Federal Reserve Takes Recession Out of Its Forecast

Key Points – Federal Reserve Takes Recession Out of Its Forecast

- August Was a Rough Month for the Markets

- Looking at Top Holdings for the Nasdaq 100 and Dow Jones Industrial Average

- Can the Federal Reserve Avoid a Recession and Engineer a Soft Landing?

- Yield Curve Remains Inverted and Signals a Slowing Economy

- 4 Minutes to Read | 8 Minutes to Watch

The data in today’s article is as of August 30, 2023.

Federal Reserve Chairman Jerome Powell’s Forecast Doesn’t Include a Recession

Can the Federal Reserve avoid a recession even if it is done raising interest rates? Federal Reserve Chairman Jerome Powell says he’s taking the word recession out of his forecast. We’re going to discuss that and break down a rough month of August for the markets in our August Monthly Economic Update.

What’s in Store for the Rest of 2023?

The month of August was kind of treacherous in the markets. We saw pullback pretty much across the board. Federal Reserve Chairman Jerome Powell also hinted at the fact that he may not quite be done with interest rates yet. We also still have a highly inverted yield curve. What does that all mean? What is the end of this year going to bring? Are we going to go into a recession?

August Market Performances

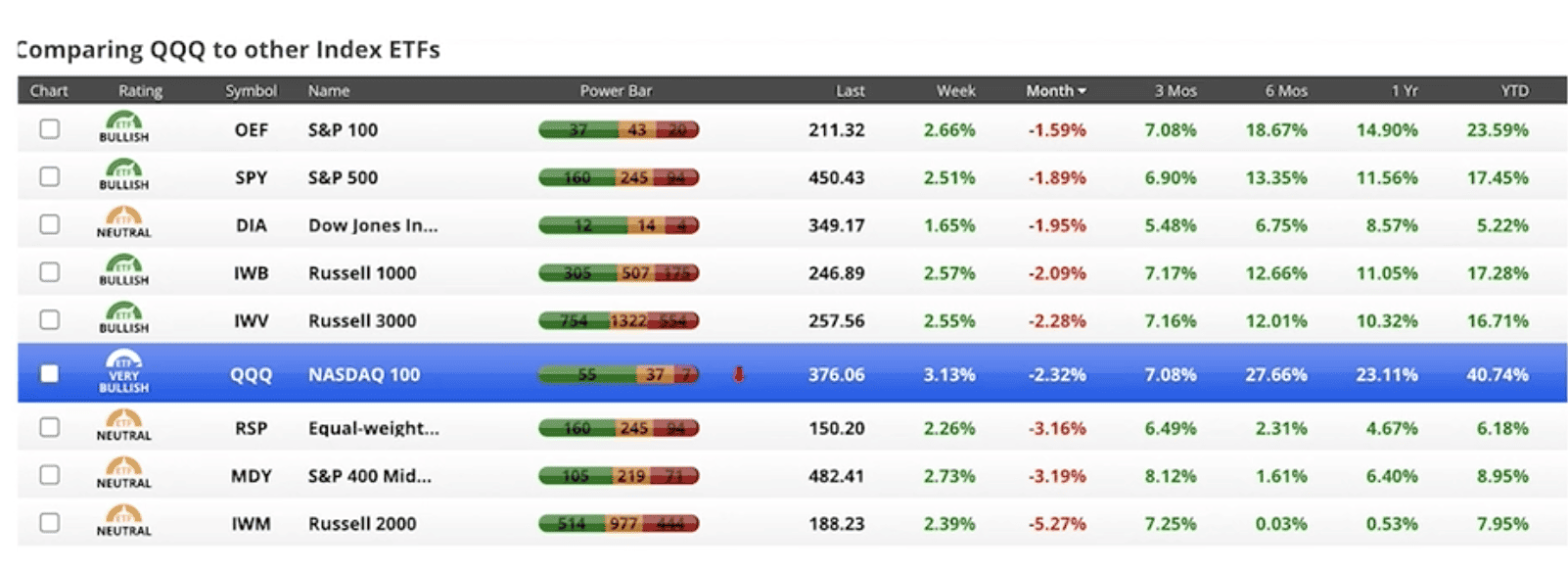

Let’s start with a quick look at the markets for August. Through August 30, the S&P 100 is the best performing index at -1.59%. The Russell 2000 is the worst performing index at -5.27%.

