Tax Planning for Individuals: 5 Tips to Save

Key Points – Tax Planning for Individuals: 5 Tips to Save

- The Value of a Financial Plan for Tax Planning

- Saving Money in the Right Places

- Understanding Tax Brackets

- Outside Factors That Impact Taxes

- Tax Planning Opportunities for Individuals

- 8 Minutes to Read | 13 Minutes to Listen

What Does Tax Planning for Individuals Entail?

Tax planning is important. There’s no disputing that. After answering the question, “What is tax planning?” on America’s Wealth Management Show, our Director of Tax Corey Hulstein, CPA discusses tax planning for individuals and five tips for saving during our Modern Wealth Management Educational Series.

5 Tax Planning Tips for Individuals

1. Get a Proper Financial Plan Done with a CFP® Professional

Let’s jump right into Corey’s first tax planning tip for individuals. It’s the No. 1 financial planning tip as well, and that’s to get a proper financial plan done with a CFP® Professional. That retirement plan is going to dictate your goals, budget, and the types of assets your working with. From there, we can start incorporating tax planning into your financial plan.

“Until we have some type of concept of what your future looks like, it’s going to be hard to make decisions for what to do in the short-term.” – Corey Hulstein

2. Save Your Money to the Appropriate Places

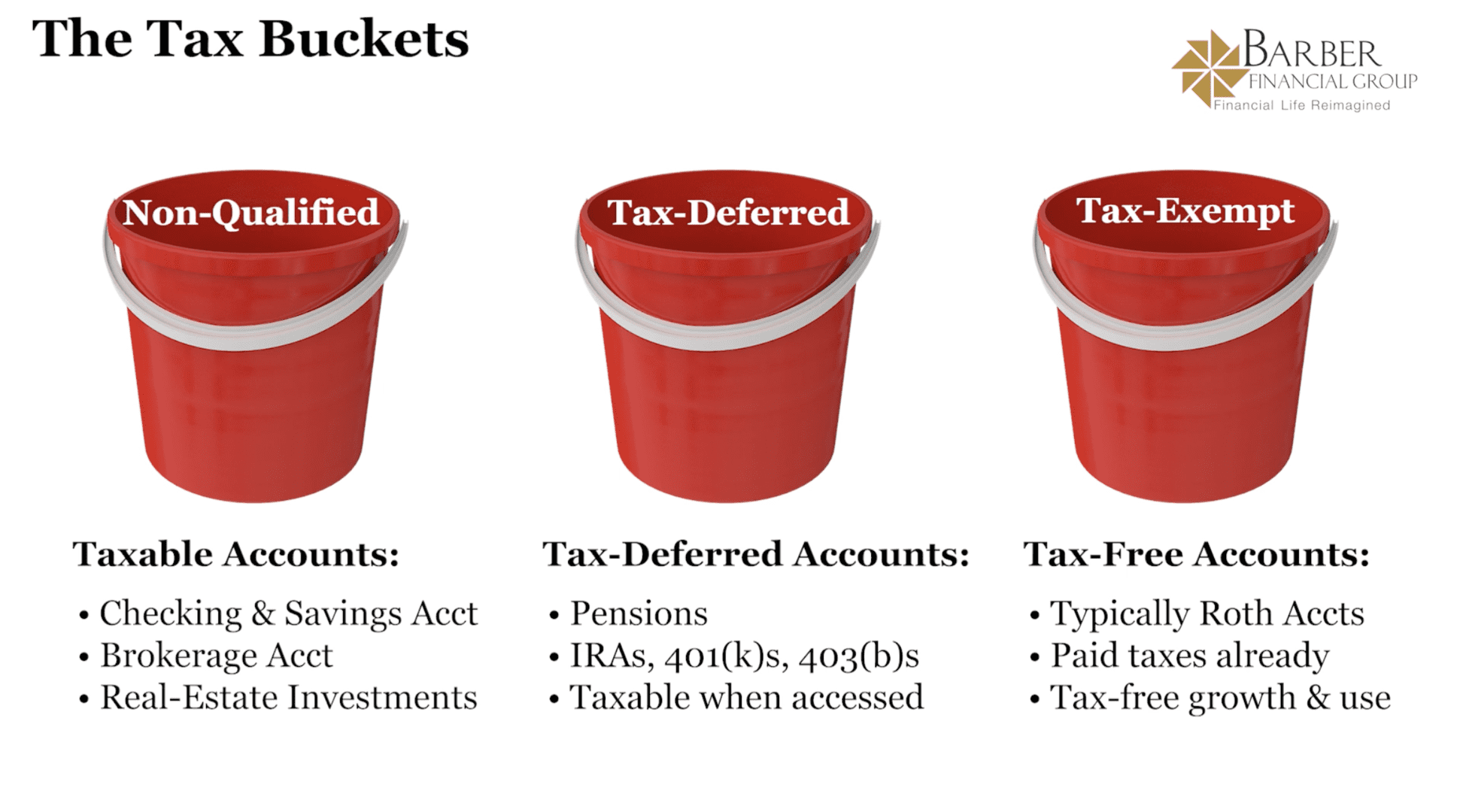

On to tip No. 2 for tax planning for individuals. Saving for retirement is critical and takes a great deal of discipline. However, saving is more complex than you might think. Why? Because where you save to matters. There are three different tax buckets that you can save to—taxable, tax-deferred, and tax-free. You can see examples of each tax bucket below in Figure 1.

FIGURE 1 – Tax Buckets

