Your Retirement Timeline

Key Points – Your Retirement Timeline

- Your Retirement Timeline Needs to Include a Financial Plan

- Looking at Your Retirement Timeline from 10-15 Years Out from Retirement, Five Years from Retirement, Two to Three Years from Retirement, and One Year from Retirement

- Creating a Budget for Retirement, and Thinking of It as a Spending Plan

- Don’t Wait Until Retirement to Fulfill Your Dreams

- 22 minutes to read | 38 minutes to listen

Along with 30 checklist items to gauge your retirement readiness, our Retirement Plan Checklist includes a timeline to help you be aware of certain things while planning for retirement. Dean Barber and Logan DeGraeve cover some of the key aspects of that retirement timeline on this week’s edition of America’s Wealth Management Show.

Show Resources:

Find links to the resources Dean and Logan mentioned on this episode below.

- Schedule: 20-Minute “Ask Anything” Session

- Download: Retirement Plan Checklist

- Education Center: Articles, Videos, Podcasts, and More

The Best Time Is Family Time

Dean Barber: Thanks so much to those who join us on America’s Wealth Management Show. I’m your host, Dean Barber. Bud Kasper is on vacation, so Logan DeGraeve for him like he did for me last week.

Logan DeGraeve: How are you doing, Dean?

Dean Barber: Doing great, buddy. Doing great.

Logan DeGraeve: How was your trip?

Dean Barber: Well, it wasn’t actually a trip. We call it a family vacation. Every year, during the week of the Fourth of July, all four of my brothers, their kids and grandkids, my kids and granddaughter, and I hang out at Table Rock Lake. It was beautiful. The weather was great and water was good. We had a lot of fun.

Logan DeGraeve: Good.

Dean Barber: I hope you had a nice Fourth of July, too.

Logan DeGraeve: I did.

Staying on the Quest of Financial Independence with the Help of a Retirement Timeline

Dean Barber: Good. I know the week before the Fourth of July, we did an Independence Day show on financial independence. Today, we want to talk to the people who are trying to get to that point of financial independence.

Several years ago, we created something called a Retirement Plan Checklist. There’s a retirement timeline within that Retirement Plan Checklist that starts to talk about things that people need to be considering 10 to 15 years out from retirement, five years out, two years out, one year out, etc.

We really want to talk to people who are hoping to get to that period in their life where they can be financially independent. Logan and I both know that doesn’t necessarily mean that you stop working. It just means that whatever you’re doing every day, you’re doing it because it’s what you want to do and not because you need money.

Your Retirement Timeline: It Starts When You’re About 10-15 Years Away from Retirement

Logan DeGraeve: Right, Dean. When you think about that, you need to start that process 10 to 15 years out. It just doesn’t happen overnight. The hardest part is saving. We know that, but what are you going to do with the rest of your life?

Dean Barber: I think that’s the big deal. There are so many people that their identity is their job and that’s what they relate their life to. When you talk to somebody that’s successful in business, they’ll start telling you about what they do for a living. People need to start thinking about what their life is going to look like after work. What are your aspirations, hopes, and dreams? It’s interesting because Logan, myself, and all the other financial planners here do something called a prioritization exercise with people that come in to visit with us. It’s part of our Guided Retirement System.

What Are the Important Things in Your Life?

In the prioritization exercise, we talk to people about the most important things in their life. How many times during that prioritization exercise has somebody ever told you that their job is the most important thing in their life?

Logan DeGraeve: Never.

Dean Barber: Never, right? How many times have people said that money is the most important thing in their life?

Logan DeGraeve: Never.

Dean Barber: Exactly. The most important thing to me is spending time with the people that I care about. The most important things to a lot of people are charitable causes, their kids, and their grandkids.

Logan DeGraeve: Health and wellness.

Dean Barber: Yep. We have several different things that we go through regarding what’s most important to people. Generally, each couple boils it down to five things that are the most important. Each person will have their own five things, and then they come together and combine what’s the most important to them.

