Retirement Analysis: Current vs. Proposed Plan

Key Points – Retirement Analysis: Current vs. Proposed Plan

- Highlighting Key Aspects of Retirement Analysis with a Sample Financial Plan

- There Are Quite a Few Things That Retirement Calculators Miss That Our Financial Planning Tool Doesn’t

- What Are Your Goals for Retirement?

- When You Claim Social Security and Tax Planning Opportunities Can Make a Massive Difference in Your Retirement

- 5 Minutes to Read

Highlighting the Capabilities of Our Financial Planning Tool

As Dean Barber, Bud Kasper, and Matt Kasper recently shared on America’s Wealth Management Show, October is National Financial Planning Month. I couldn’t agree with them that every month should be National Financial Planning Month, but I decided with fellow CFP® Professionals Logan DeGraeve and Will Doty that we should do something special to recognize it.

A few months ago, we made our industry-leading financial planning tool available for anyone to access at no cost or obligation. Beginning with this article about retirement analysis, Will, Logan, and I will be doing a three-week series that highlights the ins and outs of how our financial planning tool works. Make no mistake about it, it’s unlike an ordinary online retirement calculator.

My article on retirement analysis is going to set the stage for this series. I’m going to outline a sample client profile of Sam and Samantha Sample that will also be used in Will and Logan’s articles.

Sam and Samantha Sample Client Profile

- They are both 62 years old.

- Sam makes $120,000 a year, while Samantha makes $75,000 a year.

- Sam saves 10% to his 401(k) with a 4% company match, while Samantha saves 10% to her 401(k) with a 4% company match.

- Their combined net worth is about $1.7 million ($250,000 is taxable, $1.4 million is in IRAs, and $50,000 is in Roth IRAs).

- Their home is worth $400,000 with no mortgage.

- Social Security income for Sam at full retirement age will be $3,000 a month. Samantha’s benefit will be slightly less than that at $2,700 a month at her full retirement age.

What Are Your Goals for Retirement?

One of the biggest things that retirement calculators don’t account for that our financial planning tool does are someone’s goals for retirement. Helping people accomplish their retirement goals while taking on the least amount of possible risk is what our Guided Retirement System is all about. Let’s look at Sam and Samantha’s retirement goals to get a better sense of retirement analysis.

Sam and Samantha’s Retirement Goals

- They want to retire at 65.

- Sam and Samantha want to spend $62,400 a year (they’re also expecting to spend approximately an additional $16,000 per year on health care/Medicare).

- They plan to give $10,000 each year to charity until the end of their plans.

- Sam and Samantha will also spend $15,000 each year on travel until they turn 80.

How Much Do You Need to Retire?

It’s great that the Samples have some clear goals for retirement. But is the wealth that they’ve accrued during their working years and their income in retirement going to be enough to get them through retirement? They want to know the answer to the question that’s on every hopeful retiree’s mind—how much do I need to retire?

As we went through Sam and Samantha’s retirement analysis, they said it was important for them to receive clarity that they could have a probability of success in retirement. In our Barber Educational Series webinar, Retiring During a Recession, featuring myself and Dean, we explained that the ideal range of probability of success is in the 75-90% range.

So, let’s say their probability of success is 90%. That means that 90% of the time, they can confidently retire without making any changes to their plan. But what about that other 10%? That means that 10% of the time, they might have to make some slight adjustments or trade-offs, but they can still retire with the high degree of confidence that they’re looking for. It’s understandable to ask why you wouldn’t want your probability of success to be 100%, but that means that you’re over-funded. In other words, you’re either saving more than you need to, not spending as much as you could, or taking on unnecessary risk.

Doing a Monte Carlo Simulation

We’re going to determine their probability of success by doing what is called a Monte Carlo Simulation. Here’s where we really get into the retirement analysis. A Monte Carlo Simulation runs 1,000 different iterations and situations against your retirement plan to illustrate your probability of success. So, if they had a 90% probability of success, that means that they could confidently retire without making any changes to the plan in 900 of those iterations.

While they would be content with a 90% probability of success, Sam and Samantha aren’t just thinking about themselves in retirement. Along with ensuring that the surviving spouse is in a good financial situation should something happen to Sam or Samantha, they hope to leave behind money to their two children.

