Market Outlook and the Last Six Months with David Mitchell

START PLANNING Subscribe on YouTube

Market Outlook and the Last Six Months with David Mitchell Show Notes

David Mitchell makes his fourth appearance on The Guided Retirement Show to share his outlook for the markets and economy. He’s in his 19th year with AllianceBernstein and serves as the managing director for AllianceBernstein’s RIA and private banks in its Upper Midwest and Central division. He’s basically one of four specialists at AllianceBernstein in North America.

AllianceBernstein, which aggregate manages around $700 billion globally for every type of client you can imagine. That includes large institutions, pension funds, sovereign wealth funds, and then private clients here in the United States.

David last appeared on The Guided Retirement Show in April. He’s going to review what has happened since then and share his current market outlook.

In this podcast interview, you’ll learn:

- How the Cap-Weighted S&P 500 Compares to the Equal-Weighted S&P 500

- Money-Market Funds Eclipse $6 Trillion in Assets

- Why Bonds Performed So Poorly in August and September

- Why There’s a Big Opportunity in the Bond Market

Looking Back at David’s Market Outlook from Six Months Ago

During David’s last appearance on The Guided Retirement Show, he mentioned that he thought there would be somewhat of a headwind for equities and a tailwind for fixed income or bonds. Amid the craziness of that has happened this year, there are probably some people who think that David’s market outlook from six months ago was wrong.

Momentarily, we’re going to let David explain why he wasn’t wrong. For the record, David did go back and listen the market outlook he shared in the last episode he was on while preparing for this episode. It’s important to realize that there’s more than meets the eye when breaking down what has happened in the markets since David’s outlook from April.

If someone just took the S&P 500 and Barclays Aggregate Bond Index, they would probably say that David’s market outlook from April hasn’t come to fruition. But there are several reasons of nuance and context to that. The trajectory of a lot of what David and Dean talked about in April is still intact and is manifesting. You just need to peel back the onion a little bit.

