What to Know About CDs, Bonds, and Treasuries

Key Points – What to Know About CDs, Bonds, and Treasuries

- A Traditional 60/40 Portfolio vs. Cash Plan

- Looking at Preservation and Growth

- Can You Keep Up with Inflation?

- Breaking Down the Rare Bond Bear Market of 2022

- 10 Minutes to Read | 23 Minutes to Watch

Understanding What You Need to Know About CDs, Bonds, and Treasuries

What’s going on in the world of conservative investments? Dean Barber and Bud Kasper got down to the bottom of that, as they examine what you need to know about CDs, bonds, and treasuries on America’s Wealth Management Show. What are the characteristics, risks, and potential returns with CDs, bonds, and treasuries? There is a lot of analysis that goes into figuring all that out.

Dean and Bud are also going to compare the merits of 100% cash plan versus the traditional 60-40 portfolio. They’ll look at the risk and reward factors for each strategy to shed light on the importance of asset allocation and long-term investment goals. It’s our goal at Modern Wealth Management to provide you with an unbiased understanding of these investment options.

Subscribe on these apps or wherever you listen to podcasts:

.

.

The Latest Developments of What to Know About CDs, Bonds, and Treasuries

For the first time in almost two decades, people can make money on money markets, CDs, and treasuries. If we just look back to 2022, the rates of return on money markets, CDs, and treasuries we’re still less than 1%. You had to go out seven to 10 years on the treasuries to get above 1.5%. That still wasn’t even covering inflation.

The Steeply Inverted Yield Curve

Today, interest rates are essentially upside down. That’s why we’ve talked so much about the inverted yield curve. It’s almost as if the longer you want to commit your money to something, the lower your return is going to be.

“I was looking at a portfolio for a client last week. They had some treasuries mature and we had been laddering some treasuries. On the four-month treasury, we got him a little more than 5.5%. But when I looked at the one-year, three-year, five-year, seven-year, and 10-year treasuries, they were lower. It’s upside down. You can only get like 3.6%-3.7% on a 10-year treasury, but you can get a four-month treasury at 5.5%.” – Dean Barber

Dean and Bud haven’t seen a yield curve that’s been so steeply inverted. The inversion started in October has just become steeper and steeper for the most part.

“This is an opportunity. As I tell clients, this is our chance in a lousy environment to make lemonade out of lemons.” – Bud Kasper

Sequence of Returns Risk

With interest rates being this high, a lot of people have been asking our CFP® Professionals why they should take any risk in the market anymore. Many of them just want to use cash as their position to get the income that they need.

Is that safer than risking money in the stock or bond markets? It can in the short run. But in the long run, it’s the safest way to go broke. Inflation is too close to what the return is, so you’re not getting a maximized percentage over what you’re getting in these.

“Inside our financial planning platforms, we can access CDs from banks across the United States. That’s a huge advantage to us, but it can change hour by hour.” – Bud Kasper

Taking Advantage of Opportunities

As an example, Bud is looking at a 5.3% three-month non-callable CD and finds it attractive. The six-month is also 5.3%. So, why would you do the three-month when you could get the six-month since you’re getting the six-month for twice as long?

“It’s important to take advantage of opportunities like that. You need to stagger some of the maturities so that you have money coming up all the time. That way when things change in the markets, you have some cash available to participate.” – Bud Kasper

What the Millionaires Next Door Need to Realize About CDs, Bonds, and Treasuries

We really want to delve into the viability of somebody just using these safe instruments. If you have enough money, it can work when you have these types of rates. Most people that we talk to are the millionaires next door. They’ve worked hard their entire life. They live below their means. They’ve focused on saving and have accumulated somewhere between $1 million to $5 million or $6 million. We’ve got a few clients that have $10 million-plus, but most of them are in the $1 million to $5 million range.

“The lifestyle that they want to have doesn’t bode well for keeping everything in a short-term money market or short-term treasury type of position. From a historical perspective, it doesn’t deliver the return that we need to keep up with inflation.” – Dean Barber

We always need to consider where the source is. Where is this money being held? For example, if it’s being held in a rollover IRA, Uncle Sam is going to get his piece of the pie as well. There are tax considerations.

