Peak 65: Nearly 4.4 Million Americans Projected to Turn 65 in 2024

Key Points – Peak 65: Nearly 4.4 Million Americans Projected to Turn 65 in 2024

- What Is Peak 65?

- Things Pre-Retirees and Retirees Are Most Concerned About

- Breaking Down RetireOne and Allianz’s 2023 RIA Protected Accumulation + Retirement Income Survey

- Navigating Peak 65 with a Forward-Looking Financial Plan

- 10 Minutes to Read | 24 Minutes to Watch

What Is Peak 65?

Peak 65 is a term you’ll likely be hearing more and more in 2024. That’s because in 2024, more than 12,000 Americans are expected to turn 65 each day. That equates to nearly 4.4 million Americans turning 65 in 2024, which would be a record-breaking feat. Those statistics are significant for several reasons, especially when it comes to retirement planning. Dean Barber and Logan DeGraeve, CFP®, AIF® are going to help us break down what all to keep in mind about Peak 65.

Schedule a Meeting Get the Retirement Plan Checklist

Who Will Be Impacted by Peak 65?

Peak 65 is obviously important for people who are turning 65 in 2024 and those who are nearing retirement. But Peak 65 won’t just be impacting the Baby Boomers that are starting to retire in droves. As the Baby Boomers leave the workforce, how will companies replace their experience? And what will the retirement system look like after Peak 65?

“I don’t know if a lot of people know this, but the millennial generation is actually larger than the Baby Boomer generation by a couple of million people.” – Dean Barber

Those are just two burning questions where only time will tell with getting answers to them. The fallout of Peak 65 will be something that younger generations will need to monitor. We’ll touch more on Peak 65’s potential impact for them momentarily, but we want to kick off this article by diving into how Peak 65 could affect those who are retiring this decade.

