Seeking a Comfortable Retirement: Avoid These Common Bad Habits

Key Points – Seeking a Comfortable Retirement: Avoid These Common Bad Habits

- Do You Have a Spending Plan for Retirement?

- Why Where You’re Saving to for Retirement Matters

- Planning to Get Through Retirement, Not Just to Retirement

- Financial vs. Nonfinancial Life Planning

- 9 Minutes to Read | 23 Minutes to Watch

There’s a Huge Shift That Takes Place as You’re Seeking a Comfortable Retirement

Schedule a Meeting Get the Retirement Plan Checklist

As humans, we’re all creatures of habit. While it can be difficult for some people to realize and/or accept, seeking a comfortable retirement can disrupt habits that they’ve had for many years. There’s no doubt that retirement is something that so many people long for but remember that you’re not just retiring from something (your job). You’re also retiring to something (the goals for the rest of your life).

What Habits Should You Avoid as You’re Seeking a Comfortable Retirement?

However, if you don’t take the time to plan for retirement, the quest of seeking that comfortable retirement can seem elusive. We’re going to review three common bad habits that can prevent people from retiring so that you can avoid them.

- Not Budgeting Appropriately for Your Retirement Years

- Not Working Efficiently

- Not Having a Forward-Looking Plan

1. Not Budgeting Appropriately for Your Retirement Years

Throughout someone’s career, going to work almost every day is a very time-consuming habit. Once you retire, what are you going to do now that you’re no longer working? And now that you’re no longer receiving a paycheck, how are you going to fund your retirement? Some of your expenses in retirement are going to remain the same, but some will change. And some of them will change as you go through retirement.

Setting Up a Spending Plan

This is why setting up a spending plan for retirement is crucial. You need to outline your needs, wants, and wishes, and then determine how much they will cost. What income sources do you have to pay for those various expenses? Cash flow is always critical, but that’s especially true in retirement when you don’t have a paycheck to fall back on.

Thinking About Your Needs (Everyday Expenses)

In preparation for that paycheck going away, there may be some expenses that you don’t deem as being necessary. Eliminating them could put you in a better financial position heading into retirement. Let’s say that you regularly get lunch at a sandwich shop by your office that costs you $13. For context, ordering a turkey and provolone sub with a bag of chips and bottled water from the Jersey Mike’s close by our Lenexa office is $12.74 before tax.1 That’s about $65 a week if you go there Monday-Friday and about $260 a month.

If you’re trying to cut expenses but really like that sandwich shop, maybe you could still go there once a week (four times a month). And on the other four days of the week, you can make a sandwich from bread, lunch meat, cheese, etc. that you buy from the grocery store. Here are some prices from the Lenexa HyVee that is less than a mile from that Jersey Mike’s.

- Loaf of Sara Lee Classic White Bread2: $3.89

- Pound of Di Lusso Premium Sliced Smokey Turkey3: $7.99 per pound

- Pound of HyVee Quality Sliced American Cheese4: $6.99 per pound

- Frito-Lay Flavor Mix Party Size Variety Pack (28 bags)5: $14.99

- HyVee One Step Purified Drinking Water (24 bottles)6: $3.49

Slicing Bread, Meat, Cheese, and … Expenses?

That comes to $37.35 before tax. The chips and water would last you close to the whole month and the bread, turkey, and cheese would likely last around two weeks. Purchasing the bread, turkey, and cheese two weeks later would be $18.87 before tax. That adds up to $56.22 before tax that you would be spending a month at HyVee. While that might feel like a lot per month to spend per month just on that part of your grocery shopping list, but it’s still about $200 less per month than if you bought a sub combo from Jersey Mike’s for five days a week each month.

Obviously, lunch (and food in general) is an expense that you’ll have in your working years and in retirement. But if you have consistently used your lunch hour to go grab a bite to eat rather than packing your lunch, hopefully you can see how that can make a difference in your spending plan each month. $200 a month might not seem like much if you’re planning to spend $6,000-$7,000 a month in retirement. But if you have other areas within you’re spending plan that you’re overlooking, that can begin to add up as you’re seeking a comfortable retirement.

Are You Looking into Buying a New Home in Retirement?

Now, let’s shift gears to another expense that you’ll need in your career and in retirement—a home. Many people have the goal to buy a summer or winter home in retirement. And if your kids have moved out of the house, is downsizing something you want to consider? Before you answer that, though, think about what rightsizing looks like for you. What do you want in a new home? Having an ideal home is a priority for a lot of people as they’re seeking a comfortable retirement.

