9 Items Retirement Calculators Miss (That Our Tool Doesn’t)

Key Points – 9 Items Retirement Calculators Miss (That Our Tool Doesn’t)

- Retirement Calculators Take a Fast and Simple Approach, Which Can Lead to Complex Problems in Retirement

- How Our Financial Planning Tool Differs from Retirement Calculators

- Your Spending in Your Working Years Will Likely Be Much Different Than in Retirement

- Finding Out How You Think and Feel About Your Money

- 10 Minutes to Read

Our Financial Planning Tool vs. Retirement Calculators

This summer, we made our industry-leading financial planning tool accessible for all to use from the comfort of one’s own home. It’s the same financial planning tool that our CERTIFIED FINANCIAL PLANNER™ Professionals use with our clients, so they have seen its capabilities. Many of the things our financial planning tool covers goes beyond the scope of retirement calculators. We’ll explain why shortly, but once you’re ready to start building your plan, simply click the “Start Planning” button below.

Why We’re Making Our Financial Planning Tool Available to the Public

Our founder and CEO, Dean Barber, and the rest of our Modern Wealth Management team have seen countless occasions of where some people think they have retirement planning all figured out, but have been using a retirement calculator that didn’t cover some important things that didn’t even cross their minds.

“The online retirement calculators need to be dumbed down so much. They leave out so much detail that you’re never going to get the right answer for you,” Dean said. “You’ll get an answer that’s correct based on the data that you put in, but there’s so much data that still needs to be taken into consideration that most online calculators don’t account for. There’s a reason why we’re giving an opportunity for people to visit with one of our CERTIFIED FINANCIAL PLANNER™ Professionals so that they can get the right answers for them. It’s not supposed to be that simple and fast; it’s supposed to be accurate and provide clarity.”

Retirement Planning Needs to Be Comprehensive

It’s human nature for people to want the simple and fast answer. We illustrated that in our recent article, “How Much Do I Need to Retire?” Unfortunately, as Dean alluded to, a simple and fast approach to retirement planning can be a recipe for disaster. And most retirement calculators function on that simple and fast approach.

To attain financial clarity leading up to and through retirement, retirement planning needs to be comprehensive. Let’s review nine of those comprehensive items that retirement calculators oftentimes miss (that our financial planning tool doesn’t miss) to help you live your one best financial life.

- Insurance

- Current Tax Rates Sunset in 2026

- Debt Modules and Calculators

- Medical Expenses

- Social Security

- Inflation

- Required Minimum Distributions

- Your Asset Allocation and Potential Returns

- Your Personal Goals for Retirement

1. Insurance

Drew Jones, CFP® Professional, was kind enough to lead the charge with putting together this list of items that retirement calculators can miss. First up on his list is insurance.

“First, a lot of those online retirement calculators aren’t factoring in insurance,” Drew said. “Am I over insured, under insured, self-insured? Do I have the right amount?”

At Modern Wealth Management, we’re fortunate to work closely with various insurance agents. We want to make sure that people understand how health insurance, property casualty insurance, etc. is a part of the retirement planning picture. Retirement calculators can miss that important aspect.

Along with factoring insurance into your retirement plan using our financial planning tool, we encourage you to educate yourself about all things insurance by listening a couple of our recent podcasts with some of the insurance agents who have joined us on The Guided Retirement Show.

- Navigating Health Care Costs in Retirement with Taylor Garner

- The Ins & Outs of Property & Casualty Insurance with Sarah Askren

2. Current Tax Rates Sunset in 2026

If you don’t like to look too far ahead and want to live in the moment, we get it. That’s a good way to approach a lot of things in life. But when it comes to taxes, you really need to look multiple years ahead into the future. It’s all about assessing what tax rate you’re at now compared to what tax rate you’ll be at in the future to pay the least amount in taxes over your lifetime. This is called tax planning, and it needs to be a critical component of your overall financial plan.