“Think about that 5.3% six-month CD that I just talked about. When we take the taxes that might be drawn off the account based upon the distributions that are coming out, that can negate what the net return is.” – Bud Kasper

How CDs, Bonds, and Treasuries Fit within a Financial Plan

To help you better understand what there is to know about CDs, bonds, and treasuries, we’re going to walk through a financial plan. It’s not a super detailed plan that we would normally build out, but it’s high level so that you’ll hopefully get the idea.

All-Cash Plan

We want to illustrate from a historical perspective whether someone can use cash as their investment. If you have FDIC insurance or are buying treasuries and they’re backed by the full faith and credit of the United States government, that is perceived safety. In this example, there’s no risk in the bond market, so we’re going to use shorter-term instruments to fund the retirement income. Here are the assumptions for the 67-year-old married couple in this plan that is set to retire and max out their Social Security at full retirement age

All-Cash Plan by the Numbers

- $1 million in their IRA.

- $5,000 per month in monthly expenses.

- A 4% inflation rate throughout retirement.

- Each spouse will receive $1,825 per month in in Social Security ($3,650 total). So, of the $5,000 per month they’re spending, $3,650 will come from Social Security.

- Cash is making 5% right now. So, take the $1 million IRA and multiply it by 5%. That gives them another $50,000 a year, which equates to $4,166 a month.

- Finally, add the $3,650 per month from Social Security and the $4,166 from cash and they’ll have $7,816 a month … for now.

Don’t Forget About Uncle Sam When You’re Crunching Those Numbers

The couple probably thinks they’re in great shape with $7,816 a month, but there’s a reason we said “for now” at the end of that last bullet point. They need to remember that they’re going to need to pay taxes on every dollar they take out of the IRA. Even if it was a non-IRA, the taxes would still be due in the same fashion from the CD, money market, or treasury.

