7 Financial Planning Opportunities That You Don’t Want to Miss

Key Points – 7 Financial Planning Opportunities That You Don’t Want to Miss

- October Is National Financial Planning Month … We Celebrate It Every Month

- Looking at Current and Future Tax Rates

- How Estate Planning and Tax Planning Are Intertwined in the Financial Planning Process

- There Are a Lot of Financial Planning Opportunities You Don’t Want to Miss Outside of Your Investments

- 12 Minutes to Read | 24 Minutes to Watch

October Is National Financial Planning Month

Last week, Dean Barber and Bud Kasper, CFP®, AIF® took some time to review five important estate planning documents that everyone should have for National Estate Planning Awareness Week. Well, National Estate Planning Awareness Week is actually a part of National Financial Planning Month.

While we aim to educate people about financial planning year-round, Logan DeGraeve, CFP®, AIF® and Chris Rett, CFP®, AIF® are celebrating National Financial Planning Month by sharing seven financial planning opportunities you don’t want to miss. Let’s run through that list of financial planning opportunities you don’t want to miss before going in depth on each one.

Schedule a Meeting Get the Retirement Plan Checklist

7 Financial Planning Opportunities You Don’t Want to Miss

- Tax Bracket Management

- Roth Conversions

- Qualified Charitable Distributions

- Leave Your Legacy the Right Way After the SECURE Act and SECURE 2.0

- Properly Structuring Your Estate Documents

- Medicare, Healthcare, and Property and Casualty

- Adjusting Your Investment Strategy to Support Your Goals

Three Tax Planning Opportunities Highlight Our List of Financial Planning Opportunities You Don’t Want to Miss

1. Tax Bracket Management

The first financial planning opportunity you don’t want to miss is tax bracket management. If you’re still working, your income is what it is. However, there are things that you should look at to control those brackets. First and foremost, should you stay in a traditional 401(k) or contribute to the Roth side of your 401(k)?

What Does Bracket Management Mean for Retirees?

Tax bracket management is really a big financial planning opportunity that you don’t want to miss if you’re retired. Did you know that you have more control over your taxes in retirement than any other point of your life? If you’re retired, review all your income sources, understand how they’re taxed, and see where it falls within certain tax brackets.