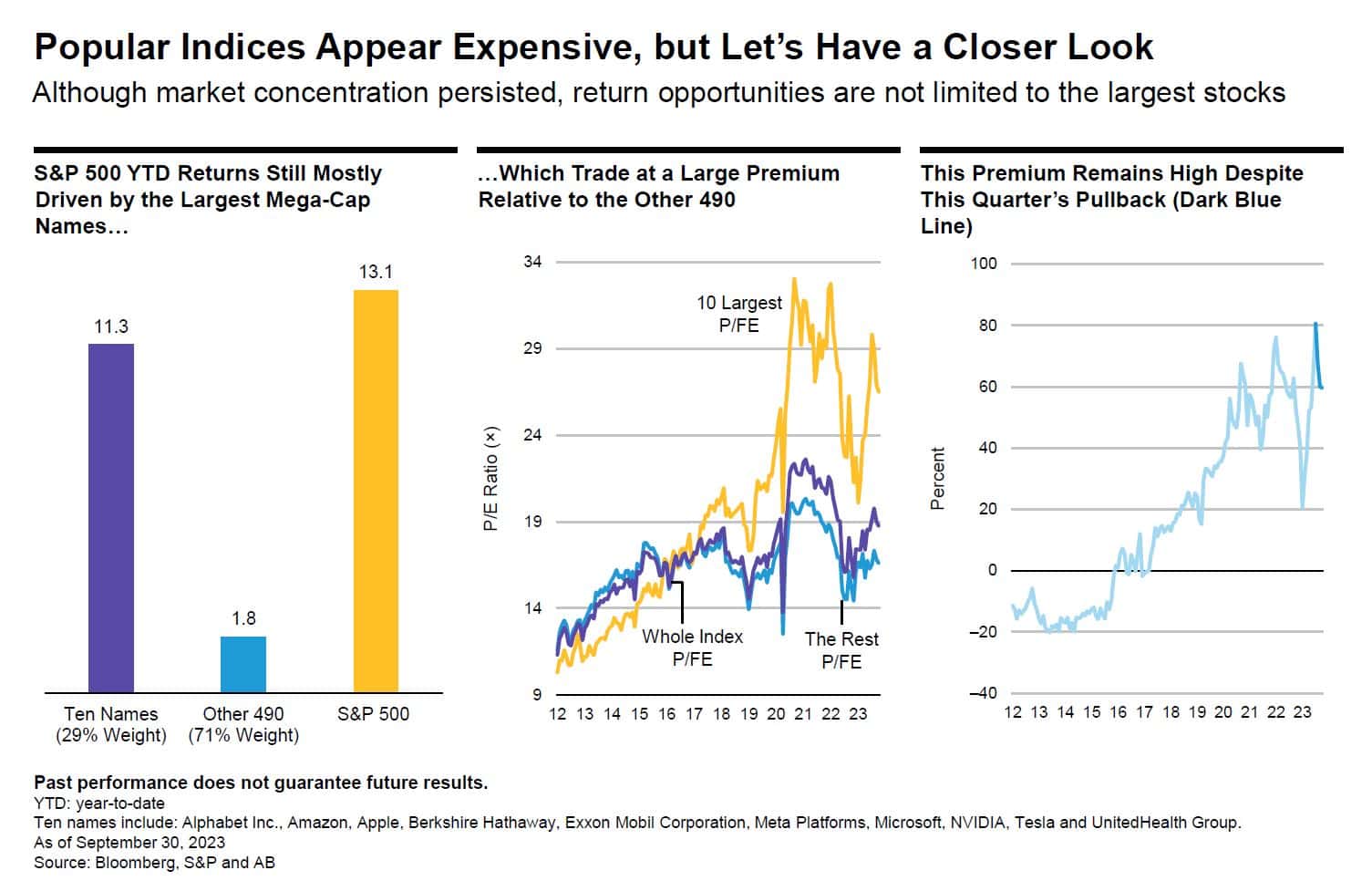

Magnificent Seven Stocks Drive the S&P 500

As Dean has mentioned in his Monthly Economic Updates, there have been seven stocks that have driven everything in the S&P 500. There are two indexes for the S&P 500—the cap-weighted and equal-weighted. With the cap-weighted S&P 500, the top 10 stocks make up 30% of the index. With the equal-weighted S&P 500, which just takes every stock, all 500 stocks are weighted equally.

The equal-weighted index, which should be more of your typical stock return this year, is essentially flat year to date. But when you look at the cap-weighted index, those top seven stocks—Microsoft, Apple, Nvidia, Amazon, Tesla, Meta, and Google—are up around 14%-15% on average. Nvidia is up around 230% this year and is driving a boat load of the return for the S&P 500.

FIGURE 1 – Popular Indices Appear Expensive But Let’s Have a Closer Look – AllianceBernstein

Should You Buy the Cap-Weighted or Equal-Weighted?

So, if you’re an investor and want to deploy money into the equity market, should you buy the equal-weighted S&P 500 because there are so many more undervalued equities there? Or do you buy the cap-weighted S&P 500? We can’t answer that for you without knowing your personal situation but are going to walk you through David’s personal investment decision. David is buying the equal-weighted after meeting with his advisor, and here’s why.

“Since the equal-weight has been in existence, this six-month to one-year window is the greatest that the cap-weighted index has outperformed the equal-weighted.” – David Mitchell

Remember that just because this is how David is investing doesn’t mean that that’s how you should be investing. It depends on your unique situation.

A Flashback to 1999?

What we’re experiencing right now in the stock market reminds Dean of 1999. Every company that had dot-com behind its name was soaring and making the overall markets look good.

“Back then, you had you had the value-oriented stocks—the brick-and-mortar companies—that were doing nothing. All the money was flying there. I think that’s what’s happening here with.” – Dean Barber

David mostly agrees with Dean on this as far as the concentration of the market goes. The only difference he sees is that back in 1999, a lot of the companies in the tech run up weren’t worth anything and eventually went away. Microsoft and Apple are great companies and aren’t going away. But they expensive now relative to the rest of the market and to their historical price earnings ratios.

