“Magnificent Seven Stocks” Continue to Drive the Market

Key Points – “Magnificent Seven Stocks” Continue to Drive the Market

- Fed Funds Rate Reaches Highest Point Since 2001

- Overvalued Price-to-Earnings Ratios

- What Are the Magnificent Seven Stocks?

- Corporate Earnings Starting a Downward Trend

- What’s Next for Interest Rates Following Another 0.25% Hike?

- 5 Minutes to Read | 8 Minutes to Watch

The data in today’s article is as of July 26, 2023.

A Very Narrow Market

Jerome Powell decided to raise rates by another quarter of a point. The equal-weight S&P 500 is gaining ground on the S&P 500, but it’s still a very narrow market with seven stocks—also known right now as the Magnificent Seven stocks—leading the way. We’ll discuss all that and more in our July Monthly Economic Update.

Another Rate Hike from the Federal Reserve

The Federal decided to raise rates by 0.25%, giving us the highest Fed funds rate in over 22 years. The last time the Fed funds rate was this high was 2001. Initially, the markets took off with that quarter-point hike with some slightly toned-down language from Jerome Powell.

Soon after, as the markets digested, the markets retreated and most of the major indexes wound up in slightly negative territory for the day. I want to break down what’s happening in the equity markets. We’re also going to break down what’s happening in the fixed income markets. Then, we’ll talk about what we see coming for the balance of this year.

Equity Market Performances

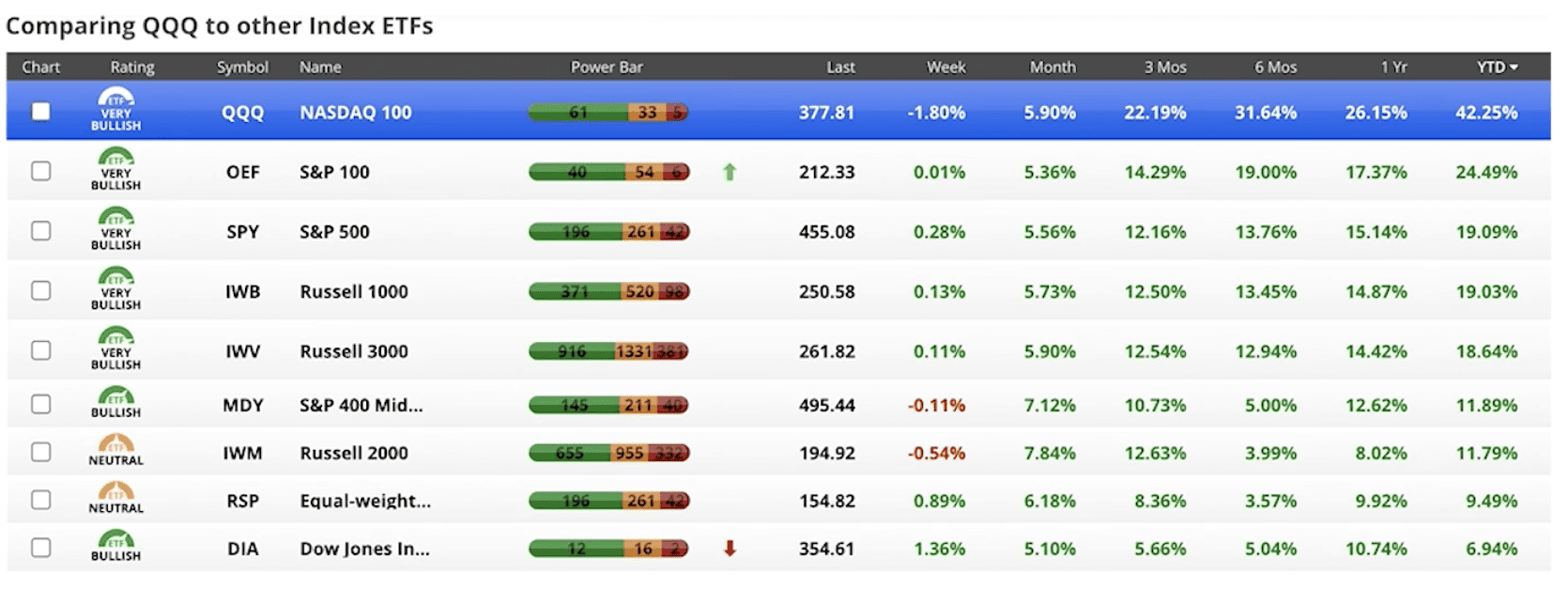

Let’s start with looking at a year-to-date view of what’s happening in the equity markets below in Figure 1.

