Market Sentiment and Inflation’s Impact with David Mitchell

START PLANNING Subscribe on YouTube

Market Sentiment and Inflation’s Impact with David Mitchell Show Notes

As we attempt to help educate people about market sentiment, we’ve continued to welcome back AllianceBernstein’s David Mitchell as a guest on The Guided Retirement Show. David last appeared on The Guided Retirement Show with Dean Barber in October 2023 to give his market outlook and review market trends from the previous six months.

Dean and David will review some of the things they discussed during that episode. David will also review the last six months of market performances again and give his updated market outlook to help people develop a better understanding of market sentiment.

Note: This was recorded on April 2, which was before the March inflation report was released.

In this podcast interview, you’ll learn:

- Shorter-Term Treasuries Oftentimes Are Closely Tied to the Fed Funds Rate

- Longer-Term Treasuries Attempt to Price in Future Growth and Inflation

- The Fed’s Challenges with Trying to Engineer a Soft Landing

- What Opportunities Dean and David Are Looking at in Equities and Fixed Income

A Great Deal of Volatility in Long-Term Treasuries

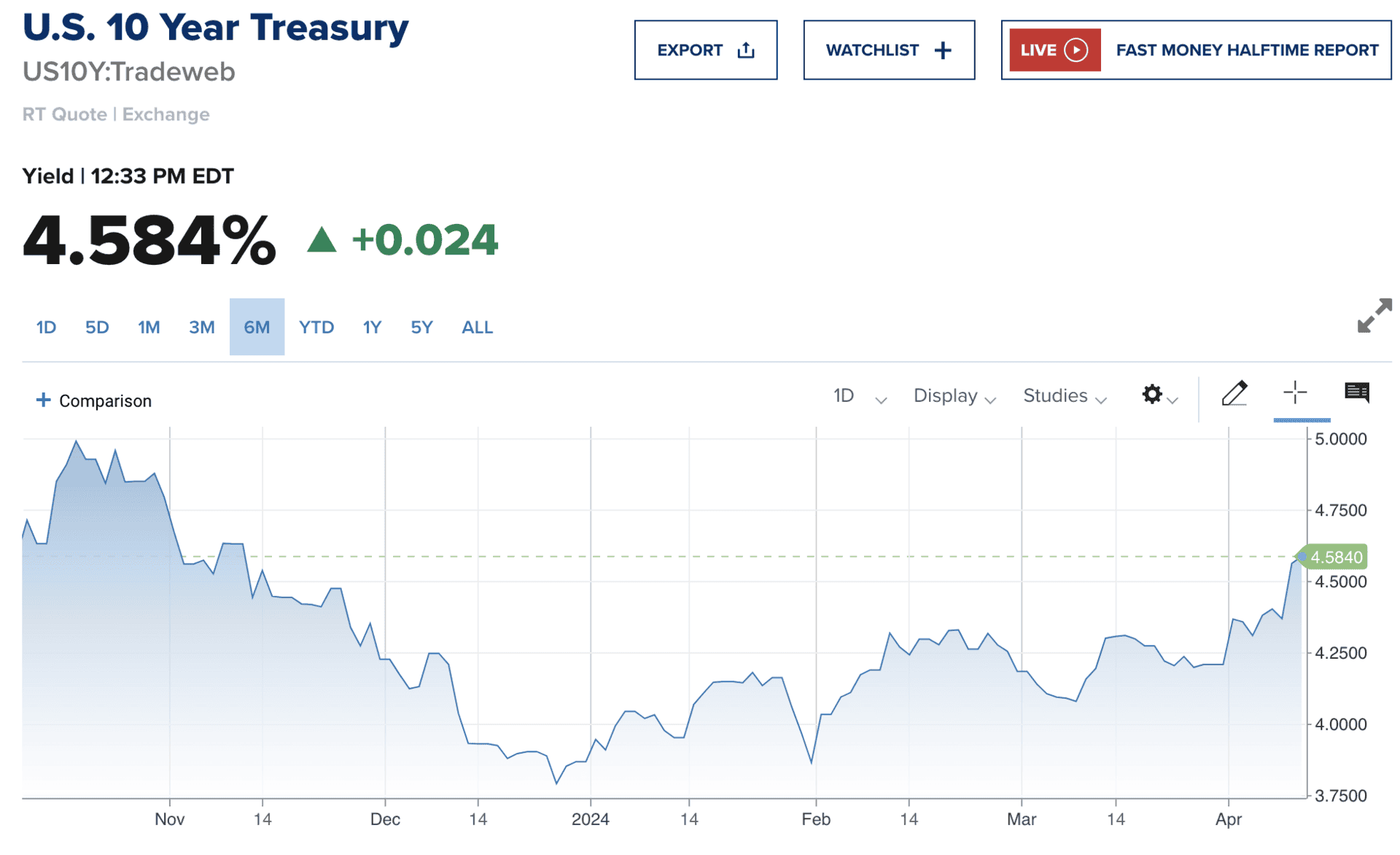

Before we dive into current market sentiment and David’s current market outlook, let’s look back at what was happening when he was last on The Guided Retirement Show in October. At that point, the 10-year treasury yield has just exceeded 5% for the first time since 2007.1

Since then, 10-year treasuries have experienced extreme volatility, dipping below 4% a couple of times and now rising back above 4.5% in early April.2

FIGURE 1 – U.S. 10-Year Treasury over the Past Six Months – CNBC/U.S. Department of Treasury

