How to Build Wealth in Your 20s

Key Points – How to Build Wealth in Your 20s

- Outlining Short-Term and Long-Term Financial Goals

- Start Saving Early

- It’s Not Just About How Much You Save, But Where You Save

- Understanding Your Asset and Tax Allocation

- 3 Minutes to Read | 3 Minutes to Watch

How to Build Wealth in Your 20s

It might sound like a crazy concept, but how to build wealth in your 20s is important. If you’re in your 20s right now, you’re probably asking, “How in the world do I build wealth?” One of our CFP® Professionals, Logan DeGraeve, is going to give a quick hit of how to get started with building wealth in your 20s. Logan understands the importance of how to build wealth in your 20s quite well with having just turned 31.

1. Start Early

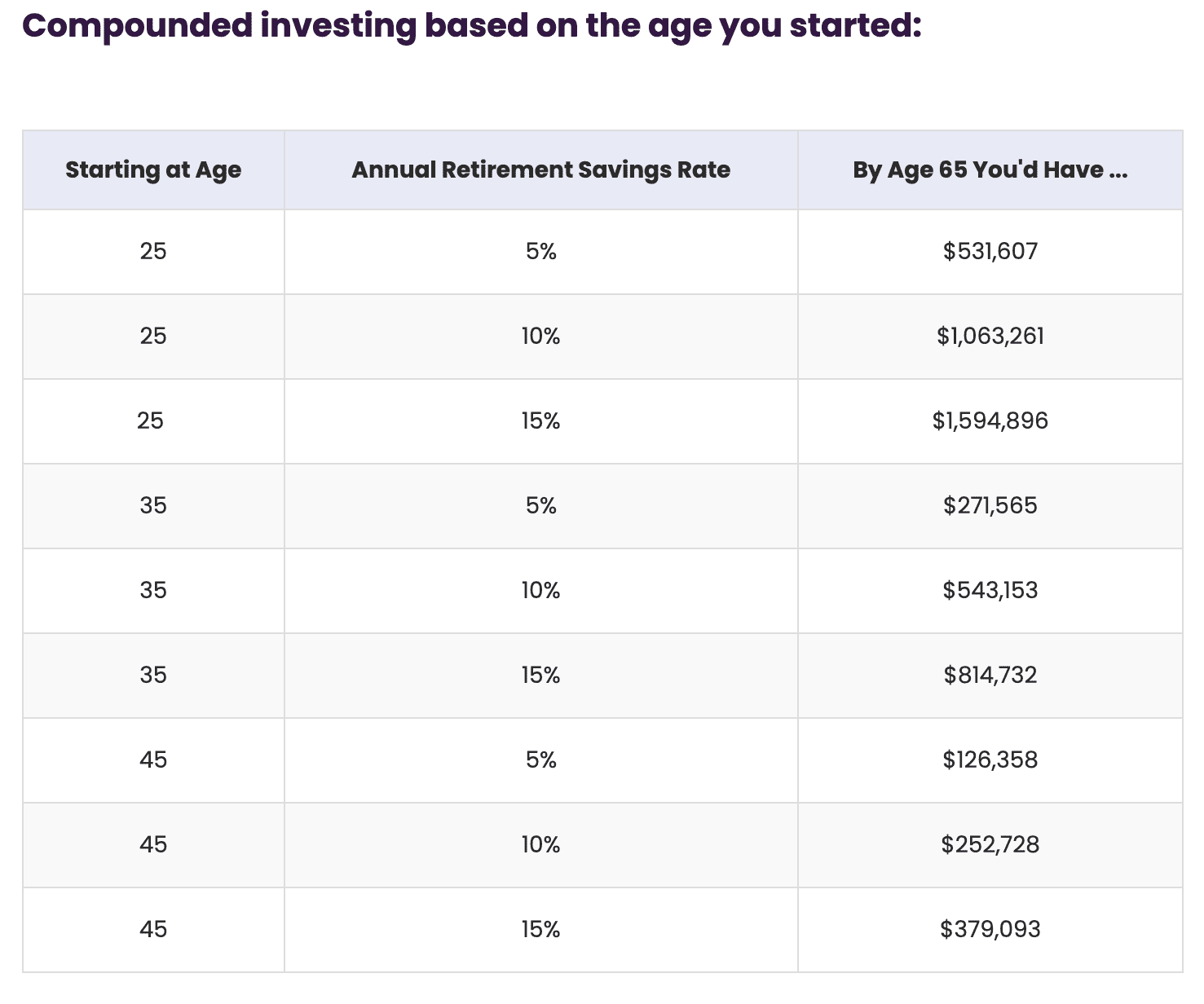

The most important thing with how to build wealth in your 20s is starting early. Let’s look at some data from a March 2022 Ally Financial study that really drives this point home. According to the U.S. Census Bureau, the average household annual income in 2020 was $67,521. If you assume that and an average annual rate of return of 6%, and saved 10% of your income starting at 25, you would have $1,063,261 by age 65.

Now, take all those same assumptions except instead of starting to save at 25, you start at 35. You would only have $543,153 by the time you were 65. See the complete breakdown in Figure 1.

FIGURE 1 – Savings by Age Study – Ally Financial

“The takeaway here is that compound interest and time are your biggest friend. Make sure at minimum that you save up to your match in your employer 401(k).” – Logan DeGraeve

2. Where to Save?

The second important thing with how to build wealth in your 20s is knowing where to save. Should you save to a traditional or Roth 401(k) or IRA? Let’s start with the 401(k)s first. When you start working in your 20s, your income is probably lower than it will be than when you’re in retirement.

That’s a good time to start focusing on the Roth bucket. You’ll pay the tax on that contribution this year, but that money will grow tax-free for the rest of your lifetime. With the traditional 401(k), you don’t need to pay the tax this year, but you’ll need to pay it when you take the money out.

“If you’re someone who is starting out in the 10%, 12%, or even 22% tax bracket, it’s a good time to start building that Roth bucket. When you get later in life and your income is higher, that might be when you want to look into deferring the taxes.” – Logan DeGraeve

3. What Are Your Goals?

When you’re figuring out how to build wealth in your 20s, what are your short-term and long-term goals? You’re probably going to be thinking about things like paying off your student loans. Do you have credit card debt? That’s bad debt and it’s critical to have a plan for how to pay that off.

