8 Ways to Combat Financial Uncertainty

Key Points – 8 Ways to Combat Financial Uncertainty

- This Financial Uncertainty Isn’t Uncommon, but It’s Still Uncomfortable

- How Long Will This Period of Financial Uncertainty Last?

- What’s Causing Us to Be in Economic Dilemma?

- It’s Critical to Take Initiative When Combating Financial Uncertainty

- 21 Minutes to Read | 38 Minutes to Listen

All the financial uncertainty that we’re dealing with seems to be coming at us from every angle. While this financial uncertainty is uncomfortable, it’s not uncommon. From the Dot-Com Bubble to the Financial Crisis, we’ve been through cycles similar to this. Dean Barber and Bud Kasper look back at some of those cycles and review eight ways to combat financial uncertainty.

START PLANNING Complimentary Consultation

Show Resources:

Find links to the resources Dean and Bud mentioned on this episode below.

- Schedule: 20-Minute “Ask Anything” Session

- Sign Up for Our Educational Series Webinars

- Education Center: Articles, Videos, Podcasts, and More

This Financial Uncertainty Isn’t Uncommon, but It’s Still Uncomfortable

Dean Barber: Thanks so much for joining us on America’s Wealth Management Show. I’m your host, Dean Barber, along with Bud Kasper. Howdy, Bud.

Bud Kasper: How are you doing, Dean? This is going to be a good show.

Dean Barber: Well, there’s an awful lot of uncertainty surrounding people.

Bud Kasper: There’s a lot of anxiety, too.

Dean Barber: There is. And I think for good reason. Bud and I talked earlier in the year that we get into cycles like this with poor market conditions, uncertain economy, and uncertain geopolitical events. It’s not uncommon, but it’s uncomfortable.

How to Combat Financial Uncertainty

I think it’s critical to have a discussion about some of the things that we see and how people can avoid making emotional decisions to combat that financial uncertainty. After we have a short discussion about this financial uncertainty and how it has come about we’re going to review these eight ways to combat financial uncertainty.

- Creating a Comprehensive Financial Plan

- Know Your Goals for Retirement — Clarity, Confidence, and Control

- Maximize Your Social Security Benefit

- Have a Plan for Health Care, Insurance, and Long-Term Care Expenses

- Make Sure Your CPA and CFP® Professional Are Working Together on Your Tax Plan

- Avoid Emotional Investing — Fear and Greed

- Use a Conservative Inflation Rate

- Avoid Probate Court, Clarify for Your Family After You’re Gone

Understanding What’s Going on Behind the Scenes

Let’s say that someone is dealing with their finances—maybe it’s their 401(k) and they’ve got an IRA and a brokerage account, etc. They’re looking at their statements or going online to check their account balances. They’ll see what was supposed to be a safe investment in their 401(k), bond aggregate, or bond mutual fund is down 12% this year. They’ll think they had a pretty good mix, but the normally beloved S&P 500 index fund is down 17% this year. Maybe they’ll look at one of their target date funds, and it’s down 15% or 16% this year.

When they don’t understand what is going on behind the scenes, the financial uncertainty can force them to make decisions that are knee-jerk reactions that can be irreversible financial mistakes. Bud and I aren’t going to sit here and say, “Don’t do anything. Just hold the course and it’ll be fine,” because we don’t ascribe to that line of thinking. That’s why we’re going to review eight ways to combat financial uncertainty and mitigate some of the risk.

How Long Will This Financial Uncertainty Last?

You can’t remove it all. But what happens is people think, “How long is this financial uncertainty going to go on?” We’re now a little over eight months into this current bear market cycle. The last bear market cycle that we had lasted about 30 days with the onset of COVID.

We had a little bit of a hiccup at the end of 2018 where the markets were down about 19%. They didn’t reach the official term of a bear market, but that shook people up a little bit. Prior to that, it was the Financial Crisis in late 2007 and into 2008 and 2009. And then before that, it was the Dot-Com Bubble.

