Stress Testing Your Financial Plan

Key Points – Stress Testing Your Financial Plan

- How Do You Go About Stress Testing Your Financial Plan?

- What Types of Risk Do You Need to Stress Test for?

- Doing a Monte Carlo Simulation

- Understanding Your Plan’s Probability of Success

- 6 Minutes to Read | 24 Minutes to Watch

What Do We Mean by “Stress Testing Your Financial Plan?”

How do you know if you can withstand a market downturn, substantial unexpected expenses, or income reduction in retirement? Those are all things that can cause a lot of financial stress, especially when you’re no longer receiving a paycheck in retirement. That’s why it’s so critical to have a forward-looking financial plan that has been stress tested through various economic conditions so you can get to and through retirement with clarity and confidence.

Dean Barber and Bud Kasper, CFP®, AIF® are going to help us explain how we go about stress testing someone’s plan. We’ll identify different types of risk that are important to plan for as you’re stress testing your financial plan and how to know if you have a successful plan.

Schedule a Meeting Get the Retirement Plan Checklist

Stress Testing Your Financial Plan Requires Financial Planning Software

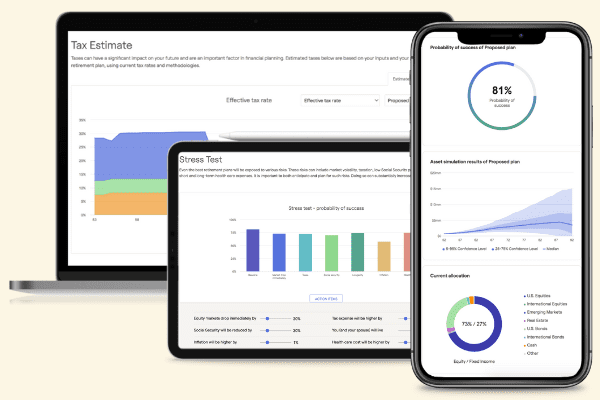

Before we outline how a financial plan is stress tested, it’s important to understand that this isn’t something that anyone can do on a typical calculator or with back-of-the-hand math. Stress testing requires financial planning software that’s typically used by financial professionals.

We provide a unique opportunity by making our industry-leading financial planning tool available to the public so that anyone can begin building their own financial plan. We believe it’s important for people to see what needs to be considered throughout the financial planning process as they’re building their plan. But again, keep in mind that this tool is designed for professional use. Click the “Start Planning” button below to begin building your personalized financial plan.

How Do You Know If You Have Enough?

As you’re stress testing your financial plan, the question you’re really wanting to know the answer to is if you’ll have enough to get to and through retirement. Our goal is to build you a plan that allows you to achieve your objectives in retirement while taking on the least amount of potential risk.

“If you don’t have financial plan that has been vetted through a CFP® Professional, CPA, risk management professional, and estate expert, you don’t really have a plan. You may have some semblance of a plan, but it’s not one that can really be stress tested through all the different environments.” – Dean Barber

Monte Carlo Simulations

As our advisors stress test your financial plan, our financial planning tool runs something called a Monte Carlo simulation. Monte Carlo simulations run thousands of different iterations and situations against your retirement plan. That simulation will give you a probability of success percentage for your plan to get you to and through retirement.

The ideal probability of success is typically between 75%-90%. If you’re thinking, “Why wouldn’t I want it to be 100%?” let us explain. If you’re probability of success is 100%, that means you’re saving too much, not spending enough, or not taking on enough much risk.

Let’s go through a quick example and say that you have a 90% probability of success. That means that 90% of the time, you can achieve your objectives in retirement without needing to change your spending. But what about the other 10% of the time? That doesn’t mean that 10% of the time that you’ll be sunk in retirement. It means that 10% of the time, you might need to slightly adjust your spending for a little while or consider trade-offs.

