Retiring with $2 Million

Key Points – Retiring with $2 Million

- Plans for Three Sample Couples

- How Each Couple Can Retire with $2 Million

- Savings Strategies for Each Couple

- What Each Couple Should Be Looking Out for

- 12-Minute Read | 33-Minute Watch

Retiring with $2 Million: Is That Enough or More Than Enough?

How much do you need to retire? Is it $1 million, $2 million, or way more than that? The answer is going to depend on your personal situation. Today, we’re going to review the sample plans of three couples—Joe and Jane Average, Bob and Beth Investing, and Sam and Samantha Ideal—who are retiring with $2 million. However, the taxation of their retirement savings is vastly different. Before we dive in with reviewing the intricacies of each couple’s plan, here are the assumptions for all three plans.

- The three couples all have $7,100 in monthly living expenses.

- Assuming a conservative 4% inflation rate for tax, education, and general expenses.

- 6.5% inflation on healthcare costs.

- 1.5% inflation on Social Security.

- 60/40 asset allocation (60% equities/40% fixed income)

- 7.9% annual rate of return and 10.2% standard deviation

Retiring with $2 Million in Only Tax-Deferred Accounts: Joe and Jane Average

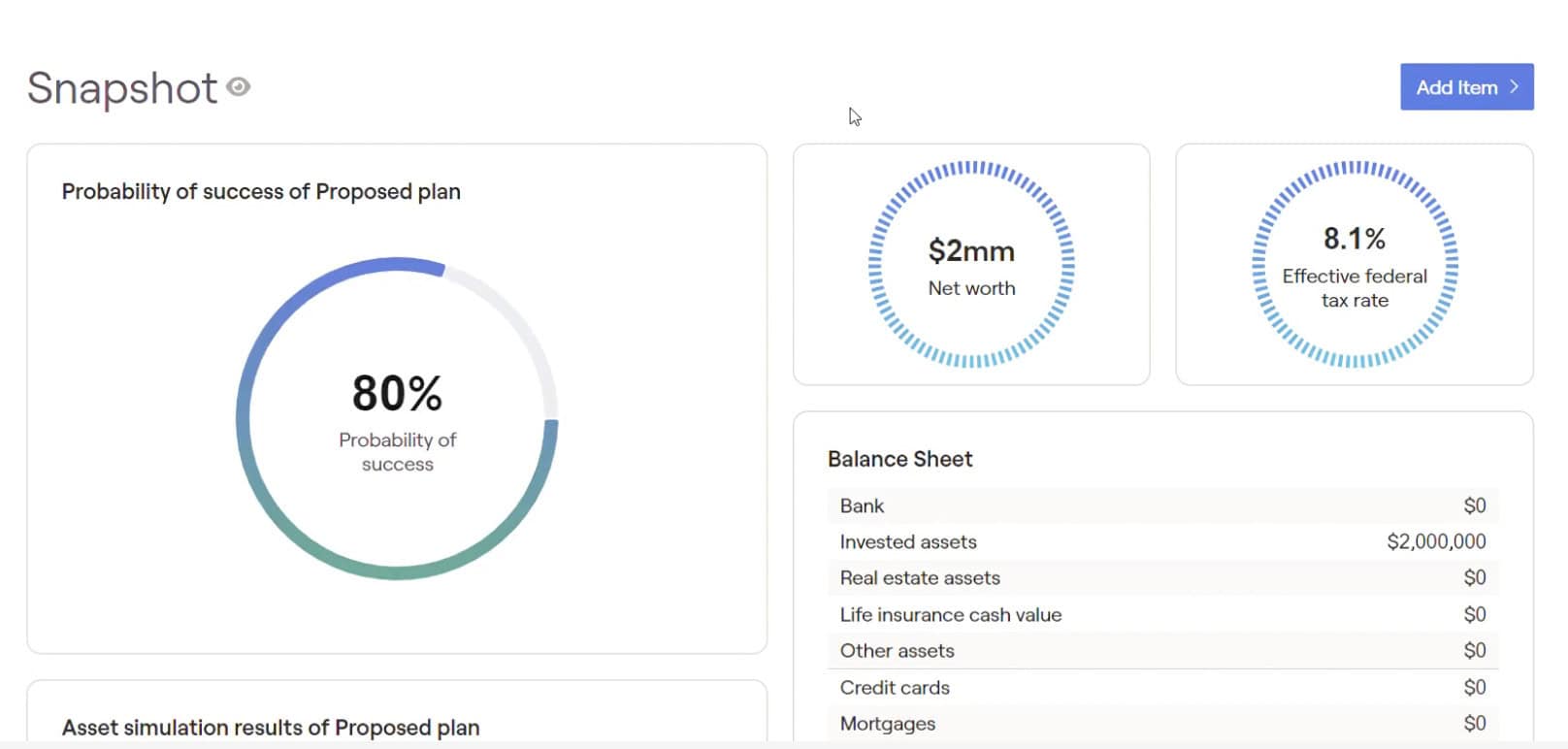

The first plan we’ll review is for Joe and Jane Average. They’re retiring with $2 million, all of which is saved in tax-deferred accounts. That means all their retirement savings have yet to be taxed. This is fairly typical, as there are a lot of people who have all their retirement savings in a traditional 401(k). Their financial plan projects them to have an 80% probability of success. But that doesn’t mean there’s a 20% chance they’ll run out of money in retirement. This means there’s a 20% chance they may need to temporarily alter their spending.

FIGURE 1 – Probability of Success for Joe and Jane Average

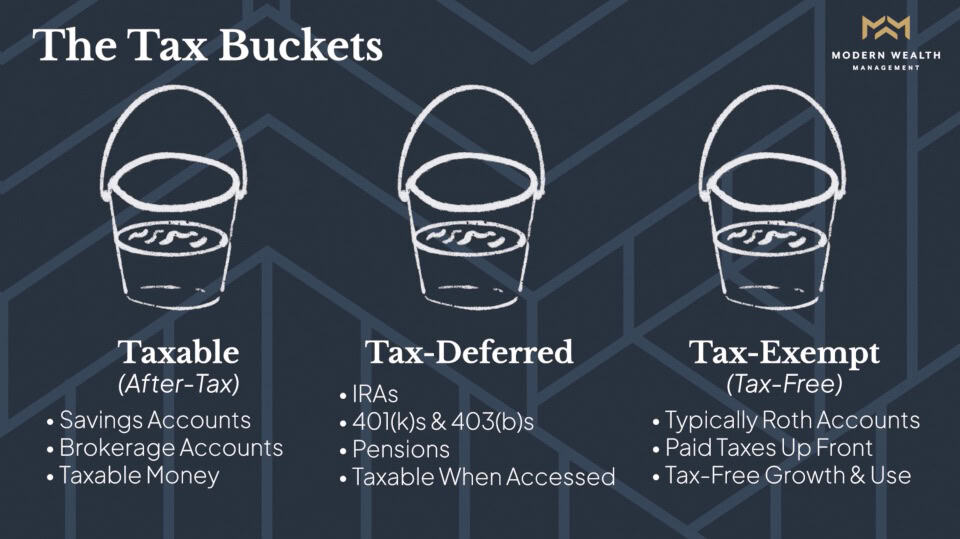

It isn’t necessarily a problem for Joe and Jane to have all their retirement savings in tax-deferred accounts, but they’ll eventually need to get their savings distributed across other tax buckets (taxable and tax-free accounts).

FIGURE 2 – The Tax Buckets

