What Is IRMAA? Medicare Income-Related Monthly Adjustment Amount

Key Points – What Is IRMAA? Medicare Income-Related Monthly Adjustment Amount

- How to Calculate IRMAA

- Reviewing the 2024 Medicare Part B and Part D IRMAA Brackets

- Making an Appeal on an IRMAA Surcharge

- Keeping IRMAA in Mind When Creating a Distribution Strategy

- 5-Minute Read

What Is IRMAA?

When a member of our team mentions “IRMAA” in a meeting with a client or prospective client, they’re not talking about someone’s great-grandmother. They’re talking about the Medicare income-related monthly adjustment amount, which is a surcharge on Medicare Part B and Medicare Part D premiums.1 Nobody wants to pay any more than they need to for Medicare, so let’s review the nuances of IRMAA.

Calculating IRMAA

Determining how IRMAA is calculated can be very confusing. First, it’s important to understand that IRMAA isn’t calculated based on your current taxable income or income from the previous tax year. It’s based on your Modified Adjusted Gross Income on your tax return from two years prior. So, if you’re trying to determine if you’ll be subject to the IRMAA surcharge in 2024, it will be based on your Modified Adjusted Gross Income from 2022.

IRMAA Income Limits

There are annual income thresholds that you need to keep in mind when trying to avoid paying more in Medicare premiums.2 The first threshold is $103,000 if you’re a single filer or married and filing separate. It’s $206,000 if you’re married and filing jointly. If your Modified Adjusted Gross Income was at that threshold or lower for 2022, your monthly Medicare Part B premium will be $174.70 per month for 2024. IRMAA wouldn’t apply in that scenario.

But what if your Modified Adjusted Gross Income was just $1 more than that baseline threshold? Check out the 2024 Medicare Part B IRMAA brackets below in Figure 1. If your Modified Adjusted Gross Income was $103,001 ($206,001 for married filing jointly) for 2022, your monthly premium jumps up to $244.60.

FIGURE 1 – 2024 Medicare Part B IRMAA Brackets – Nerd Wallet / medicare.gov

It’s easy to see why you would want to avoid moving up to the next tier from the one you’re currently on so that you’re not paying substantially more per year for your premium. If you’re married and filing jointly, you’ll need to multiply the IRMAA surcharge by two.