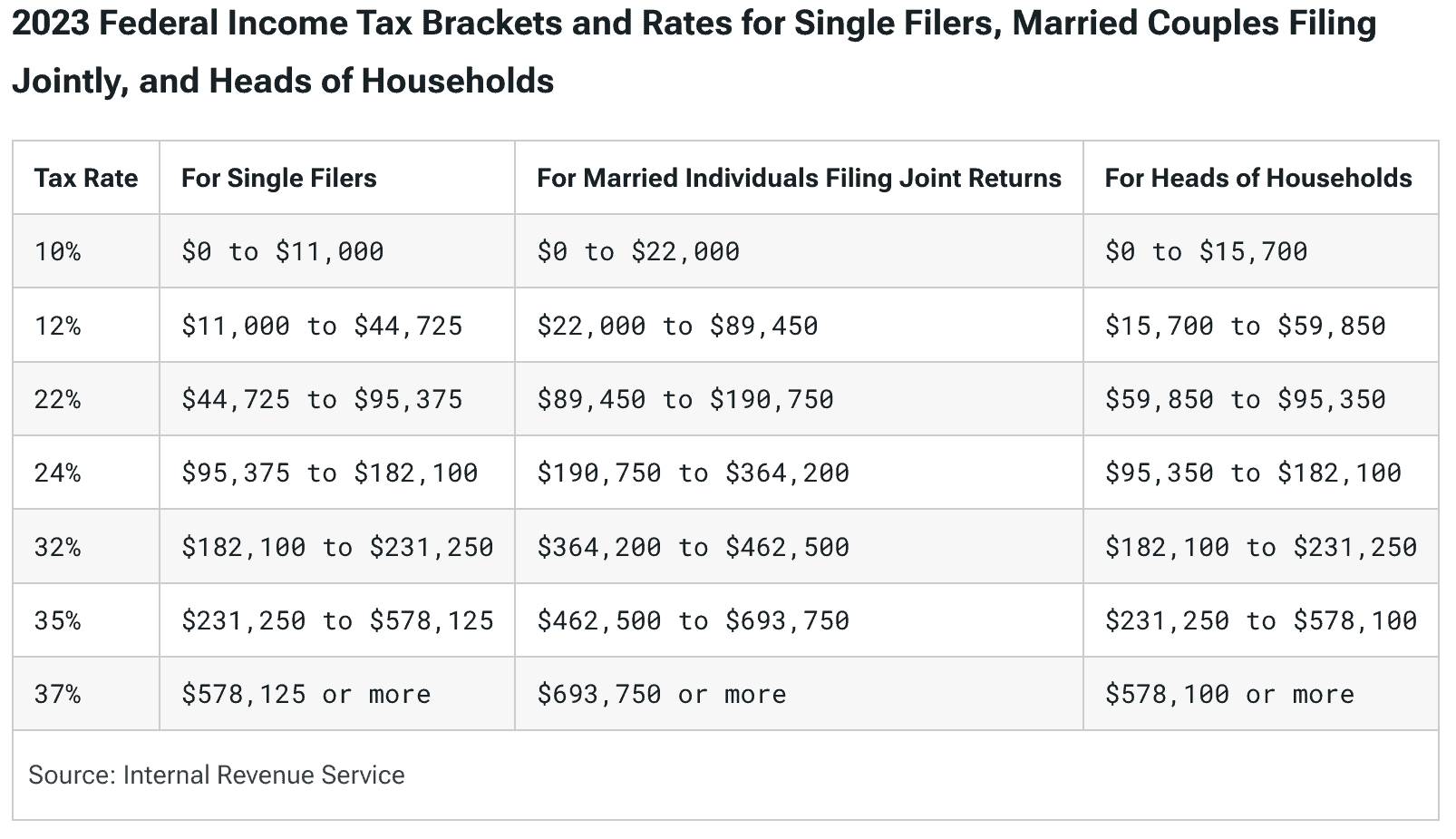

Historically speaking, the current tax rates are pretty low … for now. We’ll touch on that more momentarily. But first, let’s look at the 2023 tax brackets in Figure 1.

FIGURE 1 – 2023 Tax Rates – Tax Foundation

As you can see, there’s a huge increase between the 12% and 22% brackets. But going from the 22% to 24% bracket probably won’t make a huge difference for someone. When you’re talking about bracket management, the key is either speeding up income or slowing down income. Why would someone want to speed up income, you ask? Because as we just mentioned, we’re currently at historically low tax rates.