“The biggest problem here is they have no flexibility. Every time that they want to spend a dollar, there’s going to be a dollar of taxation riding with that.” – Corey Hulstein, CPA

For example, let’s say that the Averages want to buy a new car that costs $40,000. They would need to take more than $40,000 out of the tax-deferred account to pay for the car because the money in that account hasn’t been taxed yet. It would be more in the ballpark of $45,000-$50,000.

IRMAA Considerations

Another factor to consider (for the Averages and any couple that’s 63 and older) is IRMAA, which stands for Income-Related Monthly Adjustment Amount. IRMAA is an additional monthly cost of Medicare. It’s derived from what your income was two years prior. So, it really starts at age 63 that IRMAA comes into play since you become Medicare eligible at 65.

“It becomes a balancing act to determine your appropriate landing spot. The Medicare system is a cliff system. If you go one dollar over that threshold, you’ll be hit with the additional premiums.” – Corey Hulstein, CPA

When Should They Start Claiming Social Security?

Determining when to start claiming Social Security is something that the Averages, Investings, and Ideals will need to keep top of mind. In Joe and Jane’s scenario, that could become even more important to consider if there’s a market downturn. Here’s why.

If Joe and Jane want to spend $7,100 a month, they’re going to need to withdraw more than that from their tax-deferred bucket since that money hasn’t been taxed yet. If the market is down, they’ll need to take an even bigger withdrawal. That may force them to start claiming Social Security sooner to allow their portfolio to recover.

The longer you wait to start claiming your Social Security benefits (you’re eligible to do so at 62), the larger your monthly benefit will be. But the Averages “painted themselves into a tax corner” as Dean Barber likes to say by having all their retirement savings in the tax-deferred bucket.

The way the Social Security system works is if you have no other forms of income besides Social Security, the taxation on your benefit will potentially be very low (possibly even 0%). But as you add other forms of income, the taxation of your benefit climbs to as high as 85%.

