4 Big Tax Mistakes Retirees Need to Avoid

Key Points – 4 Big Tax Mistakes Retirees Need to Avoid

- Your Current Tax Rate vs. Your Future Tax Rate

- Considerations with Roth vs. Traditional

- Cash Flow in Retirement Is Critical

- Tax Compliance Isn’t the Same Thing as Tax Planning

- 6 Minutes to Read | 23 Minutes to Watch

Tax Mistakes That Retirees Need to Avoid

Do you think you know everything there is to know about the tax code? The truth is that you likely won’t even find a financial advisor that know everything about the tax code. Our advisors are even willing to acknowledge that. That’s exactly why we have CPAs on staff. Our CFP® Professionals work alongside our CPAs to make sure that people aware of tax planning opportunities and steering clear of big tax mistakes they need to avoid.

It doesn’t take much for a very small mistake to turn into a big one when it comes to taxes. Taxes are one of two of the biggest wealth-eroding factors in retirement (health care costs are the other). So, pay close attention as Dean Barber and Bud Kasper, CFP®, AIF® review four tax mistakes that retirees need to avoid. Here’s a sneak peek of those tax mistakes retirees need to avoid before Dean and Bud go over them.

- Not understanding bracket management

- Having all your money in one bucket

- Not knowing what money you should withdrawal and when

- Not taking advantage of tax savings opportunities

“I always say that when someone gets into retirement that someone has more control over their taxes at that time than at any other point of their life, yet they don’t know it.” – Dean Barber

Schedule a Meeting Get the Retirement Plan Checklist

4 Big Tax Mistakes Retirees Need to Avoid

1. Not Understanding Bracket Management

Our first big tax mistake that we want you to avoid is not understanding tax bracket management. Logan DeGraeve, CFP®, AIF® and Chris Rett, CFP®, AIF® also kicked off last week’s episode of America’s Wealth Management Show about financial planning opportunities you don’t want to miss by discussing bracket management. It’s particularly important for retirees.