We’re almost 15 years past the Financial Crisis. It’s been a smooth ride by and large until this year. There have been a couple of bumps along the road, but we’re in a scenario now where things are different in a very meaningful way. The thing that makes it the most different is the rapid onset of inflation, which has been caused by too much stimulus in the economy and supply chain issues.

How Is This Cycle of Financial Uncertainty Different from Past Cycles?

So, we have a lot to unpack and work through. This could be a longer cycle, much like what we saw in the Dot-com Bubble and the Financial Crisis. Now, I don’t think that housing is going to erode like it did in the Great Recession. And I don’t think that technology stocks are going to lose 70% like they did in the Dot-Com Bubble. But I think this will be a more prolonged contraction in the economy and the markets than what most people think.

Bud Kasper: That brings to mind that old saying, “If ifs and buts were candy and nuts, we’d all have a Merry Christmas,” because that’s the issue. Let me direct this comment to people that are working with 401(k)s. As you’re trying to maneuver through this financial uncertainty, you can always go back to the standard of not retiring yet, dollar-cost averaging every pay day into the selection that you have inside your 401(k).

Different Formulas for Investing

One of the problems though is that many 401(k)s don’t have the options to navigate a difficult period of financial uncertainty like this other than going to cash. It’s our job to explore all possible avenues to create income, protect principal, etc.

Coming back into vogue with this is something we’ve been working with in terms of looking at different formulas for investing. I’m talking about CDs. If you look at the amount of cash that we’re holding in portfolios right now, it has increased. We’re maybe getting 0.5% or 0.6%.

But if you look at a nine-month CD at 3% or 3.25% and think this difficult period of financial uncertainty has another six months before it corrects itself and gets back to even keel, why not get a little bit more income off a guaranteed investment as a certificate of deposit?

The takeaway from this is you need to look at all the avenues associated with it. But the overarching answer is going to be your financial plan.

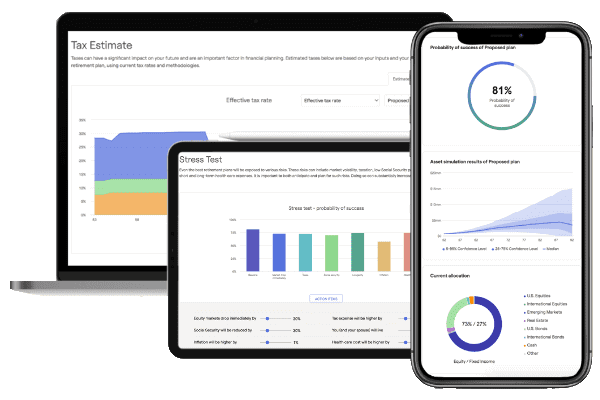

Our Guided Retirement System Factors in Times of Financial Uncertainty

Dean Barber: There’s no question about that. Of course, if you have created a comprehensive plan like Bud and I talk about all the time, we use a system called the Guided Retirement System. It basically allows you to see how changes in market and economic conditions are affecting your ability to do what you want to do. The Guided Retirement System is designed to guide you to and through retirement with the income that you need, all while still leaving resources behind to your loved ones when you pass on. The plan does all of that.

A few weeks ago, we started making the same financial planning tool that we use for our clients available to everyone. Keep in mind that this software is built for use by financial professionals, so it might be a little bit overwhelming. If you need help, just reach out to us. We’ll do a virtual meeting with you or meet with you in person to help you get started. So, get that plan built to see the clarity, confidence, and control that it can bring to you.

The Causes of This Financial Uncertainty

Before we dive into the eight ways to combat financial uncertainty, I want to talk more in depth about what’s causing it. Here’s the list of reasons I’ve come up with in no particular order.

- Inflation

- Housing

- Interest rates

- Potential for higher taxes on the horizon

- The massive amount of debt that we have incurred as a nation

- Geopolitical turmoil with Russia and Ukraine, and potentially China and Taiwan

- And, last but not least, the political turmoil in our own country

There’s uncertainty around all those things.

