Taxes on Retirement Income

Key Points – Taxes on Retirement Income:

- Social Security

- Pension Income

- Annuity Income

- IRA Withdrawals

- Interest Income

- 5 minute read

Taxes on Retirement Income

While most people are working, their tax situation is fairly straightforward. They earn income from an employer, and the employer has certain taxes deducted from their paycheck. The income earned is potentially subject to several different taxes, such as federal or state income taxes, Social Security tax, Medicare tax, or local municipality earnings taxes. However, you can still do certain things, like making contributions to tax-deductible savings accounts, to potentially reduce your taxable income while working.

Schedule a Meeting Get the Retirement Plan Checklist

How Will Your Retirement Income Be Taxed?

But when you leave your job and enter retirement, your tax situation can drastically change. Clients often ask us, “How will my retirement income be taxed?” The short answer is that it depends. Let’s take a closer look at some of the typical income sources in retirement and learn more about how that retirement income could be taxed.

Taxes on Social Security Income

For a long time, Social Security benefits were received as a tax-free source of income. In the last few decades, a few laws have passed that have had significant impacts on the Social Security system.1 Since the early 1980s,at least a portion of Social Security benefits has been subject to ordinary income tax.2

Understanding Provisional Income

It surprises many people we speak with when they learn that up to 85% of the Social Security income they receive in retirement may be taxable. Want to know how much of your Social Security income will be taxable? You’ll need to know what your provisional income is.

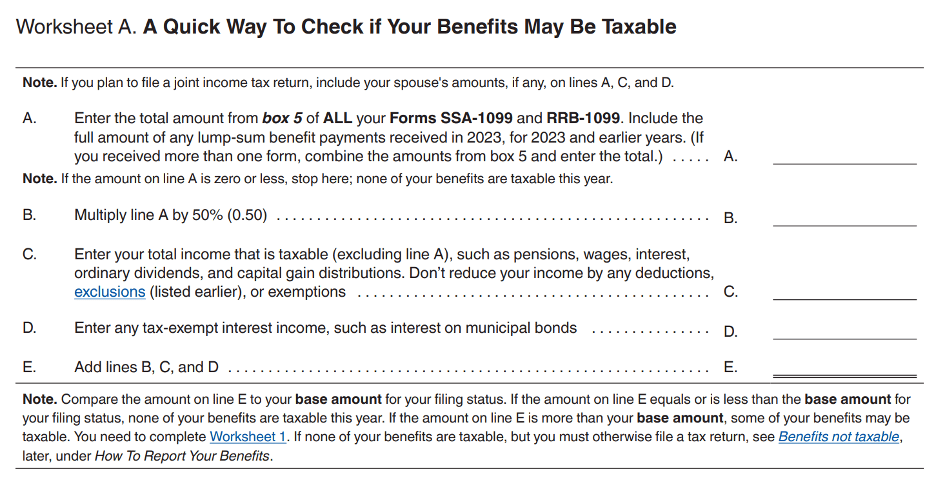

FIGURE 1 – IRS Publication 915 – IRS

Suppose you’re already receiving Social Security income. In that case, you can use the IRS Publication 915 find your provisional income amount.3 The Social Security website refers to this as “combined income.4”

If you are not yet receiving Social Security benefits, you can estimate your annual benefit and use 50% of that amount on line A. The formula is to take half of your Social Security benefits and add to all your other taxable income (pensions, IRA withdrawals, investment income, etc.). You’ll also have to add in any tax-exempt interest income. The sum of these numbers is your provisional income.

