Tax Advantages of HSAs with Marty James, CPA

START PLANNING Subscribe on YouTube

Tax Advantages of HSAs with Marty James, CPA Show Notes

We’re thrilled to have one of Modern Wealth Management’s newest team members, Marty James, CPA, join Dean Barber on The Guided Retirement Show. This will actually be Marty’s second appearance on the podcast, though. He previously joined Dean to discuss tax planning strategies in August 2022. On this episode, Marty and Dean will talk about some very specific tax strategies when it comes to HSAs.

Marty believes that HSAs are one of the most underutilized and misused part of the tax code. He’s going to explain why that is and how to use your HSA effectively.

In this podcast interview, you’ll learn:

- The Misconceptions About HSAs

- How to Maximize Your HSA

- Examples of Expenses Covered by HSA Plans

- Why You Should Look at an HSA as a Retirement Savings Account

What Are Some of the Tax Advantages of HSAs?

Let’s jump right into it. The reason HSAs can be so powerful is that they’re tax deductible going in and tax-free coming out if they’re properly utilized. The only thing that’s close to that is life insurance, but life insurance isn’t tax-deductible coming in. And, of course, there’s the Roth.

The HSA is a very simple concept, but they’ve complicated it in so many ways that people just don’t understand it completely. For employer-sponsored HSAs, most people they think it’s an employee or employer account, but it’s their individual account.

Morningstar does an annual study on HSAs that looks at what you can do with them and who has the best ones. One of the things that study showed is that only about 10% of the HSAs are invested for the long-term.

“In the accounting world, we call it the Imprest Fund. You put money in and you take it out.” – Marty James, CPA

If you can afford it to pay out of pocket for your medical expense and can continue to fund an HSA, invest in it for growth. Then, years from now, you can take that money out tax-free because you don’t need to spend it this year. If you have receipts from 20 years ago, you can use those to reimburse yourself. Just make sure to not lose your receipts. With cash register receipts, Marty recommends making a photocopy of them and getting them in a digital format. That way you’ll have a good record of that.

Tax Advantages of HSAs — They’re Tax-Deductible and Tax-Free

Here’s an example of the tax advantages of HSAs. Marty is friends with a CPA in Phoenix who had fertility issues. They spent about $100,000 on fertility treatments and ended up with twins. Marty’s friend has been funding this HSA. He held the $100,000 back so that when his kids go to college, their college funding is totally tax-deductible and tax-free. This is just one example of the tax advantages of HSAs to keep in mind.

Making the Most of Your HSA

For a lot of people, the money comes out of their paycheck and they put it in. That’s usually the best way to do it. However, most people don’t fully fund it. Oftentimes, they empty it by the end of the year and still have medical expenses outside of the HSA that they paid out of pocket. You have until April 15 to fully fund your HSA.

Let’s say that you only put $2,000 in it but had another $2,000 out of pocket. You can put $2,000 in, get your tax deduction for last year, and then as soon as the funds are available, reimburse yourself.

“You want to plan for that. You want to be sure that you have a source of money to do that for a couple of days. And it could be the bank of mom and dad. It makes complete sense to do that.” – Marty James, CPA

The advantage of choosing to do a salary reduction are the payroll taxes that you save. When you physically write a check, you’re doing that with after-FICA type money. It’s all still pre-tax.

The Tax Advantages of Investing in HSAs Long-Term

We mentioned early that about 10% of people who have HSAs are investing in them for the long-term. So, how does someone control the underlying investments in an HSA plan?

A lot of the HSAs are set up to have a certain amount in cash that you can use currently for medical type things. But then once you hit a certain threshold, you can start investing that money using ETFs—basically anything that’s available in other accounts that you have, depending on the plan. You can manage that just like your 401(k) or IRA.

It’s almost like a tax-deductible Roth IRA. Once you turn 65, you can use an HSA for your medical insurance premiums.

“In other words, you should look at an HSA plan as a savings plan as opposed to just a health savings account. They should look at it as retirement savings account.” – Dean Barber

What Qualifies as a Medical Expense Under HSA Plans?