Assessing Your Current and Future Tax Rates

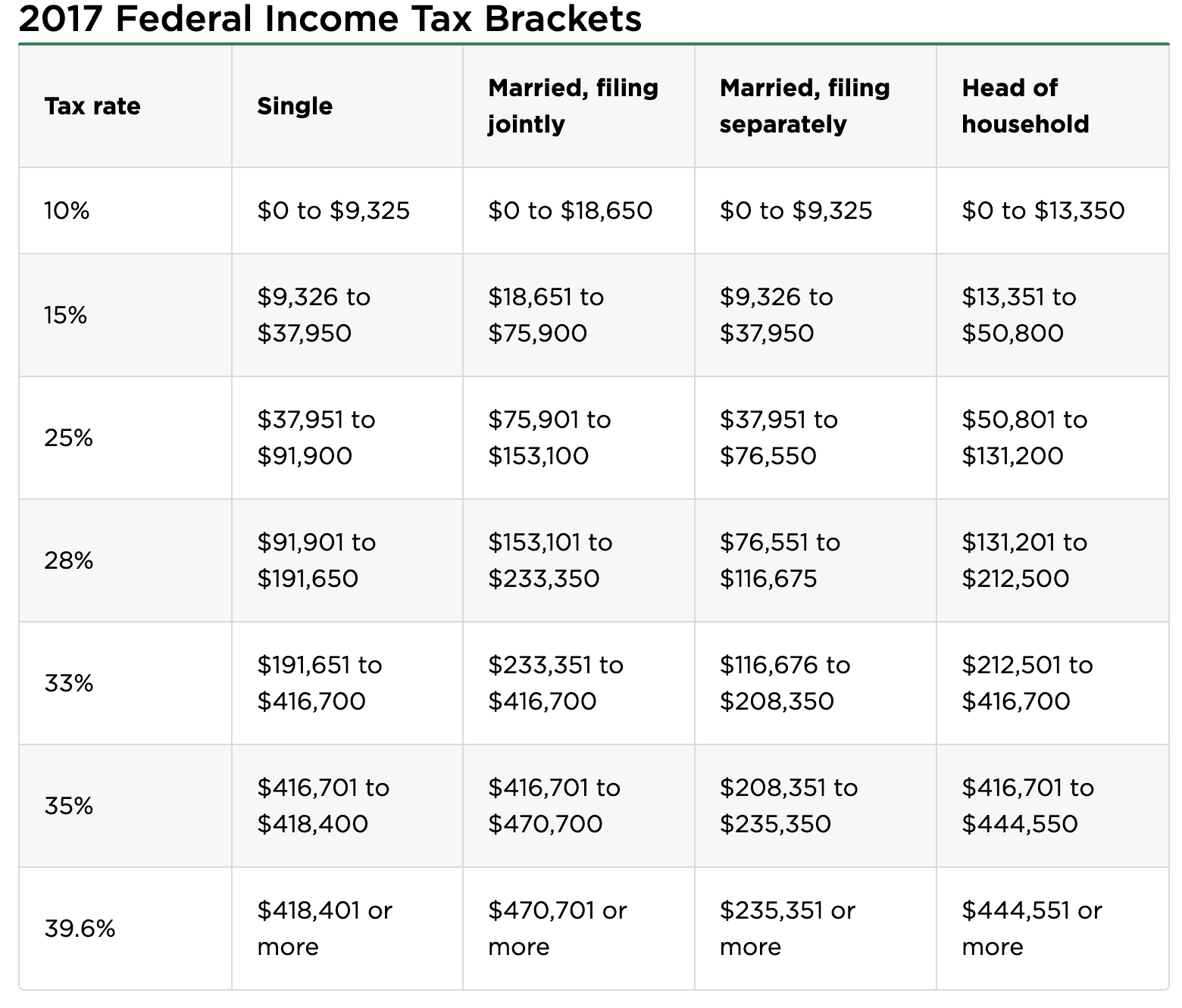

That’s likely going to change in 2026, as the Tax Cuts and Jobs Act is scheduled to sunset on December 31, 2025. The 2026 tax rates will revert to the higher tax rates of 2017, which you can see below in Figure 2.

FIGURE 2 – 2017/2026 Tax Rates – NerdWallet

If we go back to what the tax code was prior to the Tax Cuts and Jobs Act, the tax brackets are smaller. That means that you accelerate through them much faster. While the pain of paying more in taxes now isn’t fun, it beats experiencing even more pain if you’re slowing down your income and getting taxed more at higher rates starting in 2026.

“Nobody wants to pay taxes, but we’re looking at this over the longevity of someone’s retirement plan, which can be 25, 30, 35 years. If you accelerate those tax brackets today, that can save you over the long run.” – Chris Rett, CFP®, AIF®

Let’s go through an example of bracket management before we move on with our list of financial planning opportunities that you don’t want to miss. Right now, a couple that’s married filing jointly could be at the top of the 24% bracket with $364,000. Well, that 24% bracket goes up to 28% starting in 2026. And the top of that 28% bracket is just $233,000. That’s a huge difference and illustrates why bracket management is critical.

There are only so many strategies you can utilize to speed up income, though. The main strategy is through Roth conversions, which happens to be next on our list of financial opportunities that you don’t want to miss.

2. Roth Conversions

Why should you consider doing a Roth conversion? We’re not only asking this from a bracket management standpoint, but with looking at the longevity of your retirement. There are a few reasons why somebody would want to consider Roth conversions. The top reasons usually include managing taxes throughout retirement, legacy planning, and health care planning.

Notice that legacy planning and health care planning are also on our list of financial planning opportunities that you don’t want to miss. So many of these opportunities overlap with each other.

If you inherit a traditional IRA from someone who isn’t your spouse, you have 10 years to spend that down. Those non-spouse inherited IRAs typically get passed down during the beneficiary’s peak-earning years. So, imagine accelerating through the tax brackets and getting more tax-deferred assets dumped on you. Roth conversions can help with setting up a legacy that’s tax-efficient so that your heirs can reap the benefits of tax-free income.

