Interest Rate Forecast for the Rest of 2023

Key Points – Interest Rate Forecast for the Rest of 2023

- The Fed Pauses with Interest Rate Hikes

- But What’s the Next Move from the Fed?

- Dean Barber and Bud Kasper Make Their Interest Rate Forecast for the Rest of 2023

- The Latest on 30-Year Mortgage Rates and the U.S. Treasuries Yield Curve

- 10 Minutes to Read | 23 Minutes to Listen

A Pause on Interest Rate Hikes

The Federal Reserve finally hit the pause button on raising the Fed funds rate at the FOMC’s June 14 meeting after 10 consecutive hikes. What does that mean for your financial planning strategy? Dean Barber and Bud Kasper give their interest rate forecasts for the rest of 2023 on America’s Wealth Management Show. Let’s see what they have to share about what they think is next from the Fed and what it could mean for you.

What Interest Rate Forecast Can Be Made for the Balance of 2023 Following This Pause from the Fed?

The Fed’s decision to pause rate increases at last week’s FOMC meeting ended a streak of 10 meetings where they increased the Fed funds rate. The Fed funds rate range now sits at 5-5.25%.

“I think this pause was necessary. This was smart on behalf of the Federal Reserve because they need to understand from the data they’re collecting that they can keep things in a position where they can examine how effective the prior increases have been. If they get the data that they’re looking for, that kind of guides them into what’s going to happen.” – Bud Kasper

While Fed Chairman Jerome Powell did announce the pause last week, he also made his own interest rate forecast for the rest of 2023. At the culmination of the June 14 FOMC meeting, he said to expect two more hikes in 2023. One week later when giving his semiannual monetary policy report to Congress, Powell didn’t give a specific number of hikes to expect for the rest of the year, but did say that “nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

Bud and Dean’s Interest Rate Forecast for the Balance of 2023

After hearing Powell’s interest rate forecast for the rest of 2023, Bud shared his own prediction. He believes we’ll see two more 0.25% hikes later this year. Dean wasn’t quite ready to give a concrete interest rate prediction for the remainder of 2023. Instead, he wanted to focus on the now with what exactly the Fed’s decision to pause rate hikes means.

“What caused the Fed to pause and why did they do it? What’s the impact of the pause? The reaction from the markets surprised most people.” – Dean Barber

As we await to see what the Fed’s next move will be, make sure that you have a copy of our 2023 Retirement Planning Calendar. It includes all the dates of this year’s FOMC meetings and many other important dates and events that can impact your retirement. You can download your copy below.

2023 Retirement Planning Calendar

Some Interest Rate History Trivia

Before we further into what’s going on with interest rates and elaborate on Bud and Dean’s respective interest rate forecasts for the rest of 2023, let’s do some interest rate trivia. Let’s see if you can answer Bud’s trivia question for Dean. We’ll give you a hint. It’s a question about the Paul Volcker era, as there have been a lot of comparisons to the rising interest rate environment of the 1980s to what we’ve been experiencing.

Bud’s Question: What was the largest ever rate hike and when did it take place?

Dean’s Answer: It was by Paul Volcker and I believe it would’ve been in 1981. I don’t know exactly how much he raised it, though.

Correct Answer: Dean was close! The correct answer was December 1980, when Paul Volcker announced a 2% increase of the Fed funds rate.