People that don’t start thinking about that 10 to 15 years from retirement can have a hard time with that paradigm shift. Suddenly, they’ll say, “Oh, you mean I have enough money? I don’t have to work anymore? I don’t know what I’d do, though.” If you don’t start early, sometimes that paranoia or discomfort starts to set in. People will think, “Oh my gosh, I’m not going to be this person at this company anymore. I’m going to lose my identity.” You need to find what that identity is way before you decide to retire.

Don’t Wait to Start Living

Logan DeGraeve: Well, and don’t wait to start living. That’s something I talk to clients about as we go through that prioritization exercise. Maybe you want a second home in Florida, a lake house, whatever it is. You might be able to afford that 10 to 15 years before retirement. A lot of people think that they need to work until they’re 65 or until 67 because of Social Security. That’s not true. How many people do we sit down with that could retire 10 years sooner?

Dean Barber: A lot. It happens all the time. But what happens is that people get into a mode of, “All right, this is my budget. This is what I’m going to spend and I’m going to save everything else.” They get in this mode of save, save, save, save, save, save, save. They get addicted to the number that’s on their 401(k) statement or the number that’s on their IRA or brokerage account.

Logan DeGraeve: So, they’re not happy so far this year is what you’re saying.

Dean Barber: Well, they focus so much on the amount of money as opposed to thinking about what do they want their life to look like.

Creating a Spending Plan for Retirement

Logan DeGraeve: Life isn’t just about money. Yes, it’s a tool that helps do things, but let’s think about. Dean just said the word budget, and everyone hates the word budget. However, it’s very important to get an idea of what you are going to spend in retirement. Because once again, how do you know when you can retire or if you have enough if you don’t sit down and put pen to paper? It’s different for everyone.

Dean Barber: That’s what you need to do. As opposed to thinking about it as a budget, think of it as a spending plan. That’s one of the first things that you need to do 10 to 15 years out from retirement on your retirement timeline. Start evaluating what you’re spending your money on. Then, think about what you want your life to look like after you retire. What will those additional things cost during retirement?

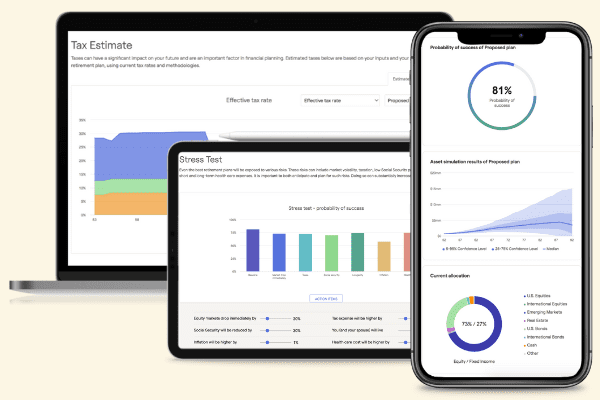

If you’re thinking about retiring and want to know if you have enough or if you’re on track, check out our industry-leading financial planning tool. It’s the same tool that we use with our clients, and you can try it at no cost.

You just start by putting in your information and how much money you have. You don’t have to put in the exact holdings or whatever. But get in there and find out where you are because it could be that you are on the pinnacle of financial independence and you don’t even know it yet. And, of course, remember to check out our Retirement Plan Checklist to get a better idea about your retirement timeline.

Are You Financially Independent?

I still like to think of retirement as financial independence, but you can call it retirement. I like to refer to it as financial independence because Logan and I both know several people that continue to work, or they do something after they have left their previous employment, because they want something to do, but they’re not doing it for the money anymore.

Logan DeGraeve: From what many of my clients have told me, if you know that your employer needs you a little bit more than you need them, it makes the days a little bit easier.

Dean Barber: It certainly does. It’s a total shift in the way that you think and feel when you get up and go to work, if going to work is what you want to do. Logan said something earlier that I think really needs to be discussed. It fits right into what we’re talking about with the retirement timeline here from the Retirement Plan Checklist.

Time Is Our Most Precious Commodity

Logan said don’t put off living until you retire. If there are things that you want to do and might be able to do them now, it’s critical to do them. I’ve seen too many in my 35 years in this industry where people wait to do those things until retirement. But then two years later, one spouse passes away and all those dreams and plans are gone. You shouldn’t wait to do things that you want to do until after you retire. There’s a good possibility for most people that they can do things now.

