Where Should I Be Saving for Retirement?

Dean Barber always says that you shouldn’t save to something without knowing the rules of getting the money out. Dean and Bud Kasper, CFP®, AIF® are going to elaborate on that as they review where you should be saving for retirement. The bottom line again is that it depends on your personal situation.

Schedule a Meeting Get the Retirement Plan Checklist

Key Points – Where Should I Be Saving for Retirement?

- Your 401(k)/403(b)/457(b) Will Likely Be Your Largest Asset as You Enter Retirement

- Roth vs. Traditional

- Options for Self-Employed People and Small Business Owners

- Viewing Your Health Savings Account as a Retirement Savings Account

- 6 Minutes to Read | 24 Minutes to Watch

Where Should I Be Saving for Retirement?

Most people understand the importance of saving for retirement and are always wondering how much they need to save. That is going to depend on several different factors, including your retirement goals, how you think and feel about money, and where you’ve been saving. We’re going to focus more on that last point. So many people get caught up in how much they need to save and don’t realize how critical it is to understand the importance of where they’re saving for retirement.

Employer-Sponsored Retirement Accounts: 401(k)s, 403(b)s, and 457(b)s

Let’s kick off this discussion on where you should be saving for retirement with what will likely be your largest asset by the time you retire: your employer-sponsored retirement account. For many of you, this is will be a 401(k), but others might have a 403(b) or 457(b). Each of these options is a good place to start saving for retirement. Most companies that offered these retirement plans will also offer a dollar-for-dollar match to your contributions.

Roth vs. Traditional

There isn’t just one step with saving to these accounts. One of the biggest decisions with where you should be saving for retirement is where to save to traditional or Roth accounts. Once again, that depends on your personal situation. But regardless, if you aren’t sure if your company offers a Roth 401(k), you need to see if they do and if it’s an option.

With traditional 401(k)s, any contribution you make will be tax-deferred. In other words, you won’t be required to pay tax on those dollars until you take them out. It’s the exact opposite with Roth 401(k)s. With those, you must pay tax on the contribution, but that money from that point on will grow tax-free.

“Sometimes the answer isn’t one or the other. Sometimes the answer is a combination of the two.” – Dean Barber

In-Plan Roth Conversions

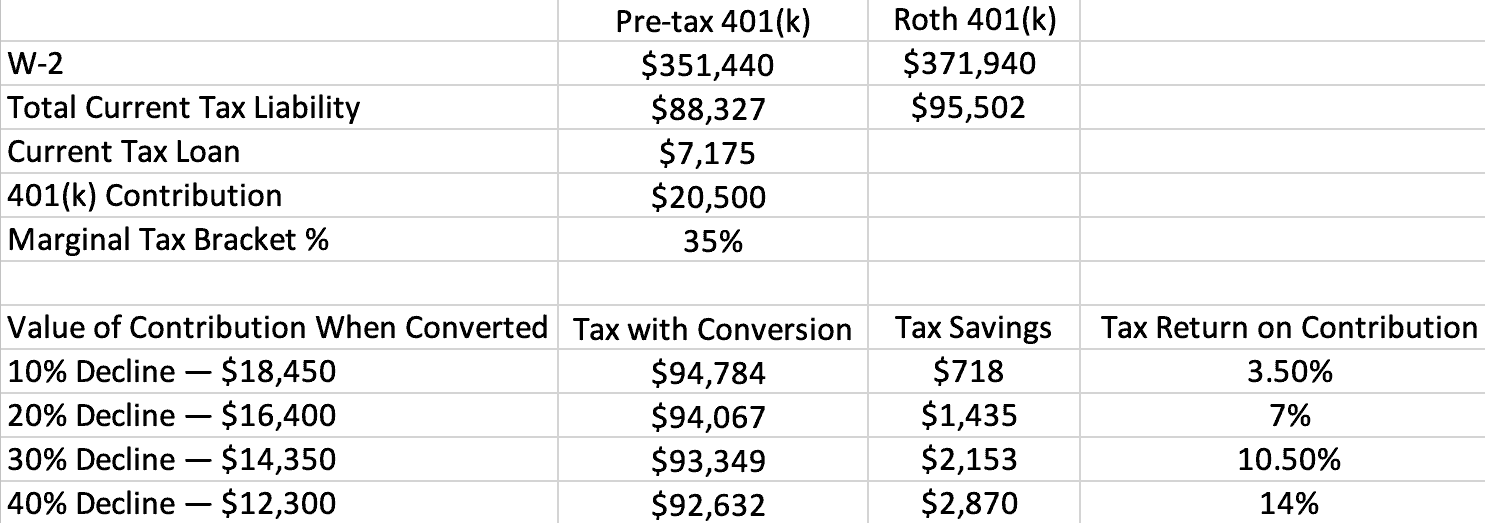

After just joining our team, Managing Director Marty James, CPA built an analysis of a high income earner saving into the traditional, but then doing an in-plan conversion if there’s a market correction. Check out Marty’s analysis below in Figure 1.