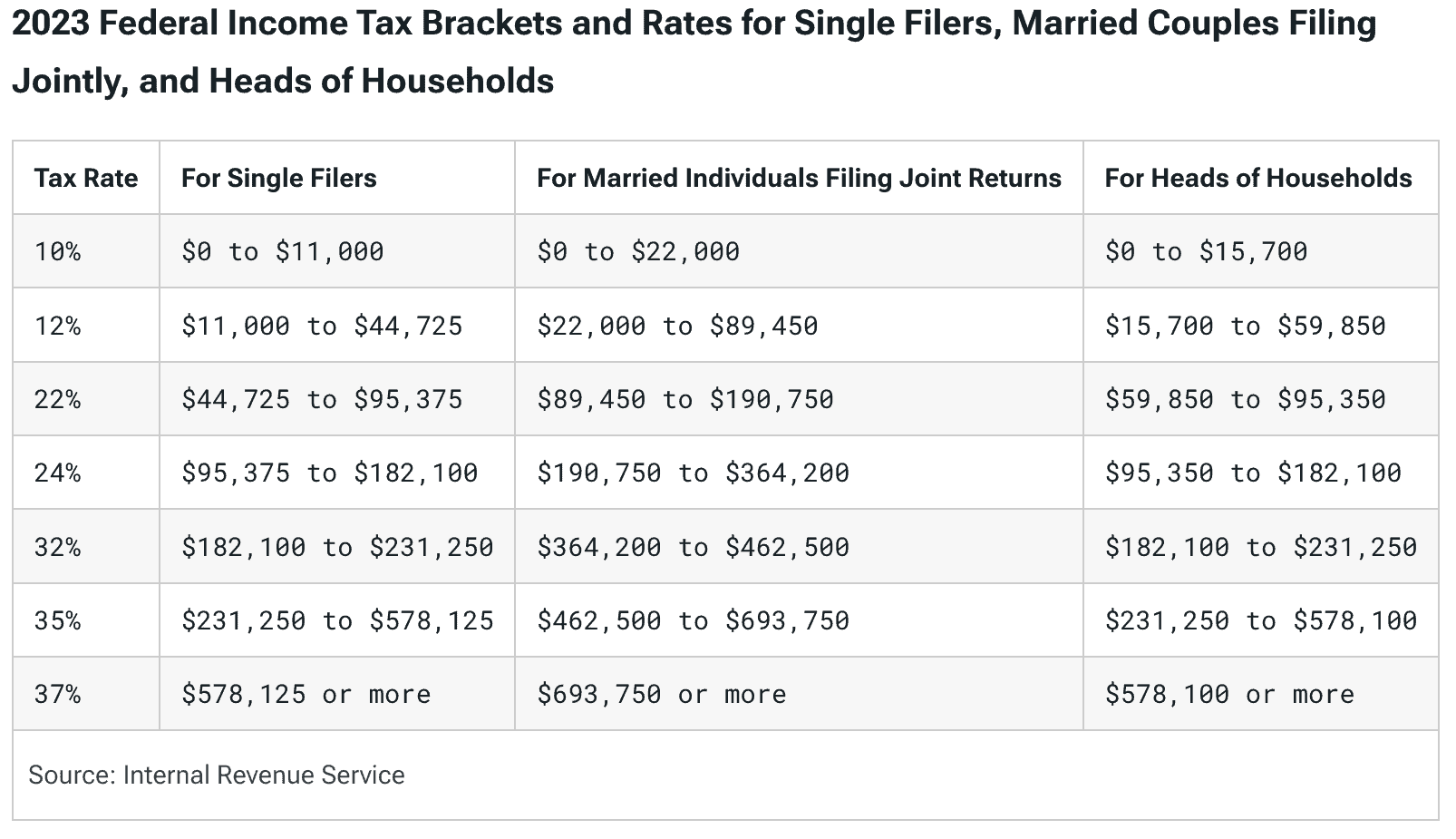

As you go into retirement, you need to review all your income sources and understand their tax ramifications. Where does all your income fall within the tax brackets? For 2023 tax brackets, there’s a massive increase between the 12% and 22% brackets. The same goes when looking at the 24% and the 32% brackets. Take a closer look at the 2023 tax brackets in Figure 1.