If you are filing your tax return as a single filer, and your provisional income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your Social Security benefits.5

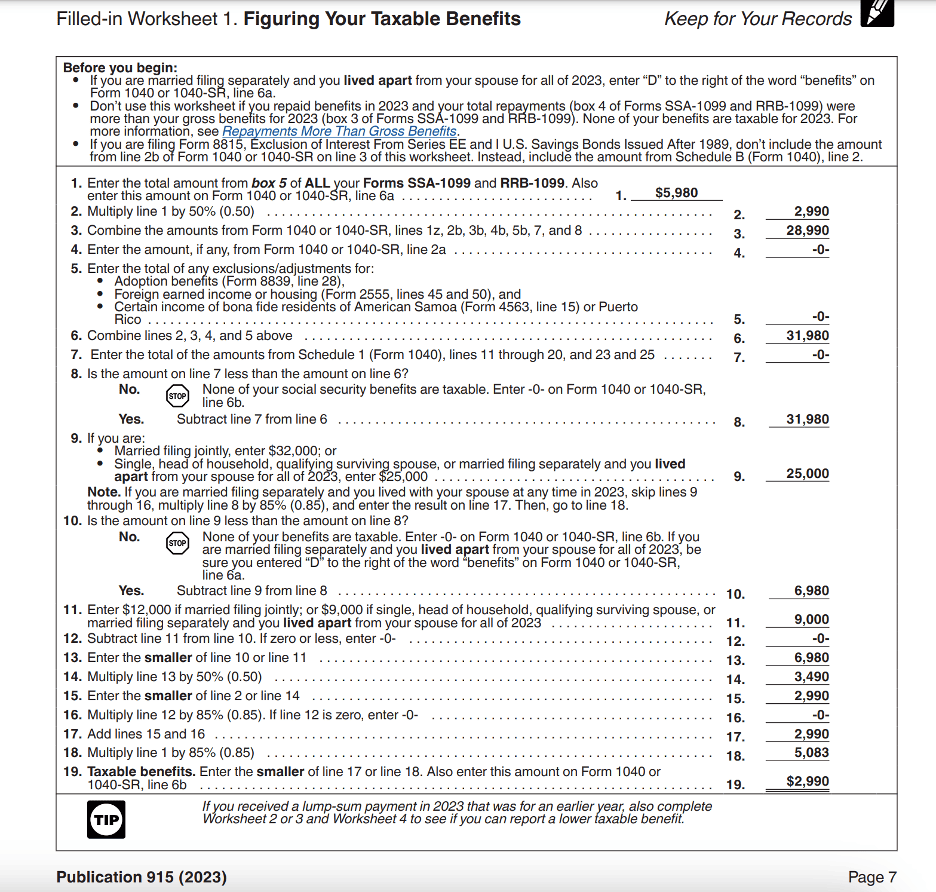

If your provisional income exceeds $34,000, you may have to pay income tax on up to 85% of your Social Security benefits. There is an IRS worksheet you can use to calculate exactly how much of your benefits will be subject to tax found in IRS Publication 915.

FIGURE 2 – Figuring Your Taxable Benefits – IRS

In addition, your Social Security benefits may be subject to state income tax. Some states don’t tax income at all, regardless of the source. At the same time, others may have certain exemptions based on age or income levels.

Taxes on Pension Income

Pension income is generally going to be subject to federal income tax. The gross amount of pension income received is usually reported on line 5 of your tax return form 1040.6 Certain forms of pension income may be exempt from state income tax. For example, Kansas generally does not consider KPERS pension income as taxable income.

Taxes on Annuity Income

If the annuity income is from a non-qualified annuity contract, it may be subject to ordinary income tax.7 For example, let’s say you invest $100,000 into a new non-qualified annuity, and over time, it grows in balance to $200,000.

One of the annuity structure benefits is that the growth was not taxable when it was earned. It’s similar to how your traditional IRA grows tax-free. When you withdraw from the annuity, some of the withdrawal counts as a return on your original investment. In contrast, the other part of your withdrawal will be regarded as a withdrawal of the growth that hasn’t been taxed yet.

Fortunately, the insurance company that issues your 1099-R will generally report the amount of the taxable withdrawal and the amount that is a tax-free withdrawal of the original investment.

Taxes on IRA Withdrawals

Withdrawals made from traditional IRAs are generally subject to ordinary income tax. In some cases, you may have made a non-deductible contribution to your IRA. In that case, you may have a portion of each withdrawal that you receive tax-free.

Withdrawals from Roth IRAs are received tax-free and do not increase your taxable income (as long as you have satisfied the five-year rule for Roth IRA withdrawals.

