Retirement Income During a Recession

Key Points – Retirement Income During a Recession

- What Is the Inverted Yield Curve Telling Us?

- Taking a Cautious Approach with Your Retirement Income

- The Difference Between Cyclical and Secular Bear Markets

- There Are a Lot of Factors that Go into Determining How Much You Need to Retire

- Where Is Your Retirement Income Going to Come from?

- 17 Minutes to Read | 33 Minutes to Listen

Retirement Income During a Recession

This week, Dean Barber and Bud Kasper tackle the possibility of an impending recession, and things you should be thinking about and and doing to protect yourself.

What to Make of These First Few Weeks of 2023

With the bear market that unfolded and the rampant inflation that we experienced last year, we were happy to bid adieu to 2022. While inflation has been very persistent, we’re seeing some signs that inflation is declining. And, so far in 2023, the markets have been reasonable. We’ve seen some recovery from the losses that took place in December.

However, it’s important to understand what’s happening from an economic perspective before getting too excited about what’s happening in the market. There are still very real signs that a recession is looming. If a recession occurs this year, people need to be prepared. That’s especially true if you’re planning to retire in the next five to 10 years.

There are things to be thinking about regarding retirement income during a recession for people who are already retired as well. Modern Wealth Management Founder and CEO Dean Barber and one of our CFP® Professionals, Drew Jones, also did an in-depth analysis on this during our Modern Wealth Management Educational Series webinar, Retiring During a Recession. Make sure to go back and watch that as well. Between that webinar and this article, we have a lot to share about retirement income during a recession.

One of the Primary Indicators of a Recession: An Inverted Yield Curve

If you’re ready to move on to greener pastures in 2023 after the pain we experienced in the markets in 2022, you aren’t alone in thinking that. But reality seems to be painting a different picture. Caution is still the best approach to take as we move forward in 2023.

As debate about a possible recession continues to escalate, we’ve been paying close attention to some significant recession indicators. One of them is the steeply inverted U.S. treasury yield curve.