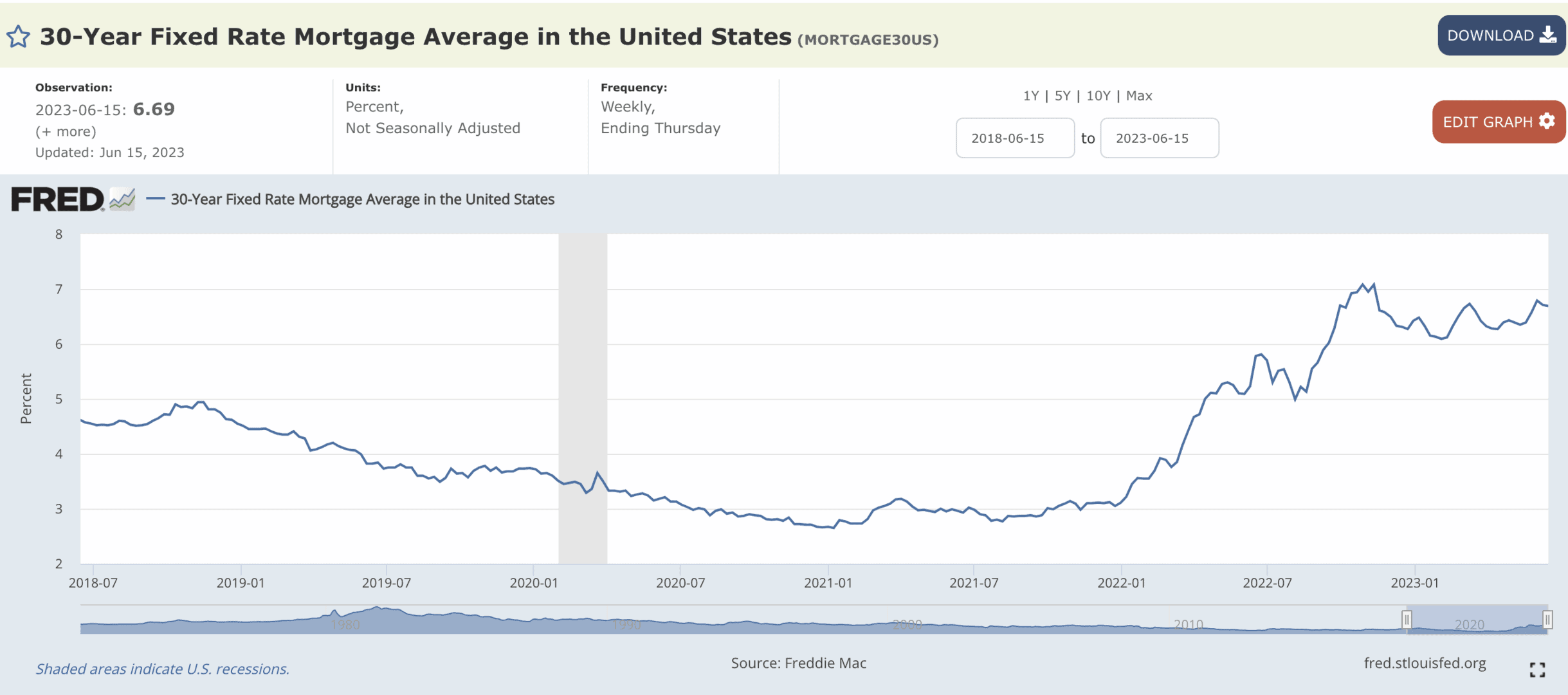

What’s the Latest with Mortgage Rates?

As we continue to look at the interest rate forecast for the rest of 2023, let’s shift our attention to mortgage rates. As of June 15, the average 30-year mortgage rate was at 6.69%. That’s a lot, but Bud is surprised that it’s not even higher. If circle back to July 7, 2022, the average 30-year mortgage rate was 5.3%. The peak was in late October/early November at 7.08%.