FIGURE 1 – Year-to-Date Equity Market Performances – Chaikin Analytics

What Are the Magnificent Seven Stocks?

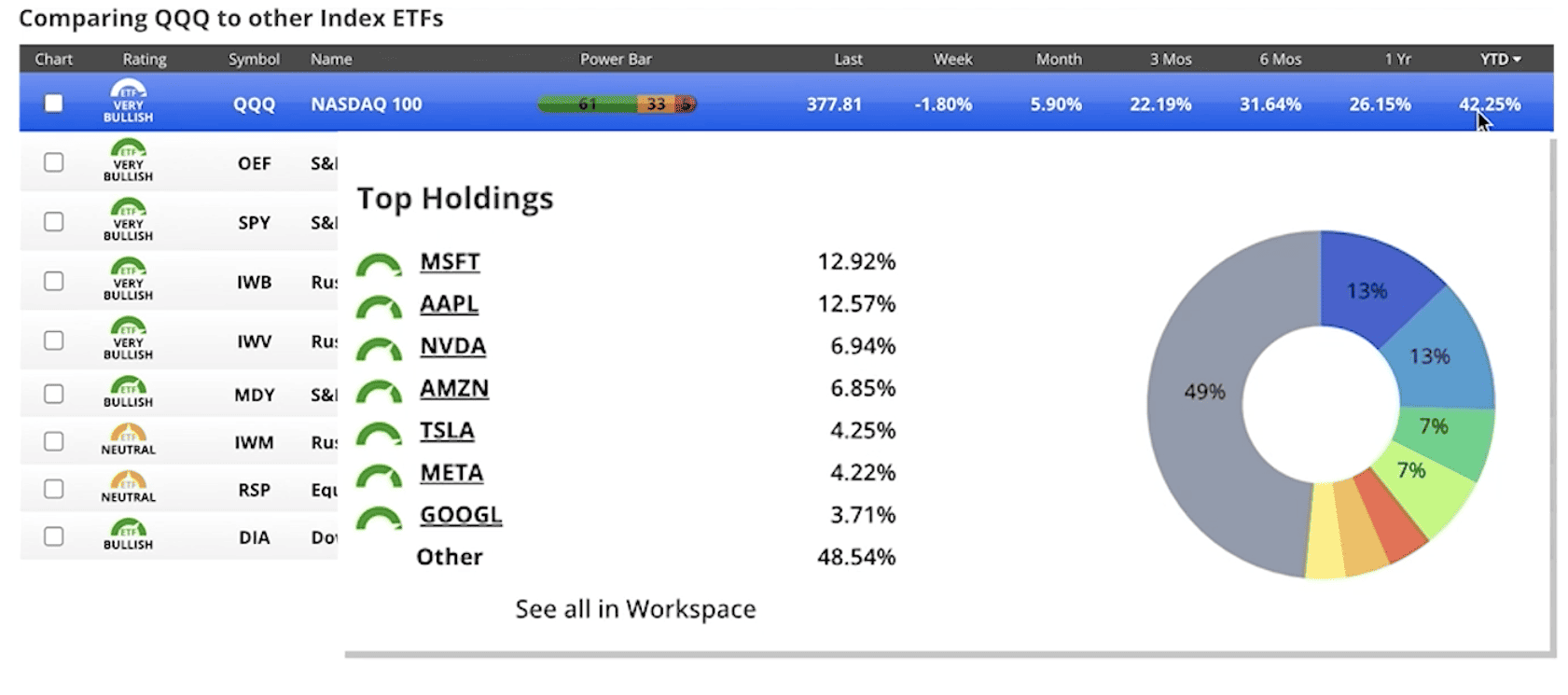

The Nasdaq is at the top of the list, higher by 42.45%. Now, I’m going to talk about seven specific stocks: Microsoft, Apple, Nvidia, Amazon, Tesla, Meta, and Google. You may have heard of them be referred to as the Magnificent Seven stocks. The Magnificent Seven stocks are making up more than 50% of the Nasdaq 100. The other 93 stocks are only making up 48.54% of that. So, most of the returns are being driven by the Magnificent Seven stocks.