A Myriad of Retirement Planning Concerns

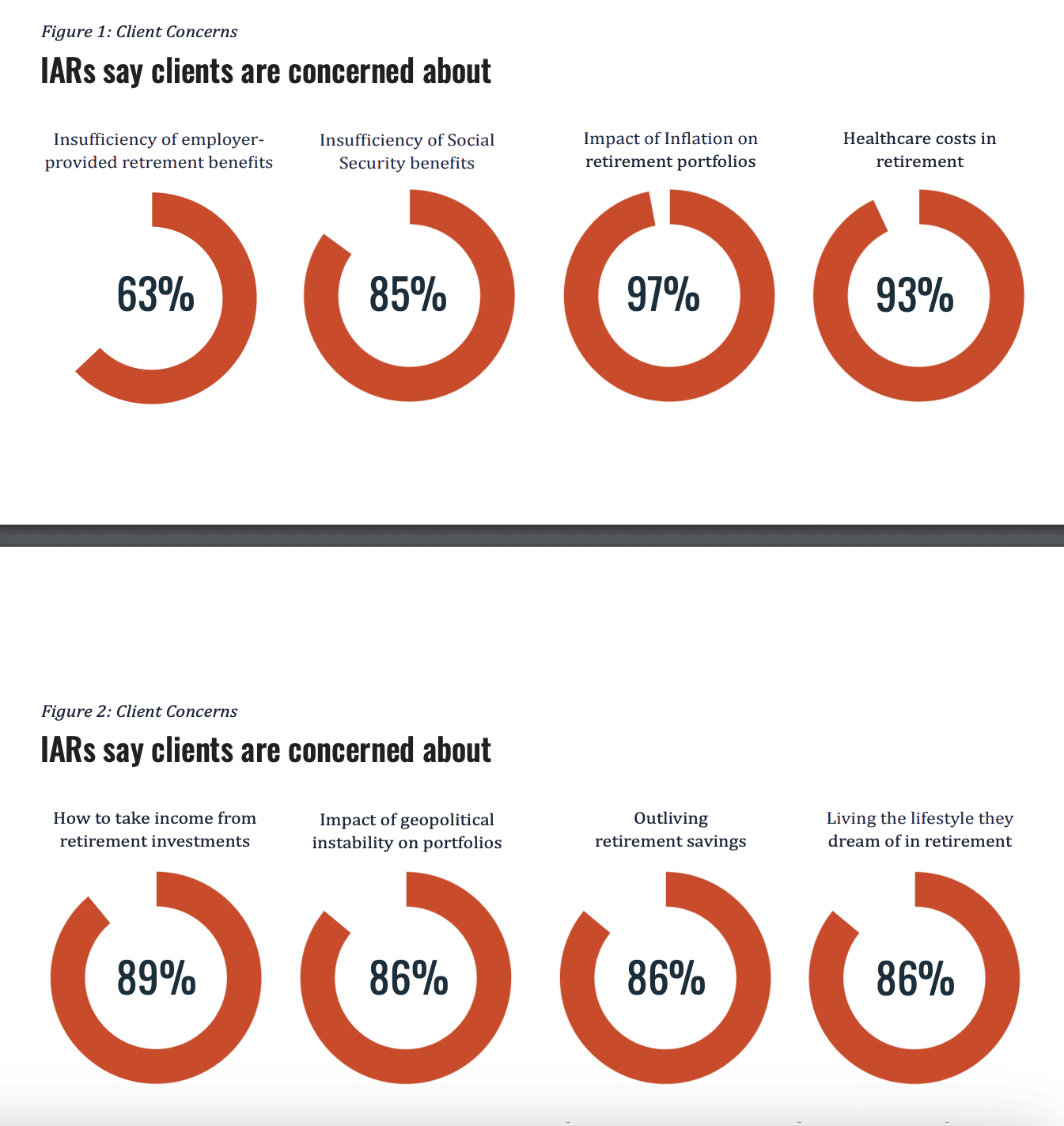

One of our chief objectives at Modern Wealth Management is to help people attain freedom from financial stress. There is a long list of factors that can cause financial stress, and Peak 65 is adding fuel to the fire. According to RetireOne and Allianz’s 2023 RIA Protected Accumulation + Retirement Income Survey, investment advisor representatives of Registered Investment Advisors have noted that more than 80% of their clients are concerned about the following:

- Insufficiency of Social Security benefits

- Impact of inflation on retirement portfolios

- Healthcare costs in retirement

- How to take income from retirement investments

- Impact of geopolitical instability

- Outliving retirement savings

- Living the lifestyle they dream of in retirement

FIGURE 1 – Retirement Planning Concerns – RetireOne/Allianz

Make no mistake about it, those things should be on your mind as you’re preparing for retirement. That’s precisely why we created our Retirement Plan Checklist and encourage people to start planning for retirement at least 10 to 15 years before they want to retire. Our Retirement Plan Checklist consists of 30 yes-or-no questions to gauge your retirement readiness and an age-and date-based timelines that can help take you to and through retirement.

So, ideally, you’ll review the Retirement Plan Checklist well before turning 65. But retirement planning isn’t just something you do once and then you’re done with it once you retire. It’s crucial to have a financial plan that’s fluid and forward-looking. Download our Retirement Plan Checklist below and make sure to review it throughout the retirement planning process.

Peak 65 Highlights Concerns About Social Security and Medicare

In one of our other article’s, How to Build Generational Wealth, we mentioned how some people are worried about a “gray tsunami” that could put an immense amount pressure on the Medicare system. While we think the term gray tsunami is a bit harsh, the concerns about the strain on the Medicare system are valid. The same goes for the stress that is being put on the Social Security system. Notice that Social Security and health care costs were two of the top concerns RetireOne’s and Allianz’s study.

Rather than giving into the financial stress from those respective situations, it’s critical to build a comprehensive financial plan. Your plan should consider things like Social Security and all your income sources in retirement. How are you and your spouse going to maximize your Social Security benefits?

Some Big Misconceptions About Social Security

Keep in mind that Social Security is different than any other income source with how it’s taxed. Social Security by itself is tax-free, but when combined with other income sources, up to 85% of your benefit can be taxable. Getting through retirement on Social Security alone simply isn’t feasible. Social Security is only intended to replace roughly 40% of an average person’s income as they head into retirement. People have been depending on it more and more, though.

It’s important to remember when you’re thinking about when to claim Social Security that the decision shouldn’t be all about you if you’re married. It’s crucial to determine how to maximize you and your spouse’s benefits. The urge to claim Social Security as soon as possible can be tempting, but keep in mind that the longer you wait to claim, the bigger the benefit. The difference between the best and worst claiming strategies can equate to a substantial amount of retirement income.

