Is Inflation Slowing?

Key Points – Is Inflation Slowing

- Inflation Rose Just 0.1% in March, so It Is Slowing

- When We Will Actually Feel the Impact of the Larger Rate Hikes?

- You Can Plan for Inflation

- Inflation Won’t Make You Go Broke, But It Will Make You Live Like You’re Broke

- 10 Minutes to Read | 23 Minutes to Listen

What’s Next with Inflation … Is Inflation Really Slowing?

For more than a year now, inflation has been wreaking havoc across the United States. Prices have been rising on pretty much everything, as it’s affected all areas of the economy. The Fed began to raise interest rates in March 2022, which many people believe was a delayed response. Many people have questioned how rising inflation will impact their ability to retire, and understandably so.

Last week, the U.S. Bureau of Labor Statistics reported that, “The Consumer Price Index for all Urban Consumers (CPI-U) rose 0.1% in March on a seasonally-adjusted basis, after increasing 0.4% in February.” And over the past year, the all-items index went up 5% prior to seasonal adjustment. The fact that inflation is slowing is welcomed news, but we’re still feeling the pain of inflation. Just look at the prices at the grocery store. Dean Barber and Bud Kasper share their thoughts on what’s going on with inflation and how you can plan for it.

How Do You Plan for Inflation?

It’s been 40-plus years since we’ve seen inflation at the levels that it’s been at over the past year. Even though inflation was extremely low for several years until this inflationary period, we were planning for the chance that what happened in the late 1970s/early 1980s could happen again. We knew that inflation could be the insidious killer of someone’s retirement.

Assessing the Fed’s Efforts to Kill Inflation

But before we talk about how to properly build inflation into your plan, there’s a question we need to ask. Do you think that the Fed has done enough to stop inflation? Here’s what Bud thinks.

“They’re doing what they think they need to do to tame inflation. But I think they blew it in terms of the timing of when this all started.” – Bud Kasper

March 16, 2022 marked the first increase of the Fed funds rate in this series of rate hikes. It was a 0.25% increase, but they got bigger in a hurry. Jerome Powell said inflation was going to be transitory, but they followed with a 0.5% increase on May 4.

“When that happened, suddenly the light came on that the Fed was behind. After that, we saw four consecutive 0.75% moves and another 0.5% hike right before the new year. Now, we’re just treading water after 0.25% hikes in February and March. I think we’re near the end of the rate hikes. If they do many more, it’s going to be damaging to the economy.” – Bud Kasper

We Likely Haven’t Started Feeling the Impact of the Big Rate Hikes

If Powell announces that they’re going to stop raising rates, does that mean that inflation will suddenly go away? The answer is no. Dean believes that the biggest problem that we have in front of us is that it takes between nine and 15 months before any rate hike makes its way into the economy. So, we’re just now seeing the effects of those first couple of interest rate hikes.

“The question is whether Powell went too far? I think Bud and I agree that he didn’t start soon enough. But did he go too far?” – Dean Barber

What Does Slowing Inflation Actually Mean?

Time will tell on that, but as we mentioned, inflation is slowing. But again, it’s important to remember that that doesn’t mean that prices are going to immediately start coming down. It means that the rate of increase for inflation has started slowing. Dean believes that inflation is coming down, but doesn’t think we’re going to get back down to the Fed’s 2-3% target rate by the end of 2023. And Bud doesn’t think that we’ll get there at all.

“Two percent is an ambitious number. I’ve lived most of my life with a 3-3.5% inflation factor with no real concerns. Now, it becomes more extreme. All the other factors going on in the world make it that much more complicated to work through this. But we will with time.” – Bud Kasper

The Pain of High Prices

The key words from Bud there being, “with time.” Keep in mind that summer is just around the corner. Gas prices are going to go up. Some people will think that inflation is going up, but it’s really just more people being in demand of gas to go wherever they’re going. And if you’re thinking gas prices in the Midwest are ridiculous and likely about to go up in the coming months, it could be worse.

“In the Midwest, I think we take for granted that gas prices are at a ‘reasonable’ level. I was in Sammamish, Washington, last weekend visiting my daughter. When we filled up the rental car to go back to the airport, it was like $80-plus for 17 gallons. I wasn’t paying attention to the price at first since I knew I had to fill the car up before taking it back to the rental place. It was $5 a gallon for regular unleaded.” – Dean Barber

When you look at core CPI, prices of food, rent, etc. have also been going up. So, people have still been feeling the pain of high prices. But will people feel pinched in their wallets enough to stop spending, which would be bad news for the economy. While Bud hopes it isn’t the case, he believes that more people will start feeling that way. The question is, how bad will it get?

The Fed’s Tightrope Walk Seems Never-Ending

Dean and Bud have talked a lot about the Fed’s tight rope walk of trying to kill inflation without causing a recession. The Fed is dealing with three big issues—banking failures, inflation, and the economy.

To bring inflation down, the Fed has needed to rapidly raise rates, which has hurt some of these smaller banks. Their desire is to kill jobs because they know that the best way to kill inflation is to increase unemployment. 70 percent of our Gross Domestic Product is consumer spending. Destroying jobs and slowing consumer spending will naturally bring down inflationary pressures.