Let’s say that you’re anticipating the purchase of a $650,000 home in retirement. You’ve built it into your spending plan and see that you can afford it. However, after you’ve searched high and low for your perfect home, the one you like the most costs $750,000. It’s crucial to understand that the decision to go with a $750,000 over a $650,000 isn’t just the difference of $100,000.

A $750,000 home compared to a $650,000 home on a 30-year loan at a 6.875% interest rate (as of March 4, 2024)7 would result in paying an extra $656.93 a month.8 And that’s not including extra property taxes. That extra $656.93 plus property taxes each month would obviously impact on your spending plan much more than the extra $200 on eating out for lunch on weekdays.

If you’re looking for expenses to cut as you’re building a spending plan for retirement—and seeking a comfortable retirement—going with the $650,000 home over the $750,000 would be a big step in the right direction. That’s just one decision you’re making that has a profound impact on the spending for the rest of your life. There will be much more wiggle room in your budget with deciding what you want for lunch each day.

When Should You Start Planning for Retirement?

As we walked through those examples of cutting expenses, hopefully is helped you realize how many trade-offs there are in the retirement planning process. That’s why it’s so important to start planning for retirement at least five to 10 years before retirement.

Making a spending plan for retirement is one of many key considerations mentioned in our Retirement Plan Checklist. It consists of 30 yes-or-no questions to ask yourself as you’re seeking a comfortable retirement, as well as age-and date-based timelines of things to think about as you’re approaching and going through retirement. Download your copy below.

2. Not Working Efficiently

The second bad habit to avoid as you’re seeking a comfortable retirement is not working efficiently. We’re going to use the sample couple of Sam and Samantha Sample to explain what we mean by that.

Sam Sample

- Saving $37,000 a year for retirement into a savings account over the course of 35 years

- Accrues $1.295 million in retirement savings with this strategy

Samantha Sample

- Saving $7,200 a year for retirement and investing it into an account that’s growing with an 8% rate of return over 35 years

- Accrues $1.339 million in retirement savings with this strategy

To elaborate on the case study that’s outlined above, Sam has spent much of his career working manual labor jobs and has had to work many hours outside of the 9:00-5:00 workday.

As Sam has persevered through his rigorous schedule, he’s saved $37,000 a year for retirement. That money has gone directly to his savings account.

The Miracle of Compound Interest

Samantha’s marketing job isn’t nearly as grueling as Sam’s job, but it doesn’t pay nearly as much either. She’s only able to save $7,200 a year for retirement. However, instead of putting that $7,200 per year into a savings account, Samantha is investing it. Her investments are growing at 8% per year.

If Sam and Samantha use these respective savings methods over the course of 35 years, who do you think will have saved more for retirement? Sam’s strategy to save everything to a savings account will give him $1.295 million. Samantha’s $7,200 a year would accumulate to $252,000 over 35 years if she saved it to a savings account. But since she’s investing it and getting 8% growth on it per year, she would accrue $1.339 million thanks to compound interest. Ultimately, the harder and longer hours Sam worked didn’t result in more money saved for retirement than Samantha.

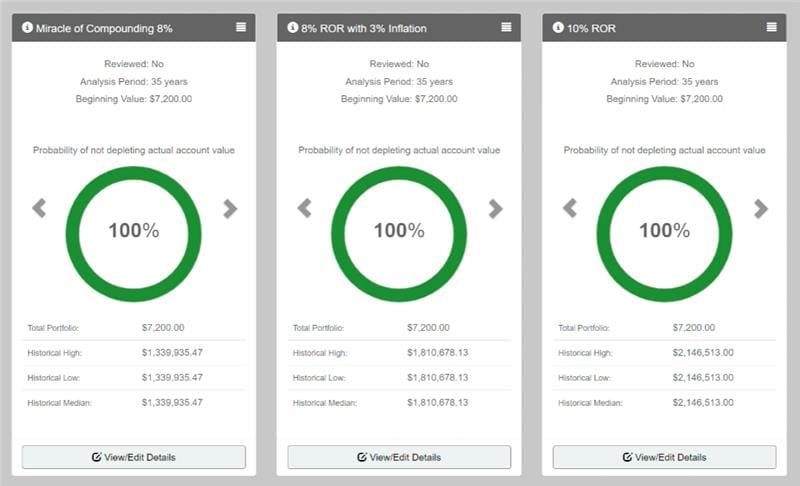

This goes to show that where you save your money truly makes a difference. Look at Figure 1, below to see how Samantha’s contributions can grow much larger just by adding a 3% inflation factor or increasing her rate of return to 10%. It’s important to note that not everyone will get these rates of return, as this varies based on your allocation.

