Disinflation vs Deflation: How Are They Different?

- Understanding Inflation, Disinflation and Deflation

- Why the Fed Has Wanted Disinflation

- And Why They Want to Avoid Deflation

- Looking Back at the Great Recession

- 5 Minutes to Read | 24 Minutes to Watch

2023 Economic Buzzwords: Inflation, Disinflation and Deflation

Inflation is a word we’ve become all too familiar with over the past couple of years, but it’s far from the only economic buzzword that’s been trending. Have you heard about disinflation and deflation and understand what each term means? Obviously, they sound similar, so there’s no shame in confusing them.

Still, it’s important to know what disinflation and deflation mean and how they’re different. Dean Barber and Bud Kasper, CFP® are going to help us with that as they offer their insight on inflation, disinflation and deflation.

Schedule a Meeting Get the Retirement Plan Checklist

Defining Inflation and Disinflation

Before we dive into explaining the differences between disinflation and deflation, let’s make sure everyone understand exactly what inflation is. The U.S. Department of Labor defines inflation as the overall general upward price movement of goods and services in an economy.

Disinflation is simply a decrease in the rate of inflation. In other words, disinflation happens when prices go up, but at a slower rate than they were previously. That has been what we’ve been experiencing for much of 2023. In fact, it’s what the Federal Reserve has been hoping for. They’ve wanted disinflation to put an end to inflation. Killing inflation has been the Fed’s No. 1 goal. Can the Fed engineer a soft landing?

“I was on the phone this week with one of the chief economists at AllianceBernstein, and they think that the economy will slow in 2024 but will remain positive. They’re seeing signs that a soft landing can be achieved.” – Dean Barber

Speaking of which, Dean will be joined by AllianceBernstein’s David Mitchell on October 24 on The Guided Retirement Show to discuss his market outlook and review the last six months. Make sure you’re subscribed to The Guided Retirement Show on YouTube so you don’t miss it!

The Vicious Circle of Inflation

The Fed’s objective to slow inflation hasn’t been an easy task. That’s evidenced by the 11 interest rate hikes the Fed has implemented since March 2022. Since 2012, the Fed has used a 2% target rate for inflation. Dean and Bud have said on several occasions that that might no longer be a realistic goal.

“The Fed wants to get us back to 2%. Can they do that without causing a recession? Or can they do that without causing a deflationary environment? There are some areas that need to deflate, such as real estate.” – Dean Barber

Let’s discuss disinflation a little bit more before moving on to deflation. The reasoning for the Fed’s 2% target goal is if a family spends the same amount year over year and only needs to pay 2% more, it won’t drastically impact how they go about paying for their day-to-day expenses. That 2% increase also gives the Fed some cushion to overcome economic declines by slashing interest rates.

However, if inflation rises well above 2%, problems can quickly surface like we saw last year. Obviously, people and businesses don’t want to pay more for their daily needs. So, people need more money to pay for their day-to-day things, and ask their employers for more money. To meet their employees’ demands, businesses typically need to increase their prices. But they’re asking people that might be struggling just to get by due to the increase in cost of daily goods. Inflation is indeed a vicious circle.

Immaculate Disinflation?

