Retirement Rules of Thumb: Let’s Bust Them

Key Points – Retirement Rules of Thumb: Let’s Bust Them

- Reviewing a 2023 Schwab Study That Debunks Some Retirement Rules of Thumb

- What’s Your Risk Tolerance?

- Is the 4% Rule a Safe Retirement Rule of Thumb to Abide By?

- How Much Do You Need to Retire?

- 6 Minutes to Read | 24 Minutes to Watch

Four Retirement Rules of Thumb

Do you have some retirement rules of thumb that you follow? Some of them might be helpful with getting you in the right mindset to save for retirement, but there are issues with every one of them. Why? Because your financial plan needs to be built based upon your unique situation.

We’re going to review four retirement rules of thumb that Schwab discussed in a June 2023 study. Those retirement rules of thumb are:

- Having 100 minus your age in stocks when you retire.

- The 4% rule.

- Having 25x your planned yearly spending heading into retirement.

- Saving between 10% to 15% of your income for retirement.

How Much Do You Need for Retirement?

So, do you follow any of those? Those retirement rules of thumb exist in the first place because people are looking for answers. Do you have enough saved for retirement? And how much is enough?

“There is a right financial answer, tax strategy, legacy planning strategy, and risk management strategy for everybody. But it’s not the same for each person because we’re all individuals. We all have our own set of circumstances, resources, spending objectives, legacy goals, health issues, or lack thereof. Everybody’s retirement plan should be tailored specifically to them.” – Dean Barber

Schwab did a great job of sharing the problems that you can run into by following each of these retirement rules of thumb. Dean and Bud Kasper are going to help us review the flaws of those respective retirement rules of thumb to further drive home the point that retirement planning looks different for everyone. You need a plan that’s customized to your specific needs, wants, and wishes.

“You won’t how much is enough for you until you go through the financial planning process.The financial planning process is a discovery process.” – Bud Kasper

Retirement Rule of Thumb No. 1: Having 100 Minus Your Age in Stocks When You Retire