FIGURE 1 – 2023 Tax Rates – 4 Big Tax Mistakes Retirees Need to Avoid

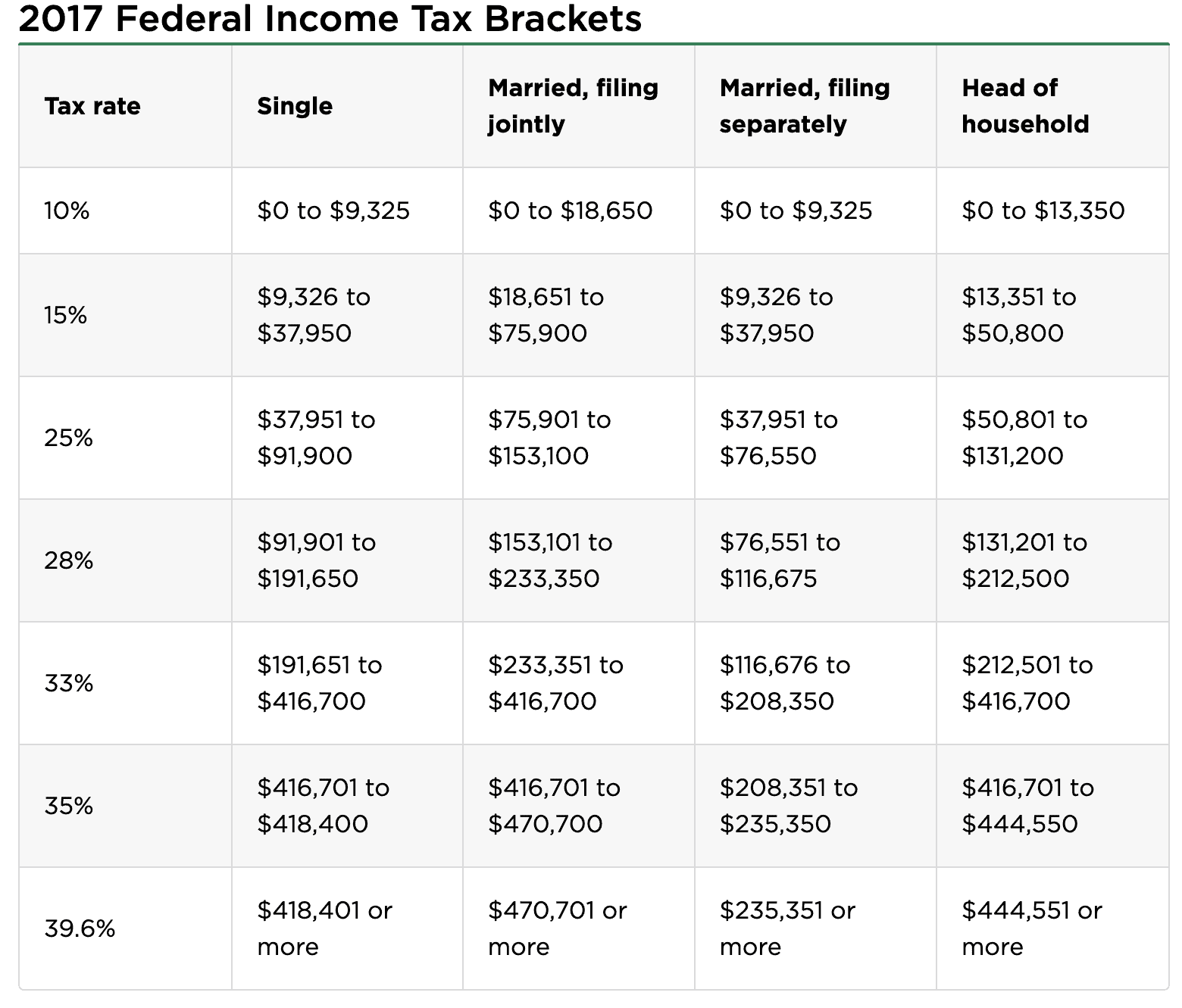

These tax rates are historically low, especially compared to what tax rates are scheduled to be starting in 2026. Since tax rates are scheduled to revert to 2017’s rates on December 31, 2025, when the Tax Cuts and Jobs Act sunsets, it might make sense to speed up your income. We’re going to elaborate on that, but first, let’s look at the 2026 tax rates.

FIGURE 2 – 2017/2026 Tax Rates – NerdWallet

The tax brackets in 2017 were much smaller than what they are now, so that will be a big change to go back to that in 2026. Since they’re smaller, you’ll be going through them much faster. 2026 is going to be here before we know it, so it’s important to consider speeding up your income while rates are still lower.

“That’s why the advisors at Modern Wealth Management have been in a full-court press to make this obvious to people that they need to understand that there is an advantage that we have in the tax codes right now that is going to go away on January 1st of 2026 if Congress does nothing. You can control what you can control.” – Bud Kasper, CFP®, AIF®

A Tax Bracket Management Example

We want to go through a bracket management example before we move on to the next big tax mistake that retirees need to avoid. Let’s say that you and your spouse are married filing jointly and are at the top of the 24% bracket, which is $364,000. Starting in 2026, the 24% bracket will become the 28% bracket. The top of the 28% bracket will be $233,350. So, there’s still a huge tax savings opportunity via bracket management between now and 2026.