Logan DeGraeve: A good financial planner doesn’t rob anyone of the most precious commodity we all have, which is time.

Dean Barber: That’s right.

How Much You Need in Retirement Depends on Your Desired Retirement Lifestyle

Logan DeGraeve: I have a perfect story for this. How many times have we sat down with someone who says they’re going to retire in five years. Well, why five years? They say five years because that’s when they’ll have enough. But what is enough and how do you define what enough is? You can’t do that without knowing what you’re going to do in retirement. Because $1 million for some people is enough.

Dean Barber: And $5 million for some is not enough.

Logan DeGraeve: Correct.

Dean Barber: It depends on what you want to do with your life. How much do you need to save? We’re still to the 10 to 15 years out from retirement on the retirement timeline. How much money is enough? What do you need to be saving today to reach your objective?

Most people are saving into a 401(k) plan. One of the worst things that happens that Logan and I see all the time is that people will have 100% of their money in the S&P 500 index in their 401(k)? It’s like, what are you doing? You’re 55 or 60, and you have 100% of your money in the S&P 500.

Logan and I just had that happen back in December. This couple’s like said they’d like to retire sometime in 2022, if possible. We met with them and figured out that they could retire today, but they needed to change their allocation and not have 100% of their money in the S&P 500. So, they went with 30% in the S&P 500 and the other 70% in cash. They had enough and were in what we call the red zone.

Going Back to the Prioritization Exercise

But let’s go back to how much do you need to be saving. How do you know how much you need to save? The only way you know how much you need to save is by looking into the future and saying, “What do I want my life to look like after retirement? What are the things that my spouse and I want to do? How do we want to live? What are the things that are going to be important to us?” I go back to that prioritization exercise.

And then should you be saving into your traditional or Roth part of your 401(k)? How do you answer that question, Logan?

Knowing Your Current and Future Tax Bracket

Logan DeGraeve: You need to know where your taxes are at today, what tax bracket you’re in, and where they’re going to be in the future. Well, how do you know what taxes are going to be in the future?

Once again, proper financial planning, distribution planning. One of the hardest things for people to grasp is what to do with all this “stuff.” For example, maybe you have a pension, Social Security, a 401(k). Now, how do you get a paycheck off it? How you save today and tomorrow and 10 to 15 years out from retirement is going to dictate how you can take money in retirement. Because if you have a traditional 401(k) with $1 million, you don’t have $1 million. Why is that, Dean?

Don’t Forget About Uncle Sam

Dean Barber: Because Uncle Sam is your partner. Some people say that have $1 million in my 401(k). Well, there’s $1 million in there, but it’s not all yours. You’re going to have maybe $650,000 because Uncle Sam is going to get part of it when it comes out. And if you live in a state where there’s state income tax, the state is going to get its part. Then, you’re left with 60-65% of it.

Logan DeGraeve: Let’s talk more about that. With traditional, we can defer some tax, but we need to pay taxes down the road. It could make a lot of sense for someone that is a high earner and has a little bit more flexibility in the future. But at the same time, what do we know that tax rates are most likely going to do in 2026?

Tax Rates Will Be Going Up

Dean Barber: The current tax cuts that came about under the Tax Cuts and Jobs Act will sunset in 2025. So, tax rates are going to go higher.

Logan DeGraeve: If I know the pound of flush right now to pay taxes, I kind of like paying taxes at the rates that they are today. Historically, tax rates are pretty low.

From the raw side of things, you have to pay tax on that income, but that money is never taxed again. Under current law, if you or your spouse passes, your kids or whoever inherits the money doesn’t have to pay tax on it either.

Dean Barber: Bud always says to only use the Roth, but I have a counterpoint to that. Let’s say that somebody has saved a decent amount of money outside of their 401(k) and has a brokerage account with some investments, bank accounts, CDs, whatever it is. They are in their peak earning years and their spending goals in retirement can keep them in a 22% bracket where they might be in a 35% bracket today. Well, that person should probably contribute to the traditional and get the tax deduction.

