How Much Do I Need to Retire?

Key Points – How Much Do I Need to Retire?

- “How Much Do I Need to Retire?” Is a Straightforward Question with a Not-So-Straightforward Answer

- “How Much Do I Need to Retire?” Shouldn’t Be the First or Only Question You’re Asking While Planning for Retirement

- The Rules for Retirement Planning Change as You Get Closer to Retirement and When You’re in Retirement

- A Forward-Looking Approach Is Critical to Determining How Much You Need to Retire

- 12 Minutes to Read

The Question Everyone Wants an Answer to: How Much Do I Need to Retire?

When pre-retirees meet with our advisors for the first time, it’s no secret that there’s one question that they’re all looking for an answer to. Sometimes they have a host of other questions leading up to that one question. But there are also way too many times where it’s the first and/or only question that they’re asking our advisors. That question is, how much do I need to retire?

Our advisors’ jobs would be a lot easier if “How much do I need to retire?” was the only question that needed to be answered for pre-retirees. However, that’s far from the case. That popular question has been asked in a few different ways as well. Sometimes it’s a bit more long-winded: Do I have enough money to do all the things that I want to do without being fearful of running out of money? And other times it’s even shorter and sweeter: Am I going to be OK?

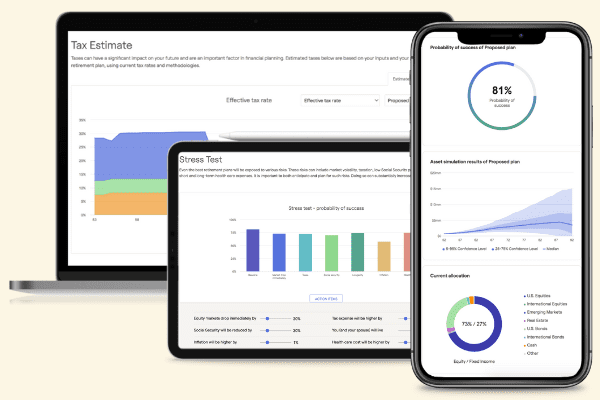

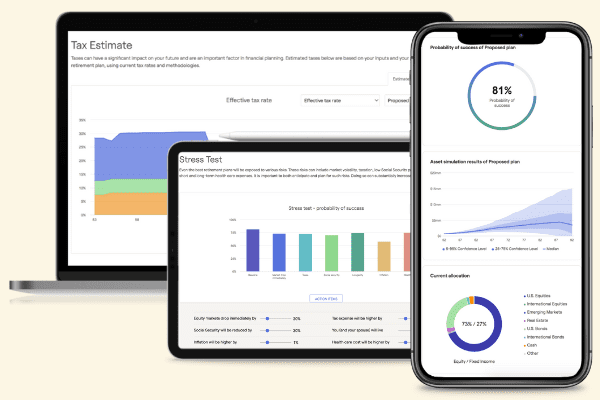

No matter how you ask that question, you won’t get a concrete answer without having a financial plan. We’re going to review some questions that you should ask yourself before “How much do I need to retire?” Those questions will show that planning for retirement is comprehensive in nature with a lot of moving parts. The way you put all those parts together could be entirely different from your friends or family members. You can begin to see the big picture of your retirement by using the same industry-leading financial planning tool that our CFP® Professionals use. Test out our financial planning tool from the comfort of your own home by clicking the “Start Planning” button below.

Do You Remember Our Retiring with $1 Million Video?

Before we get to some of the other questions to ask first, let’s go to a place where we have all gone searching for answers. Do a quick Google search for “How much do I need to retire?” and here’s the first thing you’ll read.

“Retirement experts have offered various rules of thumb about how much you need to save: somewhere near $1 million, 80% to 90% of your annual pre-retirement income, 12 times your pre-retirement salary.”

You might remember that about a year ago, we produced a video titled, Retiring with a $1 Million. In that video, we reviewed what retiring with $1 million would look like for four different couples. Those couples (the average couple, investing couple, ideal couple, and unicorn couple) all had exactly $1 million saved and the same earnings history, so their Social Security was the same.