What your retirement plan looks like is going to dictate where you should start saving more money to in the short-term.

“It’s going to depend on where you’re at in life currently. Are you in an early phase of life when income streams aren’t as large as they are later in life? How much time do you have left to save? Are you going to need access to these funds short-term? Or is this something you can wait 10, 20, 30 years to access?” – Corey Hulstein

3. Understand How the Tax Brackets Work

That brings us to our third tip for tax planning for individuals that helps you understand the rules of the game. You need to know what tax law says and allows you to do to do effective tax planning. It’s important to know that our tax system is a marginal or progressive tax system. That means that the first sources of income that you have—the first $10,000-$20,000 that you make in a given year—are going to be taxed much differently than the last $10,000 that you earn.

The first sources of income are taxed at 10%, assuming they are ordinary income. The next bucket is going to be taxed at 12%. But when someone says that you’re in the 12% bracket, that doesn’t mean that all your income will be taxed at 12%. Again, it’s a progressive tax system. Only the income that exceeds the prior bracket limits will be taxed at that new rate.

How Marginal Tax Rates Work

Let’s pretend that a married filing jointly couple earns $100,000 collectively after some type of standard deduction. These are rough numbers because these numbers change all the time depending on what year you’re looking at.

The first $20,000—give or take—is going to be taxed at 10%. The next $60,000-$65,000 is taxed at 12%. Only the excess amount is going to be taxed at 22%, so that would be $15,000-$20,000. These brackets are going to move each year depending on what happens with inflation. So, make sure you’re staying up to date on the tax brackets.