Let’s See What Our Financial Planning Tool Says for Their Retirement Analysis

After completing the retirement analysis meetings and gathering a lot of data from the Samples, it’s time to look at the proposed comprehensive financial plan that we built for the them. Let’s review some key adjustments that we made.

When You Claim Social Security Can Make a Big Difference

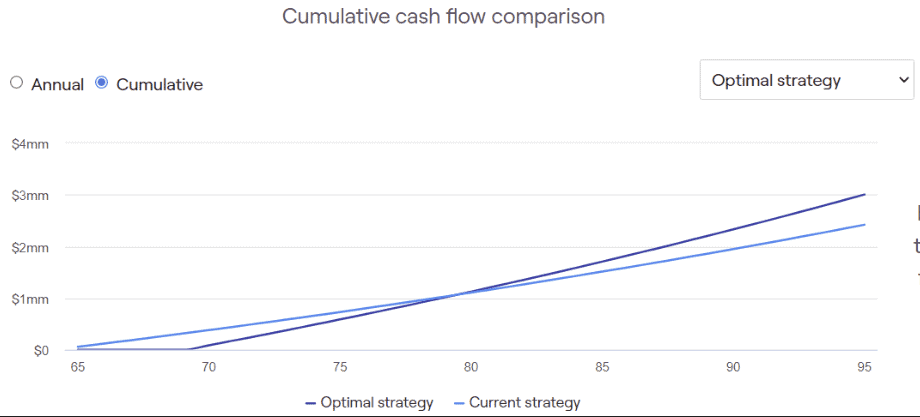

When doing some initial retirement analysis with the Samples, they had planned on claiming Social Security at 65 when they retired. After talking through Social Security with them, we explained why it makes sense for them to delay claiming it. We can see the difference in lifetime benefits below in Figure 1. The light blue line is the amount of Social Security over time if they take it at 65. The dark blue line is maximizing Social Security by delaying until 70 for the both of them.

FIGURE 1 – Claiming Social Security

Assuming they both live to 95, the lifetime benefits paid by both taking Social Security at 70 will be $3,002,988. If they were to take it at 65, the lifetime benefits would be $2,418,633. That’s a difference of almost $585,000.

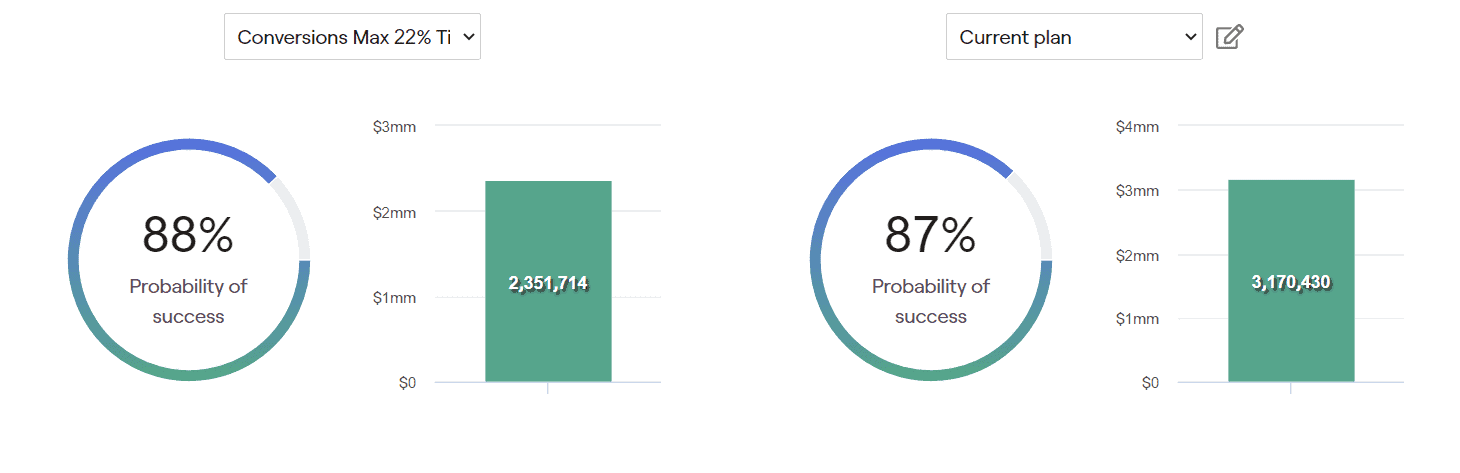

And So Can Tax Planning Strategies

In this scenario, we also looked at some tax planning opportunities. We maxed them out the 22% tax bracket for a while instead of keeping them in the 12% tax bracket. When we overlay the Social Security strategy with tax planning, we do see a slight increase in their success. That 88% probability of success is at the high end of the 75-90% ideal range, much to the delight of the Samples.

