The Definition of a Recession

Key Points – The Definition of a Recession

- Two Straight Negative Quarters in GDP

- The Fed’s Mission is to Slow Inflation, Not What Could Happen with a Recession

- Markets Rebound in July

- Look Out for More Market Volatility

- 6 Minutes to Read | 9 Minutes to Watch

Uncertainty Keeps Building

Uncertainty. That is the word of the day and the word of the year in 2022. We’ve got inflation. We now have a negative GDP for two consecutive quarters, which is the definition of a recession. Also, we have a stock market that is uncertain about what’s going on. The bond market is acting wildly as well. I’m going to touch on all that and more on the Monthly Economic Update.

The Definition of a Recession: Decline in GDP for Two Straight Quarters

A lot is happening in July. As I am recording this, it is July 28 and it’s mid morning. We just received the news a few hours ago that the economy shrank, with GDP shrinking by 0.9% in the second quarter.

Now, of course, that’s the first estimate. There will be two more estimates that’ll come out, and we’ll get a final one in a couple of months. But from the traditional definition of a recession, that officially puts us into a recession.

Now, Jerome Powell came out yesterday and talked about raising the rates by 0.75%, which was widely expected. But he did say that he felt like there were some things that were happening that could start to cool inflation a little bit.

And if that were the case, they may not need to be as aggressive for the balance of the year in raising rates. That, of course, sparked a wild rally in the stock market. And that rally continues as we speak today.

So, what does that really mean? Where are we at and what’s causing the Fed to think that the economy is cooling a little bit?

The Latest on Car Loans

I want to jump to one thing that if you haven’t seen this. I think it’s critical to do a little bit of research and reading on this. The loans on used and new vehicles have eclipsed $1.4 trillion, and there are a vast number of those loans that are in default. There is the expectation that there is going to be a huge glut of used vehicles coming onto the market through repossessions. If somebody is 90 days out on their loan or 90 days in arrears, the automobile lenders can go and repossess those automobiles.

That should start to cool the increase in car prices, bringing a lot of supply back to the used car market. That should also cool the demand for new cars. And that in and of itself could be a big deal.

Pending Home Sales Down 20% from 2021

Also, in June, the numbers came out on pending home sales. They were down 20% year over year. That is in wide part due to the increase in interest rates on the 30-year mortgage. The 30-year mortgage got near a 6% number. We’re still forecasting that that 30-year mortgage will continue to rise this year.

However, with the Fed’s talk yesterday, we started to see interest rates come back down. We do still have a yield curve inversion where the one-year and two-year treasuries are yielding higher than the 10-year treasury. That also is typically a sign of recession as we discuss the definition of a recession.

So, we have multiple signs that we’re in a recession. Recessions aren’t always bad, though, and recessions can be mild. They can be short lived. We really don’t know what the result is going to be.

