Reasons People Run Out of Retirement Money

Key Points – Reasons People Run Out of Retirement Money

- Health Care and Taxes: The Two Biggest Wealth-Eroding Factors in Retirement

- Planning for the Unexpected and Things That Are Out of Your Control

- Avoiding Poor Financial Planning Habits

- 10 Minutes to Read | 24 Minutes to Watch

Scared to Death of Running Out of Money in Retirement?

We’ve seen our fair share of mind-blowing statistics in retirement planning surveys over the years. Our jaws nearly hit the floor, though, when seeing a statistic in recent study from Allianz Life. Their survey found that 61% of Americans are more afraid of running out of money than they are of death.

Think about that for a minute. That’s insane. That’s why we can’t stress enough that everyone needs a comprehensive financial plan that gives you confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

Schedule a Meeting Get the Retirement Plan Checklist

Longevity Risk Is Very Real

So, why do most people run out of money in retirement? We compiled a list of seven main reasons that we have seen that have caused people to run out of money in retirement.

- Health Care

- Taxes

- Divorce

- Things Out of Your Control

- Retiring Too Soon

- Spending Too Much

- Poor Financial Planning

If you’re not accounting for the possibility of those things within your plan, it’s easy to be overcome by the fear of running out of money in retirement. When Dean Barber and Bud Kasper, CFP® said a couple of months ago on America’s Wealth Management Show that longevity risk is a very real fear, they weren’t kidding.

That stat from the Allianz Life survey about people being worried about running out of money in retirement backs that up. Let’s review those seven reasons people run out of money in retirement and further explain why having a plan is critical.

Reasons People Run Out of Money in Retirement

1. Health Care

We’ve said time and time again that health care and taxes are oftentimes the two biggest wealth-eroding factors in retirement. We’ll get to taxes shortly, but health care tops our list of reasons for why people run out of money in retirement.

