Tax-Efficient Investing with Stephen Tuckwood

START PLANNING Subscribe on YouTube

Tax-Efficient Investing with Stephen Tuckwood Show Notes

After making his Guided Retirement Show debut in May, Modern Wealth Management Director of Investments Stephen Tuckwood joins Dean Barber again to talk about direct indexing and custom indexing. Tuck is a Chartered Financial Analyst and wants you to have a good understanding of tax-efficient investing. It’s a big deal.

When we think about people who have invested money outside of retirement accounts, taxes can be a big wealth eroding factor and take away from the total return. That’s why we’re going to focus today on tax-efficient investing and in particular, direct indexing, which is fairly new to the average investor.

In this podcast interview, you’ll learn:

- The theory behind direct indexing and its structure

- How to remain diversified via direct indexing

- The benefits and drawbacks of direct indexing

History of Direct Indexing

Let’s start by giving a quick overview on the history of direct indexing and the theory behind it. Direct indexing has been around for a long time, but it’s mostly been used by ultra high net worth people and institutions. But thanks to some advancements in technology and specifically advancements in the load of trading costs, direct indexing is now a very useful tool for average investors to utilize as well.

“Protecting returns against the erosion of taxes is important. We want folks to keep as much as they earn as possible. It’s critical to look at doing things in a tax efficient way. That’s the big thing. Direct indexing has become one of the fastest growing parts of the general marketplace as we look at investment solutions. It really comes down to the fact that trading costs have come down practically to zero if you’re with a discount brokerage firm.” – Stephen Tuckwood

It used to be a $50 ticket charge for a buy or sell of a security. That’s what made direct indexing reserved really for those ultra-high net worth people. Even today, a lot of direct indexing providers have pretty high minimum account balances, like $250,000. That’s coming down. There are a few out there that are less than that, but that’s about the average minimum account balance. We’re going to try to explain why there is a higher minimum as we dive deeper into explaining how direct indexing works.

So, How Does Direct Indexing Work?

Dean really likes how Tuck describes the process of direct indexing, so let’s get right to it. Tuck simply breaks it into two parts—direct and indexing.

“If you think about direct, the investor owns each of the underlying positions directly. Each stock. That appears directly in their brokerage statement because they own each one of those directly. In other words, there’s no ETF or mutual fund wrapper around those hundreds of positions. We’re stripping that down and investing in these positions directly. The second part of the name is indexing. We initially select an index to track toward. So, combine those two things together and that’s it. Your direct indexing solution.” – Stephen Tuckwood

So, when you’re seeking to mirror an index, how closely will direct indexing match that index? Very closely, Tuck says, but it depends on a few things.

If you were to fund the account with cash, that gives the direct index provider the most ability to track closest. If you were to fund the account with positions of highly appreciated stocks, then the manager needs to work around some of those over time to get the tracking a lot tighter to that benchmark. It also depends on if you’re adding a lot of customization to that index. The idea is to get really close to the index over time.

An Example of Direct Indexing

There has been a lot in the news talk about ESG and the like. There are also some investors who may be averse to alcohol, tobacco, abortion, or have certain religious beliefs. So, how customized can an individual get? For example, let’s say someone is tracking the S&P 500 index and is doing so directly. The end investor can look at the underlying stocks and not include certain companies in their portfolio if they don’t agree with something related to the company.

“You can write it in an exception of the strategy. We review an intake form where we’re go through the investor’s values and beliefs. Sometimes, they might work for an S&P 500 company or a company that’s in the index and might have a lot of that stock held elsewhere that they don’t want to be investing in this particular place. We can make sure that’s never included in the opportunity set and can tailor that as much or as little as we like.” – Stephen Tuckwood

Dean thinks that a lot of people probably aren’t aware that they can do that (and might be doing so if they knew). And it’s impossible to do inside of an ETF or mutual fund because you have no control over what stock the manager buys. You’re in that vehicle with all the people as well. Their actions can affect the returns that you receive. When it’s wrapped up together, it’s really all the same thing. Stripping that away lets us dial in and come up with a truly customized solution to the client’s unique wants and needs.

Tax-Efficient Investing Is a Powerful Tool

Now that we’ve tackled the structure of direct indexing and explained some of its benefits, let’s highlight how direct indexing is tax efficient. First, you own each position directly. That means you own your own cost basis in each position. That can go down all the way to the lot level.

Let’s say you own 100 shares of Apple and bought that in two batches of 50 that each have a different cost basis. When it comes time to sell some Apple, you want to be select in the tax lot that’s more favorable to you.

