Is Inflation Still Cooling?

Key Points – Is Inflation Still Cooling?

- Breaking Down February’s Consumer Price Index Summary

- Inflation Had Been Cooling for Much of 2023

- What’s the Next Move from the Federal Reserve?

- How to Fight Inflation in Retirement

- 5 Minutes to Read | 23 Minutes to Watch

Is Inflation Still Cooling?

Schedule a Meeting Get the Retirement Plan Checklist

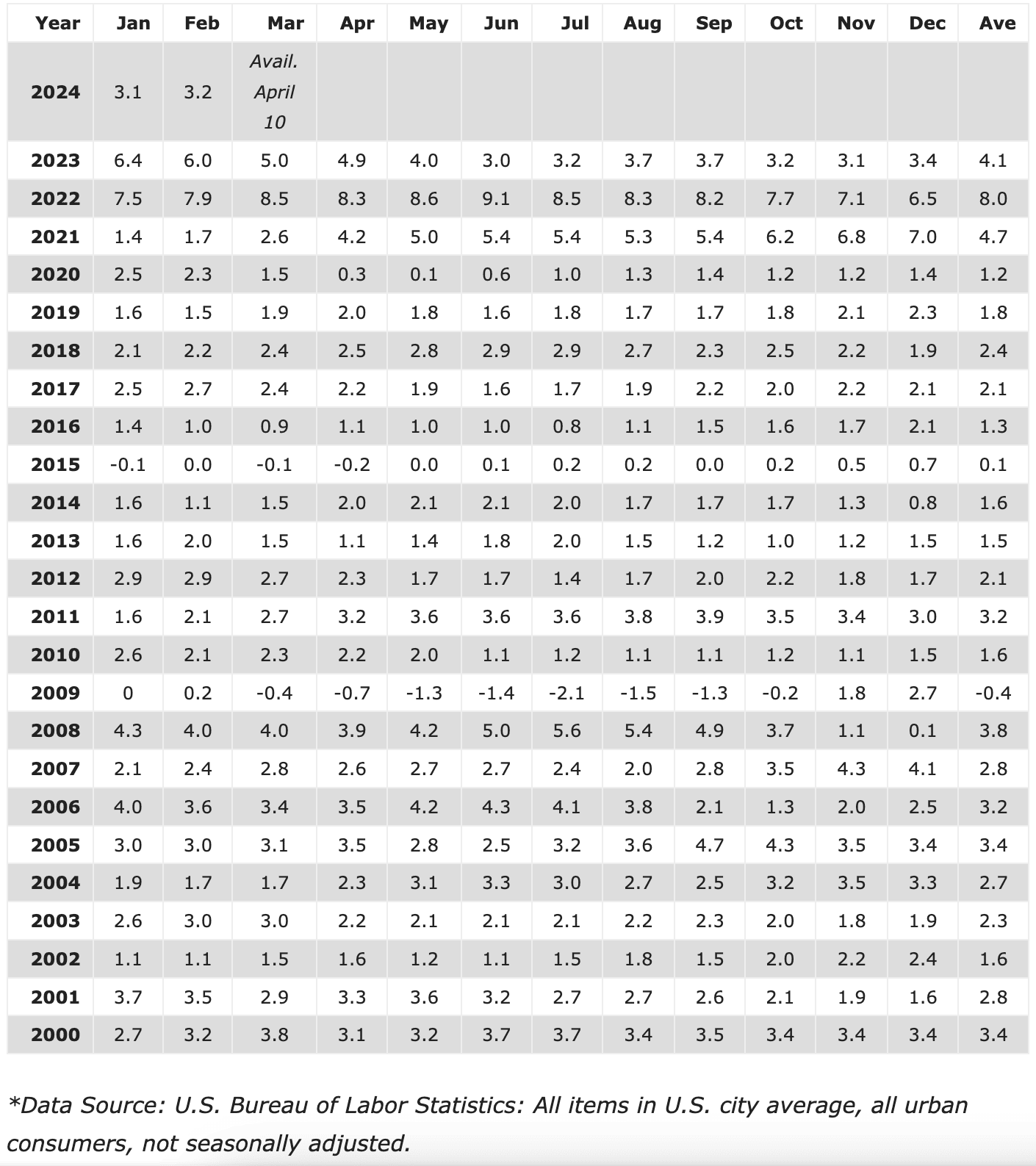

On an April 2023 episode of America’s Wealth Management Show, Dean Barber and Bud Kasper, CFP®, AIF® discussed how inflation was finally cooling after reaching a 41-year high in 2022.1 That continued to be the case for most of the rest of 2023. After year-over-year inflation hit 9.1% in June 2022, it fell to 3.1% by November 2023.2

However, the cooling trend for inflation appears to have come to a halt since then. The Consumer Price Index, which is considered as one of the leading indicators of inflation,3 increased 0.4% in February 2024 and 3.2% over the last 12 months according to the U.S. Bureau of Labor Statistics’ monthly report.4

FIGURE 1 – Year-over-Year U.S. Inflation – U.S. Bureau of Labor Statistics/U.S. Inflation Calculator

Core inflation—which doesn’t include more volatile food and energy prices—came in slightly higher than economists expected. It rose 0.4% in February and 3.8% over the past 12 months.5 Each measurement was 0.1% higher than economists were projecting.

What Will the Federal Reserve Do Next?

After the Bureau of Labor Statistics February report was released on March 12, attention now shifts to the Federal Open Market Committee’s two-day meeting on March 19-20. The Federal Reserve hasn’t wavered on its goal of 2% inflation. While inflation has cooled considerably, Modern Wealth Managing Director Bud Kasper, CFP®, AIF® has had serious doubts about whether the Fed’s 2% target is attainable. Fellow Managing Director Dean Barber has echoed Bud’s sentiments on that.

Can the Fed Get Inflation to Cool While Also Cutting Interest Rates?