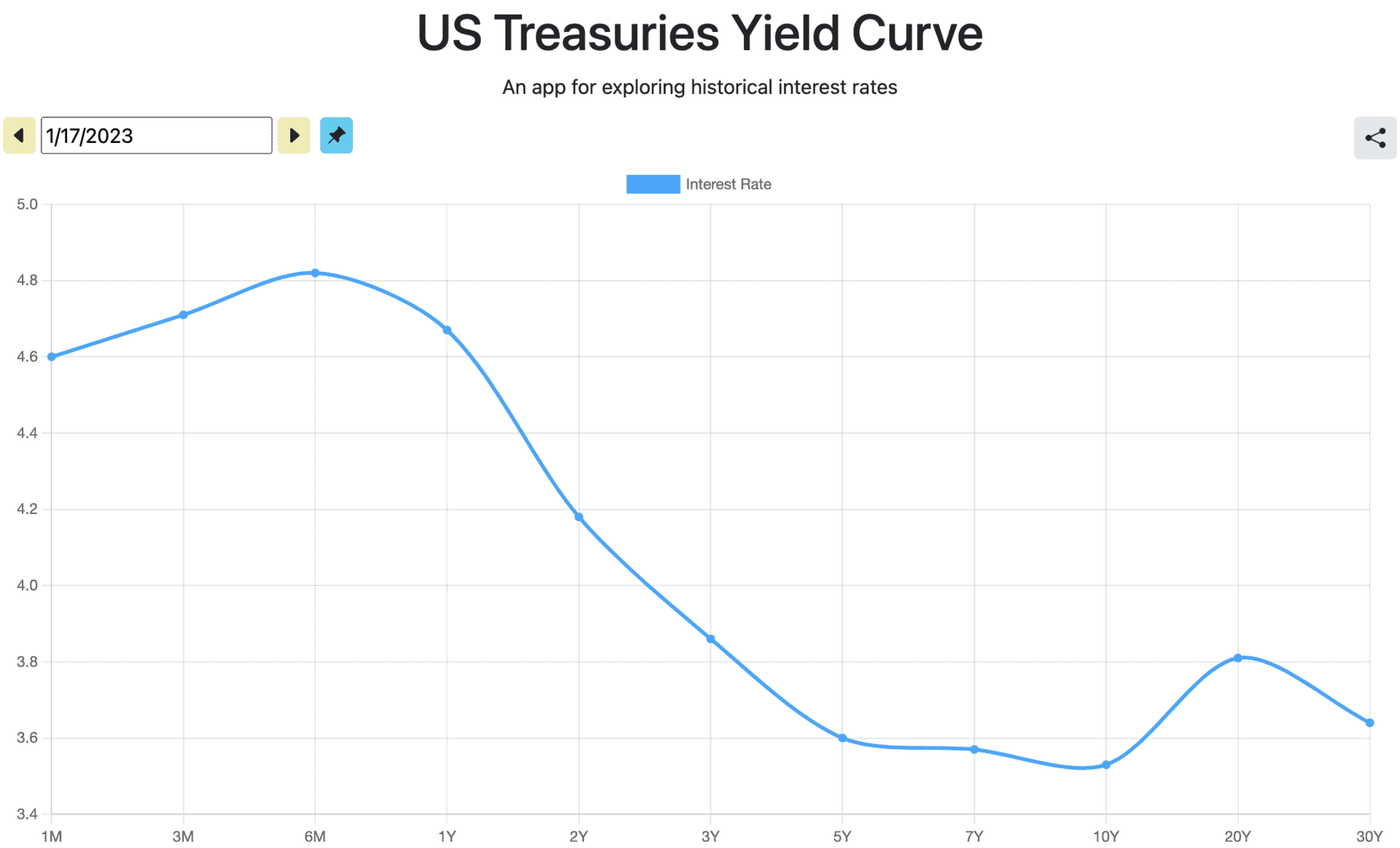

FIGURE 1 – U.S. Treasury Yield Curve

You can see in Figure 1 that the six-month treasury is the highest yielding treasury at 4.82%. If you want to purchase a 10-year treasury, it’s yielding at 3.53%. That’s the steepest inversion of the yield curve since 1981.

“A deep inversion is a sign of an extreme economic pessimism. If you buy into that, then what we need to do at this point is to continue doing what we did in the last nine months of 2022. That’s being defensive and protecting principle. If you’re trying to drive income, set enough money aside in income that you don’t put at risk. I think these are the very simple basic blocks about retirement income that people need to understand to survive these types of events.” – Bud Kasper

Every time we have seen an inversion like this, it has led to a recession. However, the timing, depth, and length of a recession are never consistent. History still tells us, though, that when we have this type of an inverted yield curve, we need to be cautious of a pending recession. And being cautious involves doing a thorough analysis of your retirement income.

Cyclical Bear Markets vs. Secular Bear Markets

When you’re assessing a bear market, it’s important to know that there’s a difference between a cyclical bear market and a secular bear market. A secular bear market is a protracted bear market. It’s one that lasts several months—maybe even a couple of years. The last two secular bear markets that we’ve had were during the Dot-Com Bubble in 2000, 2001, and 2002, and the Financial Crisis in 2008 and 2009. During both of those secular bear markets, we had multiple bull market runs. We refer to those as bear market rallies or bear market traps.

“When people see this nice run-up in the stock market like what we’ve seen so far in 2023, they think that 2022 is in the rearview mirror and that there’s no more bear market. They think that it’s time to be back in the market, but there are so many signs to still be cautious. Yes, we’re going to have bull market runs within a secular bear market. But trying to time those bull market runs can be like trying to catch a falling knife.” – Dean Barber

For retirees and near retirees, protection of your retirement income becomes just as important to the growth of the money. There’s a time to go ahead and reach for some additional returns, but this is not that time. This is the time to shelter money and be opportunistic at the right time. We need better signs that the economy can regain the momentum it had prior to 2022.

An Important Aspect of Your Retirement Income Involves Identifying Your Probability of Success

If you’ve done the right type of financial planning, you can identify your probability of success of achieving all your financial goals based on the asset allocation you have and several other factors that we’ll touch on shortly. That’s what we do within our Guided Retirement System. If you’ve done that, you can see what happens to your probability of success when you’re reducing or increasing equity exposure. You need to know that about your retirement income before a possible recession hits.

It’s critical to pay attention to what’s happening within your overall portfolio. If we do go into a recession, have you done what you need to do to protect yourself? That’s the key. There are going to be bull market runs inside of bear markets that can lull people into a false sense of security. It’s not a good feeling when the rug gets pulled out from under you and then the market continues to decline.