“There are over 600 iterations from the time you turn 62 until the time you turn 70 of how a couple can take Social Security. You need to look at all those different iterations. Let’s say that you claim it as soon as you retire versus the best claiming strategy.We can still go in and say, what happens if Social Security is reduced in 2033? Well, which one of those decisions was the best decision if it was reduced in 2033?” – Dean Barber

Social Security Isn’t Going to Run Out

While there are fears about Social Security running out, those fears are a bit misguided. It’s the Old Age and Survivors Insurance (OASI) Trust Fund that is projected to be depleted by 2033, not Social Security. Even if the OASI Trust Fund does run out, retirees will still receive about three quarters of their benefits.

Social Security won’t run out because the benefit is funded by the OASI Trust Fund AND payroll taxes of present day workers. People aren’t going to stop working or paying taxes, so Social Security benefits aren’t going to completely disappear. But determining how to maximize you and your spouse’s benefit will become that much more important.

Peak 65’s Impact on Medicare

Along with 65 being the traditional retirement age, 65 is when you become eligible for Medicare. It’s not exactly a secret that health care costs are becoming more and more expensive. The heightened inflation we’ve experienced has obviously exacerbated that. We’ll touch more on inflation momentarily.

Deciding whether to wait until 65 to retire is one of the biggest retirement planning tradeoffs because of Medicare. Medicare tends to be much less expensive than health insurance alternatives prior to turning 65. But if your financial plan shows you that you can afford the costs of those higher alternatives, why are you waiting until 65 to retire?

Dean and Logan always stress that time is everyone’s most valuable commodity. We hope that you and your loved ones live long, happy, and healthy lives, but that’s not guaranteed. Is the time you spend working worth the memories that you’re potentially missing out on with your loved ones? That’s a key question to keep in mind during the retirement planning process.

“You need to understand why you’re still working. A good financial planner’s job is to quantify that for you.” – Logan DeGraeve, CFP®, AIF®

Inflation Is Slowing, But Still Top of Mind

At 97%, the impact of inflation on retirement portfolios was the No. 1 concern of those surveyed in the RetireOne and Allianz study. While the rate of inflation continues to slow, people have still been feeling the pain of high prices at places like the grocery store (or paying for the rising health care costs that we just mentioned).

According to the Peterson-KFF Health System Tracker, health care costs and services have inflated at 114.3% since 2000 while the costs of consumer goods and services inflated by 80.8%. It’s important to remember that while we can’t control inflation, we can plan for it.

Planning for Inflation

It’s always nice to see when someone has done a good job saving for retirement, but one common issue we see when meeting with people for the first time is not planning for inflation. Let’s say that someone retired in 1999 without factoring in inflation into their financial plan. They obviously wouldn’t have been prepared for the substantial increase in prices we’ve seen since 2000.

When we’re building out someone’s financial plan, we use around a 4% inflation factor for goods, services, and other everyday expenses. However, we use around a 6.5% inflation factor for health care costs. The statistics from the Peterson-KFF Health System Tracker highlight why we do that. Outside of the Great Recession and a few months in 2005 and 2006, the annual inflation rate was lower than 4% from 2000 through 2020.

We always stress test financial plans to make sure that they can survive events like the Great Recession and Dot-Com Bubble. While those events weren’t exactly like what we’ve experienced over the past few years, planning for those instances can help you be prepared for other times of high inflation, down markets, etc.

“Inflation in retirement is a little different than during your working years. When you think about retirement expenses, you need to understand that the things you spend money on in retirement will be different than what you spent money on in your working years because hopefully you’re saving some money, traveling, and doing things.” – Dean Barber

It’s Not What Goes in; It’s What Comes Out

Planning for inflation is a crucial wealth protection tactic. But that’s far from the only planning that people need to be doing amid Peak 65. Another vital wealth protection tactic is building a forward-looking tax plan.

