Taxation on My Investments

Key Points – Taxation on My Investments

- Short-Term and Long-Term Capital Gains Tax Rates

- Taxation on Different Types of Retirement Accounts

- Factors That Impact Taxation on Real Estate

- Why ETFs Are Becoming Increasingly Popular

- 6-Minute Read | 23-Minute Watch

Schedule a Meeting Get the Retirement Plan Checklist

Taxation on Investments

The taxation on your investments depends on two main factors—the type of investment and how long you hold it. Let’s review how different investments are taxed.

Types of Investments

1. Taxation on Investments: Stock and Bonds

Let’s start with stocks and bonds. It’s important to realize that if you sell a stock or bond for a higher price than what you paid for it (your cost basis), you’ll be taxed on the difference. Note that your cost basis includes commissions and fees that were a part of the initial purchase. The profit is a capital gain. The tax rate of the capital gain will depend on how long you hold the stock or bond.

Short-term vs. Long-term Capital Gains

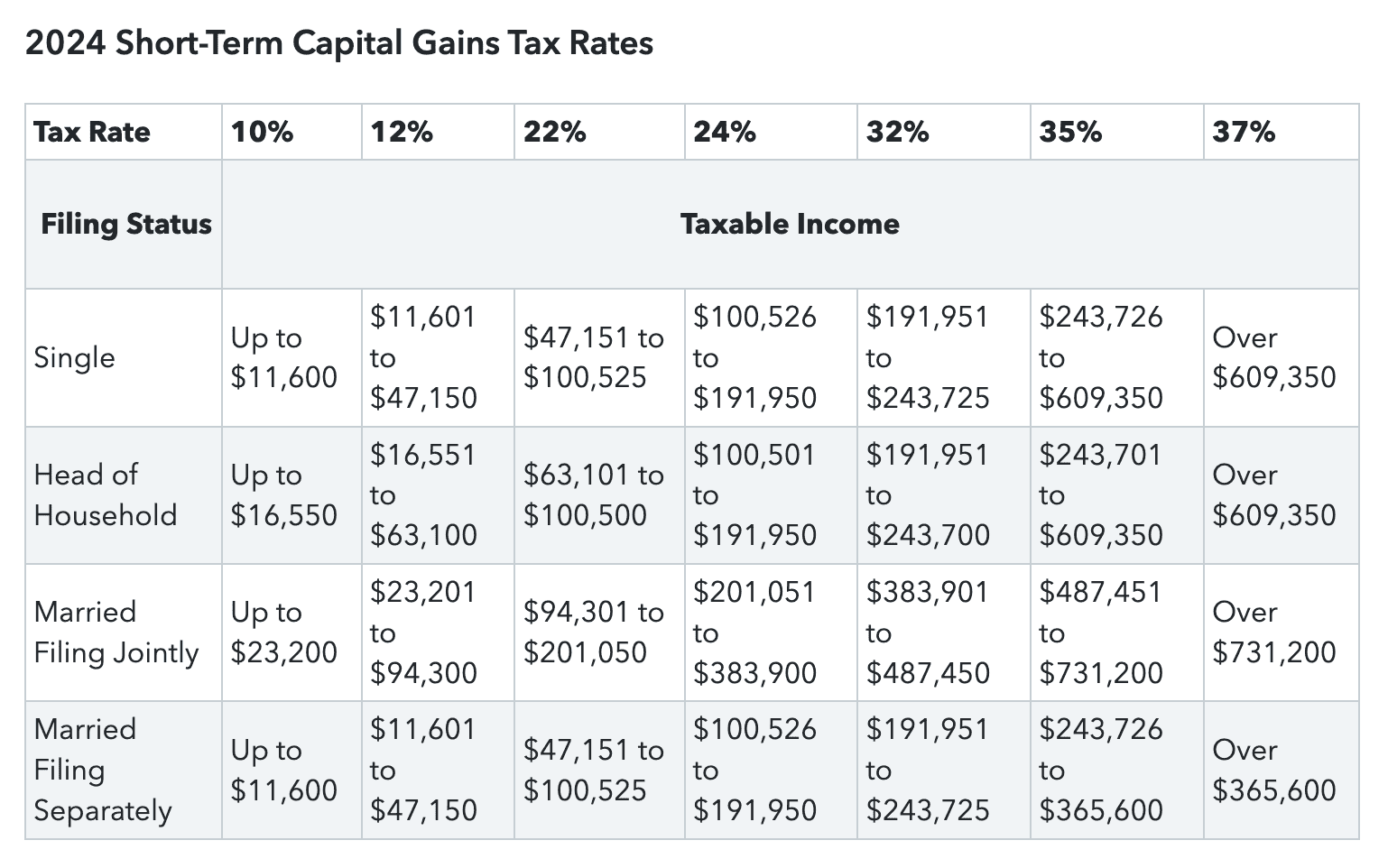

Short-term capital gains apply if you held the asset for less than a year. They are taxed at the same rates as your ordinary income.