And with health care planning, sometimes those who have been priced out or can’t qualify for long-term care look into Roth conversions in their 50s and 60s. They can utilize that tax-free Roth bucket as a longer-term bucket of money.

“With investment plans, you have money you’re going to spend today and tomorrow, money for the next five, 10 years, and then that long-term bucket where you can invest as if you’re 30 or 40 again.” – Logan DeGraeve, CFP®, AIF®

Thinking of Roth Conversions as a Hedge Against Bad Things

Roth conversions are a popular tax planning strategy because of how they can serve as a hedge against things like future higher tax rates or if a spouse passes away unexpectedly. We hope that you and your spouse both live well into your 90s or longer and we’ll build a plan accordingly.

However, that unfortunately doesn’t always happen. That’s why we also make sure to stress test your plan for events like the unexpected death of a spouse so that you both know that your plan will be OK if one of you becomes a single tax filer. This takes us back to the importance of bracket management.

For a single filer, the top of the 22% bracket is about $95,000. It’s half of what it was for married filing jointly. What happens is that you start accelerating through the tax brackets because more often than not, your income won’t be reduced greatly by one spouse passing. That’s because the higher of the couple’s Social Security benefits remains after one spouse passes away. But your Required Minimum Distributions won’t get any smaller since the IRA will just move to the surviving spouse.

“By doing Roth conversions, the goal is to make those IRA balances somewhat manageable so you’re not kicking off $100,000-$200,000 RMDs that you have to worry about in the future.” – Logan DeGraeve, CFP®, AIF®

3. Qualified Charitable Distributions

The last financial planning opportunity that you don’t want to miss as far as tax planning goes that we’re going to discuss are Qualified Charitable Distributions. As we meet with clients, they often talk about giving or wanting to donate to charities, their churches, nonprofits, etc.

There have been times where Chris and Logan have seen clients writing checks to those organizations from their checkbooks. That’s great to support those organizations. However, if you do it directly from the IRA, it’s now considered as a QCD and it doesn’t show up on your tax return.

“QCDs are a great way to lower what your base is for future RMDs while simultaneously contributing to the nonprofits, your church, and charity organizations that you’re already contributing to.” – Chris Rett, CFP®, AIF®

To be eligible for QCDs, you need to be 70½ or older. You can give up to $100,000 per year through QCDs. One thing that a lot of people don’t realize that since the RMD age has moved from 70½ to 72 and now to 73 that you can still do QCDs starting at 70½. QCDs are more impactful when you’re offsetting RMDs but doesn’t mean you need to wait to do QCDs until your 73.

Let’s say that your giving $1,000 a month to your church from your IRA. That’s $12,000 a year and it’s coming out tax-free. The only way to get it out tax-free is by giving it to charity. QCDs aren’t a one-thing-fixes-all type of thing but using them in conjunction with a lot of the other tools can help create more tax efficient plan. To learn more about QCDs, Roth conversions, and other tax planning strategies—and how they could work for you—download our Tax Reduction Strategies guide below.

Tax Reduction Strategies Guide

Financial Planning Opportunities You Don’t Want to Miss Related to Estate Planning

4. Leave Your Legacy the Right Way After the SECURE Act and SECURE 2.0

We started to get into some of the estate planning opportunities as we discussed some tax planning opportunities. They really are intertwined, and you can see that come to light as you go through the financial planning process. When it comes to leaving your legacy the right way, it’s much more of a challenge thanks to the SECURE Act and now SECURE 2.0.

We referenced earlier how all the money in IRAs has to come out within 10 years for most beneficiaries. That was one of the bigger changes within the SECURE Act. Let’s say that you’re in your 40s and inherited an IRA from your parents. Prior to the SECURE Act, you could stretch that out over your lifetime. It was more manageable from a tax standpoint.

“I think what happened was Congress realized that people are living longer and didn’t want those people to stretch those IRAs out for 40 or 50 years. They wanted all the money out of IRAs within 10 years.” – Logan DeGraeve, CFP®, AIF®

A lot of people also used to have a trust as a beneficiary for an IRA. The trust allowed them to exercise control. But under the SECURE Act, all that money must come out over a five-year period. Trust rates are very low to be at the highest tax bracket.