Roth vs. Traditional

We mentioned earlier how Social Security is tax-free by itself, but that changes when you factor in other income sources. Taxes on retirement income can catch a lot of people off guard. Oftentimes, a newly-retired person’s largest asset will be their 401(k). It’s important to understand that if you have $1 million in your 401(k) (just as an example), you don’t actually have $1 million. That’s because with traditional 401(k)s and IRAs, those accounts are tax-deferred. You don’t have to pay tax on the contribution, but you will be taxed when you’re taking the money out.

Roth 401(k)s and IRAs, on the other hand, are tax-free accounts. You’re required to pay tax when you’re contributing to a Roth 401(k) or converting a traditional IRA to a Roth IRA, but the funds and earnings will grow tax-free following the contribution/conversion.

While 2024 will be known for Peak 65, 2026 is another big year when it comes to retirement planning. That’s because on December 31, 2025, the Tax Cuts and Jobs Act will sunset. In turn, tax rates will revert to the higher rates of 2017. It should always be top of mind to pay as little tax as possible over your lifetime, which makes 2024 and 2025 crucial for tax planning.

“That’s a cost that you need to take into account. And what’s going to happen to my taxes when my Required Minimum Distributions start at 73 or potentially 75?” – Logan DeGraeve, CFP®, AIF®

Paying more in taxes now by contributing or converting to Roth might not seem ideal at the moment but think about the end result. That money will be tax-free when you take it out. If you’re planning to take that money out after 2025, you have an opportunity to do Roth conversions at a discount until 2026.

Knowing the Rules of Your Income Sources

So, think about the income sources you’ll have in retirement. Do you also have a pension or maybe have rental income in addition to your investments, Social Security, and retirement accounts? It might seem obvious, but it’s crucial to understand the tax ramifications and other rules of what happens when you take money out of the accounts you own.

We should also clarify that an investment portfolio and a financial plan aren’t one in the same. There are so many other questions you need to be thinking about pertaining to Peak 65 and retirement planning before your investments. Your investments are simply the engine that make your plan run.

Your plan will be far from complete, though, if you don’t also have a forward-looking tax plan, an up-to-date estate plan, current insurance coverages to mitigate potential risk in retirement, and a well-thought-out distribution strategy. And let’s not forget about your goals for retirement. We’ll talk more about them momentarily.

Impact of Geopolitically Instability

When we discussed inflation earlier, that was just one example of things that are out of our control that can still be planned for. Geopolitical instability is another example of that. No, we don’t have a crystal ball to predict what will happen from here in the Russia-Ukraine or Israel-Hamas wars. And we obviously can’t predict geopolitical turmoil that will surface 10-20 years from now that could impact your rate of return in retirement.

Unfortunately, we can count on some forms of geopolitical turmoil occurring during your retirement. This is another instance of where stress testing comes in. When we look at past geopolitical events that have led to economic downturns, could your current plan survive those situations? If not, what changes need to be made to enhance your plan’s probability of success?

How Do You Know How Much You’ll Need for Retirement?

We’ve witnessed countless people who have been fixated on needing to save $X-amount for retirement before they’ve built a financial plan. There’s the problem with that, though. How do you know how much you need for retirement if you haven’t outlined your retirement goals?

The amount your friend needs to save for retirement and the amount you need to save for retirement likely won’t be the same. Even if you have similar retirement goals, they won’t be exactly the same. And the way you’ve saved won’t be exactly the same. That will help dictate how much you can spend and where you’ll be spending from in retirement. Once you’ve outlined your goals and expected expenses in retirement, determine how much they’ll cost and what resources you have to pay for them. Creating a spending plan for retirement is critical so that you can have confidence that you’re doing the right things with your money.

When we build someone’s plan, we assume that the spending is going to continue at the same rate and it’s going to inflate at 4%. That’s a conservative way to do it. We can build this into the plan is that your spending is going to be greater in your early years of retirement. Then, you’ll have a plateau where the spending is going to level out and eventually decline because you don’t have the health or the energy to go and do the things that you wanted to do. Finally, you’ll have the health care phase where spending accelerates again.

“A lot of times what we want to do is to frontload the spending for someone’s retirement. If someone is 65 now in 2024, let’s plan for 15 years of spending more, knowing that you won’t feel like doing as much by the time you’re 80.” – Dean Barber

How Do You Know How Long You’ll Live?