FIGURE 1 – 2024 Short-Term Capital Gains Tax Rates – Intuit1

Long-term capital gains apply if you held the asset for longer than a year. Typically, you’ll pay less in taxes on long-term capital gains than short-term capital gains, as you can see when reviewing Figures 1 and 2.

FIGURE 2 – 2024 Long-Term Capital Gains Tax Rates – Intuit

What If You Have Capital Losses?

It’s also important to understand how to manage capital losses. Those losses can be harvested to offset some of the gains. Tax-loss and tax-gain harvesting are tax planning strategies that may potentially help your long-term tax situation. We’ll continue to discuss tax planning while we address taxation on other types of investments, but make sure that you download our Tax Reduction Strategies guide to learn about other important tax considerations.

Dividends (Stocks) and Interest (Bonds)

There’s also interest income that can be earned from bonds and dividend income that can be earned from stocks. Interest income is usually taxed as ordinary income. Examples of investments and accounts that may earn interest include checking accounts, savings accounts, mutual funds, ETFs, various bonds, treasuries, CDs, and money market accounts.

Dividend income from stocks can be taxed at ordinary income tax rates or long-term capital gain rates. Qualified dividends are taxed at long-term capital gains rates, while non-qualified dividends are taxed at ordinary income tax rates. There are a few factors that determine whether a dividend is qualified or not. A dividend is typically qualified if:

- The dividend is from a U.S. company or a foreign company that meet certain requirements of the IRS.2

- You’ve held the shares for at least 61 days out of a 121-day timeframe that starts 60 days prior to the security’s ex-dividend date. There are some exceptions where it must be held for at least 91 days over a 181-day timeframe that starts 90 days prior to the security’s ex-dividend date.

- Qualified dividends can’t be hedged.

Speaking of bonds, they could become a more attractive investment option again now that the Federal Reserve has started cutting interest rates for the first time in four years.3 Remember that there’s an inverse relationship between interest rates and bond prices. When interest rates go down, bonds price usually go up.

2. Taxation on Retirement Accounts

Your tax situation during your working years compared to your tax situation in retirement will be vastly different. Let’s review taxation on different forms of retirement income.

Social Security

Did you know that up to 85% of your Social Security benefit can be taxable? That tends to catch a lot of people by surprise during the retirement planning process. You’ll need to know how much provisional income you need to determine what percentage of your Social Security benefit is taxable.

The provisional income formula takes 50% of your Social Security benefit and adds it to any other form of taxable income plus any interest from tax-exempt bonds. If your provisional income is between $32,000 and $44,000, up to 50% of your Social Security benefits may be taxable. It may be up to 85% taxable if your provisional income exceeds $44,000.

Pensions

Pension income is typically subject to federal income tax. However, there are some forms of pension income that may be exempt from state income tax.

Annuities

Qualified annuities are funded with pre-tax contributions, while non-qualified annuities are funded via after-tax contributions. Contributions to qualified annuities are tax-deferred, similar to that of traditional 401(k) and IRA contributions, which we’ll discuss momentarily. With the contributions being tax-deferred, the funds wouldn’t be taxed until you make withdrawals. Only the annuity earnings are taxed on non-qualified annuities since they are funded via after-tax contributions. Also, keep in mind that you may be subject to a 10% penalty if you take money out of the annuity prior to turning 59½.

IRA Withdrawals

Traditional IRA withdrawals are generally subject to ordinary income tax. A 10% penalty for pre-59½ withdrawals also applies with IRAs, although there are some exceptions.

Roth vs. Traditional

One decision to keep in mind throughout the retirement planning process is whether to save to traditional or Roth accounts. While traditional IRAs are a tax-deferred asset, Roth IRA withdrawals are tax-free as long as you follow the five-year rule for Roth IRA withdrawals.

Let’s say that you’re planning to retire and have $2 million saved between your traditional 401(k) and IRAs. If that $2 million comprises most of your retirement savings, it’s important to realize that you still need to pay taxes on that money. That’s why it’s critical to prioritize tax diversification and allocate your retirement savings across taxable, tax-deferred, and tax-free accounts.

3. Taxation on Investments: Real Estate

A capital gains tax can potentially apply from the sale of a property. Your capital gains tax when it comes to real estate hinges on many factors, including how long you’ve owned your home, if you’re single or married, your tax bracket, and if your home is your main residence, secondary residence, or a rental home.

