Another Tech Bubble in 2023?

Key Points – Another Tech Bubble in 2023?

- What Changes Have We Seen in the U.S. Treasuries Yield Curve?

- Why It Still Looks Like a Recession Is in the Cards

- The Markets Are Up, But…

- Could We See Another Tech Bubble?

- A Cyclical Bull Market within a Longer-Term Secular Bear Market

- 4 Minutes to Read | 8 Minutes to Watch

The data in today’s article is as of May 31, 2023.

A Manic Month of May

There’s no shortage of crazy things happening right now. We’re going to dive into the inverted yield curve once again and dig into what’s driving the markets higher. There are some interesting things going on in the markets, specifically in tech. Is another tech bubble taking shape? I’ll look at that and much more in my May Monthly Economic Update.

Looking at How the U.S. Treasuries Yield Curve Changed in May

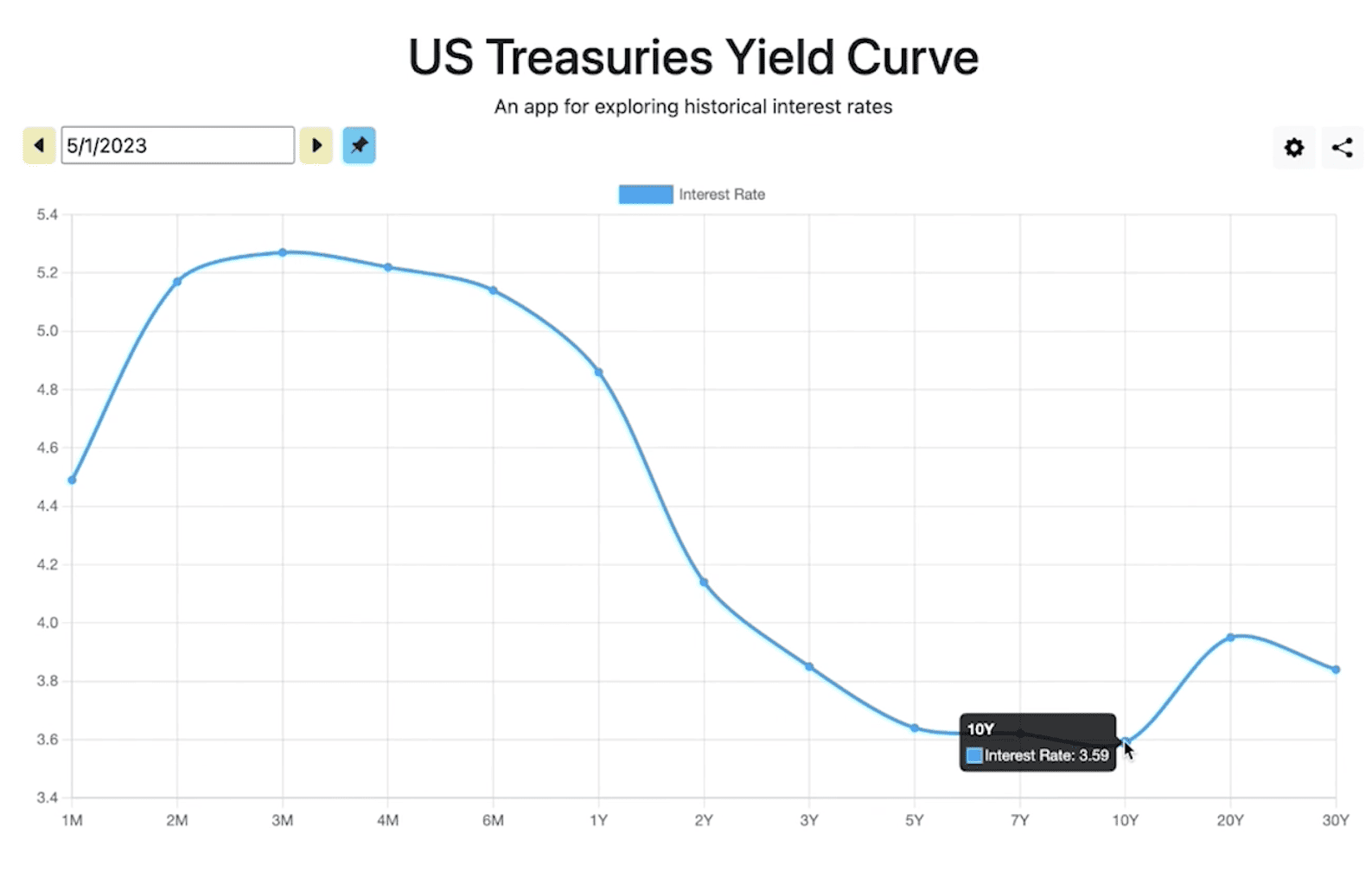

I want to start out with the yield curve. We’ve been going over the yield curve a lot lately, but I want to show you the dramatic shift in the shape of the yield curve just in May. On May 1, the one-month treasury was at about 4.49% while the 10-month treasury was at 3.59%.