Immaculate Disinflation

Throughout the current bear market, we’ve been closely following the actions of the Federal Reserve. It’s also been interesting to see what former Federal Reserve members have had to say. A couple of weeks ago, former Federal Reserve Governor Randall Kroszner made some headlines with talking about immaculate disinflation. What exactly does that mean? Well, Kroszner stated that if inflation doesn’t come down, the opportunity won’t be there for bonds or stocks to prosper.

Everybody wants the Federal Reserve to stop raising the Fed funds rate and start decreasing it so we can go back to having consistent double digit returns. The reality is that that’s not what we see on the horizon.

“This might be a little surprising, but I think we were lucky to get out of 2022 with the S&P 500 losing what it did. It could have been a lot worse. I’m not trying to frighten people. I’m just saying to be prepared. We’ve seen these returns start to come back in the first couple of weeks of the new year, which feels nice. But the reality is that those are little short-term signs in my opinion. I wouldn’t hang my hat on that. We’re not changing our position of being defensive even though we always keep a little opportunity money in our portfolios.” – Bud Kasper

Smart Money vs. Dumb Money

The bottom line is that it’s imperative to protect your retirement income. While we look for those opportunities, though, we must remember the difference between smart money and dumb money.

The smart money is your institutional investor, big pension fund managers, and institutional investors. If you follow the money flow of the smart money, it’s still going into very defensive sectors of the market, such as utilities and consumer staples.

The dumb money is the money that’s going to start chasing what they perceive as the stocks that have been beaten up. They may be down 40% or 50% or more. So, they think it’s a good time to buy. The thing is that you need to pay attention to the price-to-earnings ratio and forward-looking earnings projections of those companies to really understand if that stock is undervalued. Or is it still overvalued, even at 50% below where it was at its peak?

What Do You Want Your Retirement to Look Like?

Since this is people’s retirement income that we’re talking about, people are second-guessing whether they should retire. They’re concerned about losing value in their 401(K) because of the conditions of the market.

Well, rather than being concerned about whether this is the right time to retire, you need to be looking at your financial plan. Not having a plan is what can really make you feel like you’re running around in circles. A financial plan truly serves as a permission to do the things you want to do in retirement.

“When you build a financial plan the right way, the first thing that you’re going to do is you’re going to step into the future. You’re asking the question, what do I want my retirement to look like? When do I want to retire? What do I want my life to look like? What are the things that I want to do and that are important to me? And what are the things that are important to my spouse?” – Dean Barber

If you’re not incorporating your retirement goals into your financial plan, your plan isn’t close to be complete. Your goals are one of many things that retirement calculators don’t account for. We want to know about your goals for retirement and what’s important to you before talking to you about investments.

How Much Do You Need to Retire?

After you lay out your retirement goals, you can start figuring out how much it will cost you to do those things. And of course, there are other costs that you will need your retirement income to cover as well. Medicare/health insurance costs are likely toward the top of that list.

Right up there with health care costs as the biggest wealth-eroding factors of retirement are taxes. Are you aware of the different tax planning strategies that can help you pay as little tax as possible over your lifetime? Remember, you worked hard for your retirement income. Don’t let Uncle Sam take a big chunk of it. You can download a copy of our Tax Reduction Strategies Guide below to help with that.

And as you’re trying to determine how much you need to get you to and through retirement, you need to determine how and when to claim your Social Security benefits. You don’t want to leave money on the table when you claim your Social Security benefits, so make sure to download our Social Security Decisions Guide below.

Download: Social Security Decisions Guide

Suddenly, your financial plan starts to come together. That’s when you ask yourself, “What’s my probability of success based on the assets that I have today and my current asset allocation?” That gives you a picture of where you are today. But it doesn’t stop there once you have the picture. You want your retirement to be the best it can be, right? So, what can you do to improve your probability of success?

Can You Retire Right Now and You Don’t Even Know It?

The reason we like to start working with people 10 to 15 years before they want to retire is so they can start doing all this planning sooner rather than later. Without a financial plan, you can’t get that clear picture of how much retirement income you need to get to and through retirement.

There are a lot of people who we meet with for the first time who hope to retire three to five years from then. Sometimes, that retirement timeline ends up staying on that course. And in some instances, it could take longer since more planning is needed. But so many times we’ve met with people who think they’re three to five years from retirement when they can retire right now.

