Is a Recession Coming in 2023?

Key Points – Is a Recession Coming in 2023?

- A 10th Consecutive Increase in the Fed Funds Rate

- The Latest Challenges for Regional and Smaller Banks

- The Yield Curve Is Becoming More and More Inverted

- What to Make of the Latest Market Performances

- 6 Minutes to Read | 9 Minutes to Watch

The data in today’s article is as of May 3, 2023.

Is a Recession Coming in 2023?

Federal Reserve Chairman Jerome Powell announced a 10th consecutive increase of the Fed funds rate on Wednesday following another 0.25% hike. That brought the Fed funds rate range to 5-5.25%. We’ll discuss the latest move from the Fed, bank failures, what’s going on with the market and the economy, the ever-increasing inverted yield curve, and much more in our April 2023 Monthly Economic Update. All those talking points are leading people to ask one question—is a recession coming in 2023? Let’s look at some of this data to make the best educated guess on that.

When Will the Fed Stop Raising Rates?

It was 15 months ago that the Fed announced a 0.25% increase of the Fed funds rate. Wednesday’s announcement marked the 10th straight FOMC meeting that the Fed funds rate has increased, leading people to wonder when this cycle will end. The Fed did remove some of the language that was in their prior statement that talked about having to possibly continue increasing rates. That’s giving some people hope that this could be the final increase of this cycle.

The big dilemma that the Federal Reserve has now is that the economy is showing signs of slowing in many different areas. However, inflation is remaining stubbornly high. The worst scenario that we could imagine is having inflation continue rearing its ugly head and at the same time as experiencing a slowing economy. That could lead to something that could be similar to what we experienced back in the late 1970s and early 1980s, which was a stagnating economy with a high inflationary cycle.

The Fed Wants to Raise Unemployment to Kill Inflation

We are seeing some signs of unemployment starting to crack a little bit. The Fed needs to get the unemployment rate up. That sounds crazy, but they need to get that unemployment rate up to the 4.5-5% range because consumer spending drives 70% of our Gross Domestic Product. As long as the unemployment rate stays low and the consumer has ample dollars to spend, they’ll continue to spend.

Increased Spending on Credit

One thing that’s happening there, though, is that more spending is being done on credit than what it was just a couple of short years ago. That is hitting some of the lower-income and middle-income households hard. They’re putting the daily necessities on credit cards. Credit card debt is at an all-time high. Vehicle debt is also at an all-time high.

We are having issues in the banking sectors. The main issues that the regional banks are having today are tied very closely to the rapid rise in interest rates that the Federal Reserve has done to us over the last 15 months to try to curb inflation. We still don’t know exactly how this is going to play out.