FIGURE 1 – Samantha Sample Compound Interest

Understanding Your Asset Allocation

If you’re saving to an employer-sponsored 401(k), IRAs, or brokerage accounts, that’s great. But there’s more to it than that. It’s crucial to have a good understanding of your asset allocation. This is your asset allocation that’s based on your goals, risk tolerance, and life expectancy.

You might have a lot in common with your colleague or best friend, but their target asset allocation isn’t likely going to be the same as yours. They’ll some different goals, possibly a different appetite for risk, and life expectancy has different variables for everyone.

Determining your target asset allocation—and regularly rebalancing back to it when it waivers from that allocation—is essential because your asset allocation is one of the leading drivers of your portfolio’s return over time. Having a forward-looking financial plan that considers all those variable—as well as taxes, estate planning, and insurance needs—is paramount so that you can determine your target asset allocation.

When Do You (and Your Partner) Plan to Claim Social Security?

The decision of when to claim Social Security is also a big one as you’re seeking a comfortable retirement. But one bad habit that prevents that is the urge to claim Social Security as early as possible at age 62. Keep in mind that the longer you delay claiming your benefit, the larger it will be.

So, if you’re truly seeking a comfortable retirement, you’ll want to work with a team of professionals that is focused on making sure that you and your spouse are maximizing your Social Security benefits. There aren’t any do-overs with your decision of when to claim Social Security, so it needs to be well thought through.

Also, did you know that up to 85% of your Social Security benefit can be taxable? Not understanding how various sources of retirement income are taxed can make it very difficult to achieve a comfortable retirement.

Knowing Your Current and Future Tax Rates

Speaking of taxes, do you know what tax bracket that you’re currently in compared to the one you’ll be in the future? This is pivotal with the Tax Cuts and Jobs Act set to sunset after 2025. If that happens as scheduled, tax rates will revert to the rates from 2017, which are higher than today’s rates.

When a lot of people meet with us for the first time, they’ll typically have a lot of their retirement savings in a traditional 401(k) and IRAs. Those are tax-deferred assets, meaning that those funds won’t be taxed until you take distributions from those accounts. So, if you don’t plan to take money from those accounts until after 2025, you need to understand that you’ll not only be taxed when you access it. You’ll also be taxed at higher rates than today’s rates.

Roth vs. Traditional

However, if you have a Roth 401(k) or Roth IRAs, which have already been taxed, those assets are tax-free when you withdrawal from those accounts. If you have most of your money in tax-deferred accounts, there’s still time create some tax diversification before 2026 arrives. One way to do that is by converting funds from your traditional IRAs to a Roth IRA (Roth conversions). You’re required to pay the tax on the conversion, but from that point on, the funds will grow tax-free. You can learn more about Roth conversions and if they make sense for you by downloading our Roth Conversion Case Studies below.

If you think Roth conversions could help you with seeking a comfortable retirement, know that there are other tax planning strategies to consider as well. The goal of tax planning is to pay the least possible amount of taxes over your lifetime, not just in one year. You can learn more about tax planning below in our Tax Reduction Strategies guide.

Tax Reduction Strategies Guide

3. Not Having a Forward-Looking Plan

This leads right into our third bad habit to avoid when seeking a comfortable retirement. Having a forward-looking approach as you’re planning for retirement is paramount.

That can be easier said than done for someone like Sam Sample for our example that we gave earlier. He had his nose to the grindstone and was blindly saving for retirement. Meanwhile, Samantha saved in a manner that generated more retirement savings and had a better work-life balance. She probably thought much more about what she wanted her life to look like after retirement than Sam did.

With being so focused on work, that became a massive part of his identity. This is exactly why Bruce Godke has launched our Your Encore program. As one of Modern Wealth’s longest-tenured financial advisors, Bruce admitted to being stuck in the same mindset as Sam Sample. Bruce thoroughly enjoyed his job, but he allowed it to take over his life for much of his career.

Planning to Get to and Through Retirement

But with the help of Dean Barber, Bruce realized that he needed rediscover himself rather than constantly having work on his mind. So, Bruce and his wife, Heidi, planned a six-month long cruise, which they embarked on in January 2024 following Bruce’s retirement. Part of Bruce’s mission on the cruise is to figure out what he wants his retirement lifestyle to look like.