So, rather than just looking at your taxes for 2023 or even 2024, let’s look further down the road to a key change that will happen with the tax code. In 2026, the current tax laws of the Tax Cuts and Jobs Act will be sunsetting. That means tax rates will go back up to the rates we had in 2017. This is something that retirement calculators don’t account for that our financial planning tool does.

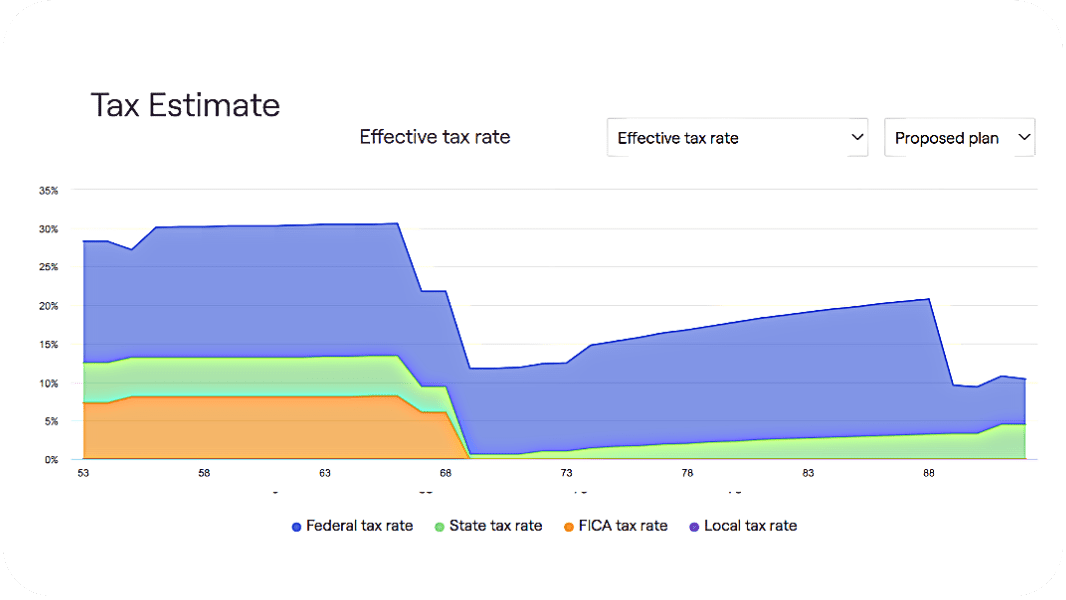

Our financial planning tool can stress test your plan to determine its probability of success in the future. It can do that by looking at things such as old tax rates to see how your plan would fair in different economic conditions. So, while retirement calculators won’t calculate how higher tax rates can impact your plan, we will with our financial planning tool. Here’s an example of what that might look like.

Download: Tax Reduction Strategies Guide

3. Debt Modules and Calculators

Next up on our list of items that retirement calculators don’t have are debt modules. Let’s go back to Drew to help explain why that’s a big deal.

“A lot of retirement calculators don’t have to debt modules,” Drew said. “When using our financial planning tool, you can see how much an interest you’re going to pay and your timeframe for paying that off If you just keep making the current payment. And what if you apply $100 to $200 more each month? What does that do to your pay off?”

Just like we mentioned with tax rates, this is another example of how stress testing with our financial planning tool can provide you clarity and confidence to your financial life. Being debt free is a great feeling, but why settle for that? With our financial planning tool, we can help you set up a spending plan for retirement. You start by looking at what your expenses are now. Then, you determine what your needs will be in retirement along with your retirement dreams. How much will that cost compared to your current expenses? Our financial planning tool can help with putting you on the right path, while a retirement calculator could miss an important factor of the equation.

4. Medical Expenses

Speaking of needs in retirement, medical expenses unfortunately fit that bill. They’re a necessity in retirement that our financial planning tool incorporates. Can the same be said for retirement calculators? Let’s ask Drew.