However, just because they all had $1 million saved doesn’t mean that they all had enough to retire. Let’s face it. The lifestyle that you want to live in retirement isn’t going to be the exact same as anyone you know. The answer for how much you need to retire is contingent on your desired retirement lifestyle.

What Are Your Needs, Wants, and Wishes in Retirement?

It might sound cliché, but if you’re going to figure out how much you need to retire, you need to have an idea of what’s important to you. That’s what the first step of our Guided Retirement System is all about so our CFP® Professionals can help you achieve your retirement goals. Here’s what CFP® Professional Logan DeGraeve had to say about the importance of that last spring.

“We need to understand how you think and feel about money, what’s important to you, and what that money needs to do for you,” Logan said. “You only need to take as much risk as you need to accomplish your goals. If you ask me, ‘What should I invest in?’ the first time you meet me, my answer will be, ‘I don’t know. I don’t know anything about you.”

So, before you get too focused on what to invest in or how much you need to retire, forget about the numbers for a minute. During the discovery meeting within our Guided Retirement System, a CFP® Professional takes you (and your spouse, if applicable) through a prioritization exercise. Of course, we’ll want to calculate your basic needs into how much you need to retire, but we want to know your wants and wishes as well.

Before we review more core components of retirement planning, you can also gauge your retirement readiness with our Retirement Plan Checklist. Along with a 30-item checklist, the Retirement Plan Checklist has an age-based timeline of things to keep in mind while you’re approaching and going through retirement. You can download the Retirement Plan Checklist below.

Download: Retirement Plan Checklist

Setting Up a Spending Plan

Once your needs, wants, and wishes have been outlined, it’s time to set up a spending plan to accomplish your retirement goals. That spending plan is built to answer that question of how much you need to retire in two parts. The first part of the spending plan involves figuring out how much you need to get to retirement. The rules change for the second part of it, as you’re trying to get through retirement.

When you’re planning for retirement, think about the things you’re spending now and how you’re paying for them. Would you be comfortable spending the same amount each month in retirement as you are while you’re still working? If you immediately answered yes and think you’re well on your way of determining how much you need to retire, let’s pause for a minute.

When you retire, your money is suddenly working for you (with what you’ve saved in 401(k)s, IRAs, etc.) rather than you working for you money. The closer you get to retirement, the more likely that your 401(k) and IRAs are your biggest assets. We’ll get into those more shortly, as they’re clearly crucial components in figuring out how much you need to retire.

You’re also going to have a lot more time on your hands when you retire. Are you going to spend that time by traveling more, volunteering, caring for your grandchildren, or maybe all of the above? That list of things to do in retirement can go on and on, but these are your wants and wishes we’re talking about. It’s a long list that you don’t mind the challenge of crossing everything off.

Your Biggest Expenses in Retirement

However, things such as longer and more extravagant trips tend to have a heftier price tag than trips during your working years. If you’ve done a good job of saving so you can travel or embark on other retirement goals, that’s great. But there are some new expenses in retirement that you can’t ignore when asking yourself, “How much do I need to retire?”

Don’t Let Uncle Sam Become Your Retirement Travel Partner

First, you must remember that taxes can become an even bigger part of your life in retirement. While saving into your 401(k) or IRAs is great during your career, you won’t be seeing all that money in retirement. Uncle Sam is going to get his share as well. So, if you think you might align with one of the couples in the Retiring with $1 Million video because you and your spouse have a combined $1 million saved in your 401(k)s or IRAs, it’s important to know that you don’t actually have $1 million.

With taxes being one of the biggest expenses for retirees, there’s good reason why our firm focuses so much on tax planning. We’re not talking about tax compliance here. Tax planning involves not just mitigating as much as possible in one year, but over your lifetime. Tax diversification is critical when it comes to tax planning, especially in retirement. If you’ve just been saving into a traditional 401(k) during your career, all your savings will be tax-deferred. That leads to less flexibility to use your savings in a tax-efficient manner in retirement. And that’s why our Lee’s Summit Office President, Bud Kasper, is such a big proponent of the Roth.

“People want to keep it simple. When their company gives them a 401(k) plan, they logically think that is the way that they’re going into retirement.” Bud said. “But what if these companies aren’t providing the Roth option? And what if they’re not thinking through the earlier part, when it’s generally better to use a pre-tax method as opposed to after-tax?”