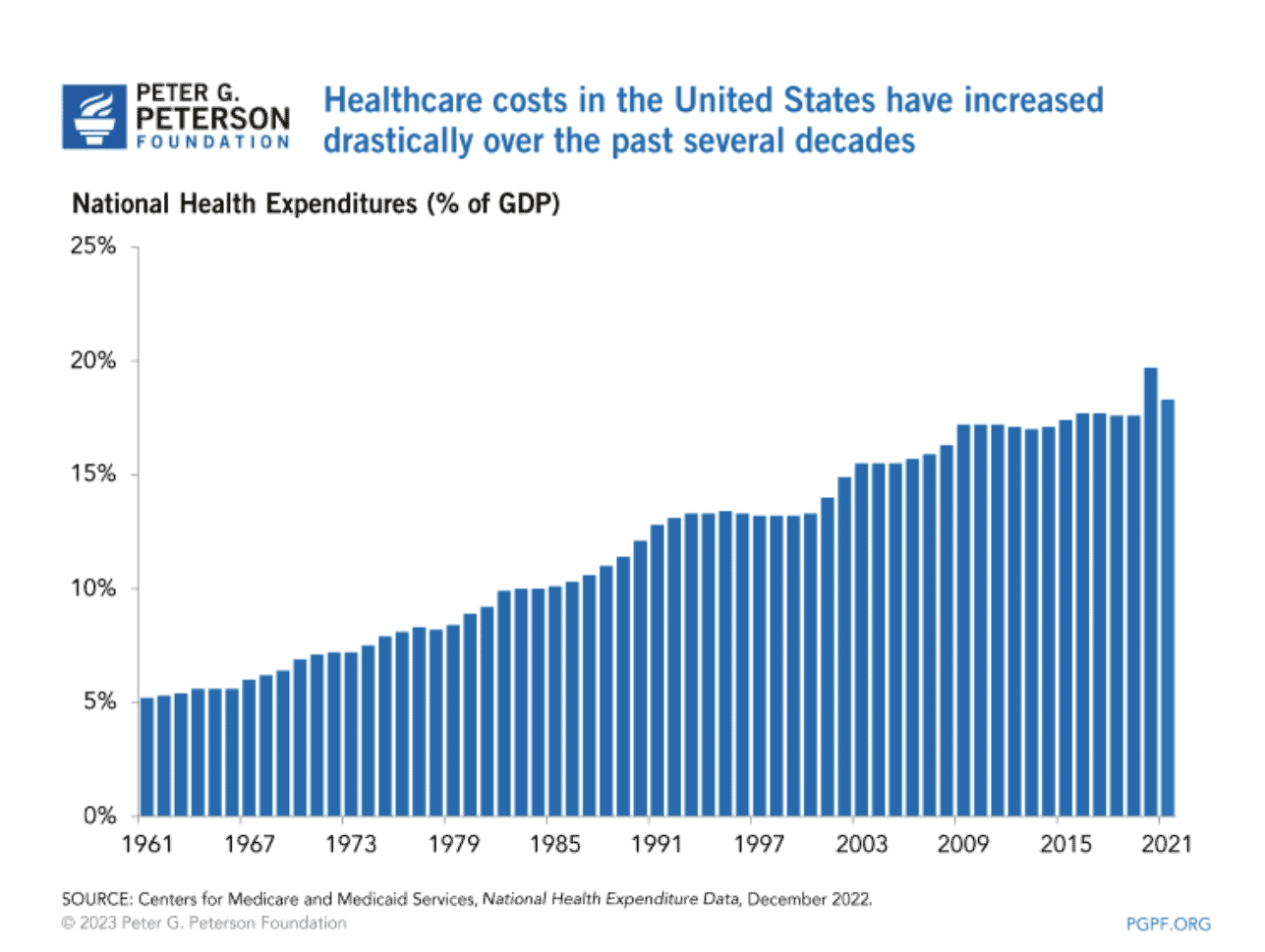

It’s so true when people say that your health is your wealth. Everyone knows that health care costs continue to get more and more expensive. According to the Peter G. Peterson Foundation, U.S. health care spending reached $4.3 trillion in 2021. That’s also insane. That’s nearly $13,000 per person and is about twice as much compared to other wealthy countries.

FIGURE 1 – Health Care Costs in the United States – Peter G. Peterson Foundation

Here’s another wild stat. Fidelity Investments projected that a 65-year-old couple that retired last year would need $315,000 just for health care costs in retirement. There has been a slew of reasons for why health care is costing so much more in the U.S. The cost of new health care technology (while it can be worthwhile) isn’t cheap. When hospitals consolidate, there can be increase in prices due low competition between remaining hospitals.

“This rapid rise in health care costs is why we inflate health care at 6.5% per year when we’re planning. We separate it from the rest of the expenses when factoring in inflation into someone’s plan.” – Dean Barber