The Irritation of Inflation

Federal Reserve Chairman Jerome Powell is trying to fight inflation, while the Biden administration wanting more stimulus. It’s like they’re fighting each other. We’re seeing strong enough numbers out there that it appears that Powell is going to have to continue to aggressively raise interest rates to stop inflation. Bud and I talked about this several weeks ago, but he has no choice.

Even though the markets are deteriorating and interest rates are rising, which is causing losses in the stock market and the bond market, those losses for mass affluent individuals is far less harmful than inflation is to the masses that live paycheck to paycheck.

It’s causing people to default on car loans and not be able to pay electric bills, water bills, and those types of things. Inflation is the one thing right now that is so different than what we had in the Dot-Com Bubble and Financial Crisis. So, how do you start combating these things that are creating financial uncertainty? It’s not one size fits all or a specific type of investment product. That’s not how you do it. Let’s begin reviewing our list of eight ways to combat financial uncertainty.

1. Creating a Comprehensive Financial Plan

First and foremost, you combat financial uncertainty by creating a comprehensive financial plan. When you look create that financial plan, there are several questions to ask yourself—many of which will correlate to the other seven ways to combat financial uncertainty.

The first thing you need to know is where you’re going. What is it that you’re trying to do? If you’re not at retirement yet, when do you want to get to retirement? And how much money do you want to spend in retirement, net of taxes, to do all the things that you want to do?

How much is health care going to cost in retirement? What kind of inflation rate should you apply to my overall plan, and should you apply different interest inflation rates to different spending? What’s your plan for health care, health insurance, and long-term care expenses?

Are your CPAs and your CFP®s working together on your tax plan? Do you have a plan to maximize your Social Security benefits? Do you have a plan for passing money to the next generation when you’re gone? How do you avoid emotional investing based on fear and greed?

The comprehensive plan can do all that. We’re going to circle back to it a few more times, but let’s move on to No. 2 on our list of eight ways to combat financial uncertainty.

2. Know Your Goals for Retirement — Clarity, Confidence, and Control

Let’s talk about goals for retirement because you really need to start every plan with the end in mind. Where are you going? What is it that you’re trying to accomplish?

Bud Kasper: Right. You need to source out your sources of income. A lot of people have been able to put a nest egg aside through a 401(k), 403(b), or whatever the case may be. That’s a special bucket because you’ve already paid tax on that money before it went in that bucket.

When it comes out, hopefully you’re gaining some interest or capital gain on that, so that can be part of your income stream. Now, when you’re retired and let’s say you’re at least 62 or older and you have a Social Security event coming up. Look at the options of taking it at the various ages to see where the greatest advantage is. And then out of that, that becomes another source of income as well.

Is that taxable? It likely it will be or could be based upon the amount of income that you’re producing in every given year. Many times, I think that investor confidence lives on a continuum of “everything will be fine” or “I give up.” And I feel that now. I feel that people are starting to say, “Is this financial uncertainty ever going to end? I’m tired of this. I never realized that it was going to be this painful.” But the only way that you’re going to survive is through the plan.

Taking Initiative When Combating Financial Uncertainty

A retired engineer who is as bright as can be visited with me this week. But I knew when he was coming in that he was spending too much money. He needed to see exactly where the income sources were coming from, what the tax events were related to that, and what adjustments he needed to make.

These weren’t necessarily permanent solutions he was looking for, but just something that was semi reactive to help combat this financial uncertainty to the situation we find ourselves now. Many people have that capability, but haven’t explored it, or more importantly, vetted it through the financial plan to see that they’re still on the path to success.

Finding Your Probability of Success

Dean Barber: Let’s talk about that and unpack what Bud just said. Because obviously this gentleman that came in as a client and already has a comprehensive financial plan. When we do the plan, let’s say your probability of success is 85%. Well, what does that mean? That means that 85% of the time, from a historical perspective, using a Monte Carlo simulation, that you can do everything you want to do and never need to adjust your spending.