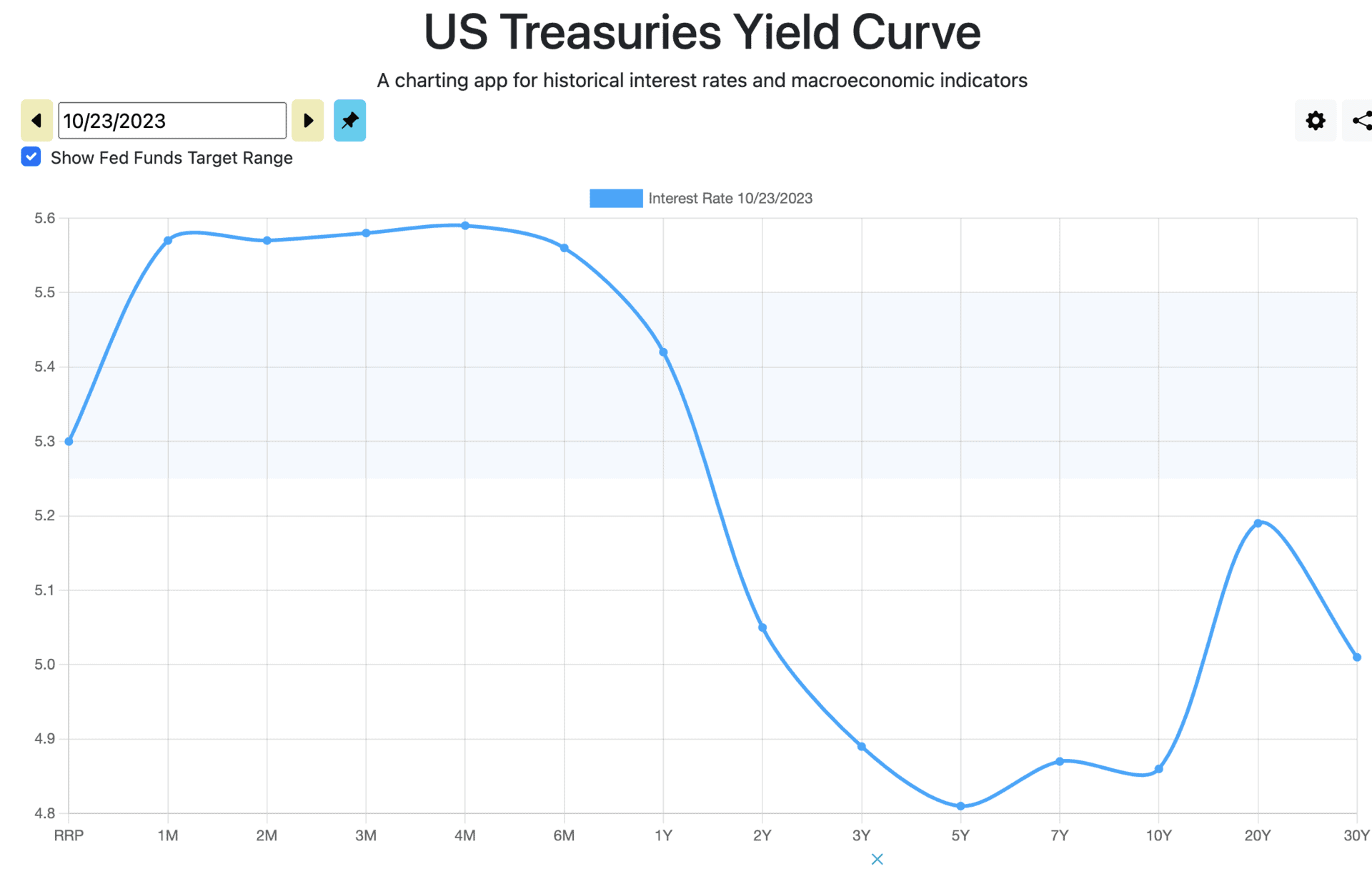

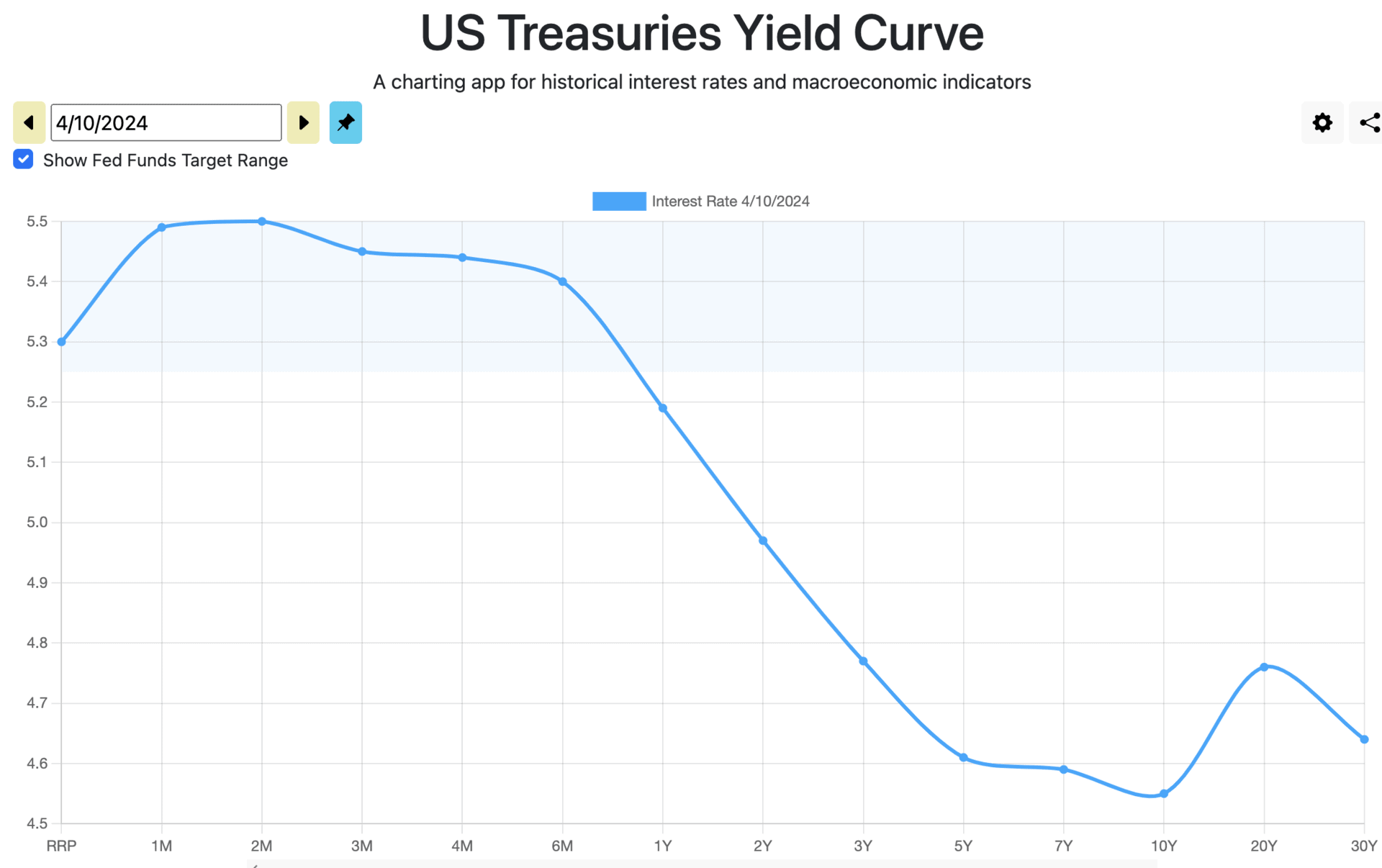

Short-term treasuries, on the other hand, have hardly experienced any movement over the past few months. On October 23, 2023, the shorter-term treasuries—ranging from the one-month to the six-month—were between 5.5% and 5.6%.3 Now, they’re between 5.4% and 5.5%.

FIGURE 2 – U.S. Treasuries Yield Curve on October 23, 2023 – U.S. Department of Treasuries

FIGURE 3 – U.S. Treasuries Yield Curve on April 10, 2024 – U.S. Department of Treasuries

Remember that interest rates and bond prices have an inverse relationship. When interest rates go up, bond prices usually fall. And vice versa. As the Fed thinks about when to start cutting interest rates and at what pace to do it at, let’s get David and Dean’s insight on the future of interest rates and inflation. Those two components have been and will likely continue to impact market sentiment.

The Correlation Between the Fed Funds Rate and Short-Term and Long-Term Treasuries

Everyone always asks David for the 30,000-foot view when it comes to assessing interest rates. The reason short-term treasury yields have not moved that much is because they’re more directly tied by what the Fed does with the overnight rate.

“They’ve stayed pretty closely linked to that because that’s the shortest part of the yield curve. However, where you have more volatility and massive swings is the 10-year treasury, which is trying to price in future growth and inflation and what the Fed might do years from now.” – David Mitchell

David and Dean agree that it can be difficult to manage clients’ emotions, financial plans, or investments on a two-to three-month time horizon. Instead, they both try to look at two-to three-year or even five-to 10-year windows.

But What’s Going on with Inflation?

