Retirement Savings by Age

Key Points – Retirement Savings by Age

- You Won’t Get an Accurate Answer to How Much You Need to Retire with a Retirement Calculator

- Reviewing a August 2023 Fidelity Study on Retirement Savings by Age

- Going to and Through Retirement with Our Retirement Plan Checklist

- 7 Minutes to Read | 24 Minutes to Watch

How Much Do You Need to Retire?

The question, “How Much Do I Need to Retire?” certainly makes for an attention-grabbing headline. And we get it. It’s a very frequently asked question and we’ve even published an article with that exact headline. But if you’re expecting to read that article and get a definitive answer to that question that includes a retirement savings by age breakdown, that’s not what you’ll find.

Unfortunately, a lot of people try to do back-of-the-hand math or use a retirement calculator to get the quickest answer possible to how much they should have in retirement savings by age. They’ll get an answer, but it won’t be correct. Why? Because your retirement savings be age goals and how much you need to retire can vary based on several different factors. Those factors include your goals, lifestyle, age, income, health, market volatility, inflation, interest rates, tax rates hikes, etc.

Some of those factors are well with in your control. Those last few items that we listed aren’t within your control, though. However, you can plan for them. The bottom line is that you need a goals-based, comprehensive financial plan that’s built by a CFP® Professional. We’re going to circle back to the point, but first, we’re going to review a retirement savings by age August 2023 study by Fidelity and some key points from our Retirement Plan Checklist.

Key Questions to Ask Yourself When Thinking About Retirement Savings by Age

First, let’s break down the Fidelity study. To Fidelity’s credit, they did pose some critical questions to consider before diving right into their retirement savings by age example.

- When will you retire?

- How much will you spend in retirement … and for how long?

- What will your savings cover in retirement?

- How can you make your retirement savings last?

- How much should you save each year for retirement?

- And how much do you need to save for retirement?

“There’s only so much that you can control about retirement planning. At the end of the day, it’s a series of trade-offs. You can work longer or retire early, save more or less, spend more or less, or take more or less risk in your investments. But it’s really what you want to do.” – Logan DeGraeve

Believe it or not, but it’s also possible to save too much for retirement. When is it time to stop saving for retirement so that you’re not overfunded? Keep that in mind as well as we’re reviewing this Fidelity study.

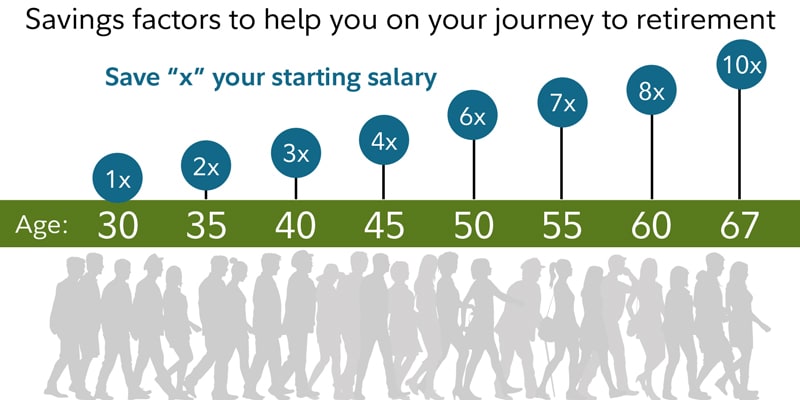

Guidelines Used in Fidelity’s Study

The guidelines that Fidelity used in their study is pretty straight forward. Start by taking your starting salary. By age 30, the study indicates that you should have that amount in retirement savings. By age 40, you should have three times your starting salary. Once you turn 50, you should have six times that amount. By age 60, you should have eight times your starting salary. And by age 67, you should have 10 times that amount in retirement savings. You can see the outline of what this looks like below in Figure 1.

FIGURE 1 – Retirement Savings by Age Example – Fidelity

The first thing that caught Logan and Matt Kasper‘s eyes when looking at Figure 1 was the assumed retirement age of 67. Full retirement age for Social Security will be 67 for those born in 1960 or later. But do you really want to work until you’re 67? A lot of people don’t, but do because they need the income. And then there are people like Matt’s dad, Bud Kasper, who is still working because he truly loves helping our clients at Modern Wealth.

“I frequently hear my dad getting asked, ‘Don’t you want to make more time for golf and things like that?’ That’s not where his passion is. He loves to be around our clients and support what their initiatives are. Everyone is going to have their own path for what they want to do in retirement.” – Matt Kasper

Behind the Numbers of Fidelity’s Retirement Savings by Age Example

So, how did they come up with that retirement savings example? The savings factor they used is based on the premise that you would be saving 15% of your retirement income starting at age 25. That does include the 401(k) employer match.

Fidelity is also assuming that you’ll be investing more than 50% on average of your savings leading up to and through retirement. As you can see in Figure 1, your expected retirement age is 67. They also used a life expectancy factor of 93 and expect you to live the same lifestyle in retirement that you did while you were working.

This Is a Retirement Savings by Age Example, Not a Guideline

Fidelity was clear to point out that their example above is just that—an example. In their study, they also shared some hypothetical sub-scenarios, such as retiring earlier or later than 67 and how that would impact the retirement savings by age factor. And they mentioned some of the factors we shared at the beginning of the article that could come into play. What if you have health issues that don’t allow you to work until 67 or get laid off at some point? Obviously, we hope neither of those happen, but your plan needs to account for potential scenarios like that.