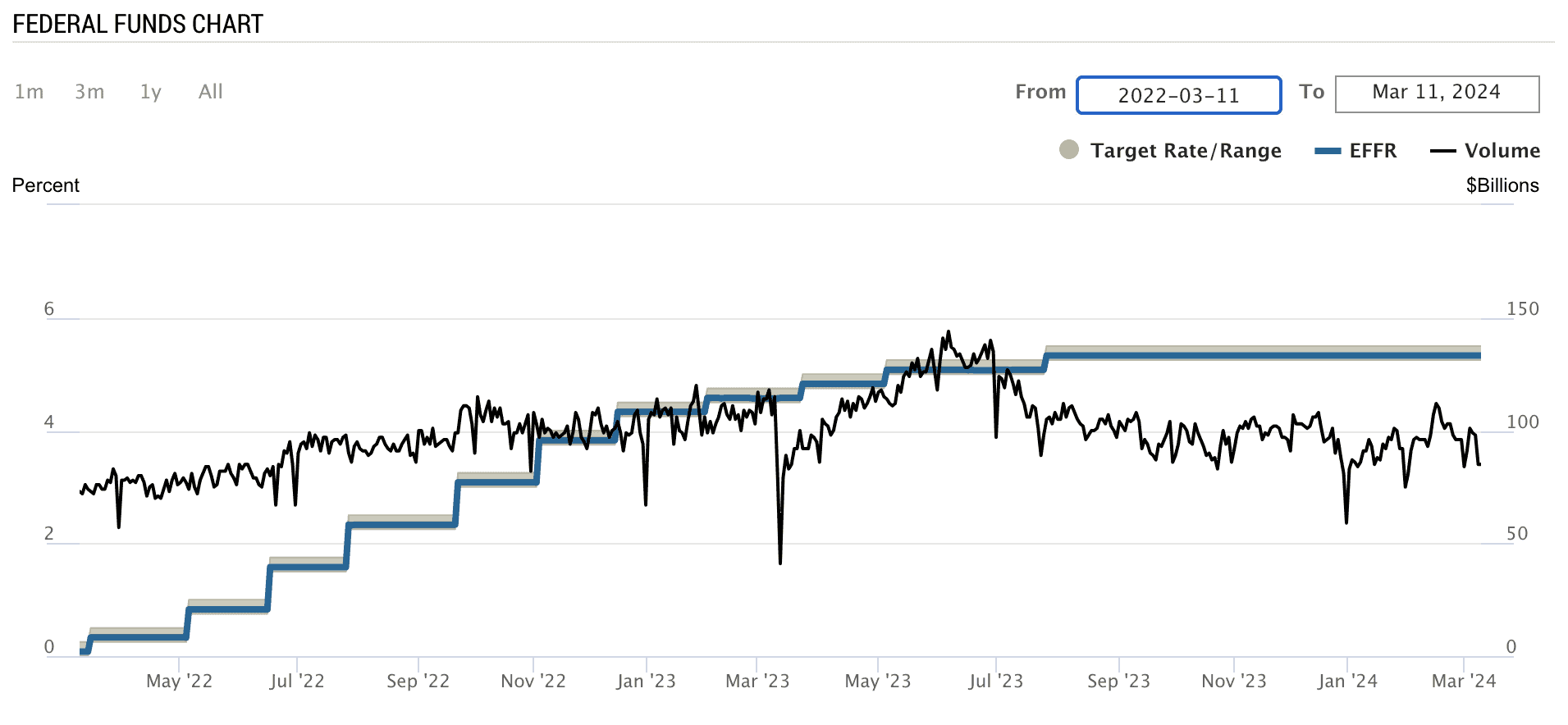

The Fed has implemented a series of 11 interest rate hikes since March 2022 in effort to achieve to kill inflation.6 Can the Fed pull off a soft landing—putting an end to inflation without causing a recession?

Along with the pressure of killing inflation, all eyes are on the Fed to see when they’ll begin cutting rates. The 11 rate hikes pushed the Fed funds rate from a 0.00-0.25% target range to a 5.25-5.50% target range.7

FIGURE 2 – Federal Funds Rate Since March 2022 – Federal Reserve Bank of New York

Federal Reserve Chairman Jerome Powell has said for a few months now to expect interest rates to begin coming down in 2024. But when Powell made his congressionally-mandated appearances on Capitol Hill on March 6-7, he couldn’t give a firm date for when that would happen.8 His top priority is cooling inflation.

“In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.” – Jerome Powell

If Inflation Was Cooling for Most of 2023, Why Didn’t I Notice It?

We can all agree that cooling inflation is something that everyone wants. But it’s important to understand that even if Powell does achieve his 2% goal, we might not see the impact of inflation cooling right away at places like the grocery store, gas station, etc. Did you notice that in 2023 and wonder why prices weren’t substantially falling? In many cases, prices continued to rise.