Fifteen percent of the time, you may need to adjust your spending at some level for a brief period. We need to talk about trade-offs. Well, if you don’t have a plan put together and are going by a gut feel. You may not need to adjust spending because your plan may be healthy enough for you to not to, but you may not understand that.

Staying Calm Amid Financial Uncertainty

I had a similar experience this last week with a couple that’s retired. They’ve been retired for a long time and are in their late 70s and early 80s. The first thing the lady said when she walked in was, “Are we going to lose our house?” And I just chuckled and said, “No, you’re not going to lose your house.”

First, they’re not even spending everything that’s coming in now. Their Required Minimum Distributions are at a point today where they’re more than they’re spending. Their bank accounts are building up. And yes, the portfolios are down a little bit this year, but they’re still significantly higher than where they were three years ago. They’ve taken a lot of money out.” And she says, “Oh, thank God.”

And again, it’s the perspective. Listening to the news about everything that’s happening can wear on you. If you have your plan together and have taken all these things into consideration, take a step back and look at the plan. Where are you at? Are you still going to be able to get to where you want to go and get there safely?

Bud Kasper: So many people can get excited. I met with someone this week who wanted to learn more about the coordination that we have between our CFP® Professionals and CPAs. We were talking about her probability of success. It was good, but not as good as what she wanted it to be.

Attaining That Clarity, Confidence, and Control

So, I showed her three items that she could change. If she saved this little bit amount of money, her probability success would jump by six points. She got very excited because she could now see that this was going to result in a more secure future for herself.

Dean Barber: That’s what it’s all about because you want that clarity, confidence, and control. What’s happening today with all this financial uncertainty will pass. But in the future, there’s going to be something else that derails the market. There’s going to be something else that derails the economy. There’s always something.

We could go back year over year for the nearly 40 years Bud has been in the industry and my 35 years in the industry, and every year there’s something. Sometimes, it gets worse and it stays worse for a longer period, which is where I think we are today.

But if you have that plan done and look at everything, you can have that clarity, confidence, and control. Our CPA reviewed the entire tax situation for that same couple that was in here this last week prior to them coming in. He wanted to make two adjustments before the end of the year that would save them $6,000 in taxes this year.

Bud Kasper: Perfect.

Dean Barber: And they’re like, “Oh, well that just made the whole meeting.”

Bud Kasper: Isn’t that exciting? And what are you missing? Well, you don’t know what you don’t know.

Dean Barber: That is exactly right.

3. Maximize Your Social Security Benefit

As we continue to discuss eight ways to combat financial uncertainty, let’s talk a little bit more about Social Security. Social Security planning is for people that have not started taking their Social Security yet. The planning on how you’re going to take your Social Security should start several years before you take your Social Security. To get a true understanding of some of the things that go into that planning, download our Social Security Decisions Guide below.

Download: Social Security Decisions Guide

You need to understand that the average couple at 62 will have north of 600 different iterations on how they can claim their Social Security. The difference between the best and the worst can result in $100,000 or more of additional income from Social Security over your lifetime. That’s a huge amount of money that can come in and help buoy up the plan and get you through times of financial uncertainty like this in the future. This also ties in with our fourth way to combat financial uncertainty, which is…

4. Have a Plan for Health Care, Insurance, and Long-Term Care Expenses

Bud Kasper: Yeah. When we have people come in that say they wanted to retire at 62, I sometimes think to myself, “Oh shoot.” And the reason I say that is because they don’t realize the expense for their health insurance prior to Medicare.

When we start to see the cost of the insurance and align it with the entire financial plan, the question would be, “Well, what if we postpone it? What if we waited until 63, 64, 65?” Now, at 65, you get full benefits. And boy, what a relief that is to the plan in terms of reducing that expense.