Markets Rebound in July

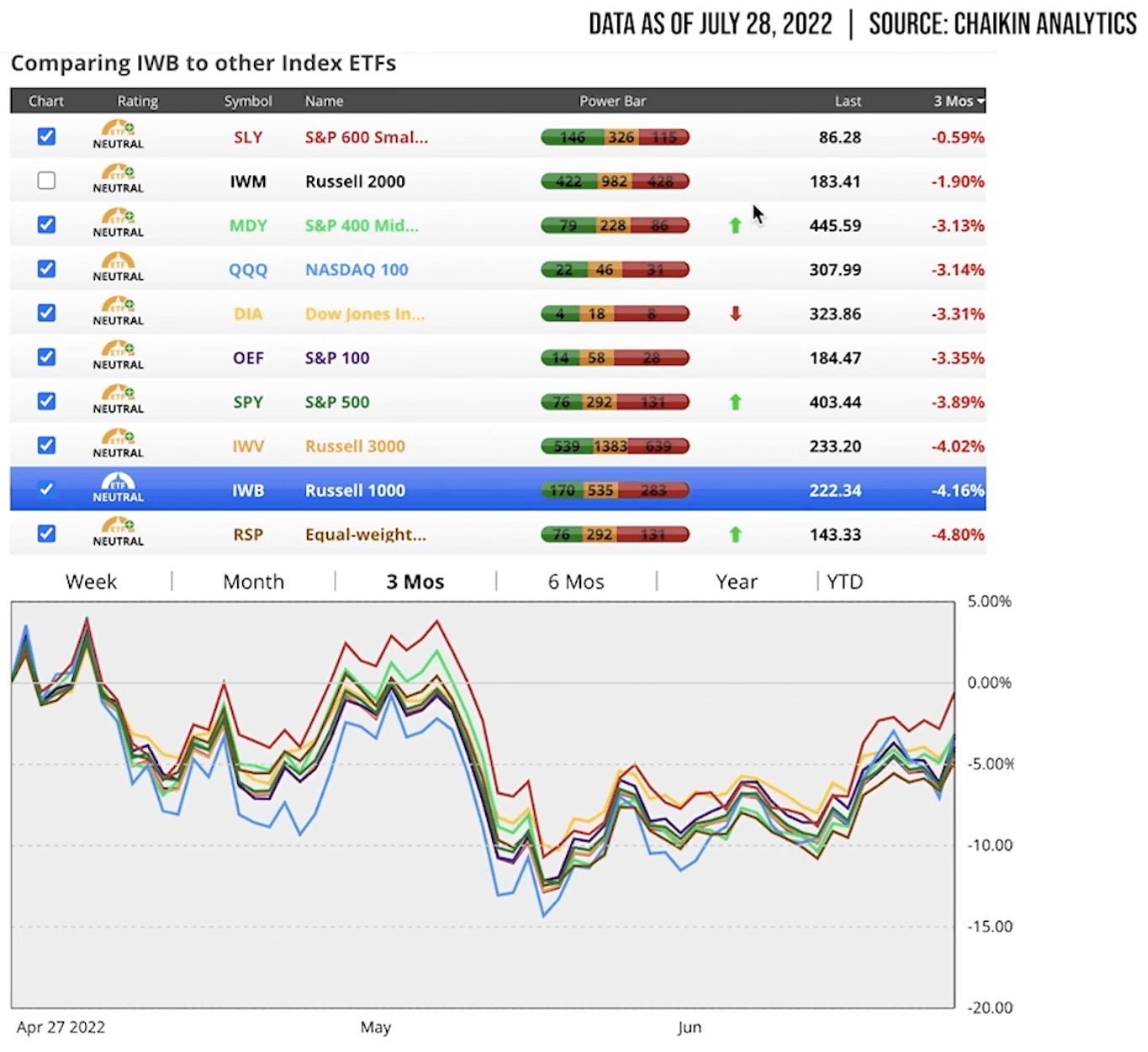

What we do know is that over the course of July, markets have rebounded greatly from the losses that they had in June. Let’s look at some of the interesting things that we see happening in the market, beginning with market performances in the last three months that are highlighted below in Figure 1.

FIGURE 1 – Last Three Months of Market Performances – Chaikin Analytics

We’re measuring everywhere from the S&P 600 Smallcap all the way down to the S&P equal weight. Over the last three months, everything is in negative territory. Small caps are down the least at -0.59%. The RSP equal weight is down the most at -4.8%.