FIGURE 2 – Top Nasdaq 100 Holdings – Chaikin Analytics

Price-to-Earnings Ratios of the Magnificent Seven Stocks

I also want to share some price-to-earnings ratios of these Magnificent Seven stocks from some research I did earlier. Microsoft is about 38. Apple is in the about 33 range. Nvidia is in the 220 range. Amazon is in the 311 range. Tesla is in the 78 range. Meta is in the high 20 range and Google is about the same. So, Google and Meta are about the only two that I would say are even close to fairly priced. Everything else is extremely overvalued at this point.

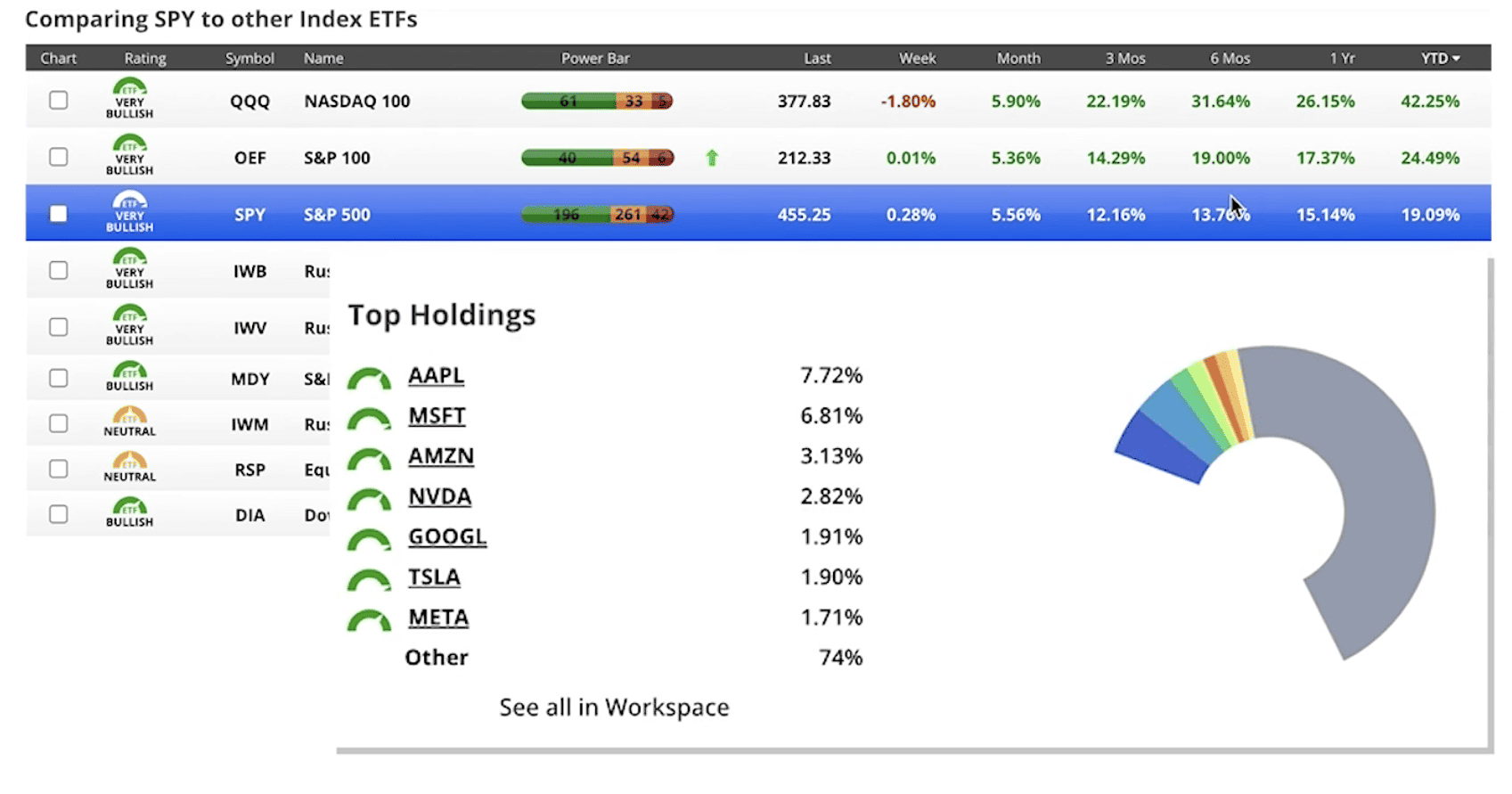

Now, if we switch to the S&P 500, it’s third in line year to date, up by 19%. But you’ll see those same Magnificent Seven stocks at the top of the heap, making up 26% of the S&P 500 and making up most of the return in the S&P 500.

FIGURE 3 – Top S&P 500 Holdings – Chaikin Analytics

What’s Going on in the RSP?