The Yield Curve Keeps Getting More and More Inverted

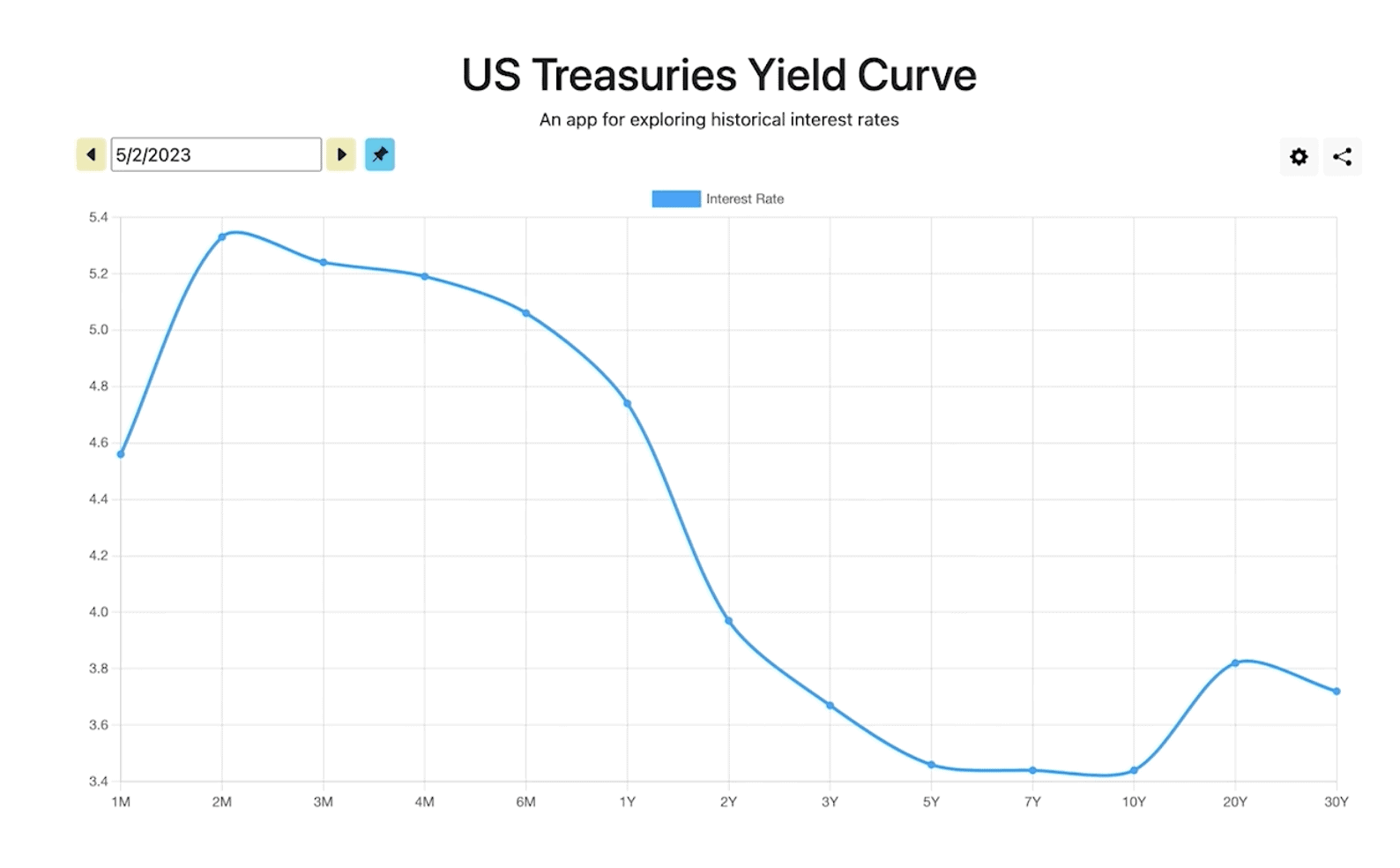

One of the things that we also need to look at when asking the question, “Is a recession coming in 2023?” is the U.S. Treasuries yield curve. We’ve been looking at this yield curve very closely for several months now. Let’s see what it looks like below in Figure 1.

FIGURE 1 – U.S. Treasuries Yield Curve

When we look at the two-month treasury today, it’s at 5.33%. The three-month treasury sits at 5.24%. The four-month is at 5.19% and the six-month treasury is at 5.06%. Then, if you look at the 10-year treasury, it’s at 3.44%. That is an inverted yield curve. It almost looks like a ski slope with a ramp at the end.

The 20-year treasury is up a little bit better than the 10-year treasury, but the 30-year treasury is still below the 20-year treasury. From a historical perspective, any time we have seen the short end of the yield curve with higher yields than the 10-year treasury has led to a recession at some point. That’s important to remember as people continue asking, is a recession coming in 2023?

We’ve seen this inverted yield curve for a while now. It started last year and keeps getting steeper and steeper. We keep seeing increases in the short end and the 10-year treasuries are falling. The 10-year treasury briefly touched 4% earlier this year. It’s now down below 3.5%. The 10-year treasury is telling us that it doesn’t like the longer-term outlook for economic activity, thinking that at some point the Fed will be forced to pivot and start to lower rates.