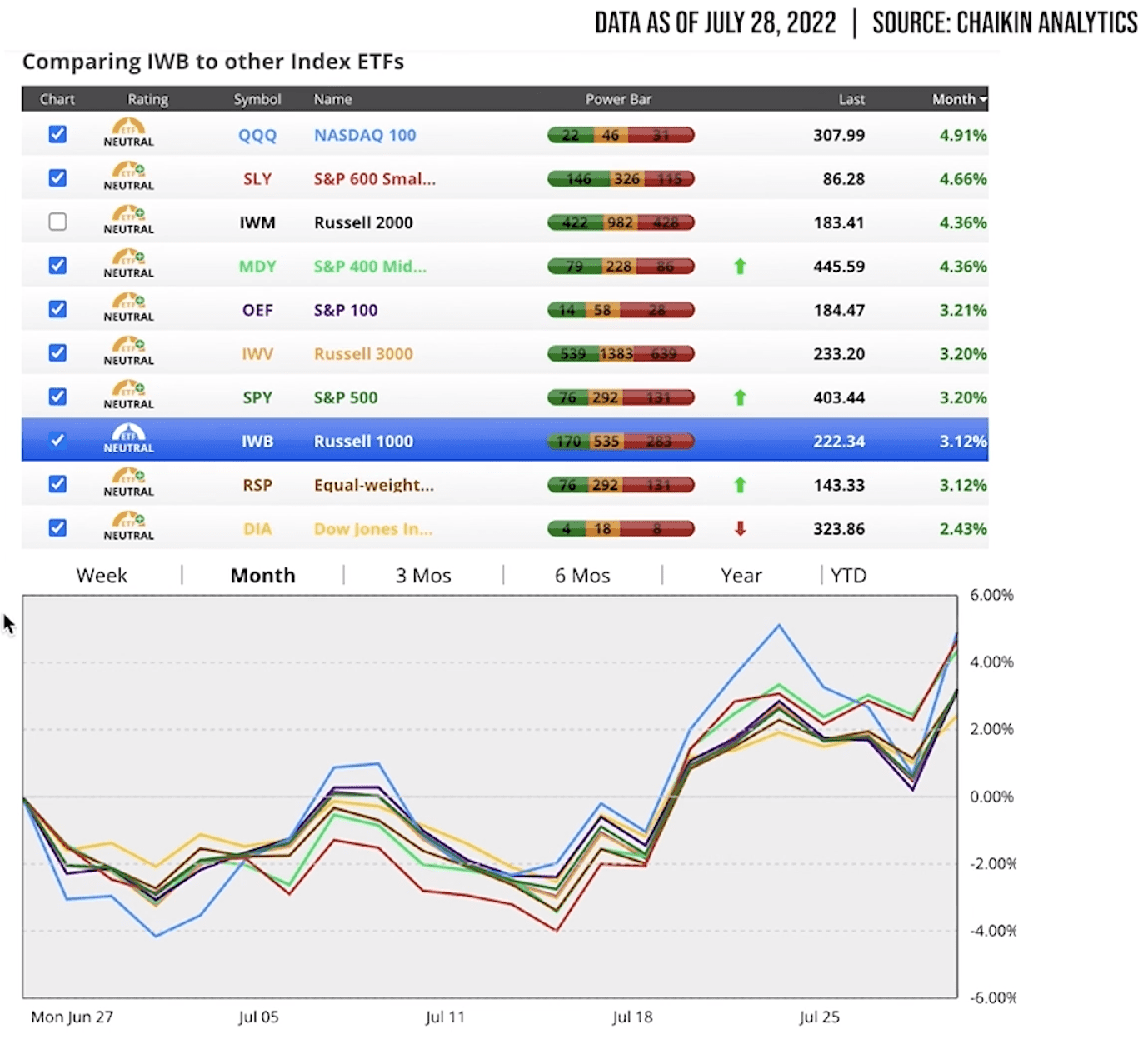

FIGURE 2 – June Market Performances – Chaikin Analytics

If we look over the course of just the last month above in Figure 2, those numbers really change. And we see the NASDAQ is our top performer of July, up 4.91%, followed by Smallcaps at 4.66%. The laggard is the Dow Jones Industrial Average. When we look at all these over the course of the last month, everything is green.