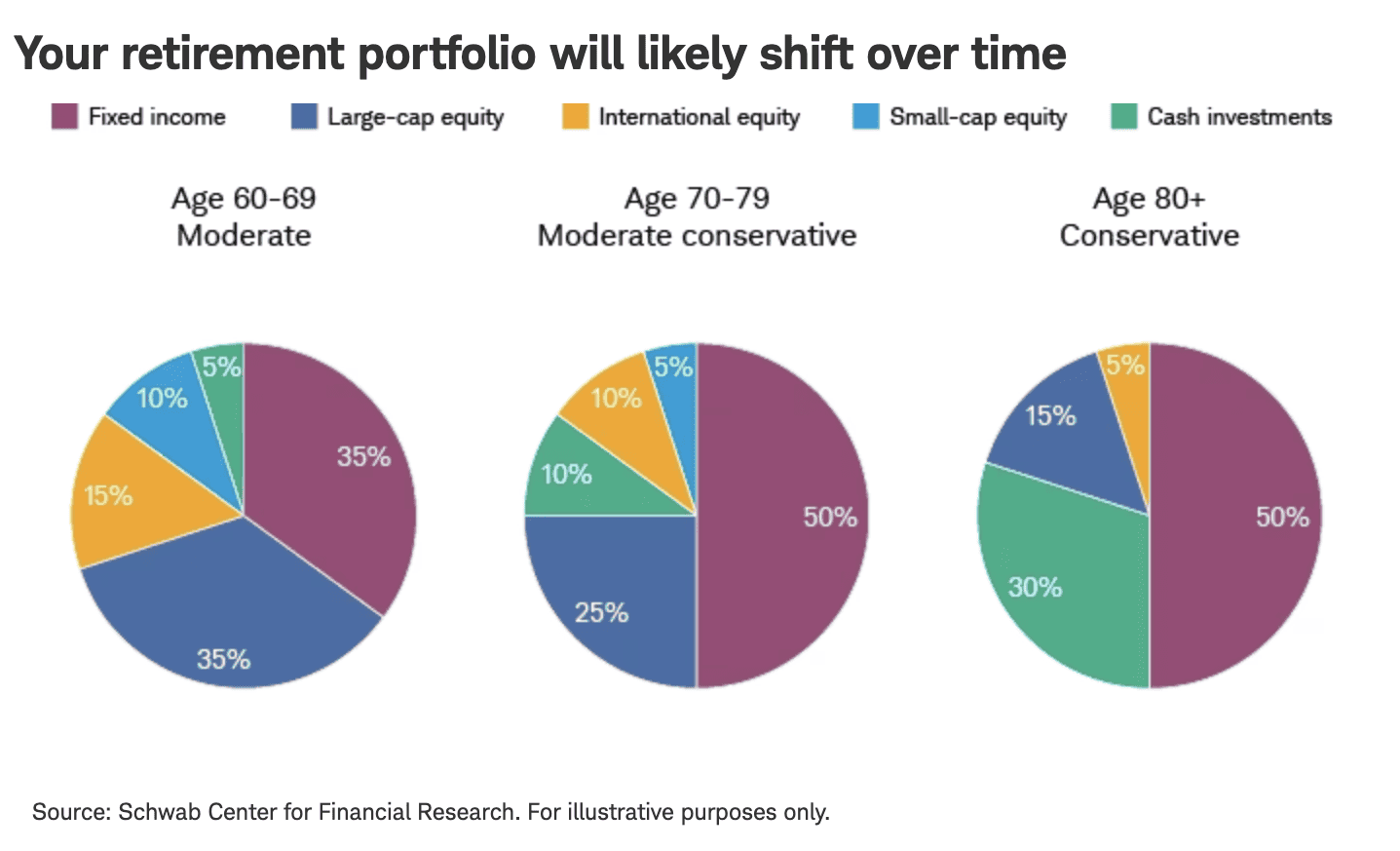

The first retirement rule of thumb that we want to bust is subtracting your age from 100 to determine the percentage of stocks in your portfolio. So, if you’re 60 and using this logic, you would have a 40-60 asset allocation—40% in stocks and 60% in bonds. In other words, you’re owning your age in bonds.

If you’re ultra wealthy and think that you can rely more on interest and dividends in retirement, there’s a chance you could use think frame of thinking as a benchmark. That retirement rule of thumb will cause a lot of people to be uncomfortable, though.

There’s also a lot of people who want to use a 60-40 asset allocation throughout retirement. That won’t work either. We’ve tried to forget about it but think about how the markets faired in 2022. It was a tough time for stocks and bonds. It was and still is critical for people to truly understand what they own.

“If you owned your age in bonds in 2022 and so far in 2023 and just owned one of the ETFs that mirrored the bond aggregate, you’d be down 16% on that portion of your portfolio. What 65-year-old wants to be 65% in an asset that has lost 16% in the last 20 months?”- Dean Barber

You can’t take a set-it-and-forget-it approach with your portfolio. Let’s say that you had a 60-40 asset allocation at the beginning of the year. You’re not likely still going to be at 60-40 today. That’s why Dean and Bud said to look into a midyear rebalance on a late-June episode of America’s Wealth Management Show.

The markets change. Your life and goals change. Your risk tolerance could change. Those are just a few of the main factors that need to be considered when determining how to properly construct your portfolio.

FIGURE 1 – Your Retirement Portfolio Will Likely Shift Over Time – Schwab

Also, keep in mind that people are living longer and longer. Outliving your money is a very real fear. It’s yet another knock on this retirement rule of thumb.

Retirement Rule of Thumb No. 2: The 4% Rule

Dean and Bud did a whole radio show on the problems with the 4% rule back in December 2021. At that time, Morningstar published a report saying that 3.3% was the new safe withdrawal rate. The bottom line with busting this retirement rule of thumb is that there shouldn’t be a standard withdrawal rate for everyone. It should depend on an individual’s financial plan.