Dean Barber: That’s the whole thing though. I’ve seen just the opposite of that where people want to retire at 58, 59, or 60 and they know that they’re going to have those medical expenses for that five, six, or seven years that are not covered by Medicare. So, let’s build it into the plan. Don’t just say that you’re not going to retire until 65 just because you think you need to wait for Medicare. Because the truth is, you may have enough resources that that’s irrelevant.

The way that I look at it is we all have the same most important commodity, and that’s time. If you’re 62, there’s no guarantee that you’re even going to make it to 65. We just found out that a good friend of Bud and I has a brain tumor. He’s only 52. You just don’t know.

So, make sure that you’re living your one best life. You can do that, especially from a financial perspective by having that plan. But let’s go back to Social Security because it relates to our fifth way to combat financial uncertainty as well.

5. Make Sure Your CPA and CFP® Professional Are Working Together on Your Tax Plan

You need to look at the different ways that you can claim your Social Security while sitting with your CERTIFIED FINANCIAL PLANNER™ Professional and your CPA at the same time. Put that into the financial plan and have the CPA look at the tax impact of claiming Social Security at different ages. The tax impact is Social Security is taxed different than any other source of income that you have. It can cause other forms of income that weren’t taxable before Social Security to become taxable, such as qualified dividends, capital gains. It’s a domino effect. So, claiming your Social Security at the right age is important.

There are a lot of Social Security claiming strategy software pieces that will run all the different iterations. They’ll tell you based on your earnings history and the date that you retire what the best possible scenario is between you and your spouse to claim Social Security. But that might not be the right answer because when you plug that answer into your plan, it could have an adverse reaction on the tax planning that the CPA may have in mind. That’s where the art of financial planning really comes in.

Bud Kasper: And when you think about it, wouldn’t you like to know what the triggering event was and how to avoid it? Of course you would. That’s going to save you money in the process of doing that. But do you have the knowledge to do that calculation? Probably not. Would it not be worth your time to talk to your CFP® Professional and CPA to get the most accurate answer you could possibly get? I would hope so.

How Does This Apply for “The Millionaires Next Door?”

Dean Barber: Here’s the thing. There are a lot of people in our geographic location and around the country that are the consummate millionaires next door. They have saved well, lived below their means, have been very frugal, and they’ve accumulated a good amount of money.

A lot of these people don’t even know that it’s possible to work with an organization where the CFP® Professional, CPA, estate planning attorney, and risk management specialists all collaborate on their behalf. Not only do they not expect something like that, they don’t even know that it exists.

But then you have the people who have $10 million, $15 million, $20 million. They know it’s available and expect it. But there are so many planning opportunities for millionaires next door that just don’t see.

Bud, how many times have you run into someone who says the have a financial advisor, but they didn’t put together a financial plan that maximizes Social Security, has tax reduction strategies, accounts for health care costs, etc? Did they have a forward-looking tax plan?

Bud Kasper: Or even vacations, things like that. It’s not all factored in with numbers. It’s what your lifestyle is going to be. You want to know, “Can I do this without damaging my future?”

Dean Barber: Right. And bottom line is that a lot of those people call themselves financial advisors and might even be a CFP® Professional, but they’re not doing financial planning. They’re simply doing asset management. Asset management is important. Money management is important. But it’s only a small piece of what you should be doing.

6. Avoid Emotional Investing — Fear and Greed

That brings us to No. 6 on our list of ways to combat financial uncertainty, which is to avoid emotional investing. If you don’t have a financial plan, you can’t avoid emotional investing because you have no real target of what you’re trying to accomplish. You’re just going to operate on fear and greed.

Bud Kasper: You’re reactive instead of proactive. That’s what planning is, it’s proactive. When you look at all these alleged advisors around the United States, what is their field of expertise? Rarely do you see CFP® Professional associated with any of those folks.

