Skills to Expect of a Financial Advisor

Key Points – Skills to Expect of a Financial Advisor

- Reviewing a Morningstar Survey about Financial Advisor Skills That People Do (and Don’t) Value

- What Is Financial Planning?

- Building a Plan That’s Based on Your Goals, Not the Goals of Your Friend or Family Member

- What Skills Do You Value in a Financial Advisor?

- 7 Minutes to Read | 23 Minutes to Watch

Skills That People Do and Don’t Value in a Financial Advisor

Choosing a financial advisor to work with isn’t a decision that should be taken lightly. If you’re looking for a financial advisor (or changing financial advisors), what skills should you expect from that person?

As you’re thinking about what skills that you value in a financial advisor, watch out for people who say they’re a financial advisor but function more like a financial salesperson. How are you supposed to spot the difference? The main thing to monitor is if they immediately start talking about what investments you should own rather than your goals and risk tolerance. That could be a red flag that they aren’t acting as a fiduciary and putting your interests before their own.

Schedule a Meeting Get the Retirement Plan Checklist

What Can We Learn About Important Financial Advisor Skills from Morningstar’s 2023 Risk and Diversity Survey?

Before we share Modern Wealth’s expectations for skills that financial advisors should have, let’s review some compelling data on this topic from Morningstar’s 2023 Risk and Diversity survey.1

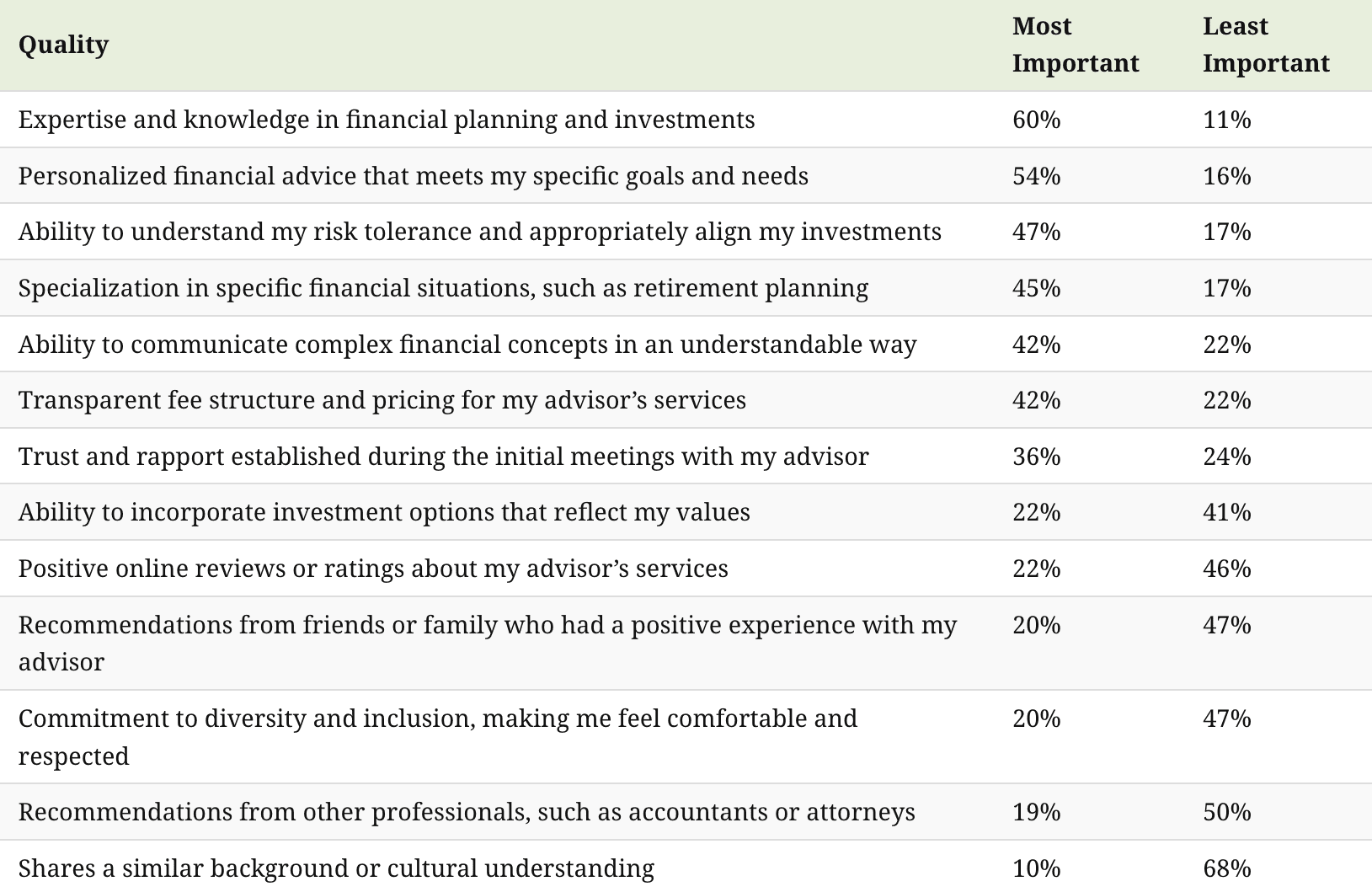

FIGURE 1 – Skills People Value in a Financial Advisor – Morningstar/Visual Capitalist2

In this survey, Morningstar polled 400 people. The survey was comprised of 150 men of color, 150 women of color, and 100 Caucasian women. But look at the bottom three financial advisor skills listed in Figure 1.