“In a situation like that (the Averages), they almost have to assume that 85% of their Social Security is going to be taxable every year because they don’t have any other pieces to move around the chess board. If they need cash, it’s going to be taxable.” – Corey Hulstein, CPA

In addition, other important factors to consider when starting to claim Social Security include which spouse is the higher earner and individual life expectancy, amongst others.

How Can the Averages Improve Their Situation from a Tax Standpoint?

So, how can Joe and Jane get out of the tax corner that they’ve painted themselves into? Looking at the long-term projected tax rate for Averages in Figure 3, they would be in the 15% bracket from their early 60s to late 70s.

FIGURE 3 – Tax Rate Projections for Joe and Jane Average

If you’re wondering where the 15% tax rate came from, tax rates are slated to go up if the Tax Cuts and Jobs Act sunsets as scheduled after 2025.1 The current 12% tax rate would change to 15% in 2026.

The Averages’ income is likely around $120,000 a year if they’re spending $7,100 a month. Eventually, they’re projected to bump into the 25% bracket. It’s important for the Averages to take advantage of the 12%/15% while they’re in it. They should also consider front-loading their spending, especially before claiming Social Security due to the taxation impact of that which we discussed earlier.

“There could be scenarios where they run income into the 25% tax bracket as more of a hedging technique. They could be hedging against things like one spouse passing away early or long-term care stays. They need to start creating some flexibility to handle the undue burdens of life.” – Corey Hulstein, CPA

This is why it’s crucial to have tax diversification rather than having all their money in the tax-deferred bucket. It would be more cost efficient for the Averages to pay for the high cost of things like long-term care from a safer bucket.

What Could Tax Rates Be Several Years from Now?

We mentioned that tax rates are projected to go up in 2026, but there’s no way of knowing what tax rates could be several years from now. Would 25% be a bad tax rate for the Averages to be at long-term or will tax law changes continue to drive up those rates? That’s something to keep in mind for a couple like the Averages who are retiring with $2 million that is all in tax-deferred savings.

“If one of the spouses were to pass away, those Required Minimum Distributions don’t get any smaller. The surviving spouse becomes a single tax filer, so the brackets become compressed, which makes it easier to run through the brackets.” – Logan DeGraeve, CFP®, AIF®

What Kind of Legacy Do Joe and Jane Want to Leave?