My Prediction on the Future of Interest Rates

I think the Fed may have one more 0.25% hike that they will do at the next meeting. After that, I think they’ll pause and not do anything with interest rates for the balance of this year. And I don’t see the Fed pivoting and starting to lower rates later this year.

Now, I’ll give my thoughts on the question, is a recession coming in 2023? I do think that we’ll run into a recessionary time later in this year. But I don’t think it’s going to be a deep recession. I don’t think this is going to be something like we had in 2008 with The Great Recession. But the economy is cooling to a point where I do believe that we could have a shallow recession. At that point, I believe that the Fed could pivot and begin to lower rates. But I don’t think that will occur until the early part of next year.

Market Performances

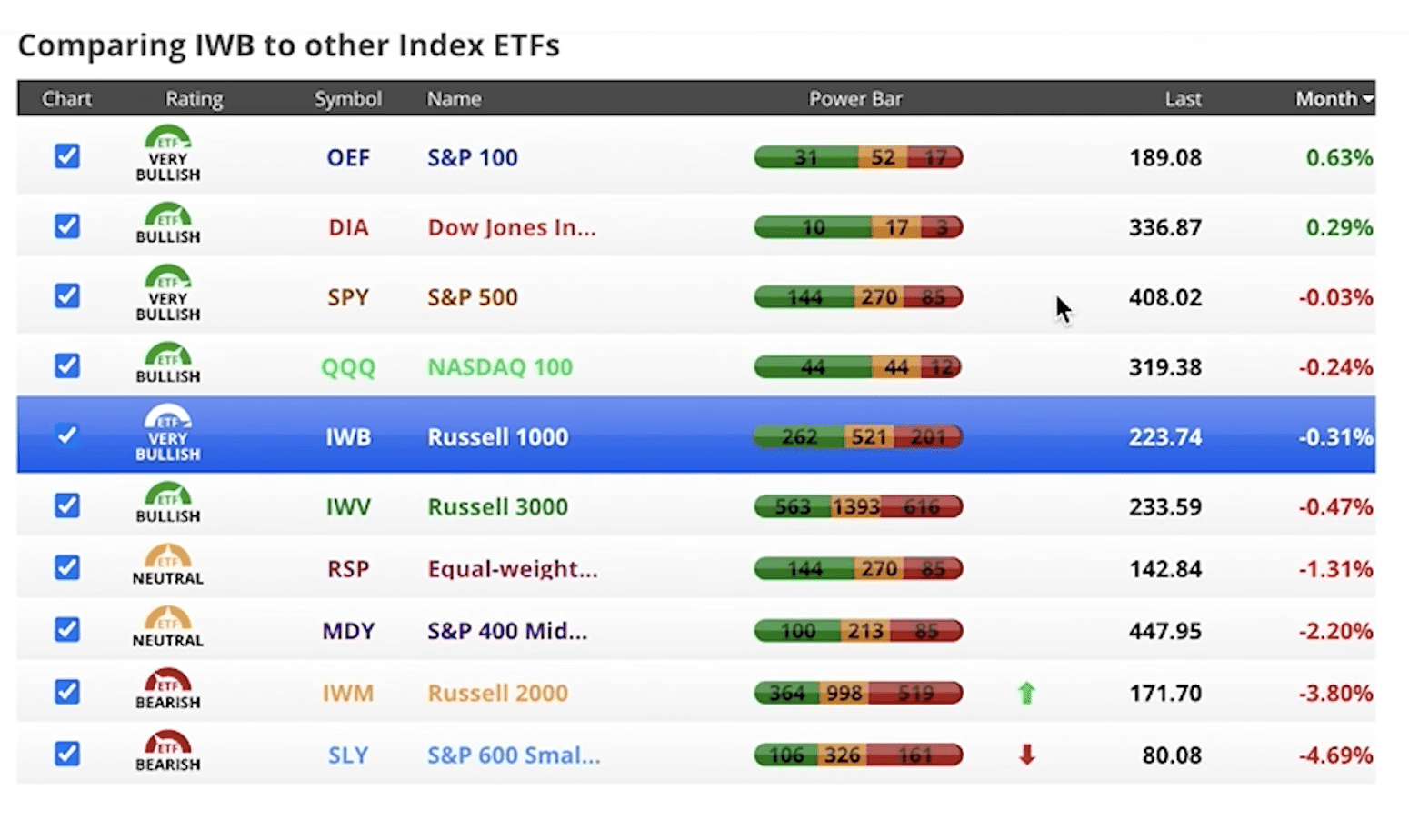

So, where does that lead us with the markets? Let’s look at the different sectors of the market, starting with last month in Figure 2.

FIGURE 2 – Market Performances from the Past Month – YCharts

This runs from April 3 to May 3. The only positive returns over the last month are the S&P 100 and Dow Jones Industrial Average, which are up by 0.63% and 0.29%, respectively. The S&P 500 followed at -0.03%. The markets were basically flat until you get down into the mid-cap and the small cap, which were down anywhere from 2-4%.