What’s Your Stance on Legacy Planning?

The SECURE Act and SECURE 2.0 mostly impacted beneficiaries. They didn’t significantly change many things for retirees. Again, the SECURE Act and SECURE 2.0 have actually helped retirees with moving back the RMD age. By 2033, the RMD age will be 75.

We usually find that retirees have one of two stances when it comes to legacy planning. One is that their kids are going to get what they get. The other approach is doing tax planning while they’re still alive so that the next generation doesn’t get overwhelmed with tax-deferred assets during their peak-earning years like we discussed earlier.

“We’re talking about two things now—the tax plan and estate planning. If any of this is confusing and you’re not 100% sure if you’ve done things the right way, make sure that your CFP® is coordinating with your CPA and an estate planning attorney.” – Logan DeGraeve, CFP®, AIF®

5. Properly Structuring Your Estate Documents

Make sure that your financial documents are set up in order and things are passing from generation to generation in a tax efficient manner. We briefly touched on having a trust, so let’s quickly review those five estate planning documents that Bud and Dean discussed last week.

- Last Will and Testament

- Revocable Living Trust

- Beneficiary Designations

- Advance Healthcare Directive: Living Will and Medical Power of Attorney

- Financial Power of Attorney

Estate Planning Isn’t Just for the Ultra Wealthy

Everyone should have some level estate plan. A lot of people think that having a trust is just for the ultra-wealthy, but that simply isn’t true. A trust helps you make sure that your assets aren’t probated and allows you to exercise control of how you want those assets to pass.

A trust can also be used to set up to protect your kids from their spouses after you pass. That’s not talked about a lot, but we have seen that with people who don’t necessarily see eye to eye with their son-in-law or daughter-in-law.

Something else that no one wants to talk about is the possibility of one of their kids passing away. The idea would be that those funds would be left for the grandkids potentially. If you didn’t care much of your son-in-law or daughter-in-law and they remarry and the assets were in their name, that becomes marital property.

“Estate planning is all about protecting your family and making sure that the dollars you worked hard for go the ones that you care about. Protection, control, and tax efficiency is what it boils down to.” – Logan DeGraeve, CFP®, AIF®

We can’t emphasize enough that those documents within your estate plan need to be revisited once a year and following major life events. If you have questions about that list of five estate planning documents that we shared, please don’t hesitate to reach out to us. Our Estate Planning Guide can also be a useful resource to brush up on your estate planning knowledge. You can download a copy of it below.

Risk Management Opportunities That You Don’t Want to Miss

6. Medicare, Healthcare, and Property Casualty

As we continue our discussion about financial planning opportunities you don’t want to miss, let’s talk about something else that can happen in retirement that can be bad. That’s risk management, AKA insurance.

Risk management is full of scenarios where you’re hedging against the unknown. Insurance is never a fun conversation unless you need it. For example, nobody wants to write that check to homeowner’s insurance. But God forbid your house burns down. Now, it’s good that you had insurance. We never want to see somebody’s house burned down.

Just like with your estate planning documents, you need to review your insurance coverages as well. Think about what home prices have done. Your house has likely appreciated largely in the past few years. Has your coverage appreciated? Has it stayed the same? Are you protected there?

Misconceptions About Medicare

Let’s touch on Medicare as well. It’s a very confusing government program. Many people aren’t 100% sure about what they should or shouldn’t have. Medicare is a huge cost if you’re not controlling your income with IRMAA. There’s a two-year lookback period that you need to be cognizant of. So, if you’re 63, you really need to pay attention to where your income is.

There are also a couple of big misconceptions when it comes to health care and retirement. Some people think that Medicare is free, but it’s not. There are also a lot of people who think they need to work until 65 because that’s when you become eligible for Medicare. That’s also not true.

“We see people retire all the time pre-65. The idea is you need to have a plan in place to make that insurance somewhat affordable.” – Logan DeGraeve, CFP®, AIF®

And Investment Management Opportunities That You Don’t Want to Miss

7. Adjusting Your Investment Strategy to Support Your Goals

That brings us to the last item on our list of financial planning opportunities that you don’t want to miss: investment management in retirement. If you’re someone that’s retiring in the next three to five years, we hope you’re looking at your allocation. If your allocation is the same allocation that it was a few years ago, you’re opening yourself up to unnecessary risk.