“That allows us to get that minute when it comes to deciding on what to sell and how. But in general, the tax-loss harvesting program that can be applied on top of a direct indexing program is one of the key benefits to this. We can obviously do this inside of a qualified account where taxes aren’t a consideration and really track a benchmark and customize. But once we move into a taxable account, this tax overlay becomes a powerful tool.” – Stephen Tuckwood

Tax-Loss Harvesting

Let’s use the S&P 500 as an example again for tracking an index. We’re not buying every position, all 500 stocks in those proportional weights. Instead, we’re buying a few hundred of them, leaving room to replace some of those positions that might have a loss at any particular time.

Maybe Pepsi goes down and that’s one of the positions that you happen to own at that time. We can harvest that loss, book it, and make it realized. Then, replace it with Coca-Cola, which has a similar risk return profile as Pepsi. By doing that, you can keep the same exposure and keep the tracking tight to the index while harvesting that loss along the way.

A Hypothetical Example of Tax-Loss Harvesting

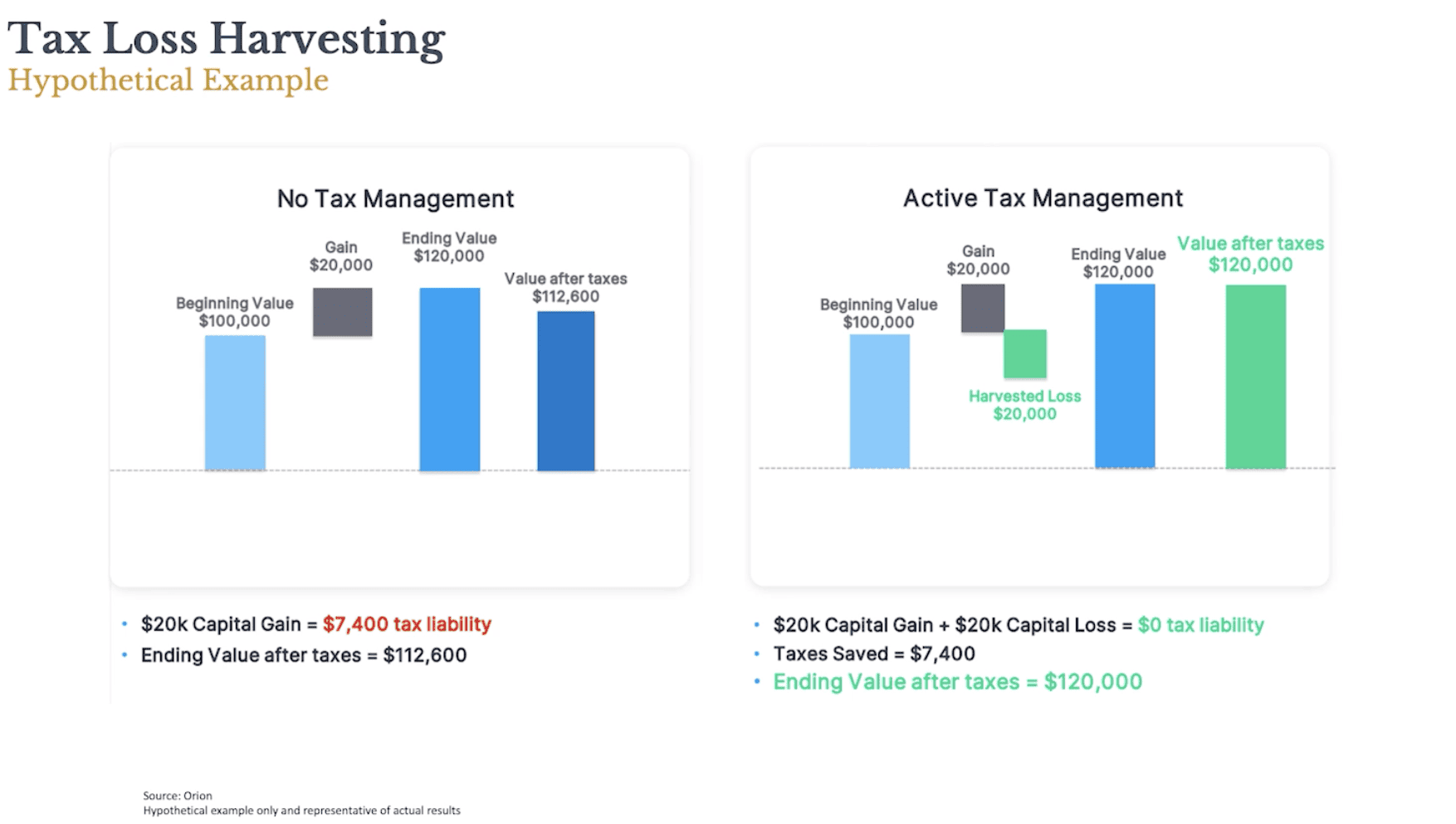

Imagine doing that over and over again with all the positions in the portfolio. Figure 1, below, also shows a hypothetical example of tax-loss harvesting and what might happen in an account.