Looking at the Future of Medicare Spending

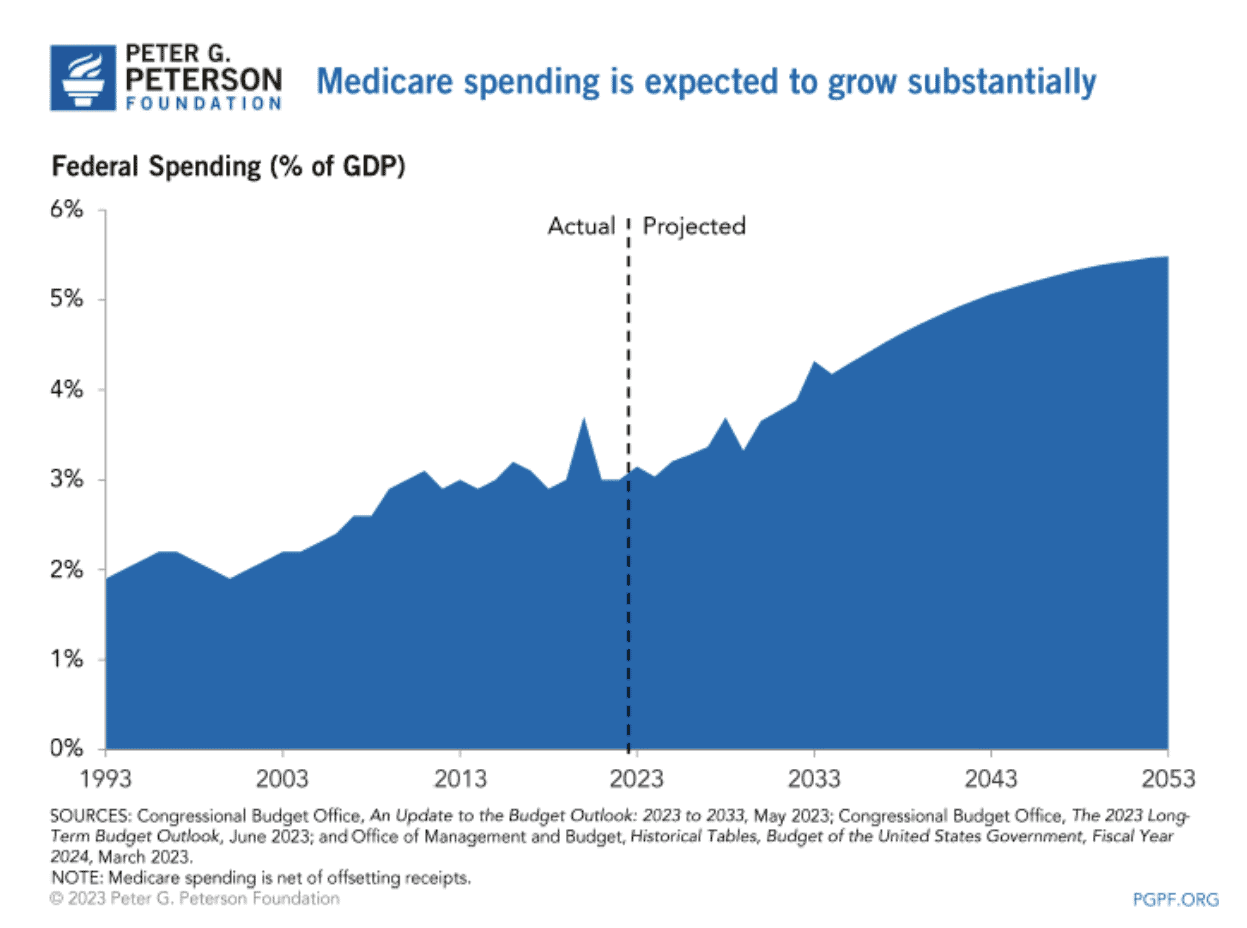

The cost of Medicare is also expected to rise substantially since people are living longer and more and more people are enrolling for it. The Congressional Budget Office anticipates that Medicare spending will almost be twice as much as it is now in 30 years. It’s currently 3.1% of GDP and is expected to increase to 5.5% by 2053.

FIGURE 2 – Medicare Spending – Peter G. Peterson Foundation

Speaking of Medicare, though, don’t forget that the Medicare Open Enrollment Period runs from October 15 through December 7. Now is the time to make any changes to ensure that your health care coverage needs are met.

Long-Term Care Costs

Before we move on to taxes, we want to focus specifically on why it’s crucial to have a long-term care plan. It’s another reason that people run out of money in retirement. The Department of Health and Human Services states that more than 50% of people turning 65 in 2023 will require long-term care at some point. Taking that one step further, about one in seven of those people are expected to require long-term care for five-plus years. Long-term care insurance and life insurance can be useful tools in mitigating the risk of running out money in retirement The bottom line is that your health truly is your wealth.

2. Taxes

Now, let’s shift gears to taxes. It’s quite common for people to save to their traditional 401(k) plan for retirement. And we want to give kudos to those people simply for being disciplined and saving for retirement. However, it’s crucial to realize that your traditional 401(k) is tax-deferred, meaning that it will grow tax-free, but it will be taxed when you take the money out in retirement. So, if you have $1 million saved in a traditional 401(k), you don’t actually have $1 million.

Having good tax diversification is important when it comes to making sure you don’t run out of money in retirement. That means having money in a tax-deferred bucket (your traditional 401(K)s/IRAs), tax-free bucket (Roth 401(k)s/IRAs), and taxable (savings/brokerage accounts).

“You have more control over your taxes during retirement than at any other time in your life because you get to control what bucket of money you’re going to spend from now.” – Dean Barber

Utilizing Forward-Looking Tax Planning to Avoid Running Out of Money in Retirement

When you’re looking at taxes in retirement, it’s critical to look at your current tax rates vs. future tax rates. It’s imperative to have that forward-looking thought process to pay as little as possible in taxes over your lifetime. That’s the goal of tax planning.

Knowing that that’s the goal, we need to be aware that tax rates are set to go up on January 1, 2026. That’s because the Tax Cuts and Jobs Act is scheduled to sunset on December 31, 2025. So, if you have most of your retirement income in a traditional 401(k) and you plan to take distributions after 2025, keep in mind that it will be taxed at an even higher rate. That’s a big reason why we’ve been doing so many Roth conversions lately. By doing a Roth conversion now, you can pay the tax on the conversion at today’s lower rates.