FIGURE 1 – U.S. Treasuries Yield Curve on May 1

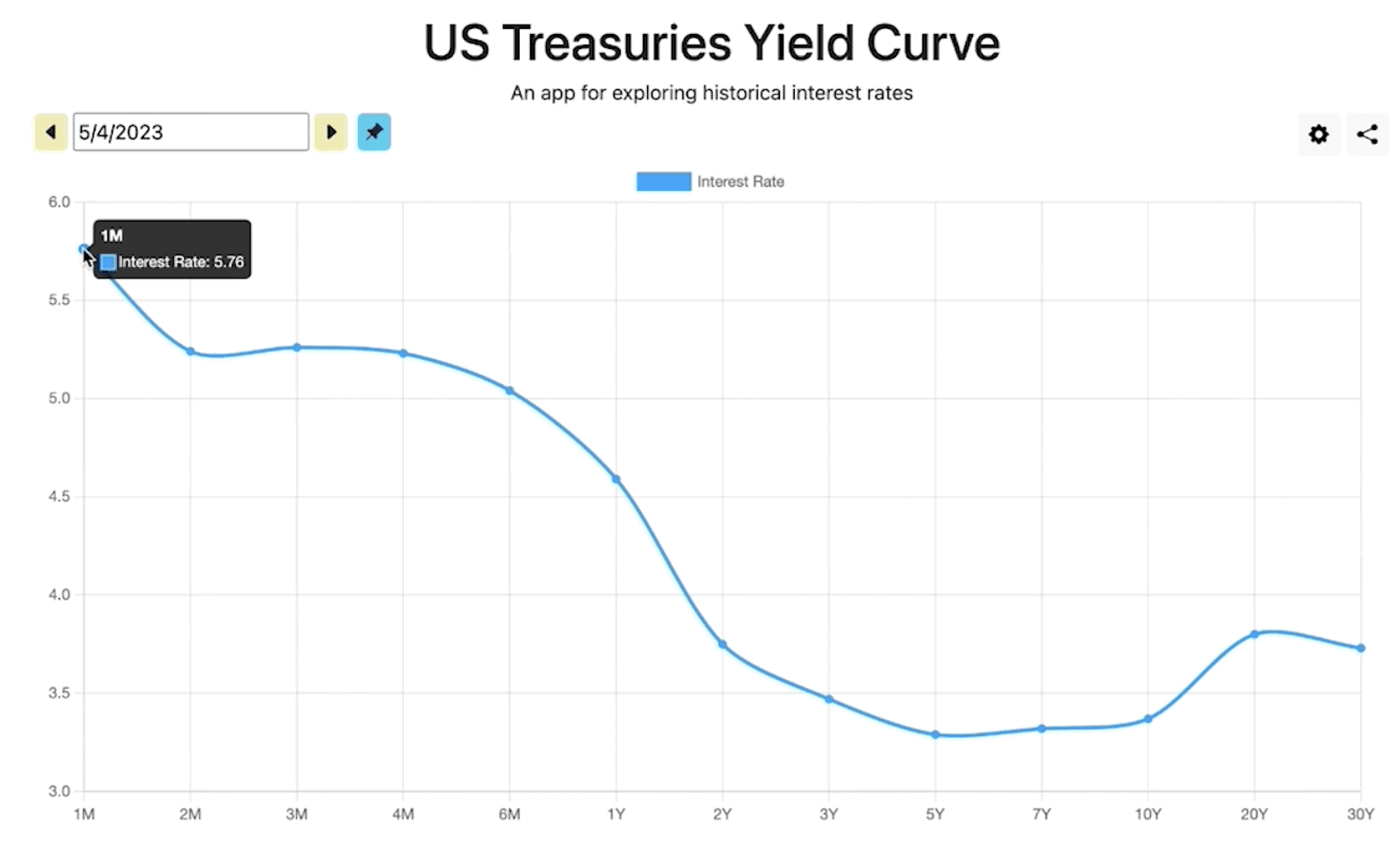

It’s very fascinating how the shape of the curve changed in May. It took just three days for the one-month treasury to jump up to 5.76%. It stuck around that 5.5% mark for the balance of the month. The one-month treasury was the highest-yielding treasury for all but three days in May.