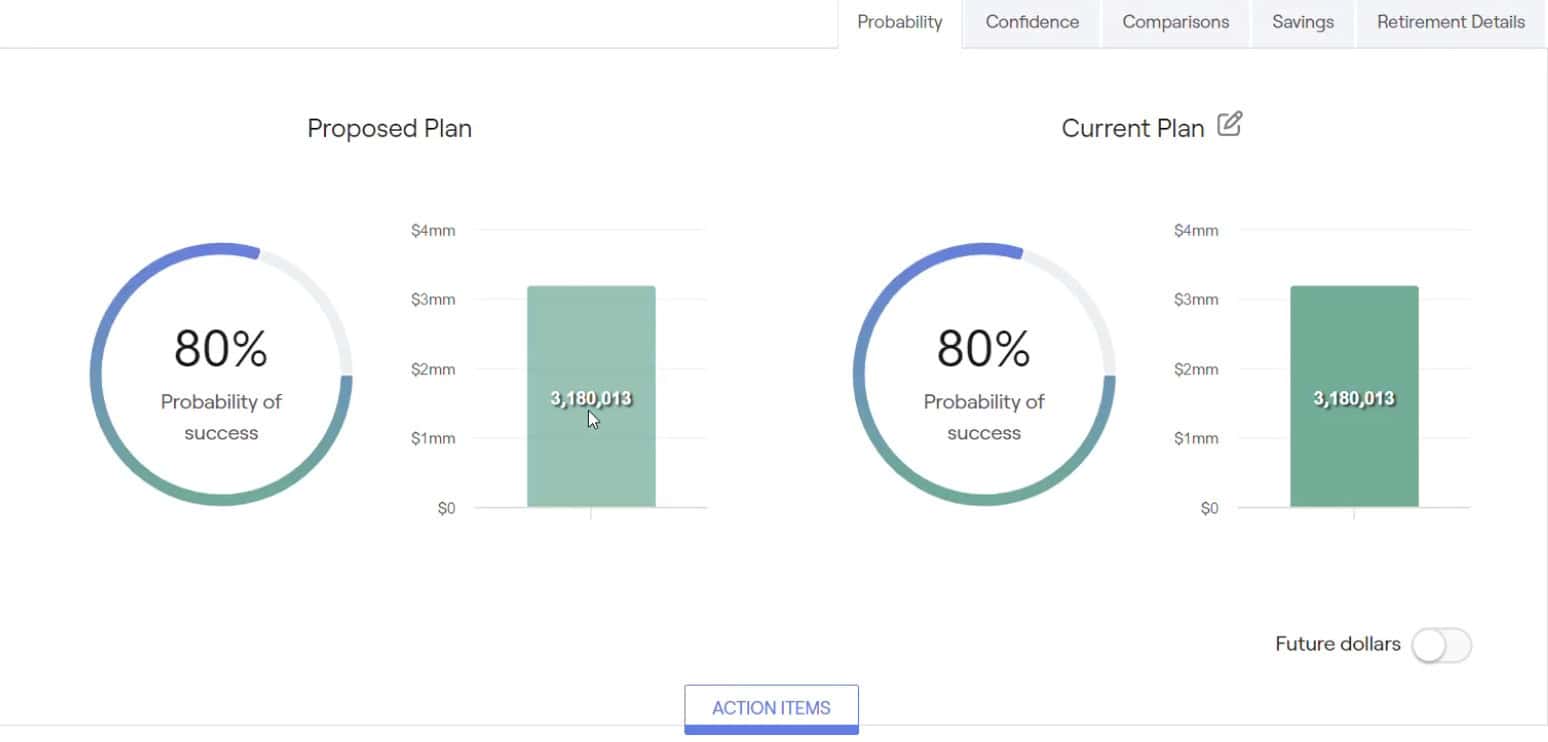

Along with thinking about what tax bracket(s) Joe and Jane will be in during retirement, they also should consider what tax brackets their beneficiaries will be in. Joe and Jane’s projected plan has them leaving a legacy of about $3.18 million.

FIGURE 4 – Joe and Jane Average’s Legacy

Under current law, non-eligible designated beneficiaries will need to withdraw all the funds from an inherited IRA over a 10-year period. If Joe and Jane’s beneficiaries inherit that IRA during their peak earning years (and/or are high income earners), that may put them into a difficult tax situation. Could it make sense for Joe and Jane to pay more tax now to hedge against that?

“We view a lot of these decisions from a family standpoint. How do we transfer the wealth efficiently to the next family? There are scenarios where people don’t have children, so some of these considerations become less valuable in that situation.” – Corey Hulstein, CPA

Qualified Charitable Distributions

Leaving a legacy isn’t just limited to building generational wealth either. For couples like the Averages that have most or all their money in traditional 401(k)s and IRAs, Qualified Charitable Distributions might be worth considering—especially if you’re 70½ and older and are passionate about charitable giving. If you’re 70½ or older, you can donate up to $105,000 a year directly from an IRA to a qualified charity via a QCD without it showing up on your tax return.

“Inherently, your account balance goes down, which softens your RMDs and make things easier to navigate in the future.” – Corey Hulstein, CPA

Retiring with $2 Million Only in a Brokerage Account: Bob and Beth Investing

The second sample couple that is retiring with $2 million is Bob and Beth Investing. Instead of retiring with $2 million in tax-deferred accounts like the Averages, the Investings have all their retirement savings in a brokerage account. They have never saved to any type of 401(k) or tax-exempt account, so all their $2 million is taxable on any given year. Bob and Beth’s financial plan projects them to have a 90% probability of success.

FIGURE 5 – Probability of Success for Bob and Beth Investing

One of the things that couples like the Investings need to be mindful of is any interest, dividends, or capital gains—all are taxable every year you incur them. It’s important that your investments behave in a way that you can control that type of income in this situation.

“From a flexibility standpoint, this is a great option. They’re only creating capital gain-type income, generally speaking. (Capital gains) have favorable tax rates at 0%, 15%, and 20%.” – Corey Hulstein, CPA

In this scenario, Corey and Logan caution against investing in mutual funds. Doing so would give up that flexibility that the Investings worked hard for. With mutual fund investing, there’s a fund manager that’s managing those funds and trying to beat the market. But each of those transactions are subject to capital gains or capital losses that aren’t within Bob and Beth’s control.

Tax-Efficient Investing

Roth conversions can potentially be beneficial in many situations, but Corey says that this isn’t one of them. That’s because Bob and Beth don’t have any tax-deferred dollars to convert to tax-free dollars. Couples like the Investings need to be tax efficient with their investments via strategies such as direct indexing.

“We’d be looking at long-term U.S. treasuries, realistically. And from the stock side, what stocks do they want from a growth position? We want to minimize the income side of things through dividend income.” – Corey Hulstein, CPA

How can a couple like the Investings that’s retiring with $2 million in taxable assets realize capital gains and live in a 0% tax rate type of environment? Also, the Investings need to determine what assets have a step-up in basis on under current law.