FIGURE 1 – In-Plan Conversion Analysis

Should the person in the analysis above save to Roth or traditional? Marty indicated this person is nearing retirement in this analysis. Knowing that, Dean would lean toward the pre-tax option since they’re in the 35% bracket. But what is this person’s bracket going to be in retirement? This is where the planning comes in. Have they been saving money outside of their 401(k) or the Roth? Do they have money that they can live on in those early years of retirement to reduce their taxable income? That way, they can convert after retirement and get money into the Roth at a lower bracket, maybe the 22% bracket?

“If they do that, suddenly they’re getting money into the Roth at a cheaper rate than going into the Roth deferral inside the 401(k).” – Dean Barber

You can also see in Figure 1 that Marty took this analysis one step further. What happens if the market drops? The person in the analysis went with traditional and got the deduction. So, if there was a market drop of 10%, their $20,500 became $18,450. In this case, Dean would convert the $18,450 to get an immediate tax savings of $718. Notice that the tax savings gets bigger in correlation with the larger market drops.

But Where Should You Be Saving for Retirement? Roth or Traditional?

Many 401(k)s will have the traditional and Roth options, and many of them have the option to do in-plan conversions, so make sure you’re aware of what your employer offers. Dean, Bud, and our Director of Tax, Corey Hulstein, CPA did a thorough analysis of Roth vs. traditional and what all to consider on The Guided Retirement Show. That’s an episode you don’t want to miss, so make sure to tune in to it. We also reviewed Roth vs. traditional and how to mitigate taxes over your lifetime in our Tax Reduction Strategies guide, which you can download below.

What Should You Do with Your 401(k) After Retirement?

While you can no longer contribute to your 401(k) after you retire, many people wonder what happens to it when they retire. Well, you have two options—leave it in your existing plan or roll it over to an IRA.

Let’s start with the pros of rolling it over to an IRA. One, you’ll have a wider choice of investment options by rolling it over to an IRA. If you’re planning to roll it over, make sure to roll it over within 60 days to avoid taxes on the rollover. The same goes for Roth 401(k)s. However, don’t roll over a traditional 401(k) to a Roth IRA because there are major tax ramifications for doing so.

The second pro to rolling over your 401(k) to an IRA applies if you’re wanting to do Roth conversions in retirement. Roth conversions are a tax planning strategy that can result in a substantial amount of tax savings over your lifetime.

Rule 72(t) and the Rule of 55

There are also some cons to rolling over your 401(k) to an IRA in retirement. The main one is that if you’re planning to retire early, as you’re still subject to the early withdrawal penalty if you access the funds prior to 59½. Keep in mind that there are exceptions to that rule, including Rule 72(t).

Before we get into specifics on saving to IRAs and other places you can save for retirement, let’s discuss the pros and cons of keeping your 401(k) in your employer plan. We already hinted at one of the cons, but there are usually limited investment options if you keep your 401(k) in your employer plan. One of the biggest pros is the IRS Rule of 55. It states that if you leave your employer after turning 55 (50 for public safety officials), you can still take 401(k) distributions or withdrawals without facing additional penalties.

Opening a Traditional IRA or Roth IRA

In addition to saving to your employer-sponsored 401(k), you can open a traditional IRA or Roth IRA while you’re still working and save to it. Traditional IRAs and Roth IRAs grow in the same respective fashion as traditional 401(k)s and Roth 401(k)s.

Creating Tax Diversification

Knowing the rules of the different places you’re saving for retirement is crucial so that you have a good understanding of your retirement cashflow. We can’t specifically address where you should be saving for retirement without knowing more about your unique situation, but one of the most common retirement planning mistakes we see people make is saving all their money to one place. It’s important to create tax diversification as you’re saving for retirement.

There are three different tax buckets that you can save to: taxable accounts, tax-deferred accounts, and tax-free accounts. The tax-free accounts are your Roth accounts, which are taxed up front and then grow tax-free. The tax-deferred accounts are your traditional IRAs, traditional 401(k)s, and pensions, which are taxable once you access them. And the taxable accounts include your savings and brokerage accounts. Diversifying your retirement savings across these different accounts can offer you flexibility from an investment and tax standpoint as you’re approaching and going through retirement.

“What are the rules going to be when it comes time you need to take it out? And what is going to allow you to get the maximum amount of income in retirement with the least amount of taxes?” – Dean Barber

Where Should You Save for Retirement If You’re a Small Business Owner or Self-Employed?

While 401(k)s, 403(b)s, or 457(b)s are great options if for most people, we haven’t fully addressed the question this article poses for those who are small business owners or self-employed. Yes, traditional and Roth IRAs can still be solid options, but don’t forget about Simplified Employee Pension (SEP) IRAs, Savings Incentive Match Plan for Employee (SIMPLE) IRAs, and Solo 401(k)s. Under SECURE 2.0, small business owners and self-employed individuals has traditional and Roth options for SIMPLEs, SEPs, and Solo 401(k)s.

“Oftentimes, the amount of money that they can put into these plans are far greater than what someone who is working for a corporation.” – Bud Kasper, CFP®, AIF®

SEP and SIMPLE IRAs and Solo 401(k)s

SEP IRA contributions function similar to traditional IRAs in that the contributions are tax-deductible. But SEPs do have a couple of additional advantages. One, like Bud mentioned, they have significantly higher contribution limits than traditional IRAs. And two, you can contribute to SEPs as an employer and employee. But you still need to be careful because the percentage you put in for yourself needs to also be put in for your employees.