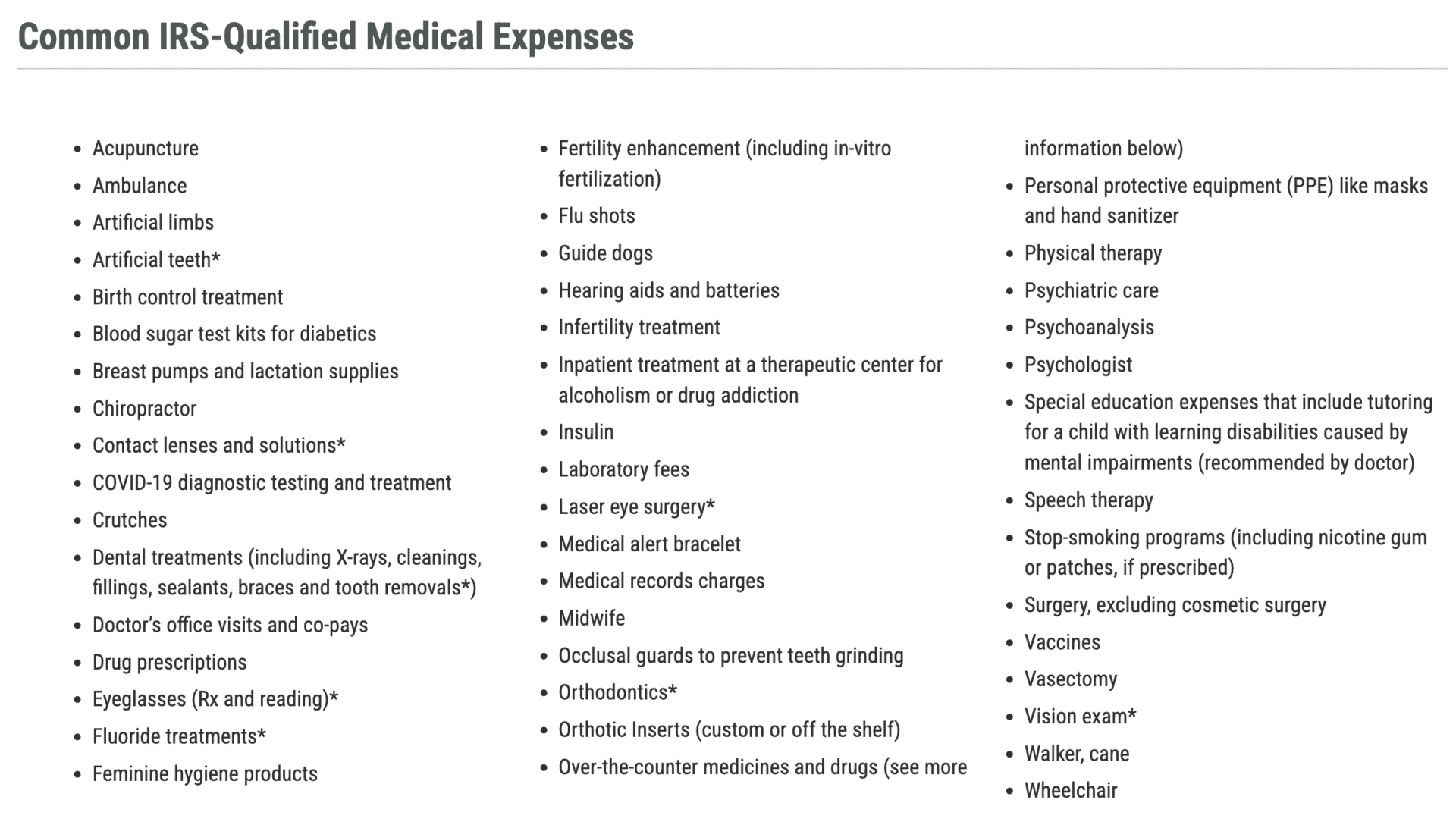

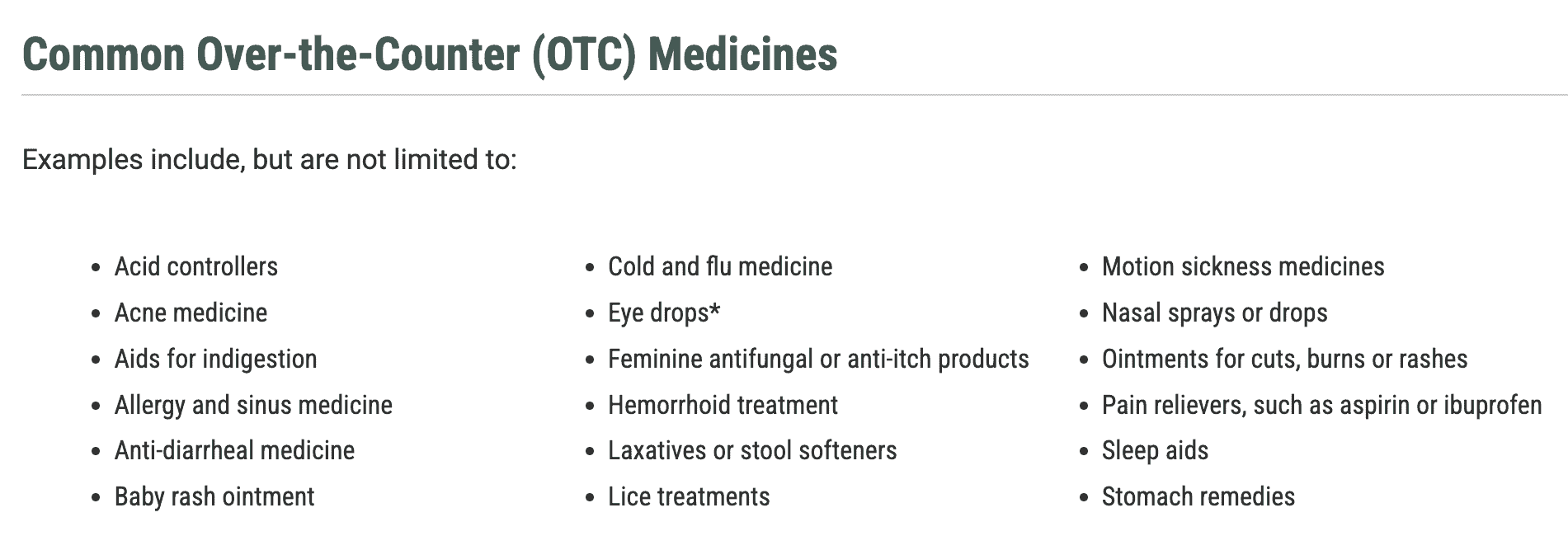

Most people get an HSA credit card when they have money in the HSA plan and use it when they have medical expenses. There’s a long list of medical expenses that qualify to be paid for using an HSA plan. To see the IRS’s full list, download Publication 502. You can also see the common IRS-qualified medical expenses and over-the-counter medicines below in Figures 1 and 2.

FIGURE 1 – Common IRS-Qualified Medical Expenses – HSA Bank

FIGURE 2 – Common Over-the-Counter Medicines – HSA Bank

Compound Growth is One of the Tax Advantages of HSAs

The more Dean thinks about it, the more he thinks that people should think about HSAs differently. He really wants people to understand that they’re getting a tax deduction when the money goes in. If you can afford to put that money in there and use regular money to pay for any excess health care costs throughout the course of every year, you’re just letting it grow.

“And it’s not just your contributions. If you’re investing it properly, you can get compound growth on that, which can be used later in life to pay for health insurance expenses, prescription drugs, and other doctors’ expenses.” – Dean Barber

What Happens to Your HSA Plan After You Retire?

Remember that you can’t keep contributing to HSAs after you get on Medicare. So, let’s say that you’ve accumulated $150,000-$200,000 in your HSA plan and are about to retire. What happens to that HSA plan when you retire? Does it stay with the employer or does it roll over to another HSA plan that you’re self-directing, much like you would with an IRA or Roth IRA?

It could stay there because it’s really your account. Again, it’s technically not with the employer. That’s why your employer doesn’t give you guidance on it because they have no exposure.

“If the HSA you have with employer doesn’t give you any good investment options, you can roll money out of that plan into one that does.” – Marty James, CPA

So, you can basically control everything even though it’s an employer-sponsored plan. But if you’re self-employed, you’re probably asking, “What about me? How do I get money into an HSA?”

It’s the same way anybody else does. You’ll have the self-employed health insurance deduction, but then you also have an HSA deduction that you make. It’s an adjustment down to that adjusted gross income number.

High Deductible Plans

There is a special type of insurance plan that you’ll have to be on to qualify for an HSA. It’s a high deductible plan. There are high deductible plans for single people high deductible plans for families, which you can put more in. Marty has seen people mess that up and not realize it, but it hasn’t been policed very well either.

The Affordable Care Act states that young adults can stay on their parents’ health insurance until they’re 26. To spend money out of your HSA on your kids’ medical expenses, they need to be a dependent. So, if you have a dependent who has graduated from college, but is still on your health insurance, they’re no longer your tax return. You can no longer make medical reimbursements out of that HSA, even though they’re covered under your health insurance.