FIGURE 1 – Market Performances – Chaikin Analytics

Nasdaq 100 Top Holdings

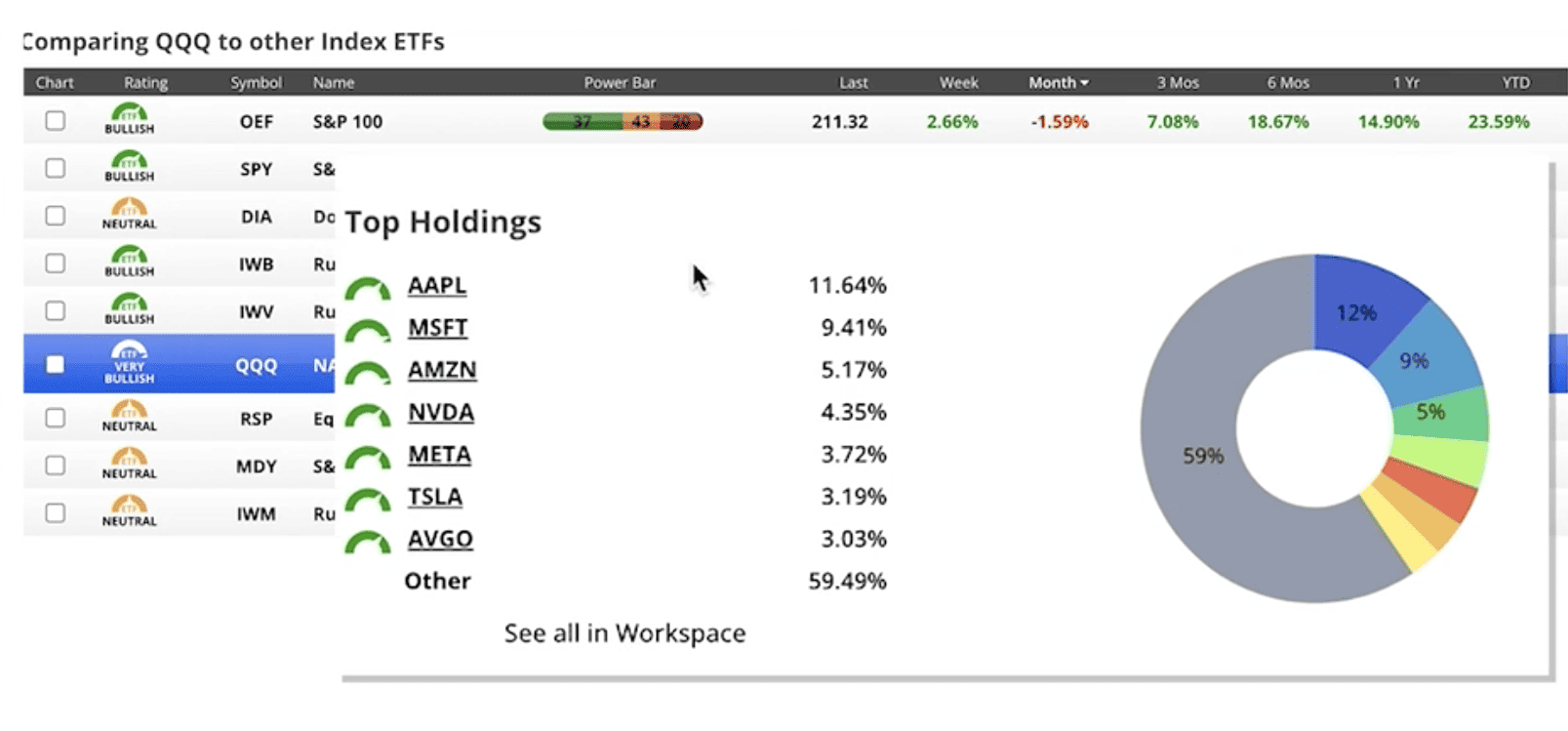

I’ve been pointing out over the last several months whether these indexes are in bullish territory, neutral territory, or bearish territory. Today, everything is neutral, bullish, or very bullish. The Nasdaq 100 is the one that is very bullish right now. Seven of the stocks in the in the Nasdaq 100 are making up about 40.5% of the total index.