While there was a lot of diversity among the people that Morningstar surveyed, sharing a similar background/cultural understanding with their financial advisor was what they least valued. A commitment to diversity and inclusion from their advisor was the third financial advisor skill that they least valued. Let’s take a deeper dive into the survey by reviewing the top and bottom three financial advisor skills that people value.

Financial Advisor Skills That People Value

1. Expertise and Knowledge in Financial Planning and Investments

Notice that it says financial planning and investments and not just investments. It’s important to have a good understanding of what financial planning is. Financial planning is comprised of tax planning, risk management, estate planning, and investment management.

To make sure we’re crystal clear, an investment plan should be included within your overall financial plan. As you’re planning for retirement, you need to realize that cash flow is key. When your paycheck goes away in retirement, your money must start working for you.

What income sources are you going to have in retirement? Do you know how much you have in retirement savings and how your investments are performing? It might sound cliché, but you need to understand the ins and outs of what you own. That’s imperative so you can create a spending plan for retirement that outlines your expenses and assets to pay for those expenses.

For example, if you have $1 million saved in a traditional 401(k), do you realize that you don’t actually have $1 million? That’s because the money you’re saving to your 401(k) hasn’t been taxed yet. Taxes on retirement income is right up there with health care costs as the some of leading wealth-eroding factors in retirement.

The pillars of financial planning are intertwined in so many ways. Make sure that you’re working with a financial advisor who has the skill of educating you about financial planning.

2. Personalized Financial Advice That Meets My Specific Goals and Needs

Many of our advisors would likely rank this as the No. 1 skill to expect from a financial advisor. When you’re working with an advisor to build a financial plan, it needs to be personalized to your needs, wants, and wishes. Before an advisor can effectively provide financial advice, they need to know what’s important to you. What do you envision when you think about your retirement lifestyle? If your job has been a huge part of your identity, what’s your identity going to be in retirement?

Building a plan that’s based on your friend and neighbor’s goals and needs can quickly go wrong, even if you have similar goals and needs. Think about how many specific variables come into play here.

- Do you have the exact same earnings history?

- Is your health situation identical to theirs?

- Do you have the same asset and tax allocation?

- Do you plan to spend the same amount each month in retirement?

The answer to all those questions is likely no. And there are so many more financial planning considerations related to your needs and goals that need to be vetted through as well. Make sure you’re working with a financial advisor who is doing that vetting.

Whether you have a financial advisor or are looking for one, we encourage you to read through our Retirement Plan Checklist. It’s comprised of 30 yes-or-no questions that gauge your ability to successfully get to and through retirement. It also includes age-and date-based timelines that list several retirement planning items to think about.

3. Ability to Understand My Risk Tolerance and Appropriately Align My Investments

Another financial planning item that’s unique to you is your risk tolerance. Everyone thinks and feels about money in their own way. Based on your risk tolerance and goals, what should you invest your money in? We can’t stress enough, though, that your advisor shouldn’t immediately talk to you about what to invest your money in. They need to get to know you first.

Investment risk is one of many risk factors to keep in mind as you’re approaching and going through retirement. Have you considered these common risks in retirement that Logan DeGraeve, CFP®, AIF® and Chris Rett, CFP®, AIF® reviewed on America’s Wealth Management Show?

Those risks can be the root of financial stress for a lot of people. When we’re building financial plans for people, our goal is for the plan to give them more confidence that they’re doing the right things with their money, freedom from financial stress, and time to spend doing the things they love.

Financial Advisor Skills That People Don’t Value (As Much)

1. Shares a Similar Background or Cultural Understanding

Let’s shift gears to the financial advisor skills that people don’t value. As we mentioned earlier, No. 1 is sharing a similar background or cultural understanding. It can help for your advisor to have a similar background or cultural understanding, but that shouldn’t be a top priority as long as your advisor upholds a fiduciary standard.

Your needs, wants, and wishes should always come first. Building a forward-looking financial plan can’t just happen in one day. There is a lot of planning that goes into creating the plan and it doesn’t stop once that plan is built. You and your advisor will need to regularly review your plan and update it as necessary. That’s because your needs, wants, and wishes are going to change as you approach and go through retirement. The same goes for your health, market conditions, your family situation, etc.