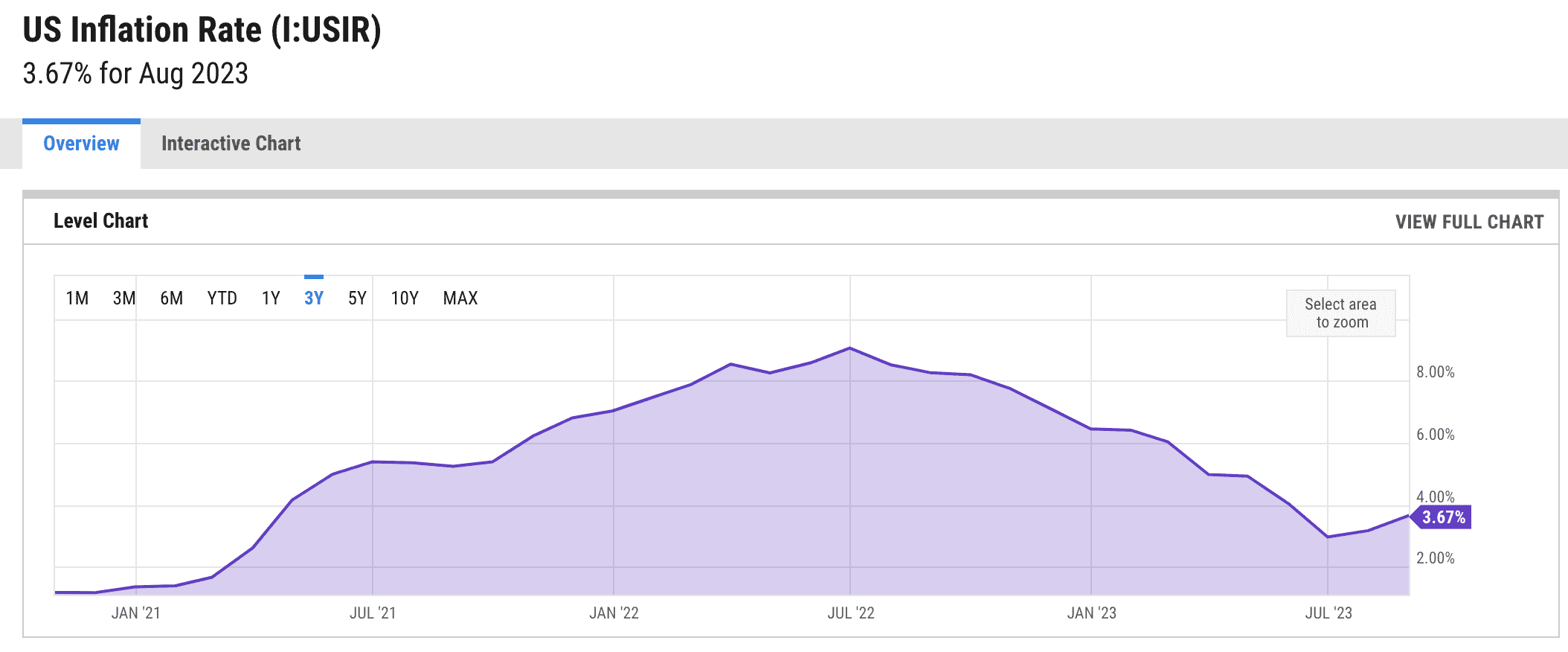

Inflation peaked at 9.1% in June 2022. That was a time we’d all probably like to forget. It slowed all the way to 2.97% by June 2023, but the September CPI report is expected to indicate a 3.6% increase in inflation according to FactSet.

FIGURE 1 – US Inflation Rate – YCharts

But if the inflation rate is substantially lower than last summer, why are prices not dropping? In fact, some prices are still going up. Well, that’s disinflation. Or immaculate disinflation as some economists have coined it. FOMC Chairman Jerome Powell said otherwise, though, at the FOMC’s September meeting in Jackson Hole, Wyoming.

“I wouldn’t call this disinflation immaculate. There’s a good question as to what’s around the corner at the last mile.” – Jerome Powell

It’s still too early to tell what the end effects of the Fed’s substantial interest rate hike cycle will be. Remember that an interest rate hike isn’t typically felt in the economy until nine to 12 months following the hike. So, what will the Fed’s next move be and when could rates finally start to decline? Those are two big questions that don’t have clear answers. We’ll see what happens at the FOMC’s October 31-November 1 meeting.

Defining Deflation

Now that we’ve reviewed the inflationary environment from the past year and a half or so and explained the process of disinflation, let’s define deflation. Deflation is the sustained decrease in the price level of goods and services. It’s usually associated with the contraction in money and credit supply in the economy.

Prices decline during times of deflation, which obviously can make consumers happy. However, deflation can be detrimental to the economy. Its root causes are typically a decline in consumer demand, an overabundance in production of goods and services, or an economic downturn.

There are dangers with deflation because typically when we have deflation, it means we’re in a recession. Our economy has cycles. It ebbs and flows, so think of it as a pendulum. That pendulum swings too far one way or another. It never stops in the middle where it should be. That’s how it is with the Fed’s 2% inflation target rate.

“Inevitably, it’s going to swing too far one way or the other—too much inflation, not enough inflation. If we go to deflation, we have a recession, companies laying people off, foreclosures, and bankruptcies. Deflation is a dangerous thing.” – Dean Barber

Using the Great Recession to See the Full Picture of Inflation, Disinflation and Deflation