Your 20s is a popular time to buy a home or look into buying a home. You’ll need to think about how much you want to put down for a down payment. What type up loan do you want to take and what type of home do you want?

It’s important to have a long-term vision with your goals as well. If you’re in your 20s and starting a family, think about college expenses for your children. And when do you want to retire? What do you want your retirement to look like?

“At most, you’re probably just trying to save. Making sure that you don’t blow your money during your 20s and 30s when you’re in your accumulation years is critical.” – Logan DeGraeve

4. Asset Allocation vs. Tax Allocation

Next up on our list for how to build wealth in your 20s is understanding asset allocation vs. tax allocation. Again, you have your tax-deferred (traditional), tax-free (Roth), and taxable (checking/savings) buckets. Look at your tax plan and make sure that you’re not saving to the wrong buckets. For instance, if you have a 401(k), you don’t want to be deferring taxes at 10%.

Bonus: Emergency Savings

In addition to having a bucketing strategy for taxable, tax-free, and tax-deferred income, it’s paramount to have your money saved to short-term, medium-term, and long-term buckets. One of the main reasons for that is so that you can build up emergency savings, which should be in a short-term bucket. By the time you’re financial planning in your 30s and 40s, set a goal to have six months of spending within an emergency fund (three months of spending if you’re married and have similar income).

Share This with People You Know Who Are in Their 20s

There’s a lot more to how to build wealth in your 20s, but we want to make sure that you’re aware of the key points to get started. Remember, the biggest things with how to build wealth in your 20s is to save as much as you can.

Typically, the clients we serve are in their retirement years. If you’re within that demographic, please share this to your kids and/or grandkids so they understand how to build wealth in their 20s. As always, if you or your kids/grandkids have any questions about how to build wealth in your 20s, please don’t hesitate to reach out to us. Our CFP® Professionals can go over those questions with you during a 20-minute “ask anything” session or complimentary consultation.

We look forward to discussing the best avenues for how to build wealth in your 20s, whether it’s for you or your kids/grandkids. Thanks again for tuning into the Modern Wealth Management Educational Series.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.