Let’s say that they bought Amazon at $10 a share and it’s $100 a share in the future. If they were to sell those shares, they would most likely incur capital gains. They would need to realize capital gains along the way to get their $7,100 net income per month. But if they have other investments in their portfolio that potentially don’t have capital gains that are as large, those may be better options for their long-term bucket of money.

Speaking of long-term, let’s look at how much Beth and Bob would be leaving behind from a legacy standpoint. They would leave more than $3.81 million behind, and none of it would be taxable to their beneficiaries due to the step-up in basis.

FIGURE 6 – Bob and Beth Investing’s Legacy

The Taxable Bucket Is Always Liquid

People can sometimes neglect saving to the taxable bucket at times because it’s always liquid and always accessible.

“It takes a lot of discipline to build up this bucket without a big liquidity event.” – Logan DeGraeve, CFP®, AIF®

As you can see in Figure 6, some tax strategies were implanted to create about $200,000 more for the Investings to leave behind. Doing so also increased their probability of success by 4%. If the Investings aren’t comfortable about leaving that big of a legacy, that just means that they have about $200,000 more that they can spend.

Keeping Wealth Transfer Top of Mind

If leaving a legacy (whether it’s to their loved ones or favorite charity) is important to you, remember to keep the tax implications in mind. If the Investings had the same amount of Amazon stock as the Averages, they may want to consider gifting it charity and get a large charitable deduction or to their child so they might be able to pay 0% capital gains as well. Giving away the highly appreciated securities so no one is paying extra tax on those is something to consider.

“When we see couples like this, a lot of times they’re business owners that sold their business and now have after-tax cash.” – Logan DeGraeve, CFP®, AIF®

When Should the Investings Begin Claiming Social Security?

We discussed why couples retiring with $2 million like the Averages should consider delaying when they claim Social Security, but what about couples like the Investings who have their $2 million in the taxable bucket? It might make sense for them to claim their Social Security earlier because they don’t need to worry about the tax implications like the Averages did.

Could the Investings Be in Position to Retire Early?

Health insurance is something that will also need to be top of mind for all three couples that are retiring with $2 million. Let’s say that Bob and Beth want to retire before 65, but are worried about how they’ll pay for health insurance until becoming Medicare eligible.

The Affordable Care Act offers subsidized health insurance, but you must understand how to qualify for the subsidies. Your family’s income will dictate what your individual premiums will be. Again, it comes down to control and taxability of the funds. This fact pattern gives the Investings a much greater outcome on the Affordable Care Act insurance compared to the Averages.

“In this scenario, they have all the control and flexibility in the world to make their income as low as zero if they really wanted to. Ideally, we’re looking at people from about $50,000 to $75,000 for people who are on Affordable Care Act insurance.” – Corey Hulstein, CPA

Why Having a Set-It-and-Forget-It Plan Would Be Problematic for the Investings

The Investings have a higher probability of success than the Averages, but that doesn’t mean they can retire with $2 million and make no changes to their plan. A couple like the Investings would likely need to look at where they’re sending their money about once a quarter—specifically looking at tax-loss harvesting.

With tax-loss harvesting, you’re selling a position at a loss and immediately getting back to a similar position. We’ll use Pepsi and Coke as examples here. Let’s say Pepsi is down 10% so far this year and you sell it. Due to wash-sale rules, you can’t be Pepsi again for 30 days. Take that money from selling Pepsi and invest it immediately in Coke, which typically behaves the same in the markets at Pepsi. By doing so, you would incur the capital loss for tax purposes.