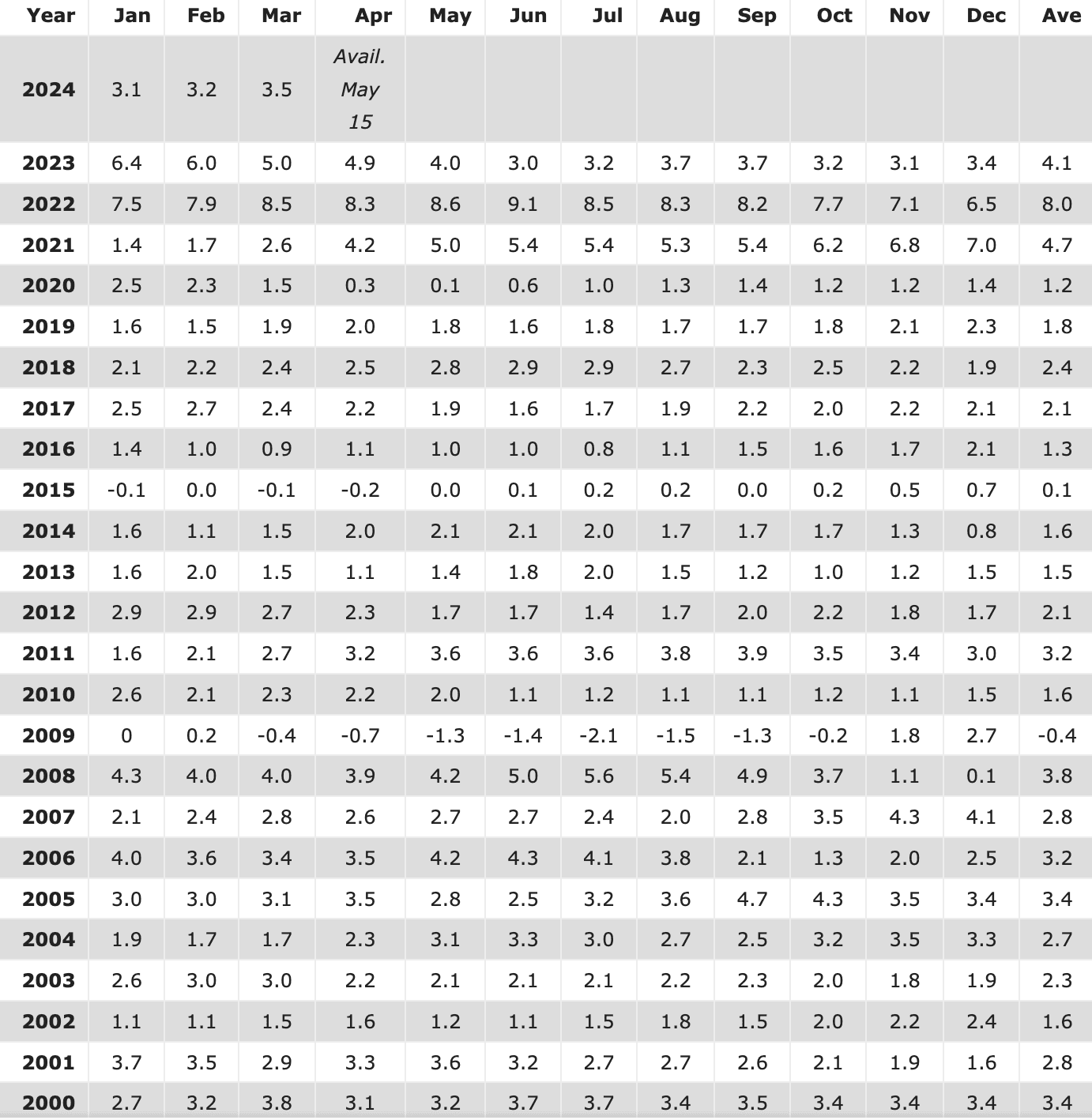

Inflation has cooled considerably since it hit 9.1% in June 2022.4 It even dropped a full percentage point from 6.0% to 5.0% from February 2023 to March 2023. However, the Consumer Price Index (CPI) accelerated faster than economists projected in March 2024.5 It came in at 3.2% in February 2024 and was projected to come in at 3.4% in March 2024, but ended up at 3.5%.

FIGURE 4 – Annual Inflation Rates – U.S. Inflation Calculator

Can the Fed Still Engineer a Soft Landing?

It’s important to understand that while prices themselves haven’t been going negative, the rate of increase has been coming down.

“(That trend) started post-COVID in goods, where we saw a lot of inflation. Then, it went to food and energy post-Russia/Ukraine. Now, it’s been more in some of the services—specifically shelter inflation— which gets into home prices and rents. That’s been a bit stickier here recently.” – David Mitchell

Lower income families and individuals start to feel shelter inflation first, not people that already own their own home. If you and your partner have been locked in a 15-year or 30-year mortgage for several years, you probably haven’t felt the brunt of shelter inflation rate the last couple of years.

Why the Fed Will Start Cutting Rates Before Getting to Its Target Inflation Goal

The Fed’s annual target for inflation remains at 2%,6 so there’s still a lot of work to be done for that to happen. If inflation is normalizing and growth remains resilient in the face of higher-for-longer interest rates, how will the Fed achieve a soft landing? Unfortunately, we don’t have a crystal ball to answer that question. That being said, David did find a quote from Federal Reserve Chairman Jerome Powell from December 2023 to be quite telling.7

“The reason you wouldn’t wait to get to 2% to cut rates is that it would be too late. You want to be reducing restriction on the economy well before 2%, so you don’t overshoot.” – Jerome Powell

David’s takeaway from Powell’s quote is the old adage of that if rates are raised high enough for long enough, something will break.8 But what could break with how strong the economy has been? Well, there are a few things that have caught David and Dean’s eyes.

