How Our Financial Planning Tool Works

So, you’re curious how our financial planning tool works? That’s great! Below, we’ll go through the steps of creating your account and inputting the necessary information to get you started. The tool then analyzes your plan and shows your plan’s probability of success.

What Is in Our Financial Planning Tool?

Before we begin, below is a quick video about our financial planning tool.

Getting Started

To begin the sign-up process, follow this link.

Step 1: Your Family Profile

In this section, you will add your family members and include information like ages, retirement dates, and residence.

Step 2: Salary and Other Income

Next, you will add any pertinent details, such as you and your spouse’s salaries, Social Security, and other income sources.

Step 3: Your Savings

Here, you will enter your and your spouse’s retirement plan savings. This includes 401(k)s, IRAs, cash savings, and more.

Step 4: Link Your Accounts

Your next steps include linking bank accounts, investment accounts, credit cards, loans, other assets, and insurance accounts.

Step 5: Your Expenses

You’re almost there! Please list your family’s general monthly expenses, not including mortgage or insurance premiums

Step 6: Your Goals

Finally, we reach arguably the most important step, which is adding goals to your account. For instance, those goals could include you and your spouse’s desired retirement age, charitable goals, potential monthly retirement expenses, estimated health care costs, and more.

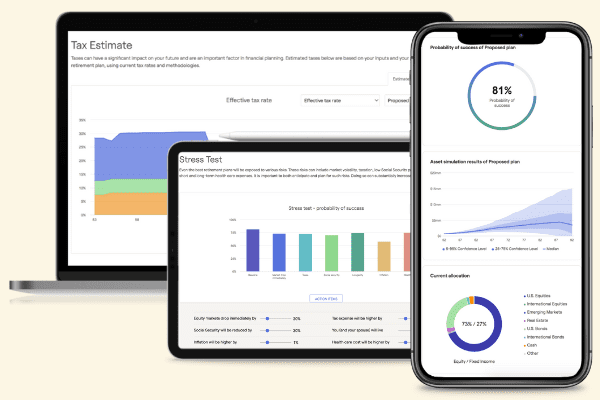

Assessing Your Plan’s Probability of Success

After you fill out your information, our financial planning tool then provides you with a preview of your plan’s probability of success. You can then review your plan and track your progress at your leisure.

Start Building Your Plan Today

We hope this walkthrough has been helpful and look forward to better understanding your personal goals for retirement. Get started today with our financial planning tool by clicking below.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.