“That gives people a sense of freedom that they haven’t had before. It doesn’t necessarily mean that people will retire at that point in time, but at least they know where they stand. Once that plan is built, now you can stress test that plan. What would happen if we were to go into a recession? What were to happen if we were to have higher interest rates or higher inflation?” – Dean Barber

Again, you can then see what all that does to your probability of success and your plan. You can start making adjustments if there’s a recession on the horizon. What adjustments can we make to make sure that your plan still succeeds? Playing those what-if scenarios and understanding the right asset allocation and tax allocation is the beauty of having a financial plan.

Where Is Your Retirement Income Going to Come from?

Let’s say that you’re preparing to retire and you’ve already told your company that you’re leaving. Your main concern is where your retirement income is going to be coming from. When we’re building out someone’s plan, we always try to set aside a year and a half to two years of income to get cash flow to our clients as they enter retirement. The balance of the portfolio will need to be managed.

“You need to always remember that conservative will serve you best until you find out that the market is in a good economic state. Then, we can reach for some higher returns. But you need to be able to protect your retirement income and money.” – Bud Kasper

While you can never eliminate downward volatility, there are ways to mitigate it. 2022 is very difficult because we saw the bond market drop almost as much as we saw the stock market drop a few times in 2022. That was due to the rising interest rates and the rising interest rates were due to higher inflation. The question is, has the Fed done a good enough job at this point to curb inflation and bring it back down to their 2% target? Or do they still have a lot of room to go?

More Mass Layoffs and Declining Wholesale Prices

Nobody really knows the answer to that question, but we can all have our opinions. Along with inflation continuing to be top of mind, we’re starting to see more and more mass layoffs. Microsoft announced it was laying off 10,000 people. Amazon announced another round of layoffs that’s impacting 18,000 people. Wholesale prices also fell by 0.5% in December, which was more than anticipated.

All that news is building more anticipation for the next FOMC meeting, which is scheduled for January 31/February 1. The dates for every FOMC meeting and many important dates that can impact your retirement are on our 2023 Retirement Planning Calendar, so make sure to download your copy below.

2023 Retirement Planning Calendar

What’s the Next Move by the Fed?

When the Federal Reserve started rapidly raising interest rates, they thought that inflation was going to be transitory. Dean and Bud said back in 2021 that the Fed should have started raising rates sooner. The fact that they didn’t start raising rates sooner exacerbated the inflation issues that we’re facing still today. We should expect another rate hike at the next FOMC meeting. Dean thinks it could be another 0.5% increase, while Bud believes we could see a 0.25% hike.

“I think the markets are anticipating another hike, but we still need to be cautious of the possibility of a recession. We were saying this last year that the rapid rise in rates could crush many parts of the economy and send us into a recession.” – Dean Barber

Bud’s reasoning for the possibility of a 0.25% are because of those mass layoffs we mentioned earlier. If the Fed continues to raise rates at a sharp pace, a longer, deeper recession could be in store.

The Fed has a terminal inflation rate of 2% that they refer. While inflation did fall for a sixth straight month to 6.5% in December, that’s obviously a long way from 2%. Bud thinks that if it gets back down to 3% that we will see a significant improvement in market conditions, confidence, and things like that.

“People want to know that the Federal Reserve has their hands on the steering wheel at 10 and two and that they are helping this economy move in the right direction. I don’t think a lot of people know how difficult and challenging that can be.” – Bud Kasper

Looking at Retirement Income for Someone Who Is 10-15 Years from Retirement

We talked a little bit earlier about the difference between start to plan for retirement 10-15 years from retirement compared to three to five years from retirement. Let’s dive a little bit deeper into that to highlight the importance of having adequate retirement income during a recession.

For people who are 10 to 15 years away from retirement, asset allocation typically wouldn’t be a big concern. It still isn’t even that big of a concern if we’re going into a short-term recession unless you work for a company that could potentially lay you off. Finding a new career when you’re 10 years away from your desired retirement date obviously isn’t ideal.

Important Questions About Your Retirement Income

But the real question for people who are 10-15 years from retirement really should be, how much do you need to save to get to where you want to be? And where should you save that money? Should you put that money into a traditional 401(k) or Roth 401(k) or traditional IRA or Roth IRA?