Many of the same factors that play a role in determining your ideal asset allocation also come into play with determining a safe withdrawal. What your neighbor, friend, or coworker considers to be a safe withdrawal rate might not feel so safe to you. Or vice versa. The best withdrawal strategy is one that’s dynamic.

“A lot of people need to see the numbers to get comfortable with how much they can spend in retirement. We put it under so many screens to bring confidence to the decision at that time. That’s also where our CPAs come in because the tax implications are quite different. If you’re taking less money out in the last of of your retirement, there are ways to make that money back because you’re spending differently.” – Bud Kasper

Inflation is another huge factor that you need to plan for. As Dean likes to say, inflation won’t cause you to go broke, but it can cause you to live like you’re broke. When our advisors meet with people who have been DIY retirement planning, one of the most common flaws they see is not properly accounting for inflation. Having a 1% or 2% inflation rate applied to your plan can be a recipe for disaster. The past couple of years have shown why with the high inflationary period we’ve been in.

And remember, things inflate at different rates. While your mortgage has a fixed rate (it won’t inflate), things like college tuition and health care expenses will inflate at higher rates than the goods at the grocery store. Make sure to keep that in mind as you’re determining your safe withdrawal rate. The 4% rule is a retirement rule of thumb that isn’t for everyone.

Retirement Rule of Thumb No. 3: Having 25x Your Planned Yearly Spending Heading into Retirement