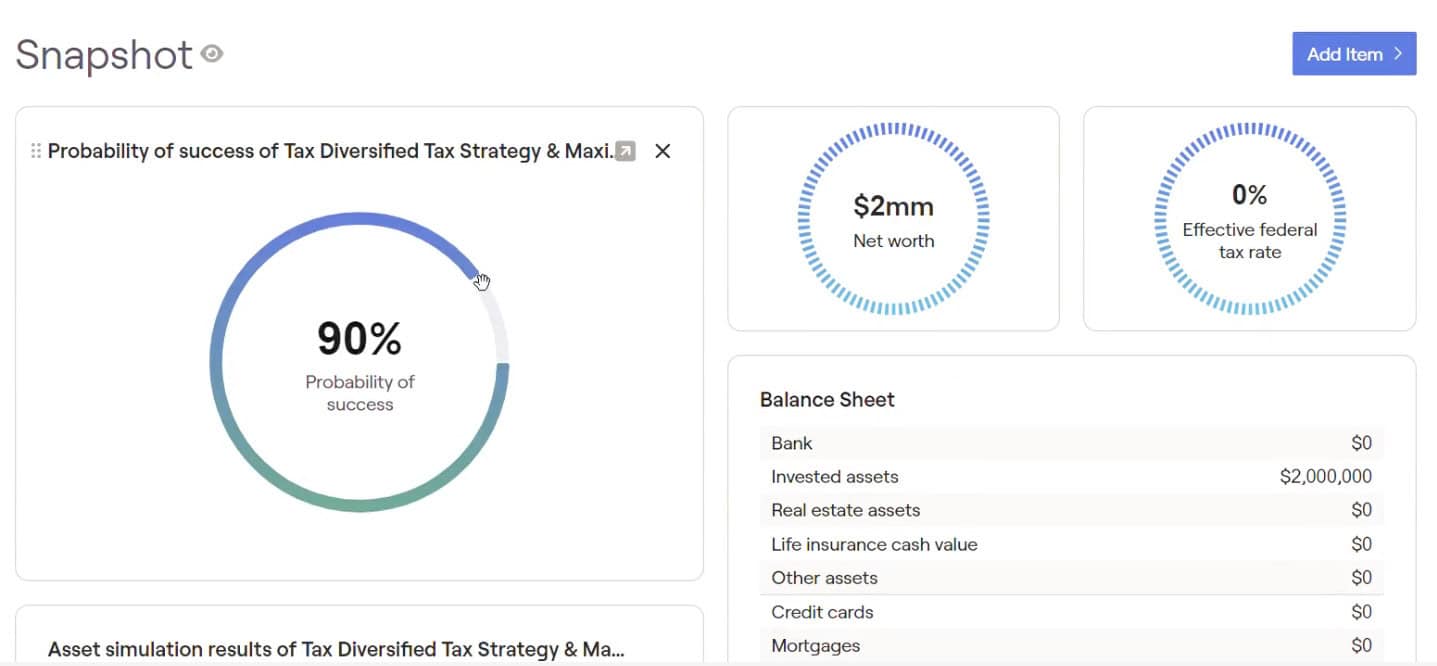

Retiring with $2 Million with Tax Diversification: Sam and Samantha Ideal

This sets the stage for reviewing the plan for Sam and Samantha Ideal. The Averages and Investings both had pros and cons to their plans. While they both were retiring with $2 million, the potential issues with their respective plans stemmed from having all their savings in one tax bucket. That won’t be the case for the Ideals, who have a 90% probability of success.

FIGURE 7 – Probability of Success for Sam and Samantha Ideal

The Ideals prioritized having tax diversification by saving $1.25 million in taxable accounts and $375,000 each in tax-free and tax-deferred accounts for a total of $2 million. Unlike the Investings and Averages, the Ideals have money in the tax-free bucket. The Ideals are well positioned to get more money into the Roth as well via Roth conversions.

Let’s say that they want to do a $50,000 Roth conversion in one year. We’ll assume the taxes on that conversion will be about 20% ($10,000) between federal and state. So, on a $50,000 conversion, only $40,000 of it will get into the Roth bucket. However, the Ideals can pay that $10,000 out of the taxable bucket without really impacting their tax return.

“That allows them to maximize the conversion and get that full dollar over to the Roth bucket of money.” – Corey Hulstein, CPA

The Power of Tax Planning

By taking advantage of tax planning opportunities like Roth conversions and having tax diversification, the Ideal’s find themselves in a more advantageous situation than the Average’s and Investing’s in terms of their long-term tax rate.