FIGURE 1 – Tax-Loss Harvesting Example – Orion | Hypothetical example only and representative of actual results.

On the left-hand side on Figure 1 is an account that has a starting value of $100,000 at the beginning of the year. It invests in the market in general, let’s say the S&P 500. It’s sort of like a standard ETF. The market has a good year. We’re up 20%, so we’ve made $20,000. That gives us an end value of 120. But if you wanted to liquidate that position for whatever reason and use that money, then you’d have to pay tax on those gains. You can see that there’s been a haircut that Uncle Sam has taken.

Compare that to the right-hand side of Figure 1. It has the same exposure, but within a tax-harvesting strategy where we’ve been able to harvest losses throughout the year. In this case, we’ve realized and captured $20,000 of losses. We end up with a $20,000 gain because we have the same returns as the benchmark over time. But we have those losses booked that we could offset in the event that we wanted to liquidate that position.

“It’s just a great benefit. They’re not always going to equal each other, the gains and the losses, but the point is that there’s an additional benefit, an additional attempt to increase value by actively harvesting the losses throughout time. You just wouldn’t get that with an S&P 500 ETF or mutual fund.” – Stephen Tuckwood

To sum it up, the direct indexing—the owning of the individual securities—is being combined with the tax-loss harvesting. That’s what creates the tax-efficient investing.

Beware of Phantom Gains in Mutual Funds

Another thing that we want to point out is that ETFs are more tax friendly than most mutual funds. In mutual funds, you can have something called a phantom gain. That phantom gain can come from a position that the fund manager might have bought three, four, five, six years ago that has a lot of appreciation.

Then, they sell it because it’s become too large of a position or don’t like it anymore. Then, they have a gain in that stock inside of a mutual fund that until this point has just simply pushed up the price per share. When that gain is realized inside the fund, there’s a capital gain distribution to the client. But the share price dropped by the same amount as a capital gain distribution. So, they need to pay taxes on something that they didn’t get any benefit for unless they owned that mutual fund for the entire time.

“It’s not a nice thing at all if you’ve ever gone through that when there’s a down year in your fund that you’ve gotten into and there’s been a tax bill at the end of it. The mutual fund structure in general isn’t very particularly tax friendly to investors. As a reminder, you’re in that fund with other people, so you share in that vehicle. If you’re in there with a large investor and they redeem throughout a bad year and you’re sticking with it, that’s when those phantom gains often occur is when there’s a big proportional movement out of the fund that you’re in.” – Stephen Tuckwood

Tax-Optimized Withdrawals and Tax-Optimized Charitable Giving

There are also benefits to direct indexing with tax-optimized withdrawals and tax-optimized charitable giving. It gets back to the point of owning your own cost basis and each underlying position as defined by the particular lot.

“A lot of times when we think about charitable giving, we look at highly appreciated stock and automatically choose the most highly appreciated position in your portfolio and give that to charity. There are benefits around that rather than selling it yourself and then giving cash. So, that same concept applies.” – Stephen Tuckwood

As you’re choosing what to gift, we were taking into consideration not only the appreciated portion of it, but how it affects the rest of the portfolio and how it tracks to the benchmark. In a more optimized manner, it might be a position that’s not that obvious that you’d be gifting that amount to. Again, our objective along the way is to reduce tracking error or increase tracking in general to that index. It’s more of a thoughtful approach than just straight gifting of your most highly appreciated stock.

A Sense of Control

Because it is individual positions and it is down to the account level for each individual client, it’s all their own. They’re not doing this with anybody else. They get to have far more control than what they would with selling an ETF or gifting a mutual fund. This is way better.