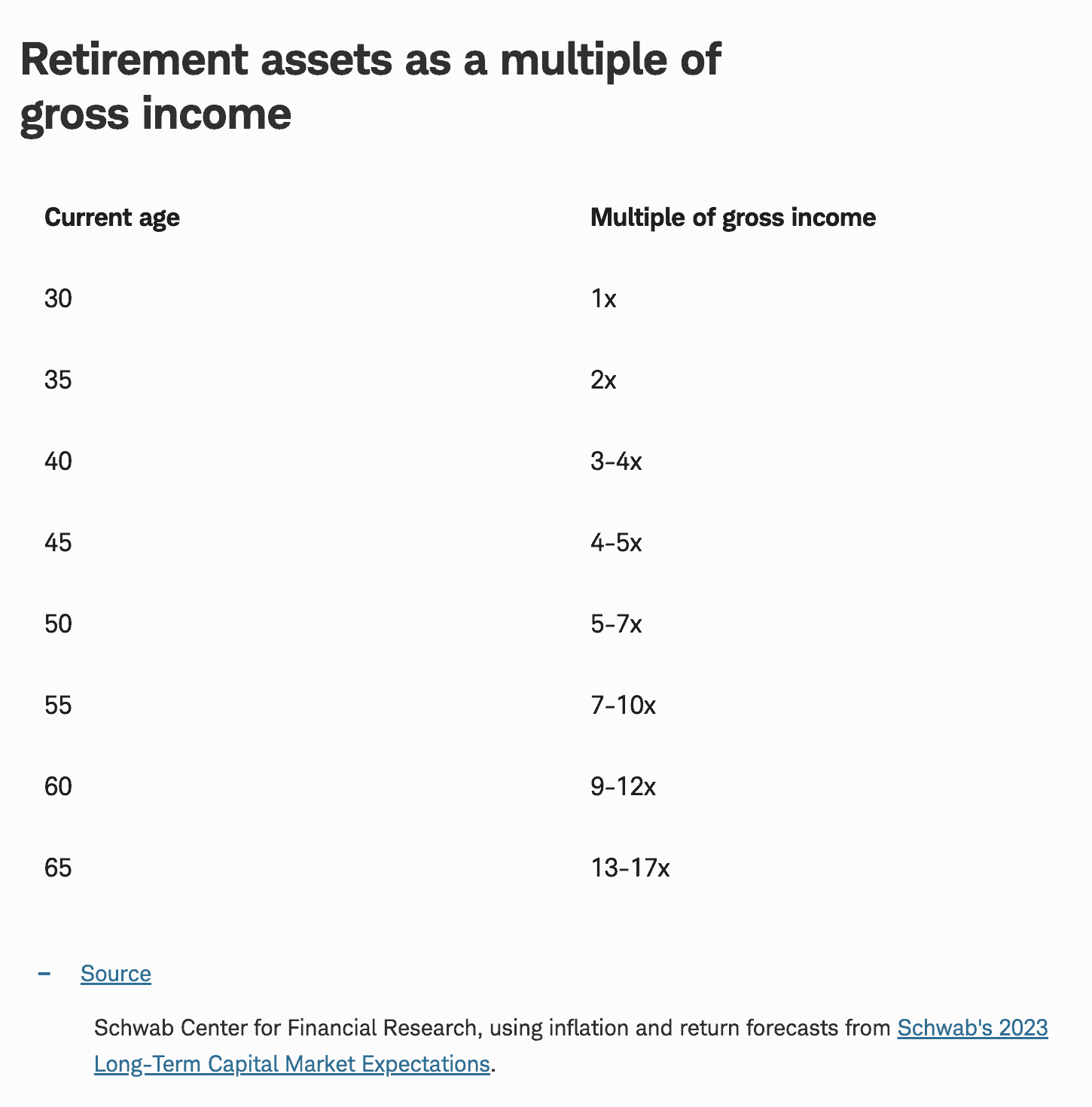

Having 25x your gross income by the time you retire is another retirement rule of thumb that people use, but there are a lot of issues that can quickly surface. Where should we start? First, using gross income rather than net income can give you a big false sense of security. Gross income also factors in retirement contributions that you will no longer have once you retire.

“Most people who have gross income of $100,000 haven’t saved $2.5 million for retirement. The people who have $2.5 million saved for retirement usually have well more than $200,000 a year in household income. This retirement rule of thumb is saying that that couple should have $5 million saved for retirement.” – Dean Barber

And what about Social Security? Many people depend on Social Security as a substantial income source in retirement, but it’s not factored into the 25x of current gross income. Figure 2 shows the timeline of how this retirement rule of thumb is expected to play out.

FIGURE 2 – Retirement Assets as a Multiple of Gross Income – Schwab

Let’s stay on the topic of Social Security for a minute. Social Security by itself is a tax-free income resource. But when you bring other income sources into the picture, it can become taxable. Did you know that up to 85% of your Social Security can become taxable?

This is yet another example of why net income is what you should keep in mind rather than gross income. Understanding the taxation rules of your income sources can be very complex. That’s why it’s critical to work with a CFP® Professional that works alongside a CPA that will review your financial plan from a tax perspective.

Retirement Rule of Thumb No. 4: Saving Between 10% to 15% of Your Income for Retirement

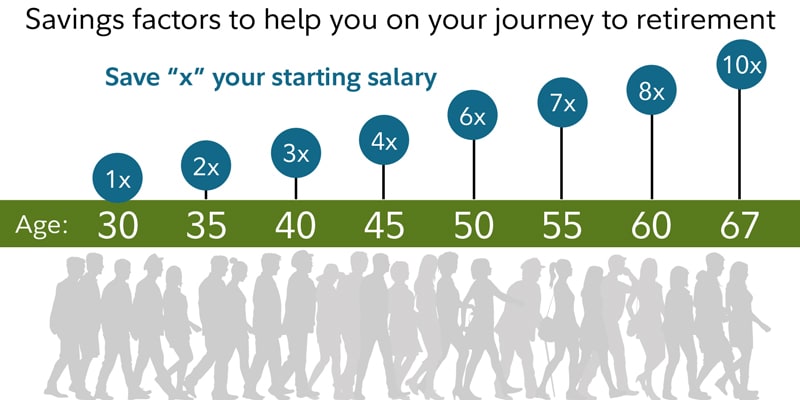

If you tuned into America’s Wealth Management Show last week, you got to hear Logan DeGraeve and Matt Kasper go in depth on this retirement rule of thumb. The reviewed an August 2023 study from Fidelity about retirement savings by age.