“A lot of retirement calculators don’t factor in medical expenses or long-term care stays into the plan,” Drew said. “Our financial planning tool does all that.”

During an episode of America’s Wealth Management Show, Bud Kasper and Logan DeGraeve outlined five different types of financial plans, and used a medical analogy in the process. They explained various ways of how not having a plan, a set-it-and-forget-it plan, an “average” plan, and a do-it-yourself plan can be problematic. Whenever our CERTIFIED FINANCIAL PLANNER™ Professionals see examples of those latter three plans, they aren’t surprised when they hear that a retirement calculator had been used.

Our financial planning tool utilizes a comprehensive planning approach that incorporates things like medical expenses and the other items on our list. Which brings us to Logan and Bud’s medical analogy. You should meet with a CFP® Professional and a CPA to go over your financial plan at least once a year, just as you would with a check-up at the doctor’s office. Our CFP® Professionals will account for different medical expenses, life expectancy, and other health care-related factors while reviewing your plan. The same thing can’t be guaranteed from most retirement calculators.

9 Items Retirement Calculators Miss (That Our Tool Doesn’t) on America’s Wealth Management Show

Most online retirement calculators miss crucial pieces of the retirement puzzle. While they will give an accurate answer for the data you put in, they’re missing so many other things important to retirement. Dean Barber and Bud Kasper review nine items retirement calculators miss that our tool doesn’t.

5. Social Security

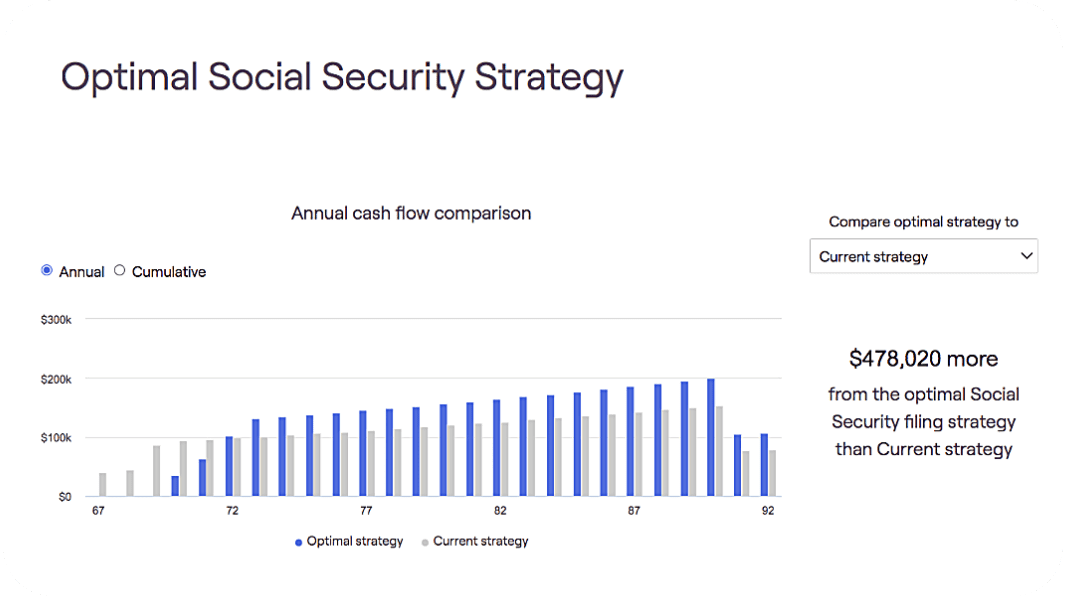

There are hundreds of different iterations in which you can claim Social Security. That goes far beyond the scope of retirement calculators, but not our financial planning tool. You can also assess how you should claim Social Security by downloading our Social Security Decisions Guide.