Your advisor needs to be on the same page with you about all those factors regardless of whether you share a similar background or cultural understanding. They should stress test your plan to determine your probability of success if something like a market downturn, long-term care stay, or another unexpected expense should arise during retirement.

2. Recommendations from Other Professionals, Such as Accountants or Attorneys

Many people don’t expect their advisor to receive recommendations from other financial professionals because they’re already working with them. We have a counterpoint to this, though. Have you ever played the game telephone?3 Things can easily get lost in translation in brief passing. That’s what you’re putting to chance when you’re having separate conversations with your financial advisor, CPA, estate planning attorney, etc.

That’s why we’ve built a wealth management team at Modern Wealth Management. In addition to having CFP® Professionals that lead our advisor teams, we have CPAs, CFAs, risk management experts, and estate planning specialists that work alongside our advisors. We value our team approach to wealth management because it allows each team member to hone their specific skills rather than putting pressure on one advisor to know everything.

T-3. Commitment to Diversity and Inclusion, Making Me Feel Comfortable and Respected

This ties right in with No. 1 on the list of financial advisor skills that people don’t value. We want all our clients—regardless of race, gender, or any other demographic—to feel comfortable and respected. We do our best to show that by making sure that they’re gaining more confidence that they’re doing the right things with their money, freedom from financial stress, and time to spend doing the things they love.

T-3. Recommendations from Friends or Family Who Had a Positive Experience with My Advisor

If you go back and look at Figure 1, you’ll see that there was actually a tie for third on financial advisor skills that people value the least. We’ve already touched on this a little bit as well but remember that your friend or family member’s situation is going to differ in many ways from yours, even if you feel like you’re attached at the hip.

That’s great if your friends or family members had a positive experience with their advisor. But even if you share the same advisor, you’re not going to have identical financial plans. There’s nothing wrong with still listening to financial planning recommendations from friends and family. In fact, we even encourage listening to them. But don’t just utilize a specific financial planning strategy without seeing how it impacts your plan. Maybe thinking about their recommendations will open your eyes to another financial planning opportunity. In the end, their plan is their plan, and your plan is your plan.

What Skills Do You Expect from a Financial Advisor?

Hopefully the assessment of Morningstar’s survey that we’ve done has opened your eyes about what skills to expect from a financial advisor. No matter your situation, you should have high expectations of the skills that your financial advisor possesses. The same goes with the other wealth management professionals that are working for you.

If you want to learn more about how our wealth management team members will utilize their skills to work for you, start a conversation with our team below.

We’ll put your values and goals first as we’re building your personalized plan. We look forward to learning more about your situation and providing you a modern look at what wealth management is all about.

Skills to Expect of a Financial Advisor | Watch Guide

00:00 – Introduction

01:02 – Football Players and Financial Advisors

03:27 – What People Value Most via Morningstar

05:36 – Considering the Bigger Picture

10:36 – Expectations of the Millionaire Next Door

14:41 – Why a Team Approach Can Make Sense

16:43 – What You Should Expect

19:13 – What We Learned Today

Articles

- Wealth Planning: Securing Your Financial Future with Jeremiah Johnson, AIF®

- Don’t Miss Out on Your Money: Redefining Risk Management

- Components of a Complete Financial Plan with Logan DeGraeve, CFP®, AIF®

- Starting the Retirement Planning Process

- Setting Up a Spending Plan for Retirement

- Nonfinancial Life Planning with Bruce Godke

- Growth vs. Value Investing in 2024 with Brad Kasper

- 10 Ways to Fight Inflation in Retirement

- What Happens to Debt When Someone Dies?

- What Is a Monte Carlo Simulation?

- Retiring During a Recession

- What’s the Meaning of Wealth Management?

- Why You Need a Financial Planning Team with Jason Gordo

Past Shows

- What’s the Meaning of Wealth Management?

- 5 Financial Planning Considerations

- What Is Financial Planning?

- 5 Estate Planning Documents That Everyone Needs

- Understanding Retirement Asset Allocation

- Retirement Cash Flow: What You Need to Know

- Retirement Savings by Age

- 5 Factors More Important Than Rate of Return

- Taxes on Retirement Income

- Health Care Costs During Retirement

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- Asset Allocation vs. Tax Allocation

- Don’t Retire without Doing These Things First

- Reviewing Your Retirement Checklist

- What Should I Invest My Money in?

- 5 Common Risks in Retirement

- 4 Big Tax Mistakes Retirees Need to Avoid

- Reasons People Run Out of Retirement Money

- Financial Stress: How Do You Deal with It?

- Stress Testing Your Financial Plan

- 5 Long-Term Care Questions to Ask

- Unexpected Expenses and How to Plan for Them

Downloads

Other Sources

[2] https://www.visualcapitalist.com/sp/what-people-value-in-a-financial-advisor/

[3] https://icebreakerideas.com/telephone-game/

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.