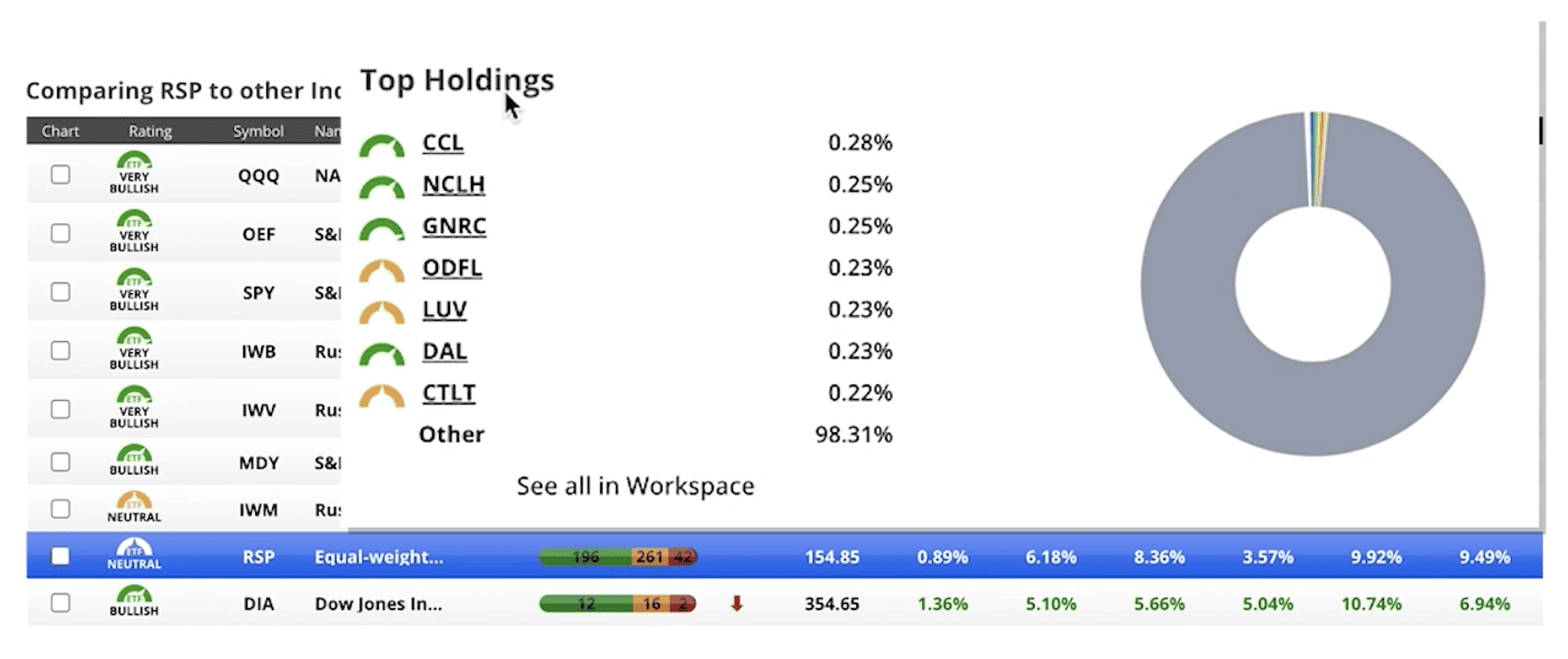

One of the things I pointed out last month was the RSP, which is the equal weight S&P 500. That’s only up by 9.49% year to date. But what’s interesting is that we have started to see some of the other stocks within the S&P 500 gain a little traction. Look back at Figure 1. The RSP is up by 6.18% over the past month, while the S&P 500, which is overweighted in technology, is only up by 5.56% and the Nasdaq 100 is only up by 5.9%. So, we’re finally starting to see some traction in some of the other stocks. Some of those other stocks are starting to take off.

Over the last three months, the RSP equal weight is up by 8.36%. You’ll also see in Figure 4 that those Magnificent Seven stocks aren’t concentrated at the top. In other words, you’ve got an even distribution or a fairly even distribution between all 500 stocks in the S&P 500.

FIGURE 4 – Top RSP Holdings – Chaikin Analytics

So, we’re starting to see a little bit of a shift there. We’ll need to give this a little bit of a time to see if it holds on. If that holds on, knowing the nature of how much these other stocks that are making up a vast majority of the Nasdaq and a huge percentage of the S&P 500, those could begin to lag behind a bit as people begin to realize the elevated value that they have today. But long story short, we had a great month of July.

Corporate Earnings Starting a Downward Trend

There is something that’s kind of bothering me, though. We have seen the corporate earnings start to tilt downward. And the same time that we’re seeing the corporate earnings start to tilt downward, we’re seeing the S&P 500 continue to elevate. Those two things can’t happen simultaneously for any long period. Either corporate earnings are going to have to turn around quickly to start to catch up with what the S&P 500 is doing and the rest of the market or we’re going to have to see a pullback in the S&P 500. Most likely, that will be led by the large technology stocks.