FIGURE 3 – Retirement Savings by Age Example – Fidelity

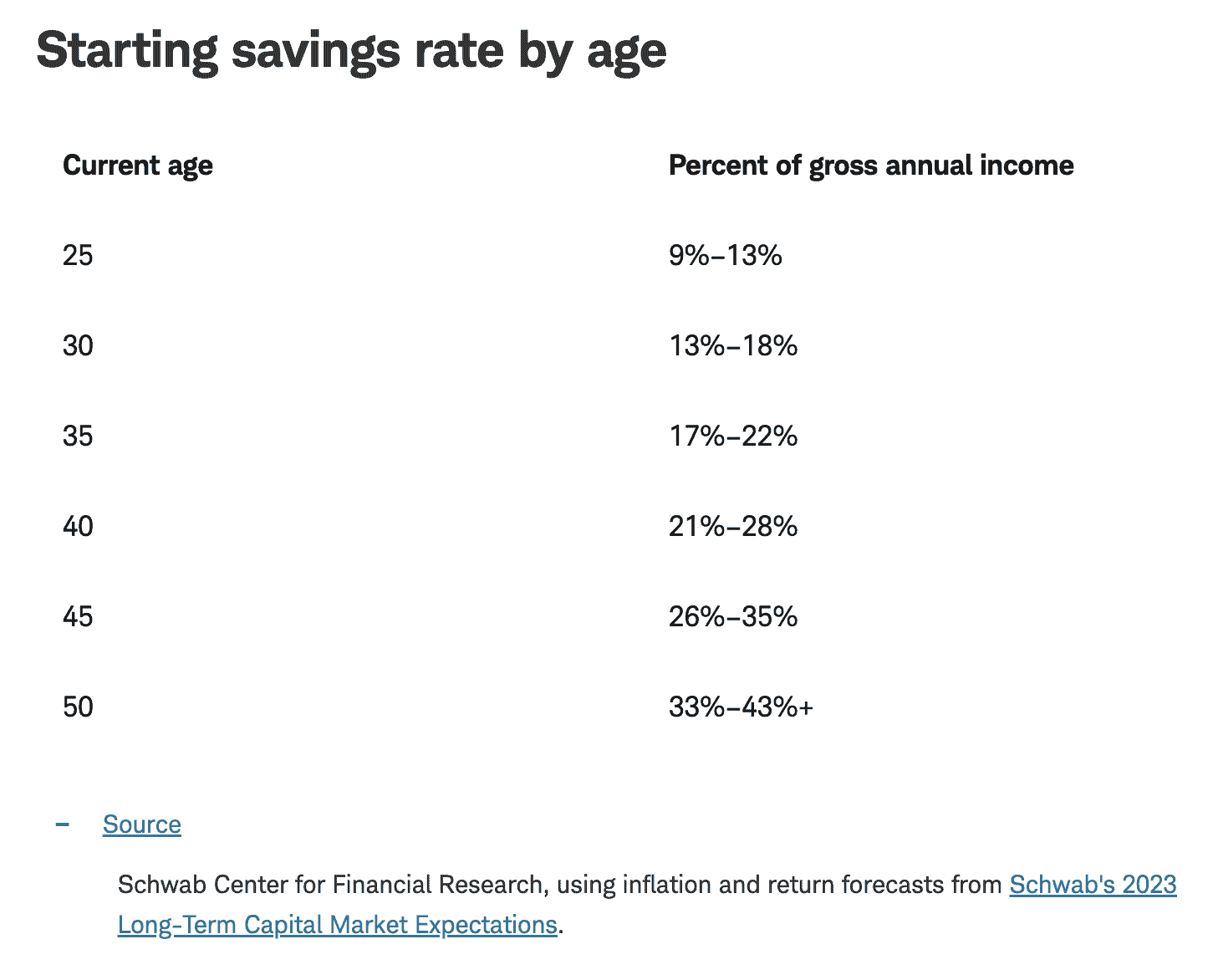

Fidelity’s study used a savings factor that was calculated based on a multiple of your starting salary. Schwab put together a similar retirement savings by age timeline using the retirement rule of thumb of saving 10% to 15% of your income for retirement (including an employer match). Where people can really run into a problem here is if you don’t start saving in your 20s or early 30s. This retirement rule of thumb won’t work if you needing to play catchup.