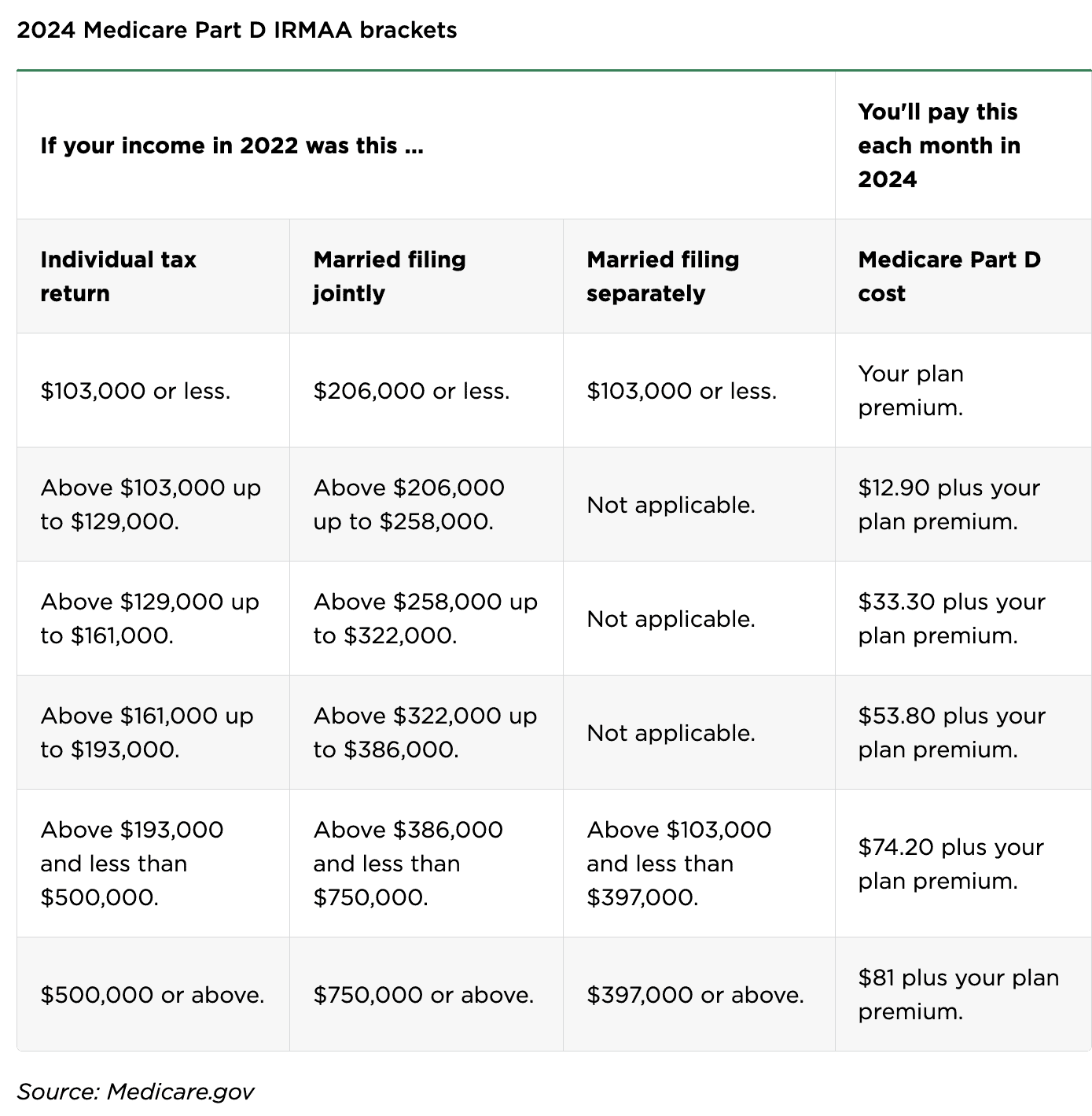

The same income thresholds apply for the 2024 Medicare Part D IRMAA brackets. Look at Figure 2, below, to see how much you would need to pay each month in addition to your plan premium for your Medicare Part D cost.

FIGURE 2 – 2024 Medicare Part D IRMAA Brackets – Nerd Wallet / medicare.gov

Do You Have a Medicare Advantage Plan?

Many people are aware that they become eligible for Medicare at age 65. If you anticipate getting on Medicare at 65, it’s important to understand that your premiums will be based upon your Modified Adjusted Gross Income at age 63.

The IRMAA surtax is also enforced for Medicare Advantage beneficiaries whose Modified Adjusted Gross Income is above the $103,000 (single filer)/$206,000 (married filing jointly) threshold. If they have a Medicare Advantage prescription drug plan, they would also be subject to the additional Medicare Part D costs.

Will the IRMAA Brackets Be the Same in 2025?

The 2025 IRMAA brackets will be released by Medicare in the fourth quarter of 2024. IRMAA is adjusted for inflation each year, so you could be in luck if you were slightly over one of the IRMAA threshold levels for 2024. Figure 3, below, shows some estimates for 2025 IRMAA brackets from financial professionals who specialize in the nuances of IRMAA and Medicare planning.3

FIGURE 3 – Projected IRMAA for 2025 – Kiplinger

If you had lower Modified Adjusted Gross Income in 2023 than you did in 2022, maybe you’ll have a lower IRMAA surcharge in 2025 (or maybe you won’t have one at all). There’s even a possibility to get your IRMAA surcharge waived if your income has dropped substantially following a recent life-changing event, such as retirement, death of a spouse, or divorce. If that’s the case for you, you can contact the Social Security Administration to make an appeal or file Form SSA-44 with the Social Security Administration to start the process.4

What If Your Income Has Substantially Increased?

