2024 Tax Brackets: IRS Makes Inflation Adjustments

Key Points – 2024 Tax Brackets: IRS Makes Inflation Adjustments

- 2023 vs. 2024 Tax Brackets

- Understanding Marginal Tax Rates

- Looking Ahead to Tax Brackets for 2026

- Standard Deduction for 2024

- 4 Minutes to Read

IRS Makes Inflation Adjustments for 2024 Tax Brackets and Standard Deduction

On November 9, the IRS announced several inflation adjustments for the 2024 tax year. The two primary adjustments were to income tax brackets and the standard deduction. Before we review those inflationary adjustments, we want to be clear on something that can be confusing. These changes are for the 2024 tax year, and your return for the 2024 tax year is due on April 15, 2025.

The 2023 tax year on the other hand will end on December 31, 2023, and your return for it is due on April 15, 2024. The changes that we’re reviewing won’t impact that. Now, let’s see how the 2024 tax brackets and standard deduction will compare to the 2023 tax brackets and standard deduction.

How Do the 2024 Tax Brackets Compare to the 2023 Tax Brackets?

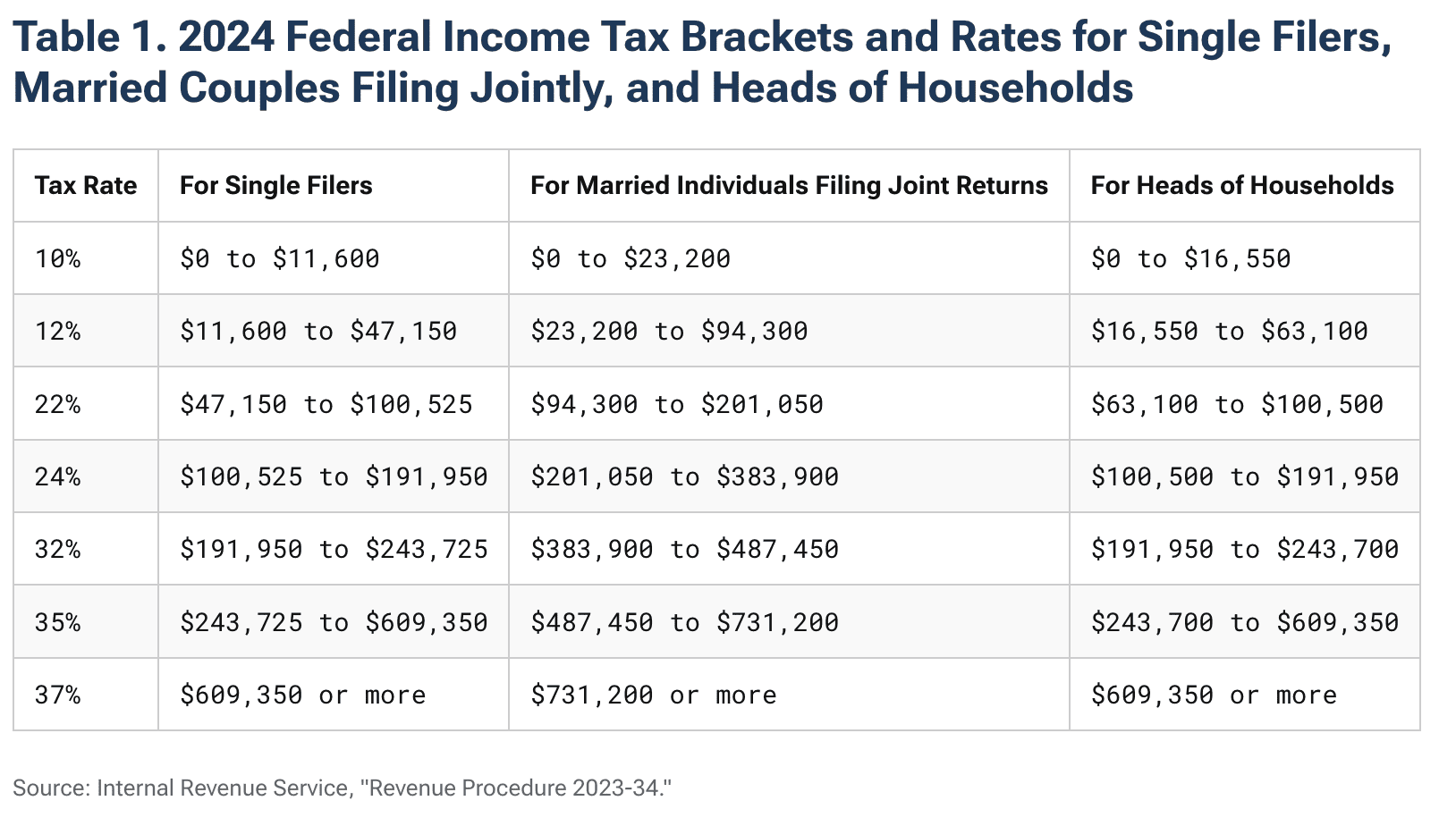

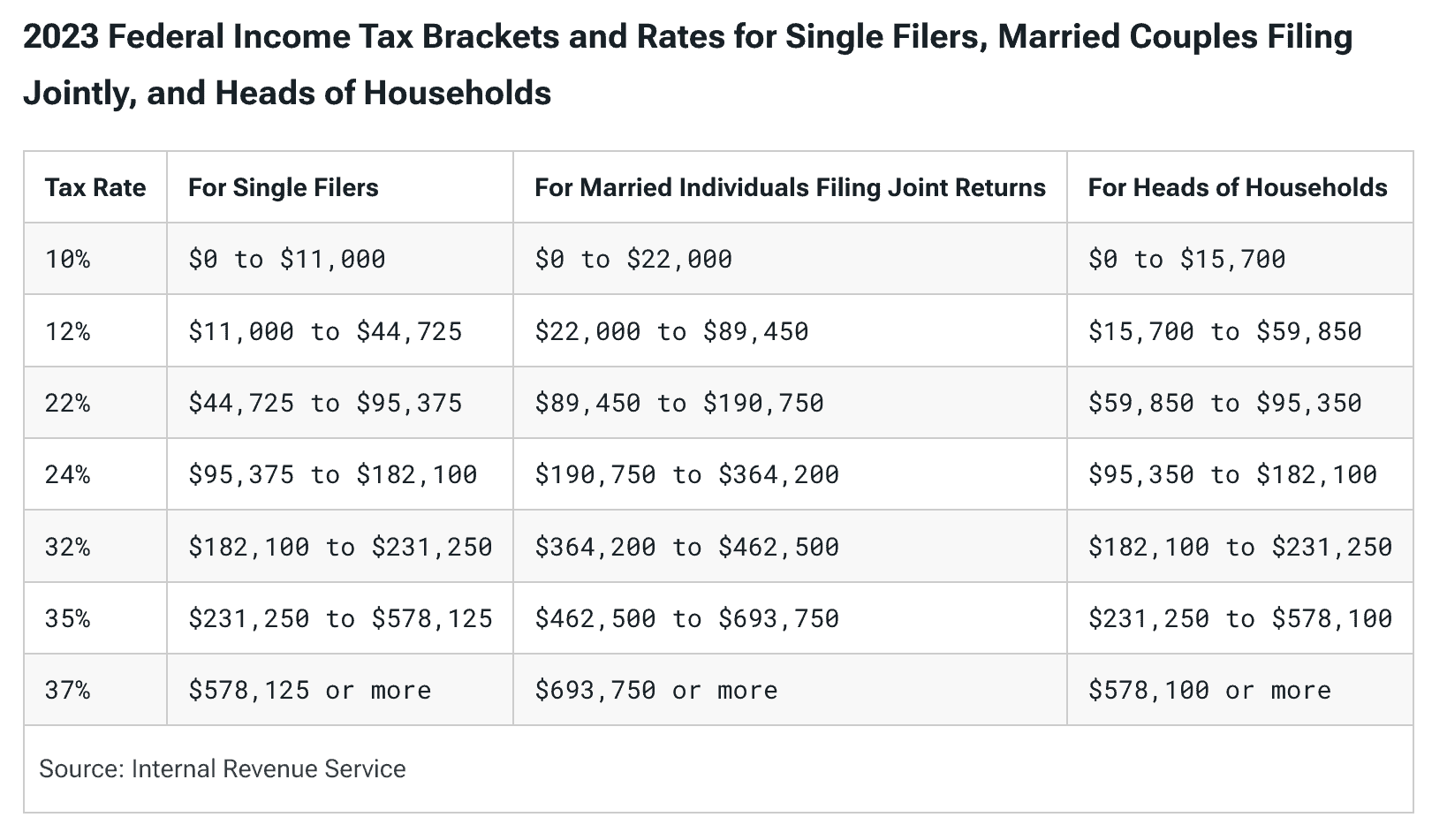

We’re going to start with comparing the 2023 and 2024 tax brackets. The inflation adjustments mean that taxpayers will need to earn more to hit a higher tax rate than they did in 2023. Check out how the 2024 tax brackets compare to the 2023 tax brackets in Figures 1 and 2 below.