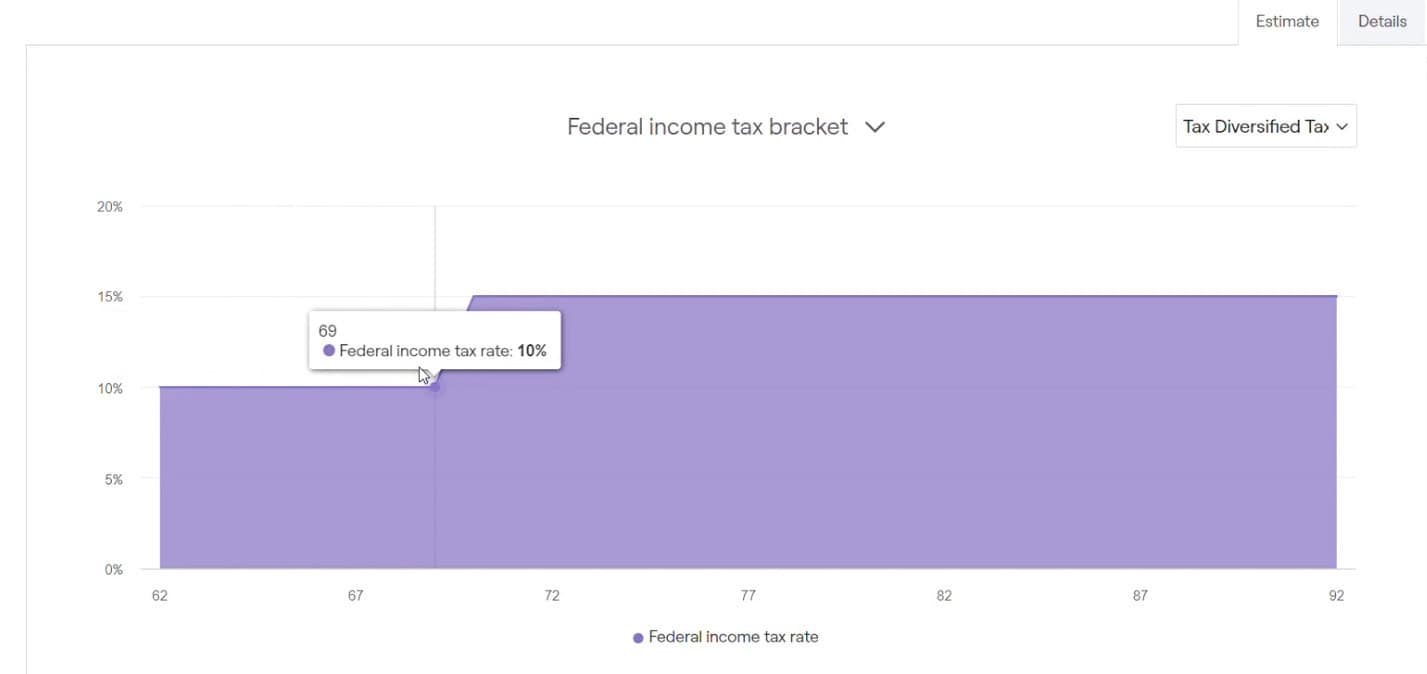

FIGURE 8 – Tax Rate Projections for Sam and Samantha Ideal

The Ideals would be at the 10% tax rate from age 62 all the way to age 70. Once they reach age 70, it jumps to 15%. However, they never reach the 25% bracket like the Averages eventually did in their late 70s.

If the Ideals retire at 62 with $375,000 in their tax-deferred bucket and $1.25 million in their taxable bucket, they might never take a withdrawal from their IRA.

“On a yearly basis, you should be sitting down with your CFP® Professional and CPA in the same room to figure out not only the best tax strategy for this year, but how that helps you over a 10, 15, 20-year period. Someone like the Ideal’s from age 70 until they die is potentially paying 10% to 15% less taxes a year because of what they did ages 62 to 70.” – Logan DeGraeve, CFP®, AIF®

Other Considerations for the Ideals

With the situation the Ideals are in, Logan and Corey would advise them not to begin claiming Social Security at 62. The Ideals should consider front-loading some of their Roth conversions because of the potential long-term growth and because of how it would be more detrimental to do the conversions while on Social Security.

Charitable donations are also something that might be worth considering for the Ideal’s. However, if charitable giving is important to the Ideal’s, that could be a reason to keep money in their IRAs to do QCDs rather than converting to Roth. They need to be tactical about their true end goal at age 70½.

Tax Planning Is a Pivotal Part of Financial Planning

As we wrap up this article on retiring with $2 million, think about your goals and make sure that your financial plan is tailored around them. Once you have a goals-based plan in place, that’s when you need to review it with a CPA so see what tax planning strategies could be most effective for you.

“You’re kind of flying blind if you don’t know where you want to go or what you want to do. What’s the purpose behind wanting to do Roth conversions (or other tax planning strategies)? We try to quantify financial decisions for clients. By doing certain moves, maybe you can leave more money behind or spend more.” – Logan DeGraeve, CFP®, AIF®

What Kind of Legacy Do Sam and Samantha Want to Leave?

Speaking of leaving money behind, let’s look into what kind of legacy the Ideals want to leave. Remember that all three couples were retiring with $2 million. Look at how much more the Ideals can leave behind compared to the Averages or Investings. They would be leaving $4.5 million behind—primarily due to the tax planning strategies they implemented.

FIGURE 9 -Sam and Samantha Ideal’s Legacy

Let’s circle back to the Averages’ plan. As their retirement accounts grew, so did their taxes. Since the Ideals did Roth conversions on the front end to incur some taxes early, they benefited from more tax-efficient growth.

Retiring with $2 Million: The Main Takeaway

Hopefully this case study on retiring with $2 million has helped you to understand that saving for retirement isn’t just about how much money you have. It’s about where you’ve saved and regularly reviewing your plan.

“Any one of these three scenarios is malleable. We can make improvements for each couple, but the strategies we’ll use will be very different.” – Corey Hulstein, CPA

Rather than try to compare your situation to one of these couples, start a conversation with our team about building a financial plan that’s designed around your goals. Whether you’re retiring with $2 million, $20 million, or $200 million, it’s important to work with a team of professionals that puts your needs, wants, and wishes first.

