Health Care Costs During Retirement

Key Points – Health Care Costs During Retirement

- What Needs to Be Consider with Health Care Costs During Retirement?

- The Employee Benefit Research Institute’s Report on Projected Health Care Expenses

- Medicare by the Numbers

- Planning for the Possibility of Requiring Long-Term Care

- 6 Minutes to Read | 24 Minutes to Watch

Planning for Health Care Costs During Retirement

For those of you gearing up to retire within the next few years, you may be wondering how your health care costs during retirement might look. There are several factors at play. We’re going to dive those to give you a better understanding of your health care costs during retirement.

Schedule a Meeting Get the Retirement Plan Checklist

Medicare for Health Care Costs During Retirement

An individual becomes eligible for Medicare at the age of 65. This is an important fact to remember when you are deciding how long you will work. For example, if you plan to retire before reaching this age, you’ll need to consider how you’ll handle medical insurance for the period between your retirement and your 65th birthday.

One option may be to use a short-term major medical plan. These plans are short-term options designed to cover a need while you’re between health insurance plans. Another option is an Affordable Healthcare Act health plan. Your monthly premium on these plans will depend on several factors, including your age, income, and the level of coverage you choose.

The ABCs of Medicare

For those of you retiring at 65 or later, you’ll generally be eligible to file for Medicare insurance plans. There are a lot of different ways to structure your health insurance plans through Medicare. For example, you may determine to enroll in Medicare Part A (hospital insurance), Part B (health insurance), and Part D (prescription drug plan).