FIGURE 1 – 2024 Tax Brackets – Tax Foundation/IRS

FIGURE 2 – 2023 Tax Brackets – Tax Foundation/IRS

Standard Deduction for 2024

We also want to touch on the inflationary adjustments for your standard deduction for 2024. Your standard deduction is the set dollar amount that you can use to lower your amount of taxable income. The standard deduction for people who are married filing jointly will go up $1,500 for the 2024 tax year, up from $27,700 to $29,200.

If you’re a single filer, you’ll see a $750 increase in the standard deduction. It’s going up from $13,850 to $14,600. And for heads of households, the standard deduction will bump up $1,100, from $20,800 to $20,900.

Understanding Marginal Tax Rates

As you’re reviewing the 2023 and 2024 tax brackets, remember that these are marginal tax rates. Here’s an example to explain what we mean by that. Let’s say that you and your spouse have $250,000 of taxable income. That would put you in the 24% bracket for the 2024 tax year. However, that doesn’t mean that all $250,000 is going to be taxed at 24%.

With marginal tax rates, you graduate through the tax brackets. So, your first $22,000 would be taxed at 10%. That maxes out the top of the 10% bracket. Your next $67,450 of taxable income would be taxed at 12% (that takes you to the top of the 12% bracket at $89,450). Then, your next $101,300 of taxable income would be taxed at 22%, taking you to the top of the 22% bracket at ($190,750). At this point, you finally reach the 24% bracket. So, take your $250,000 of taxable income and subtract it from $190,750. That results in $59,250 of taxable income that’s taxed at 24%.

Tax Bracket Management

If you’re unclear about how the tax brackets work—or more importantly, how tax bracket management works—make sure to consult a tax professional. Let’s discuss the importance of understanding tax bracket management a little bit before we round out this article with comparing the standard deduction in 2023 compared to 2024.

Bracket management is all about distribution planning. What accounts are you taking from to fund your lifestyle? Everyone should have a budget—or as we like to call it, a spending plan—that lets you know what you can spend each year for your plan to be successful. The accounts you’re taking from will directly correlate with what tax bracket you end up in.

With tax bracket management and forward-looking tax planning, you’re looking at what tax bracket you’re currently in compared to what tax bracket you’ll be in in the future. Today, we’re in a relatively low tax environment. However, that appears to be changing beginning in 2026. That’s because the Tax Cuts and Jobs Act is scheduled to sunset on December 31, 2025, which mean tax rates will revert to the higher levels of 2017. It’s important to prioritize where you’re funding from so you can take advantage of the current low rates.