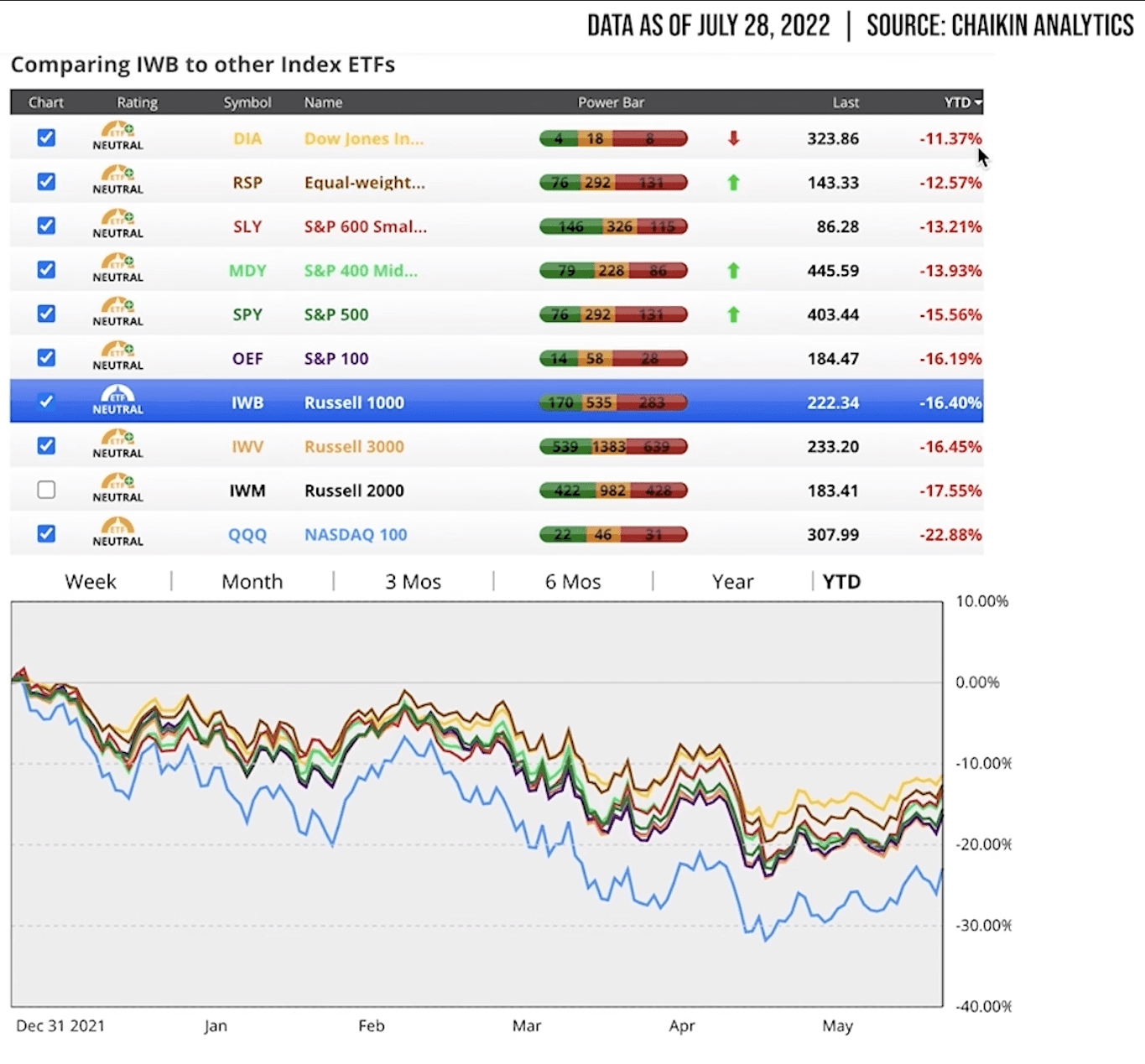

FIGURE 3 – Year-to-Date Market Performances – Chaikin Analytics

But if we look at year-to-date above in Figure 3, the picture isn’t near as pretty. The NASDAQ is the worst performer year-to-date at -22.88%. The Dow Jones Industrial Average is the best performer at -11.37%. That is through the close on July 27.

