How Do Capital Gains Taxes Work?

Key Points – How Do Capital Gains Taxes Work?

- The Differences Between Short-Term and Long-Term Capital Gains

- Calculating Capital Gains and Losses

- Capital Gains Tax Rates for 2023

- Understanding Phantom Gains

- 7 Minutes to Read | 23 Minutes to Watch

What Are Capital Gains Taxes … And How Do They Work?

There are so many things that can be overlooked when someone takes a DIY approach to retirement planning. One of them is capital gains taxes. What are capital gains taxes and how do they work? We’re going to cover that and explain why it’s one of many reasons to work with a CFP® Professional that works alongside a CPA.

Tax Rates Are Set to Go Up in 2026

Taxes come in all shapes and sizes. It’s interesting for Dean Barber and Bud Kasper to watch young people getting their first job and realize everything that gets taken out of their paycheck. Imagine if you got to keep every dollar you made.

However, Dean and Bud do believe that we have some favorable tax rates right now. But it doesn’t look like they’ll stay very favorable for long, as the Tax Cuts and Jobs Act is set to sunset on December 31, 2025. That means that tax rates will go up in 2026 (back to 2017’s rates) if Congress does nothing between now and then.

When you think about taxes, capital gains taxes are one of those taxes that you have some control over. There are some instances where you have no control, such as phantom gains. We’ll explain those shortly.

“Controlling capital gains and understanding the timing of capital gains is critical to keep as much of your money as you can.” – Dean Barber

Understanding Capital Gains and Losses

Let’s do a high-level review of what capital gains and losses are. Whether it’s your house, a piece of property, or a stock or bond that you purchased, most of your personal belongings are considered as capital assets. According to the IRS, “when you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss.”

So, if an asset is sold for more than its original price (also referred to as cost basis), it’s a capital gain. On the flip side, if it’s sold for less than its cost basis, it’s a capital loss.

“The biggest difference between the two is that every time you have a capital gain, it shows up on your tax return. But if you have a capital loss and don’t have capital gains to offset it, you can only use $3,000 of that capital loss in that given year. You get to keep using it until it’s gone, but it’s not nearly as favorable as the capital gain is punitive.” – Dean Barber

The Two Types of Capital Gains and How They’re Taxed

There are two types of capital gains—short-term capital gains and long-term capital gains. Short-term capital gains only apply to gains of sold assets that you owned for one year or less. Therefore, long-term capital gains involve sold assets that you owned for longer than one year.

The big difference between short-term and long-term capital gains is how they are taxed. Short-term capital gains are typically taxed at your ordinary income tax rate. That’s the rate that you pay on your normal income. Long-term capital gains on the other hand usually receive preferential tax treatment. Their tax rates tend to be lower than ordinary income tax rates and will depend on an individual’s overall income, what state they live in, and what assets are being sold.