Whether you’re turning 65 in 2024 and are in the thick of Peak 65, you’ve already turned 65, or have a few years until turning 65, we hope you’ll live well past 65. However, if that becomes a reality, will you have enough money to get through retirement? Getting to retirement is just part of the equation. As you’re building a financial plan, you need to focus on how to get through retirement.

The question then becomes, “how long of a retirement should I plan for if I don’t know when I’ll die?” Well, we don’t have an answer for that. No one does. We like to take a conservative approach because we don’t want anyone to run out of money in retirement. So, we typically plan for about a 30-year retirement, but it depends on your specific circumstances.

Do You Want to Leave a Legacy?

The goal for many retirees isn’t just to get themselves and their spouses to and through retirement. Oftentimes, retirees will want to help their children and/or grandchildren get a start on saving for retirement. After all, the concerns addressed in RetireOne and Allianz’s survey are on the minds of younger generations as well.

Having a current estate plan is crucial so that you and your beneficiaries will be on the same page about your final wishes and how you want your assets to be passed on. That’s a key component to building generational wealth.

Do You Have Any Questions About Peak 65?

If you’re turning 65 in 2024 or have already turned 65 and still have concerns about Peak 65 and retirement planning in general, let us know. It’s not too late to build a financial plan that can give you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

The same goes for anyone who hasn’t turned 65 yet. All these retirement planning concerns surrounding Peak 65 can be and should be planned for. If you have any questions about Peak 65 and how to go about planning for your retirement, start a conversation with our team below.

Starting early with retirement planning is so important. Even if you’re well into retirement, it’s pivotal to regularly review your financial plan to ensure that it’s allowing you to achieve your goals while taking on the least amount of potential risk. And make sure to forward this article along to your siblings, children, and other family members. Peak 65 doesn’t just pertain to people turning 65 in 2024. It impacts everyone, and we want to make sure that you have a personalized financial plan that gets you to and through retirement.

Peak 65: Nearly 4.4 Million Americans Projected to Turn 65 in 2024 | Watch Guide

00:00 – Introduction

00:32 – What Is Peak 65 and What’s It Mean for Retirees?

05:00 – Inflation is the Biggest Concern for Retirees According to Study

08:38 – Social Security Concerns and the Workforce

13:27 – Stress Testing Your Financial Plan

16:33 – Creating a Spending Pattern

19:21 – Rebalancing Your Portfolio

20:53 – What We Learned Today

Articles

- Financial Stress: How Do You Deal with It?

- Components of a Complete Financial Plan with Logan DeGraeve

- How to Build Generational Wealth

- Maximize Social Security Benefits

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Claiming Your Social Security

- Rising Long-Term Care Costs

- How to Mitigate Inflation on Health Care Costs

- Health Insurance Options for Retirees Under 65

- Starting the Retirement Planning Process

- 10 Ways to Fight Inflation in Retirement

- The Great Recession’s History Remains Relevant

- Dot-Com Bubble History Remains Relevant

- Taxes on Retirement Income

- Retiring with $1 Million

- What to Do with Your 401(k) After Retirement

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Retirement Planning 101: Back to the Basics with Chris Rett, CFP®, AIF®

- What Is a Monte Carlo Simulation?

- How Much Do I Need to Retire?

- Setting Up a Spending Plan for Retirement

- Family Financial Planning with Matt Kasper

- RMD Questions: What Are Required Minimum Distributions?

Past Shows

- Reviewing Your Retirement Checklist

- Don’t Retire without Doing These Things First

- Your Retirement Timeline

- Retiring Before 62: What You Need to Consider

- Couples Retirement Planning: What You Need to Know

- Retiring Before 65: What You Need to Consider

- Why When You Retire Matters

- 4 Retirement Risks That Are Out of Your Control

- Is Inflation Slowing?

- Stress Testing Your Financial Plan

- 7 Wealth Protection Tactics

- What Is Tax Planning?

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

- 5 Long-Term Strategies for a Better Retirement

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

- 5 Factors More Important Than Rate of Return

- 5 Estate Planning Documents That Everyone Needs

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- Retirement Savings by Age

- Longevity Risk in Retirement and How to Plan for It?

- How to Spend When You First Retire

- RMD Age for 2023: What’s My Required Beginning Date?

Downloads

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.