Reading Your Balance Sheet and Income Statement

Key Points – Reading Your Balance Sheet and Income Statement

- Back to Sam and Samantha Sample to Learn the Basics of Reading Your Balance Sheet and Income Statement

- A Balance Sheet Outlines the Assets You Own Versus the Debts You Owe

- Your Income Statement Accounts for Everything Coming in and Going Out

- Once Again, National Financial Planning Month Should Be Every Month

- 4 Minutes to Read

Covering the Basics of Reading Your Balance Sheet and Income Statement

After Drew Jones’s article, Retirement Analysis: Current vs. Proposed Plan, and Logan DeGraeve’s article, Understanding Your Tax Allocation, I’m thrilled to round out our National Financial Planning Month three-part series with this article, Reading Your Balance Sheet and Income Statement.

If you remember from Drew’s article to begin the series, he introduced a sample client couple, Sam and Samantha Sample. Let’s review Sample’s background and their retirement goals so we can accurately assess their balance sheet and income statement.

Sam and Samantha Sample Client Profile

- They are both 62 years old.

- Sam makes $120,000 a year, while Samantha makes $75,000 a year.

- Sam saves 10% to his 401(k) with a 4% company match, while Samantha saves 10% to her 401(k) with a 4% company match.

- Their combined net worth is about $1.7 million ($250,000 is taxable, $1.4 million is in IRAs, and $50,000 is in Roth IRAs).

- Their home is worth $400,000 with no mortgage.

- Social Security income for Sam at full retirement age will be $3,000 a month. Samantha’s benefit will be slightly less than that at $2,700 a month at her full retirement age.

The Sample’s Goals for Retirement

- They want to retire at 65.

- Sam and Samantha want to spend $62,400 a year (they’re also expecting to spend approximately an additional $16,000 per year on health care/Medicare).

- They plan to give $10,000 each year to charity until the end of their plans.

- Sam and Samantha will also spend $15,000 each year on travel until they turn 80.

Balance Sheet in Retirement

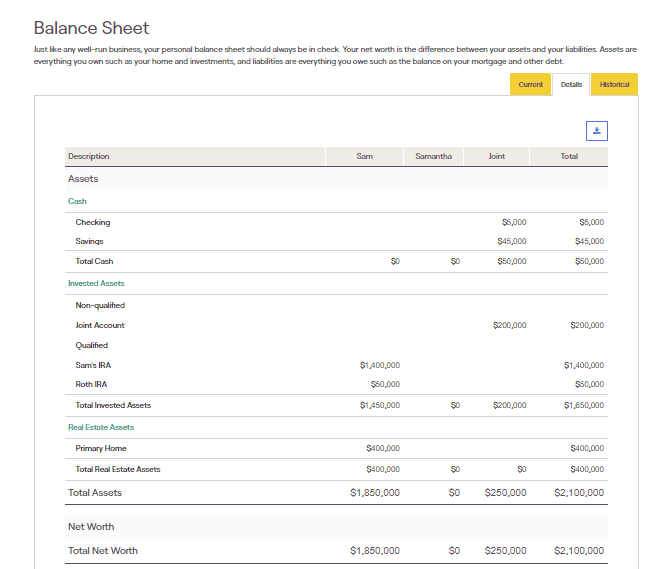

Let’s start by looking at Sam and Samantha Sample’s balance sheet. They are entering retirement with no debt, so good for them. A balance sheet is very simple and straight forward. It outlines the assets you own versus the debts that you owe.

FIGURE 1 – Balance Sheet

In this example from the Samples, they have about $1.7 million in liquid assets and $400,000 in real estate assets with no debt. That gives them a total net worth of $2.1 million. If they had debt, this would go against their liquid and hard asset net worth.

For example, let’s say they had a mortgage of $200,000. That would bring their total net worth down to $1.9 million. The balance sheet should also clearly state the titling of each asset, meaning it’s jointly owned or owned by one of the spouses like an IRA, which can only be owned by one person. The same goes for any debt. At the end of the day, it comes down to assets owned versus debts owed.