“The Roth IRA is a tax bucket. You put money into it after you’ve already paid taxes on that money. But when it grows and you take money out later, it’s all tax-free—not only for you but for your heirs. The Roth IRA is the best tax code ever written.” – Dean Barber

Understanding What Tax Planning Strategies Are Available to You

That being said, there can be unintended consequences to doing Roth conversions. If you’re charitably inclined and are 70½ or older, it can make sense to leave money in traditional to do Qualified Charitable Distributions. Roth conversions can also throw you into a higher Medicare bracket. So, make sure you’re consulting a tax professional as you’re considering Roth conversions or other tax planning strategies. Also, don’t forget to download our Tax Reduction Strategies guide to see what tax planning strategies can enhance your plan’s probability of success.

“These are all strategies that apply when you’re working with the CFP® Professional in coordination with the CPA to get that net result.” – Bud Kasper, CFP®

3. Divorce or Early Death of a Spouse

Health care and taxes are the clear-cut top two reasons that people run out of money in retirement. However, events like divorce or the early/unexpected death of a spouse can blindside people in retirement from an emotional and financial perspective.

Obviously, we don’t wish divorce or the early death of a spouse upon anyone. But a huge, but complicated component to financial planning is planning for the unexpected. How would losing half of your retirement savings impact your probability to retire success if you got divorced prior to retirement? A prenuptial agreement can alleviate the financial pain of divorce and counseling could hopefully prevent divorce altogether. Regardless, the possibility of divorce is something that needs to be considered in the financial planning process even if it isn’t fun to think about.

With a death of a spouse, keep in mind that the surviving spouse only retains the higher of a couple’s Social Security benefits. This serves as a reminder that you can’t just think about yourself when claiming Social Security. So, rather than claiming your benefit right away when first eligible at 62, it oftentimes makes more sense to delay claiming so you get a bigger benefit. That way if you or your spouse does suddenly pass away, the surviving spouse will have a bigger benefit.

Also, the surviving spouse becomes a single tax filer and therefore will likely move into a higher tax bracket. You can probably see now that the reasons on our list of why people run out of money can overlap quite a bit.

4. Things Out of Your Control

Taxes and your health are also examples of things that you have some control over in retirement. Investments are an obvious example of something you can control in retirement as well. You get to choose what investments that you want in your portfolio to serve as the fuel of your overall financial plan.

However, there are things that are out of your control in retirement too. We’ll use inflation and bear markets as examples. Neither one is fun to experience as we know all too well from the past couple of years. Even though inflation and bear markets are out of our control, we can plan for them.

What happens if we have a lost decade? That means that we would go through a 10-year period with no growth in the market.

“If we went through the 1970s again, that would be ugly.” – Managing Director Ken Osiwala

Stress Testing Your Financial Plan

If your plan assumed market growth over the course of your retirement and it doesn’t perform to your expectations, how will you compensate for that? When we build someone’s financial plan, we stress test for the possibility of prolonged bear markets and high inflation.

Dean and Bud have both had people come to them over the years thinking that they already had a perfect financial plan. One immediate flaw that they’ve pointed out with a lot of those plans, though, is not factoring the possibility of a bear market or higher inflation.

The past couple of years have shown that only factoring in a 1% or 2% inflation factor across your plan won’t work. And keep in mind that things inflate at different rates. For example, you have your mortgage that won’t inflate at all. We’ve all seen how the prices at the grocery store have been inflating. Those health care costs we mentioned earlier are inflating at even higher rates. That’s why we typically use a 4% inflation factor for your everyday spending needs, but a 6.5% inflation factor for health care costs.

As Dean always says, inflation won’t cause you to go broke, but it’ll make you live like you’re broke. Make sure that you’re properly planning for inflation, bear markets, and other things that can be out of your control so that you won’t run the risk of running out of money in retirement.

“We stress test for those unforeseen events that could happen. It’s the same reason why if there’s something that goes wrong during a flight, the pilot goes through their checklist in case of an emergency. We want to address all those things before they happen so that we have a plan on how to address them and don’t react emotionally.” – Dean Barber