Download: Social Security Decisions Guide

6. Inflation

Just like we can’t seem to escape inflation anywhere we go in 2022, we’re not escaping it on our list of items that retirement calculators miss that our financial planning tool doesn’t.

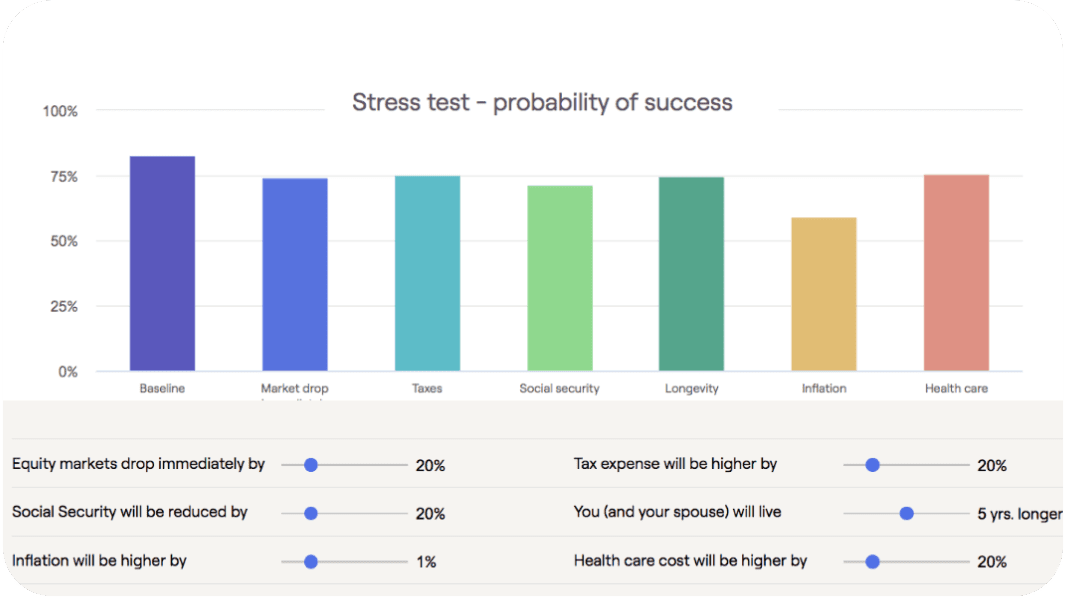

“Inflation is obviously on people’s minds right now,” Drew said. “So, you can use different stress tests for inflation, market drops, taxes, Social Security, longevity, higher health care costs. All that can be ran on our financial planning tool as opposed to those online calculators.”

Another thing that makes our CFP® Professionals cringe is when people come to them with a plan that only has a 1% or 2% inflation rate across the board. Prior to the past year, people might have thought that was a brilliant method. This year has proved that method can fail miserably.

With our financial planning tool, we typically use about a 4% inflation rate for common expenses. However, everything doesn’t inflate in the same nature. Take health care expenses for example. We inflate that at a higher rate than the common expenses, typically around 6% or 7%.

Not factoring in inflation can turn your plan upside down. So, don’t make the mistake of using a retirement calculator and dismissing inflation. Check out our financial planning tool to see for yourself how inflation rates within a financial plan matter.

7. Required Minimum Distributions

While we touched on tax rates sunsetting in 2026 earlier, let’s dive a little bit more into taxes on our list of items that retirement calculators can miss. Once you turn 72, you must begin to take Required Minimum Distributions from your traditional IRAs. So, what can you do before turning 72 to ensure that you’re not falling into a huge tax trap?

Well, RMDs are on our list of six reasons to consider Roth conversions, so we’ll start there. Converting traditional IRAs to Roth IRAs now also makes a lot of sense before tax rates go up after 2025. The relationship between RMDs and the Roth can get complicated, though, especially if you’re using a retirement calculator.