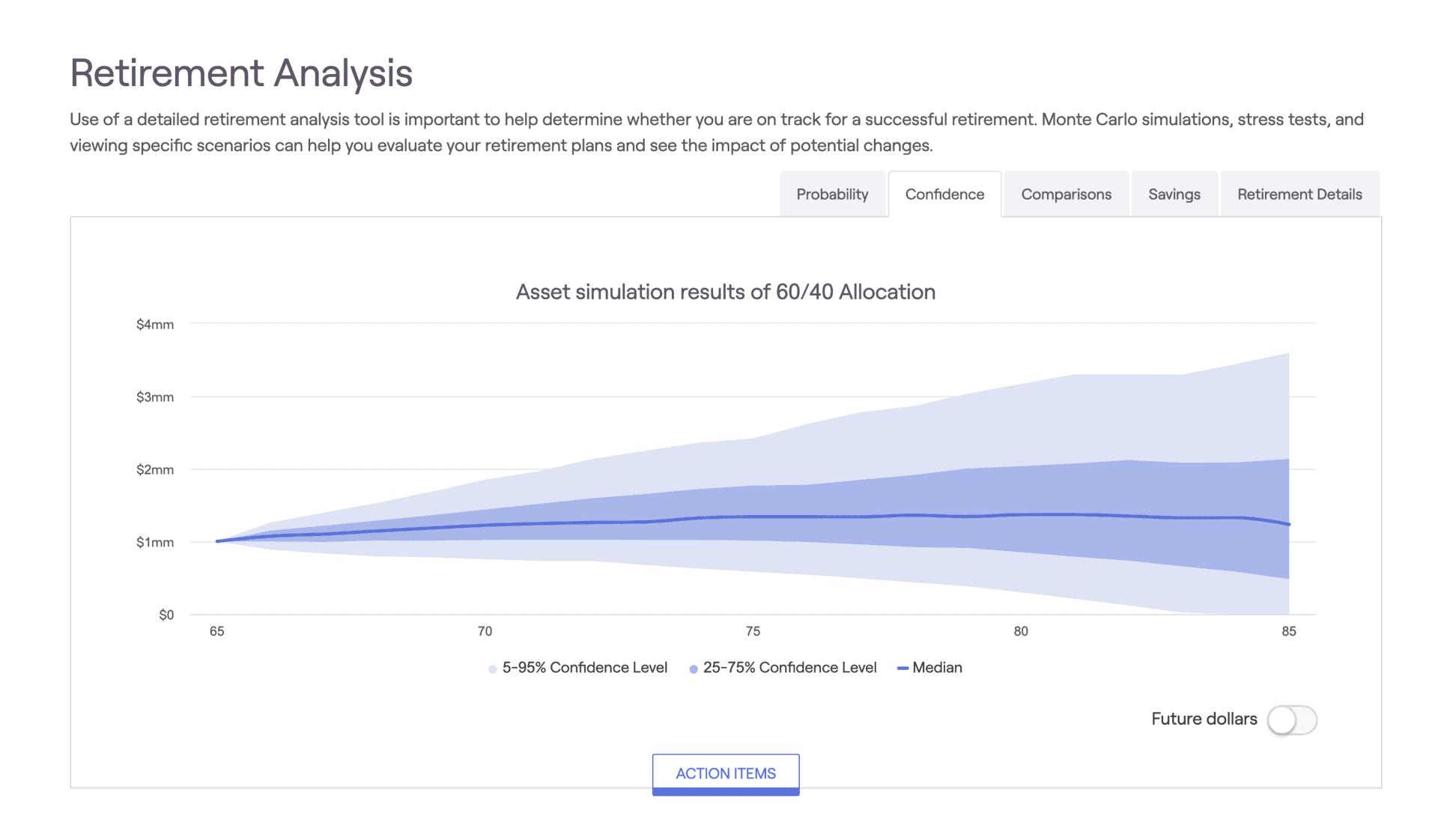

A Plan with a 60-40 Portfolio

Before we wrap up the results of the cash plan, let’s look at what the traditional 60-40 portfolio would do. We’re going to this to you in what is called a Monte Carlo simulation. A Monte Carlo simulation basically simulates 1,000 lifetimes. It takes historical returns and randomizes them. Then, it puts the best of the best together, the worst of the worst together, and everything in between.

Your Plan’s Probability of Success

In this example, they have a 90% probability that they could spend that $5,000 a month and keep up with 4% inflation. So, 90% of the time, they wouldn’t need to adjust their spending. They can keep up with inflation and they’ll be fine. There’s a 10% chance that they may need to adjust spending at some point in the future. That is a successful plan.

They have the probability to wind up with about $3.5 million from their $1 million IRA if they live to 85. But the same probability of that occurring is the probability of them running out of money at 83. Running out of money is just as likely as winding up with $3.5 million. About $1.5 million is the baseline of where they would wind up with that 60-40 portfolio.

FIGURE 1 – 60-40 Plan Outcome

“A lot of people develop a false sense of security with these higher interest rates. They’ll want to put 50% of their portfolio in those because of that. You can’t be shortsighted because the inflation nemesis is out there. That’s going to take away spending power. So, we still need to look for growth. Granted, we’re going to be in periods where growth is going to be less important to us than preservation. That is where we need to understand the person that we’re working with and what their tolerance is for risk. We want you to understand the probabilities of success specific to your situation.” – Bud Kasper