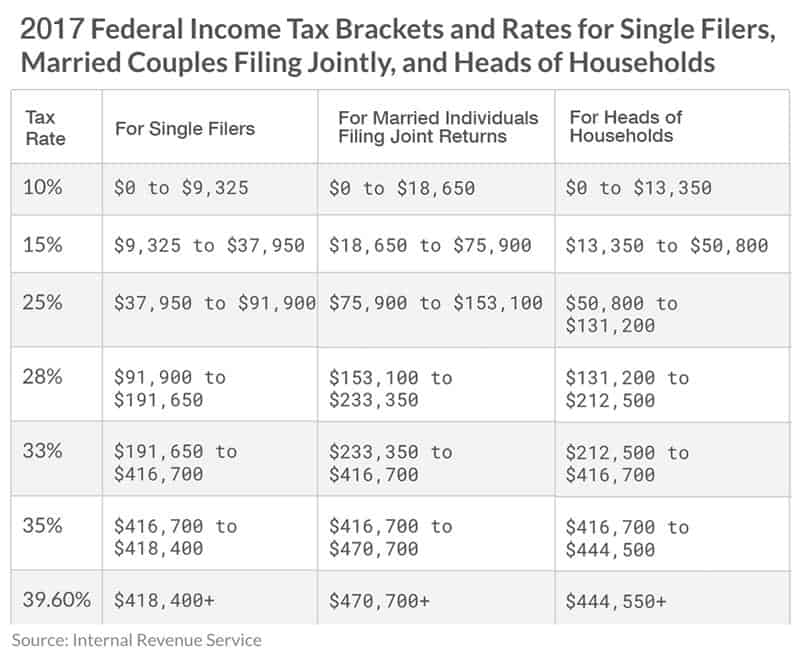

Now that we’ve highlighted how the progressive tax system works, it’s important to note that this system isn’t set in stone with our current tax rates. Our current tax rates are set to expire on December 31, 2025. They’re reverting to the tax rates we had back in 2017 prior to the Tax Cuts and Jobs Act. The 10% bracket is set to remain in place in 2026, but there are some significant changes after that which we’ve detailed below in Figure 2.

FIGURE 2 – 2026 Tax Brackets – Internal Revenue Service

“When looking at tax planning for individuals, it’s going to be very important to look at the next three years. Does it make sense to pay more tax today, knowing that rates are likely heading up in the future?” – Corey Hulstein

4. Make Sure Your CPA and CFP® Professional Work Together

Our fourth tax planning tip for individuals ties in closely with our first tip. It’s to make sure that your CPA and CFP® Professional work together. You want to make sure that there are no unintended consequences within your tax plan.

Social Security

One of the biggest tax planning concerns that we have for retirees are the effects are Social Security benefits and Medicare premiums. Social Security is taxed very uniquely compared to any other item in the tax code. As we increase our other sources of income through interests, dividends, capital gains, etc., the taxability of your Social Security benefit also increases.

“That’s why we need to make sure that there aren’t any unintended tax planning consequences. If your Social Security benefits become more taxable, you need to appropriately account for that and determine if it’s a good decision for you long-term.” – Corey Hulstein

Medicare Premiums

And then there are Medicare premiums that need to be considered. Medicare premiums are means tested. The government looks at what level of income that you and potentially your spouse has. If your income exceeds certain thresholds, you’ll be charged more in Medicare premiums than the average individual.

Capital Gains

Another unintended tax planning consequence for individual is the impact on capital gain income. If your income stays below certain income threshold levels, your capital gains aren’t taxed at the federal level. By increasing your income through Roth conversions or other tax planning strategies, your capital gain income can start being taxed at 15%.

“We thought we were adding income in those 10% or 12% tax brackets, but what ended up happening is that your capital gain income is also taxed at 15%. We have this unintended consequence of thinking we’re getting income out at 10% or 12%, but the true percentage of that action is closer to 25% to 27% taxation.” – Corey Hulstein

State Income Taxes

One last thing on unintended tax planning consequences. Make sure that your CPA and CFP® Professional are analyzing your tax plan so that it makes sense for whatever state you live in. Different states have different state income tax rules. For example, there are going to be different key thresholds that will cause Social Security to become taxable. Your CPA and CFP® Professional need to know those rules with state income taxes as well.

5. Always Look Out for Tax Planning Opportunities

Last, but not least, our fifth tax planning tip for individuals is to look out for tax planning opportunities. It’s also important to pay attention to the political landscape because the rules can always change.

Roth Conversions

One of the big opportunities we look at for our clients are Roth conversions. Like we mentioned earlier, it’s quite likely that our tax rates are going to go up in 2026. Does it make sense to expedite income through Roth conversions?

