Q2 2023 Quarterly Market Update

Key Points – Q2 2023 Quarterly Market Update

- Are We in a New Tech Bubble?

- Are We in a Silent Recession?

- What Happened in Q2 2023 and Looking Back at Q1 2023

- What’s Going on with the Yield Curve?

- 5 Minutes to Read | 11 Minutes to Watch

Dean and Bud Are Back with Their Q2 2023 Quarterly Market Update

Back in April, Dean Barber and Bud Kasper did something new on the Modern Wealth Management Educational Series when they gave their Q1 2023 Quarterly Market Update. Now that Q2 2023 is behind us, it’s time for them to give their Q2 2023 quarterly market update.

It Looks Like We’re in a New Bull Market, But…

From all appearances, it looks like the markets are on fire, we’re in a new bull market, and the economy is strong. But if you really look at what’s happening, that isn’t the case.

“I think people are desperate to have a strong move in the market that would be sustainable. But I think the sustainability of this market is in question.” – Bud Kasper

The RSP Equal Weight vs. the Cap-Weighted S&P 500

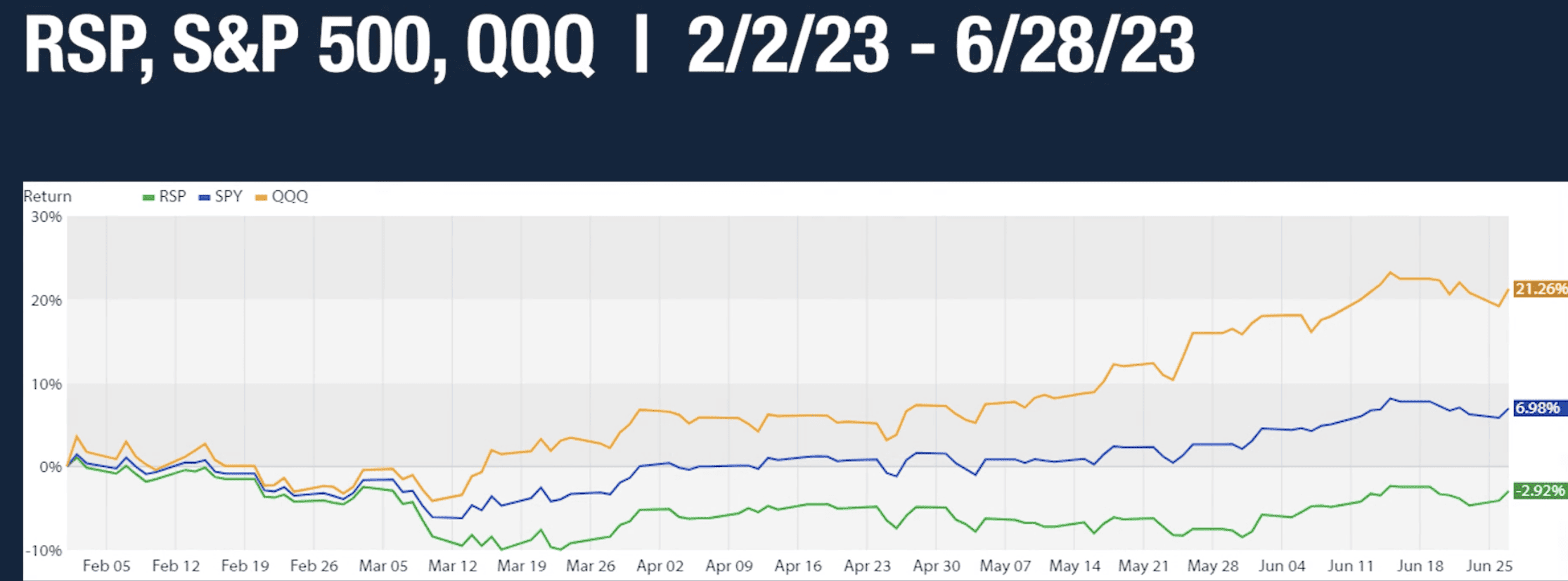

We started to see a major divergence from the RSP Equal-Weighted ETF, which is the equal-weighted S&P 500, and the cap-weighted S&P 500. The RSP owns shares of all 500 companies of the S&P 500, while the bigger companies drive much of the return or loss in the cap-weighted S&P 500.

There have been about five to seven stocks that have been driving a large portion of the return in the S&P 500 in recent weeks. And they’re all tech companies. As of June 28, Apple, Microsoft, Amazon, Nvidia, Google, and Meta made up 26% of the S&P 500’s market capitalization.

More Irrational Exuberance?

If you look at the RSP from February 2 through June 28, it’s at -2.92%. Meanwhile, the S&P 500 is at 6.98%.

“We have a divergence of about 10% there. That’s the largest divergence from the equal-weighted S&P 500 to the cap-weighted S&P 500 since the Dot-Com Bubble.” – Dean Barber

In that same February 2 – June 28 timeframe, the Nasdaq-100 is at 21.26%. But it gets more interesting, those same six stocks that make up 26% of the S&P 500 make up 52% of the Nasdaq-100.

FIGURE 1 – Market Performances from February 2 Through June 28

“You need to ask the question, ‘Are we in a new tech bubble? Think about Alan Greenspan back in 1998 when he said there was irrational exuberance in the market. He’s not here to say that there’s irrational exuberance now, but is there irrational exuberance in the high concentration of the few tech companies that are driving the market?” – Dean Barber

Bud believes that’s the case. But that doesn’t mean that they’re not going to be important a year from now as they are now. However, we shouldn’t see that divergence that these six companies have over the remaining companies that make up the S&P 500.