The Latest Challenges Facing Regional Banks

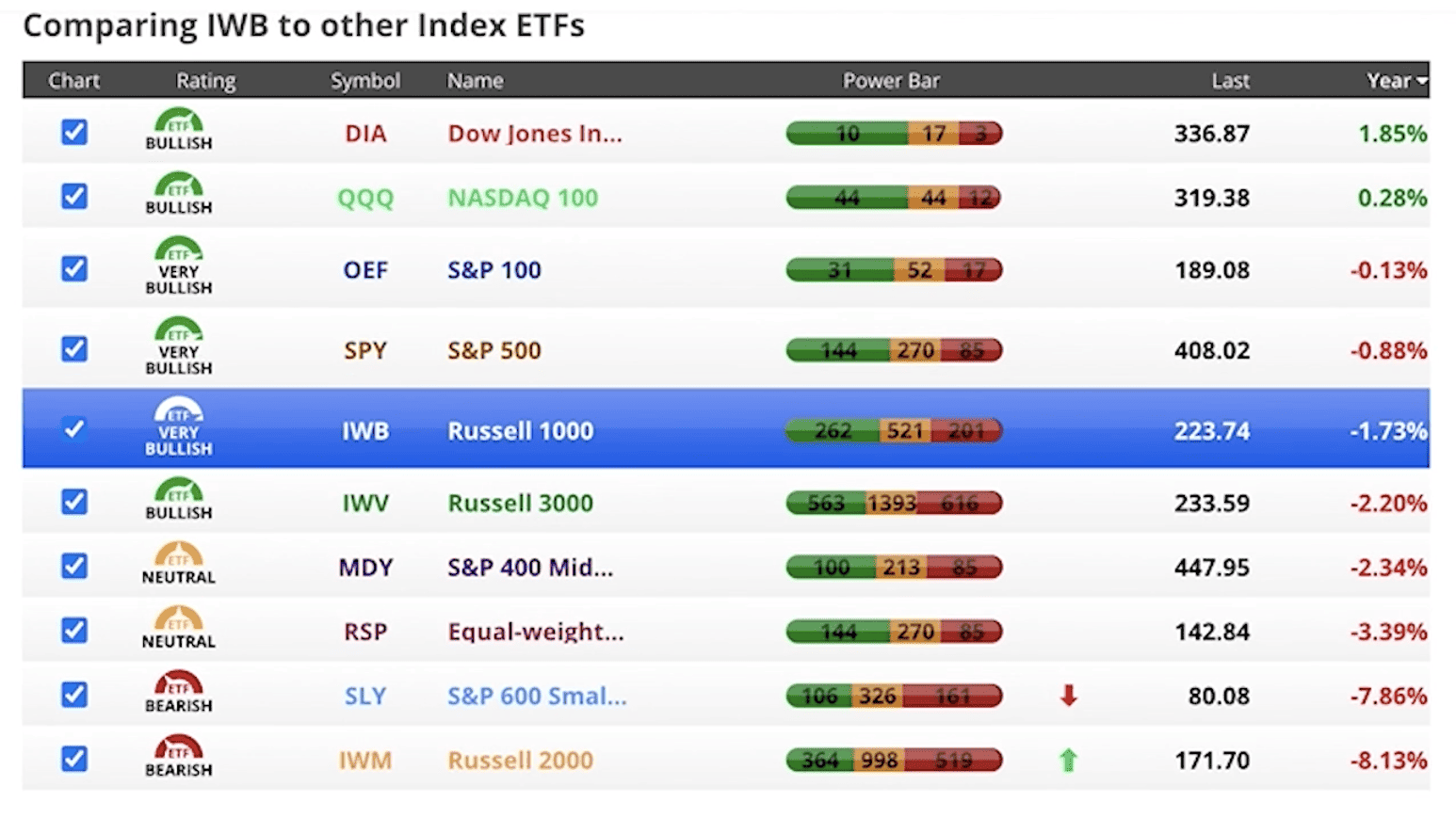

If we look back over a one-year period in Figure 3, you can see all the fits that the market has been under.

FIGURE 3 – Market Performances from the Past Year – YCharts

There’s a tight range here, but it’s still flat over the last year. The small cap is doing worse than our large cap over the last 12 months. The reason for that is because in the small cap arena, you see a lot of regional bank stocks. A lot of the regional bank stocks are getting beat up due to what happened with Silicon Valley Bank and a couple of the other small banks that have failed.

The rapid increase in interest rates has hurt the regional banks. If you think about what’s happened, a lot of these regional banks bought treasuries back in 2019, 2020, and 2021. They were buying longer-term treasuries to try to get yields that were attractive so that they could pay decent rates on their deposits. Those treasury values today have been eroded because of the rapid rise in interest rates.

Home Lending

The other challenge that the regional and small banks are facing is that they’re doing most of the home lending. They have a lot of loans on the books that are anywhere from like 2.8% to 4%. With money market accounts in many areas paying for 4-4.5%, these banks now need to be competitive to have people want to put deposits with them. They need to match those rates, but it’s very difficult for them to do that when they’ve got their assets on the books with loans at anywhere from 2.8-4%.

So, I think that the regional banks could struggle for a while. But I don’t think we’re looking at anything like the banking crisis like we had in The Great Recession.

Outlook for the Balance of 2023