If you’re an employer that is also the owner of the company, you can easily leak up into a 50% tax because you’re paying all the Medicare premiums for the employer and employee, the Social Security tax (that makes up your FICA), federal income tax, and potentially a state income tax.

SIMPLE IRAs give self-employed people and their employees the opportunity to make contributions and tend to be much simpler (no pun intended) to navigate than 401(k)s.

Solo 401(k)s are intended for business owners with no employees. While you can’t contribute to a Solo 401(k) if you have any full-time employees, it can also cover your spouse if they earn income from your company.

Defined Benefit Plans

Self-employed individuals and small business owners can also create defined benefit plans.They can fund a plan to define a future benefit. So, they can create their own pension. But once again, if you’re putting in for yourself, you must put the same percentage in for your employees.

“Where this makes sense is if you have a business owner who is maybe in their mid to late 50s. They want to sock away as much money as possible on a pre-tax basis and their employees are all in their 20s.” – Dean Barber

Health Savings Account (HSA)

If you tuned into The Guided Retirement Show episode with Dean and Marty, you’ll know that your health savings account should really be viewed as a retirement savings account. There are tax advantages of HSAs that can make a huge difference as you’re saving for retirement, so make sure to catch this episode if you missed it.

Most people have access to HSAs but don’t utilize them correctly. They think of it as a way to get money into their pre-tax HSA and then get it out in the same year to pay for health care expenses. But what if you just saved all your medical receipts? Then, when you get to retirement, you’ve invested your HSA just like your 401(k) and all the growth can come out and you can reimburse yourself for all the medical expenses you had. That money comes out just like a Roth 401(k)/IRA in that it’s totally tax-free.

“The other thing that most people don’t understand is that even though that HSA is offered by your employer, once that money goes into the HSA, it’s your money.” – Dean Barber

Real Estate

We enjoy covering a wide range of financial planning topics with some very knowledgeable subject matter experts on The Guided Retirement Show. In one of our episodes from 2022, Dean sat down with Realto CEO Brian King to discuss accessing liquidity inn REITs and private real estate markets. Make sure to check out this episode as well if you’re interested in investing in real estate to provide rental income or capital appreciation as you’re saving for retirement.

Diversification Is Key

The main takeaways here with where you should be saving for retirement is that it’s critical to save to different places and to understand the rules of how to access your money when you need it. Where you should save for retirement doesn’t have a one size fits all answer. It really does depend on your personal situation.

As you’re trying to figure out where you should be saving for retirement, make sure that you review our Retirement Plan Checklist. It’s designed to gauge retirement readiness for you and your spouse with 30 yes-or-no questions and an age-based timeline of retirement considerations. Download your copy below!

Starting a Conversation with Us About Where You Should Be Saving for in Retirement

With there being so many things that factor into the retirement planning process, it’s pivotal to be working with a team of financial professionals. At Modern Wealth, we have CFP® Professionals, CPAs, CFAs, estate planning specialists, and insurance specialists that work in a coordinated effort for our clients. One of their goals is to figure out where you should be saving for retirement.

“Putting the three C’s (CFP® Professionals, CPAs, CFAs) together puts us in the Big C, which is control. That’s what our clients are looking for from us.” – Bud Kasper, CFP®, AIF®

But in order for them to figure that out, they need to your goals, where you’ve been saving to so far, and your risk tolerance—among other things. So, let’s get started on that. You can schedule a conversation with us below.

In the end, we want to build a plan that gives confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love. Figuring out where you should be saving for retirement is clearly a key part of building your goals-based plan. Our team is excited for the opportunity to build that plan with you.

Where Should I Be Saving for Retirement? | Watch Guide

00:00 – Introduction

02:26 – Retirement Planning Resources

05:14 – Roth vs. Traditional

06:05 – In Plan Roth Conversions

12:10 – The Power of HSAs

14:29 – Why a Plan is Key

17:11 – Self-Employed and Small Business Owners

22:20 – What We Learned Today

Articles

- How Much Do I Need to Retire?

- Optimizing Your 401(k) for Retirement with Drew Jones

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- What Is Tax Diversification?

- What to Do with Your 401(k) After Retirement

- Tax Planning Strategies with Marty James

- What Are the Tax Buckets?

- Tax Advantages of HSAs with Marty James, CPA

- Accessing Liquidity in REITs and Private Real Estate Markets with Brian King

- Why You Need a Financial Planning Team

Past Shows

- How Does a Roth IRA Grow?

- Retirement Cash Flow: What You Need to Know

- Can I Retire Early? Becoming Financially Independent

- The IRA Early Withdrawal Penalty: How to Avoid the 10% Penalty

- Converting to a Roth IRA: What Are the Pros and Cons?

- 4 Big Tax Mistakes Retirees Need to Avoid

- Don’t Retire without Doing These Things First

- Financial Stress: How Do You Deal with It?

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.