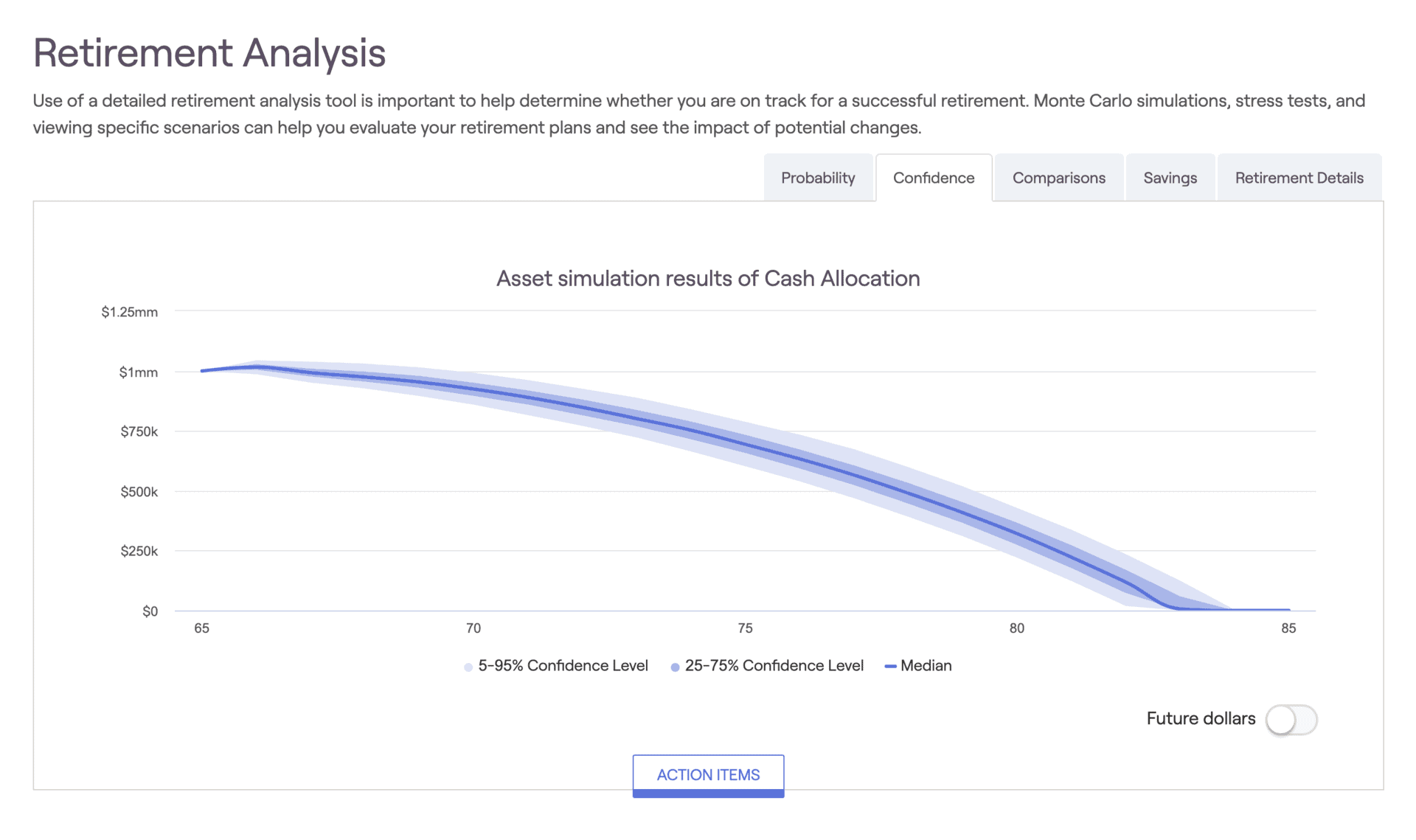

Circling Back to the All-Cash Plan

Speaking of probabilities of success, let’s circle back and look at the probability of success of using cash. These are short-term money markets, CD type instruments, and treasuries. It’s going to take all the historical returns, including the really high rates of the late 1970s and early 1980s and the very low rates from the last few years.

If they invested in cash, not one time from a historical perspective could they keep up with inflation and maintain their principal value through age 85. In fact, 100% of the time they ran out of money completely somewhere between ages 83 and 84.

FIGURE 2 – Cash Plan Outcome

The Bottom Line with What to Know About CDs, Bonds, and Treasuries

That might seem kind of grim, but nobody is ever going to run out of money like that. The people that accumulate $1 million aren’t going to let that happen. They’re going to live like they’re broke. To prevent going broke, they’re going to live like they’re broke. But that’s not what anybody wants in retirement.