Potential Cracks in the Economy?

While economic growth been strong and unemployment has remained low despite many headwinds, could there be some signs of concern that are becoming more evident? The Fed needs be cognizant of those potential pain points as they determine when it’s safe to start lower rates.

Some key things to monitor includes delinquencies on credit cards being at an all-time high9 and automobile loan delinquencies are at the highest rate since 2010.10 And as far as the housing market is concerned, the unadjusted purchase index was 23% lower than this time last year according to the Mortgage Bankers Association’s April 10 Weekly Report.11 There’s a chain reaction of economic activity with that considering how homebuying correlates with what’s going on at Home Depot, Lowe’s, and various furniture stores.

“There’s a big ripple effect there. Then, you’ve got all the companies that carry massive amounts of debt. That debt is now rolling over and going from (potentially) a 2% to 5% rate to 7%, 8%, 9%. Therefore, it costs those companies more money and hurts their profitability, which could lead to layoffs.” – Dean Barber

If those companies elect not to lay anyone off, their alternative is to raise prices. That’s the opposite of what the Fed is trying to accomplish because that could cause inflation to remain high.

Taking a Forward-Looking Approach

David and Dean still believe that the Fed is on the right track to begin to lower rates. They’re not ruling out that the path to getting there could be a rocky one, but again, they don’t have a crystal ball to predict that. But let’s run through a hypothetical situation that David laid out of how things could play out.

Rather than focus on when the first rate cut could be, let’s fast forward to December 2025. In this hypothetical scenario, inflation continues to normalize to get to between 2% and 2.5% by that time. Also, let’s say that growth comes down to 2% and the Fed funds rate falls to around 4%.

By December 2025, what do you think asset prices will be? What will market sentiment be like then? David and Dean both believe that they will go up across the board. The question, though, is what kind of stocks, bonds, real assets, and alternative investments will you want to own between now and December 2025?

Gauging Future Market Sentiment by Reflecting on Past Market Performance

David and Dean aren’t here to give you specific investment advice, but they do want to educate you about how to gauge market sentiment so you can make those decisions with confidence. So, let’s continue to break down how different asset classes have performed since David last appeared on The Guided Retirement Show in October 2023.

Look at the small-cap index and the small companies that historically carry the most amount of debt. Then, look at the mid-cap index—and not just the profitable companies. Dean points out that there has been a lot of acceleration in the small-cap and mid-cap indexes.

“Those indexes in some cases are outperforming the S&P 500 with the mega-caps. You might be asking the question, ‘Why is that?’ It’s because they’re looking at this whole scenario that rates are going to start to come down, so it may not be as bad as what people had anticipated. That’s where you’re going to start to see the movement early on.” – Dean Barber

Dean believes there is some good values out there in the small-and mid-cap space because they weren’t “bid up through the roof.” Examples include low PE stocks, high-dividend stocks, and high free cash flow stocks. Dean expects all those to be higher if the Fed funds rate is closer to 4% rather than 5.25%-5.5%.

Cap-Weighted S&P 500 vs. Equal-Weighted S&P 500

Throughout much of 2023, Dean tracked the performance of the cap-weighted S&P 500 vs. the equal-weighted S&P 500 in his Monthly Economic Updates. Two months doesn’t make a trend, but for the past two months, small caps value and the equal-weight S&P 500 has outperformed the cap-weighted S&P 500.

Look at some of the most intriguing factors that investors have historically had to pay a higher valuation or higher multiple for the privilege to own. They include companies with the highest return on equity, highest return on assets that run very efficiently and generate a lot of free cash flow.