FIGURE 2 – Nasdaq 100 Top Holdings – Chaikin Analytics

AVGO, which is Broadcom, has entered the top seven. The other 93 stocks are 59.49% of that index. That index did lose 2.32% in August. However, it is up 40.74% year to date.

Now, remember, the Nasdaq was the worst performing sector for 2022. It’s barely back to where it was in January 2022, even though it has been an extremely strong performer.

Dow Jones Industrial Average Top Holdings

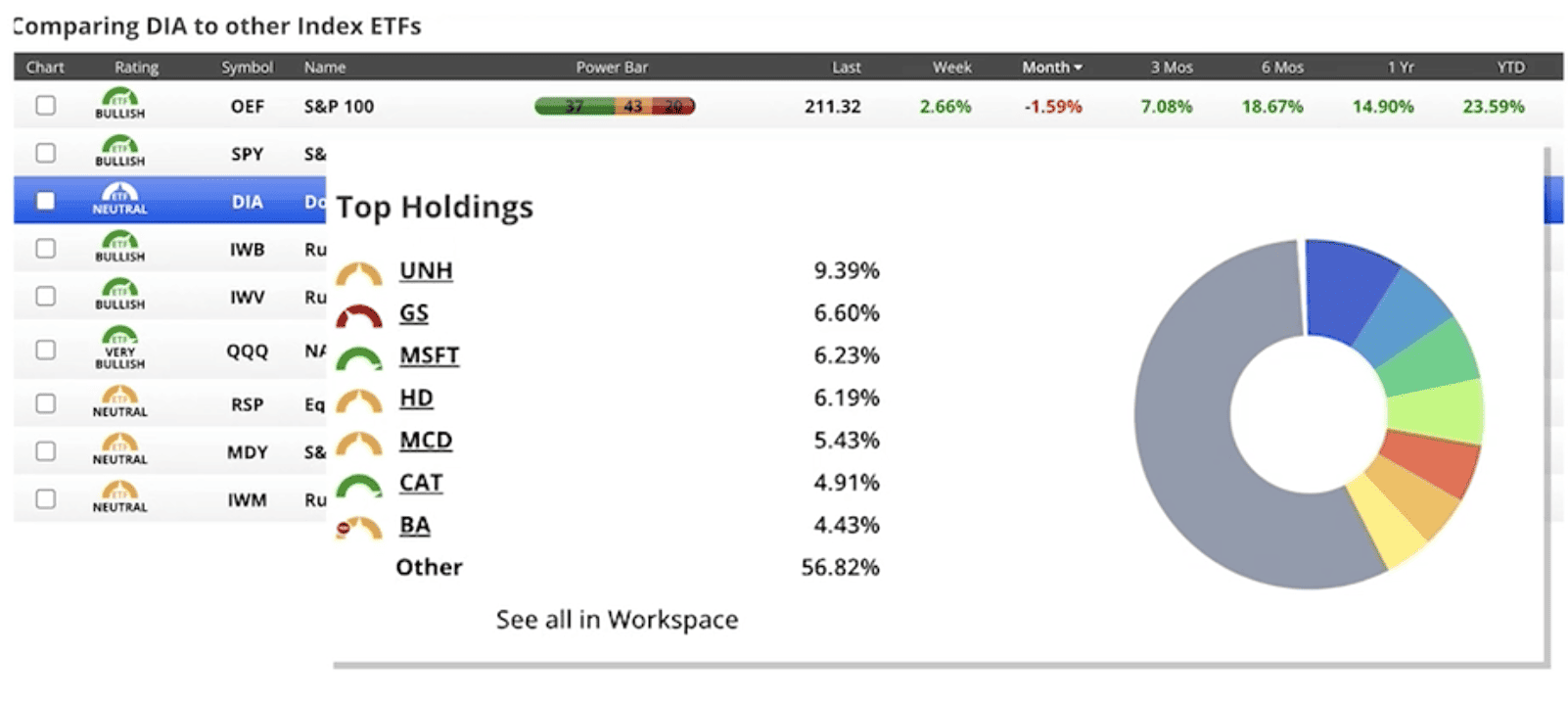

The Dow Jones Industrial Average is our lagger for the year at 5.22% year to date and -2% in August. Now, let’s look at the Dow Jones Industrial Average’s top holdings.