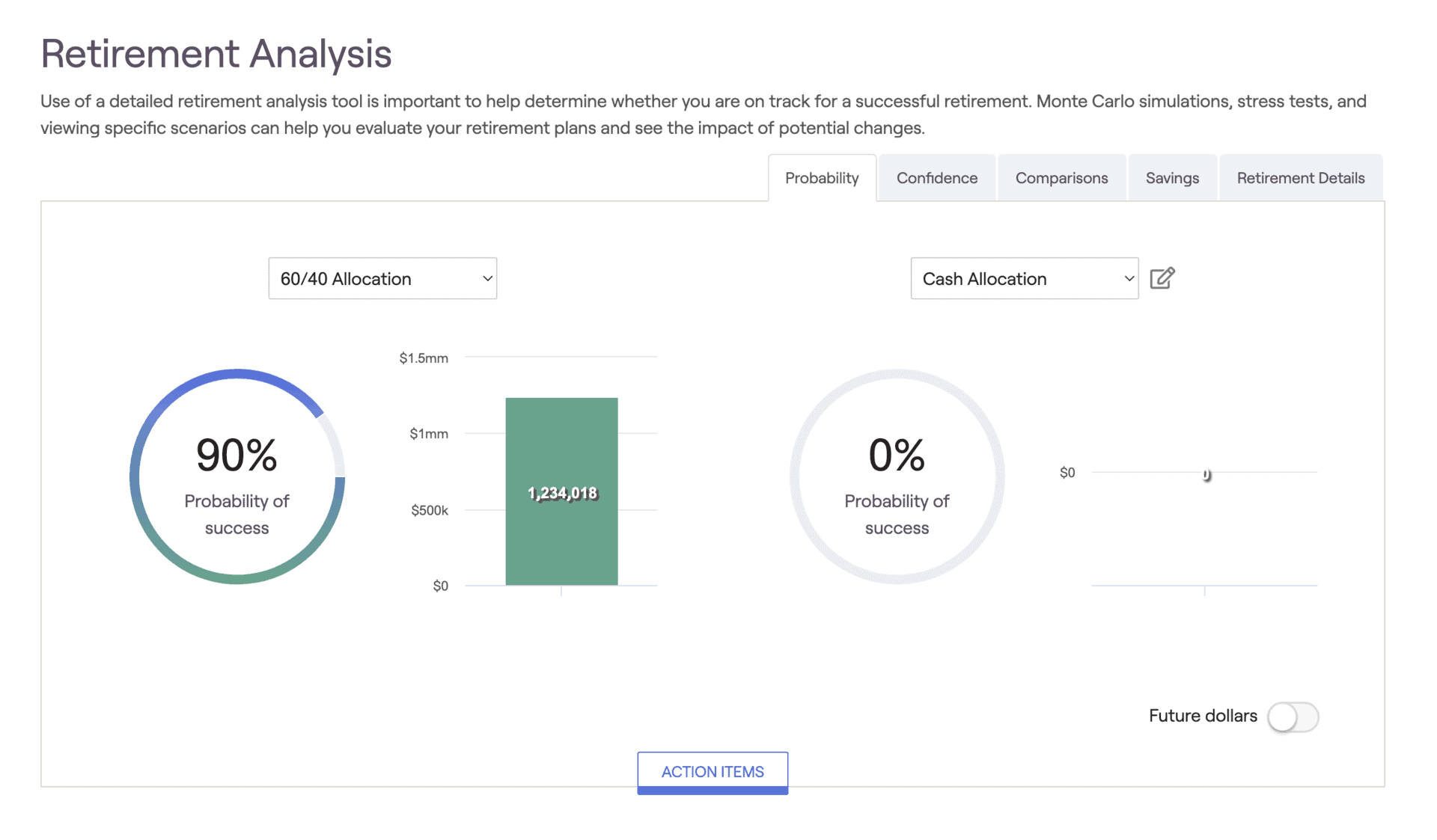

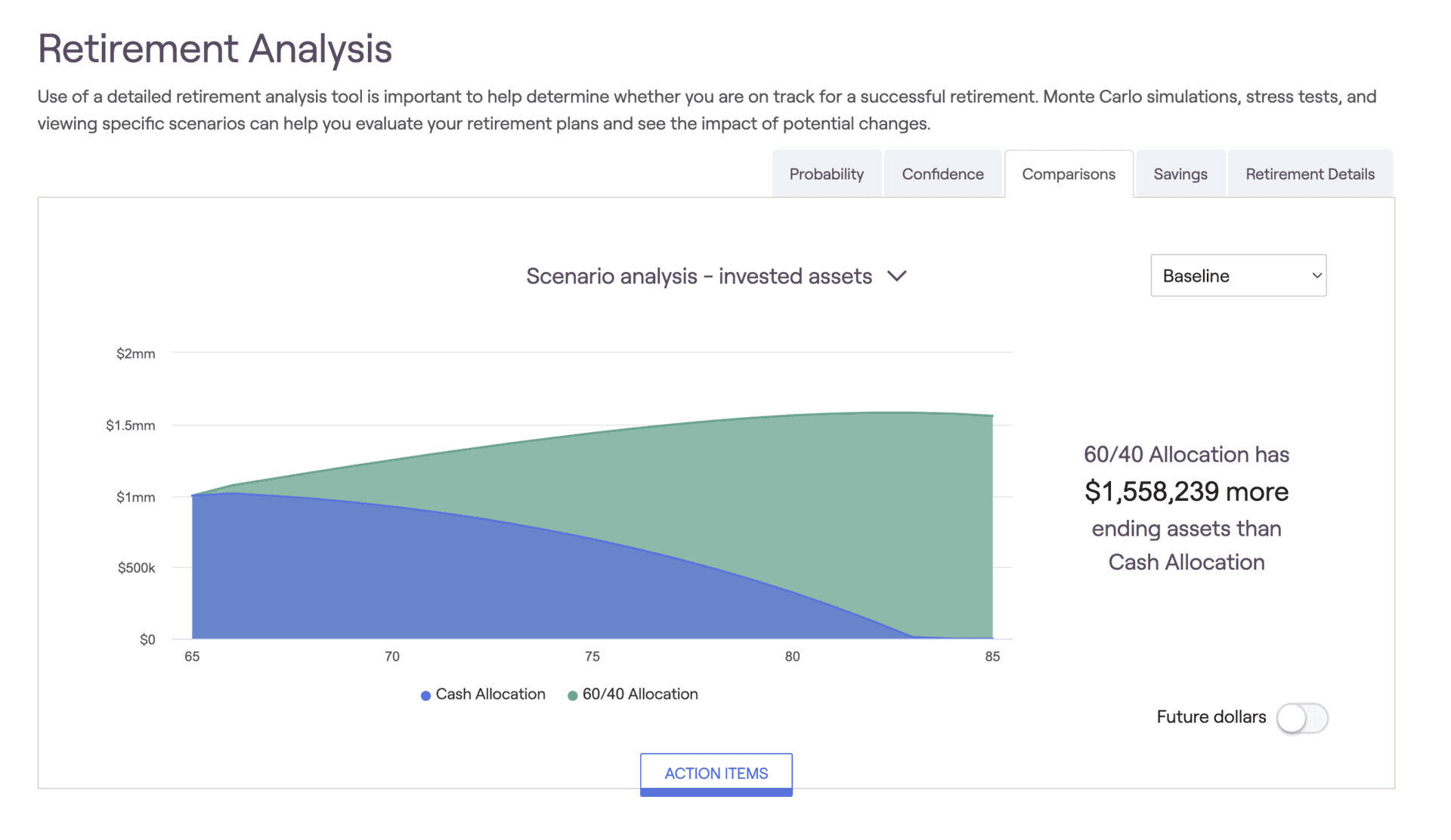

Comparing the Cash Plan to the 60-40 Portfolio

If we look at the cash plan and 60-40 portfolio side by side, the 60-40 portfolio gave them a 90% probability of success. They wouldn’t need to change their spending habits and they could keep up with 4% inflation. But with the all-cash plan, they had a 0% probability of success.

FIGURE 3 – Plan Comparison of Success

FIGURE 4 – Plan Comparison Timeline

“People are saying they hate the stock market because it’s all over the place and everything. Well, it is. The stock market can be volatile. But if you’re working with the right person, you can tame that volatility down to an acceptable level even though there would be no guarantee associated with what that was.” – Bud Kasper

The probabilities of success are significant. But you won’t know your probability of success unless you dig into the plan and understand all the places that you can get money from for income in retirement and how to make it work as efficiently as possible. That’s why our CPAs come in and help us make sure that we’re getting as Uncle Sam out of your life as much as we can.