“Nvidia and rest of the Magnificent Seven get all the headlines. I almost want to put those seven stocks over here (to the side) and talk about these other 2,500-3,000 stocks because there are a lot of interesting themes starting to emerge within that subset of stocks that just don’t get the headlines.” – David Mitchell

Another Tech Bubble?

Think about this for a minute. If you have a 401(k), what’s in it? Many people would probably say the S&P 500—large growth stocks. Those stocks have excelled and for good reason due to a strong run in the technology sector. But remember how the cap-weighted S&P 500 was driven by tech prior to the Dot-Com Bubble.

“That percentage recently eclipsed what it was during the Dot-Com Bubble. That begs the question, ‘Are we are we looking at a bubble in technology in these mega caps or is there enough room to run in those areas to support the 30, 40, 50, 60 times PE ratios? Or are they going to come back down to reality?” – Dean Barber

Of the 500ish stocks in the S&P 500, one thing that investors always look at is what percentage the largest top 10 holdings make up of the entire index. The S&P 500 hasn’t been this concentrated in 50 years.12 It almost hit 30% in 1999-2000 and it’s at 33% now.13 Nvidia, Meta, Amazon, Microsoft, Alphabet, Apple, and Tesla are leading the way.

How AI Has Impacted Market Sentiment

David says that the big difference between the Dot-Com Bubble and the current concentration within the S&P 500 is that those companies that we just listed are real companies with real cash flows. And AI is real.

“Anything levered to AI is going up in unison because people want to own AI. Ultimately, it will shake out with what companies are at the forefront of capitalizing on AI as a business model, networking systems, cloud infrastructure, things like that.” – David Mitchell

David has realized that when a lot of people hear the term “bubble” from an economic perspective, they think things need to crash and go down. He doesn’t think the price of the Magnificent Seven stocks need to crash. But he wonders if there is a time that we’re about to experience over the next one or maybe even five years where the other types of companies start to catch up.

Back in October 2023, Dean asked David if he would by the cap-weighted S&P 500 or the equal-weighted S&P 500. David said the equal-weight. It’s not that he didn’t want to own any shares of the Magnificent Seven. He just doesn’t want them to make up 30% of his stock portfolio. There’s just less risk in the equal-weight, less risk in high-dividend paying stocks, and less risk in value because there are better valuations.

“That’s where I think it goes back into having more balanced risk, a more barbell approach. This might be an opportunity to take some of the profits and rebalance.” – David Mitchell

Could We Enter a Recession in the Next Few Years?

As Dean thinks about what could be in store for the next 18 to 36 months, he envisions that the economy will continue slowing, potentially avoiding a recession. If there is a recession, he thinks it would be very mild and short lived.

Dean agrees with David in thinking that we’ll see an easing of rates from the Fed. He believes that will translate into increased values for fixed income in the bond sector and increased values for a lot of the equity sectors. But, of course, there could be disruptors. There could be things that come up that there are no signs of today—those black swan-type things.

“From a pure economic and fundamentals standpoint, it was kind of off to the races in the first quarter of 2024. Even with bonds being slightly negative in the first quarter, you’re still seeing that 60-40 portfolio up 4% or 5% on the year. Maybe we could just do that every quarter.” – Dean Barber

Or Will the Good Times Keep Rolling?

Unfortunately, it isn’t realistic to expect that to happen. David wants people to realize that a lion’s share of your return for the year in stocks and bonds usually comes in two to three months. That begs the question, will those 60-40 portfolios end the year much higher than they’re at now?

Nothing really shocks David anymore, but he would be surprised if he came back on The Guided Retirement Show in the fall and 60-40 portfolios were up close to 20%.

Will There Be Better Opportunities in Equities or Fixed Income?

Looking ahead again to December 2025, Dean believes it will be easier to make money over that timeframe in the fixed income market rather than the equity market. That being said, Dean thinks there will be good opportunities in the equity market if you approach it in the right areas.

In the next 18 months, bonds can pay you capital gains, which David says cash will never do. He says it’s easier to predict the total return with bonds because the income of a bond is the engine that drives a return.