“In the fourth quarter of 2022 and early in the first quarter of 2023, we weren’t seeing that. Jobs were still coming in at higher numbers. Now, you’re starting to see a reversal. Tech has been laying people off big time. Banks are starting to lay people off. Bonuses were substantially down on Wall Street. The impact is coming through. People are becoming more constrained with some of their spending because this is kind of a survival period for a lot of companies. Unfortunately, some of the smaller companies won’t because there’s too much pressure on them to make a profit.” – Bud Kasper

Is the Fed Done with Rate Hikes?

That raises another question. Let’s say that the Fed goes with another 0.25% at their next meeting. Then, maybe we’ll see some clear signs of a slowing economy and perhaps enter a recession during the second half of the year. Will that cause the Fed to pivot and immediately lower rates? Or will the Fed leave interest rates high for a prolonged period to ensure that inflation has been squashed?

“I think that after we see some stabilization that they’ll starting lower rates again. They want to restimulate the economy. But let’s calm the waters and get this more under control. We can’t afford for that to take place for a very long period because it doesn’t stimulate what we need to have in the economy to get the growth back on track.” – Bud Kasper

How Can You Fight Inflation?

Now that we’ve talked about how the Fed plans to fight inflation, let’s talk more about how you can fight inflation. Step one is that inflation needs to be factored into your plan. When we build someone’s plan, we always factor in what the current inflation rate is and can increase that if necessary to understand what the net benefit will be for the client in terms of the amount of income that the plan is supporting.

It’s rare but we sometimes do meet with people for the first time that already have a financial plan. But when we take a deep dive into the plans that those people have, one of the biggest shock factors that we have is the low inflation number that has been put on their plan. They’d be using a 2-2.5% inflation number.

“We would take that same plan and apply a 3.5-4% inflation number. The outcome is traumatically different. If you don’t understand what I’m talking about, you need to build a comprehensive plan first. The plan is going to be your future spending and the resources you have to pay for it. If you stress test that plan by applying a higher inflation rate, it drastically changes the outcome.” – Dean Barber

Hopefully, you’ve realized how having a 2-2.5% inflation rate could derail your plan after going what we’ve been through with the high inflationary period over the past year or so. But there’s more to it than just applying that 3.5-4% inflation number to your plan.

Different Things Inflate at Different Rates

There’s another problem related to inflation that we oftentimes see in people’s plans when we’re meeting with them for the first time. They’ll apply one inflation rate across their whole plan, but different things inflate at different rates. Health care is what really exploits that issue because it inflates at a much faster rate than other expenses. We’ll apply a 6.5% inflation rate to health care.

On the opposite end of the inflation rate spectrum, there’s mortgages. Oftentimes, people will go into retirement and still have a mortgage. Maybe they have 10-15 years left on it. Well, we know there’s one thing that doesn’t inflate, and that’s your mortgage payment. You can inflate the taxes and insurance, but the base mortgage payment of principal and interest is going to stay the same and have a finite ending point.

So, when someone says they want to spend $8,000 a month in retirement, what is that $8,000 going toward? You need to build all those things such as health care, your mortgage, travel, necessary goods and services, etc. into your plan and understand what inflation rate to apply to them.

A Few More Points on Health Care

Let’s talk about health care costs a little bit more before moving on. A lot of people automatically wait until at least 65 to retire because that’s when they can get on Medicare. While the health insurance options for retirees who are 65 or younger can be pricey, you don’t know if you can’t afford it until running it through your plan.

Another thing that people need to be aware of is the IRMAA tax on Medicare. There was someone who Dean recently talked to who had been told to do Roth conversions. Roth conversions can be a very beneficial tax planning strategy, but you need to be methodical about them.

“He had picked an amount that just felt like a comfortable number and hadn’t discussed their IRMAA situation with a financial professional. This person was only 63 and had no idea what Roth conversions would do to their Medicare premiums. That doesn’t really have anything to do with inflation, but it has to do with how the plan should be built.” – Dean Barber

If you’re looking to build a financial plan and are struggling to get started, we encourage you to review our Retirement Plan Checklist. It consists of 30 yes-or-no questions that gauge your retirement readiness and has age-and date-based timelines of things that could impact your retirement. Download your copy below!

Download: Retirement Plan Checklist

The Application of Inflation to Your Financial Plan

While inflation might be slowing, it’s important to understand how to apply inflation to your plan and how you’re impacted by it. Working with a CFP® Professional is critical to understanding how it all comes together within your plan.