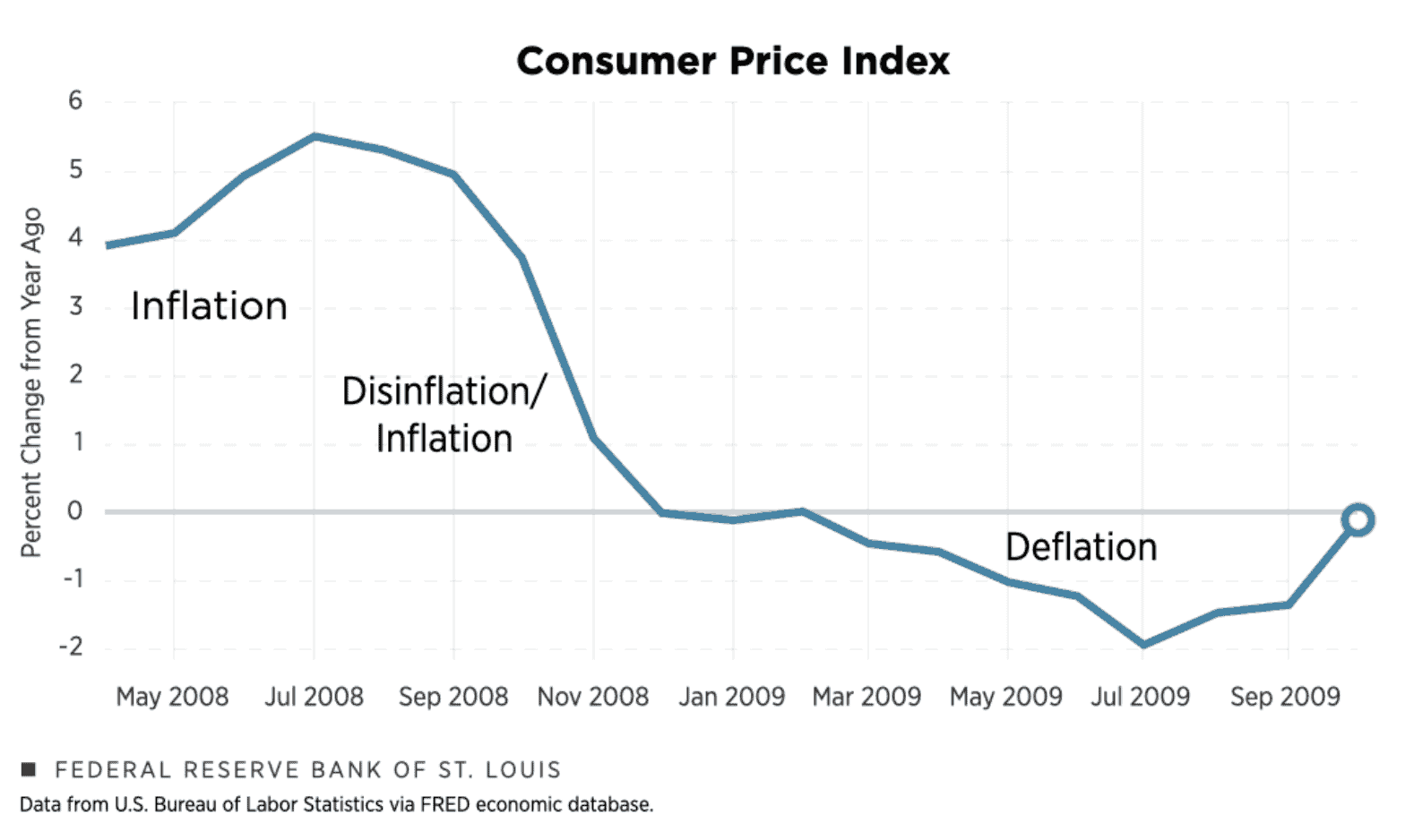

Disinflation vs. Deflation

That is what is known as disinflation. It occurs when there is a decrease in the rate of inflation—meaning that prices still increase, but at a slower rate than they had been. Disinflation has actually been the Fed’s goal to help with engineer a soft landing.

It’s important to understand that disinflation is not the same thing as deflation. Deflation occurs when there is a sustained decrease in the price level of goods and services. When prices tumble during deflationary times, that can initially turn some frowns upside down for consumers.

The catch is that deflation can wreak havoc on the economy. It usually occurs when consumer demand falls and there’s an overproduction of goods/services. Deflation oftentimes means we’re in a recession. That’s not something that the Fed wants either, but again, its No. 1 goal is ending inflation.

