Why Compound Interest Is Key

Key Points – Why Compound Interest Is Key

- The Value Compound Interest Can Have on a Retirement Plan

- Examples of Compound Interest When You Start Saving at Different Ages

- Why Compound Interest Is Such a Crucial Tool in Financial Planning

- 4 Minutes to Read | 8 Minutes to Watch

What Is Compound Interest?

Compound interest is key to retirement planning. Modern Wealth Management Lead Advisor Chris Rett, CFP® will help us understand compound interest, the difference between compounding interest and simple interest, the value of compounding interest for retirement, the Rule of 72, and how to use compound interest for your retirement.

Compound Interest: The Eighth Wonder of the World

So, what is compound interest? Albert Einstein defined compound interest is the eighth wonder of the world. He or she who understands it, earns it. He or she who doesn’t, pays it. And here is Investopedia definition.

= [p (1 + i)n] – p

= p [(1 + i)n – 1]

p: principal

i: annual interest rate

n: number of compounding periods

If you’re confused, you’re not alone. Let’s simplify it. Ben Franklin describes compounding interest as, “Money makes money. And the money that money, makes money.” In other words, interest on top of interest.

Compounding Interest vs. Simple Interest

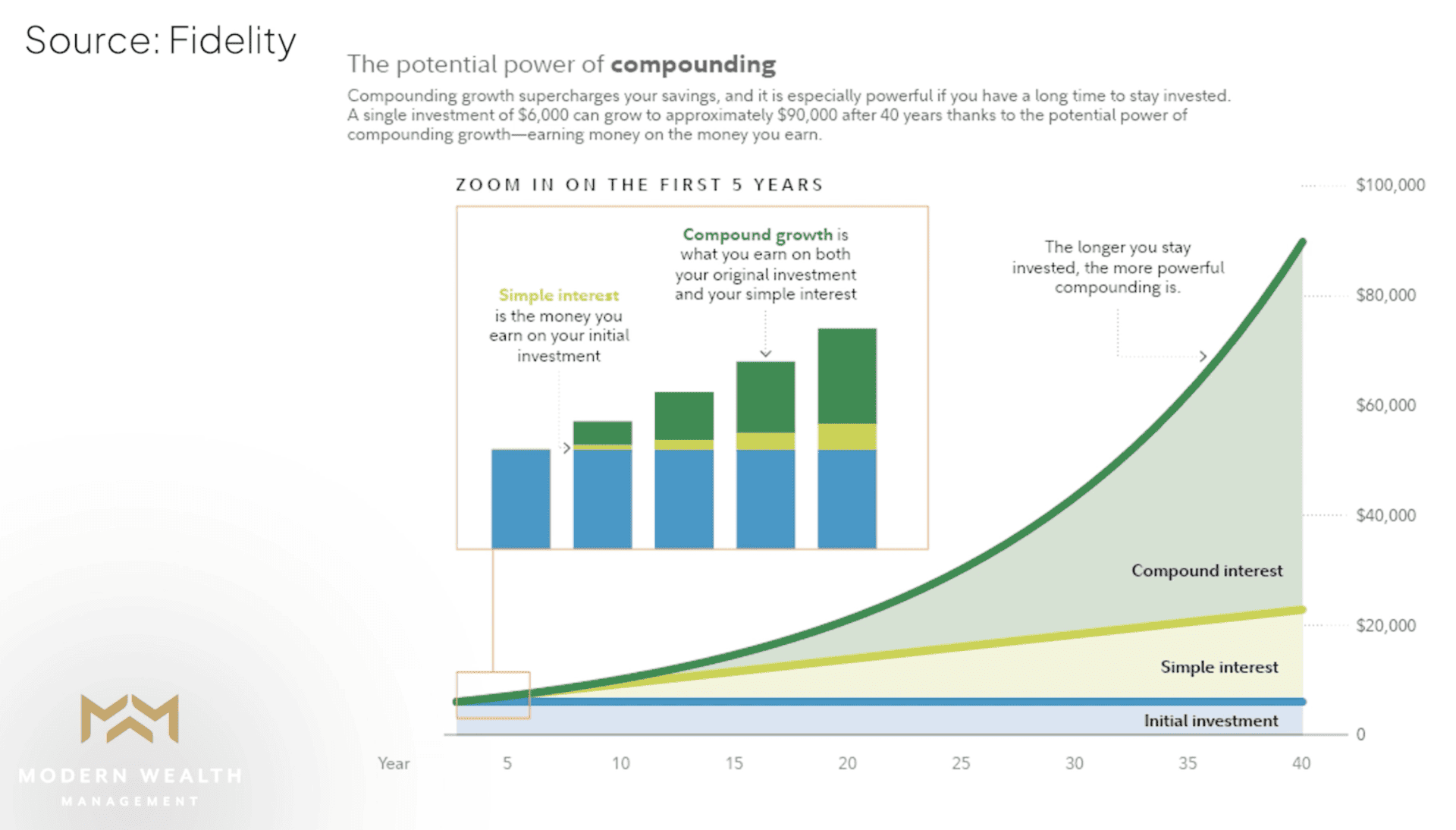

To better illustrate this, it is easy to see compounding interest versus simple interest. Think of simple interest as a straight line like you see below in Figure 1.

FIGURE 1 – Compounding Interest vs. Simple Interest – Fidelity

Simple interest is like a CD. You invest in a CD and it pays you a certain percentage every year on time until the CD matures. That interest on that CD doesn’t earn you any additional interest. It’s just a flat, simple interest.

Compounding interest is interest that is earned on top of the interest that you earned. As you can see above in Figure 1, it’s that ever accelerating exponential growth rate that you see. To conceptualize the value of compounding interest for a retirement, there’s an old fable that Chris likes to reference.

Using a Fable to Understand Compound Interest