To learn more about how to optimize your 401(k) for retirement, check out our 401(k) Survival Guide below.

Download: 401(k) Survival Guide

Tax Rates Will Be Going Up in 2026

With the Roth option, you’re paying those taxes up front when making the contributions and have more flexibility with your retirement savings. What’s more, is that we need to keep the current and future tax code in mind when asking how much you need to retire. The tax code is terribly complicated, but one key takeaway is that tax rates will be sunsetting back to the 2017 rates after 2025. Once the Tax Cuts and Jobs Act sunsets in 2026, we’ll have higher tax rates than we do right now.

So, whether you’re thinking about contributing to a Roth 401(k) or doing a Roth conversion, keep in mind that it might be in your best interest to do so now while you’re in a lower tax bracket. By doing Roth conversions, you can also avoid starting Required Minimum Distributions at 72. That is one of a few ways to mitigate taxes and decrease that amount that you need to retire.

To explore other ways to pay as little tax as possible over your lifetime, review our Tax Reductions Strategies Guide.

Download: Tax Reduction Strategies Guide

Health Care Expenses

Along with taxes, health care is typically one of the biggest expenses for retirees. If you want to retire before 65 (Medicare age), have you explored the market place or what COBRA offers? Whether you’re waiting until you’re on Medicare or not, health care coverage can often be dismissed by people who have lived a healthy lifestyle. We would love nothing more than to see that healthy lifestyle continue well into retirement. But either way, health care is a massive component when determining how much you need to retire. Let’s review a couple of different scenarios.

Living Past Your Life Expectancy

As we just mentioned, our whole Modern Wealth Management team hopes that you live a long, happy, and healthy retirement. If that’s the case, hopefully you won’t ever be knee deep in medical bills. But what if you live past your life expectancy? That question has deep meaning to it for Dean Barber, and led to our firm being founded.

Dean remembers his grandfather telling him that he was planning to live until he was 76 because that’s how long his father lived. While Dean was glad he got to spend more time with his grandfather, he ended up living until he was 86. That meant that he had to live the last few years of his life with Dean’s mom because he had saved enough just to live until 76.

To ensure that the same thing doesn’t happen to any Modern Wealth Management clients, Dean says it’s important to plan for a longer life expectancy than what you might think.

“More time does put more stress on the plan itself. But if you can live to 95 or 100 and your plan says you’ve can have enough money to do that, that’s great,” Dean recently said on America’s Wealth Management Show. “If you do live a shorter time despite having that longer life expectancy factored into your plan, you’re just going to leave more money to your beneficiaries or to your surviving spouse. That obviously helps them after you’re gone.”

When Health Care Can Truly Wreak Havoc on Your Plan

While living longer than your life expectancy can put you in a financial bind, it pales in comparison to falling well short of it. Dean has told a few stories on America’s Wealth Management Show about when someone has met with him and told him that their doctor said they’re in great health, but then they pass away very unexpectedly shortly thereafter. Of course, that’s about as heartbreaking as it gets, as so many retirement goals were unfulfilled.

And sadly, there’s more havoc that tends to follow when something like that happens. The surviving spouse suddenly becomes a single tax filer. We’ll discuss the role that Social Security claiming strategies play in determining how much you need to retire momentarily, but the Social Security benefits are directly impacted by this situation as well.

“Like we talked about with setting up a spending plan, what happens if your spouse passes away? We know that the smaller of the two Social Security checks is going to go away,” Will Doty said in a Modern Wealth Management Educational Series event titled, Maximizing Social Security Benefits. “That’s why you think about the widow’s benefit before making that claiming decision. It’s not just about yourself. It’s about both spouses and we want to understand those dynamics.”

What About a Long-Term Care Stay?

In a perfect world, you and your spouse will pass away around the same time so neither of you has to deal with grief and too much financial fallout. Unfortunately, that doesn’t always happen, though. One spouse might live a long healthy life, while the other passes away earlier than expected and/or have a long-term care stay. The possibility of a long-term care stay(s) also needs to be factored in when asking yourself how much you need to retire. Let’s go back to Will again for some background on that.