FIGURE 2 – U.S. Treasuries Yield Curve on May 4

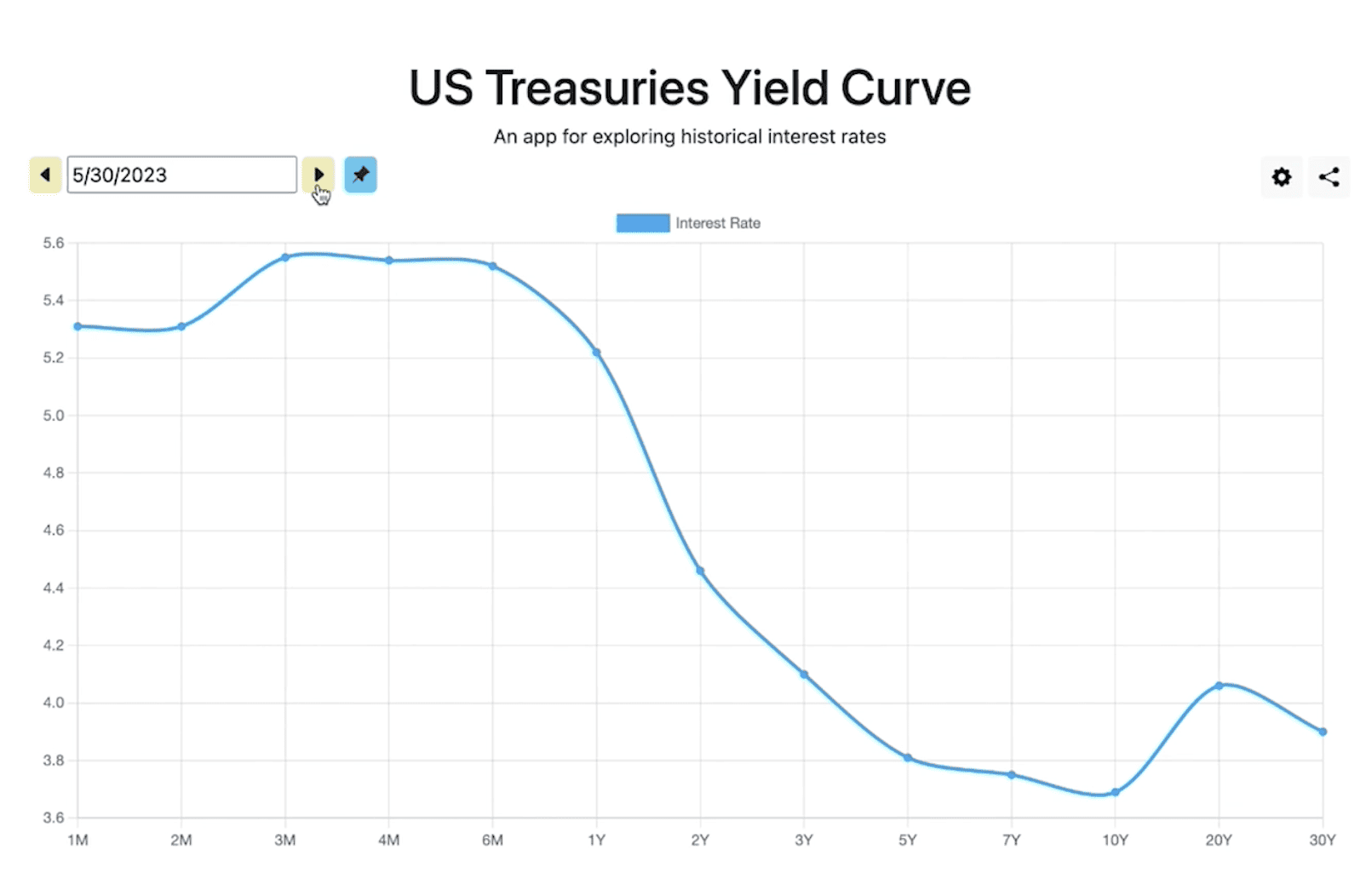

That changed for the final few days of May. The three-month and four-month treasuries were at 5.55% and 5.54%, respectively on May 30. Meanwhile, the 10-year treasury was at 3.69% and the one-month treasury was at 5.31%.