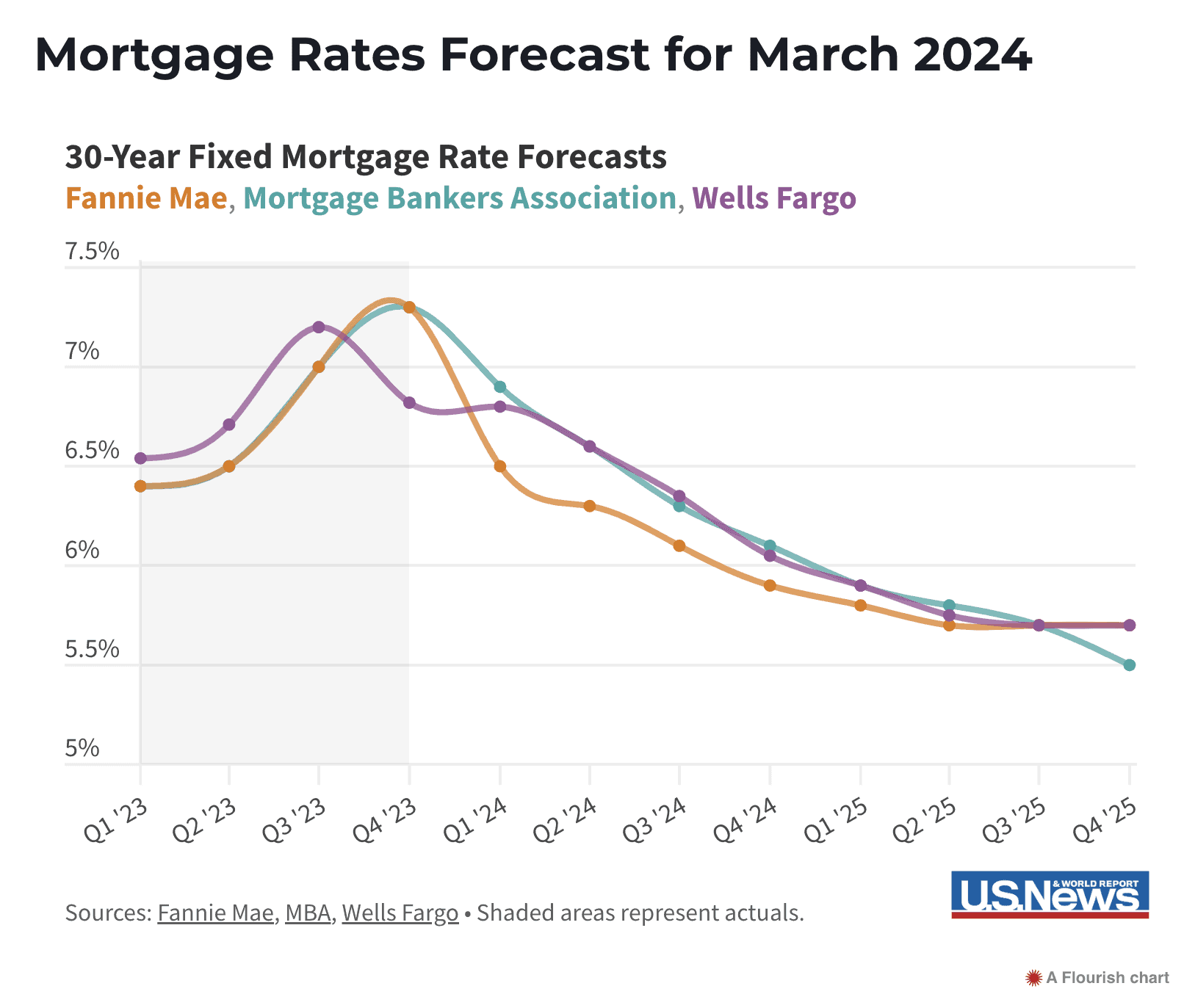

An Exception Where Deflation Is Needed

However, if you’ve been monitoring the housing market, it’s more than fair to ask if real estate needs to deflate. 30-year mortgage rates remain over 7%.9 They are projected to fall when the Fed begins cutting rates,10 but will that happen? That’s yet another reason to pay close attention to the Fed’s actions in the coming months.

FIGURE 3 – Mortgage Rates Forecast for March 2024 – U.S. News/Fannie Mae/MBA/Wells Fargo

Is Deflation on the Horizon?