FIGURE 3 – Nasdaq 100 Top Holdings – Chaikin Analytics

You have UnitedHealth Group, Goldman Sachs, Microsoft (which was also in the Nasdaq 100), Home Depot, McDonald’s, Caterpillar, and the Boeing Company. The big value names have not performed nearly as well as the high-flying tech names due to the AI craze. The Dow Jones Industrial Average, although it’s only up 5.22% this year, was one of the better performing indexes last year at -10%. It’s still not back to where it was in January 2022 either.

Can the Federal Reserve Avoid a Recession and Achieve a Soft Landing?

I believe that the strength that we see in the economy will continue to fuel markets higher. As always, you’re going to see choppiness out there, but things seem to be going along smoothly. I think the markets are leaning toward Jerome Powell not hiking interest rates anymore.

He did say something interesting during his one of his last speeches, noting that the Federal Reserve has removed the word recession from its forecast. That means that he truly believes that the Fed can engineer a soft landing by slowing the economy to a point where inflation slows without putting us into a recession.

Now, I want to be the contrarian here and say that because Jerome Powell and the Federal Reserve are taking the word recession out of the forecast, that probably means that there will be some form of mild recession.

Encouraging Signs in the Housing Industry

However, we are seeing signs of improving numbers in new construction for homes. I went through an economic study on that last week. It appears that what was a significant decline in new home construction seems to have bottomed out and is moving back in the right direction. That will bode well for all kinds of different sectors of the economy.