“Roth conversions take money out of that tax-deferred bucket to the tax-free bucket. The minute you take the money out of the tax-deferred bucket, it becomes taxable. How do we get growth on that account inside a Roth, knowing that the rate of tax that you’re paying today is going to be cheaper than where we’re at in the future? Not only are you paying tax at a cheaper rate, but you’re shooting to get that growth tax-free.” – Corey Hulstein

Charitable Giving

Another point of view that we want to address with tax planning tips for individuals focuses on charitable giving. Are you already donating money to charity with very little tax benefit due to the way that the tax code is structured? Charitable donations are going to be easier to deduct in 2026. But are there some moves you can make between now and then to maximize something that you’re already doing?

One option is bunching your donations. That’s giving two years of donations in one year and then taking the next year off. There are also donor-advised funds that could be an option. Donor-advised funds allow you to donate multiple years of donations in one year. We set up a different fund where you get the tax benefit today, but spread out the money to charity over several years. It can go to whatever charity you want as long as it’s a 501(c)(3) organization.

Qualified Charitable Distributions

Another tax planning strategy for individuals is a Qualified Charitable Distribution. QCDs are only available to those who are 70½ or older. They take money right out of an IRA and that money goes directly to the charitable organization.

“From a tax perspective, the donor gets no tax benefit. We can’t write that off on the return. We take money out of that account that we’ve never paid tax on, and that’s not a taxable transaction. We’re taking money out at zero tax and sending it off to the charity of your choosing.” – Corey Hulstein

It also qualifies as your Required Minimum Distribution. For example, if you’re 75, and you want to send $10,000 to charity, that lowers your RMD for that year down to $20,000.

Harvesting Gains

As we begin to wrap up our discussion on tax planning for individuals, there are a couple more topics we want to touch on or make additional points on. When you’re meeting with your CPA and CFP® Professional, figure out with them what your plan is for capital gains. Does it make sense to harvest some gains? Or do you need to expedite some losses for capital gains? What capital gain strategy makes sense for you in the current year?

When Should You File for Social Security?

So many people want to claim their Social Security right when they’re eligible to at 62. We work actively with our clients to determine when the right time is for them to claim Social Security. That’s a complicated discussion. It depends on what assets you have available. What time do you need the cash flow to start coming in? And what’s going on with the market?

“Currently, the downward market spiral is pushing more of our clients to take Social Security earlier than planned. We don’t want to need to take money out of retirement accounts when the market declines.” – Corey Hulstein

Estate Planning

Lastly, make sure you talk about estate planning with your CPA and CFP® Professional. This is one of the most critical areas of the tax code because of the SECURE Act and SECURE Act 2.0. Wealth transfer is going to become more important with IRAs and Roth IRAs.

We need to make sure that you have a plan in place for how that money transfers. What are the best short-term steps that you can take to take care of your loved ones long-term?

When in Doubt, Consult Your CPA and CFP® Professional

Hopefully, this discussion has given you a few things to think about when it comes to tax planning for individuals. Remember, this isn’t a comprehensive list. It’s very important to work with a CPA and CFP® Professional that have your best interests in mind. All these tax planning tips for individuals need to be individualized for what your plan looks like and how your assets are saved.

Who is inheriting your money? Is charitable giving important? There is a lot to consider with tax planning for individuals. And it all starts with a financial plan. You can begin building your plan with our industry-leading financial planning tool. This is the same tool that our CFP® Professionals use with our clients. And we’re giving you the opportunity to use it from the comfort of your own home. Just click the “Start Planning” button below, and you can access it at no cost or obligation.

Let Us Know If You Have Any Questions

As we mentioned in our tax planning tips for individuals, working with a CFP® Professional and CPA together is critical. Well, we’re giving you the chance to schedule a meeting with one of our CFP® Professionals and/or CPAs to ask questions about tax planning for individuals or other components of financial planning. Check out our schedule below to meet with us for a 20-minute “ask anything” session or complimentary consultation.

We can meet with you in person, on the phone, or virtually. Just let us know what works best for you.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.