Treasury Bonds vs. Corporate Bonds

On the bond side, there are two different types of bonds we want to discuss—treasury bonds and corporate bonds. There are high investment grade treasury bonds. Those include your U.S. Treasuries, which are the largest, most liquid asset in the world. That’s why the bond benchmark is essentially flat or barely negative this year as well.

However, there’s a story going on within the bond market, sort of like the Magnificent Seven with equities. High yield corporate bonds are up 5% to 7%. It’s a market that is much more idiosyncratic with what’s been delivering the returns than just the headline number.

What About Cash?

Assets in money-market funds are at all-time highs, eclipsing $6 trillion in assets in August. There are a lot of people, David included, that have been sitting in cash. And you can finally earn a return on cash. If you’re a saver, it’s great. But people are looking for a way to deploy that capital in a way that makes sense for the next one to three years or longer depending on individual circumstances.

“This is a question of tradeoffs that I think is universal right now in our industry—moving cash off the sidelines.” – David Mitchell

Two Brutal Months for Bonds

There are two places to go with that cash in a traditional asset allocation model—fixed income or equities. Some of the big bond managers and economists are saying it’s time to move out a little bit longer on maturity. That’s one of the biggest reasons why the treasury market and investment grade bonds underperformed this this summer.

Coming into October, we saw a little bit of a stabilization. But August and September were two of the worst consecutive months for bonds going back to 1980-1981 or even last year.

The reason for that is because a lot of large institutional money managers like AllianceBernstein started recommending to clients in late 2022-early 2023 to begin extending their maturities to buy back duration.

“Even if you can’t get the timing exactly right, if you were looking out 12 to 24 months, the math on bonds with were yields as high as it were looked very attractive relative to the median stock.” – David Mitchell

Where’s the Demand for Bonds Coming from?

One reason the bond market was down so much in August and September was a lot of those large institutional money managers and insurance companies, etc., had already extended durations. So, there wasn’t a lot of demand there to sop up these higher yielding treasuries as there might have been earlier this year, late last year.

That begs the question, where does the demand come from if all the firms like AllianceBernstein have already maxed out their duration within their typical bond mutual fund? It needs to come from that $6 trillion sitting in cash.

“What is the spark that ignites that mom-and-pop retail investor to start moving money off the sideline and begin buying bonds again? That will stabilize interest rates and you’re going to see it move very quick the other way.” – David Mitchell

All Eyes Remain on the Federal Reserve

What David said there sparked a question from Dean. Will the Federal Reserve need to adamantly say that they’re done raising interest rates for that to happen? Dean believes that a lot of people have the mindset that they can get around 5% on a money-market account that’s liquid every day and don’t want to get tied up into bonds. For example, why would you buy a five-year treasury and that’s under a 5% yield? Well, allow Dean to explain why.

“The thing that people don’t think people realize is that in order to get 5% in that money market, rates need to be the same place a year from now than they are today.” – Dean Barber

First, David completely agrees with Dean that FOMC Chairman Jerome Powell and the Fed will need to be explicit that they’re done raising rates and that they’ve conquered inflation. David doesn’t think that they’re ready to do that quite yet.

“I think that would help provide the gasoline to that to that bond-fire. That’s the first thing.” – David Mitchell