If you’re wondering when the last time deflation occurred in the U.S., it was the Great Recession.11 Check out the measurements from the consumer price index during and immediately following the Great Recession in Figure 4.12

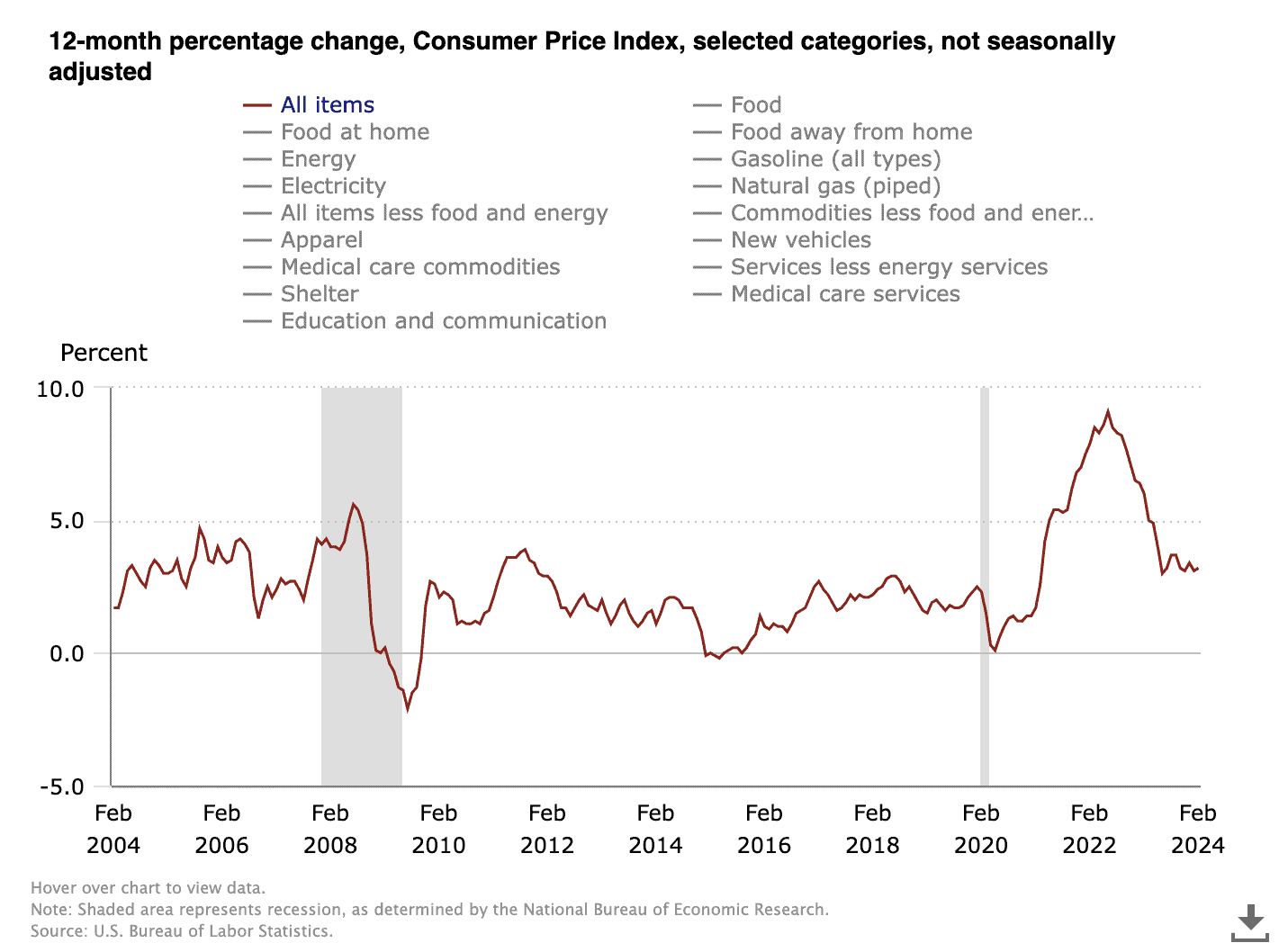

Now, let’s look at Figure 5 to see how that timeframe compares to the last couple of years when it comes to year-over-year changes in CPI.

FIGURE 5 – 12-month Percentage Change in CPI – U.S. Bureau of Labor Statistics

Planning for Inflation, Disinflation, and Deflation

We clearly aren’t in another Great Recession, but it’s easy to see how there are some similar trends. And those are trends that we can continue to learn from. While we all hope inflation cools to the point where we can feel some relief when making everyday purchases, what if deflation does surface while you’re in retirement? That’s something that you need to plan for.