Analyzing Trade-Off Scenarios in Retirement

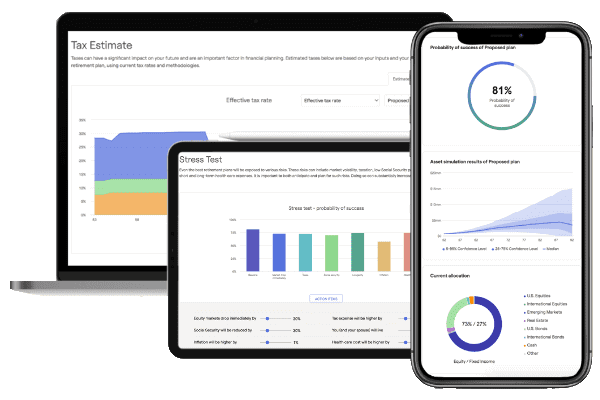

For example, one of Bud’s clients has been preparing to retire and was getting close to his desired retirement date. He and his wife recently met with Bud to review their probability of success and how their plan was holding up against inflation. They also wanted to build a pool in their back yard that would cost them around $150,000.

Bud ran the numbers to see how that pool would impact their probability of success, and it fell by nearly 10%. They weren’t very comfortable with that. While Bud wishes it would’ve worked to implement the pool into the plan without issue, he was proud of them for realizing the clarity that their plan was giving them.

The Clarity That Comes from a Financial Plan

And that didn’t mean that they couldn’t go ahead with building the pool. After getting that clarity, they understood what adjustments they would need to make to their plan to build the pool. In this case, the husband liked his job and decided that he would delay retirement by another year and a half. He was going to get more money in his 401(k) to get to the point that they would be comfortable.

“This is an example of a trade-off. They wanted the pool. But to get the pool, he had to work for another year and a half. Now, when would a person want to know that? Before or after the retire? It’s before. That’s what your plan can do. It can provide that clarity.” – Dean Barber

Oftentimes, there are trade-offs. And in many cases, you won’t need to make a trade-off and you’ll see that you can make a big purchase without negatively impacting your probability of success. But the only way to know for sure is by having a financial plan.

What Does Your Spending Look Like?

While that gentleman was still working, let’s discuss how the situation might have transpired if he was already retired amid these inflationary pressures. It’s crucial to realize that inflation won’t cause you to go broke, but it will make you live like you’re broke. During these inflationary times, the first thing we’re doing with clients when reviewing their plans is reviewing their spending.

Let’s use Dean’s example from earlier and having $8,000 a month for retirement. If you were spending $8,000 a month at the beginning of last year, how much do you need per month this year to cover your needs, wants, and wishes? It’s going to be more than $8,000 because of inflation.

“If they say they’re spending $8,000 still, my first question will be, ‘What are you sacrificing?’ There’s no way they’re doing and buying as much with $8,000 as they were 12-18 months ago. They need to talk to your CFP® Professional about the things that have become much more expensive. If they were spending $8,000 a month and now are spending $8,500 a month to do the same things, they need to build that into the plan. How does that $8,500 impact them?” – Dean Barber

Whether inflation is prevalent like it has been lately or not, you need to review your spending every year. You need to understand the impact of what you’re spending. And don’t just live like you’re broke because you think you can’t afford something. Build it into your plan.

The Big Takeaway About Inflation Slowing

The bottom line is that we can say inflation is slowing, but we don’t know if it’s going to lead to a recession. Many people believe that it is, but the most important thing you can do is to build a financial plan that has inflation properly applied to it. Then, stress test for a bear market during your retirement.

Knowing where to get starting with building your plan can be the hardest part. As we mentioned earlier, our Retirement Plan Checklist is a great tool to get you started. We’re also making our industry-leading financial planning tool available for you to use at no cost or obligation. It will allow you to build a plan that’s unique to you from the comfort of your own home. You can begin building your plan today by clicking the “Start Planning” button below.

We also can’t stress enough how important it is to get a conversation started with a CFP® Professional. A good CFP® Professional can build your plan help you better understand how inflation needs to be factored into it. You can schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone—it’s whatever works best for you.

Is Inflation Slowing? | Watch Guide

Introduction: 00:00

Has the Fed Done a Good Job?: 01:32

We’re Seeing Inflation Slow: 04:19

Building Inflationary Periods in Your Plan: 09:45

Your Plan Should Show You Options: 14:34

Conclusion: 22:35

Resources Mentioned in this Episode

Articles, Podcasts, Webinars, and Other Videos

- Inflation Expectations for 2023

- The Federal Reserve’s Monetary Policies

- A Historic Half-Point Hike of the Fed Funds Rate

- Retiring During a Recession

- A Banking Crisis Amid the Fed’s Fight Against Inflation

- How to Mitigate Inflation on Health Care Costs

- Mortgage Tips for Different Phases of Life with Tim Kay

- What Is a Monte Carlo Simulation?

- Setting Up a Spending Plan for Retirement

- ABCs of Medicare

- Medicare Changes in 2023 with Taylor Garner

- Navigating Health Care Costs in Retirement with Taylor Garner

- 6 Reasons Roth Conversions Could Work for You

- Tax Planning Strategies with Marty James

- When Will the Bear Market Be Over?

Other America’s Wealth Management Show Episodes

- 10 Ways to Fight Inflation in Retirement

- The Impact of Rising Interest Rates

- More Interest Rate Hikes on the Way?

- Recession Fears Remain High for the Holidays

- The Effect of Rising Interest Rates on the Economy

- 5 Types of Financial Plans

- Retirement Age: It’s Just a Number

- Stress Testing Your Financial Plan

Downloads

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.