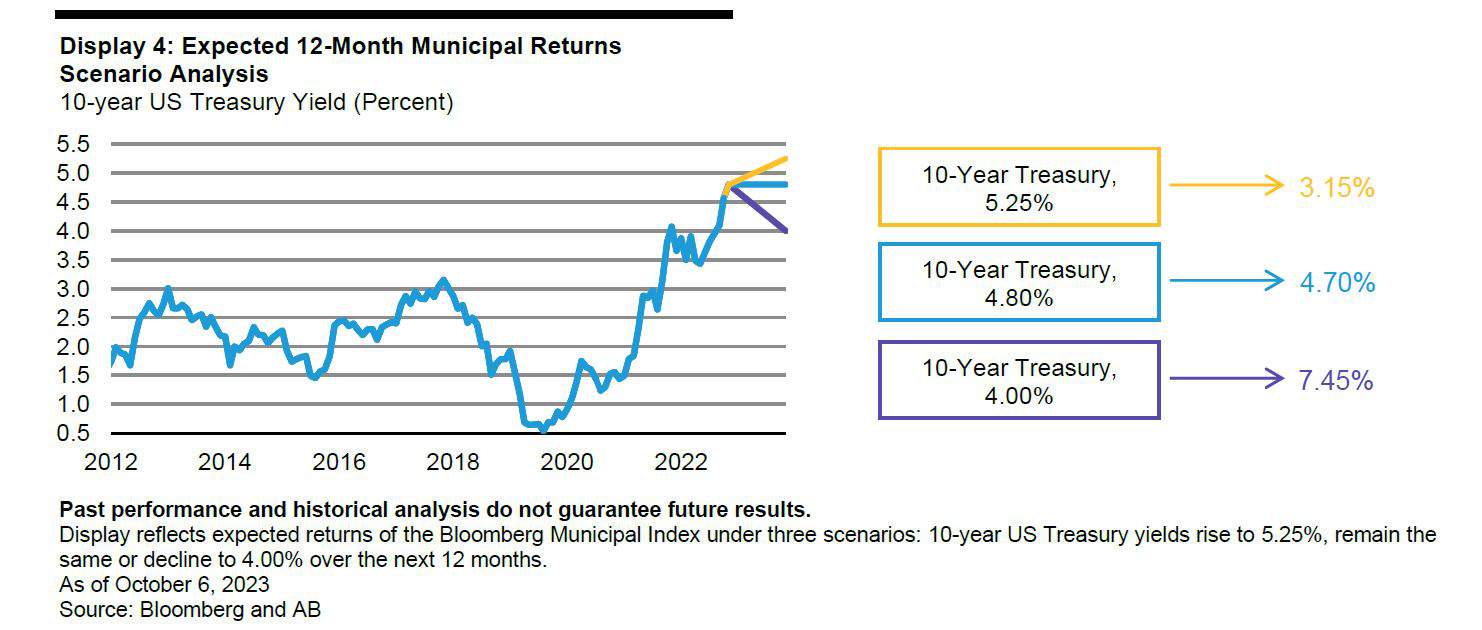

A Huge Opportunity in Bonds

Second, will that 5% in money-market funds exist throughout the next 12 months. And third, if you look at now the bond math return of moving to a more diversified basket of bonds, you’re looking at a point now that when interest rates fall, you’re going to be earning a total return in the double digits.

“It’s going to take some sort of mass information herd mentality to get folks to understand that this is the greatest potential return on bonds that they’ve had since the 1980s over than over a 12-to 24-month timeframe.” – David Mitchell

We haven’t seen an opportunity like this in the bond market in a long time. Remember to step back and ask yourself, “What’s a bond worth?” It’s issued and matures at par, and par is 100. In January 2022, AAA municipal bonds were trading at 115. They were a 15% premium, so their yield to maturity was not very attractive. It was less than 1%. But now you can build a good portfolio of munis near or below par.

Keeping the Taxable Equivalent Return in Mind

David and his team believe that the symmetry of the upside versus very limited downside with munis, even if rates stay up, is very good. But the thing that drives David crazy about munis is that the wealth management services industry as a whole doesn’t remind people enough of the taxable equivalent return.

If you’re in a high tax bracket, 35%, 37% and you’re buying a diversified muni portfolio with the average yield to maturity of around 5%, you can get close to a 9% taxable equivalent return. Then, let’s say the 10-year gets back to the low 3% range next year, which is currently in AllianceBernstein’s market outlook, you could get a taxable equivalent total return of 14%, 15% off the top by the end of 2024. We haven’t seen that in decades.