5. Retiring Too Soon

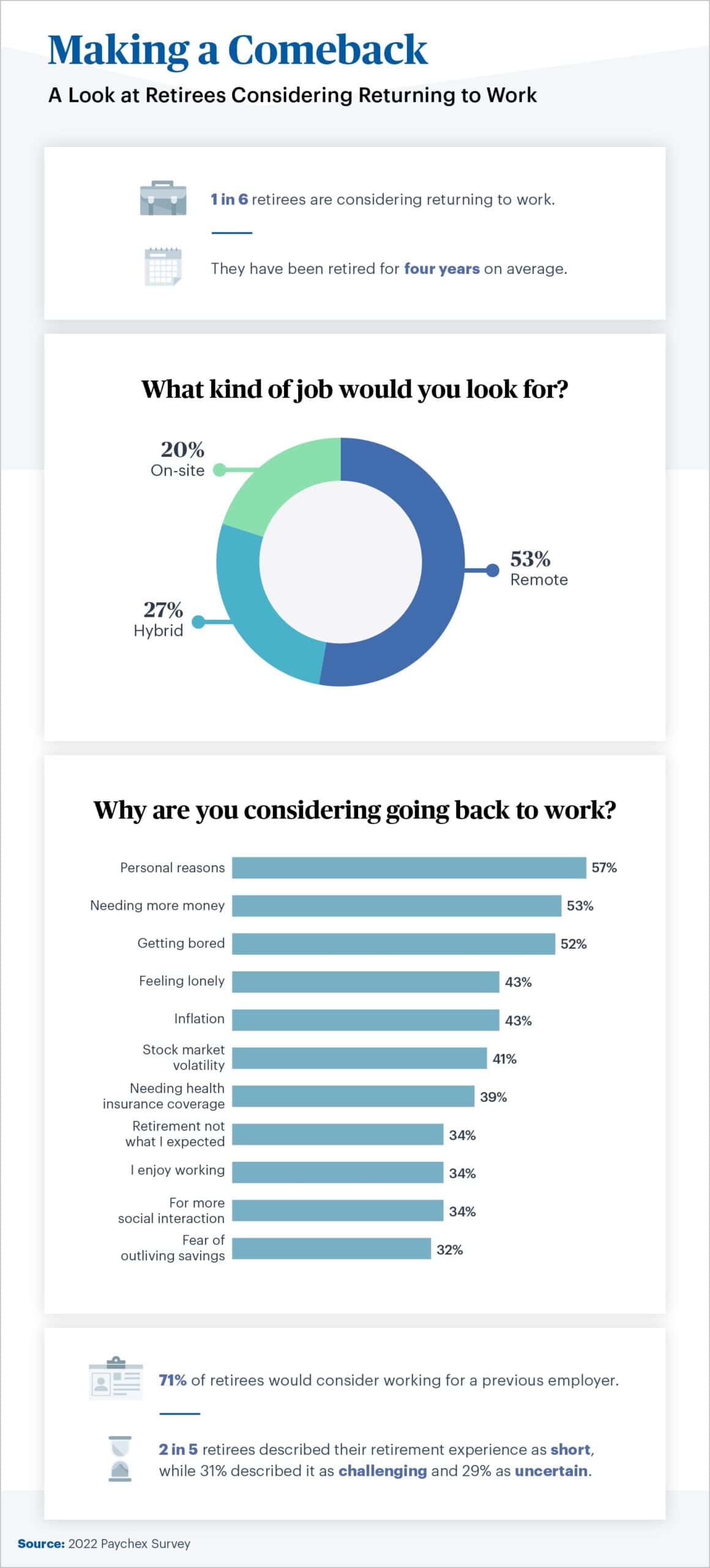

These next two reasons that people run out of money in retirement are obvious answers, but that doesn’t mean that we can just gloss over them. Just last week, Logan DeGraeve, CFP® and Chris Rett, CFP® reviewed a 2022 Paychex survey about the various reasons that retirees having been going back to work. We’ve already discussed some of those reasons on this list of reasons people run out of money in retirement.

FIGURE 3 – Making a Comeback – Paychex

On the flip side of this, we hear from people all the time that they don’t think they can retire until 65 (Medicare age) or full retirement age for Social Security. Well, the only way you can know how much you need to get too and through retirement is by having a fluid financial plan.

“Don’t retire too soon, but don’t work too long either. The financial plan will tell you the day that it’s OK to go ahead and retire because we stress test for all these unknown things.” – Dean Barber

We don’t want you to go back to work unless it’s something you truly want to do. It’s critical to start planning for retirement at least five to 10 years prior to retirement so that you don’t have financial stress of possibility retiring too soon and running out of money in retirement. We encourage you to review our Retirement Plan Checklist with your spouse to gauge your retirement readiness. It consists of 30 yes-or-no questions and an age-based timeline of crucial retirement considerations. Download your copy below!

6. Spending Too Much

Again, spending too much is another obvious reason that people run out of money in retirement. But why is that? Before we even start talking with people about their investments or specific financial planning techniques, we simply want to know what’s important to them. We need to know that to define their ideal retirement lifestyle.