Taxes on Interest Income

If you have a brokerage account generating dividends, interest, or capital gains, that income may be included in your taxable income. The two types of ordinary dividends are qualified dividends and non-qualified dividends.8

Non-qualified dividends are taxed as ordinary income, while qualified dividends generally receive favorable tax treatment by taxing capital gains rates. On tax return form 1040, you (or your tax preparer) will report the total amount of qualified and ordinary dividends on line 3.

The interest paid by bonds may be subject to income tax. Generally speaking, if you receive interest from a municipal bond, that income will be exempt from federal taxes (and possible exempt from state income taxes).

However, if the interest received is from a corporate bond or U.S. Treasury bond, that income counts as taxable income. The total amount of taxable and nontaxable interest income you receive is on line 2 of tax return form 1040.

You may owe capital gains tax as a result of selling an investment or property for a gain. To determine whether you will owe tax on capital gains, you’ll need to calculate your total taxable income (with the gain included). In 2023, for single tax filers, if your taxable income was below $44,625 ($89,250 for married-filing-joint), you did not owe any tax on capital gains income.

For single tax filers whose taxable income exceeds $44,625 but does not exceed $492,300 ($553,850 for married-filing-joint), the tax rate on long-term capital gains income is 15%.

Do You Have Any Questions About Taxes on Retirement Income?

A strong argument could be made that tax planning is just as important, if not, maybe more important, for retirees than workers. We also highlighted how critical tax planning is in our Tax Reduction Strategies Guide, which we highly recommend that you download below.

Because of the complexity of the tax code and the wide variety of income sources in retirement, it’s important that retirees consider speaking with a qualified tax professional to get a handle on their tax situations. For example, someone who has a significant capital gain may trigger a variety of “tax landmines,” such as increasing the amount of their taxable Social Security income, jumping up to a higher tax bracket, or paying more for their Medicare premiums.

To learn more about taxes on your retirement income, start a conversation with our team below.

We don’t want you to make any big tax mistakes as you’re preparing for and eventually going through retirement. Our team is ready to go to work for you to make sure nothing falls through the cracks with your tax situation. It’s our goal to give you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

Taxes on Retirement Income | Watch Guide

00:00 – Introduction

01:08 – Taxes on Social Security Income

05:11 – Taxes on Pension Income

09:13 – Taxes on Annuity Income

10:45 – Taxes on IRA Withdrawals

15:10 – Managing Taxes Throughout Retirement

18:10 – Municipal Bonds

22:24 – What We Learned Today

Articles

- Maximizing Social Security Benefits

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- How Bonds Fit into a Financial Plan

- Why You Need a Financial Planning Team with Jason Gordo

- Nonfinancial Life Planning with Bruce Godke

Past Shows

- Where Should I Be Saving for Retirement?

- 5 Tax Secrets Retirees Need to Know

- Are Retirement Benefits Taxable?

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

- The IRA Early Withdrawal Penalty: How to Avoid the 10% Penalty

- What Should I Invest My Money In?

- How Does a Roth IRA Grow?

- How Do Capital Gains Taxes Work?

- Examining Municipal Bonds in 2024

- What Is Tax Planning?

- What Are Tax Brackets?

- Health Care Costs During Retirement

- 4 Big Tax Mistakes Retirees Need to Avoid

- 7 Wealth Protection Tactics

- Financial Stress: How Do You Deal with It?

Downloads

Other Sources

- [1] https://www.ssa.gov/history/ssa/ssa2000chapter1.html

- [2] https://www.ssa.gov/history/taxationofbenefits.html

- [3] https://www.irs.gov/pub/irs-pdf/p915.pdf

- [4] https://www.ssa.gov/benefits/retirement/planner/taxes.html

- [5] https://finance.yahoo.com/news/social-security-provisional-income-lead-121212793.html

- [6] https://www.irs.gov/forms-pubs/about-form-1040

- [7] https://www.forbes.com/advisor/retirement/non-qualified-annuity/

- [8] https://www.kiplinger.com/investing/stocks/dividend-stocks/601396/qualified-dividends-vs-ordinary-dividends

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.