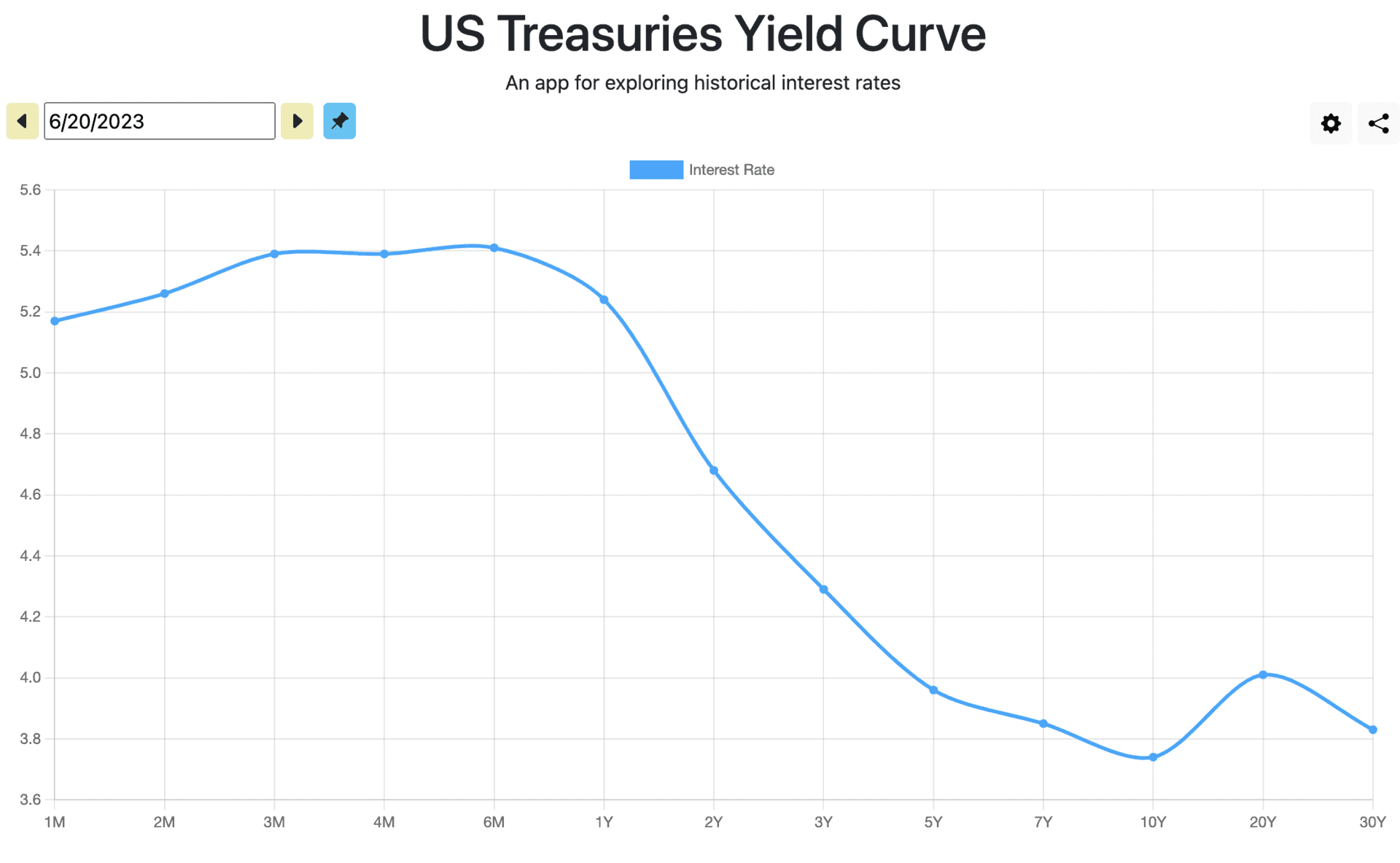

How Is the Yield Curve Looking?

Needless to say, the bond market reacted accordingly to that. If you’ve been following along with Dean’s Monthly Economic Updates over the past year, you’re well aware of how steeply inverted the U.S. treasury yield curve has become. Dean does find it interesting, though, that since June 14, the interest rate cycle really hasn’t changed.

FIGURE 2 – U.S. Treasuries Yield Curve

We saw the three-month inch up just slightly from 5.37% to 5.39%. And the one-year is at 5.4%, which is fairly attractive. However, the 10-year is still significantly lower at 3.8% (although that is down from 3.9% on June 14). It’s still concerning to have a steeply inverted yield curve, where short-term rates are far higher than long-term rates.

“It is a concern because it shows a flaw in the economy. From that perspective, it’s our job to make lemonade out of lemons. The shorter the maturity line, the higher the rate that we can get. In many portfolios, people should be looking at putting some of their safest part of their portfolio—perhaps in a three-month or six-month CD or in a treasury.” – Bud Kasper

You’ll get a little bit higher return in a treasury than you will in the short-term CD rate. There are places to find U.S. treasury deposits that you can invest in with it. It’s probably a smart thing at this point.

Laddering Treasuries

Think about this regarding treasuries. Let’s take that three-month at 5.39%. At the end of three months, roll it into the next three months. It keeps you somewhat liquid. You’re only in a 90-day time frame, so you can free your money up if there are better opportunities in the future. For people that have wanted that safe money, our CFP® Professionals have been laddering treasuries since last October.

“A year and a half ago, somebody would have laughed at us if we would have talked about laddering treasuries. You would’ve been getting like 0.23% or something like that. Inflation has reared its ugly head. It wasn’t transitory like the Fed thought. It has hurt a lot of people.” – Dean Barber

Difficulties at FedEx Could Shed Light on Future Economic Activity

That inflation obviously decimated the markets, so we’re hopeful that the Fed’s actions will take hold and we can get back to some sense of normality. FedEx is one company in particular that has felt the brunt of high inflation and rising interest rates. On June 21, FedEx reported its third consecutive decline in quarterly revenue as it adjusts to lower demand following a surge in business during the pandemic. To reduce costs, FedEx has implemented measures such as reducing flight hours and parking aircraft.