Methodical Roth Conversions

Then, as soon as they retire, they can begin a methodical Roth conversion strategy. They can convert in the 22% or 24% bracket where they were actually earning in a higher bracket. Then, you’re winning the game.

Logan DeGraeve: Something else that you need to consider that few people know about is a 0% capital gains rate. If you do have a large joint brokerage account, you could live on that and pay very little tax for a long time. But to Dean’s point, is that the right move?

Well, how do you know without a financial plan that looks at where your taxes are going to be in the future? How many times have someone said, “I’m in a 0% tax rate. I have this figured out.” Yeah, you have it figured out now, but in two years you’re going to be in a 32% tax bracket.

Learning More About Our Financial Planning Tool

Dean Barber: Right, because Required Minimum Distributions and Social Security are going to kick in. If you’re saying, “Okay, guys, how do I figure this out?” That’s where our financial planning tool comes in. We’ve had so many people start using this tool. We’re making it available for you to use from the comfort of your own home. It’s the same financial planning tool that we use for our clients. Just start entering your information of where you’re at, what you have today, and what your Social Security is going to look like.

If you have pensions, you can put them in there. Put in how much you’re putting into your 401(k). What’s in there? If you desire, you can link your accounts so that it pulls in your asset allocation. If you do that, that’s going to give you the most accurate view of where you stand today. It’ll show you based on historical numbers and using Monte Carlo simulations what the probability is that you’re going to get to where you want to be with where you are today.

Everyone Should Have an Estate Plan

As we continue to discuss your retirement timeline on our Retirement Plan Checklist, there’s one more thing I want to mention before outlining things to do when you’re five years from retirement. That’s estate planning. Why is that important?

Logan DeGraeve: Because everyone should have an estate plan. It covers things like guardianship provisions for the kids. God forbid you’re 30 years old, have two kids, and something happens. Who’s going to take care of the kids?

Dean Barber: And it’s health care directives and so on.

Logan DeGraeve: Powers of attorney.

Dean Barber: People think an estate plan is for when they die. Well, not necessarily.

Logan DeGraeve: Or that estate planning is just for the ultra-rich. That’s not true either.

Dean Barber: No, it’s not. A good trust will tell people how they want their finances and everything to be handled if they become incapacitated. It’s critical. The estate plan is a good part of that. You shouldn’t wait until you get to retirement or think you’re going to pass away.

Your Retirement Timeline: Five Years from Retirement

Now, let’s discuss things to think about when you’re five years from retirement on the retirement timeline. The rules and the game really start to change. One of the things that really needs to change is your asset allocation.

You need to start thinking about protecting what you’ve accumulated, especially if you’re really close to the number that you need. And you don’t know the number until you’ve done a financial plan. Like we said earlier, so many people put all their money in the S&P 500 or, even crazier, in cash in their 401(k). You should never have 100% in anything.

Logan DeGraeve: Dean makes a good point. Just because we’re saying that you maybe need to back off risk, you don’t have to do that with all your money. But you don’t want money that you’re going to spend in the next five to 10 years 100% in equities.

Dean Barber: Last week, Logan and I had a meeting with a couple that’s retiring this year. We showed them something that was powerful with going from 20% equity up to 70% equity.

Marrying the Financial Plan with the Investment Plan

Being a CERTIFIED FINANCIAL PLANNER™ Professional, I talk a lot about marrying the financial plan with the investment plan. It doesn’t make a lot of sense for people, but once we understand who you are, what you want to do, and what you’re trying to accomplish, we can tell you exactly how much risk you need to accomplish what you want to do.

What I mean by that is that couple that Dean mentioned could take 20% stock market or equity risk or they could take 50% and they were at the same probability of success. In times like this, we can back off risk if we want and keep the plan where it’s at.

Now, what’s the trade-off of that? Long term, maybe we don’t leave as much money behind. But if that’s not a goal or priority, why does it matter?

Why Asset Allocation Matters

Dean Barber: Right. So, let’s share some live numbers here. This couple could be 20% equities, 80% fixed income and from a historical perspective, they have a 95% probability of success. That means that 95% of the time, they would never need to adjust their spending plan in the future. Five percent of the time, there’s the possibility that they may need to adjust their spending plan slightly for a short period of time.