“The amount of money that you need to have an income to hit that 28% bracket is actually lower. The income is lower and you hit the higher brackets sooner. Even for the individual whose income may not be changing, bracket management is critical.” – Dean Barber

2. Having All Your Money in One Bucket

Understanding tax bracket management is just part of the equation, though. As we mentioned from the get-go, to review all your income sources and understand their tax ramifications. Along with tax brackets, you have tax buckets. You have three different tax buckets for your income—taxable, tax-deferred, and tax-free. Having all your money in one of those buckets is a big tax mistake that retirees need to avoid.

The problem is that we see a lot of people who have most of their money in one of those buckets when we begin working with them. For most people, their 401(k) ends up being their largest asset. Saving to your 401(k) is a good thing, but which side of it are you saving to? The traditional side or the Roth side?

Roth vs. Traditional

The traditional side of it is the tax-deferred bucket. You don’t need to pay any tax until taking the money out. While that might sound appealing to put off taxes, remember that tax rates are going up in 2026. It can make a lot of sense to pay that tax before those rates go up.

You can do that by either saving to the Roth side of your 401(k) in the first place or by doing a Roth conversion. By doing that, you’re paying the tax on the contribution or the conversion, and then all the earnings are tax-free. You can learn much more about Roth conversions and other tax planning strategies in our Tax Reduction Strategies guide. Download your copy below to see what all needs to be considered when it comes to tax planning.

Tax Reduction Strategies Guide

“My job as a CFP® Professional that works with our CPAs is to minimize the amount of taxes that would be applied in any given year. Sourcing your income in certain amounts before you need to do Required Minimum Distributions becomes an art form.” – Bud Kasper, CFP®, AIF®

Just the thought of tax-free income might make you want to become a Rothaholic like Bud. There are a lot of pros to contributing and/or converting to Roth. However, there can be some unintended consequences of Roth conversions, specifically being thrown into a higher Medicare bracket.

If you have all your money in the tax-free Roth bucket, you’re also missing out on the opportunity to do Qualified Charitable Distributions. For those who are 70½ or older, QCDs are a great tax savings tool for those who are charitably inclined. With QCDs, you’re giving money directly from your traditional IRA to charity and it doesn’t show up on your tax return. You can give up to $100,000 a year to charity via QCDs.

3. Not Knowing What Money You Should Withdrawal and When

Next up on our list of big tax mistakes retirees need to avoid is not knowing what money you should withdrawal and when. Having a solid understand of your cash flow in retirement is critical. There’s actually another trio of buckets that’s important to keep in mind here as well. With cash flow, you have a short-term, intermediate, and long-term buckets.

Ideally, your short-term bucket will be comprised of liquid assets, including cash and low-risk investments. Those will cover your immediate expenses and serve as emergency funds. The short-term bucket serves as a safety net. It provides you with quick access to money without needing to liquidate long-term investments at suboptimal times.

Next is your intermediate bucket. It should consist of investments with moderate risk and return potential. The assets in your intermediate bucket can be available within a few years and act as a bridge between your short-term needs and long-term growth. Your intermediate bucket could consist of balanced mutual funds, bonds, and shorter-term real estate investments.

Last but not least is your long-term bucket, which should include investments with more growth potential (i.e.: stocks and real estate). The goal of the assets in your long-term bucket is for them to grow over time. They should give you with income and capital appreciation so you can sustain your retirement cash flow over the course of your retirement.

4. Not Taking Advantage of Tax Savings Opportunities

We’ve touched on some tax savings opportunities through this article. A lot of people are either unaware of them or don’t understand them. Either way, not taking advantage of tax savings opportunities is a big mistake that retirees need to avoid.

What to Consider with Social Security

Here’s another example. Did you know that up to 85% of your Social Security can be taxable? We’ve met with a lot of people who didn’t even know that Social Security can be taxable. When should you start taking Social Security? If you postpone Social Security, how do you benefit from that? If you start taking Social Security, should your spouse take Social Security?