FedEx has aimed to counter the decline in package volume by increasing shipping rates. However, FedEx executives don’t think there will be a major improvement in business conditions anytime soon. According to FedEx CEO Raj Subramaniam, factors such as inflation, higher interest rates, and a slowdown in global trade are expected to dampen parcel volumes and revenue growth.

“The measure of shipping rates, freights, and things like that are kind of a precursor to economic activity. This tells me that FedEx is seeing a continued slowdown and a future slowdown of shipping. If that’s the case, that tells me that this inverted yield curve is indeed telling us that we are headed into a slowing economic condition.” – Dean Barber

The Fed has been adamant about getting back to its 2% target rate for inflation, but Bud doesn’t think that’s a realistic goal right now. He thinks they should be thrilled if they can get it back down to 2.5%. These increased prices are recessionary.

“How much higher can the Fed go without totally disrupting the economy? We’ve seen so far is it’s been able to digest this information relatively well compared to what we’ve seen in prior years when the Fed was raising rates. Now that they have made this pause, I think it is a smart thing from their perspective because they’re so data dependent. They need to have that information to really know if another quarter point or half point is going to help? What’s the game plan here?” – Bud Kasper

How Are the Markets Reacting to the Pause and Interest Rate Forecast for the Rest of 2023?

Now, let’s look back at Dean’s May 2023 Monthly Economic Update, where he explained how seven stocks are really driving the return of the S&P 500. When Dean recorded that Monthly Economic Update on May 31, Apple, Netflix, Amazon, Mirror, Microsoft, Tesla, and Nvidia accounted for 120% of the S&P 500’s return so far in 2023.

“That’s a very narrow group of companies that all are tied to the artificial intelligence craze that’s going on. I don’t know if what we’ve seen that’s happening in the markets is real.” – Dean Barber

Price-to-Earnings Ratios

We’re going to review price-to-earnings ratios for some of those stocks that we just mentioned. The price-to-earnings ratio is the price of the stock relative to its forward-looking earnings for the next 12 months. The price-to-earnings ratio on the S&P 500—the average of all 500 stocks—is 21.94. That’s considered to be on the on the higher end of fair value. Let’s review some of these P/E ratios.

- Google: 27

- Meta: 35

- Nvidia: 227

- Microsoft: 36

- Amazon: 304

- Tesla: 80

- Apple: 31

Out of those stocks, Apple, Google, Meta, and Microsoft are the most fairly valued. Those are all still growth companies even though they’re giant companies. Nvidia and Amazon on the other hand have significantly high P/E ratios. But Bud does want to make a quick point about those two.

“The dynamics associated with those companies versus companies like Walmart and Procter & Gamble are very different because they have exciting things in their future. They trade at a multiple that’s greater than what the averages, for sure. The question is whether their business expand enough to support those type of P/Es.” – Bud Kasper

Comparing Nvidia and Amazon to Other Stocks in the S&P 500

Right now, it’s easy for people to navigate toward those tech companies. But if you look at the P/E ratios on those stocks and at the percentage of the S&P 500 that those companies make up, it’s enormous. So, what does that tell you about the rest of the companies in the S&P 500?

“There are companies in the S&P 500 that are good, strong global companies with P/E ratios between seven and 10 right now. So the question is, should I be buying those stocks relative to buying Nvidia or Amazon?” – Dean Barber

They’re going to have lower P/Es and volatility factors. But remember, if the economy isn’t growing exponentially, it’s going to be difficult for all companies. Bud read a report the other day where a manager of a large number of assets said that more than 380 of the company stocks of the 500 in the S&P 500 weren’t worth owning.

“He said the remaining balance is really the universe that we’re working out of to formulate portfolios that they feel will grow in the future.” – Bud Kasper

Questions to Ask Yourself as We Continue to Make Interest Rate Forecasts in 2023

If you look at the Equal Weight ETF of the S&P 500—which means all 500 companies have an equal weight rather than being weighed by market capitalization or by value—returns are slightly positive this year. However, people are still seeing those headlines about those six or seven tech companies that are skewing things and making investors think that everything is OK.