“You don’t know what you don’t know. Oftentimes, people don’t even know what questions they should be asking.” – Dean Barber

Finding Out What Questions You Should Be Asking in Our Retirement Plan Checklist

That’s exactly why we created our Retirement Plan Checklist. It simulates the thinking of all the things that you need to be do be doing as you head into and through retirement. Our Retirement Plan Checklist includes age-based and date-based timelines as well as 30 yes-or-no questions that you need to ask yourself during the retirement planning process. You can download your copy below.

If you download the Retirement Plan Checklist, take note of how many of the 30 questions are about your portfolio construction strategy. There aren’t any. That’s not to say that proper portfolio construction isn’t important, but it shouldn’t be the first thing you’re asking about as you’re planning for retirement. There are so many other things that need to be considered first.

“The investments are the fuel that allows you to do the things that you want to do. You should never have an investment discussion with a CFP® Professional until all you’ve completed a plan.” – Dean Barber

Summing It All Up with What to Know About CDs, Bonds, and Treasuries

So let’s recap what we’ve discussed about what there is to know about CDs, bonds, and treasuries. There is an opportunity to sit on the sidelines if you’re uncomfortable with the economic environment, political environment, etc., and still make a reasonable return. That’s something that we haven’t been able to do for almost two decades.

“It’s been a long time—half of Bud and I’s respective careers. We’ve been in an environment where money markets, short-term CDs, and short-term treasuries just didn’t offer us ability to make any money .” – Dean Barber

Also, if you have enough money and don’t care about leaving much of a legacy, you only need to earn 1% or 2% and you can spend everything you want to spend. But if you’re the average millionaire next door who needs your money to generate more of a return than you spend each year so that you can keep up with inflation and continue to live the lifestyle that you want, you still need to have a well-constructed portfolio.

Financial Planning Is Pivotal

And, like we showed in the example with comparing the 60-40 portfolio to the all-cash plan, your probability of success matters. Financial planning is the key.

“We didn’t even delve into Social Security maximization, tax reduction strategies, and all the other things that go into the plan. We didn’t break out inflation into all the different areas where somebody spends money. All we did here was try to illustrate that even though rates are high right now, it’s not the long-term solution for most people.” – Dean Barber

So, what are you waiting for? It’s time to start building your plan today to get you to and through retirement. We’re giving you the opportunity to do exactly that with the same financial planning tool that our CFP® Professionals use with our clients. You can use it from the comfort of your own home and at no cost or obligation by clicking the “Start Planning” button below.

Do You Have Questions About What There Is to Know About CDs, Bonds, and Treasuries?

We should note that while this tool can get you started and make you think about several things that a retirement calculator won’t calculate, it is intended for professional use. If you have any questions as you’re using our tool, please don’t hesitate to reach out. We’re happy talk with you more about what to know about CDs, bonds, and treasuries. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, by phone, or virtually—whatever works best for you.

What You Need to Know About CDs, Bonds, and Treasuries | Watch Guide

00:00 – Introduction

01:12 – CDs and Money Markets are Making Money

03:52 – Why Take Risk with These Safer Options?

07:18 – 60/40 Plan vs Cash (Fixed Income) Plan

16:52 – Managing Risk

19:29 – What We Learned Today

Resources Mentioned in This Episode

- Inverted Yield Curve Signals Recession

- What Is Yield Curve Inversion?

- Investment Risk in 2023 with Garrett Waters

- 10 Ways to Fight Inflation in Retirement

- What Are the Tax Buckets?

- Taxes on Retirement Income

- Retiring with $1 Million

- Maximizing Social Security Benefits

- What Is a Monte Carlo Simulation?

- How Bonds Fit into a Financial Plan

- Proper Portfolio Construction with Stephen Tuckwood

- Maximizing Social Security Benefits

- Tax Planning Strategies with Marty James

Past Episodes

- Asset Allocation Versus Tax Allocation

- Is Inflation Slowing?

- The Effect of Rising Interest Rates on the Economy

- Converting to a Roth IRA: What Are the Pros and Cons?

- 5 Types of Financial Plans

- What Is Financial Planning?

- 9 Items That Retirement Calculators Miss (That Our Tool Doesn’t)

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.