2023 Capital Gains Tax Rates by the Numbers

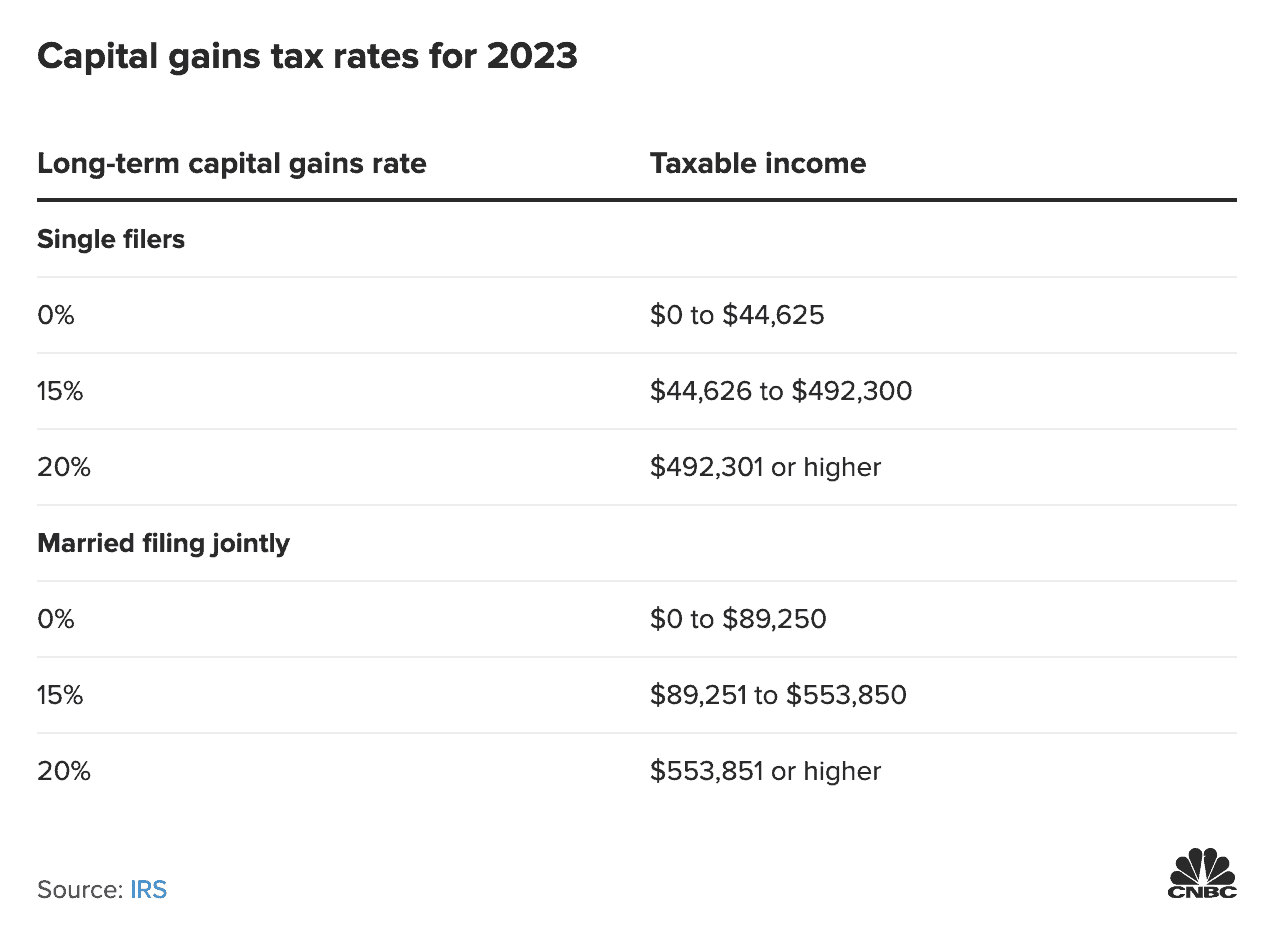

In most cases, the tax rate for net capital gains isn’t more than 15%. Here’s a quick rundown of what tax rates apply in some specific scenarios.

FIGURE 1 – Capital Gains Tax Rates for 2023 – IRS/CNBC

However, there is an exception. If you’re married filing jointly and your taxable income exceeds $250,000, you’re subject to a 3.8% surtax for the Affordable Care Act.

What Are Phantom Gains?

Now, let’s explain phantom gains. Phantom gains typically occur from an equity mutual fund. Sometimes they’ll occur from a bond mutual fund, but most of the time they’ll occur in an equity mutual fund that isn’t held in any kind of a tax-deferred account. Capital gains on a taxable account—whether it’s individually owned, jointly owned, or owned in a trust—that are a result of mutual fund selling a stock have no effect on the value of your account.

Example of a Phantom Gain

For example, let’s say that you had a mutual fund that had a $10 per share value. At some point, that fund manager unloaded some stocks that it had purchased years ago and it resulted in a 10% capital gain. So, a $1 per share capital gain. By law, they had to distribute that capital gain. Typically, it reinvests back and buys more shares, but the share price drops by the same amount as the capital gain.

If it was a $1 capital gain and you had a $10 per share price, suddenly you have a $9 per share price. But you own more shares because that capital gain reinvested and bought more shares.

”The value of your account didn’t change, but the capital gain shows up on your tax return. That’s why we call in a phantom gain.” – Dean Barber

If you’re going to buy a mutual fund inside of a taxable account, you need to look for the embedded gains in the fund at that time. And what’s the turnover ratio of that fund? You need to be careful with the likelihood of there being a taxable gain that’s a phantom gain that you could be buying into.

“Oftentimes what you need to do is go in and sell your shares to get your capital gain rate rather than the phantom that comes in after that. That’s not necessarily what you want to do. But if you’re in a qualified account like an IRA, 401(k), or something like that, there are no issues because all that continues to be taxed at the results of whatever vehicle you’re in at that time.” – Bud Kasper

Direct Indexing

From an investing standpoint, something is occurring today that is slowly but surely taking the investment world by storm. That’s direct indexing. Direct indexing is all about controlling the taxes on a taxable account. Our Director of Investments Stephen Tuckwood talked all about direct indexing with Dean on The Guided Retirement Show. In case you missed it, make sure to subscribe to The Guided Retirement Show so you can tune in and not miss any other episodes.