You can plan for inflation, disinflation, and deflation by building a forward-looking financial plan that has been stress tested through periods like the Great Recession. When you’re fighting inflation while you’re working, you obviously have a paycheck that you can fall back on during times of economic uncertainty. Stress testing your financial plan for high inflation, down markets, etc. is critical as you’re planning for when that paycheck goes away in retirement.

You’ll notice that stress testing and inflation are both mentioned multiple times in our Retirement Plan Checklist. It’s comprised of 30 yes-or-no questions that gauge your retirement readiness as well as age-and date-based timelines that highlight several retirement considerations. You can download your copy below.

Don’t Go into Retirement with a Plan of Hope

We all hope that inflation will cool and that inflation won’t hang over our heads in retirement. But do you really want to leave something like your retirement to chance? Along with having a financial plan that is regularly stress tested, you should have a team of financial professionals that’s working for you.

At Modern Wealth, our team consists of CFP® Professionals, CPAs, CFAs, estate planning specialists, and risk management specialists. Each team member is committed to giving you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love. Inflation can oftentimes be one of the biggest instigators of financial stress, but it doesn’t have to be. To learn more about how to plan for inflation, start a conversation with our team below.

When we build financial plans, we don’t just apply one inflation factor to all the expenses within your spending plan. It’s important to understand that different expenses inflate at different rates. For example, we’ll typically inflate your everyday expenses at 4%, but will inflate health care costs at 6.5%. That’s because health care costs have been inflating at a much higher rate than goods and services.13

If you go back to Figure 1, you’ll see that inflation was under that 4% mark from October 2008 to March 2021. But by using that 4% factor (and 6.5% for health care costs), you can lessen the blow during times of higher inflation. Instead of constantly stewing about inflation cooling, make sure you’re properly planning for inflation within your financial plan with the help of a team of professionals. We’re ready to help you do exactly that at Modern Wealth.

Is Inflation Still Cooling? | Watch Guide

00:00 – Introduction

01:45 – Inflation – Too Hot, Too Cold?

04:46 – Year Over Year Inflation

08:04 – Is this a Year of Rate Cuts Globally?

11:24 – Addressing Inflation in Your Financial Plan

14:56 – The Markets and Interest Rates

22:12 – What We Learned Today

Articles

- Federal Reserve Takes Recession Out of Its Forecast

- Richcession or Recession: Where Are We Heading?

- The Great Recession’s History Remains Relevant

- 10 Ways to Fight Inflation in Retirement

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Why You Need a Financial Planning Team with Jason Gordo

- Setting Up a Spending Plan for Retirement

Past Shows

- Is Inflation Slowing?

- The Effect of Rising Interest Rates on the Economy

- Disinflation vs. Deflation: How Are They Different?

- Stress Testing Your Financial Plan

- Planning for Uncertainty in Retirement

- Don’t Retire with Doing These Things First

- 5 Financial Planning Considerations

- Meet Modern Wealth Management

- 7 Wealth Protection Tactics

- Financial Stress: How Do You Deal with It?

- 7 Overlooked Budget Items in Retirement

Downloads

Other Sources

[1] https://www.crfb.org/blogs/2022-inflation-hit-41-year-record

[2] https://www.usinflationcalculator.com/inflation/current-inflation-rates/

[3] https://www.investopedia.com/terms/c/consumerpriceindex.asp#

[4] https://www.bls.gov/news.release/cpi.nr0.htm

[6] https://www.thestreet.com/fed/fed-rate-hikes-2022-2023-timeline-discussion

[7] https://www.newyorkfed.org/markets/reference-rates/effr

[9] https://www.marketwatch.com/guides/mortgages/mortgage-rates-for-monday-03-11-2024/

[10] https://money.usnews.com/loans/mortgages/mortgage-rate-forecast

[12] https://www.stlouisfed.org/open-vault/2023/august/explaining-inflation-disinflation-deflation

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.