Should I Get Out of Debt Before I Retire?

Should I Get Out of Debt Before I Retire?

- Good Debt vs. Bad Debt

- Looking at the History of Mortgage Interest Rates

- Understanding Opportunity Cost

- Credit Card Debt Is Not Something You Want to Carry into Retirement

- 4 Minutes to Read | 24 Minutes to Watch

Is It OK to Retire with Debt?

Should I get out of debt before I retire? It’s one of the more common questions we get when we meet with people getting closer to retirement. It’s important to understand that not all debt is the same. Let’s examine different types of debt to help determine whether you should get out of debt before you retire.

What’s Your Mortgage Interest Rate?

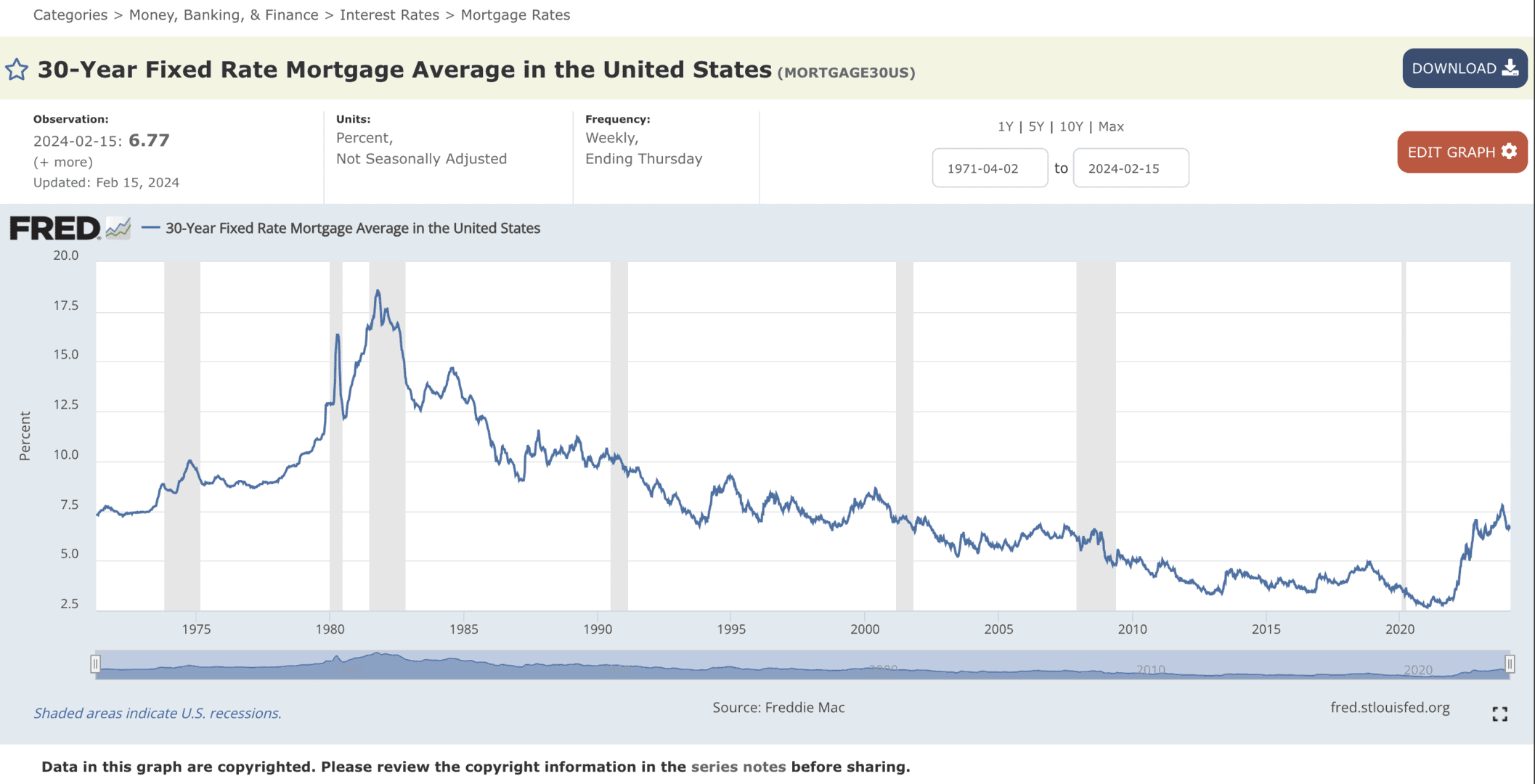

The most common liability on a balance sheet we see is a mortgage when asked if someone should get out of debt before they retire. For a long time, it was almost taboo to retire and still be making a mortgage payment. If you took out a mortgage in the early 1980s, chances are good that your mortgage interest rate was as high as 18.5% (this was the average rate in October 1981, according to Freddie Mac).1

But look at Figure 1. If you refinanced or bought a home in 2020 and 2021, you’re probably smiling ear to ear with a mortgage interest that’s around 3% or lower. While inflation has driven up the costs of goods and services, health care, and various other expenses, remember that your mortgage interest rate is a fixed rate. That means if you have a mortgage interest rate in that 3% ballpark, it won’t increase or decrease for the duration of your mortgage.