Income Statement in Retirement

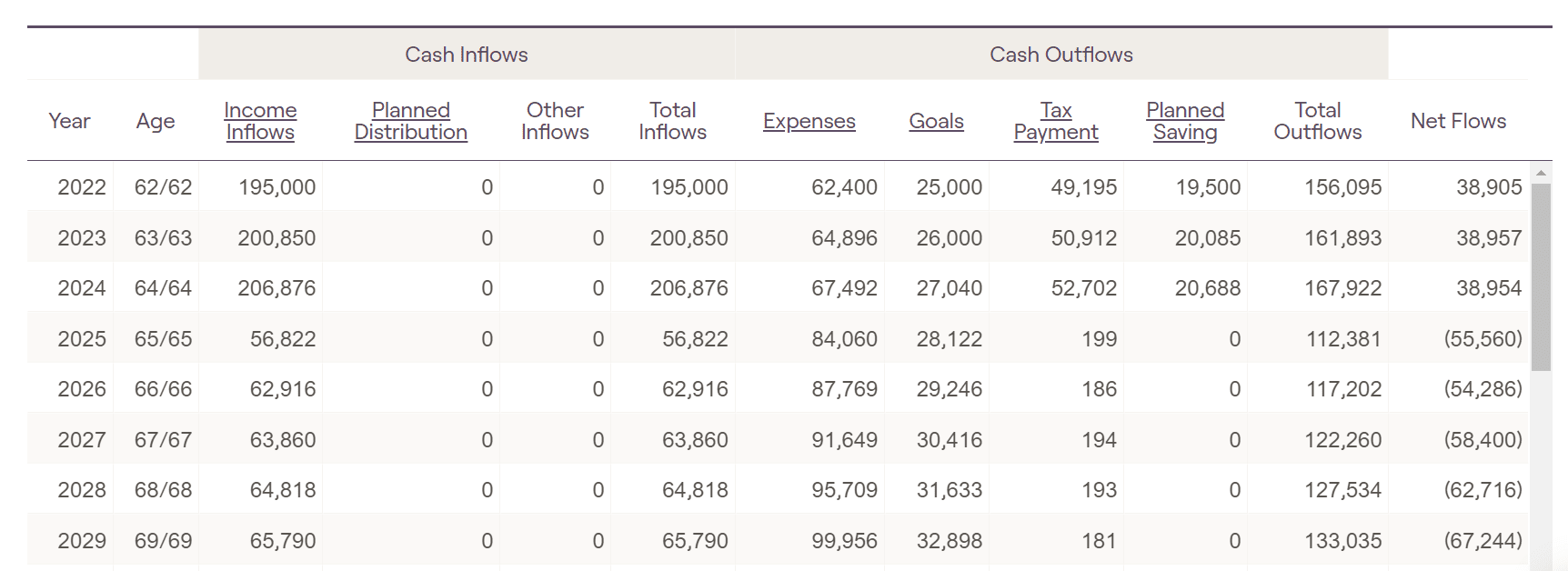

Now, let’s look at Sam and Samantha’s income statement. When most people hear the words income statement, they usually think of it more from a business perspective. In retirement, we still have an income statement. Much like a business, it accounts for everything coming in and going out.

For the most part, your income statement in retirement is quite simple. It’s your income coming in (wages, Social Security, pensions, withdrawals) versus your living expenses, goals, and taxation. The income statement helps in knowing how much money needs to be withdrawn after fixed income such as Social Security to cover the rest of your needs and taxation.

FIGURE 2 – Income Statement

A Comprehensive Financial Plan Completes the Retirement Puzzle

Remember that while your balance sheet and income statements are useful resources, there’s a third piece the retirement puzzle that you can’t go without. That is a comprehensive financial plan.

What Works for the Samples Won’t Necessarily Work for You

Going back to Drew’s article again, the proposed plan that we built for the Samples gave them an 88% probability of success in retirement. That means that 88% of the time that they could confidently retire without needing to make any changes to their plan. And 12% of the time, they could still retire comfortably but might need to make some minor adjustments.

That’s great news for the Samples. But just because this financial plan worked for them doesn’t mean it will work for you or anyone else. Even if your income has been somewhat similar throughout your career, how you’ve been saving might be different. And the chances of you having the exact same retirement goals as the Samples is highly unlikely. That’s why our Guided Retirement System is geared specifically to your retirement goals as we’re building your financial plan. We want to help you answer the question that everyone is asking, “How Much Do I Need to Retire?”

Financial Planning Is a Year-Round Process

While this article concludes our National Financial Planning Month series, it bears repeating that every month should be National Financial Planning Month. One of the ways we celebrate financial planning year-round is by giving everyone access to our industry-leading financial planning tool. You can begin building your plan from the comfort of your own home at no cost or obligation by clicking the “Start Planning” button below.

If you have any questions about reading your balance sheet and/or income statement or any facet of financial planning, we welcome the opportunity to answer them. You can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals by clicking here. We can even screen share with you while using our financial planning tool to help bring clarity and confidence to your financial situation.

Whether it’s in the last few days of “National Financial Planning Month” or any other month, we hope to celebrate financial planning with you very soon. Your celebration starts by building your financial plan, so that you can live your one best financial life.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.