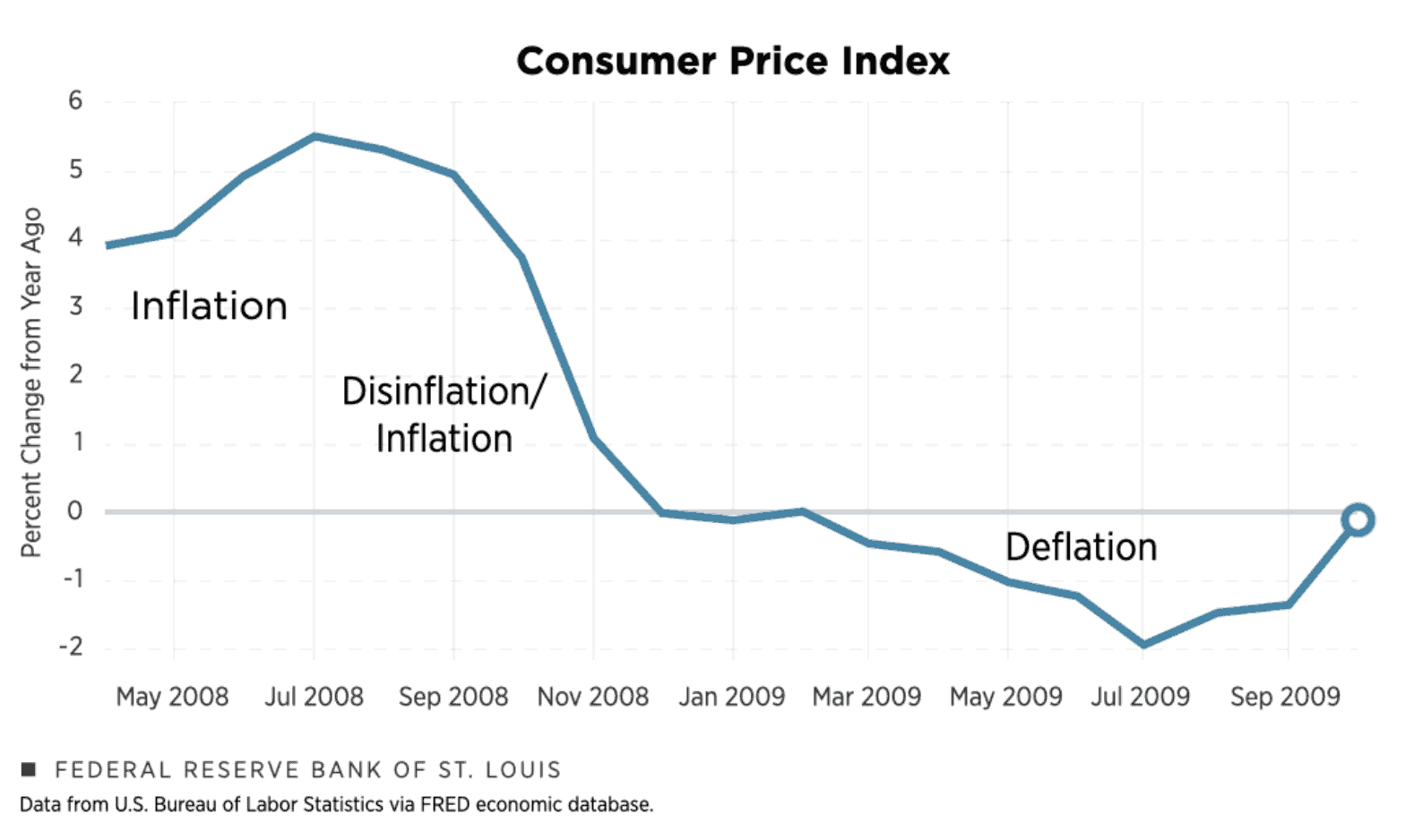

The last time we had deflation was the Great Recession, so let’s look back on that to get a better understanding of inflation, disinflation and deflation. Figure 2, below, shows the change in CPI during the Great Recession and the early aftermath of it.

FIGURE 2 – Consumer Price Index During the Great Recession – Federal Reserve Bank of St. Louis

So, we saw inflation from April 2008 to November 2008, disinflation from July 2008 to November 2008, and deflation from March 2009 to October 2009. It’s important to remember some advice from Mark Twain here—history doesn’t repeat itself, but it does often rhyme. We all know that we aren’t in the midst another Great Recession, but as Shane Barber pointed out back in August 2022, we saw some similarities that we can learn from.

“We can take a financial plan and stress test it through specific times like the Great Recession. Therefore, people can walk in with their eyes wide open to the possibility of these different types of events. From a retirement perspective, it’s critical to know what path you’re going to be on and will that path take you to where you want to be?”

Is Deflation on the Way or Is Inflation Going to Stick Around?

In August 2023, Economist Dieter Wermuth shared that disinflation that we’ve been experiencing for much of 2023 could soon turn into deflation.