In the fable, somebody is proposed $1 million today or a penny today that doubles every day for a month. Which would you choose? If you had elected the penny, you would have a penny on the first day. On the second day, you would have two pennies and so on and so forth until the month is up. By Day 10, you would have $5.12. That’s a far cry from the $1 million that you were proposed on the first day. By Day 15, you’re still only at $163.84.

It isn’t until Day 28 that you exceed that initial $1 million offer, when you’d be at $1,342,177. If you had taken the ladder of the two options and selected a penny on Day 1 that doubles every day, by day 30, you would have $5,368,709.

“All the difference that you see with that penny is compounded growth. That original penny doubled every day for 30 days straight to the tune of $5,368,709. You nearly outpaced the $1 million investment initially that you would have been offered by about five times. That’s the value of compounding interest.” – Chris Rett

How Does Compound Interest Work?

So, how does compound interest work? How can we estimate compound interest as it pertains to our retirement? To do that, the popular rule that we like to use in the investment rule is the Rule of 72.

The Rule of 72

With the Rule of 72, you take 72 divided by the average interest rate. That’s how long it takes your investment to double.

For example, the S&P 500, which is commonly referred to as the stock market, is a great barometer for the stock market. Since its inception in 1928, the S&P 500 has an average rate of return of 9.82%. If you take this and want to invest your money in 100% of the S&P 500. That would not be advisable for somebody nearing retirement.

But let’s say you’re 20, 25, 30 and want to follow the Warren Buffett method and invest 100% in the S&P 500. When you apply the Rule of 72, your money would double theoretically every seven years and four months. For a 30-year-old who is starting to invest and is looking to retire around 65, that’s almost five times your money would double.

“If you have a $10,000 investment, that becomes $20,000 every seven years and four months. That is the power of compounding interest. You only put in a certain amount, but now your interest is starting to make interest on your original investment.” – Chris Rett