Types of Risk to Stress Test for in Your Financial Plan

Now that we’ve explained how stress testing your financial plan works, let’s review a handful of key risk factors that you need to stress test for in your financial plan.

1. Market Volatility

We’ve certainly experienced more than our fair share of market volatility over the past couple of years. People that retired at the end of 2021 without a financial plan likely experienced a lot of financial stress right away in retirement.

Having double digit negative returns in stocks and bonds in 2022 wasn’t exactly a pleasant surprise. It can be tempting to put all your eggs in one basket if certain stocks, bonds, etc. are doing exceptionally well. That isn’t advisable, though, especially given the heightened market volatility we’ve experienced over the past couple of years. Remember that while market volatility can be uncomfortable, it’s not uncommon. That’s why it’s critical to spread your assets across different asset classes to hedge against market risk.

Stress Testing Against Prolonged Market Downturns

When we build financial plans, we stress test back through decades of previous market cycles to ensure that you can sustain prolonged market downturns in retirement. Some periods we frequently look back to are the early 1980s when inflation was considerably higher than it was during the summer of 2022, the Dot-Com Bubble, and the Great Recession.

Have the past couple of years been exactly like those periods? No. But there have been some similarities. How could events like that impact your income and savings as you’re preparing for retirement? Stress testing your financial plan back to those periods can help you see if your plan can survive similar scenarios if they were to happen again.

Stress testing your plan against different risk factors is something that we cover in our Retirement Plan Checklist. It’s a 30-question checklist that also includes an age-based timeline of things to consider as you’re approaching and going through retirement. Download your copy below!

2. Interest Rate Increases

Along with being mired in a prolonged market downturn throughout 2022, we also had to deal with rapidly rising interest rates. That bled over into 2023 as well. The Fed Funds rate was at or near 0% for nearly 15 years until the Fed began raising rates in March 2022. The Fed Funds rate is now in the 5.25%-5.5% range, and rates are expected to remain higher for longer. We haven’t experienced a Fed funds rate that high since right before the Great Recession.

People that were able to get 3% or lower on a 30-year fixed mortgage before this rising interest rate cycle are likely feeling much better than people that are trying to get a 30-year mortgage at 7% or so. The last time we saw mortgage rates this high was right before the Dot-Com Bubble. It has dropped from 7.79% in late October to 7.29% currently, so that could lead to some homebuyers wanting to get back to the market. If you have the itch to jump back in, make sure to stress test your financial plan first.

3. There’s Bad Debt and Good Debt

It’s a goal for a lot of people to go into retirement debt free. It’s a good goal to have, but keep in mind that there’s bad debt and good debt. If someone can’t pay for basic necessities in cash and needs to put it on a credit card, that’s bad debt. That’s not a situation you want to be in going into retirement. Whether it’s refinancing to get a lower interest rate or shortening the timeframe to pay off debt, don’t let rising interest rates get the best of you.

There’s also good debt. Mortgages with low interest rates are the primary example of good debt. So, if you’re one of the people that has a mortgage rate in the 3% range or lower and are heading into retirement, that’s not debt that will derail your retirement.

4. Unexpected Expenses

Maybe you’re not necessarily looking to buy a new house but are still needing to make some costly home renovations, such as a new roof or HVAC system. We never know when those unexpected expenses will arise, but they need to be planned for.

Unexpected expenses can take many different shapes or forms. They can include market downturns and rising interest rates, which are out of your control. But again, you can still plan for them by stress testing your financial plan.

Some of the most common and most expensive unexpected expenses are health care costs. Does your current health insurance effectively cover your health care needs? Health-related risks can turn your life (and your spouse’s life) upside down in a hurry, so it’s critical to be properly insured.

And obviously health insurance is just one example. It’s important to review your life insurance, property and casualty insurance, long-term care insurance, homeowner’s insurance, car insurance, and various other insurance coverages.