“To speculate about deflation again at this point looks premature at first glance, but not at the second. For several reasons the risk of a falling consumer price level has increased.” – Economist Dieter Wermuth

But others are concerned that inflation could take off again like it did back in the 1970s.Like Dean mentioned earlier there are some sectors, like real estate, that need to deflate. Residential real estate is out of control with 30-year mortgages around 8%.

“This is reminiscent of back to Jimmy Carter’s presidency where people are struggling to get into a home. Of course, all this is impacting economic activity. It’s very uncomfortable and it’s not productive to the to the gross domestic product of our country.” – Bud Kasper, CFP®

There are people that are relying on credit cards to make ends meet. That’s much different than making a purchase with a credit card to get a few points to fly for free or get cash back. People are borrowing money on a monthly basis just do the essentials.

The bottom line is that the Fed still has a lot on its plate and needs to be careful. Like we said earlier, all eyes will continue to be on the Fed ahead of its next meeting.

We Can’t Predict Inflation, Disinflation and Deflation, But We Can Plan for It

We wish we had a crystal ball and could tell you what’s going to happen next, but that crystal ball doesn’t exist for anyone. Still, it’s our responsibility to follow the economic trends—whether we’re experiencing inflation, disinflation or deflation—to help people make educated and informed decisions to get to and through retirement.

The Relationship Between Interest Rates and Bond Prices

For example, let’s say we go into a period of deflation. The best asset you can own is one that people are bailing out of right now, and that’s bonds. A bond is a loan to an entity, and as long as you’re loaning to a solid entity, you’re going to get your money back.

“As we have a disinflationary or deflationary environment or recession, what’s naturally going to occur is a decrease in interest rates. And a decrease in interest rates will have a positive impact on the value of the bond. Not only can you get the coupon from the bond, but you can get some appreciation as we go into that type of an environment.” – Dean Barber

Bonds were down 13% last year and they’re negative again this year. They did come back earlier in the year only to find themselves back down at this point. Could they drop further? It’s certainly possible.

“This has been a 40-year low for bonds. It’s especially hard for people in retirement who understand that bonds are supposed to be a buffer to volatility. The return coming off those bonds is typically a stabilizer for income that comes into the equation for distributions.” – Bud Kasper, CFP®

A Roaring Comeback in Store for Longer Maturity Bonds?

The old saying is that stocks are a get-rich investment and bonds are a stay-rich investment. While that hasn’t been true lately, that’s important to remember. While it’s anyone’s guess on what will happen next, Dean thinks it’s a good idea to still own some longer maturity bonds.

“With where interest rates are at, if we’re in this disinflationary or deflationary environment, those longer maturity issues are going to come roaring back if the Fed needs to pivot and the begin to lower rates.” – Dean Barber

If you’ve already reviewed our Retirement Plan Checklist, you might remember that there were questions about fixed income investments as well as poor market conditions and inflation. All that and much more needs to be considered as you’re planning to get to and through retirement. Our Retirement Plan Checklist includes 30 yes-or-no questions and an age-based and retirement timelines of key retirement considerations. Download your copy below!

If you have any questions and/or concerns about inflation, disinflation or deflation, we want to hear from you. Again, while those economic trends aren’t something we can control, we can plan for them. Don’t let economic buzzwords like inflation, disinflation and deflation drive your decisions. Put a plan together that looks at your personal situation and then have that plan stress tested. Make sure that no matter what happens that you’re going to be OK.

You can discuss how to go about that during a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals. See our schedule below to schedule a time for an in-person, virtual, or phone meeting.

We hope this discussion about inflation, disinflation and deflation has given you a better understanding of what’s been going on in the economy. As always, make sure to stay tuned for Dean’s Monthly Economic Update, which will be released shortly after the Fed’s next meeting.

Watch Guide | Disinflation vs Deflation: How Are They Different?

00:00 – Introduction

01:13 – Disinflation, Deflation, and Inflation

04:28 – Today’s Economy

06:50 – Let’s Talk About Bonds

13:26 – Inflation’s Peak

16:55 – Dangers of Deflation

22:19 – What We Learned Today

Articles

- Federal Reserve Takes Recession Out of Its Forecast

- Monetary Policy Tools: The Fed’s Latest Actions with Brad Kasper

- The Long-Term Market Outlook with David Mitchell

- Why the Great Recession’s History Remains Relevant

- Components of a Complete Financial Plan with Logan DeGraeve

Past Shows

- 10 Ways to Fight Inflation in Retirement

- Inflation Rates and the Fed

- Interest Rates and Bond Prices

- Don’t Retire without Doing These Things First

- Stress Testing Your Financial Plan

- 4 Retirement Risks That Are Out of Your Control

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.