From October 26, 2023, to February 15, 2024, the average 30-year fixed mortgage rate average dropped from 7.79% to 6.77%. If you’ve been wanting to buy a new home or perhaps a summer or winter home in retirement, the Federal Reserve’s actions—particularly with whether they decide to start cutting rates in 2024—is something you’ll likely want to monitor.

Using Investments or Savings to Pay Down Debt Before You Retire

We also regularly get asked if someone should use investments or savings to get out of debt before they retire. When you consider whether you should take a withdrawal from an investment account or a savings account to pay down debt, you need to consider something called opportunity cost, which is the loss of potential gain from other alternatives when one alternative is chosen.2

Opportunity Cost

Let’s say, hypothetically, you’ve got a mortgage with a rate around 4%, locked in for the next 20 years, at which point the mortgage will be paid off. You plan to retire in five years and would really like to not have to make a mortgage payment once you retire. You have more than enough money sitting in an old 401(k) or IRA to pay off the mortgage.

For the sake of this hypothetical scenario, let’s also assume that you are over the age of 59½. Therefore, you aren’t subject to any early withdrawal penalties. Your investments in the account are divided into 50% U.S. stocks, and 50% U.S. bonds. If you were to expect a rate of return on your investments similar to the average annual return of the S&P 500 since 1957 for a similar portfolio, you’d expect an average annual return of 10.7%.3

- Option A) Take a withdrawal from your investments with a potential return of 10.7% to pay off a debt that is costing you 4%. Your opportunity cost is 6.7% (the long-term average return you are giving up). In addition, any amount you withdrawal is likely subject to be taxed as ordinary income.

- Option B) Continue to make the regularly scheduled mortgage payments.

This is obviously an over-simplified example, but the rational decision would be to take Option B should you decide to use investments or savings to get out of debt before you retire.

Should I Get Out of Credit Card Debt Before I Retire?

Now, if let’s say we’re dealing with credit card debt instead of a mortgage. According to Forbes Advisor’s weekly credit card rates report, the average credit card interest rate was 27.91% on February 20, 2024.4 Prioritizing paying this debt off before retirement sounds much more reasonable when considering the opportunity cost. Paying off credit card debt to help you get out of debt before you retire is a good decision.

Tax Efficiency and Debt

As we round out this article on whether you should get out of debt before you retire, let’s briefly discuss the most tax-efficient order to invest and pay down debts. This order needs to be adjusted based on each person’s individual goals and risk tolerance, but paying off high-interest debt is one of the highest priority items.

So, Should I Get Out of Debt Before I Retire?

There’s no clear rule of thumb for the question of whether you should pay off debt. It does depend on several factors. Consider your opportunity cost, any tax implications, and your cash flow projections in retirement, among other things.

As always, we’re happy to meet with you to analyze your debt-payoff strategy and customize it within your personalized financial plan. Whether you have questions about whether to get out of debt before retirement or other financial planning questions, you can ask them by starting a conversation with us below.

We hope this article has helped you understand the different types of debt that you may have as you head into retirement and how to prioritize paying them off. There’s a lot that can be overlooked when trying to do this analysis on your own. Working with a team of financial professionals can go a long way toward alleviating debt-related financial stress as you prepare and go through retirement. Our team at Modern Wealth is ready to work for you.

Resources Mentioned in This Article

- The Difference Between Good Debt & Bad Debt with Logan DeGraeve, CFP®, AIF®

- Retiring with Debt: What’s OK?

- Reviewing Your Balance Sheet and Income Statement

- Mortgage Tips for Different Phases in Life with Tim Kay

- 10 Ways to Fight Inflation in Retirement

- Consumer Debt Is at an All-Time High

- Health Care Costs During Retirement

- Unexpected Expenses and How to Plan for Them

- Monetary Policy Tools: The Fed’s Latest Actions with Brad Kasper

- The IRA Early Withdrawal Penalty: How to Avoid the 10% Penalty

- 5 Factors More Important Than Rate of Return

- Tax-Efficient Investing with Stephen Tuckwood, CFA

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- 5 Common Risks in Retirement

- Retirement Rules of Thumb: Let’s Bust Them

- Retirement Cash Flow: What You Need to Know

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- What Is Financial Planning?

- 7 Overlooked Budget Items in Retirement

- Why You Need a Financial Planning Team with Jason Gordo

- Financial Stress: How Do You Deal with It?

Other Sources

[1] https://fred.stlouisfed.org/series/MORTGAGE30US

[2] https://www.stlouisfed.org/open-vault/2020/january/real-life-examples-opportunity-cost

[3] https://www.businessinsider.com/personal-finance/average-stock-market-return

[4] https://www.forbes.com/advisor/credit-cards/average-credit-card-interest-rate/

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.