There are also scenarios in which your income can increase and therefore trigger the IRMAA surcharge. Doing Roth conversions prior to and during retirement may be appealing for several reasons, specifically due to the tax-free treatment of Roth IRAs after pay tax on the conversion. However, doing a Roth conversion will increase your Modified Adjusted Gross Income.

That’s one of many reasons why you should consult a tax professional prior to doing a Roth conversion. Many people are unaware that there are potential drawbacks with Roth conversions. Download our Roth Conversion Case Studies white paper to learn more considerations for why it may or may not make sense for you to do a Roth conversion.

Creating a Distribution Strategy

A large IRA distribution, large investment gains in a taxable account, or the sale of a business or home are other actions that could result in an IRMAA surcharge. For example, let’s say that you want to purchase a new vehicle with money from your IRA. Or maybe you’ve made a real estate transaction and have incurred a large capital gain. Either scenario could move you up to the next level of IRMAA and potentially cause more of your Social Security to become taxable. That could allow you to consider more Roth conversions up to the next IRMAA threshold.

It’s important to realize that up to 85% of your Social Security benefit can be taxable. Social Security is taxed differently than any other source of income. When you’re considering when you (and your spouse, if applicable) will begin claiming Social Security, you need to factor in when (and how much) you’ll be withdrawing from other income sources.

Tax Planning Strategies

At Modern Wealth, our CPAs work alongside our CFP® Professionals to create a distribution strategy for our clients so that they don’t get caught off guard by IRMAA surcharges and/or more of their Social Security being taxable. Many people who come to us as prospective clients have most of their retirement savings in tax-deferred accounts (typically a traditional 401(k) and IRAs). But if you have $X amount in your 401(k) and IRAs, you must remember that money hasn’t been taxed yet.

As we mentioned earlier, large IRA withdrawals and large Roth conversions may trigger the IRMAA surcharge. Instead, it might be worth considering smaller Roth conversions over a few years. Doing smaller, methodical Roth conversions can also help prevent moving up into a higher tax bracket. Remember that there are also no Required Minimum Distributions for Roth IRAs.

Qualified Charitable Distributions could also be a strategy to consider if you have a large IRA, 70½ or older, and charitably inclined. You can donate up to $105,000 each year directly from your IRA to a qualified charity without it showing up on your tax return, and it will reduce your Modified Adjusted Gross Income and reduce your RMDs in the process.5

Do You Have Any Questions About IRMAA?

IRMAA can be a very rude awakening if you’re not aware of it. So, let’s plan for it. If you have any questions about what we’ve covered or IRMAA as it pertains to your situation, start a conversation with our team below.

You’ve worked too hard for your money to have it be wiped out due to IRMAA and excess taxes. Our team is ready to build you a forward-looking financial plan that’s tailored to your goals and that considers taxation, risk management, estate planning, and investments.

Resources Mentioned in This Article

- 2024 401(k) and IRA Contribution Limits

- 5 Reasons Not to Convert to a Roth IRA

- 2024 Tax Brackets: What You Need to Know

- Tax Planning Tips with Corey Hulstein, CPA, and Marty James, CPA, PFS

- Retiring with $2 Million

- Health Care Costs During Retirement

- Roth Conversion Decisions for 2024

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

- Retirement Planning for Small Business Owners with Drew Jones, CFP®, AIF®

- 5 Long-Term Strategies for a Better Retirement

- How Do Capital Gains Taxes Work?

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Taxes on Retirement Income

- Retiring Before 62: What You Need to Consider

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- How Do I Pay Less Taxes?

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- Tax Planning Strategy: 5 Tips to Save

- 2024 Tax Brackets: IRS Makes Inflation Adjustments

- How to Reduce RMDs with 5 Strategies

- What Is a QCD? Qualified Charitable Distribution

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

Downloads

Other Sources

[1] https://www.ssa.gov/forms/ssa-44.pdf

[2] https://www.nerdwallet.com/article/insurance/medicare/what-is-the-medicare-irmaa

[4] https://www.ssa.gov/medicare/lower-irmaa

[5] https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.