Should you be looking to acquire some companies that are undervalued right now? Should you be looking to reduce some exposure to some of the technology companies whose P/E ratios are out of control? Or should you be looking to deploy some money into the treasuries and create a treasury ladder? These are just a few questions to ask yourself as we continue to make interest rate forecassts in 2023.

S&P 500 Forecast for the Balance of 2023

Along with giving interest rate forecasts for the remainder of 2023, we want to look at what the S&P 500 might be at by year’s end as well.

A lot of the big institutional money managers have been calling for an S&P 500 of about 4200 by the end of the year. Right now, we are at 4372.

Remember that we said the S&P 500’s P/E ratio of 21.94 was a little bit on the high side of being fairly valued. So, if we get back down to 4200 on the S&P 500, that’s 173-point drop, which would be about a 5% decline from where we are today.

“Doesn’t the activity in the stock market tell you that people are hungry to get back into the winning side? But is that the smart thing to do at this point? With the likelihood of two more increases from the Federal Reserve, it’s still going to be a very challenging market going forward. That’s even with this burst that we’ve had in the last six to seven weeks. How long is that going to last? I don’t know the answer to that, but I know we have our challenges out there that are recessionary.” – Bud Kasper

Is It Time to Rebalance?

That begs the question if it is time to rebalance your portfolio. For example, if you started the year with a 60-40 portfolio—60% equities, 40% fixed income—you’re going to have more than 60% equities now. Is it time for a mid-year rebalance? Maybe you should take some of the profits that you’ve made in the equity portion of your portfolio and reposition into something safer.

“It could be time to rebalance with the markets valued at where they are today. We can’t be greedy. There are a lot of people that are saying that this isn’t the beginning of the next bull market. They’re calling it a bear trap. That would be a cyclical bull market in the middle of a longer-term secular bear market. Could we go back to the lows that we hit in October 2022? Or was that the low point and we’re just going to have some volatility from here?” – Dean Barber

That’s why you need to be smart and prudent with your money. Asset allocation and diversification are still key. Make sure that you don’t get so overweighted in technology that you’re get a bunch of stocks that are really overvalued because when they come down, they can come down hard.

What Is Your Interest Rate Forecast for the Rest of 2023?

It’s going to be interesting to see how this year unfolds. And as it does unfold and as Powell continues to give updated interest rate forecasts in 2023, we’ll keep you updated on how it can impact you. There’s a lot of uncertainty that we’re still dealing with, but the one thing that we are certain about is that everyone needs a financial plan. So many people immediately ask, “Am I going to be OK?” during in times of uncertainty. A comprehensive financial plan is the only thing that can give you a clear answer.

A Financial Plan Gives You Clarity Even During Uncertain Times

If you’re not a Modern Wealth client, we have a couple of ways that we can assist you in building your plan (or checking on the strength of your current plan if you’re unsure about it). First, we encourage you to check out our industry-leading financial planning tool. Our tool allows you to build a plan that’s centered around your retirement needs and goals. You can begin building your plan at no cost or obligation by clicking the “Start Planning” button below.

And if you have any questions—whether it be about the future of interest rates, inflation, or anything else that can impact your ability to retire successfully or remain retired—just let us know. The same goes for if you have questions as you’re using our financial planning tool. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, by phone, or virtually.

Watch Guide |

00:00 – Introduction

00:42 – The Fed Hits Pause

02:58 – How Big Was the Biggest Rate Hike Ever and When?

04:11 – Mortgage Rates Roller Coaster

05:40 – Treasuries and Interest Rates

08:03 – Shipping and Economic Signs

09:57 – Six Stocks Driving the Market

14:18– 2023 Retirement Planning Calendar

15:02 – The FOMC Operation to Flatten the Yield Curve

15:58 – 10 Fed Funds Rate Increases Since March 2022

18:28 – Is it Time to Rebalance?

21:29 – What Did We Learn Today?

Resources Mentioned in This Episode

Articles

- Another Tech Bubble in 2023?

- When Will the Bear Market Be Over?

- The Federal Reserve’s Monetary Policies

- Is a Recession Coming in 2023?

- 8 Questions Retirees Are Asking with Chris Rett

- Bear Market Rallies

- Inflation and Supply Chain Issues Are Intertwined

- Components of a Complete Financial Plan with Logan DeGraeve

Past Episodes

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.