Once we’ve figured out what’s important to you and your spouse, we want to build a plan that’s centered around your needs, wants, and wishes. How are you going to fund your retirement goals? You do that by creating a spending plan for retirement. This is a big part of what makes your overall plan personalized to you. It’s built around your specific needs, wants, and wishes, not your friend’s or neighbor’s. Make sure to be as specific as possible with your spending plan so you don’t have any doubts about spending too much and running out of money in retirement.

“Let’s say you want to take your family on a vacation, and it costs $20,000. However, that was much more than what you would normally spend. So, we stress test it into the portfolio to see whether it will reduce the success of your plan moving forward. At least you’re making an intelligent decision. You might say you can do it but would feel more comfortable only spending $15,000.” – Bud Kasper, CFP®

7. Poor Financial Planning

This all leads us to the premise of today’s post—poor financial planning can lead to running out of money sooner than needed. We want you to have a plan that considers these various retirement risks so that you can get to and through retirement with clarity and confidence. Starting the retirement planning process at least five to 10 years before retirement is key because of how many things there are to consider.

“The biggest mistake in financial planning that I see is people trying to oversimplify. They don’t take into consideration the 30 items on our Retirement Plan Checklist.”- Dean Barber

One way to avoid poor financial planning is by having a team of professionals that’s working for you. Two of the key players on a financial planning team should be a CFP® Professional and CPA that are working together. Your CFP® Professional will work with you to build out your goals-based plan, which will need to be reviewed from a tax perspective. That’s where the CPA comes in. Estate planning, risk management, and investment management are also key components as well. That’s why we have estate planning, insurance, and investment specialists on our financial planning team at Modern Wealth.

Having a Plan Is Key

So, let’s start planning. Whether you’re starting to plan for retirement or are worried about running out of money in retirement, a financial plan is pivotal. If you have questions about our financial planning process or some of the reasons that people run out of money in retirement, we want to hear from you. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals via our schedule below.

We can meet with you in person, virtually, or by phone—it’s whatever is easiest for you. We’re excited about the opportunity to build you a plan that gives you confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love.

Watch Guide | Reasons People Run Out of Retirement Money

00:00 – Introduction

01:24 – The Retirement Plan Checklist

03:12 – Big Issues with Terminology

05:43 – 1) Healthcare

08:59 – 2) Taxes

14:54 – 3) Divorce/Early Death of a Spouse

16:24 – 4) Things Out of Your Control

17:41 – 5) Retiring Too Soon

20:08 – 6) Spending Too Much

22:17 – 7) Poor Financial Planning

23:44 – What We Learned Today

Articles

- Components of a Complete Financial Plan with Logan DeGraeve

- ABCs of Medicare

- What Is Medicare Open Enrollment?

- Rising Long-Term Care Costs

- Taxes on Retirement Income

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Retiring with $1 Million

- What Is Tax Diversification?

- What Are the Tax Buckets?

- Tax Planning for Individuals: 5 Tips to Save

- Tax Rates Sunset in 2026 and Why That Matters

- Roth Conversion Decisions for 2023

- Tax Planning Strategies with Marty James

- What Is a Monte Carlo Simulation?

- Claiming Your Social Security

- Maximizing Social Security Benefits

- Proper Portfolio Construction with Stephen Tuckwood

- When Will the Bear Market Be Over?

- Lost Decade of the 1970s and Why It Still Matters

- Mortgage Tips for Different Phases in Life with Tim Kay

- The Guided Retirement System

- Setting Up a Spending Plan for Retirement

- Starting the Retirement Planning Process

- Why You Need a Financial Planning Team with Jason Gordo

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP® and Corey Hulstein, CPA

Past Shows

- Longevity Risk in Retirement and How to Plan for It

- What Is Wealth? 4 Types of Wealth

- How to Build Generational Wealth

- Life Insurance in Retirement: Do I Still Need It?

- Retirement Savings by Age

- What Is Tax Planning?

- Converting to a Roth IRA: What Are the Pros and Cons?

- How Does a Roth IRA Grow?

- Rules for Inherited IRA Distributions – What Are the Latest Changes?

- What Is Financial Planning?

- Retiring Before 62: What You Need to Consider

- 4 Retirement Risks That Are Out of Your Control

- 10 Ways to Fight Inflation in Retirement

- Stress Testing Your Financial Plan

- Retiring Before 65: What You Need to Consider

- Can I Retire Early? Becoming Financially Independent

- Couples Retirement Planning: What You Need to Know

- Don’t Retire Until Doing These Things First

- Meet Modern Wealth Management

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.