The Capital Appreciation from Bonds

For example, let’s say that you have some individual municipal bonds in your portfolio and the prices are 102 and 104. That means that you have a 2% to 4% premium on those bonds. However, maybe the yield on your portfolio as a whole is still at about 4.5%. If you’re going to get 4.5% and it’s tax-free, and rates drop by 1% to 1.25% by December 2025, you could pick up some good appreciation.

“You get that income in addition to that return—the price appreciation on top of it.” – David Mitchell

David remembers talking with Dean on The Guided Retirement Show in October 2023 about it being a very intriguing entry point for bonds. But he and Dean didn’t imagine that November and December would be a great period for bonds return to the extent that they were. That shows how quickly you can get paid in bonds with capital appreciation. Bonds can offer consistency in the stability of their income, which you can project out—whether you plan to live off it, need to take some of it for retirement, or reinvest it.

“What’s great about bonds is that there’s a higher likelihood to understand what you’re going to earn over time.” – David Mitchell

Understanding Market Sentiment

As we wrap up this article on market sentiment, Dean and David want you to remember to not wait for the Fed to start cutting rates if you want to get into bonds. By that time, it will be too late.

Part of understanding market sentiment is realizing that the market will always move in advance of the Fed. David thinks that the markets have moved a lot already if the quote from Jerome Powell that we shared earlier is a good indication.

“People that want to be in fixed income need to start moving that money out on the duration timeline. Get something out there that can get capital appreciation that can still give you a good yield that you can lock in.” – Dean Barber

If you wait and stay in cash and rates go down, you’ll be paying more higher prices for fixed income, which equals lower yields. That’s the trade off if you wait.

Do You Have Any Questions About Market Sentiment and Inflation’s Impact?

As always, we want to thank David and the insight he shares with us and our listeners on The Guided Retirement Show. We look forward to David returning in the fall to revisit what he and Dean covered on this episode and share the latest economic trends that are impacting market sentiment.

If you have any questions about what David and Dean covered or about how market sentiment relates to your specific situation, start a conversation with our team below.

We hope that you found what David and Dean shared to be informative and that it helps educate you to make the right decisions with your money, which in turn can give you freedom from financial stress and more time to spend doing the things you love.

Resources Mentioned in This Article

- Market Outlook and the Last Six Months with David Mitchell

- 10 Ways to Fight Inflation in Retirement

- The Effect of Rising Interest Rates on the Economy

- Interest Rates and Bond Prices

- Is Inflation Still Cooling?

- Federal Reserve Takes Recession Out of Its Forecast

- The Fed and the Markets Face Multiple Headwinds with Brad Kasper

- The S&P 500 Cap-Weighted vs. Equal-Weighted Index

- Mid Cap Stocks Lead the Way in March

- Magnificent Seven Stocks Continue to Drive the Market

- Another Tech Bubble in 2023?

- Dot-Com Bubble History Remains Relevant

- Reviewing Rebalancing Strategies

- Q1 2024 Quarterly Market Update

- Examining Municipal Bonds in 2024

Other Sources

[2] https://www.cnbc.com/quotes/US10Y

[3] https://www.ustreasuryyieldcurve.com/

[4] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[6] https://www.cnbc.com/2024/04/10/fed-meeting-minutes-point-to-caution-on-inflation.html

[7] https://www.nytimes.com/2024/02/01/business/interest-rates-federal-reserve-stocks-bonds.html

[9] https://www.cnbc.com/select/us-credit-card-debt-hits-all-time-high/

[10] https://money.com/auto-loan-credit-card-bill-delinquencies/

[12] https://www.axios.com/2024/02/05/sp500-magnificent-seven-stock-market

[13] https://www.goldmansachs.com/intelligence/pages/is-the-sp-too-concentrated.html

Investment advisory services offered through Modern Wealth Management, an SEC Registered Investment Advisor

The views expressed herein represent the opinion of Modern Wealth Management, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Modern Wealth Management. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Modern Wealth Management or any other person. While such sources are believed to be reliable, Modern Wealth Management does not assume any responsibility for the accuracy or completeness of such information. Modern Wealth Management does not undertake any obligation to update the information contained herein as of any future date.