People who are 10-15 years out from retirement still have plenty of opportunities to take advantage of. Even with stock and bond prices being down, remember that you’re dollar-cost averaging with every paycheck into your 401(k). This is opportunity. For example, let’s say that we knew that within six months that the market was going to go back within 10% of where we finished 2022. You would be changing your allocation in favor of stocks because of that.

That will eventually happen, whether it’s in 2023 or 2024. But for people that have 10-15 years before retirement, this is an opportunity to put more money into your portfolio that will allow you to get future gains, which will come. That’s how you should think about retirement income during a possible recession.

If you have some money that you want to invest, the natural question that you’ll probably want to ask if what to do with it. The first question you should be asking, though, is when you’ll need to use that money. If you’re not going to need it for 10 years, the chances that you put money into the market today and it’s worth more in 10 years are very high.

What Is a Lost Decade?

Now, there have been a couple of times in history where we’ve gone into a lost decade. We referenced one of them earlier. It started in January 2000 and the bear market that spanned from 2000 into 2002. It lasted almost three years. The market almost recovered or barely above that in early 2008. But then the Financial Crisis hit. We barely got back to breaking even by the end of 2010. That was a lost decade.

But we are already at a point where prices have pulled back from their peak. If you’re 10-15 years from retirement and have time on your side, going into the market with any piece of money might not be the move right now, but dollar-cost averaging like we mentioned earlier is something to strongly consider over the course of the next 12 months or so.

“That’s exactly what you do with a 401(k) because it’s every paycheck that’s going into the program. It doesn’t serve our clients purposes or our purposes to be pollyannish about this. There’s a well-known money manager that is saying that we’re on the verge of a new bull market, but I can’t get behind that. The fundamentals associated with an improving economy have not appeared yet, but I’m confident that it will occur. We’ve need to get things right first, and that’s what the Federal Reserve is trying to accomplish.” – Bud Kasper

We Can’t Predict the Future, But We Can Plan for It

When we look at what we’re experiencing right now in terms of the economy itself, the fact that interest rates are continuing to rise contracts the economy. It doesn’t expand the economy. As we stay on that path, that contraction is going to eventually put ourselves in a position where we’re not so overvalued in the markets.

While Bud didn’t reveal the name of the money manager he mentioned earlier, there is one money manager who usually very quick to predict bull markets who isn’t doing so right now. That’s Brian Westbury of FirstTrust. He believes that the worst of what we are going to experience in the secular bear market has not yet occurred.

There are a lot more economists who are saying that there’s more pain ahead rather than that everything is rosy. Nobody knows if there is going to be a recession and how long or deep it could be, but it’s very likely that there will be one. The real issue, though, is what you should be doing with your money. How much should you be saving in terms of retirement income and where should you be putting that money?

The Fear of Running Out of Money

As people enter retirement, one of their biggest fears is usually running out of money before running out of life. Oftentimes, tough or uncertain economic conditions can cause fearful people to live like they’re broke when they don’t need to. The reason they do that is because they don’t have a financial plan in place that allows them to see what a comfortable amount is to spend. So, they wind up under spending and not living the life that they truly want.

And when investors begin to get fearful, annuity salespeople are thrilled. The annuity salespeople are going to tell those investors that they need to be in an annuity that will give them a fixed amount of income. While there oftentimes is a place for an annuity within a portfolio, they aren’t something you should depend on long-term.

Weathering the Storm

Dean and Bud have both been putting people into government bonds and CDs that are paying 4.5% on three months depending on the day. That’s based on a one-year annualized return, but they’re get one-fourth of that on a 90-day deal. Strategically, we want money to be available at the appropriate time for people to find themselves back into the market. At this point, we don’t see that opportunity. We’ve also raised a lot of cash inside portfolios. This is the flexibility that people need to understand to weather the storms that we’re in and still come out on the other side to a much-improved situation.

The Relationship Between Bond Prices and Interest Rates

The other thing that has become attractive for the first time in decades is municipal bonds. There are some opportunities in municipal bonds. Remember, though, that all bonds are not all created equal. You need to understand the bond market before you start investing in bonds.

A year ago, bonds were trading at substantial premiums, which meant that their yield to maturity wasn’t very attractive. But because of the increase in interest rates, a lot of those bonds are now trading back now closer to par, which makes their yield to maturity far more attractive. If you’re in a higher tax bracket, that can be someplace that you need to go as well.