“Once we learn about who you are and what you want to do for the rest of your life, you’ll then begin working with Corey and his team to determine how to pay less taxes over your lifetime.” – Logan DeGraeve, CFP®, AIF®

In addition to CFP® Professionals and CPAs, our team consists of CFAs, estate planning professionals, and risk management specialists. All our team members are ready to work together on your behalf to build you a plan that’s designed to give you more confidence to make informed decisions with your money, freedom from financial stress, and time to spend doing the things you love.

Resources Mentioned in This Article

Podcasts/Videos

- Retiring with $1 Million

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Taxes on Retirement Income

- Monthly Living Expenses for Everyone’s Budget

- Mitigating Inflation on Healthcare Costs with These 7 Strategies

- Maximizing Social Security Benefits

- Understanding Retirement Asset Allocation

- 5 Factors More Important Than Rate of Return

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- How Does a 401(k) Work with Michelle Cannan, CPFA™, QKA®, QKC

- 5 Long-Term Strategies for a Better Retirement

- Retiring Single with $1.5 Million Saved: How Much Can You Spend with Will Doty, CFP®, AIF®

- Retiring Before 65: What You Need to Consider

- Roth Conversions Before and After Retirement with Will Doty, CFP®, AIF®

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Financial Checklist After the Death of a Spouse

- 5 Long-Term Care Questions to Ask

- What Is Tax Diversification?

- RMD Strategies Before and After Retirement

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- Transferring Wealth: IRAs Are a Bad Option

- Peak 65: Nearly 4.4 Million Americans Projected to Turn 65 in 2024

- How to Build Generational Wealth

- What Is a QCD? Qualified Charitable Distribution

- Charitable Giving in Retirement

- How to Reduce RMDs with 5 Strategies

- Reasons People Run Out of Retirement Money

- How Do Capital Gains Taxes Work?

- Roth Conversion Decisions for 2024

- 5 Reasons NOT to Convert to a Roth IRA

- Strategic Investing Through Retirement with Stephen Tuckwood, CFA

- Retirement Planning for Small Business Owners with Drew Jones, CFP®, AIF

- What to Know About CDs, Bonds, and Treasuries

- Growth vs. Value Investing in 2024 with Brad Kasper

- Affordable Care Act Subsidies – How to Qualify for Them with Marty James, CPA, PFS

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

Articles

- Have I Saved Enough to Retire?

- What Is a Monte Carlo Simulation?

- 10 Ways to Fight Inflation in Retirement

- Tax Rates Sunset in 2026 and Why That Matters

- What If We Go Back to Old Tax Rates?

- Health Insurance Options for Retirees Under 65

- Taxes on Inherited Property

Other Sources

[1] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.

RightCapital is a financial planning software that integrates retirement, tax, investment, and estate planning, allowing advisors to create personalized plans based on client data. It uses scenario modeling to project future outcomes, incorporates tax-efficient strategies, and tracks progress over time. The software considers a limited set of asset classes, such as U.S. Large Growth, International Equities, Emerging Markets, Bonds, and Cash, which are broad categories and not specific securities or products. These asset classes are not exhaustive, and other investments with similar or superior characteristics may exist. Assets not classified into these categories are grouped under “Other.” RightCapital cannot guarantee a complete or accurate depiction of a user’s financial situation or goals. In its Monte Carlo Simulation, asset classes are grouped into six categories with estimated return assumptions based on historical index data, not actual investments. Past performance of indices does not guarantee future results, and no investor has achieved the exact performance shown.

This article utilizes RightCapital software. Please note that Modern Wealth Management LLC and RightCapital are separate and unaffiliated entities. The data presented is believed to be sourced from reliable and reputable sources, though it should not be interpreted as a recommendation to buy or sell any security, strategy, or investment. The information provided is for general informational purposes and should not be construed as financial, tax, or legal advice specific to your individual situation. Your financial outcomes may differ based on a variety of factors, including but not limited to your unique investment portfolio, actual returns, income levels, tax circumstances, investment objectives, and goals. The analysis provided is based on hypothetical assumptions, and past performance or historical data is not necessarily indicative of future results. Therefore, any example provided in this article is purely illustrative and should not be taken as a guarantee of future performance or outcomes. Modern Wealth Management offers financial advice only to clients with whom we have a formal agreement to provide such services. Please note that financial situations vary widely from person to person, and outputs from this tool may change based on individual inputs, the nature of the investments considered, and other factors. We strongly encourage you to consult with a qualified tax, financial, or legal professional before making any decisions or taking any actions based on the information presented in this article.