FIGURE 3 – U.S. Treasuries Yield Curve on May 30

Here is the month in review so you get an even better idea of how the month played out.

The Inverted Yield Curve Continues to Signal a Likely Upcoming Recession

Once again, this inverted yield curve still tells us that there’s a high likelihood that a recession is around the corner. You might be wondering that if a recession is around the corner, what in the world is going on with the stock market?

Strong Market Performances

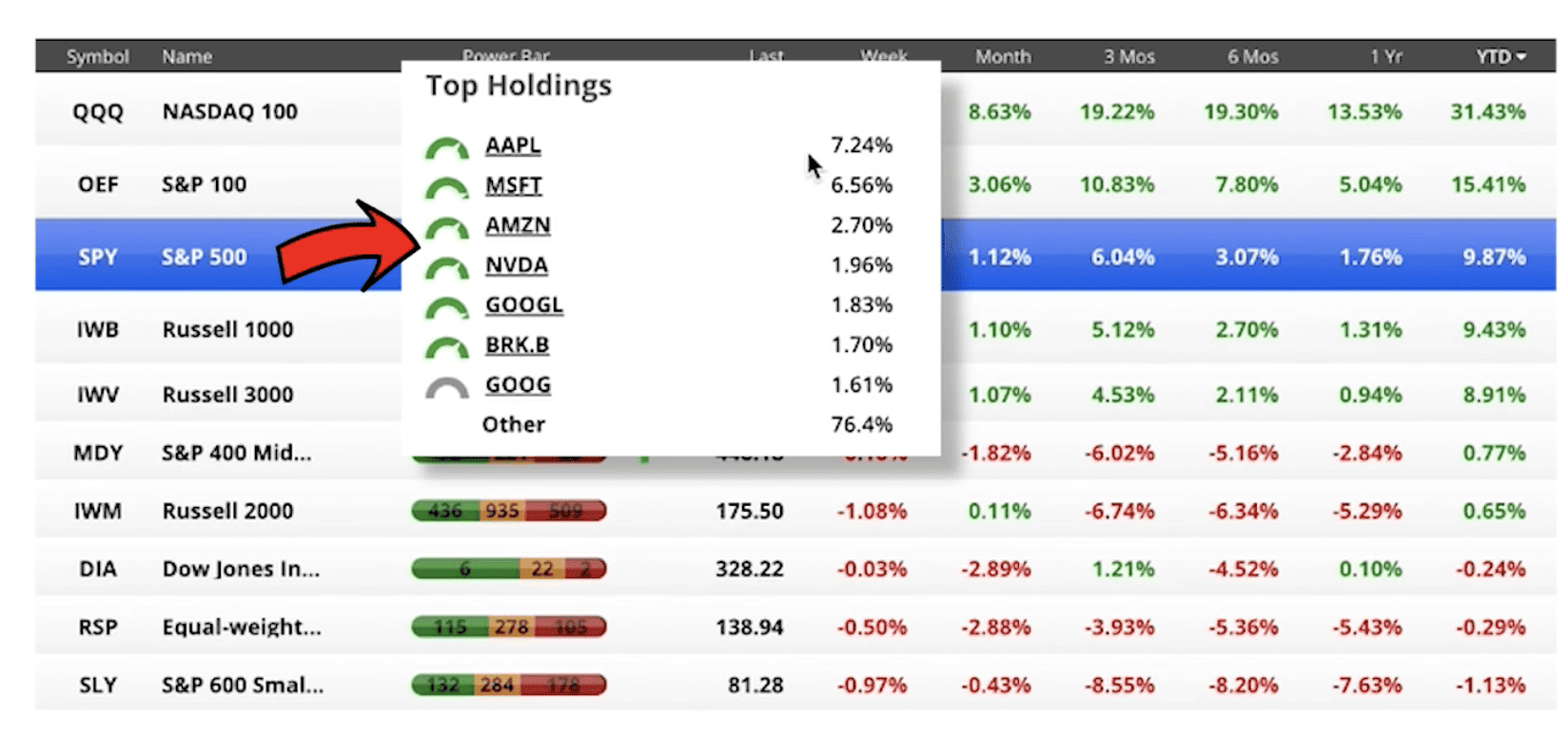

The stock market is up this year. The S&P 500 is up nicely. The NASDAQ is the leading index that is up. If we just look on a year-to-date basis, the NASDAQ 100 is up 31.43%. The S&P 100 is up 15.41% and the S&P 500 up 9.87%. The NASDAQ was up 8.63% in May alone.