The Clarity That Comes from a Financial Plan

Before we wrap up this article on retirement income during a recession, let’s go back to the idea of being fearful of running out of money. It’s a very real fear. Through a proper financial plan, you can see a safe amount to spend. Dean, Bud, and our other advisors have seen too many times instances of people not spending as they could because they have that fear of running out of money.

It’s important for people to understand that when you’re early on in retirement, that’s when your health is the best. That’s when you have the most energy to do the things that you want to do. If that fear is gripping you and you don’t have clarity, it’s probably because you don’t have that well-defined plan that shows you exactly how much is OK to spend.

Living Your One Best Financial Life

During your working years, you’re used to receiving clarity from a paycheck. You know how much is coming in and coming out after things like health insurance and taxes are being taken out of your paycheck. Once you hit into retirement, if you haven’t built a financial plan, there’s no way to know the right amount that you can spend.

We want you to have the clarity to do the things you want to do in retirement, whether that’s going on vacations, buying a second home, paying for your grandchildren’s educations, giving to charity, etc. That gets back to your probability of success we mentioned earlier. It’s a mathematical calculation that takes into account all sources of income, whether it’s taxable, tax-deferred, or tax-free, and puts it all into a calculated format. It allows you to see how your plan fares if you take out X-amount per year in varying market conditions.

If that probability of success comes in around 70%, that’s a little bit iffy when talking about having all the money you need for the rest of your life. But if your probability of success is in that 75%-90% range, that’s more of an ideal situation. If you’re in that range, times like we’re going through today won’t cause your probability of success to change all that much, if at all, because all the different economic conditions have already been factored in.

“When we’re determining your probability of success, we’re looking forward 20, 25, 30, 35 years so that you’re getting through retirement. Having the tools in place to show people exactly what that experience would be like is a rare opportunity. Unfortunately, too many people aren’t getting that exposure.” – Bud Kasper

The Many Things That Determine Your Probability of Success

It’s important to remember that your probability of success fluctuates depending on your asset allocation and tax allocation. Your probability of success also depends on how and when you’re claiming Social Security and tackling health care expenses. And, of course, inflation is a big factor in determining your probability of success as well.

There are all sorts of things that can affect your probability of success. Whether you’re in retirement or nearing retirement, you can get clarity on where your retirement income should be and what you should be saving into prior to retirement. That clarity that you need with your retirement income is provided in a financial plan.

Let’s Start Planning

So, where do you start with building a financial plan? Well, we’re glad you asked. We’re giving you the opportunity to build your unique financial plan that incorporates the many things we’ve discussed by using our financial planning tool. It’s the same tool that our CFP® Professionals use with our clients, and you can access it from the comfort of your own home at no cost of obligation. Just click the “Start Planning” button below to begin building your plan today.

As you’ve hopefully realized, you can’t just build your plan and then expect to coast right through retirement and be set. Your plan will change as your life changes. If you have questions about your retirement income, how and where to save, how to go about building your plan, etc., let us know. You can schedule a 20-minute “ask anything” session or a complimentary consultation with one of our CFP® Professionals by clicking here. You can meet with us in whatever way is most comfortable to you, whether that’s in person, virtually, or by phone. We look forward to the opportunity to meet with you about how you can live your one best financial life.

Retirement Income During a Recession | Watch Guide

Disclosures and Introduction: 00:00

2023 So Far So Good: 01:04

Inverted Yield Curve Indicating Recession: 02:37

Cyclical vs. Secular Bear Markets: 04:34

The “Immaculate Disinflation”: 08:25

Smart Money vs. Dumb Money: 09:55

Why the Financial Plan Matters: 11:53

2022 Bond and Stock Markets: 15:28

Mass Layoffs Feeding Recession Fears: 16:37

The Fed’s Next Move: 17:10

What if You’re 10-15 Years from Retirement?: 19:27

Bull or Bear in Our Near Future?: 23:07

Biggest Fear for Retirees: 25:14

Conclusion: 32:29

Resources Mentioned in this Episode

Articles:

- What Is Yield Curve Inversion?

- Bear Market Rallies

- What Is a Monte Carlo Simulation?

- How Much Do I Need to Retire?

- 8 Ways to Prepare for a Recession

Other Episodes

Downloads:

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.