Putting All the Pieces of the Retirement Puzzle Together

Dean Barber: It’s especially rare for the CFP® Professional and CPA to be in the same office. That’s where the magic starts to happen. When looking at your overall tax situation, the two biggest costs that are going to be in front of you in retirement are likely going to be health care and taxes. Well, what plays into that? Inflation. And what plays into that? Social Security. Your investments. All of it ties together, and you can really see why by downloading our Tax Reduction Strategies Guide below.

Download: Tax Reduction Strategies Guide

I always say that at some point in time, just about every financial decision that you make is going to show up on your tax return at some point. If you can design the plan right, by first having a CERTIFIED FINANCIAL PLANNER™ Professional build that plan and then have a CPA review from a tax perspective on a regular basis, suddenly you can start getting ahead in a meaningful way.

It All Starts with a Plan

And it’s something that’s in your control as opposed to inflation, the housing market, interest rates, national debt, and geopolitical and domestic uncertainty that are totally out of your control. You can put some things in your control, but you need to have that plan first.

Bud Kasper: Yeah. The best of both worlds—two professionals working for a common good.

Dean Barber: Absolutely. The people that we’ve worked with for several years are still doing what they want to do. They’re still traveling and doing the things that are important to them. Why? Because they started with a comprehensive financial plan that mapped out all the ways to combat financial uncertainty that we’ve been talking about. They have the clarity in their overall financial situation, which gives them confidence and control.

7. Use a Conservative Inflation Rate

One of the things that we’ve done on a consistent basis is apply an inflation rate to our client’s financial plans that is higher than what people think that you should be doing. Until the last 12 to 18 months, we’d been in an inflationary period that was running around 2%. So, we’d see financial plans built with a 2% inflation rate while we’re here using a 4% inflation rate. It’s double what everybody else is doing.

People ask us why we do that. Well, if you go back over the last 50 years, that’s what it has been. You can’t take a small subset of a timeframe where we went through two major economic downturns and two major recessions and apply that inflation rate for your future. You just can’t do that. That’s why applying the right inflation rate in your financial plan is one of the things that you can do to combat financial uncertainty.

Bud Kasper: When we apply the inflation factor into the financial plan, it changes the numbers radically many times.

Dean Barber: Even 0.5% gives you a totally different outcome.

Bud Kasper: Yeah. Let me circle back to talking about the woman I met with this past week. She realized the inflation factor that she initially had before she met with me was ridiculous. It was 0.5%. On an historical base, we rarely ever hit 0.5%. You need to use a real number because that is critical to understanding what you might be living through.

Remember That Things Inflate Differently

Dean Barber: Right. The idea is to get you to and through retirement with the right inflation rate. The other important part is that you apply a different inflation rate to things like health care and property taxes than you do to food, travel, etc. All these things are going to inflate at different rates. If you just apply one blanket rate, especially 0.5%, that’s insane. Your plan is not going to be accurate. That’s one of the critical things that you need to do.

What’s Your Spending Plan?

And obviously, as we build out financial plans, we’re not saying, “What’s your budget?” We’re saying, “What’s your spending plan? What are you going to spend money on in retirement?” We need to know how to put the different inflation rates on those different pieces.

Bud Kasper: However, Dean and I both know that so many people in our profession are just selling investments. They don’t have the overarching plan to vet the success of being in those investments or for what length of time. Therefore, if we don’t have a thorough understanding of what you’re currently doing with your money and being able to show you what the history was of it and the potential of it moving forward, how do you know you’re in the right arena?

8. Avoid Probate Court, Clarify for Your Family After You’re Gone

Dean Barber: You don’t. It’s a guessing game at that point. Well, we’ve finally reached our eighth way to combat financial uncertainty, which is avoiding probate court and clarifying for your family after you’re gone. That can be for your spouse, children, and grandchildren.

That involves properly titling assets, the potential of a trust and a will, and tying all that together with your overall strategy. And that strategy should be designed to protect you while you’re alive. If you become incapable of making decisions, these documents should allow those that you assign as a successor or trustee to make those decisions the way that you want them to be made. They should also allow for a smooth transition from one generation to the next.