Staying Diversified Via Direct Indexing

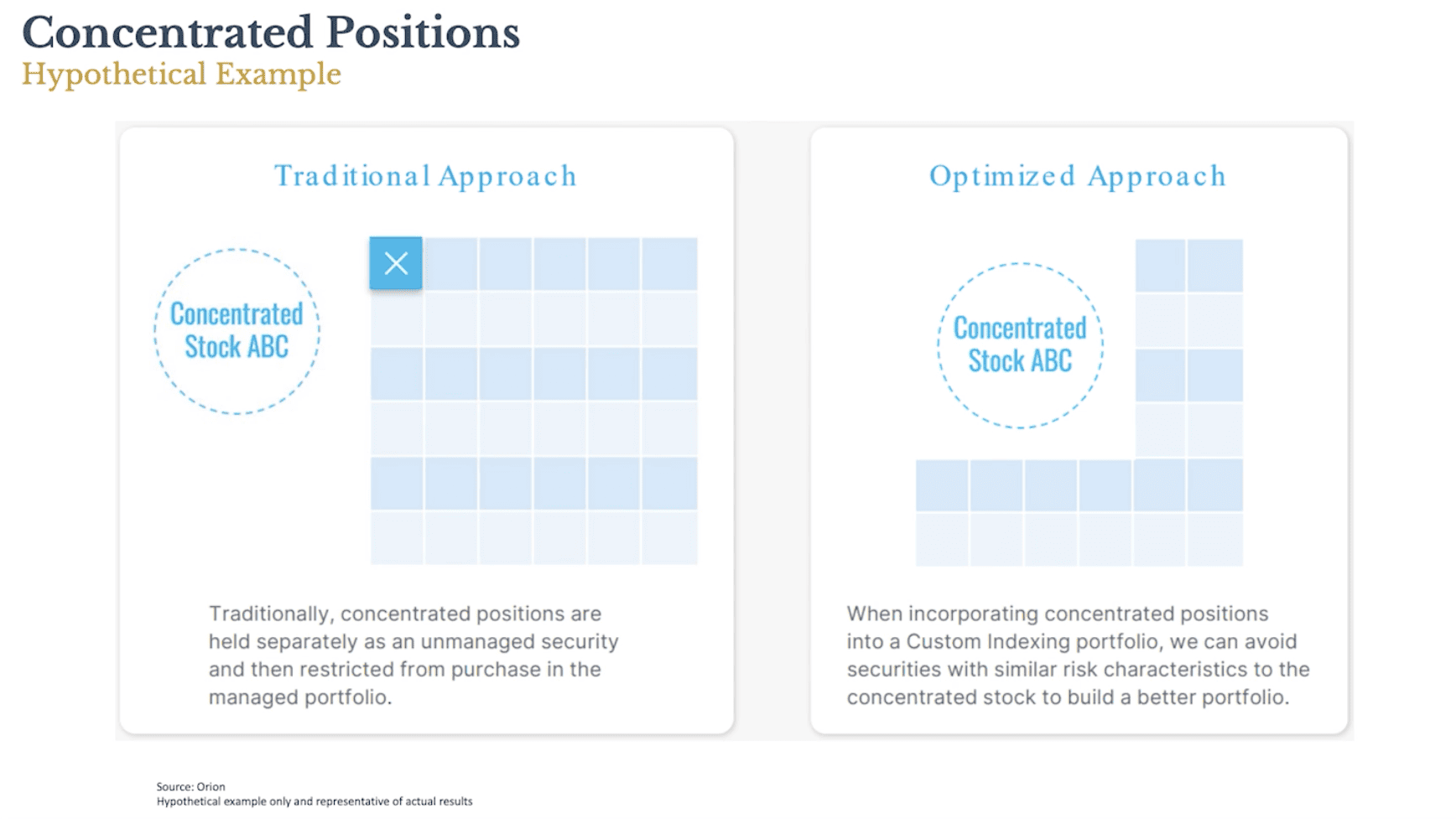

Like we mentioned earlier, there are a lot of situations where someone works for a publicly traded company or has a position(s) that is highly appreciated. In a situation like that, they got into something really early and did very well, but then it becomes a disproportionately large portion of their portfolio. The goal is to be generally diversified. So, we want to look at how direct indexing manages around that and how it benefits an individual client.

The old way of doing things was just to segregate that position, hold it in a different account, and then continue to manage the other portion of the portfolio as we would. You can see an example of that on the left of Figure 2 below.

FIGURE 2 – Concentrated Positions – Orion | Hypothetical example only and representative of actual results.

With direct indexing, what you can do is recognize that you have that position and exposure within the portfolio and then optimize the other positions that we’re purchasing around it.

“If it’s a technology name, then our exposure to other technology companies might not be as high in the general portfolio to offset that exposure. It’s a really great way of taking a holistic picture and bringing portfolio management all together rather than having this segregated concept where we’re just recognizing that it’s there but not able to manage around it effectively.” – Stephen Tuckwood

Equal Weighting vs. Cap Weighting

We also want to talk briefly about equal weighting versus cap weighting. When you look at the S&P 500 index and the pure index, it’s cap weighted. It’s based on the capitalization, the size of each company, and how much of the index they make up. So, can you do cap weighted and equal weighted? Could you’d go a NASDAQ 100 index or use the Dow 30? Tuck is going to review the limits of what a person can do if they want to take advantage of direct indexing.