If they go up to 70% equities, they were at a 93% probability of success. At 70% equities, the chances of them leaving behind a larger legacy was there. It was like $11.5 million. If they’re at 20% equities and 80% fixed income, it was only about $5.5 million of legacy.

So, what’s the goal here? What are we trying to accomplish? It’s all still the same spending amount, right? What we want an answer is what you want your lifestyle to look like. If leaving a big legacy is important, that’ll adjust the allocation. That basically says that in times of uncertainty like we’re in right now, it’s OK to back off on the equity position because you don’t need to have it there to accomplish your objectives.

Logan DeGraeve: Dean and I saw that in December when we said, “Hey, you can retire.” It was hard for them to take less risk because they were 100% equities.

Dean Barber: But when we met with them last week, they’re like, “I’m so glad you guys told us.”

Logan DeGraeve: They thought we were crazy. The S&P 500 just came off a 28% year.

Dean Barber: Yeah. And a good year the year before that.

Having a Financial Plan Is Eye-Opening

Logan DeGraeve: Dean and I couldn’t have figured that out without having a financial plan done.

Dean Barber: That’s right. You need to have a financial plan. It’s the most eye-opening thing that you can ever have. A financial plan is critical to understanding risk, tax allocation, and all that. If you want the help of one of our CERTIFIED FINANCIAL PLANNER™ Professionals, all you need to do is let us know. We’ll be happy to get somebody online and help you build that plan out. The idea is to allow you to see where you’re at on your journey to your financial independence. And if you’re already retired, we can help you see if your current lifestyle is sustainable?

The Clarity Received from a Financial Plan

I had somebody call me a couple of weeks ago who was a little nervous about everything that’s going on. They were about to take their family to Colorado and the trip was like $20,000. She was wondering about whether she should put off the trip. I’m like, “We built that into your plan and you’re at a 95% probability of success. Take the trip. It’s fine.”

Logan DeGraeve: Absolutely. I have one probably a little bit better than that. About a week ago, I got a phone call from a gentleman who is planning to retire at the end of July. He’s very nervous about what’s happened in the market. I reminded him that he was at a 99% probability of success before the year. Even with the market dropping, he’s still at 99%. He can still retire as scheduled.

To Dean’s point with all the noise and everything that’s going on out there, how do you know how it’s impacted you without a financial plan? When you don’t have clarity and confidence, that’s when you have anxiety.

Let’s talk about the most important thing, in my opinion, to do when you’re five years out from retirement on the retirement timeline. It’s time to focus in on that budget.

Accounting for Inflation in Your Financial Plan

Dean Barber: And make sure that you’re including inflation and understanding that different things that you spend money on. If you don’t have the budget, you can’t do inflation properly. Because where are you spending your money? And what are things inflating at? What should you build into your plan?

Logan DeGraeve: For example, basic living expenses are going to inflate differently than health care and college. Why? Someone may argue right now, but generally speaking, health care and college are going to inflate higher than everything else. Also, where is your medical coverage going to come from if you retire before 65?

Taxes and Health Care Are Likely Your Largest Expenses in Retirement

Dean Barber: Yeah. Do you have a company plan that’s going to carry you through? Do you need to get independent coverage? What’s that going to cost? You need to build that into your plan. A couple at age 60 is going to look at somewhere $18,000 to $20,000 a year for private healthcare.

Logan DeGraeve: It’s going to be their largest expense.

Dean Barber: It will. The two biggest expenses in retirement are usually taxes and health care.

Logan DeGraeve: You’re really wanting to make people retire here, Dean.

Dean Barber: The whole idea is to wake up every morning and do what you want to do because it’s important to you and not doing it for a paycheck. And Logan, how many times have we seen somebody retire and then they’ll get a contracting job or they’ll do something where they’re just doing it for fun. They’re doing it for something to do, but they’re not doing it for the paycheck anymore.

Logan DeGraeve: One of the best parts of our job is giving good news that lets people do the things that they want to do.