With direct indexing, you’re essentially moving the mutual fund or ETF wrapper and you’re individually buying the stocks that make up that index. You establish your cost basis individually and then through an algorithm there is constant tax-loss harvesting going on to offset capital gains.

“The tax-loss harvesting that takes place inside the direct indexing method allows for very tax-efficient growth in stocks because you’re actively harvesting the losses.” – Dean Barber

Direct Indexing Examples

Let’s use Coca-Cola and Pepsi as examples to help explain direct indexing. Let’s say that you own Coca-Cola, it falls in price, and you want to capture that loss. You don’t want to forgo the ability to get the gain when Coca-Cola goes back up. So, you sell Coca-Cola and buy Pepsi.

As the industry moves higher, Pepsi goes up and you get the gain. But you already captured the Coca-Cola loss—and it’s a realized loss—to offset any capital gains.

“That’s what I call making lemonade out of lemons. I’ve been engaged with that type of investing for some time and it’s incredibly efficient.” – Bud Kasper

Direct indexing in a taxable account can be appealing if you have strong feelings about industries that you want excluded from your investing strategy. You can shape that investment to your personal beliefs.

Since you’re buying a lot of individual positions, your minimums for direct indexing are far higher than if you’re buying an ETF. There’s no minimum to buying an ETF. So, not everyone has access, but most people with money have access to direct indexing. They might just not know about it yet.

Creating a Forward-Looking Tax Strategy

Another way that we can control capital gains is by creating a forward-looking tax strategy. So, let’s look again at those capital gains tax rates for 2023. Let’s say you’re heading into retirement, you have a highly appreciated stock that’s making up 20-25% of your portfolio, and you want to trim that position over time. If you’ve done a good job of saving some money outside of retirement accounts that you can spend without causing a tax liability, you can start selling off some of that stock and stay below those capital gains tax rate thresholds.

“You won’t undo it all at once, but you can reset your cost basis in your individual stock. You can take a stock that’s highly appreciated into an account where you’re doing the direct indexing. That way, you’re using those offsets to offset the capital gains on the stock. It’s a beautiful thing to control how that capital gains tax is done.” – Dean Barber

The Bottom Line with Capital Gains Tax Rates

To do all that, though, you need a financial plan. And you need to have a CPA working with your CFP® Professional to create your long-term tax strategy. That CPA needs to understand that if you have a highly appreciated asset that you need to trim that position over time.

“If you haven’t already created the plan and the CPA isn’t there with your CFP® Professional, you’re just going to be selling that or doing whatever, not knowing whether it’s the right strategy.” – Dean Barber

And speaking of tax strategies, make sure to download a copy of our Tax Reduction Strategies guide. It’s a 12-page guide that includes several strategies that could reduce your tax burden over your lifetime. Download your copy below!

Download: Tax Reduction Strategies Guide

“People can fall short when they get a short-term vision and want immediate gratification. It’s important to understand that taxes are going to be a factor of your life as long as you have money, make money, and live in the U.S. You should try to create a situation where you pay as little tax as possible—not in a given year, but over your lifetime.” – Dean Barber

Do You Have Any Questions About How Capital Gains Taxes Work?

If you have questions about capital gains tax rates and how they could apply to your unique situation, schedule a conversation with one of our CFP® Professionals and/or CPAs by clicking here.

You have the option between scheduling a 20-minute “ask anything” session or an hour-long complimentary consultation. We can meet with you in person, by phone, or virtually depending on what works best for you. It’s important to us for you to have a good understanding of your overall tax situation so you can pay as little tax as possible over your lifetime.

How Do Capital Gains Taxes Work? | Watch Guide

00:00 – Introduction

01:55 – Today’s Tax Rates

03:05 – What Is a Capital Gain?

08:13 – TRIVIA

10:26 – Phantom Gains

12:57 – Direct Indexing

16:50 – Creating a Forward-Looking Tax Strategy

22:24 – What We Learned Today

Articles

- Tax Rates Sunset in 2026 and Why That Matters

- Tax-Efficient Investing with Stephen Tuckwood

- Components of a Complete Financial Plan with Logan DeGraeve

Past Shows

- DIY Retirement Planning: What Can Be Overlooked?

- What Is Tax Planning?

- 8 Tips on Saving for Retirement

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.