Are We in a Silent Recession?

Dean and Bud recently pointed this out on America’s Wealth Management Show, but Stansberry Research stated that most of the economy is in a “silent recession.” The definition of a recession is two consecutive negative quarters of GDP. We had that a few months ago, but that was essentially ignored.

What’s happened with inflation has hurt a lot of people. A few weeks ago, FedEx declared that they need to do things differently because they’re seeing a vast slowdown in number of parcels that are being shipped. The shipping industry is a precursor to what’s happening in the rest of the economy. There are very few places that are doing extraordinarily well while the others are struggling as we go from Q2 2023 to Q3 2023.

“If you look at the price of gasoline, which is a major factor for inflation, if we didn’t have it at a reasonable price today, those multiples would look completely different.” – Bud Kasper

Price-to-Earnings Ratios

Let’s talk a little bit more about multiples. Nvidia is a stock that’s been in the news a lot lately. It’s a chip maker and could play a very big rile in AI. Nvidia’s stock has shot up through the roof. Year-to-date, Nvidia’s stock is up 186.55%. We haven’t seen those types of returns since the Dot-Com Bubble.

“Here’s the thing. When you look at price-to-earnings ratios on Nvidia, it’s 217.63. It’s trading at 217 times next year’s earnings.” – Dean Barber

That means one of two things must happen. Either productivity will need to increase substantially or it will need to narrow and come back to some sense of normality.

Amazon is another example of this. It’s up 53.79% year-to-date. So, it’s not quite as sky high as Nvidia. However, Amazon’s price-to-earnings ratio is 313.

“We could go through all these—Apple, Amazon, Microsoft, Nvidia, Google, and Meta—and there’s only a couple of them that have a reasonable price-to-earnings ratio. Google and Meta’s price-to-earnings’ ratios are in the high 20s or low 30s.” – Dean Barber

Going back to last year, the QQQ, which is a technology-based ETF, was down 33%. It’s now up 36% at the end of Q2 2023. Is that sustainable? We don’t know. We’re fairly surprised that it was able to make it up within the matter of six months.

Looking Back at Q1 2023 to Better Understand Q2 2023

If we reflect on Q2 2023 and 2023 as a whole, the Fed raised rates until pausing on June 14. Still, they said that more rate hikes are likely to come for the rest of 2023. We have seen real estate prices start to come down. Dean has a good friend in the mortgage business who said that there’s a phenomenon taking place with home prices that he believes will keep home prices elevated.

“He gave the number of people that want to move, which is in the millions, and the number of people who are willing to move, which is a fraction of that because they can’t go up from a 3% to a 7% interest rate. So, they’re staying in those houses. That means that the inventory of homes is still very low. That’s keeping the prices elevated even though interest rates have increased. Therefore, it’s putting more pressure on home affordability for the average American.” – Dean Barber

There’s a sticker shock that comes with the elevation of property value and people are feeling it. The taxes coming off this are going to be huge. Is that justifiable? There are going to be a ton of challenges on that front.

Continuing to Watch the Yield Curve

We’ve also continued to keep a close eye on the inverted yield curve in Q2 2023. And we’ll continue to do so in Q3 2023. It’s still steeply inverted. From a historical perspective, that usually points to a recession.

“We have a tough road ahead. If we were to look at fair value for the S&P 500, it’s probably 5% below where it is today. Some people would argue it’s even 10% lower than where it is today. So, what does that mean for equity returns for the balance of this year?” – Dean Barber

Don’t Give into Fear and Greed When Investing

It’s natural to have fear of missing out (FOMO) when we’re finally getting decent returns in the S&P, but it’s also dangerous if you get greedy about it and don’t understand that those decent returns are only being driven by a few stocks.

“Cautious optimism could be the theme for the second half of 2023. But I’m more cautious than optimistic. I don’t think there’s any way that we see the same types of returns out of these tech companies in the second half of the year that we saw in Q1 and Q2 2023.” – Dean Barber

Patience, Patience, Patience

For retirees and soon-to-be retirees, it’s pivotal to have patience right now. You don’t want to make a mistake to the downside. If you can hold on to what you have and get incremental increases until we can work through the rising interest rate cycle (even though it’s technically on pause now) that we’ve been going through since March 2022. Dean and Bud believe that we’re closer to the end of it than the beginning, but we need to be patience with re-regulating ourselves to having normal expectations.

Building a Comprehensive Financial Plan

And along with patience, you need a financial plan that can help provide you more confidence, freedom, and time in retirement. If you don’t already have a financial plan, that’s where it all starts. When using our industry-leading financial planning tool, you’ll see that financial planning is about so much more than your investments. Your plan needs to incorporate tax planning, estate planning, risk management, how you’re claiming Social Security, and so much more. Your investments are simply the engine that makes your plan run. To begin building your plan, click the “Start Planning” button below.

If you have questions about what happened in Q2 2023, what to think about during Q3, or about building or updating your plan, we’re here for you. To schedule a meeting to ask your questions, click the “See Our Schedule” button below. You can either schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® Professionals.

Thanks for following along for our Q2 2023 quarterly market update. We hope all is well with you and look forward to touching base with you again for our Q3 2023 quarterly market update.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management, LLC, an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management, LLC does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.