U.S. Treasuries Yield Curve Remains Steeply Inverted

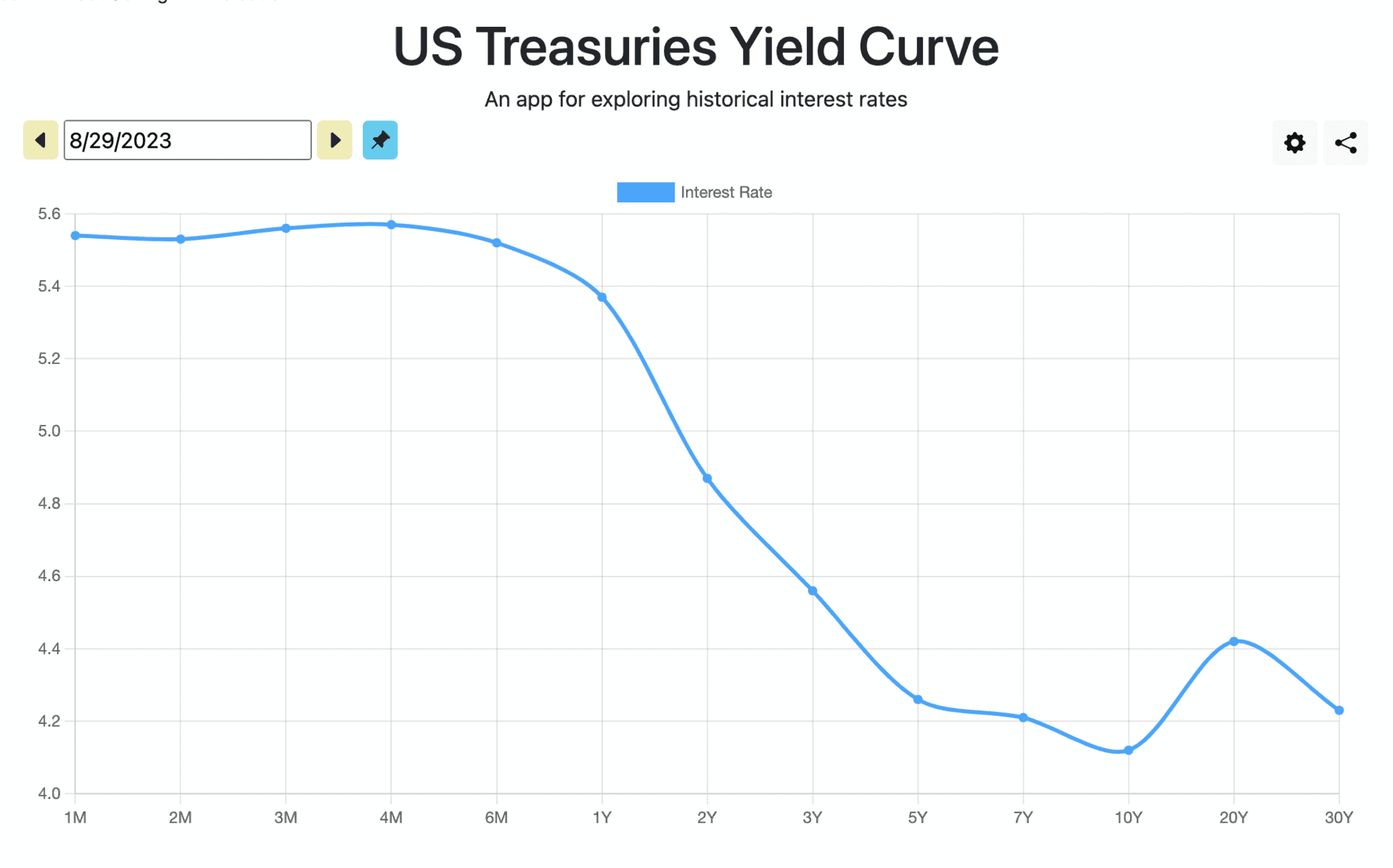

One thing that hasn’t changed a whole lot is the U.S. Treasuries yield curve. I’ve been sharing this with you all year long. It’s still steeply inverted.

FIGURE 4 – U.S. Treasuries Yield Curve

The 10-year treasury is at 4.12%, while the four-month treasury is the highest yielding treasury at 5.57%. The three-month is almost identical at 5.56%. The yields on the short end of the yield curve are still far higher than the longer-term yields. The 20-year is at 4.42% and the 30-year is at 4.23%.

Yield Curve Signals a Slowing Economy

And remember, as we see this inverted yield curve, it typically means that the bond market doesn’t believe that the economic growth that we’re seeing today will continue for a long period. I don’t know if it’s going to be three months, six months, nine months, or 12 months, but that leads me to believe that there will be a slowing of the economy. I believe that the Fed will be forced to reverse course and begin to lower interest rates sometime over the next 12 to 18 months.

Opportunities with Elevated Interest Rates

That being said, I also believe that the elevated rate environment that we find ourselves in today is likely to be here for quite some time. So, take advantage of the higher interest rates on short-term savings. You may consider taking some money out of the bank and letting us put that in a one-month, two-month, or three-month treasury for you and ladder those things out to where you’ve got some money maturing once a month. That can help you get a good yield for the first time in about 20 years on short-term safe money. So, there is a little bit of a silver lining with interest rates as high as they are.

However, that does raise questions about the overall price-to-earnings ratio on the S&P 500. When we look at rates where they are today, it’s hard to justify where the S&P 500 sits today. It should be 15% to 20% lower than what it is. If we have interest rates lower, that can support the price-to-earnings ratio with where we are today. So, one or two things needs to happen. Interest rates need to come down or the S&P 500 needs to come down. Let’s hope that it is a softening economy and that the Fed can back off a little bit, lower interest rates, and support the markets where they are today.

Remembering That Your Financial Plan Is Unique to You

With that, it’s always important to remind you that your portfolio is your portfolio. It’s very individualized to you. If you’re a Modern Wealth client, make sure that you’re reflecting on your goals, overall objectives, and tolerance for risk with your financial advisor. Don’t hesitate to contact your advisor if you have any questions.

If you’re not a Modern Wealth client, it’s critical to have a fluid, forward-looking financial plan. Having a financial plan that has been stress tested for things like major market downturns can give you clarity and confidence as you’re approaching and going through retirement.

Do You Have Questions About Your Plan or Whether the Federal Reserve Can Avoid a Recession?

If you have any questions about what that personalized financial plan might look like or anything specific about whether the Federal Reserve can avoid a recession, you can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can meet with you in person, virtually, or by phone—it’s whatever works best for you.

Thank you for joining me for our August Monthly Economic Update. We’ll continue to keep a close eye on things and will report back to you again for our September Monthly Economic Update.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.