But here’s the cool thing about that. Let’s say that your child is still on your health insurance. They’re covered by a family high deductible plan. They can also fund an HSA, but it’s not at the single rate. They can put money in at the family rate.

“This is a good way for parents that have a little extra money and want to help the kids out to fund some of that retirement savings for health care.” – Marty James, CPA

HSA Plan Contribution Limits

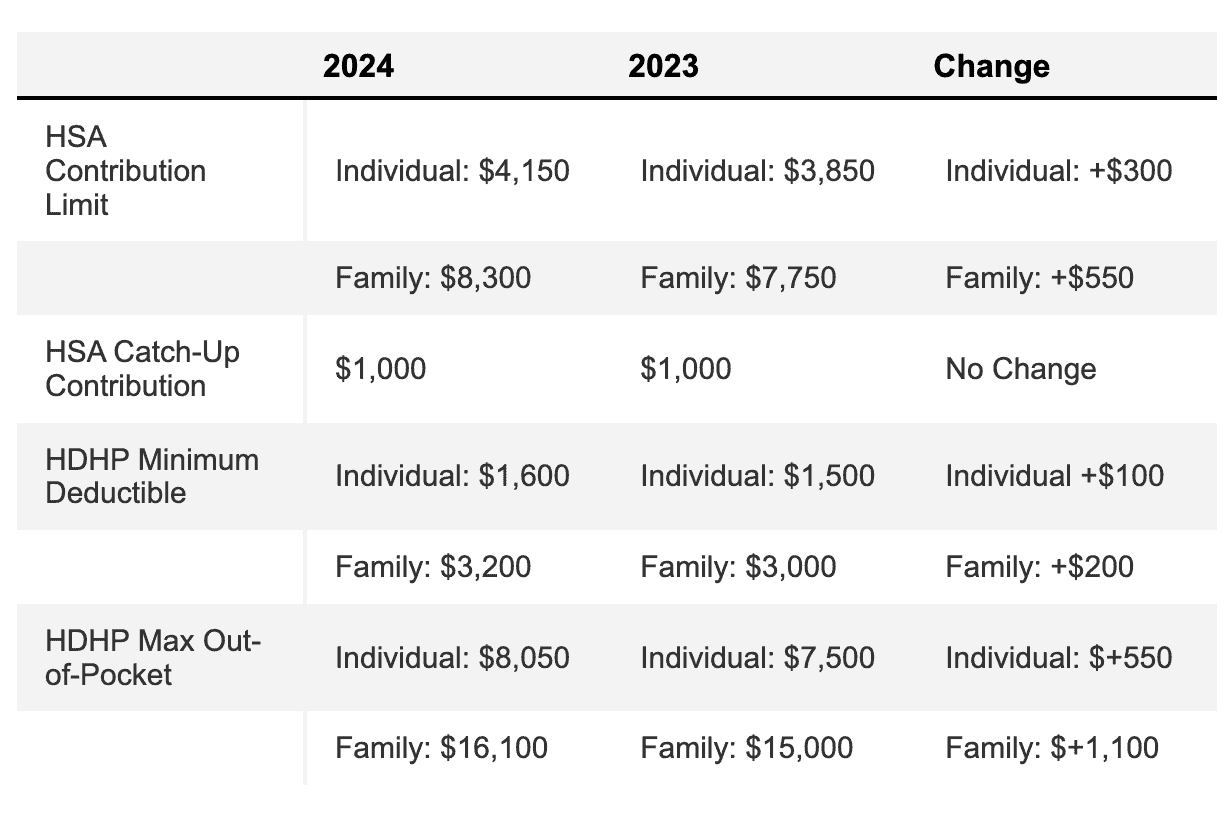

It really is important to think of your HSA as a retirement savings plan. There are annual contribution limits for HSAs just like there are for 401(k)s and IRAs. They’re adjusted each year based on inflation.

FIGURE 3 – HSA Contribution Limits – Kiplinger/IRS

Marty has a family plan for him and his wife and he maximizes his contribution each year. Since Marty and his wife are both 55 or older, they can also make catch-up contributions to their family plan. Marty’s wife can also establish an HSA—even if she’s not working—and do a catch-up contribution only to that. That’s how Marty and his wife can get the most money into their HSAs.

After Marty explained that to Dean, it didn’t take long for Dean to chime in with a follow-up question. What if Marty’s wife was employed by an employer that also had a high deductible plan and offered an HSA? Can Marty and his wife both do a family plan so they could get more money?

The answer is no. They’re still going to be limited to the tax return limit for their family.