Comparing 2026 Tax Brackets to 2023 and 2024 Tax Brackets

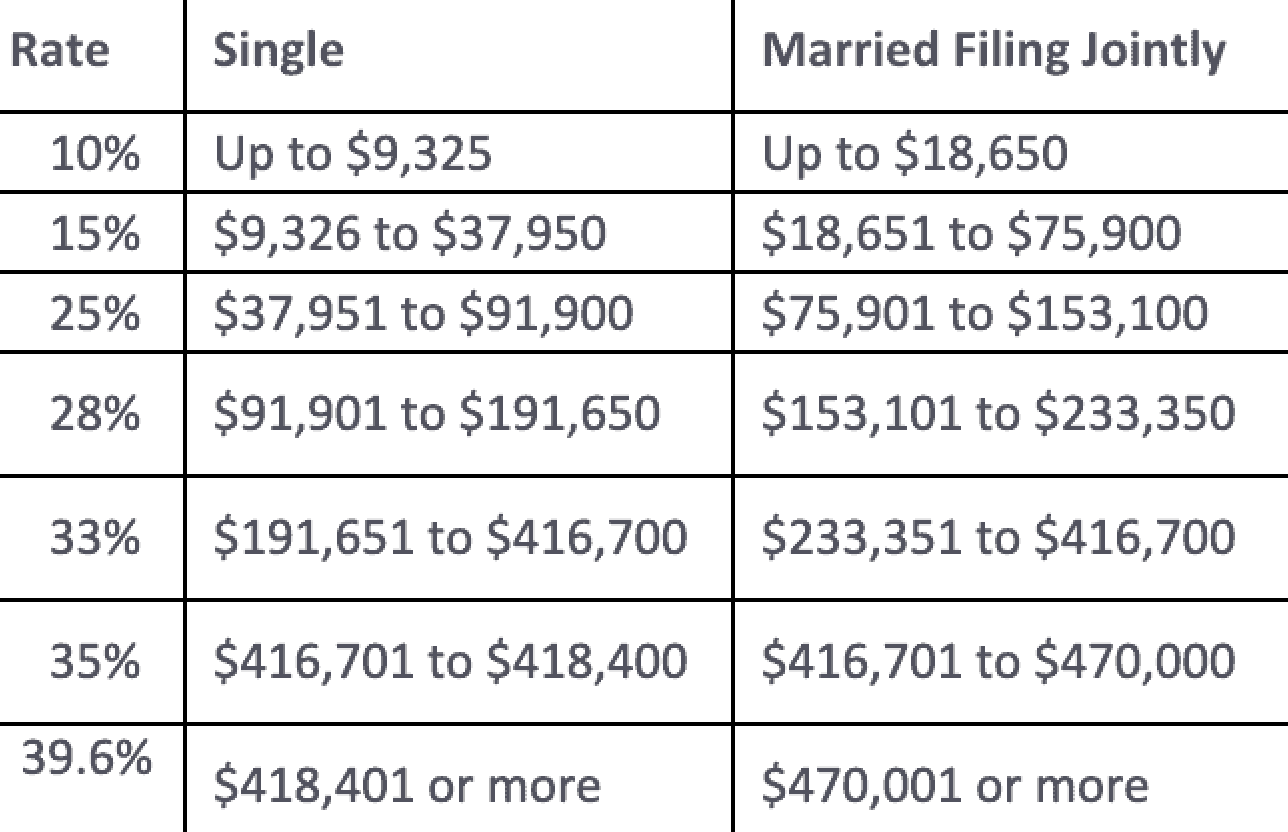

Check out the 2026 tax brackets below in Figure 3 and see how they compare to the 2023 and 2024 tax brackets.

FIGURE 3 – 2026 Tax Brackets – IRS

Doing Roth Conversions at a Discount

Along with the tax rates being higher in 2026, notice that it takes less income to go through the brackets faster. This is why we’ve talked so much lately about utilizing tax planning strategies, such as Roth conversions, prior to 2026 while rates are still relatively low. By doing a Roth conversion, you’re converting money from your tax-deferred traditional IRA to a tax-free Roth IRA. You’re required to pay tax on the conversion. However, the funds within your Roth IRA will grow tax-free from that point on.

While there’s a pain point that you go through with paying the tax on the conversion, remember the goal is to pay as little tax over your lifetime rather than just one year. Choosing to keep money in the traditional IRA through 2026 means that you would be taxed on the distribution when rates are higher.

You essentially have an opportunity to do Roth conversions at a discount until 2026. That doesn’t mean that Roth conversions won’t still be impactful after 2026. There’s just an opportunity for a bigger impact now with taking advantage of today’s lower rates.

QCDs Are Another Popular Tax Planning Strategy

Roth conversions can result in a substantial amount of tax savings, but they aren’t for everyone. There are instances where it can make more sense to keep money in traditional. For instance, let’s say that you’re 70½ or older and charitably inclined. You have the opportunity to do Qualified Charitable Distributions. Through QCDs, you can currently give up to $100,000 a year directly from an IRA to a qualified charity without it showing up on your tax return. That will increase to $105,000 in 2024.

In addition to considering QCDs, there are other reasons why Roth conversions might not make sense for you. One of them is potentially being thrown into a higher Medicare bracket. We can’t emphasize enough that it’s critical to work with a CPA and CFP® Professional together so that you can avoid costly mistakes and capitalize on tax planning opportunities. You can also learn more about forward-looking tax planning by downloading our Tax Reduction Strategies guide.

Tax Reduction Strategies Guide

Do You Have Any Questions?

Between the 2023, 2024, and 2026 tax brackets, and the 2023 and 2024 standard deductions, we realize that we threw a lot of numbers at you. If you have any questions about your tax situation or how your tax plan is a critical component of your overall financial plan, start a conversation with us below.

As we look at the tax brackets for 2023 and 2024 and then ahead to 2026, how can we make sure that you’re paying as little tax as possible over your lifetime? That’s one of our team’s top priorities as we’re taking people through the financial planning process. We welcome the opportunity to provide clarity and confidence about your tax and overall financial situation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.