And of course, that is part of the overall comprehensive financial plan where we use our Guided Retirement System. When you think about it, if you’ve done the financial plan right, you’ve tackled all eight of these ways to combat financial uncertainty and nothing gets left aside.

A Few More Points on Avoiding Emotional Investing

I want to go back quickly, though, to avoid emotional investing. One of the ways that you do that is by completing the plan. Bud mentioned something a minute ago about being transparent with everything you have going on right now. What are all your resources? Where is all your money invested?

Then, we can look at that and we can say that based on the way that your money is positioned today and the resources you have, here’s the risk that you have of not being able to do what you need to do. Or it could be that you’re too conservative. It could be that you’re too aggressive.

The Goldilocks Portfolio

Everybody has a portfolio that I call the Goldilocks portfolio. That’s the one that’s just right for you. It’s not the one that’s right for your neighbor, uncle, aunt, brother, sister, coworker, or whoever. It’s for you based on what you want to happen.

Bud Kasper: And that is historically accurate. If you look at a portfolio, was that the same portfolio you had 10 years ago, five years ago, whatever? It needs to be brought up to speed when we do it in the application of the financial plan. When we see how the current investment portfolio would react during adverse times, it many times surprises people the amount of risk they have in their portfolio. And boy, have they found that out in the last nine months.

Dean Barber: Well, of course. And then, the question is, “Does it matter?” Think about a dial. When you get all the way to the right on that dial, and that’s 100% probability of success. When you start moving the dial counterclockwise, you’re getting less and less probability of success.

It’s interesting when we start applying different models of portfolios. For example, 10% bonds and 90% equities, 20% bonds and 80% equities, and so on. If you go too far into equities, that dial starts to move back the other way. It starts to move counterclockwise. That might be counterintuitive to some people, but the reality is that you’re taking on more risk than what you need. But there is that Goldilocks portfolio that’s going to be based on your own personal financial situation.

Working with Financial Professionals Who Focus on All Eight Ways to Combat Financial Uncertainty

Bud Kasper: There are so many financial advisors that will be happy to sell you an investment. But there’s only a small percentage of that number that are working with CFP® Professionals and CPAs in orchestration on a comprehensive financial plan. If you’re not having that experience, you’re missing out.

Dean Barber: And you may be smart enough to be do it all on your own and not be missing anything. But a good, honest financial planner, a CERTIFIED FINANCIAL PLANNER™ Professional, or CPA will tell you if that’s the case. Again, we’re giving you the opportunity to use the same financial planning tool that our CERTIFIED FINANCIAL PLANNER™ Professionals use with our clients. By clicking the “Start Planning” button below, you can access the financial planning tool from the comfort of your own home and see how you can personally combat financial uncertainty while building a financial plan.

We’re allowing you to have access to our financial planning tool because we want you to have clarity, confidence, and control leading up to and through your retirement. As you’re navigating the tool, please keep in mind that it’s designed for professional use. So, if you have any questions that arise while using it, you can simply schedule a 20-minute “ask anything” session or complimentary consultation with one of our CERTIFIED FINANCIAL PLANNER™ Professionals. They will screen share with you while using the tool to help answer your questions.

Bud Kasper: It’s so unique to have that opportunity. I don’t know of any other firm that is doing it this way.

Dean Barber: Yeah. And it’s no cost, no obligation. We appreciate you always joining us on America’s Wealth Management Show. Remember, you can catch us anytime, anywhere, on your favorite podcast app. Just look for America’s Wealth Management Show, click subscribe, and you’ll get notified every time a new episode comes out. We’ll be back with you next week, same time. Everybody stay healthy and stay safe.

Schedule a Complimentary Consultation

Click below to get started. We can meet in-person, by virtual meeting, or by phone. Then it’s just two simple steps to schedule a time for your Complimentary Consultation.

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.