Part of that will involve helping other people determine their retirement lifestyle as he builds Your Encore. Bruce truly enjoys helping people, so he’s going to continue doing that in retirement. Is helping people—whether it’s your grandchildren or children or your favorite charities—important to you? If so, make sure that gifting and/or charitable giving is prioritized within your forward-looking financial plan.

And Potentially Planning to Leave a Legacy

Leaving a legacy is important to a lot of people. However, running out of money in retirement is arguably the biggest risk people face in retirement. You can’t leave a legacy if you run out of money in retirement.

Whether you’re wanting to leave a legacy or just focus on getting through retirement, how are you supposed to know how much you need to save for retirement? Well, again, that depends on your unique needs, wants, and wishes. Having a forward-looking financial plan incorporates all the financial and nonfinancial planning factors that need to be considered so that you can achieve a comfortable retirement. Not having a plan is a bad habit that can quickly prevent you having a comfortable retirement.

If you have any questions about the bad habits we’ve discussed (or other possible bad habits you’re concerned about) and how to avoid them, start a conversation with our team below.

It’s our goal for our team of professionals to build you a plan that gives you more confidence that you’re doing the right things with your money, freedom from financial stress, and time to spend doing the things you love. We’re here to help you seek a comfortable retirement.

Seeking a Comfortable Retirement: Avoid These Common Bad Habits | Watch Guide

00:00 – Introduction

00:50 – Some Bad Habits Around Spending

07:30 – Your Money Isn’t Working Efficiently for You

11:31 – Not Considering Taxes is a Bad Habit

15:21 – Social Security Claiming Bad Habits

16:06 – The Bad Habit of Focusing TOO Much on Finances

20:23 – What We Learned Today

Articles

- Finding Financial Independence

- Nonfinancial Life Planning with Bruce Godke

- Starting the Retirement Planning Process

- Setting Up a Spending Plan for Retirement

- Making a Big Purchase in Retirement

- Retirement Planning 101: Back to the Basics with Chris Rett, CFP®, AIF®

- Strategic Investing Through Retirement with Stephen Tuckwood, CFA

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Maximizing Your Social Security Benefits

- Why You Need a Financial Planning Team with Jason Gordo

- Introducing Your Encore

- Family Financial Planning with Matt Kasper, CFP®, AIF®

- Charitable Giving in Retirement

- How Much Do I Need to Retire?

- Why Compound Interest Is Key

- What Are Tax Brackets?

- Tax Rates Sunset in 2026 and Why That Matters

- What If We Go Back to Old Tax Rates?

- What to Do with Your 401(k) After Retirement

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF® and Corey Hulstein, CPA

- What Is Tax Diversification?

- Tax Planning Strategies with Marty James, CPA, PFS

Past Shows

- Your Retirement Lifestyle: What Do You Want Your Retirement to Look Like?

- 5 Long-Term Strategies for a Better Retirement

- Retirement Cash Flow: What You Need to Know

- 7 Overlooked Budget Items in Retirement

- Rightsizing vs. Downsizing: What Are the Differences?

- Top 5 Financial Planning Considerations

- Reviewing Your Retirement Checklist

- Where Should I Be Saving for Retirement?

- Understanding Retirement Asset Allocation

- Longevity Risk in Retirement and How to Plan for It

- Retiring Before 62: What You Need to Consider

- Taxes on Retirement Income

- 5 Common Risks in Retirement

- How Does a Roth IRA Grow?

- Converting to a Roth IRA: What Are the Pros and Cons?

- What Is Tax Planning?

Downloads

Other Resources

[1] https://www.jerseymikes.com/cart

[2] https://www.hy-vee.com/aisles-online/p/99379/Sara-Lee-Classic-White-Bread

[3] https://www.hy-vee.com/aisles-online/p/61938/Di-Lusso-Premium-Sliced-Smoked-Turkey

[4] https://www.hy-vee.com/aisles-online/p/1517760/HyVee-Quality-Sliced-American-Cheese

[5] https://www.hy-vee.com/aisles-online/p/2673152/FritoLay-Flavor-Mix-Party-Size-Variety-Pack-28Ct

[6] https://www.hy-vee.com/aisles-online/p/56352/HyVee-One-Step-Purified-Drinking-Water-24-Pack

[7] https://www.foxbusiness.com/personal-finance/todays-mortgage-rates-march-4-2024

Investment advisory services offered through Modern Wealth Management, LLC, an SEC Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management an SEC Registered Investment Adviser. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.