5. Losing Your Job

Obviously when you retire, you have the understanding that you’ll no longer be receiving a paycheck from your employer. But what if you’re approaching retirement and are suddenly laid off or have your income reduced? The same question goes for your spouse.

Losing your job can tie right in with unexpected expenses because it still puts a dent into your cash flow. In the event that you or your spouse loses your job prior to retirement, having emergency funds are obviously crucial. How much you need to have in emergency funds will on your lifestyle, expenses, and many other variables. Typically, it’s recommended to have at least three to six months’ worth of emergency savings.

6. Miscellaneous Unique Risk Factors

Everyone has different feelings toward different types of risk. So, stress testing your financial plan isn’t going to look the same as it will for your best friend, neighbor, or sibling. If there are personal risk factors that you think could impact your retirement cash flow, let your advisor know so you can stress test against them and plan accordingly.

“A plan for me is going to be different than a plan for you. It’s just the nature of what it is. We need to take into account all the factors that are related to your specific situation.” – Bud Kasper, CFP®, AIF®

Stress Testing Your Plan Isn’t a One-and-Done Thing

Stress testing your plan is crucial as you’re preparing for retirement, but don’t just think that you won’t need to stress test your plan anymore after you’ve retired. Your life is going to change through retirement. So are the markets and many of the other risk factors we’ve mentioned.

“What could destroy your plan? It could be higher inflation, the premature death of a spouse, a spouse needing intensive long term health care, a poor stock market, rapidly rising interest rates, a recession, some sort of geopolitical conflict, wars. All kinds of things could get in the way. We’ve seen all these things people should be stress testing for.” – Dean Barber

If you have new goals that you want to accomplish in retirement, add them to the plan and stress test it to see if your probability of success drastically changes. Let’s make sure that your plan is allowing you to accomplish your goals while taking on the least amount of risk.

If you want to learn more about how to go about building your financial plan and how to stress test it, let us know. To go through whatever questions you have about stress testing financial plan, start a conversation with us here.

We hope this article has helped to illustrate the importance of having a plan and regularly stress testing it as your circumstances change. Let’s build a plan that can give you more confidence that you’re doing the right things with your money, freedom from financial stress, and more time to spend doing the things you love.

Stress Testing Your Financial Plan | Watch Guide

00:00 – Introduction

01:32 – What Is Stress Testing?

07:30 – Stress Test for Higher Inflation

08:17 – Longevity Risk & Long-Term Care Risk

12:00 – Stress Test for Higher Taxes in the FUTURE

13:44 – Stress Testing to Stay on Track

17:27 – Roth Conversions

18:51 – What We Learned Today

Articles

- Richcession or Recession: Where Are We Heading?

- Components of a Complete Financial Plan with Logan DeGraeve

- How Much Do I Need to Retire?

- What Is a Monte Carlo Simulation?

- 2022 Was Unusual for Bonds, Tough on Stocks

- Investment Risk in 2023 with Garrett Waters

- Dot-Com Bubble History Remains Relevant

- The Great Recession’s History Remains Relevant

- Bond Yields Keep Rising

- The Difference Between Good Debt and Bad Debt with Logan DeGraeve

- The Ins and Outs of Property and Casualty Insurance with Sarah Askren

- Talking to Your Spouse About Money

- Why You Need a Financial Planning Team

Past Shows

- Unexpected Expenses and How to Plan for Them

- Planning for Uncertainty in Retirement

- Financial Stress: How Do You Deal with It?

- Asset Allocation vs. Tax Allocation

- 10 Ways to Fight Inflation in Retirement

- The Effect of Rising Interest Rates on the Economy

- Retiring with Debt: What’s OK?

- Retiring Before 65: What You Need to Consider

- Couples Retirement Planning: What You Need to Know

- Life Insurance in Retirement: Do I Still Need It?

- 5 Long-Term Care Questions to Ask

- Retirement Cash Flow: What You Need to Know

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

Downloads

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.