The Power of Starting Early

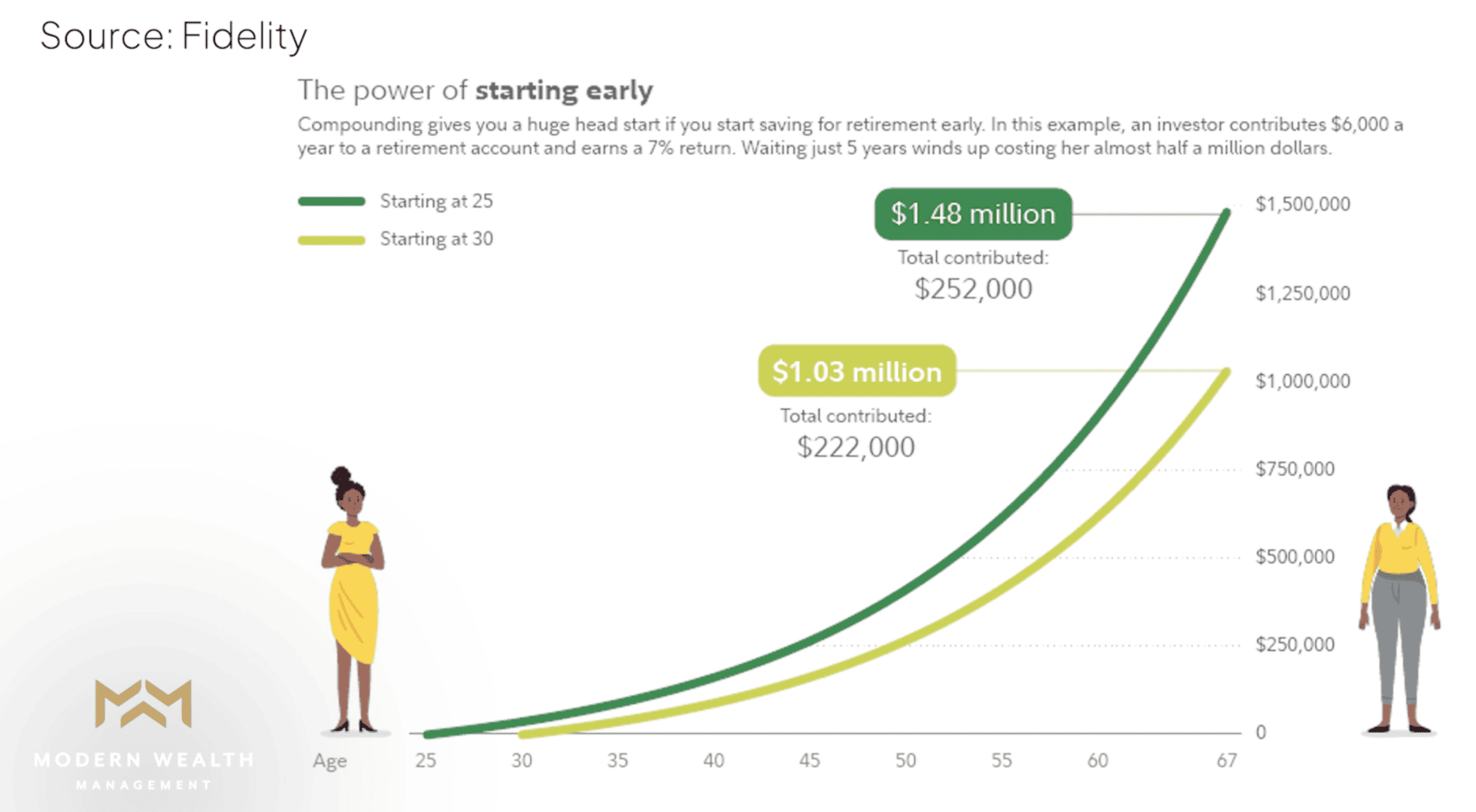

Fidelity showed the value of compounding interest and starting early in a study by comparing a 25-year-old and a 30-year-old.

FIGURE 2 – The Power of Starting Early – Fidelity

FIGURE 2 – The Power of Starting Early – Fidelity“That is the power of compounding interest when you utilize it with time on your side. This gets even more exponential when we start talking about the tax classifications of investing and introducing Roths vs. tax-deductible or tax-deferred investments like a traditional IRA or 401(k). We have numerous studies on that. We’ve talked about that extensively.” – Chris Rett

Do You Have Questions About Compound Interest?

We recommend looking at that if you’re 25, 30, 35 or even 40 years old. And if you’re not in that age range, there is still likely someone that you know who is—maybe your children or grandchildren—who can benefit from compound interest. If you’re interested in learning more about this, reach out to us. We want to figure out how it can work for you. To further discuss compound interest and how it impacts your retirement planning, you can see our schedule below to schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals. We can meet with you in person, virtually, or by phone.

You can also begin to see the power of compounding interest by using our industry-leading financial planning tool. This is the same tool that our CFP® Professionals use with our clients, and you can use it from the comfort of your own home. Simply click the “Start Planning” button below to begin building your plan today.

And if you think of some questions about compounding interest or anything else that relates to your retirement as you’re using our tool, please don’t hesitate to reach out to us. We’ll be happy to walk you through those questions to help give you more confidence, freedom, and time in retirement.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.