Still in Bear Market Territory

So, everything still in negative territory. You can see the 20% line in Figure 3 for a bear market. And of course, the NASDAQ eclipsed that all the way back in March. It wasn’t until we got into April and May where we really said this is officially bear market territory. That is defined as a 20% decline or more from any previous market high. So, we do know that we are in that bear market territory.

And just because we’ve had some bounce back and the S&P 500 is now only down 15.56% doesn’t mean that the bear market is over, but it could mean that the bear market is over. Nobody really knows where the bottom is. They don’t ring a bell at the bottom and they don’t really ring a bell at the top and say, “Hey, it’s time to get out. It bottomed out and here’s time to get back in.”

More Market Volatility to Come

We do believe that the volatility in the market is going to continue. We don’t think that for any stretch that the volatility is gone. Valuations have come back into a more fairly valued level than what we talked about toward the end of last year. And of course, valuations are coming down because stock prices are coming down.

The other thing that’s happening that we really need to be aware of is that companies are reporting earnings that are below Wall Street’s expectations. Let’s just use the S&P 500 as an example. It’s all predicated on the earnings of those 500 companies within the S&P 500.

If they’re benchmarking average earnings of $230 per share for all companies combined, that $230 would give us a fair value in the market at a 16 multiple at about 3725. We’re a little over 4000 on the S&P 500 today, so that’s still a little bit above value.

My point is that it’s going to be very difficult from the level that we have today that unless we see companies earnings pick up significantly, it’s going to be difficult for us to imagine that the stock market has a long ways to go from here because it was so overvalued before.

Inflation Is the Key Factor in Today’s Economy

What we’re looking at today, obviously, is inflation. That’s our key factor here. Inflation is the key factor behind what the Fed’s looking at. If we can start to see the inflation numbers come down, if the Fed can stop raising rates or slow the pace of rate increases, that’s going to be a shot in the arm to the market. The markets will respond very favorably to that. So, keep a close eye on what’s going on with inflation.

The Fed has a real double-edged sword. They know that they need to stop inflation. That’s more important to them than causing a recession. They’re well aware of the definition of a recession as well and are more concerned about inflation. Because inflation is hurting the average American far more than a bumpy stock market is hurting the wealthy individuals. So, keep an eye on inflation.

If inflation starts to cool, I think that the Fed will slow their rate of increases and that fuels some growth in the market. It is possible that we see a nice little bull run for the next month or two, but I still think there’s going to be choppiness.

Don’t just think that if the Fed only raises rates by a quarter and says they may be able to slow those in the future that we’re out of the woods. We are still very much in uncertain times. And uncertain times cause all kinds of market volatility, as we’ve experienced so far this year.

We’re Here to Answer Your Questions

As always, I want to encourage you to keep the lines of communication open with your advisor. Even if you’re not an existing client of Modern Wealth Management, we’re still giving you an opportunity to access the same financial planning tool that our CFP® Professionals use. Just click the “Start Planning” button below to use our financial planning tool from the comfort of your own home or office.

We understand that all this uncertainly leads to a lot of questions. Even though we highlighted a simple definition of a recession with two consecutive negative quarters from the GDP, this situation we’re in is far from simple. If you have any questions about what we’re going through or about our financial planning tool, you can schedule a 20-minute “ask anything” session or complimentary consultation with one of our CFP® professionals at no cost or obligation.

And with that, I just want to say thank you to all of you for the trust and confidence that you’ve placed in us here at Modern Wealth Management. We wish you well and I will be back with you in a month. Thanks again for joining us for the monthly economic update.

Investment advisory services offered through Modern Wealth Management, Inc., an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.