If we look at the stock and bond markets today and over the next six to nine months, I have a few different thoughts. I believe that the stock market still has some headwinds. There’s light at the end of the tunnel, but it’s going to be a bumpy road in the stock market over the next six to nine months. I think that the bond market is beginning to see where there may be some tailwinds behind it. The traditional bond market was a really ugly asset class in 2022, but it may start to look better as the Fed completes its rate hiking cycle. Even if they just put it on pause, that should allow bonds to begin to recover and provide a reasonable return for the balance of this year.

Whether or Not a Recession Is Coming in 2023, You Need a Financial Plan

We’ll keep an eye on things, especially with the question, is a recession coming in 2023, being raised. And as always, we’re here to answer any questions that you have. If you’re a Modern Wealth Management client, don’t hesitate to contact your advisor. Make sure that they know what you’re thinking and we will do everything that we can to keep an eye on things and keep you positioned in a way that you need to be positioned based on your overall financial plan.

If you’re not a Modern Wealth Management client, you need to have a comprehensive financial plan that gives you confidence that you’re doing the right things with your money, freedom from financial stress, and time to do the things you love. You can start building your plan from the comfort of your own home with our industry-leading financial planning tool. What is your probability of success in retirement? You can find out at no cost or obligation by clicking the “Start Planning” button below.

Have Questions?

If you have questions as you’re creating your plan, the possibility of a recession, or anything else related to your financial life, let us know. To ask those questions, simply click here to schedule a meeting with one of our CFP® Professionals. You have the option to schedule a 20-minute “ask anything” session or complimentary consultation. We can meet with you in person, by phone, or virtually—whatever is easiest for you.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.