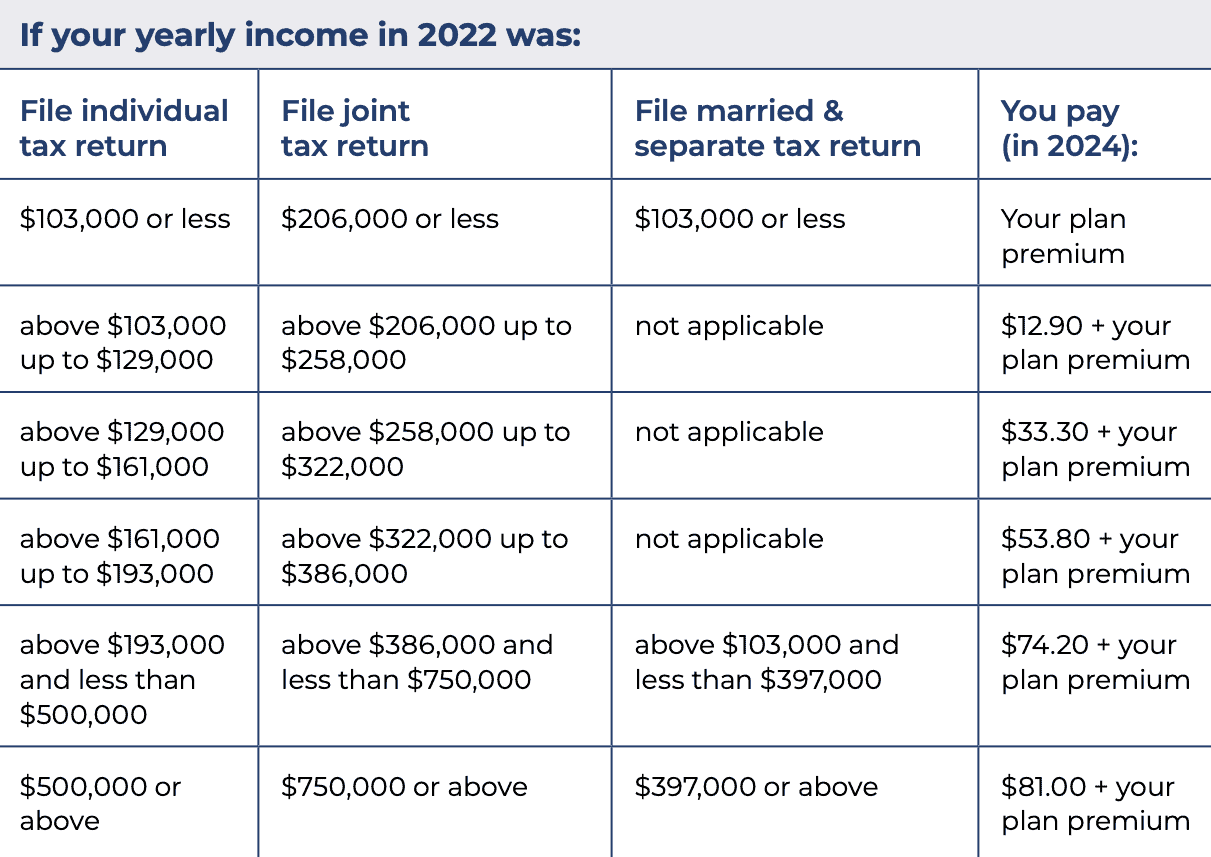

There is no monthly premium for Part A. For Part B, the monthly premium in 2024 is $174.70.1 That was nearly a $10 increase from 2023, when it was $164.90.2 Monthly premiums for a Part D prescription drug plan will range depending on your income from two years prior. See the chart below for estimated Part D monthly premiums.3

FIGURE 1 – Estimated Medicare Part D Monthly Premiums – Medicare.gov

Medicare Supplement Plans

You may choose to include an additional policy to supplement Medicare parts A, B, and D. We refer, aptly, to these plans as Medicare supplement plans or Medigap plans. They are useful because, without them, you may face high deductible and no maximum out-of-pocket limits. There are several different supplement plans available, and they each have different premiums and benefits.

Breaking Down Research on Projected Health Care Expenses from the Employee Benefit Research Institute

The Employee Benefit Research Institute, a non-profit research group, released a report in January 2024 that estimated the cost of health expenses for Medicare beneficiaries.4

“Health care costs in retirement can be considerable and may not necessarily be a salient issue for workers. To project how much Medicare beneficiaries may need to save to have a reasonable chance of meeting their health care spending requirements in retirement, EBRI built a simulation model allowing for uncertainty due to mortality and rates of return on assets in retirement.” – Jake Spiegel, ERBI Health and Wealth Benefits Research Associate

In the report, Spiegel shared that ERBI’s model reflects updates to Medicare Part D that changed due to the Inflation Reduction Act of 2022. Of course, no two Medicare beneficiaries are the same, so the ERBI also stress tested for differing assumptions about Medicare Advantage and Medigap plans that are available to be purchased.

Medicare by the Numbers

In 2023, the ERBI estimated that some couples could require as much as $383,000 for health care costs during retirement.5 Well, we mentioned earlier that the Medicare Part B monthly premium rose nearly $10 for 2024. The annual deductible for Medicare Part B beneficiaries also went up, from $226 in 2023 to $240 in 2024.6

When factoring in all the annual adjustments for Medicare beneficiaries—including to deductibles, premiums, and prescription drug costs—the ERBI projected that some couples could require up to $413,000 for health care costs during retirement as of their January 2024 report.

That $413,000 for health care costs during retirement is definitely a number that can catch someone’s attention. The ERBI clarified that that is an “extreme case” for a couple that has exponential needs for prescription drugs. And like the ERBI’s other projections, that $413,000 is for that couple to have a 90% chance of adequately covering their health care costs during retirement.

Planning for Higher Health Care Costs During Retirement

Hopefully, you and your spouse are in good health and aren’t in that ballpark of that extreme case. Still, anyone’s health situation can change on a whim. As we’ve noted, health care costs during retirement are still rising. That’s something you need to plan for even if you are in good health.

Logan DeGraeve, CFP®, AIF® and Chris Rett, CFP®, AIF® shared on America’s Wealth Management Show that inflation needs to be a big part of the conversation when you’re planning for health care costs during retirement. We shared this statistic in our 7 Overlooked Budget Items in Retirement blog post, but it bears repeating that health care costs increased by 114.3% from 2000 to July 2023.7 In comparison, consumer goods and services inflated by 80.8% in the same timeframe.

So, when we’re building someone’s financial plan, we inflate health care costs during retirement at 6.5% to 7% and most other day-to-day expenses at a 4% rate. Health care and inflation are two key items referenced in our Retirement Plan Checklist that you need to plan for. Our Retirement Plan Checklist consists of 30 yes-or-no questions and age-and date-based timelines that help you gauge your retirement readiness. You can download your copy below.

Average Health Care Costs for Men and Women

Another component that’s worth noting is how health care costs during retirement are oftentimes higher are for women than they are for men. The ERBI’s report for 2024 projected that a man will need to have $184,000 in savings “to have a 90% chance of meeting their health care spending needs in retirement.” That’s compared to $217,000 for women.

The ERBI also projected health care costs during retirement for couples with a Medigap plan with average premiums. For those couples to have a 90% chance of meeting their health care spending needs in retirement, they’ll need to save $351,000.