Tax Diversification Matters

As we wrap up with discussing things to do when you’re five years out from retirement on the retirement timeline, it’s important to figure out where your money is coming from. Taxes matter. You’re no longer in that accumulation phase of life. You have what you have. Depending on the account, that’s going to impact your tax.

Dean Barber: Then that comes back to tax diversification. Where is your money? Is it in Roth? Is it in traditional? Maybe it is in cash? Or is it in taxable accounts?

Logan DeGraeve: And what do you spend first?

Dean Barber: Right. Or do you spend a portion of all of it? You need to create that spending plan and then figure out what your withdrawal strategy.

Logan DeGraeve: The best thing about retiring is that it’s the first time in your life, to some degree, that you can control your taxes.

A Proper Financial Plan Can’t Simply Be Done in a Spreadsheet

Dean Barber: No doubt about it, Logan. Think about this, Logan. How many people have you met within the last five years that are new people coming that are looking for some clarity on where they’re at and already have a real financial plan already?

Logan DeGraeve: Very few.

Dean Barber: I could probably count on one hand the number of people that I’ve met in 35 years that have showed me their plan and already have everything under control. Most people don’t. A plan is not your investments. That’s a part of a plan, but you shouldn’t even think about how you’re investing your money or what your asset allocation should be. You can’t answer that question until you’ve completed the financial planning process.

Logan DeGraeve: You can’t spreadsheet a financial plan. Looking at an average return in a 4% drawdown, that just does not work. Because in times like this, you’re taking out more than 4% of your money if you haven’t adjusted your withdrawal stream.

Your Retirement Timeline: Two to Three Years from Retirement

Dean Barber: Right. You need to think about that distribution strategy. When you’re two to three years out from retirement, you really need to focus in on that asset allocation and start thinking about the tax allocation.

How and When You Claim Social Security Makes a Big Difference

You also need to create your Social Security claiming strategy. This is really a critical piece. People don’t understand that a couple at age 62 can have up to 600 different iterations on how they can claim Social Security. The difference between the best decision and the worst decision can easily amount to more than $100,000 of additional Social Security income over the same lifetime with the same earnings history.

Logan DeGraeve: It’s a critical piece and it’s lifetime income. You don’t want to get it wrong. Once you make a decision, there’s no going back. Oftentimes, people have an idea in their head of what they want to do with Social Security and it’s out of stubbornness. It really is.

I had a gentleman that I met with last week that said, “I’m 62. This is my benefit I’ve paid into.” That’s completely fair. But his spouse never worked. So, he’s the only one with the highest Social Security benefit. It’s not just about him because when a spouse passes, only the highest benefit stays. I was showing him the plan and explained that he needs to wait until at least 67. Because if he passes at 73, God forbid, his wife is going to need to go get a job.

Dean Barber: How did that conversation go?

Logan DeGraeve: He and his wife thanked me. They were glad I showed them that. Once again, we all have preconceived notions about things. You don’t know what you don’t know.

Don’t Get Caught Up in the Possibility of Social Security Reductions Down the Road

Dean Barber: Some people hear that Social Security isn’t going to be able to fund 100% of its payments by 2034, 2035, whatever it is. Whether it is or not, we can run in the plan that we’re going to have a Social Security reduction of 20% in the next 10 years. That doesn’t mean that your Social Security strategy changes. Because the right social security strategy, whether there’s a reduction in or not, is still going to be the right Social Security strategy. Don’t get caught up in that.

Logan DeGraeve: When you say right, it’s not looking at Social Security necessarily in a vacuum.

Dean Barber: You can’t do that. You’re right.

Logan DeGraeve: You need to look at your overall financial plan. That includes tax planning, investment planning. And sometimes that plan can change in time. What I mean by that is your Social Security is guaranteed to grow every year. As we’ve seen so far this year, your investments aren’t guaranteed to grow every year. Sometimes maybe we take less pressure off than investments and get on Social Security. It’s not a set-it-and-forget-it thing.

Keep in Mind How Social Security Is Taxed

Dean Barber: That’s right. The other piece about Social Security is it’s taxed different than any other asset that you have. You need to build how social security is taxed into your overall retirement plan. There’s a special provision, but the point is make the right Social Security decision for you and your spouse, but don’t just look at Social Security by itself.