Bond Market Reflects Unease in the Economy

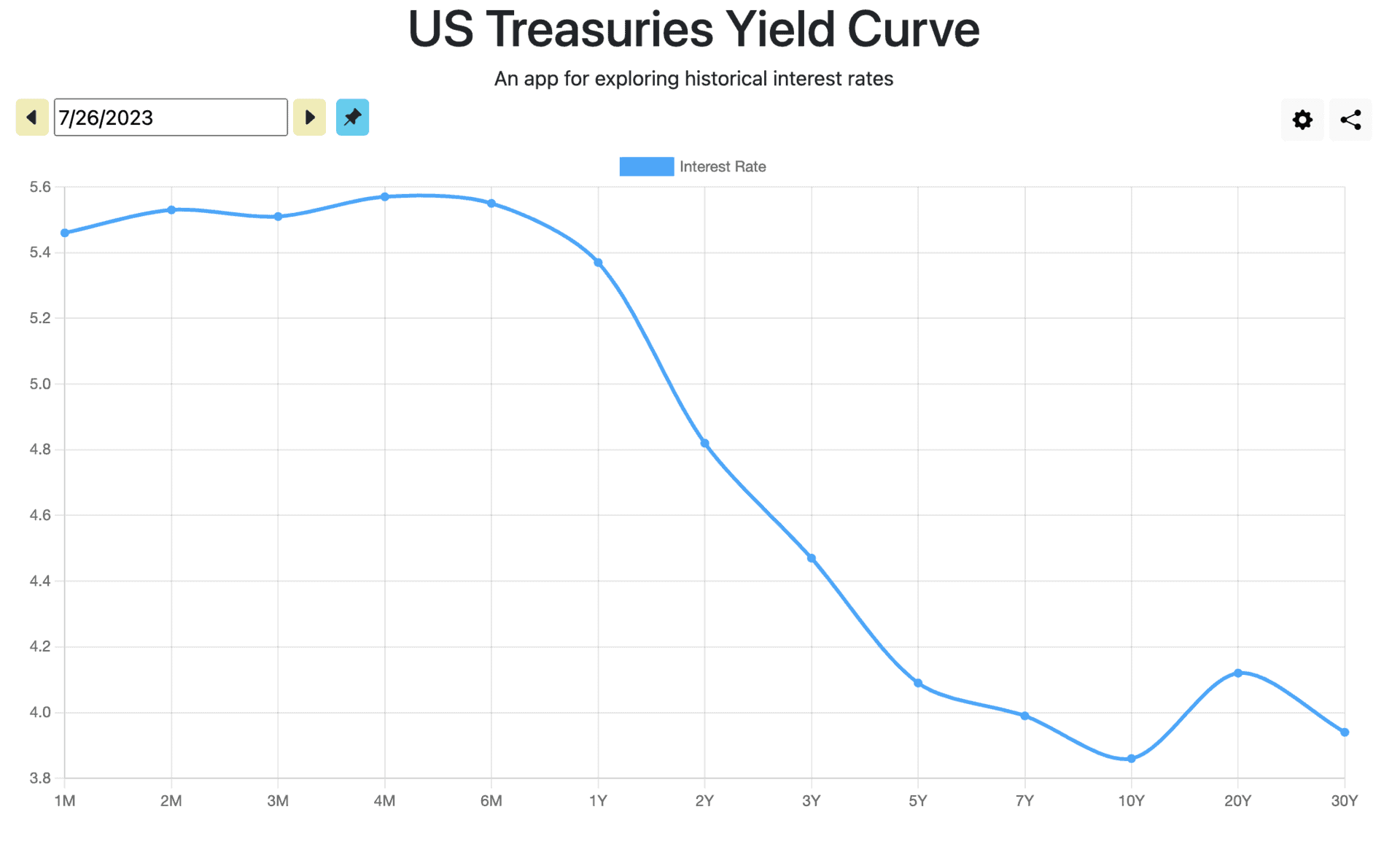

If we look at what’s happening in bonds right now, the treasury yield curve is still as inverted as it’s ever been.

FIGURE 5 – U.S. Treasuries Yield Curve

Our highest yielder now is the six-month at 5.57%. The four-month is at 5.55%. The three-month a 5.51% and the two-month a 5.54%. But if we look at the 10-year, it’s still below 4%. This inverted yield curve is basically telling us that the bond market does not believe that what’s happening in the economy is sustainable.

What’s Next for Interest Rates Following Another 0.25% Hike?

In fact, most of the things that we’re looking at today lead us to believe that over the course of the next six months, we should see the economy continue to slow. That would mean that Jerome Powell could take a pause on interest rate hikes. I don’t think we’re going to see a reversal and have Powell start to reduce rates later this year. If he does that, I believe that will be sometime in the first half of 2024.

We’re going to keep a close eye on everything. The markets obviously have rebounded nicely. If you look at most of the major indices, we’ve gotten back a lot but not all of what they took away from you in 2022. For the most part, we’re looking at 18 to 19 months of really no return out of most of the major indices because of what 2022 did.

Markets Are Emotional and Need Clarity

Here’s the bottom line. Markets are very emotional and need clarity. The fact that inflation has started to slow a little bit has a lot of people betting that the Fed will begin to lower rates later this year. I don’t believe that’s going to be the case. Obviously, I don’t have a crystal ball. Nobody does. If that does happen, I think that could sustain the markets at the levels that they are today.

If we don’t see a reversal and we see another interest rate hike, that’s going to put a little bit of pressure on equities. Looking forward to the next 24 to 36 months, I think we will see an ease in interest rates, which means that bonds could present a reasonable opportunity and a bit of a tailwind for bonds over the next 12 to 18 months. At the same time, we could have a little bit of headwinds for U.S. domestic equities.

Have Any Questions?

With that, I just encourage you to always make sure that you stay in contact with your advisor here at Modern Wealth. If you have any questions, we’re always here and we’re always ready to answer those questions to help you in any way we can.

The same goes for those who aren’t clients of ours. If you have any questions, you can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. You have the option of meeting with us in person, by phone, or virtually.

Thank you for tuning into our July Monthly Economic Update. We’re looking forward to reporting back to you a month from now for our August Monthly Economic Update.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.