The ERBI did the same breakdown for men and women enrolled in Medicare Advantage plans. Again, ERBI found that women need to have more saved than men to attain 90% odds to cover their health care costs during retirement. Men would need $99,000, while women would need $116,000. And to round out the ERBI’s findings, they project that couples with Medicare Advantage plans will need $189,000 in savings to have that 90% chance of having enough to accommodate for their health care costs during retirement.

The big catches with Medicare Advantage plans, though, is that they sometimes have limited network options and potentially need approval prior to specific prescriptions or services are covered.

Planning for a Long-Term Care Stay

Later in life and retirement, your health care costs may increase due to health complications associated with aging. Depending on the circumstances, you may require some form of long-term care. If you plan on aging in place as long as possible, but require nursing care, and choose to have in-home nursing care provided, the costs may be higher than a similar level of care provided in an assisted living facility.

According to SeniorLiving.org and Genworth, the national annual average costs of a home care aide and a home health aide are $53,560 and $55,650, respectively.8 SeniorLiving.org and Genworth also project that the national average cost of assisting living in 2024 will be $4,917.9 That adds up to being just over $59,000 a year.

While those specific health care costs continue to soar, they pale in comparison to the national average cost of nursing homes according to SeniorLiving.org and Genworth.10 For semiprivate rooms, the monthly average cost is $8,641 ($103,700 annually). For private rooms, it’s $9,872 a month ($118,457 annually).

Long-Term Care Health Care Costs in Retirement

Let’s round out this article on health care costs during retirement with a couple more staggering stats on long-term care. LongTermCare.gov estimates that people 65 or older have nearly a 70% chance of requiring some iteration of long-term care.11 While the remaining people that are 65 or older wouldn’t require long-term care at all, LongTermCare.gov estimates that 20% of that demographic would require long-term care for five-plus year.

We can’t stress enough how essential it is to consider health care costs during retirement into your financial plan. This starts with an honest self-assessment of your health. It would be best if you also considered your preferences for how you receive the care. Do you prefer to remain in your home?

You should factor in the higher costs of in-home nursing care. If you prefer to move out of your home into an assisted living facility, use those costs in your projections. In either case, plan on between two and five years of some form of long-term care at the end of your life.

Talk with Your Family

All too often, people never make their wishes known, not wanting to have difficult conversations with their spouse or family. This can lead to disagreements, confusion, and frustration later on. Especially when it comes time to make decisions about health care costs during retirement. If you’re married, talk with your spouse about your preferences for health care. And if you have children, you’ll want to bring them in the loop.

If you’d like to discuss how to more effectively integrate planning health care costs into your retirement plans, start a conversation with our team below.

Like many things in retirement planning, this needs to be custom-tailored to you and your family’s plans.

Health Care Costs During Retirement | Watch Guide

00:00 – Introduction

01:19 – EBRI Study Findings

02:38 – Let’s Talk About Medicare

05:47 – What About Retiring Before 65?

08:43 – Having a Plan for Health Care is Crucial

09:42 – The Costs of Long-Term Care and Assisted Living

16:19 – It’s Important to Have These Conversations

19:46 – Inflation and Health Care

22:14 – What We Learned Today

Articles

- Affordable Care Act Subsidies – How to Qualify for Them with Marty James, CPA, PFS

- What Is Medicare Open Enrollment?

- How to Mitigate Inflation on Health Care Costs

- Rising Long-Term Care Costs

- Family Financial Planning with Matt Kasper

Past Shows

- Why When You Retire Matters

- Retiring Before 65: What You Need to Consider

- Can I Retire Early? Becoming Financially Independent

- Stress Testing Your Financial Plan

- 7 Overlooked Budget Items in Retirement

- Reviewing Your Retirement Checklist

- Don’t Retire without Doing These Things First

- Couples Retirement Planning: What You Need to Know

Downloads

Other Sources

[1] https://www.cms.gov/newsroom/fact-sheets/2024-medicare-parts-b-premiums-and-deductibles

[3] https://www.medicare.gov/Pubs/pdf/11579-medicare-costs.pdf

[6] https://www.kiplinger.com/retirement/medicare/what-youll-pay-for-medicare

[8] https://www.seniorliving.org/home-care/costs/

[9] https://www.seniorliving.org/assisted-living/costs/

[10] https://www.seniorliving.org/nursing-homes/costs/

[11] https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.