“In other words, we can split it 50-50 or it could be whatever percentage. But there’s a maximum amount that can go in.” – Marty James, CPA

Getting Your Money Out of an HSA

As we begin to wrap up this article, let’s go over some tips and tricks to get money out of your HSA. Like Marty previously mentioned, saving your receipts is very important. That’s because if you’ve saved receipts over the years, you can just reimburse yourself. It’s going to be up to you to prove it to the IRS that you have these receipts. You don’t need to send the receipts to anybody.

“It doesn’t have to go to a pharmacy, doctor, or hospital. You just say, ‘I’m going to make a withdrawal out of my HSA.’” – Dean Barber

When you file your tax return, you’re saying that you used all these funds for qualified medical expenses. The burden of proof is on you. Let’s take Marty’s CPA friend from Phoenix as an example. When he’s taking out $25,000 a year from his HSA to pay for his children’s college, he won’t need to show receipts with his tax return in the event he is audited. He just needs to have documentation of them.

Why Aren’t People More Excited About the Tax Advantages of HSAs?

Dean learned a lot from Marty with talking to him about the tax advantages of HSAs, and we hope you have as well. Marty and Dean agree that people don’t utilize HSAs as much as they should because a lot of people don’t understand the tax advantages of HSAs.

“If I had a limited amount of funds, I would contribute to my 401(k) and get the maximum match. Then, I’d be looking at that HSA to be sure that fully happens. When you can do both, do both.” – Marty James, CPA

The key is that you must have legitimate medical expenses after the HSA plan has been established to pull that money out later.

What Else Are People Unaware of About HSAs?

Marty always spends a lot of time talking to people each tax season about properly utilizing their HSA. There are a lot of times when he sees people not maxing out their spouse’s catch-up contribution. It’s something that’s easily missed. And just simply be aware of how old you are.

“When you turn 50, you get to put more money into your 401(k). Well, when you turn 55, you get to put more money into your HSA.” – Marty James, CPA

Hopefully this information about the tax advantages of HSAs has helped you to think about how HSAs should be a part of your overall retirement strategy. Dean and Marty have worked in the financial services industry for nearly 70 years combined and very rarely see someone who has $100,000-$200,000 in an HSA. And it’s because they spend it all.

“I think it goes back to the old Section 125 Flexible Spending Accounts where people say, ‘if I don’t spend it, I’m going to lose it.’ I think that’s some of the mentality that’s still out there.” – Marty James, CPA

A Sneak Peek at a Future Episode of The Guided Retirement Show

Marty is already excited to join Dean again on The Guided Retirement Show. On a future episode of The Guided Retirement Show, Dean and Marty will talk about bridging the gap for health care expenses between the time you retire and when you become eligible for Medicare if you retire before 65. They’ll discuss how to qualify for the Affordable Care Act credits and still have enough money to live on.

“Let’s say someone is planning to retire at 60 and is funding their HSA fully. They’re accumulating these medical bills when they’re trying to bridge that gap to the Medicare to maximize credits. Now they can reimburse themselves and get some money to live on.” – Marty James, CPA

So, be on the lookout for that episode on a future season of The Guided Retirement Show. And don’t forget let your friends know about this episode with Marty so that they’re aware of the tax advantages of HSAs. We want to make sure that you and your loved ones understand how to utilize an HSA and get the tax advantages from it like Marty and Dean have discussed.

If you have any questions about the tax advantages of HSAs, start a conversation with us here. We’re looking forward to talking with you about how an HSA can be a useful tool as you’re planning to get to and through retirement.

Watch Guide | Tax Advantages of HSAs with Marty James, CPA

00:00 – Introduction

01:38 – The HSA is Underutilized in Financial Plans

05:16 – Investing HSA Funds

10:05 – Qualifying for HSA Plans

11:36 – HSA Contribution Limits

13:22 – Tips for Getting HSA Money Out

14:36 – Get Excited About HSAs!

17:13 – Wrapping Up

Resources Mentioned in This Article

- Tax Planning Strategies with Marty James

- Life Insurance in Retirement: Do I Still Need It?

- How Does a Roth IRA Grow?

- Why Compound Interest Is Key

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- 10 Ways to Fight Inflation in Retirement

- Starting the Retirement Planning Process

- Optimizing Your 401(k) for Retirement

- ABCs of Medicare

- Retirement Planning for Self-Employed Individuals and Small Business Owners

- Retirement Savings by Age

- Retiring Before 65: What You Need to Consider

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC, does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.