Let’s say that someone was wanting to retire at the start of 2023 and they didn’t change their allocation in 2022. If they were aggressive, they probably lost 18%, 20% last year

“Those are life-changing events that are hard to come back from. Yes, the market does always come back, but the reality is that it can be painful.” – Logan DeGraeve, CFP®, AIF®

Marrying Your Financial Plan with Your Investment Plan

Logan and Chris both talked with several people who thought they were never going to be able to retire because of the market volatility we experienced in 2022. Overtaking risk paired with economic volatility is the feeling that you’re not going to be able to retire. But that stems from not having that plan.

“It all comes down to marrying a finite financial plan that is based off your goals, hopes, and dreams with your investment plan. Understand why you’re taking the risks that you’re taking.” – Logan DeGraeve, CFP®, AIF®

These Financial Planning Opportunities Frequently Overlap

These seven financial planning opportunities that you don’t want to miss are all so closely tied together. Your tax plan is going to change your estate plan. Your tax plan has an impact on your risk management plan with Medicare and insurance premiums. It has an impact on your investment plan.

The coordination of a well put together financial plan that’s being reviewed by experts in all subjects—investments, tax, estate, insurance—is what’s important. You can begin to see how all this comes together in our Retirement Plan Checklist. It consists of 30 yes-or-no questions that gauges your retirement readiness and includes an age-based timeline of key retirement considerations. Download your copy below.

“If you’re confused, nervous, or scared, you’re not alone. There are a lot of people that are thirsting for knowledge and want to learn more about this and how it impacts them. Reach out to somebody for help because this is a huge understanding that you shouldn’t be doing alone.” – Chris Rett, CFP®, AIF®

If you do have any questions about these seven financial planning opportunities that you don’t want to miss, let us know. You can start a conversation with us by clicking here. We can share with you how our team at Modern Wealth works together to address these opportunities by building a plan that’s unique to you. We don’t want you to miss these financial opportunities and look forward to further discussing them with you.

7 Financial Planning Opportunities That You Won’t Want to Miss | Watch Guide

00:00 – Introduction

01:41 – 1) Bracket Management

05:04 – 2) Roth Conversions

08:41 – 3) QCDs

11:47 – 4) Leave Your Legacy the Right Way After SECURE and SECURE 2.0

14:58 – 5) Properly Structuring Your Estate Documents

17:56 – 6) Medicare, Healthcare, and Property & Casualty Insurance

19:54 – 7) Adjusting Your Investment Strategy to Support Your Goals

21:19 – What We Learned Today

Articles

- What Are Tax Brackets?

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Taxes on Retirement Income

- Tax Rates Sunset in 2026 and Why That Matters

- 2023 Roth Conversion Decisions

- Tax Planning Strategies with Marty James

- Social Security Benefits for a Surviving Spouse

- RMD Questions: Questions About Required Minimum Distributions

- What Is the SECURE Act?

- Understanding the SECURE Act 2.0 with Ed Slott

- Why You Need a Financial Planning Team with Jason Gordo

- Family Financial Planning with Matt Kasper

- What Is Probate and Why Should I Avoid It?

- Redefining Risk Management: Don’t Miss Out on Your Money

- Mortgage Tips for Different Phases of Life with Tim Kay

- ABCs of Medicare

- 2023 Tax Brackets: IRS Makes Inflation Adjustments

Past Shows

- 5 Key Estate Planning Items to Address

- October Is National Financial Planning Month

- Converting to a Roth IRA: What Are the Pros and Cons?

- What Is a QCD? Qualified Charitable Distributions

- RMD Age for 2023: What’s Your Required Beginning Date?

- What Is Tax Planning?

- Rules for Inherited IRA Distributions: What Are the Latest Changes?

- How Does a Roth IRA Grow?

- Longevity Risk in Retirement and How to Plan for It

- Stress Testing Your Financial Plan

- Retiring Before 65: What You Need to Consider

- Asset Allocation vs. Tax Allocation

- Meet Modern Wealth Management

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.