own home and figure out your plan’s probability of success using our financial planning tool. Click the “Start Planning” button below to begin building your personalized financial plan.

What Questions Do You Have About Our Retirement Planning Resources?

There’s no cost or obligation to using our financial planning tool, so even if you’re second guessing yourself about starting to plan for retirement, this is a great place to start. And if you’re second-guessing yourself about anything in the retirement planning process, that’s OK!

Our team of professionals is here for you to ask whatever questions that are on your mind. You can ask those questions during a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone—it’s whatever is easiest for you. We hope that our retirement planning resources can help you in your journey to and through retirement. Let’s get started by building a plan that gives you more of the confidence, freedom, and time in retirement.

Resources Mentioned in This Article

- Meet Modern Wealth Management

- DIY Retirement Planning: What Can Be Overlooked

- Components of a Complete Financial Plan with Logan DeGraeve

- Ed Slott – In Studio

- What Is Tax Planning?

- Tax Planning During Tax Preparation Season with Corey Hulstein

- Tax Rates Sunset in 2026 and Why That Matters

- What Are Tax Brackets?

- Tax Planning Strategies with Marty James

- Claiming Your Social Security

- Couples Retirement Planning: What You Need to Know

- Maximizing Social Security Benefits

- Another Tech Bubble in 2023

- 8 Ways to Prepare for a Recession

- Investment Risk in 2023 with Garrett Waters

- ABCs of Medicare with Tom Allen

- Mortgage Tips for Different Phases in Life with Tim Kay

- The Ins and Outs of Property and Casualty Insurance with Sarah Askren

- Family Financial Planning with Matt Kasper

- 9 Items That Retirement Calculators Miss (That Our Tool Doesn’t)

- How Much Do I Need to Retire?

- The Guided Retirement System

- What Is a Monte Carlo Simulation?

- Starting the Retirement Planning Process

- Planning a Large Family Vacation

- 10 Ways to Fight Inflation in Retirement

- Stress Testing Your Financial Plan

- When Will the Bear Market Be Over?

- Rising Long-Term Care Costs

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.