It is possible to reduce or avoid the capital gains tax if you sell your primary residence if you follow certain IRS guidelines. You can potentially get up to a $250,000 exemption if you’re single and $500,000 exemption if you’re married, that is available once every two years. Make sure you’re aware of the potential deductions, exemptions, and exclusions that you may qualify for to potentially lower the capital gains tax.

Capital gains guidelines are different for rental and investment properties than they are for your primary residence. When it comes to rental and investment properties, there’s a 25% depreciation recapture tax that may potentially apply in addition to short-term or long-term capital gains tax depending on how long you own the property, your income, and filing status.

4. Taxation on Investments: Mutual Funds and ETFs

Let’s shift gears now to discuss taxation on mutual funds and ETFs. ETFs typically have fewer taxable events than mutual funds. That being said, both are still subject to capital gains tax and taxation of dividend income.

Mutual fund managers need to constantly rebalance the fund by selling securities, whether it’s to accommodate shareholder redemptions or reallocate assets. Selling securities within the mutual fund creates capital gains for the shareholders.

ETF managers accommodate investment inflows and outflows via in-kind transactions. Investors sometimes utilize ETFs as a loophole to get around the wash-sale rule, which applies to those who purchase substantially identical securities or stocks within 30 days of selling them at a loss. ETFs aren’t substantially identical to individual stocks, thus how the loophole is created.

5. Taxation on Investments: Cryptocurrency

We also want to briefly touch on the taxation of cryptocurrency. It generally receives similar tax treatment as stocks and bonds. Whether cryptocurrency is taxed as capital gains or ordinary income depends on how you acquired it and how long you hold it.

Other Key Factors with Taxation on Investments

Understanding how different types of investments are taxed is just one piece of the puzzle when assessing your overall tax situation. It’s important to understand that the current tax rates within the Tax Cuts and Jobs Act are lower than what tax rates would be in 2026 if the TCJA sunsets as scheduled after 2025.4

Whether it’s keeping up to date on tax law or understanding the taxation of specific investments, taxation can be difficult to comprehend and the potential ramifications for any mistakes may be costly. That’s why it’s important to work with a CFP® Professional that works alongside a CPA to review your financial plan from a tax perspective. We have CFP® Professionals and CPAs as a part of our team at Modern Wealth.

If you have questions about taxation on your investments and other critical tax considerations, start a conversation with our team below.

Taxation on My Investments | Watch Guide

- 00:00 – Taxation on Stocks and Bonds

- 08:04 – Taxation on Retirement Accounts

- 17:21 – Real Estate

- 19:19 – Mutual Funds and ETFs

Resources Mentioned in This Article

- What Should I Invest My Money In?

- Understanding Cost Basis

- What to Know About CDs, Bonds, and Treasuries

- 2024 Tax Brackets: IRS Makes Inflation Adjustments

- Taxes on Retirement Income

- Avoiding Costly Mistakes When Claiming Social Security with Ken Sokol

- Are Retirement Benefits Taxable?

- Understanding Your Tax Allocation

- How Does a 401(k) Work with Michelle Cannan, CPFA™, QKA®, QKC

- The IRA Early Withdrawal Penalty: How to Avoid the 10% Penalty

- Revisiting Roth vs. Traditional with Bud Kasper, CFP®, AIF®, and Corey Hulstein, CPA

- How Does a Roth IRA Grow?

- The Roth IRA Five-Year Rule

- Tax Rates Sunset in 2026 and Why That Matters

- What If We Go Back to Old Tax Rates?

- The CFP® Professional and CPA Relationship with Logan DeGraeve, CFP®, AIF® and Corey Hulstein, CPA

- Tax Planning Tips with Corey Hulstein, CPA and Marty James, CPA, PFS

- Why You Need a Financial Planning Team with Jason Gordo

- How Do I Pay Less Taxes?

- How Bonds Fit into Your Financial Plan

- Examining Municipal Bonds in 2024

- Retiring with $2 Million

- 5 Long-Term Strategies for a Better Retirement

- Understanding Retirement Asset Allocation

- Pension Plans: Defined Benefit Plans vs. Defined Contribution Plans

- How Do Capital Gains Taxes Work?

Downloads

Other Sources

[2] https://www.irs.gov/pub/irs-drop/n-06-101.pdf

[3] https://www.cnbc.com/2024/09/18/fed-cuts-rates-september-2024-.html

[4] https://taxfoundation.org/blog/tcja-expiring-means-for-you/

Investment advisory services offered through Modern Wealth Management, Inc., a Registered Investment Adviser.

The views expressed represent the opinion of Modern Wealth Management a Registered Investment Advisor. Information provided is for illustrative purposes only and does not constitute investment, tax, or legal advice. Modern Wealth Management does not accept any liability for the use of the information discussed. Consult with a qualified financial, legal, or tax professional prior to taking any action.