Logan DeGraeve: That’s an important piece. I’ve been doing a lot of tax planning meetings with my clients and our CPAs here. You don’t fully understand how Social Security can be taxed and the impact on your plan unless you’re meeting every year with your CPA and CERTIFIED FINANCIAL PLANNER™ Professional. If you’re not doing that, you’re missing something.

Dean Barber: It’s a collaborative relationship for sure. That’s why we hired CPAs to join our team here. It’s to do the tax planning. That’s a critical component.

Your Retirement Timeline: One Year from Retirement

Now, let’s move to one year out from retirement on your retirement timeline.

Logan DeGraeve: I think one thing that’s important to remember here is that financial planning is a series of trade-offs. You get a plan done and maybe the results are favorable. What’s that mean? You can spend more, give more, and retire sooner.

Dean Barber: Or you can take less risk.

Logan DeGraeve: On the same token, maybe the plan isn’t on track. What are you going to do? Work longer? Save more? Take more risk?

Dean Barber: Or maybe you need to forego some of the ideal things that you wanted to do.

Logan DeGraeve: But once again, what’s the theme of today? You don’t know what you don’t know.

You Can Start to Realize Why the Retirement Timeline Begins 10-15 Years from Retirement

Dean Barber: That’s right. You need to get the plan. When you’re one year out, that year flies by and retirement is going to be here before you know it. You need to make sure that you have everything established.

If you have a pension, you need to understand, are you taking a joint pension? Joint and survivor? Are you taking a single life? Does a pension maximization strategy make sense? Do you have things covered such as long-term care? Have you thought about those things? Have you stress tested your plan for that?

Again, go back to that tax allocation, asset allocation. This is the time when you really narrow down on that spending plan and make sure that’s accurate.

Making Sure That You’re Checking All the Retirement Readiness Boxes

Logan DeGraeve: It’s also making sure that you’ve looked at things. I’ll say life insurance, for example. A lot of times you get into retirement and if you still have the same life insurance you had when the mortgage was big and the kids were small, it may not make sense.

Dean Barber: You may not need it, but there also may be a need to carry life insurance into retirement.

Logan DeGraeve: We use it with tax planning strategies.

Dean Barber: Absolutely.

Logan DeGraeve: You might say, “Well, that’s crazy. How would that make sense?” We’re not going to get in that today, but double check before you just say you’re going to stop.

Dean Barber: One more thing really quick. Let’s say that you have 100% of your money in an IRA tax-deferred account. Maybe you want to create a tax strategy for the surviving spouse to convert 100% of that to a Roth IRA. Well, buy a life insurance policy and pay pennies on the dollar for those taxes and you can make that happen.

Logan DeGraeve: Why is that so important? Because if one spouse passes, those Required Minimum Distributions don’t get smaller, but you become a single tax filer.

Your Retirement Timeline Needs to Include a Financial Plan

Dean Barber: And pay a lot more taxes. All right. There’s so much. It’s so complicated. There’s so much in this Retirement Plan Checklist and I want to encourage you to start getting your plan put together. You can get it built with our financial planning tool and do it from the comfort of your own home. You can do it on your own. We’re allowing you to use the same financial planning tool that we use for our clients. Get started by clicking the “Start Planning” button below.

It’s critical when you start using this financial planning tool that you put accurate data in. You can link your accounts. It can pull in the actual asset allocation and tax allocation. That’ll give you the most accurate view of where you’re at in your journey to financial independence.

It’s also critical that you have an accurate spending plan, how much do you want to spend in retirement. If you need some help with this, you can schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CERTIFIED FINANCIAL PLANNER™ Professionals. And make sure and get a copy of the Retirement Plan Checklist.

We appreciate you joining us here on America’s Wealth Management Show. I’m Dean Barber, along with Logan DeGraeve. We’ll be back with you next week, same time, same place. Everybody stay healthy and stay safe.

Schedule Complimentary Consultation

Click below and select the office you would like to meet with. Then it’s just two simple steps to schedule your complimentary consultation. We can meet in-person, by virtual meeting, or by phone.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.