“Maybe the current expenses are higher than normal or you or your spouse has a stay in a long-term care facility than longer than normal for that age. You want to make sure that the surviving spouse is going to be OK financially,” Will said in a Modern Wealth Management Educational Series event titled, Setting Up a Spending Plan for Retirement. “For example, if I’m 80 and plug into my plan that I’m going to end up in a long-term care facility for three years for an extra $120,000. Is my wife going to be OK financially until she’s 95 if that’s the case? Understanding that dynamic of the plan is important.”

Taking a Deeper Dive into Social Security

Speaking of life expectancy, let’s talk more about Social Security now. There are roughly 500 iterations of how to claim Social Security for the average 62-year-old couple right now. The difference between the best and worst claiming strategies for them can be tens or hundreds of thousands of dollars. And that’s a big deal since Social Security can oftentimes be the largest source of income for retirees.

Social Security is also tax-free by itself, but many people don’t realize that changes when other income sources are factored in. Your mood in retirement can change in a hurry if up to 85% of your Social Security becomes taxable.

Social Security is also another reason why stress testing your financial plan is so important. Maybe it works best for you to claim at 62, but your spouse should wait until 70? Or vice versa? You can other key points to consider about Social Security by reviewing or Social Security Decisions Guide below.

Download: Social Security Decisions Guide

Don’t Forget About Inflation When Asking, “How Much Do I Need to Retire?”

As we’ve explained with Social Security, taxes, health care, and setting up a spending plan, so much of retirement planning involves a forward-looking approach. Inflation is yet another reason why that forward-looking approach is crucial. Up until about 18 months ago, inflation might have seemed like a foreign word to some people. Our CFP® Professionals have seen that first-hand with how some people have thought about factoring inflation into their plan. Let’s just say that a 2% inflation rate across your whole plan won’t lead to a high probability of success.

The past year and a half has shown us why that won’t work. After being nearly non-existent for years, inflation is up close and personal with us right now at more than 9%. With back-to-back 75 basis point hikes, the Federal Reserve is trying to get inflation back in check. They had hoped to achieve a soft landing (slowing inflation with causing a recession), but after back-to-back quarters of negative GDP, we’re technically in a recession.

What Is and Isn’t in Our Control?

A recession, inflation, and rising interest rates have been some of the main ingredients of the recipe of uncertainty that we’ve had in 2022. Inflation, interest rates, the tax rates we mentioned earlier, and market volatility are all retirement risks that our out of our control. But remember, you can still plan for all those risks so that you aren’t feeling as uncertain about your financial life as those who don’t have a financial plan.

Let’s stay on the topic of inflation just a bit longer before we wrap up. When accounting for inflation in your financial plan, all your expenses shouldn’t be inflated at the same rate. For example, the health care expenses we discussed earlier should have a higher inflation rate than other living expenses. At Modern Wealth Management, we use about a 4% inflation factor for non-health care expenses and 7% for health care expenses. Again, even if you’ve lived a healthy life to this point, anything from prescriptions to long-term care stays are far from cheap. Having a higher inflation rate for health care expenses in your plan can at least ease the pain in your wallet while you’re battling what’s ailing you.

The Bottom Line: You Need a Financial Plan to Determine How Much You Need to Retire

If you started reading this article and thought you might get an exact number on how much you need to retire, we hope you understand now why that getting the answer is not that simple. This article is just a brief overview of what to think about when determining how much you need to retire. With all those things fresh in your mind, we encourage you to learn about how they apply to specifically to you by utilizing our financial planning tool. By clicking the “Start Planning” button below, you can take another step in determining how much you need to retire.

We’re Here to Answer Any Questions

It’s important to know that our financial planning tool is intended to be used by financial professionals. So, if there’s something that you’re struggling to understand, there’s no need to feel bad. This is complicated stuff. If you have any questions about how much you need to retire or how to use our financial planning tool, you’re more than welcome to contact us.

You can ask us your questions by scheduling a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals. They can meet with you in person or during a virtual meeting and screen share with you while using our financial planning tool. They’re looking forward to the opportunity to help you figure out how much you need to retire.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.