“There are different timelines that are formatted into your income plan. We want to mitigate taxes while still providing income that our clients need.” – Bud Kasper, CFP®, AIF®

We want to be clear that there’s a big difference between tax compliance and tax planning. Figuring out what your quarterly estimates should be is something that most CPAs do, but there’s a huge difference between that and forward-looking tax planning. With tax planning we’re looking at your current tax rate and comparing it to what it will be in the future.

There are a lot of people who make the mistake of thinking that they’ll automatically be in a lower tax bracket in retirement. Well, we showed with the comparison between the 2023 and 2026 tax brackets that that won’t likely be the case. Paying more tax today isn’t convenient now, but the whole point of tax planning isn’t just to focus on the present. The goal is to figure out how to pay the least amount in taxes over your lifetime. That’s tax planning to a T.

“The amount of money that you avoid sending off to the government is substantial.” – Dean Barber

Bonus: Not Understanding the Tax Advantages of HSAs

We take tax planning very seriously at Modern Wealth. That should be evident in our next episode of The Guided Retirement Show with Dean and Marty James, CPA . Marty and Dean will discuss Health Savings Accounts (HSAs). There are a lot of tax mistakes retirees need to avoid related to HSAs. Make sure to check out that episode so that you’re not missing opportunities that people have been missing by not properly utilizing their HSAs and the tax advantages that they have.

Working with a CFP® Professional and CPA Together

This brings us full circle to why it’s crucial to work with a CFP® Professional and CPA that work together. That’s one of the most important aspects of our financial planning team at Modern Wealth Management.

At Modern Wealth, our CPAs don’t just do tax preparation. They work alongside our CFP® Professionals to do forward-looking tax planning for our clients and sit in on annual tax planning reviews. They look over financial plans from a tax perspective to ensure that people are taking advantage of tax planning opportunities and not making any of the big tax mistakes that retirees need to avoid.

If you have questions about what forward-looking tax planning could look like for you and how to avoid big tax mistakes in retirement, start a conversation with us. We can further explain how having a tax plan is a key piece of your goals-based financial plan.

We hope that what we’ve shared will help you avoid making any big tax mistakes in retirement. Please don’t hesitate to reach out to us with any questions about how to go about paying as little tax as possible over your lifetime rather than just in one year.

4 Big Tax Mistakes You Need to Avoid | Watch Guide

00:00 – Introduction

01:20 – The 4 Big Tax Mistakes

04:51 – What Is Tax Planning?

06:38 – Understanding Bracket Management

10:06 – Using the Tax Buckets

12:20 – What Are Tax Planning Opportunities?

15:31 – Back to the Buckets

17:54 – Roth Conversions, Brackets, and Where to Spend from and When

21:09 – What We Learned Today

Articles

- Tax Planning Strategies with Marty James

- What Are Tax Brackets?

- Taxes on Retirement Income

- Tax Rates Sunset in 2026 and Why That Matters

- What Are the Tax Buckets?

- What Is Tax Diversification?

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Optimizing Your 401(k) for Retirement with Drew Jones

- Roth Conversion Decisions for 2023

- 2023 Tax Brackets: IRS Makes Inflation Adjustments

- Charitable Giving in Retirement

- Investment Risk in 2023 with Garrett Waters

- Tax Planning During Tax Preparation Season with Corey Hulstein

- Why You Need a Financial Planning Team

- RMD Questions: What Are Required Minimum Distributions?

Past Shows

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP® and Corey Hulstein, CPA

- 7 Financial Planning Opportunities That You Don’t Want to Miss

- How Does a Roth IRA Grow?

- Converting to a Roth IRA: What Are the Pros and Cons?

- What Is Tax Planning?

- What Is a QCD? Qualified Charitable Distribution

- Retirement Cash Flow: What You Need to Know

- Unexpected Expenses and How to Plan for Them

- What to Know About CDs, Bonds, and Treasuries

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.