“The muni market really started being attractive about a year ago. And as interest rates have moved, there have been times when it wasn’t quite as attractive. But overall, it’s even more attractive today than it was a year ago.” – Dean Barber

Why Municipal Bonds Could Make Sense for Someone Like David

David doesn’t own many bonds with being in his early 40s, but he’s been contemplating owning munis for a variety of reasons with his taxable accounts. Here’s why David thinks munis could make sense for him even with being 15-20 years from retirement.

“While the pain of resetting to higher rates and the price declines on paper feels real, as long-term bond investors, you want to root for higher yields. The engine of a bond’s return is that cash, is that coupon. We’re fortunate that we’re going to get cash-plus percent when the yields fall again.” – David Mitchell

Stagflation’s Potential Place in a Market Outlook

But let’s say that rates do remain higher for longer like Jerome Powell has indicated and the Fed doesn’t pivot. You can still earn very high returns because yields have doubled and tripled in many cases within a very short period.

FIGURE 2 – Expected 12-Month Municipal Returns Scenario Analysis – AllianceBernstein

Look at Figure 2 and what it tells us about the 10-year U.S. treasury yield. It appears that our worst-case outcome is a stagflation scenario. Stagflation means that inflation remains stubbornly high, preventing the Fed from pivoting, while growth simultaneously declines. David and his team believe there’s about a 10% chance of stagflation through the end of 2024.

“A stagflationary phenomenon is very high energy and oil prices. It contributed to the late 1970s recession. It hurts the consumer with rising energy prices.” – David Mitchell

Stagflation forces you to move your discretionary income down because you’re spending more on energy. But since it’s an inflationary metric, the Fed can’t help the consumer by cutting interest rates. While there’s only a 10% chance of stagflation within David’s market outlook, that could be a potential problem.

The Potential Impact of the Hamas Attack on Israel

Keep in mind that David put together his market outlook just before the Hamas attack on Israel. That could bring a new dynamic to the potential for stagflation because we could have higher energy prices for quite a bit. But David confirmed that he doesn’t expect his long-term market outlook to change much as it relates to the chances of slagflation.

“What’s great about our business is that a lot can change in a week, but long-term math doesn’t. Trajectories don’t often change, but the path of how you get there can change. Volatility can change.” – David Mitchell

Stagflation Hypotheticals

Still, let’s run through some hypotheticals with stagflation. Let’s think about what could happen if energy prices stay high and growth slows. Or what could happen if we do go into a recession, which is a true stagflationary event? And let’s say the 10-year treasury goes from 4.65%-4.7% to 5.65%-5.7%.

“In a AA five-year muni bond, you’re starting income is so high that your total return would basically be flat over the next 12 months. That’s even if the 10-year rises another 1%, which is a very low probability.” – David Mitchell

Conversely, there’s a 40% chance in AllianceBernstein’s market outlook, that the 10-year drops 1% to around 3.5%-3.6%. Some of David’s colleagues believe it could drop even lower. There’s still an upside around 8%.