“If there’s an index, it can be tracked. It’s as basic as that. I always raise some caution in terms of which you are choosing. You need to be comfortable with the risk profile of that particular index. So, I wouldn’t encourage folks too minute or in a particular corner of the market. But just broadly speaking, any of these broad indices you could opt to track against.” – Stephen Tuckwood

Drawbacks of Direct Indexing

So, we’ve talked about a lot of the benefits of direct indexing. We’ve talked about personalization. Every investor can do it. You can choose your index. You can restrict positions and you can reflect your personal values and beliefs in what you own. And you get the tax-loss harvesting, so you’re keeping more of your money away from Uncle Sam and keeping it in your pocket. But as with everything, there are some drawbacks with direct indexing.

More Physical Mail or Email

When you’re owning each position, you’re talking about hundreds of positions. So, if your statements come through the mail, you’re going to get pages and pages and pages of statements. If you didn’t know that would be the case, that might come as a little bit of a surprise. We encourage people to recognize that and maybe elect for email or electronic statements.

The other drawback of direct indexing is trade confirmations. Like we said, there’s going to be ongoing tax-loss harvesting throughout the year. There are going to be initial trades upfront measured in the hundreds if you’re funding this with cash. Throughout the year, as this system looks to track and optimize to that index, there are going to be trades. If you get those trade confirmation email alerts every time there’s a change in your account, you might want to turn those off as well.

Those are the two biggest drawbacks of direct indexing, but Dean and Tuck both believe the benefits outweigh the drawbacks.

The Expense of Direct Indexing

We’re not going to talk specifically about price, but we’re guessing that you might be wondering how the expense of direct indexing compares to mutual funds and ETFs. Broadly speaking, it’s a lot less than an active mutual fund and it’s not a rock bottom fee in terms of what we’re seeing in some of these ETFs.

“Direct Indexing is very reasonable on average in the marketplace for what is such a compelling strategy. The other thing to contemplate is that the index you choose is the key decision up front because that’s the risk return profile that you’re going to be receiving in general. Make sure you’re comfortable with the size of that allocation and that particular index that you’re tracking to. But in terms of price, it’s competitive and comparable with a lot of ETFs.” – Stephen Tuckwood

It also depends on the provider of this strategy too. There are a handful of companies that provide direct indexing and they all have slightly different pricing. It’s just like all the mutual funds and ETFs have slightly different pricing. Make sure to speak with an advisor that can clearly define what those costs are.

Direct Indexing Is Becoming More and More Popular

With what Dean and Tuck know about direct indexing, they’re not surprised that they’re seeing more and more of it. Maybe you can understand that as well with everything that Tuck has shared about direct indexing. It’s one of the fastest growing sectors of the equity investing portion of a client’s portfolio.

“Once more people really understand it and learn what it is, they’ll be asking for it far more than they’re asking for individual ETFs or mutual funds. When ETFs were originally introduced, they really started it. It was a slow run, but it started putting some pressure on the actively managed mutual funds. Now you even have actively managed ETFs. The ETF market has grown substantially while the mutual fund area has shrunk a little bit.” – Dean Barber

Direct indexing can be especially valuable in taxable accounts. And for the person that wants to invest based on their values, be transparent, and understand what they own, it works well within retirement accounts as well.

“Direct indexing is a great solution in a lot of cases. We’ve just scratched the surface in terms of application. Once we get into some more complicated tax situations and the like where we’ve got a tax professional helping us, you can really do some great things with this approach.” – Stephen Tuckwood

Do You Have Questions About Tax-Efficient Investing?

When you’re working with the CFP® Professional, a Chartered Financial Analyst, and a tax professional, you can really customize this to what you want. Our team is starting to see some magical things happen with this at Modern Wealth.

If you have questions about what direct indexing could look like for you and how to go about tax-efficient investing, we want to hear from you. You can ask us your questions about direct investing and the importance of tax-efficient during a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone—it’s whatever works best for you. We look forward to showing you how you might be able to personally benefit for direct indexing.

Tax-Efficient Investing with Stephen Tuckwood | Watch Guide

00:00 – Introduction

01:44 – What Is Direct Indexing?

06:00 – Customized Investing

08:05 – Tax-Efficient Investing

12:49 – Taxes on ETFs and Mutual Funds

16:12 – Concentrated Positions

19:17 – Cons to Direct Indexing

21:13 – Costs of Direct Indexing

22:47 – What We Learned Today

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC, does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.