Our financial planning tool can help you see how much and when you should consider doing Roth conversions. Remember, we’re not just looking at your tax situation this year or next year. We want to ensure that you’re playing the least possible amount in taxes over your lifetime, not just in one year.

8. Your Actual Allocation and Potential Returns

If you’ve listened to America’s Wealth Management Show regularly over the past year, there’s a good chance you probably have heard Dean and Bud talking about asset allocation and rebalancing. This has a huge effect on whether people can be successful, and retirement calculators can often miss this.

For example, let’s say you started 2020 with a 60/40 allocation. That could have very well been a logical allocation for you. But then, COVID-19 hits and the market drops substantially. And then, there’s suddenly a rapid recovery with stocks thriving. By the start of 2021, you might have actually had an allocation of 75/25 where just a year ago you were at 60/40. This new 75/25 allocation may have put you at unnecessary risk if you didn’t rebalance. 2021 was a strong year, so if you started the year at 75/25 and you didn’t rebalance, then you likely ended up even more weighted in equities by the end of 2021.

The point is that if you stuck with that 60/40 allocation (or pretty much any allocation) for a long time without rebalancing, you were likely exposing yourself to way too much risk. There are a lot of factors that go into determining what your allocation should be, and many of them aren’t included in retirement calculators.

This is another scenario where stress testing your financial plan is crucial. There’s no doubt that we’ve seen an absurd amount of market volatility over the past year or so. While that has caused a lot of uncertainty among pre-retirees and retirees alike, the stress testing our CFP® Professionals have done have helped them see the big picture of their financial situation. For example, they have looked back a lot lately to other big market downturns, like the Dot-Com Bubble and Great Recession. That not only shows them how their financial plans would have fared back then, but it gives them a better perspective of how they need to position themselves financially going forward if this market downturn continues.

9. Your Personal Goals for Retirement

As we wrap up our list of nine items that retirement calculators can miss, we wanted to end it with arguably the most important item. When one of our CFP® Professionals meets with a prospective client for the first time, investments aren’t the first part of the discussion. First, we want to understand your personal retirement goals to understand the way you think and feel about your money.

“Our financial planning tool is a cash flow-based program, so it wants to know pre-retirement and retirement goals with your spending,” Drew said.

Learning about who the individual is and their goals for retirement before planning is a crucial step. Whether pre-retirees realize it or not, there’s a change of their state-of-mind as you approach and begin retirement. Your income and spending during your working years is different than in retirement. Maybe you want to travel more. We’ll put that special trip into the financial planning tool and see how it could impact your plan’s probability of success. A retirement calculator, on the other hand, won’t have a good idea about your personal retirement goals.

“One of the big issues with people who are using retirement calculators and trying to do this on their own is that they’re heading into an era of life that they’ve never entered before,” Dean said. “They’re wanting to see where they are in relationship to retirement readiness, but don’t realize that all the rules that they have followed to accumulate money are about to suddenly change. If they don’t understand how those rules change and what they need to be considering going into retirement, that’s where most people’s retirement plans fail.”

Make Sure You’re Not Missing the Items that Retirement Calculators Can Miss

If you happen to be a do-it-yourselfer when it comes to financial planning, we understand and respect that. Our goal here is to make sure everyone—whether you’re a client of ours or not—isn’t missing any of the nine items that we’ve reviewed that retirement calculators can miss. So, at no cost or obligation, we encourage you to click the “Start Planning” button below to check out our financial planning tool and ensure that you’re dotting all the I’s and crossing all the T’s during your journey to and through retirement.

As we stated early on in this article, our financial planning tool isn’t meant to be simple and fast. Retirement calculators will take that simple and fast approach, but look at all the things we listed that they could miss.

If you have questions about different components of our financial planning tool, please reach out to us. You can click here to schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CFP® Professionals. During that meeting, they can screen share with you while using the financial planning tool to help get your questions answered. We don’t want you to miss anything that retirement calculators are missing in the big picture of your retirement.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.