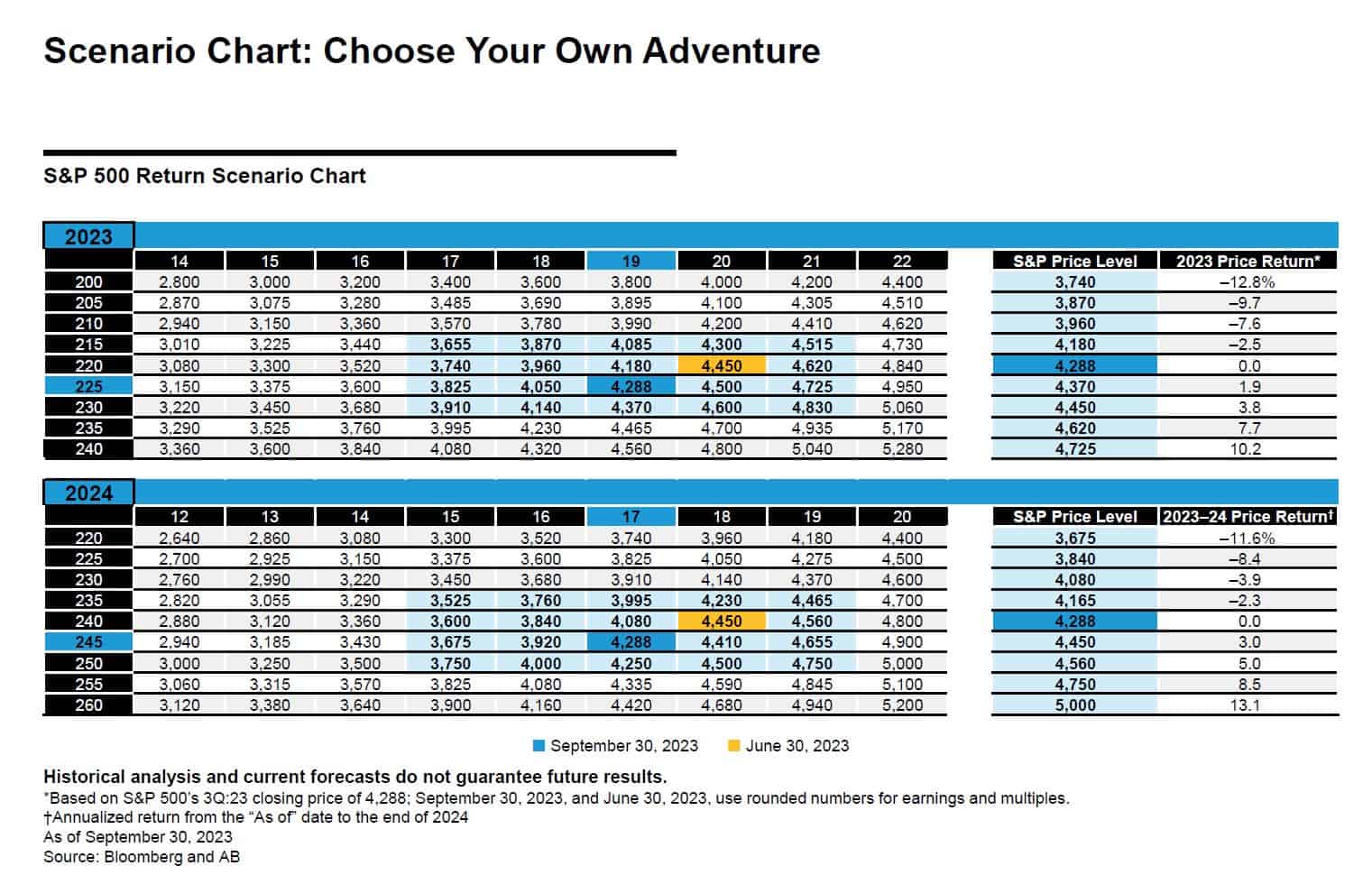

Comparing the Bond Market Outlook to the Stock Market Outlook

Check out Figure 3 as we look into the risk vs. return or tradeoffs between stocks and bonds right now.

FIGURE 3 – S&P 500 Return Scenario Chart: Choose Your Own Adventure – AllianceBernstein

If you look at David’s 2024 stock market outlook, the bull case and the bear case are about equal. The bear case is that the S&P 500 could be down 10% to 13%. The bull case is that the market could be up 10% to 13%. Again, with the bond market outlook, the bear case is that you’re flat and the bull case could mean that you’re up double digits.