FIGURE 2 – Tax Planning Opportunities

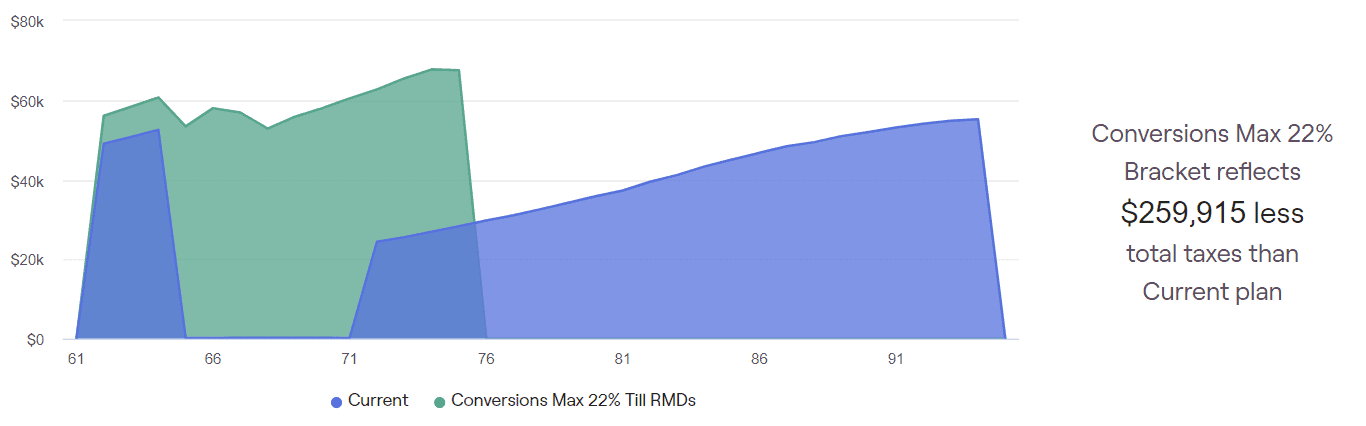

Where we see a much bigger impact by tax planning and delaying taking Social Security are the tax savings over the life of the plan. So many people can get caught up in looking at how much they’re paying in taxes in one year. By looking at your current tax rate AND future tax rate and doing multi-year tax planning, it can result in hundreds of thousands in tax savings. Just look at what it did for the Samples below in Figure 3.

FIGURE 3 – Tax Savings

Over $259,000 in taxes weren’t paid because the Samples paid more tax now at the current rate than what it will be after 2025 when the Tax Cuts and Jobs Act sunsets. We’re reverting back to the higher tax rates of 2017 once it sunsets. Stay tuned for more about what to understand about your tax allocation, as Logan will be reviewing this for the next part of the series.

So, when you combine the $259,915 in tax savings with the $584,355 saved in delaying Social Security, that’s $844,270 that the Samples would gain just from those two modifications. What a difference that some retirement analysis basics can make!

It’s Your Turn to Do Some Retirement Analysis

After seeing the Sample’s current plan vs. the one that we proposed, we hope that you will take some time to utilize our financial planning tool and begin your own retirement analysis. We’re giving you the opportunity to start building your plan from the comfort of your own home. Just click the “Start Planning” button below begin your retirement analysis and build your plan today.

Whether you have some questions over what I went over with the Samples or want to review some things with your plan, we welcome the opportunity to help you answer those questions. You can schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CFP® Professionals by clicking here. We’ll even screen share with you while using our financial planning tool so you can feel comfortable with using the tool.

More importantly, we want you to feel comfortable with getting to and through retirement. As Dean always says, we’re committed to providing you clarity with this retirement analysis while building your financial plan. That clarity leads to confidence in your ability to have control over your retirement. We look forward to helping people attain clarity, confidence, and control in retirement—not only during Financial Planning Month, but every month.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.