FIGURE 4 – Starting Savings Rate by Age – Schwab

Again, everyone is going to have a different answer to the question, “How much do I need to retire?” Your retirement goals, lifestyle, how much and where you’ve saved, and your health are all going influence how much you need for retirement. And what about your spouse’s goals and lifestyle?

“Did you save it to a traditional or Roth 401(k)? Did you save it to a savings account? Where is your money saved? What are the tax ramifications?” – Dean Barber

As you’re planning for retirement, take some time to review our Retirement Plan Checklist with your spouse. It takes you through a 30 yes-or-no questions that gauge your retirement readiness and includes an age-based timeline of things to consider as you’re approaching and going through retirement.

Building a Goals-Based Financial Plan

The takeaway here is that there are really two retirement rules of thumb that you should follow. One is having a financial plan that’s designed around your needs, wants, and wishes. The other is working with a team of financial professionals that’s putting your needs, wants, and wishes at the forefront.

Our team at Modern Wealth consists of CFP® Professionals, CPAs, estate specialists, insurance specialists, and investment specialists that work together for you. Rather than using the four problematic rules of thumb that we reviewed, we want to start building a plan that gives you clarity, confidence, and control leading up to and during retirement.

“Of all the people who have come to us at Modern Wealth, there hasn’t been anyone that I know of that’s said, ‘I’m here too soon.’ It’s always the opposite. They wish they would’ve known what we’ve told them five, 10 years ago and started the retirement planning process sooner.” – Dean Barber

Have Any Questions?

If you have any questions about how our retirement planning process works, please don’t hesitate to reach out to us. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. Depending on what works best for you, we can meet with you in person, virtually, or by phone. We’re ready to build you a financial plan that gives you confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things that you love.

Retirement Rules of Thumb: Let’s Bust Them | Watch Guide

00:00 – Introduction

02:15 – Rule #1: 25x Your Gross Income for Retirement Savings

07:15 – TRIVIA

08:40 – Rule #2: 100 Minus Your Age for Stock Allocation

11:48 – Rule #3: The 4% Rule

18:38 – Rule #4: Saving 10-15% of Your Income for Retirement

22:33 – What We Learned Today

Articles

- Investment Risk in 2023 with Garrett Waters

- 2022 Was Unusual for Bonds, Tough on Stocks

- Proper Portfolio Construction with Stephen Tuckwood

- What Is Driving the Stock Market?

- How to Mitigate Inflation on Health Care Costs

- How Much Do I Need to Retire?

- Revisiting Roth vs. Traditional with Bud Kasper and Corey Hulstein, CPA

- Building Wealth in Your 20s

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Components of a Complete Financial Plan with Logan DeGraeve

- Starting the Retirement Planning Process

- Tax Planning Tips with Corey Hulstein, CPA and Marty James, CPA, PFS

- How to Build Generational Wealth

- Don’t Miss Out on Your Money: Redefining Risk Management

- Setting Up a Spending Plan for Retirement

Past Shows

- 8 Tips on Saving for Retirement

- Safe Withdrawal Rates

- Asset Allocation vs. Tax Allocation

- Rebalancing Your Portfolio: Looking at a Midyear Rebalance

- Longevity Risk in Retirement and How to Plan for It

- 10 Ways to Fight Inflation in Retirement

- DIY Retirement Planning: What Can Be Overlooked?

- Retirement Savings by Age

- Couples Retirement Planning: What You Need to Know

- Retirement Readiness: Are You Ready to Kick Off Your Retirement?

- Financial Planning in Your 30s and 40s

- What Is Tax Planning?

- Meet Modern Wealth Management

- What Is Financial Planning?

- Converting to a Roth IRA: What Are the Pros and Cons?

- Getting Ready for Retirement: Don’t Retire without Doing These Things First

Downloads

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.