“As a more seasoned investor, if you’re depending upon your risk tolerance, bonds do still look very attractive pound for pound. The path is questionable, but the outcome looks to be more certain.” – David Mitchell

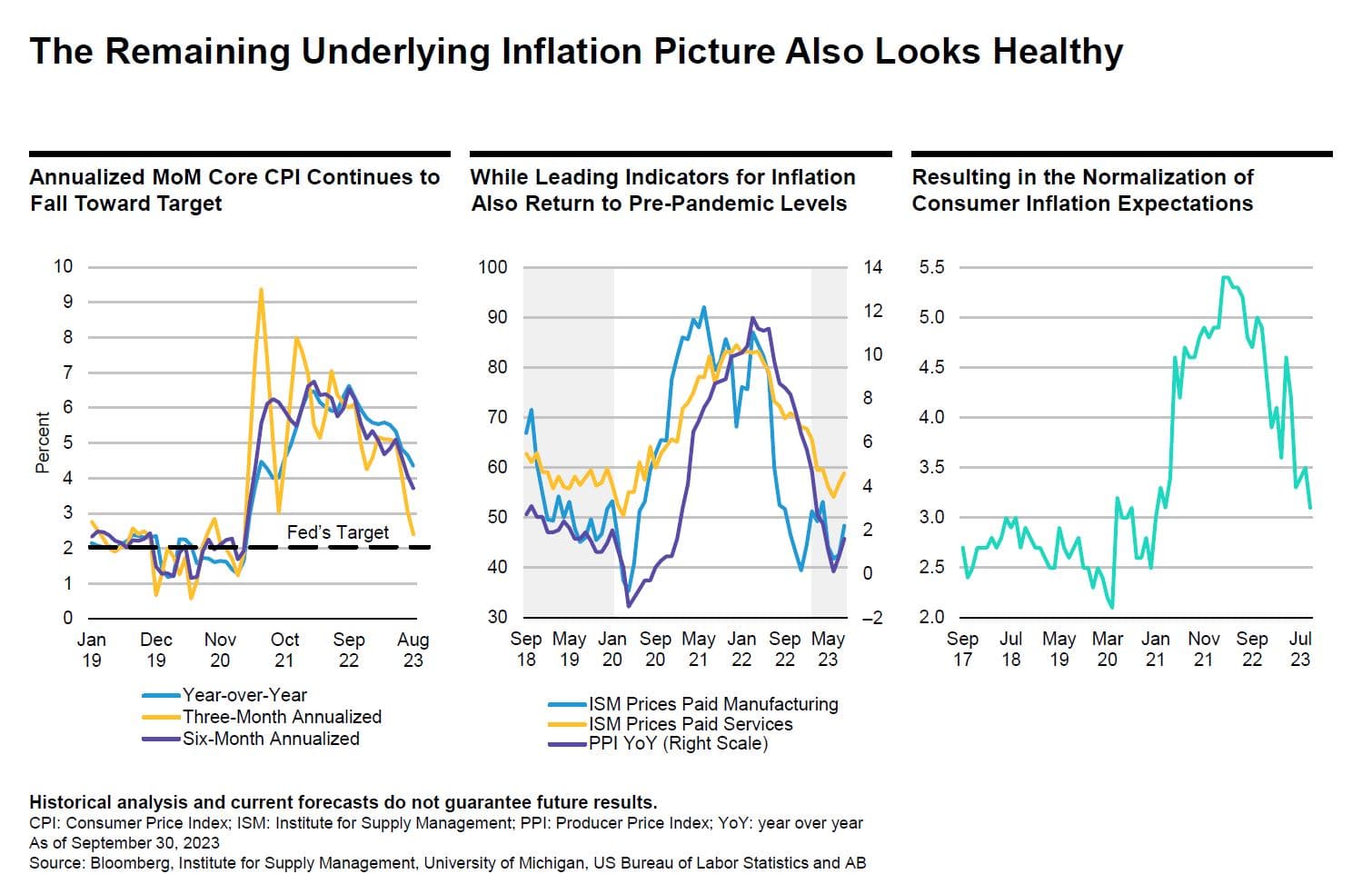

The Underlying Inflation Picture within David’s Market Outlook

So, what causes a 10% to 13% return next year? In the bull case scenario, underlying inflation continues to trend in the right way.