FIGURE 4 – Year-to-Date Market Performances – Chaikin Analytics

But there’s something strange going on here and it’s visible. Look at the RSP Equal Weight. It takes all the stocks in the S&P 500 and weighs them equally in that ETF. The RSP Equal Weight is down by 0.29% on the year, while the S&P 500 is up by 9.87%.

Look at this. Apple makes up 7.24% of the S&P 500. The S&P 500’s top holdings after that are Microsoft, Amazon, Nvidia, Google, and Berkshire Hathaway Class B shares.

FIGURE 5 – S&P 500 Holdings – Chaikin Analytics

Is a Tech Bubble Forming?

Here’s the thing. If you take these seven stocks—Apple, Netflix, Amazon, Mirror, Microsoft, Tesla, and Nvidia—they account for 120% of the S&P 500’s return so far this year. There seven stocks driving the entire market. That means everything else is down. This is shaping up to look like a tech bubble that is surrounded by all the mania over artificial intelligence.

Wild P/E Ratios in Tech

Every time we’ve had tech stocks go up this fast, it’s ended in something that is not so nice. Let’s use Nvidia as an example. It’s one of the ones that has been in the news a lot lately. The price-to-earnings ratio on Nvidia is 204. That means it’s trading at 204 times next year’s forward-looking earnings. That’s insane.

Could This Tech Bubble Keep Rising?

When you have a stock market that is moving higher, driven by only a handful of stocks, that means there’s trouble in other places. Could that tech bubble continue to rise? Absolutely. Could it go higher than it is today? Absolutely.

Is It Time to Rebalance?

But does it mean that we should take all our money and shift it into the technology sector or into the NASDAQ 100? No, it doesn’t mean that at all. It means that if you have some money in those particular areas and have some nice profits on those this year, you might want to think about rebalancing. You might want to think about taking some of those profits off the table, especially if you own those individual stocks.

What’s Going to Happen with the Debt Ceiling?

The real story here that we’re still monitoring is what will happen with the debt ceiling. I think it will get passed, possibly even by the time you’re reading this. There’s a lot of noise around it, but we’ve been there before. It’s created a lot of hype in the market.

A Cyclical Bull Market within a Longer-Term Secular Bear Market

But I think the one thing that’s really driving the markets right now is the technology stocks. It’s just a handful of them. It’s very narrow and that typically doesn’t set up well for this being the beginning of a new bull market.

What I believe we’re in right now is a cyclical bull market inside of a longer-term secular bear market. I still anticipate quite a bit of volatility throughout this year. So, buckle up and hang on. It’s important to take some time to sit down with your financial advisor. If you’re a Modern Wealth Management client, you can contact you advisor here to review your plan and ask any questions that are on your mind. Let’s make sure that your plan is still on track.

A Headwind for Stocks and a Tailwind for Bonds

If we can reduce risk in your portfolio without reducing your probability of success in your plan, this would be a time to have that type of a discussion. I believe that there will be opportunities in the future, but right now there’s more of a headwind for stocks and a tailwind for bonds.

Asset allocation is still the key. I don’t think we’re going to wind up in a year like we had in 2022 where both stocks and bonds got hammered. I think the worst for bonds is far behind us. As a recession looms, that could spell difficulty for stocks, but also spell opportunity for bond holders.

Building a Financial Plan

We’re also here to help anyone who isn’t a Modern Wealth client, and we have a few ways of doing so. The bottom line is that if you’re thinking about retirement and don’t have a financial plan, you need one. A financial plan can give you confidence, freedom, and time as you make your way to and through retirement. It’s even more critical to have a plan amid the uncertainty we’re facing. You can begin building your plan from the comfort of your own home by using our financial planning tool. By clicking the “Start Planning” button below, you can start building your plan at no cost or obligation.

It’s also critical to work with a CFP® Professional throughout the retirement planning process. If you have any questions about the inverted yield curve, tech bubble, a potential recession, or where you’re at with planning for retirement, let us know. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, by phone, or virtually depending on what works best for you.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.