What’s Your Desired Retirement Lifestyle?

After sharing what all went into determining their savings factor, Fidelity also posed one more key question. Do you expect your expenses to go up, down, or stay the same when you retire? Fidelity’s example has you living the same lifestyle in retirement as you did when you were working. That isn’t possible, though, because all that time you spent working is going to be spent doing something else.

Hopefully, you’ll be doing more of the things you enjoy in retirement, which means your expenses would likely be more in retirement. Fidelity did give additional hypotheticals based on how the retirement savings by age factor would change based on desired retirement lifestyle. If you’re not expecting your expenses to go up in retirement, why not? You only get one shot at retirement. Let’s build a plan that’s been stress tested for things like market downturns, a long-term care stay, high inflation, and the costs of your retirement goals.

“What do you want your financial plan to deliver for you? Until you clearly define your goals, you won’t know how much you need to save.” – Logan DeGraeve

Creating a Spending Plan for Retirement

If you want to travel more in retirement, let’s factor that into your plan. A crucial part of the retirement planning process is building a spending plan for retirement. This is something that we recommend doing at least 10-15 years before retirement. If you download our Retirement Plan Checklist, you’ll notice it includes a timeline of things to consider as you approach and go through retirement.

Our first retirement consideration under the 10-15 years out from retirement part of the timeline is to create a spending plan. Again, what are you spending now and what do you expect to spend in the future? The Retirement Plan Checklist takes a forward-looking approach to help you gauge your retirement readiness. Download your copy below and review it with your spouse to get a better idea of the many factors that go into calculating retirement savings by age.

A Key Retirement Savings by Age Consideration: Where Are You Saving to?

To truly understand how much you can comfortably spend, you need to understand what you own. As you approach your peak earning years, your 401(k) is likely going to be your biggest asset. The Fidelity study mentioned getting an employer match on your 401(k). Is that match going to the Roth or traditional side of your 401(k)? If you’re saving to the traditional side, you get a tax deduction when putting the funds into the account. That money will grow over time tax-deferred, but once you take the distributions, they become taxable.

It’s the opposite with the Roth. You’re taxed up front when the money goes in, but the earnings grow tax-free and are tax-free when you take the distributions. How your retirement income is taxed has a profound impact as you’re determining your retirement savings by age. One of the main goals with retirement savings by age is to mitigate taxes over your lifetime, not just in one year. To learn more about how forward-looking tax planning can make a huge difference for you before and during retirement, download our Tax Reduction Strategies guide below.

Download: Tax Reduction Strategies Guide

“At the end of the day, the most important thing is saving. If you’re early in your career, at least make sure you’re saving to the match in your 401(k). If you can make a Roth IRA contribution, great. But what you need to be cognizant of is when you’re 50, 55, 60, you should have a really good idea of what retirement is going to look like.” – Logan DeGraeve

A Team Approach to Retirement Planning

Trying to understand the complexities of the tax code on your own isn’t easy. That’s why we have CPAs that in-house that study it each day and work with our CFP® Professionals to review our clients’ financial plans from a tax perspective. Our CFP® Professionals, CPAs, estate planning specialists, investment specialists, and insurance specialists all have a unique lens with the many factors that go into retirement savings by age.

Our team of professionals works together and puts the prospective clients’/clients’ needs when building/reviewing a financial plan. It’s our mission to create a plan that’s unique to you. Remember that the retirement savings by age factors can change over time, so your plan needs to be fluid and forward-looking. And the earlier you start saving for retirement, the better.

“We all know the miracle of compounding. The earlier you get started, the better off you’re going to be. You don’t need to overwhelm yourself with savings in your 40s and 50s if you start in your 20s and 30s. But if you don’t have a plan, you don’t have any type of clarity about if you’re on track.” – Matt Kasper

To figure out what all needs to be considered as you’re planning for retirement, schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. You can meet with us in person, virtually, or by phone depending on what works best for you. We can’t wait to get to work on building a plan that gives you clarity, confidence, and control as you’re approaching and going through retirement.

Retirement Savings by Age | Watch Guide

00:00 – Introduction

01:19 – An Quick GPS Analogy

03:24 – Critical Questions to Ask Yourself

05:03 – How to Make Your Retirement Savings Last

07:13 – How Much Do You Save?

10:37 – Fidelity Retirement Savings Study

13:40 – Saving By Age

14:52 – Starting Early Is Critical!

17:38 – Where to Start?

19:48 – Where To Save?

21:38 – What Did We Learn Today?

Articles

- Components of a Complete Financial Plan with Logan DeGraeve

- Setting Up a Spending Plan for Retirement

- Starting the Retirement Planning Process

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Optimizing Your 401(k) for Retirement with Drew Jones

- Tax Planning for Individuals: 5 Tips to Save

- When Is It Time to Stop Saving for Retirement?

- Why Compound Interest Is Key

Past Shows

- How Much Do I Need to Retire?

- 9 Items Retirement Calculators Miss (That Our Tool Doesn’t)

- 4 Retirement Risk That Are Out of Your Control

- Stress Testing Your Financial Plan

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- What Is Financial Planning?

- Your Retirement Timeline

- Getting Ready for Retirement: Don’t Retire without Doing These Things First

- Couples Retirement Planning: What You Need to Know

- What Is Tax Planning?

- DIY Retirement Planning: What Can Be Overlooked?

- Retiring Before 62: What You Need to Consider?

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.