FIGURE 4 – The Remaining Underlying Inflation Picture Also Looks Healthy – AllianceBernstein

There have been some one-off months anomalies. Last year, it happened with medical spending. Recently, it’s been within the services industry with airline tickets and hotels since a lot of people are still traveling. But in aggregate, David believes that inflation continues to move in the right direction.

The Fed has been unwavering with wanting to see inflation in the 2% range. In the bull case, we get back to that with inflation. And then Powell can finally declare victory.

“If that happens, you get a bull case for equities and you get a bull case for bonds.” – Dean Barber

Remember that we’re coming out of a bear market in stocks and bonds from 2022. Those usually don’t happen at the same time. Typically, you own stocks and bonds in a balanced portfolio because they’re offsetting mechanisms to each other.

Recapping David’s Market Outlook

So, let’s sum up David’s market outlook for 2024. He anticipates that inflation will continue to move down, Powell declaring that the Fed has conquered inflation, the economy will slow but not into a meaningful recession (AKA, a soft landing), and stocks and bonds being up 10%-15%.

In the worst-case scenario, there’s a chance for stagflation. Stocks would be negative and bonds would be flattish. Therefore, bonds wouldn’t give you the offsetting diversification that you need when stocks are down.

It’d really be something for bonds to have another bear market because starting cash yields and interest rates are so high. So, your margin for safety is that much more.

You Can Buy Bonds at a Discount

Something that Dean really wants people to understand from David’s market outlook is that you can currently buy bonds at a discount. And as long as that bond doesn’t default, it’s going to land at par.

“You can have certainty that you can buy AA bonds at discounts. It doesn’t happen very often.” – David Mitchell

Dean recently had a review with a client that AllianceBernstein has an individual muni portfolio for where the current yield is 4.8%. However, the yield to maturity is 4.9% because they got some discounts in the portfolio. And that’s tax-free.

“For anybody that’s in a high-income bracket, this is the first opportunity in probably a decade and a half that people have had in that tax free environment. – Dean Barber

Looking for Opportunities Where They Exist

Dean thinks It would be interesting for people to understand what can happen in that environment and the sheer attractiveness of what’s there in something that’s very safe, especially with munis.

The muni market has one of the lowest default rates of any type of bond in the world. It’s way higher than corporate bonds. The muni market is fundamentally in a very strong place. You want to look for opportunity where it exists.

“The math is the math is the math. As long as your time horizon as an investor is longer than or as long as the duration of the underlying bond portfolios, the likelihood of ever losing money is very low. You would need to have mass defaults.” – David Mitchell

So, after seeing David’s market outlook, how do you feel about your portfolio? Remember that what David shared is intended for educational purposes. There are various aspects of your personal situation that will impact what investments are best for you. To start a conversation about your unique situation and what all to consider before making investment decisions, see our schedule below.

We hope that you found what David shared to be helpful and look forward to him returning to The Guided Retirement Show in the near future. As always, please don’t hesitate to reach out with any questions.

Watch Guide | Long-Term Market Outlook and the Last Six Months with David Mitchell

00:00 – Introduction

01:59 – What We Talked About Last Time

05:33 – S&P 500 Cap Weight vs Equal Weight

08:07 – Let’t Talk About Bond Maturity

16:20 – What About the 10-Year Treasury?

18:49 – The Path to a Return in Equity Markets

25:19 – Wrapping it Up

Resources Mentioned in This Article

- The Long-Term Market Outlook with David Mitchell

- Magnificent Seven Stocks Continue to Drive the Market

- Dot-Com Bubble History Remains Relevant

- What to Know About CDs, Bonds, and Treasuries

- Monetary Policy Tools: The Fed’s Latest Actions

- 10 Ways to Fight Inflation in Retirement

- Interest Rates and Bond Prices

- Financial Planning in Your 30s and 40s

- Bond Yields Keep Rising

- Federal Reserve Takes Recession Out of Its Forecast

- 2022 Was Unusual for Bonds, Tough on Stocks

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC, does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.